Aviation Connectors Market by Application (Landing Gear, Engine Control System, Avionics, Cabin Equipment, Others), Type (PCB, High Power, High Speed, RF Connectors, Fiber Optics), Shape (Circular, Rectangular), & Region - Global Forecast to 2022

[168 Pages Report] The aviation connectors market was valued at USD 4.13 Billion in 2016 and is projected to reach USD 5.52 Billion by 2022, at a CAGR of 4.97% during the forecast period. The base year considered for the study is 2015, and the forecast period is from 2016 to 2022.

Objectives of the Study:

Objectives of this study are to analyze the aviation connectors market, along with statistics from 2016 to 2022, as well as to define, describe, and forecast the aviation connectors market on the basis of end user (commercial, business jets, military, and others), shape (circular and rectangular), application (landing gear, avionics, cabin equipment, engine control system, and others), type (PCB, fiber optic, high power, high speed, RF connectors, and others), and platform (fixed wing and rotary wing). These segments and subsegments have been mapped across major regions, namely, North America, Europe, Asia–Pacific, and the Rest of the World.

The report provides in-depth market intelligence regarding market dynamics and major factors influencing the growth of the aviation connectors market (drivers, restraints, opportunities, and industry-specific challenges), along with an analysis of micromarkets with respect to individual growth trends, future prospects, and their contribution to the aviation connectors market.

The report also covers competitive developments such as partnerships, joint ventures, mergers, new product launches and developments, and research & development activities in the aviation connectors market in addition to business and corporate strategies adopted by the key market players.

The aviation connectors market is projected to grow from USD 4.13 Billion in 2016 to USD 5.52 Billion by 2022, at a CAGR of 4.97% during the forecast period. Factors such as increase in aircraft orders and deliveries across the globe, need for modern avionic systems, increasing flight safety, and decreasing operational & maintenance cost are the major growth factors for the aviation connectors market. The market has been segmented on the baisis of application, type, shape, platform, end user, and region.

Based on application, the aviation connectors market has been segmented in landing gear, in-flight entertainment, avionics, cabin equipment, and others. The avionics segment is anticipated to grow at the highest CAGR during the forecast period. Increase in aircraft orders and deliveries across the globe are the major growth factors for the aviation connectors market. The market is also driven by the need for modern avionic systems. Increasing concerns over flight safety, and reducing operational & maintenance cost have led to the need for modern aviation connectors.

Based on type, the aviation connectors market has been segmented into PCB, fiber optic, high power, high speed, RF connectors, and others. The fiber optic segment is estimated to account for the largest market share in 2016, owing to the increased procurement of fiber optics to cater to the rising demand for high-speed data transmission and increasing use of new telecommunication technologies such as FTTx applications.

Based on shape, the aviation connectors market has been segmented into circular and rectangular connectors. The circular connectors segment is anticipated to witness higher growth due to the increasing demand for connectors from 3C application (computers, communications, and consumer electronics) in the aviation sector, and increasing demand for advanced features, convenience, and connectivity products.

Based on platform, the aviation connectors market has been segmented into fixed wing and rotary wing. The fixed wing segment is anticipated to witness higher growth due to the increase in air passenger traffic across the globe and upgradation of aircraft, which is leading to the increase in demand for fixed wing commercial aircraft. Hence, this will result in the growth of aviation connectors market for fixed wing.

