Push-to-talk Market by Offering (Hardware, Solutions, and Services), Network Type (LMR and Cellular), Vertical (Government & Public Safety, Aerospace & Defense, and Transportation & Logistics) and Region - Global Forecast to 2028

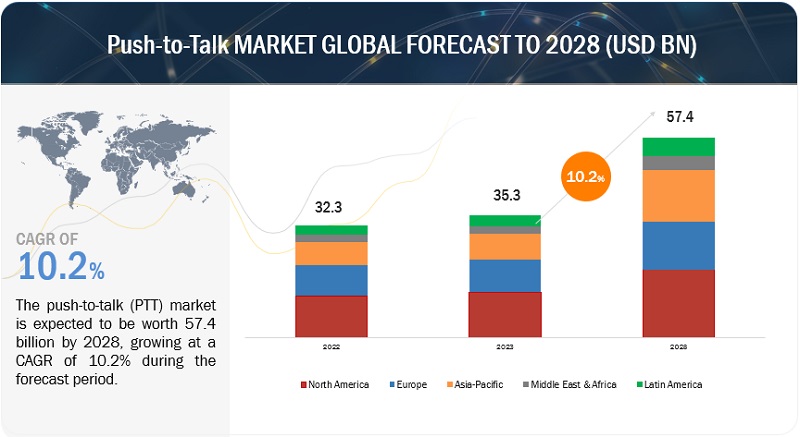

The global Push-to-Talk Market is expected to grow from USD 35.3 billion in 2023 to USD 57.4 billion by 2028, with a compound annual growth rate (CAGR) of 10.2%. The availability of PTT applications on a wide range of consumer devices, including smartphones and tablets, has significantly contributed to their accessibility and popularity among a broad user base. This accessibility stems from the versatility and compatibility of PTT apps, allowing users to communicate seamlessly across different platforms and operating systems, which is driving the PTT market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

To know about the assumptions considered for the study, download the pdf brochure

Push-to-Talk Market Dynamics

Driver: Proliferation of rugged and ultra-rugged smartphones

The proliferation of rugged and ultra-rugged smartphones is driven by the increasing need for durable, reliable, and resilient mobile devices in various industries and outdoor activities. The integration of PTT functionality further enhances their value, making them essential tools for professionals and adventurers operating in challenging environments. As technology continues to advance, it is expected that these devices to evolve further, offering even more features and capabilities to meet the demands of their diverse user base.

Restraint: Dependence on a stable network connection

PTT technology, whether in the form of dedicated PTT devices or mobile apps, relies on a continuous network connection to enable instant communication. When a user presses the PTT button, their voice is transmitted over the network to the recipients, emulating the functionality of a traditional two-way radio. The restraint here lies in the dependence on a stable network connection. If a user is in an area with weak or no network coverage, such as remote wilderness locations, underground tunnels, or areas with heavy network congestion, PTT communication can suffer from latency, dropouts, or complete failure. This limitation is particularly critical in emergency situations, where immediate and reliable communication is essential.

Opportunity: Standardization of infrastructure platforms

The standardization of infrastructure platforms presents significant opportunities for various industries and organizations. Standardizing infrastructure platforms for PTT opens up opportunities for seamless interoperability. This means that PTT devices and systems from different manufacturers can work together effortlessly. Organizations can choose the best PTT hardware and software solutions for their needs without worrying about compatibility issues. This interoperability is particularly advantageous in industries like public safety and emergency response, where various agencies and departments need to coordinate communication during critical situations.

Challenge: LMR and PTT interoperability issues

The interoperability challenges between Land Mobile Radio (LMR) systems and Push-to-Talk (PTT) solutions can pose significant hurdles in the seamless communication landscape, especially in sectors where instant and reliable communication is paramount. LMR systems, including analog and digital variants like TETRA or P25, have been widely used by public safety agencies and other critical infrastructure sectors for many years. These systems often operate on proprietary or specialized technologies. In contrast, modern PTT solutions are predominantly software-based and utilize internet protocol (IP) networks. Bridging the gap between these diverse technologies is a significant challenge, as LMR systems are not inherently designed to integrate with IP-based PTT systems.