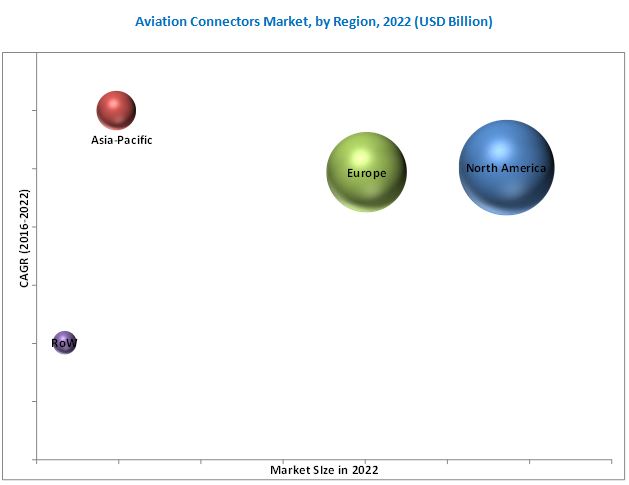

The geographical analysis of the aviation connectors market includes regions such as North America, Europe, Asia-Pacific, and RoW. The Asia-Pacific aviation connectors market is anticipated to grow at a significant CAGR from 2016 to 2022, owing to factors such as increasing air passenger traffic and companies venturing into aircraft manufacturing business in this region. Growing concern over flight safety, and reducing operational & maintenance costs have led to the demand for modern avionics systems.

Existing backlog in aircraft deliveries may restrain the growth of the aviation connector market. Products offered by various companies operating in the aviation connector market have been listed in this report. Recent development and contract sections of the report include essential products developed and contracts undertaken by various companies. Major players in the aviation connector market include TE Connectivity (U.S.), Amphenol Corporation (U.S.), Carlisle Group (U.S.), and Bel Fuse Inc. (U.S.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

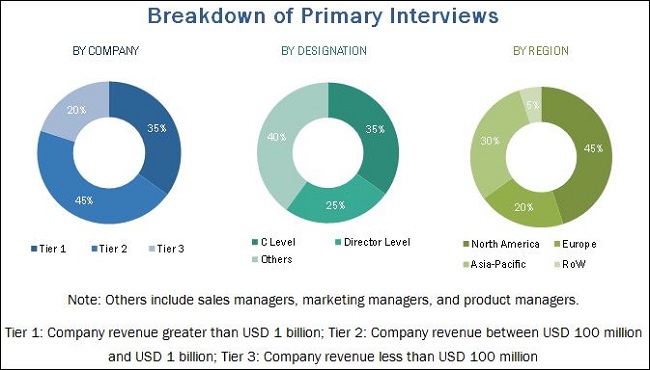

2.2.2.2 Breakdown of Primaries, By Company, Designation, and Region

2.3 Factor Analysis

2.3.1 Introduction

2.3.2 Demand-Side Indicators

2.3.2.1 Demand for Greater Bandwidth, and Reduced Usage of Size, Weight and Power (SWAP)

2.3.3 Supply-Side Indicators

2.3.3.1 Increase in R&D Investment for Better Design and Cost Effectiveness

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Aviation Connector Market

4.2 Market, By Region

4.3 Market, By End User & Region

4.4 Market, By Application

4.5 Market, By Type

4.6 Market, By Shape

4.7 Market, By Platform

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market: By Shape

5.2.2 Market: By Type

5.2.3 Market: By Application

5.2.4 Market: By End User

5.2.5 Market: By Platform

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth in the Number of Aircraft Deliveries

5.3.1.2 Shift Towards Electric Architecture and Technology

5.3.2 Restraints

5.3.2.1 Existing Backlogs of Aircraft Deliveries

5.3.3 Opportunities

5.3.3.1 Diverse Applications of Connectors in an Aircraft

5.3.4 Challenges

5.3.4.1 Obtaining Quality Accreditations

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Technological Specifications