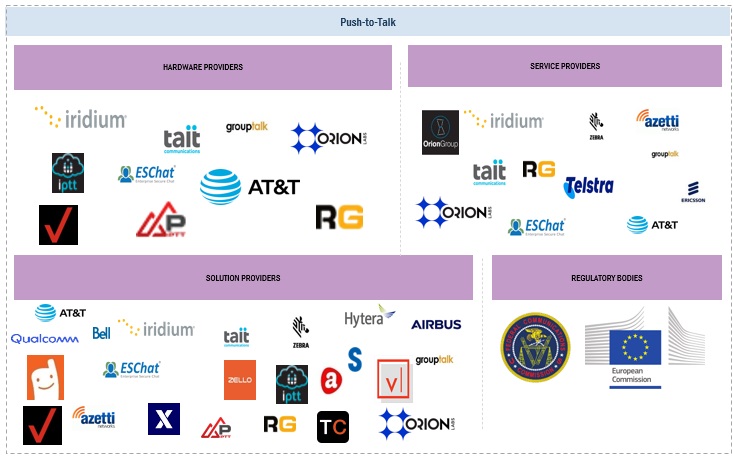

Push-to-Talk Market Ecosystem

Prominent companies in this market include well-established, financially stable PTT hardware, solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US)

By network type, land mobile radio segment to hold the largest market size during the forecast period

Land mobile radio (LMR) PTT systems offer rugged hardware designed for durability in harsh environments, and they operate on dedicated radio frequencies, providing robust coverage and ensuring that critical messages reach their intended recipients. While newer technologies like cellular PTT have emerged, LMR PTT remains a vital tool for mission-critical communications in industries where reliability and resilience are paramount.

Bu service, the support & maintenance service segment is expected to register the fastest growth rate during the forecast period.

The PTT technology support & maintenance service segment plays a crucial role in ensuring the uninterrupted functionality of PTT communication systems. This service encompasses a range of activities aimed at keeping PTT devices and networks operational. It includes regular software updates, firmware upgrades, troubleshooting, and hardware repairs. Additionally, PTT technology support & maintenance services offer proactive monitoring to detect and address potential issues before they disrupt communication. This segment is vital for industries such as public safety, transportation, and logistics, where instant and reliable communication is essential for day-to-day operations.

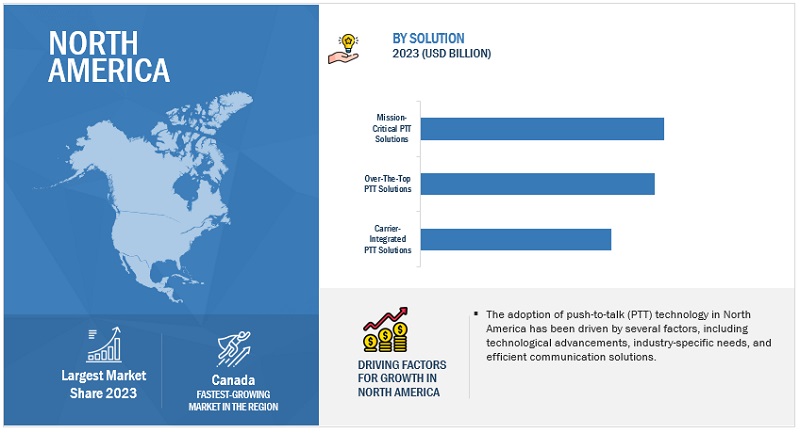

North America is expected to hold the largest market size during the forecast period

North America is expected to dominate the PTT market during the forecast period. Commercially, PTT technology has been integrated into the daily operations of businesses across North America. The ability to improve communication, streamline tasks, and enhance coordination among mobile workforces led to its widespread adoption. Companies in fields such as logistics, construction, and healthcare found value in PTT solutions.

Market Players:

The major players in the PTT market are AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the PTT market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering (Hardware, Solutions, and Services), Network Type, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US). |

This research report categorizes the PTT market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Hardware

-

Solutions

- Carrier Integrated Ptt Solution

- Over The Top Ptt Solution

- Mission-Critical Ptt Solution

-

Services

- Consulting

- Implementation

- Support & Maintenance

Based on Network Type:

- Land Mobile Radio

- Cellular

Based on Vertical:

- Government & Public Safety

- Aerospace & Defense

- Transportation & Logistics

- Manufacturing

- Construction & Mining

- Energy & Utilities

- Travel & Hospitality

- Healthcare

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East

- KSA

- UAE

- Rest of Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In May 2023, Qualcomm’s subsidiary, Qualcomm Technologies, Inc., acquired Autotalks. Through the acquisition, the Autotalks standalone safety solutions was expected to be incorporated into Qualcomm Technologies’ expanding Snapdragon Digital Chassis product.

- In July 2022, Ericsson acquired Vonage, This acquisition was expected to support Ericsson’s strategy to leverage technology leadership to grow its mobile network business and expand into enterprise.

- In May 2022, Motorola Solutions, in partnership with Arya Communications & Electronics Services and Arya Omnitalk Wireless Solutions, launched WAVE PTX in India.

Frequently Asked Questions (FAQ):

What is the definition of the PTT market?

The PTT market includes PTT hardware, solutions/applications and associated services that help in establishing a two-way radio communications service, which operates with a push of a button on devices such as smartphones, rugged PTT devices, and accessories (headsets, microphones, etc.). The PTT technology addresses the need within enterprises and emergency first responders to communicate time-critical information quickly and efficiently.

What is the market size of the PTT market?

The PTT market is estimated at USD 35.3 billion in 2023 to USD 57.4 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 10.2%. from 2023 to 2028.

What are the major drivers in the PTT market?

The major drivers in the PTT market are the growing demand for PoC, proliferation of rugged and ultra-rugged smartphones, growing need for driver safety, and transition of LMR systems from analog to digital.

Who are the key players operating in the PTT market?

The key market players profiled in the PTT market are AT&T Inc. (US); Verizon Wireless (US); Motorola Solutions, Inc. (US); T-Mobile (US); Qualcomm Incorporated (US); Zebra Technologies Corporation (US); Telstra Group Limited (Australia); Hytera Communications Corporation Limited (China); Telefonaktiebolaget LM Ericsson (Sweden); Bell Canada (Canada); Iridium Communications Inc. (US); Tait Communications (New Zealand); Airbus SE (Netherlands); L3Harris Technologies, Inc. (US); ServiceMax, a PTC Technology (US); Simoco Wireless Solutions (UK); GroupTalk (Sweden); Orion Labs, Inc. (US); Zello Inc. (US); Procore Technologies, Inc. (US); VoxerNet LLC (US); International Push to Talk Ltd (England); Enterprise Secure Chat (US); AINA Wireless (US); Azetti Networks (Spain); PeakPTT (US); RugGear (China); ProMobi Technologies (India); and TeamConnect (US).

What are the key technology trends prevailing in PTT market?

The key technology trends in PTT include 5G networks, mesh networking, IoT, and ML.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for PoC- Proliferation of rugged and ultra-rugged smartphones- Growing need for driver safety- Transition of LMR systems from analog to digitalRESTRAINTS- Dependence on stable network connectionOPPORTUNITIES- High-speed 5G network to enhance push-to-talk-related operations- Standardization of infrastructure platformsCHALLENGES- LMR and PTT interoperability issues- High existing investments by public sector to deploy LMR systems

-

5.3 INDUSTRY TRENDSBRIEF HISTORY OF PUSH-TO-TALK TECHNOLOGY- 1990s- 2000s- 2010s- 2020sECOSYSTEM ANALYSIS- Solution providers- Service providers- Hardware providersCASE STUDY ANALYSIS- Case study 1: Windsor Regional Hospital used Bell Push-to-Talk solution to help its nonclinical teams provide outstanding patient care- Case study 2: Hydro-Quebec worked with Network Innovations and Tel-Loc to leverage Iridium Push-To-Talk (PTT) solutions for keeping field workers, medical and safety personnel, and operations centers connected throughout development of new utility line- Case study 3: Orion Labs increased Summit Hospitality Group's operational efficiency across properties with its PTT Voice Services- Case study 4: Zello’s ZelloWork helped YRC Worldwide improve communications for dispatchers- Case study 5: Connexus Energy selected Motorola's WAVE to improve workforce communicationsVALUE CHAIN ANALYSISTARIFF AND REGULATORY LANDSCAPE- Tariff related to Push-to-Talk devices- Regulatory bodies, government agencies, and other organizations- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryPATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsHS CODE: TELEPHONE SETS (8517)- Export scenario for HS Code: 8517- Import scenario for HS Code: 8517TRENDS AND DISRUPTIONS IMPACTING BUYERS’/CLIENTS’ BUSINESSESKEY CONFERENCES & EVENTS, 2023–2024PRICING ANALYSIS- Average selling price trend of key players, by solution and service- Indicative pricing analysis, by hardwareKEY STAKEHOLDERS & BUYING CRITERIA- Key stakeholders in buying criteria- Buying criteriaBEST PRACTICES IN PUSH-TO-TALK MARKET- Choose appropriate equipment- Set up group and private channels- Practice emergency protocolsCURRENT AND EMERGING BUSINESS MODELS- Subscription-services model- Integration-with-other-application model- Paid add-ons modelPUSH-TO-TALK FRAMEWORKS AND TECHNIQUES- Push-to-talk techniques- Push-to-talk frameworkTECHNOLOGY ANALYSIS- Key technologies- Complementary technologies- Adjacent technologiesFUTURE LANDSCAPE OF PUSH-TO-TALK MARKET- Push-to-talk technology roadmap to 2030KEY FEATURES OF PUSH-TO-TALK DEVICES- Multimedia sharing- Real-time location tracking- Communication- Integration- Alerting & broadcasting- LMR interoperability- End-to-end encryption- Web dispatch