6.2.1 Real World Requirements

6.2.2 Interconnect Considerations

6.2.3 Signal Integrity

6.2.4 Size, Weight, and Speed

6.2.5 Mobile, Miniature, and Modern

6.2.6 Commonality and Crossover

6.2.7 Ongoing Upgrades

6.3 Technology Trends

6.3.1 Backplane Connectors

6.3.2 I/O Connectors

6.3.3 Optical Interfaces

6.3.4 High Density Subminiature Connectors

6.4 Technological Advancements

6.4.1 Impact of Technological Advancements on the Aviation Connector Market

6.4.1.1 Industry Consolidation

6.4.1.2 Globalization

6.4.1.3 Relentless Cost Pressures

6.4.1.4 Organizational Productivity

6.4.1.5 Industry Standardization

6.5 Mapping of Top Manufacturers and Latest Innovations in the Aviation Connector Market

6.6 Pricing Analysis on the Basis of Shape

6.7 Patent Registrations (2011-2013)

7 Aviation Connectors Market, By End User (Page No. - 62)

7.1 Introduction

7.2 Commercial

7.3 Business Jets

7.4 Military

7.5 Others

8 Aviation Connector Market, By Type (Page No. - 67)

8.1 Introduction

8.2 PCB (Printed Circuit Board)

8.3 High Power

8.4 High Speed

8.5 RF Connectors

8.6 Fiber Optic

9 Aviation Connectors Market, By Shape (Page No. - 74)

9.1 Introduction

9.2 Circular

9.2.1 Coaxial Connectors

9.3 Rectangular

9.3.1 D Subminiature Connectors

10 Aviation Connectors Market, By Application (Page No. - 78)

10.1 Introduction

10.2 Landing Gear

10.3 Engine Control System

10.4 Avionics

10.5 Cabin Equipment

10.6 Others

11 Aviation Connectors Market, By Platform (Page No. - 84)

11.1 Introduction

11.2 Fixed Wing

11.3 Rotary Wing

12 Regional Analysis (Page No. - 88)

12.1 Introduction

12.2 North America

12.2.1 By Country

12.2.2 By Application

12.2.3 By Shape

12.2.4 By Type

12.2.5 By Platform

12.2.6 By End User

12.2.7 U.S.

12.2.7.1 By End User

12.2.8 Canada

12.2.8.1 By End User

12.3 Europe

12.3.1 By Country

12.3.2 By Application

12.3.3 By Shape

12.3.4 By Type

12.3.5 By Platform

12.3.6 By End User

12.3.7 U.K.

12.3.7.1 By End User

12.3.8 France

12.3.8.1 By End User

12.3.9 Germany

12.3.9.1 By End User

12.3.10 Italy

12.3.10.1 By End User

12.3.11 Rest of Europe

12.3.11.1 By End User

12.4 Asia-Pacific

12.4.1 By Country

12.4.2 By Application

12.4.3 By Shape

12.4.4 By Type

12.4.5 By Platform

12.4.6 By End User

12.4.7 Russia

12.4.7.1 By End User

12.4.8 Japan

12.4.8.1 By End User

12.4.9 China

12.4.9.1 By End User

12.4.10 Rest of APAC

12.4.10.1 By End User

12.5 Rest of the World (RoW)

12.5.1 By Region

12.5.2 By Application

12.5.3 By Shape

12.5.4 By Type

12.5.5 By Platform

12.5.6 By End User

12.5.7 Latin America

12.5.7.1 By End User

12.5.8 Middle East

12.5.8.1 By End User

12.5.9 Africa

12.5.9.1 By End User

13 Competitive Landscape (Page No. - 116)

13.1 Introduction

13.2 Market Share Analysis of Top Players in the Aviation Connector Market

13.3 Regional Mapping of Leading Companies in the Market

13.4 Top Five Mergers & Acquisitions in the Market

13.4.1 New Product Launches

13.4.2 Partnerships, Agreements, and Acquisitions

13.4.3 Others (Events, Recognition, and Certifications)

14 Company Profiles (Page No. - 125)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 Introduction

14.2 Financial Highlights of Major Players in the Market

14.3 Amphenol Corporation

14.4 TE Connectivity

14.5 Carlisle Companies Inc.

14.6 Esterline Corporation

14.7 Bel Fuse Inc.

14.8 Eaton Corporation

14.9 ITT Corporation

14.10 Smiths Group PLC

14.11 Radiall

14.12 Rosenberger Group

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

15 Appendix (Page No. - 161)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (68 Tables)

Table 1 Innovations in Market

Table 2 Patent Registrations

Table 3 Market Size, By End User, 2014-2022 (USD Million)