-

6.1 INTRODUCTIONOFFERING: PUSH-TO-TALK MARKET DRIVERS

-

6.2 HARDWAREGROWING NUMBER OF END-USE DEVICES TO DRIVE ADOPTION OF PTT HARDWARE

-

6.3 SOLUTIONSPUSH-TO-TALK SOLUTIONS TO ENABLE RELIABLE COMMUNICATION FOR MISSION-CRITICAL PURPOSESCARRIER-INTEGRATED PTT SOLUTIONOVER-THE-TOP PTT SOLUTIONMISSION-CRITICAL PTT SOLUTION

-

6.4 SERVICESCONSULTING- Need for technical expertise in setting up robust PTT system to drive demand for consulting servicesIMPLEMENTATION- Implementation services to help critical communications organizations operate at their highest capacitySUPPORT & MAINTENANCE- Need for 24/7 real-time support to fuel demand for support and maintenance services

-

7.1 INTRODUCTIONNETWORK TYPE: PUSH-TO-TALK MARKET DRIVERS

-

7.2 LAND MOBILE RADIOGROWING ADOPTION IN PUBLIC SAFETY VERTICAL TO DRIVE MARKET FOR LAND MOBILE RADIO SYSTEMS

-

7.3 CELLULARHIGH SPEED AND LOW LATENCY COMMUNICATIONS TO DRIVE MARKET

-

8.1 INTRODUCTIONVERTICAL: PUSH-TO-TALK MARKET DRIVERS

-

8.2 GOVERNMENT & PUBLIC SAFETYNEED FOR RELIABLE, STABLE, AND FLEXIBLE GROUP COMMUNICATION SYSTEM WITH PTT FUNCTIONALITY TO BOOST MARKETGOVERNMENT & PUBLIC SAFETY: PUSH-TO-TALK USE CASES- Emergency command centers- Search and rescue operations- Fire departments

-

8.3 AEROSPACE & DEFENSEREAL-TIME COORDINATION DURING MILITARY OPERATIONS AND REMOTE CONTROL OF UNMANNED VEHICLES TO DRIVE MARKETAEROSPACE & DEFENSE: PUSH-TO-TALK USE CASES- Air traffic control- Tactical communication

-

8.4 TRANSPORTATION & LOGISTICSRELIABLE DELIVERY OF SHIPMENTS AND REAL-TIME TRACKING OF FLEETS TO BOOST MARKETTRANSPORTATION & LOGISTICS: PUSH-TO-TALK USE CASES- Fleet management and dispatch- Warehouse operations

-

8.5 MANUFACTURINGPUSH-TO-TALK SOLUTIONS TO HELP MANUFACTURERS IMPROVE WORKER SAFETY AND PRODUCTIVITYMANUFACTURING: PUSH-TO-TALK USE CASES- Maximize worker safety- Streamline communications

-

8.6 CONSTRUCTION & MININGPUSH-TO-TALK SOLUTIONS TO OFFER EFFECTIVE COMMUNICATION OPTIONS AT CONSTRUCTION SITESCONSTRUCTION & MINING: PUSH-TO-TALK USE CASES- Site coordination- Remote monitoring

-

8.7 ENERGY & UTILITIESPUSH-TO-TALK DEVICES TO ENABLE REAL-TIME COMMUNICATION AND ENSURE SAFETY OF LARGE WORKFORCES IN ENERGY & UTILITIES VERTICALENERGY & UTILITIES: PUSH-TO-TALK USE CASES- Smart grid management- Disaster response and recovery

-

8.8 TRAVEL & HOSPITALITYINTEGRATED VOICE AND BUSINESS APPLICATIONS TO IMPROVE OVERALL GUEST AND TRAVELER EXPERIENCETRAVEL & HOSPITALITY: PUSH-TO-TALK USE CASES- Event management- Maintenance and housekeeping

-

8.9 HEALTHCAREFASTER RESPONSE TIMES AND IMPROVED COLLABORATION TO PROPEL MARKET GROWTHHEALTHCARE: PUSH-TO-TALK USE CASES- Speedy response time- Security and safety

-

8.10 OTHER VERTICALSOTHER VERTICALS: PUSH-TO-TALK USE CASES- Network maintenance- Administrative communication- Store management

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTNORTH AMERICA: PUSH-TO-TALK MARKET DRIVERSUS- Highly developed telecom infrastructure and presence of several PTT vendors to drive marketCANADA- Adoption of critical communication solutions to fuel market growth

-

9.3 EUROPEEUROPE: RECESSION IMPACTEUROPE: PUSH-TO-TALK MARKET DRIVERSGERMANY- Increase in developments in PoC services to boost marketUNITED KINGDOM- Increasing demand for digital transformation to drive marketFRANCE- Advanced economy and flourishing IoT, AI, and ML technologies to drive marketITALY- Increasing adoption of cloud-based PTT devices to fuel market growthSPAIN- Increasing popularity of smartphones and other mobile devices to drive marketNORDICS- High level of mobile adoption and growing demand for real-time communication to increase adoption of push-to-talk technologyREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: PUSH-TO-TALK MARKET DRIVERSCHINA- Continuous demand for integrated voice and data on mobile devices to drive marketINDIA- Rise in adoption of PTT solutions in defense services to drive marketJAPAN- Surge in demand for cost-effective communication solutions to fuel market growthAUSTRALIA & NEW ZEALAND- Need for more secure and reliable communication solutions to boost marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET DRIVERSMIDDLE EAST- KSA- UAE- Rest of Middle EastAFRICA- Transition from analog to digital systems to accelerate market growth

-

9.6 LATIN AMERICALATIN AMERICA: RECESSION IMPACTLATIN AMERICA: PUSH-TO-TALK MARKET DRIVERSBRAZIL- Spike in demand for remote solutions in organizations to boost marketMEXICO- Telecom reforms and government initiatives to boost adoption of PTT technologyREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

10.8 PTT PRODUCT BENCHMARKINGPROMINENT PTT SOLUTION PROVIDERS- AT&T Enhanced Push-to-Talk platform- Verizon Push to Talk Plus- T-Mobile Push-to-Talk (PTT)- QChat Push-to-Chat solution- Airbus AgnetPROMINENT PTT SERVICE PROVIDERS- WAVE PTX- Bell Canada Push-to-Talk Service- Ericsson Mission-Critical Services

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY PTT VENDORS

-

11.1 MAJOR PLAYERSAT&T- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERIZON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMOTOROLA SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewT-MOBILE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQUALCOMM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewERICSSON- Business overview- Products /Solutions/Services offered- Recent developmentsAIRBUS- Business overview- Products/Solutions/Services offered- Recent developmentsBELL CANADA- Business overview- Products/Solutions/Services offered- Recent developmentsZEBRA TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsTELSTRA- Business overview- Products/Solutions/Services offered- Recent developmentsHYTERA- Business overview- Products/Solutions/Services offered- Recent developmentsIRIDIUM COMMUNICATIONSTAIT COMMUNICATIONSSERVICEMAXL3HARRIS TECHNOLOGIES

-

11.2 STARTUPS/SMESGROUPTALKORIONZELLOVOXERIPTTESCHATAINA WIRELESSAZETTI NETWORKSTEAMCONNECTVOICELAYERSIMOCO WIRELESS SOLUTIONSPEAKPTTRUGGEARPROMOBI TECHNOLOGIES

- 12.1 INTRODUCTION

-

12.2 ENTERPRISE MOBILITY MANAGEMENT MARKETMARKET DEFINITIONMARKET OVERVIEWENTERPRISE MOBILITY MANAGEMENT MARKET, BY COMPONENTENTERPRISE MOBILITY MANAGEMENT MARKET, BY ORGANIZATION SIZEENTERPRISE MOBILITY MANAGEMENT MARKET, BY DEPLOYMENT MODEENTERPRISE MOBILITY MANAGEMENT MARKET, BY VERTICAL

-

12.3 MOBILE DEVICE MANAGEMENT MARKETMARKET DEFINITIONMARKET OVERVIEWMOBILE DEVICE MANAGEMENT MARKET, BY COMPONENTMOBILE DEVICE MANAGEMENT MARKET, BY OPERATING SYSTEMMOBILE DEVICE MANAGEMENT MARKET, BY VERTICAL