Table 4 Commercial Segment, By Region, 2014-2022 (USD Million)

Table 5 Business Jets Segment, By Region, 2014-2022 (USD Million)

Table 6 Military Segment, By Region, 2014-2022 (USD Million)

Table 7 Others Segment, By Region, 2014-2022 (USD Million)

Table 8 Market Size, By Type, 2014-2022 (USD Million)

Table 9 PCB Segment, By Region, 2014-2022 (USD Million)

Table 10 High Power Segment, By Region, 2014-2022 (USD Million)

Table 11 High Speed Segment, By Region, 2014-2022 (USD Million)

Table 12 RF Connectors Segment, By Region, 2014-2022 (USD Million)

Table 13 Fiber Optic Segment, By Region, 2014-2022 (USD Million)

Table 14 Market, By Shape, 2014-2022 (USD Million)

Table 15 Circular Segment, By Region, 2014-2022 (USD Million)

Table 16 Rectangular Segment, By Region, 2014-2022 (USD Million)

Table 17 Market, By Application, 2014-2022 (USD Million)

Table 18 Landing Gear Segment, By Region, 2014-2022 (USD Million)

Table 19 Engine Control System Segment, By Region, 2014-2022 (USD Million)

Table 20 Avionics Segment, By Region, 2014-2022 (USD Million)

Table 21 Cabin Equipment Segment, By Region, 2014-2022 (USD Million)

Table 22 Others Segment, By Region, 2014-2022 (USD Million)

Table 23 Market Size, By Platform, 2014-2022 (USD Million)

Table 24 Fixed Wing Segment, By Region, 2014-2022 (USD Million)

Table 25 Rotary Wing Segment, By Region, 2014-2022 (USD Million)

Table 26 Market Size, By Region, 2014-2022 (USD Million)

Table 27 North America Market Size, By Country, 2014-2022 (USD Million)

Table 28 North America Market Size, By Application, 2014-2022 (USD Million)

Table 29 North America Market Size, By Shape, 2014-2022 (USD Million)

Table 30 North America Market Size, By Type, 2014-2022 (USD Million)

Table 31 North America Market Size, By Platform, 2014-2022 (USD Million)

Table 32 North America Market Size, By End User, 2014-2022 (USD Million)

Table 33 U.S. Market Size, By End User, 2014-2022 (USD Million)

Table 34 Canada Market Size, By End User, 2014-2022 (USD Million)

Table 35 Europe Market Size, By Country, 2014-2022 (USD Million)

Table 36 Europe Market Size, By Application, 2014-2022 (USD Million)

Table 37 Europe Market Size, By Shape, 2014-2022 (USD Million)

Table 38 Europe Market Size, By Type, 2014-2022 (USD Million)

Table 39 Europe Market Size, By Platform, 2014-2022 (USD Million)

Table 40 Europe Market Size, By End User, 2014-2022 (USD Million)

Table 41 U.K. Market Size, By End User, 2014-2022 (USD Million)

Table 42 France Market Size, By End User, 2014-2022 (USD Million)

Table 43 Germany Market Size, By End User, 2014-2022 (USD Million)

Table 44 Italy Market Size, By End User, 2014-2022 (USD Million)

Table 45 Rest of Europe Market Size, By End User, 2014-2022 (USD Million)

Table 46 Asia-Pacific Market Size, By Country, 2014-2022 (USD Million)

Table 47 Asia-Pacific Market Size, By Application, 2014-2022 (USD Million)

Table 48 Asia-Pacific Market Size, By Shape, 2014-2022 (USD Million)

Table 49 Asia-Pacific Market Size, By Type, 2014-2022 (USD Million)

Table 50 Asia-Pacific Market Size, By Platform, 2014-2022 (USD Million)