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 RISK ASSESSMENT: PUSH-TO-TALK MARKET

- TABLE 5 PUSH-TO-TALK MARKET: ECOSYSTEM

- TABLE 6 TARIFF RELATED TO TELEPHONE SETS WITH CORDLESS HANDSETS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PUSH-TO-TALK MARKET: PORTER’S FIVE FORCES MODEL ANALYSIS

- TABLE 12 PATENTS FILED, JANUARY 2021–AUGUST 2023

- TABLE 13 LIST OF PATENTS IN PUSH-TO-TALK MARKET, 2021–2023

- TABLE 14 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 15 AVERAGE SELLING PRICES OF KEY PLAYERS, BY SOLUTION AND SERVICE

- TABLE 16 INDICATIVE PRICING ANALYSIS, BY HARDWARE

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 20 PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 21 HARDWARE: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 HARDWARE: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 24 PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 25 SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 CARRIER-INTEGRATED PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 CARRIER-INTEGRATED PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 OVER-THE-TOP PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 OVER-THE-TOP PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MISSION-CRITICAL PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 32 MISSION-CRITICAL PTT SOLUTION: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 34 PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 35 SERVICES: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 SERVICES: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 CONSULTING: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 CONSULTING: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 IMPLEMENTATION: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 IMPLEMENTATION: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 SUPPORT & MAINTENANCE: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 SUPPORT & MAINTENANCE: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 44 PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 45 LAND MOBILE RADIO: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 LAND MOBILE RADIO: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 CELLULAR: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 CELLULAR: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 50 PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 51 GOVERNMENT & PUBLIC SAFETY: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 GOVERNMENT & PUBLIC SAFETY: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 AEROSPACE & DEFENSE: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 AEROSPACE & DEFENSE: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 TRANSPORTATION & LOGISTICS: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 TRANSPORTATION & LOGISTICS: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 MANUFACTURING: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 MANUFACTURING: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 CONSTRUCTION & MINING: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 CONSTRUCTION & MINING: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 ENERGY & UTILITIES: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 ENERGY & UTILITIES: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 TRAVEL & HOSPITALITY: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 64 TRAVEL & HOSPITALITY: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 HEALTHCARE: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 HEALTHCARE: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 OTHER VERTICALS: PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 OTHER VERTICALS: PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 PUSH-TO-TALK MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 PUSH-TO-TALK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 US: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 84 US: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 85 US: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 86 US: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 87 US: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 88 US: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 89 US: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 90 US: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 91 US: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 92 US: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 93 CANADA: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 94 CANADA: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 95 CANADA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 96 CANADA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 97 CANADA: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 98 CANADA: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 99 CANADA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 100 CANADA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 101 CANADA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 102 CANADA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 104 EUROPE: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 106 EUROPE: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 107 EUROPE: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 108 EUROPE: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 110 EUROPE: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 112 EUROPE: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: PUSH-TO-TALK MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 114 EUROPE: PUSH-TO-TALK MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 GERMANY: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 116 GERMANY: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 GERMANY: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 118 GERMANY: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 119 GERMANY: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 120 GERMANY: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 121 GERMANY: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 122 GERMANY: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 123 GERMANY: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 124 GERMANY: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 130 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: PUSH-TO-TALK MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 137 CHINA: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 138 CHINA: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 139 CHINA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 140 CHINA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 141 CHINA: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 142 CHINA: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 143 CHINA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 144 CHINA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 145 CHINA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 146 CHINA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 160 MIDDLE EAST: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 164 MIDDLE EAST: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 168 MIDDLE EAST: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST: PUSH-TO-TALK MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 170 MIDDLE EAST: PUSH-TO-TALK MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 171 KSA: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 172 KSA: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 173 KSA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 174 KSA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 175 KSA: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 176 KSA: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 177 KSA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 178 KSA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 179 KSA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 180 KSA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: PUSH-TO-TALK MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 193 BRAZIL: PUSH-TO-TALK MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 194 BRAZIL: PUSH-TO-TALK MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 195 BRAZIL: PUSH-TO-TALK MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 196 BRAZIL: PUSH-TO-TALK MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 197 BRAZIL: PUSH-TO-TALK MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 198 BRAZIL: PUSH-TO-TALK MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 199 BRAZIL: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2017–2022 (USD MILLION)