Table 51 Asia-Pacific Market Size, End User, 2014-2022 (USD Million)

Table 52 Russia Market Size, By End User, 2014-2022 (USD Million)

Table 53 Japan Market Size, By End User, 2014-2022 (USD Million)

Table 54 China Market Size, By End User, 2014-2022 (USD Million)

Table 55 Rest of APAC Market Size, By End User, 2014-2022 (USD Million)

Table 56 Rest of the World Market Size, By Region, 2014-2022 (USD Million)

Table 57 Rest of the World Market Size, By Application, 2014-2022 (USD Million)

Table 58 Rest of the World Market Size, By Shape, 2014-2022 (USD Million)

Table 59 Rest of the World Market Size, By Type, 2014-2022 (USD Million)

Table 60 Rest of the World Market Size, By Platform, 2014-2022 (USD Million)

Table 61 Rest of the World Market Size, By End User, 2014-2022 (USD Million)

Table 62 Latin America Market Size, By End User, 2014-2022 (USD Million)

Table 63 Middle East Market Size, By End User, 2014-2022 (USD Million)

Table 64 Africa Market Size, By End User, 2014-2022 (USD Million)

Table 65 Top Five Mergers & Acquisitions in Aviation Connectors Market

Table 66 New Product Launches, 2013-2017

Table 67 Partnerships, Agreements, and Acquisitions, 2013-2017

Table 68 Events, Awards, and Certifications, 2013-2017

List of Figures (59 Figures)

Figure 1 Research Process Flow

Figure 2 Aviation Connector Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Aviation Connector Market, By Shape, 2016 & 2022 (USD Billion)

Figure 8 Aviation Connector Market, By Type, 2016 & 2022 (USD Billion)

Figure 9 Aviation Connector Market, By Application, 2016 & 2022 (USD Billion)

Figure 10 Aviation Connector Market, By End User, 2016 & 2022 (USD Billion)

Figure 11 Aviation Connector Market, By Platform, 2016 & 2022 (USD Billion)

Figure 12 Aviation Connector Market in Asia-Pacific Region is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 13 New Product Launches Was the Key Growth Strategy Adopted By the Major Players in the Aviation Connector Market Between 2013 and 2017

Figure 14 Increase in Aircraft Deliveries is Expected to Drive the Aviation Connector Market During the Forecast Period

Figure 15 North America Accounted for the Largest Share of the Aviation Connector Market in 2016

Figure 16 Commercial Segment Led the Aviation Connector Market in 2016

Figure 17 Avionics Application Segment Led the Aviation Connector Market in 2016

Figure 18 Aviation Connector Market, By Type, 2016 & 2022 (USD Million)

Figure 19 The Circular Segment is Projected to Lead the Aviation Connector Market During the Forecast Period

Figure 20 The Fixed Wing Segment is Projected to Grow at the Highest CAGR During Forecast Period

Figure 21 Aviation Connector Market Segmentation

Figure 22 Aviation Connector Market Segmentation: By Shape

Figure 23 Aviation Connector Market: By Type

Figure 24 Aviation Connector Market: Market Dynamics

Figure 25 Aircraft Deliveries Between 2005 and 2015

Figure 26 Order Backlogs of Aircraft Manufacturers (Airbus & Boeing)

Figure 27 Technological Advancements

Figure 28 Aviation Connector Market, By End User, 2016 & 2022 (USD Million)

Figure 29 Fiber Optic Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Circular Segment is Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 31 Cabin Equipment Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Aviation Connector Market, By Platform, 2016 & 2022 (USD Million)

Figure 33 Geographic Snapshot: Aviation Connector Market, 2016 & 2022

Figure 34 North America Aviation Connector Market Snapshot

Figure 35 Europe Aviation Connector Market Snapshot

Figure 36 Asia-Pacific Aviation Connector Market Snapshot

Figure 37 Companies Adopted New Product Launches as the Key Growth Strategy Between 2013 and 2017