- TABLE 200 BRAZIL: PUSH-TO-TALK MARKET, BY NETWORK TYPE, 2023–2028 (USD MILLION)

- TABLE 201 BRAZIL: PUSH-TO-TALK MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 202 BRAZIL: PUSH-TO-TALK MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 203 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 204 PUSH-TO-TALK MARKET: DEGREE OF COMPETITION

- TABLE 205 OFFERING FOOTPRINT

- TABLE 206 VERTICAL FOOTPRINT

- TABLE 207 REGIONAL FOOTPRINT

- TABLE 208 COMPANY FOOTPRINT

- TABLE 209 PRODUCT LAUNCHES, 2020–2023

- TABLE 210 DEALS, 2020–2023

- TABLE 211 PTT MARKET: DETAILED LIST OF STARTUPS/SMES

- TABLE 212 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 213 PTT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 214 COMPARATIVE ANALYSIS OF PROMINENT PTT SOLUTION PROVIDERS

- TABLE 215 COMPARATIVE ANALYSIS OF PROMINENT PTT SERVICE PROVIDERS

- TABLE 216 AT&T: COMPANY OVERVIEW

- TABLE 217 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 219 AT&T: DEALS

- TABLE 220 VERIZON: COMPANY OVERVIEW

- TABLE 221 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 VERIZON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 223 MOTOROLA SOLUTIONS: COMPANY OVERVIEW

- TABLE 224 MOTOROLA SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 MOTOROLA SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 226 MOTOROLA SOLUTIONS: DEALS

- TABLE 227 T-MOBILE: COMPANY OVERVIEW

- TABLE 228 T-MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 T-MOBILE: DEALS

- TABLE 230 QUALCOMM: COMPANY OVERVIEW

- TABLE 231 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 QUALCOMM: DEALS

- TABLE 233 ERICSSON: COMPANY OVERVIEW

- TABLE 234 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 ERICSSON: DEALS

- TABLE 236 AIRBUS: COMPANY OVERVIEW

- TABLE 237 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 AIRBUS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 239 AIRBUS: DEALS

- TABLE 240 BELL CANADA: BUSINESS OVERVIEW

- TABLE 241 BELL CANADA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 BELL CANADA: DEALS

- TABLE 243 ZEBRA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 244 ZEBRA TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 ZEBRA TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 ZEBRA TECHNOLOGIES: DEALS

- TABLE 247 TELSTRA: COMPANY OVERVIEW

- TABLE 248 TELSTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 TELSTRA: DEALS

- TABLE 250 HYTERA: COMPANY OVERVIEW

- TABLE 251 HYTERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 HYTERA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 HYTERA: DEALS

- TABLE 254 EMM MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

- TABLE 255 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

- TABLE 256 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

- TABLE 257 ENTERPRISE MOBILITY MANAGEMENT MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

- TABLE 258 MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 259 MOBILE DEVICE MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 260 MOBILE DEVICE MANAGEMENT MARKET, BY OPERATING SYSTEM, 2016–2021 (USD MILLION)

- TABLE 261 MOBILE DEVICE MANAGEMENT MARKET, BY OPERATING SYSTEM, 2022–2027 (USD MILLION)

- TABLE 262 MOBILE DEVICE MANAGEMENT MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 263 MOBILE DEVICE MANAGEMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- FIGURE 1 PUSH-TO-TALK MARKET: MARKET SEGMENTATION

- FIGURE 2 PUSH-TO-TALK MARKET: RESEARCH DESIGN

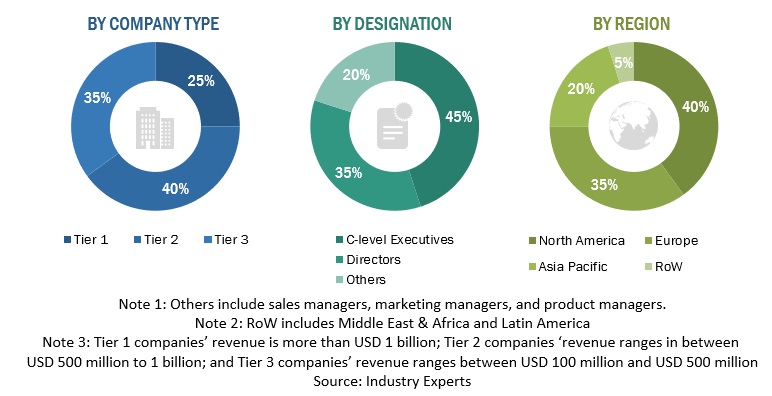

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF OFFERINGS IN PUSH-TO-TALK MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): PUSH-TO-TALK MARKET

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 10 PUSH-TO-TALK MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 11 PUSH-TO-TALK MARKET: REGIONAL SNAPSHOT

- FIGURE 12 PROLIFERATION OF PUSH-TO-TALK TECHNOLOGY OVER CELLULAR NETWORKS TO DRIVE GLOBAL MARKET

- FIGURE 13 HARDWARE SEGMENT TO HOLD LARGEST MARKET SHARE IN PUSH-TO-TALK MARKET IN 2023

- FIGURE 14 CELLULAR SEGMENT TO WITNESS HIGHER GROWTH RATE IN FORECAST PERIOD

- FIGURE 15 MISSION-CRITICAL PUSH-TO-TALK SOLUTION SEGMENT TO LEAD MARKET IN 2023

- FIGURE 16 GOVERNMENT & PUBLIC SAFETY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 MISSION-CRITICAL PUSH-TO-TALK SOLUTIONS AND GOVERNMENT & PUBLIC SAFETY TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PUSH-TO-TALK MARKET

- FIGURE 19 BRIEF HISTORY OF PUSH-TO-TALK TECHNOLOGY

- FIGURE 20 PUSH-TO-TALK MARKET: ECOSYSTEM

- FIGURE 21 VALUE CHAIN ANALYSIS: PUSH-TO-TALK MARKET

- FIGURE 22 PUSH-TO-TALK MARKET: PORTER’S FIVE FORCES MODEL

- FIGURE 23 NUMBER OF PATENTS GRANTED ANNUALLY, 2021–2023

- FIGURE 24 TOP 10 PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2021–2023

- FIGURE 25 PUSH-TO-TALK TELEPHONE SETS EXPORT, BY KEY COUNTRY, 2015–2022 (USD BILLION)

- FIGURE 26 PUSH-TO-TALK TELEPHONE SETS IMPORT, BY KEY COUNTRY, 2015–2022 (USD BILLION)

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 29 ONE-TO-MANY PUSH-TO-TALK OVER CELLULAR GROUP SESSION (VOICE TRANSMISSION) PTT FRAMEWORK

- FIGURE 30 SOLUTIONS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 OVER-THE-TOP PTT SOLUTIONS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 SUPPORT & MAINTENANCE SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 TRAVEL & HOSPITALITY SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 38 GLOBAL PTT MARKET COMPANY EVALUATION MATRIX, 2023

- FIGURE 39 GLOBAL PTT MARKET STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 40 VALUATION AND FINANCIAL METRICS OF KEY PTT VENDORS

- FIGURE 41 AT&T: COMPANY SNAPSHOT

- FIGURE 42 VERIZON: COMPANY SNAPSHOT

- FIGURE 43 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 44 T-MOBILE: COMPANY SNAPSHOT

- FIGURE 45 QUALCOMM: COMPANY SNAPSHOT

- FIGURE 46 ERICSSON: COMPANY SNAPSHOT

- FIGURE 47 AIRBUS: COMPANY SNAPSHOT

- FIGURE 48 BELL CANADA: COMPANY SNAPSHOT

- FIGURE 49 ZEBRA TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 50 TELSTRA: COMPANY SNAPSHOT

This research study involved extensive secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the PTT market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for the companies offering push-to-talk hardware, solutions, and services for various industry verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Push-to-talk market. The primary sources from the demand side included Push-to-talk end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations. After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the PTT market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of PTT offerings, such as solutions, and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the PTT market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Push-to-Talk Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Push-to-Talk Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the PTT market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The PTT market includes PTT hardware, solutions/applications and associated services that help in establishing a two-way radio communications service, which operates with a push of a button on devices such as smartphones, rugged PTT devices, and accessories (headsets, microphones, etc.). The PTT technology addresses the need within enterprises and emergency first responders to communicate time-critical information quickly and efficiently.

Key Stakeholders

- Information Technology (IT) directors, managers, and support staff

- Network and system administrators

- Operations improvement managers

- Dispatch managers

- Communications and distribution managers

- Enterprise mobility managers

- Mobile device managers

- PTT specialists

- Account managers and sales managers

- Value-Added Resellers (VARs)

Report Objectives

- To determine and forecast the global PTT market by offering (hardware, solutions, and services), network type, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the PTT market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall PTT market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the PTT market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Push-to-talk Market