Figure 38 Market Shares of Top Players in the Aviation Connector Market, 2016

Figure 39 Key Players in the Aviation Connector Market, By Region

Figure 40 New Product Launches, Partnerships, Acquisitions, and Agreements, and Others Were the Key Growth Strategies Adopted By Companies Between 2013 and 2017

Figure 41 Regional Revenue Mix of Top 5 Market Players

Figure 42 Amphenol Corporation: Company Snapshot

Figure 43 SWOT Analysis: Amphenol Corporation

Figure 44 TE Connectivity: Company Snapshot

Figure 45 SWOT Analysis: TE Connectivity

Figure 46 Carlisle Companies Inc.: Company Snapshot

Figure 47 SWOT Analysis: Carlisle Companies Inc.

Figure 48 Esterline Corporation: Company Snapshot

Figure 49 SWOT Analysis: Esterline Corporation

Figure 50 Bel Fuse Inc.: Company Snapshot

Figure 51 SWOT Analysis: Bel Fuse Inc.

Figure 52 Eaton Corporation: Company Snapshot

Figure 53 SWOT Analysis: Eaton Corporation

Figure 54 ITT Corporation: Company Snapshot

Figure 55 SWOT Analysis: ITT Corporation

Figure 56 Smiths Group PLC: Company Snapshot

Figure 57 SWOT Analysis: Smiths Group PLC

Figure 58 Radiall: Company Snapshot

Figure 59 SWOT Analysis: Radiall

Research Methodology:

The research methodology used to estimate and forecast the aviation connectors market begins with obtaining data on key aviation connectors equipment statistics through secondary sources such as government sources and organizations, for instance, Airports Council International, Market outlook (Boeing, Airbus and Bombardier), International Air Transport Association, Civil Aviation Authority, World Bank database, corporate filings, for instance, annual reports, investor presentations, and financial statements, and trade, business, and professional associations, among others. The bottom-up approach has been employed to arrive at the overall size of the aviation connectors market from the revenues of the key players and their shares in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with market experts such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the aviation connectors market engineering process, and arrive at the exact statistics for all the segments and the subsegments. The breakdown of profiles of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The aviation connectors market comprises product developers and manufacturers such as TE Connectivity (Switzerland), Carlisle Companies Inc. (U.S.), Eaton Corporation (Ireland), Esterline Corporation (U.S.), and Bel Fuse Inc. (U.S.), among others. These companies offer advanced technological systems, products, and services.

Target Audience

- Aviation Connectors Manufacturers

- Aviation Connectors Wholesalers, Retailers, and Distributors

- Aircraft Manufacturers

- Subcomponent Manufacturers

- Raw Material Suppliers

- Airline Operators

- Regulatory Bodies

“This study answers several questions for the stakeholders, primarily which market segments they should focus on during the next two to five years to prioritize their efforts and investments”.

Scope of the Report

This research report categorizes the aviation connectors market into the following segments and subsegments:

-

By End User

- Commercial

- Business Jets

- Military

- Others

-

By Shape

- Circular

- Rectangular

-

By Application

- Landing Gear

- Avionics

- Cabin Equipment

- Engine Control Systems

- Others

-

By Type

- PCB

- Fiber Optic

- High Power

- High Speed

- RF Connectors

- Others

-

By Platform

- Fixed Wing

- Rotary Wing

-

By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

-

Market Segment by Platform

- By Subsegment

-

Market Segment by Application

- Country-wise break-up

Growth opportunities and latent adjacency in Aviation Connectors Market

We are looking for the country-wise aircraft in the category of 2-10 and 10-20 seat capacity. For this capacity aircraft, classification by engine type—Piston, Turboprop, Turbofan, and Jet is required. We would also be interested to know aircraft manufacturers and price of the aircraft. Thanks & Best Regards

I would like to know the distribution market value for connectors and electromechanical products in Europe for aerospace and defense.