Critical Communication Market by Offering (Hardware, Services), Technology (Land Mobile Radio, Long-Term Evolution), End-Use Vertical (Public Safety, Transportation, Utilities, Mining), and Region (North America, Europe, APAC, RoW)-Global Forecast to 2024

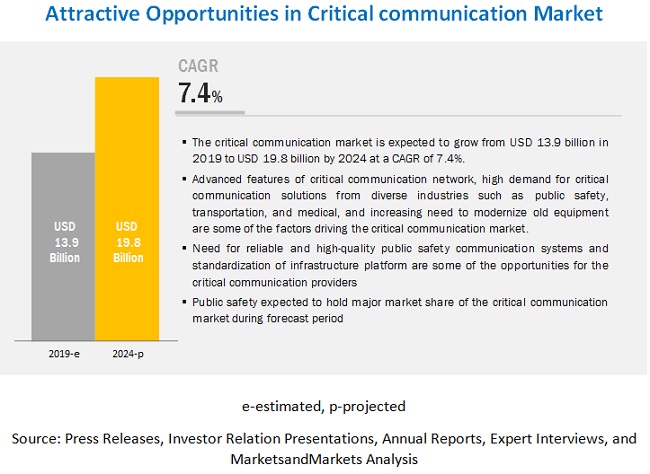

Critical communication market report share is expected to grow from USD 13.9 billion in 2019 to USD 19.8 billion by 2024, at a CAGR of 7.4%.

Advanced features of critical communication network, increase the need to modernize old equipment, and high demand for critical communication solutions from diverse industries such as public safety, transportation & medical are the major driving factors for the market’s growth during the forecast period.

Owing to factors such as the critical communication infrastructure includes group calling, rapid voice call setup, and high-quality audio and video. Complex systems incorporating trunking and digital capabilities enable multiple features, such as video conferencing and real-time HD videos. Also, modern critical communication networks have state-of-the-art features such as multi-network operation with spectrum sharing techniques, network security capabilities, temporary deployable systems, and quality of services.

Hardware to dominate critical communication market during the forecast period

A few of the vital components forming a critical communications system are command and control systems, infrastructure equipment, and end-user devices. Hardware is expected to hold a larger share of the critical communication market, because of the rising demand from the ongoing as well as new deployment of critical communication networks in various end-use verticals such as public safety, transportation, utilities, mining, others. Moreover, major developments in oil and gas plants to improve their operations through intrinsically safe and highly reliable networks and concerns toward public safety and security are the key factors fueling the growth of the market.

LTE technology to account for the highest demand in the critical communication market during the forecast period

LTE is the next global standard for critical communications, according to several industry representatives, consultants, and end-users. Factors such as the adoption of LTE by FirstNet by public safety organizations in the US, the inclination of the UK Home Office toward LTE, and plans of South Korea to build a nationwide LTE network for public safety are driving the development of LTE for critical communications. The requirements of public safety communications are rapidly changing, involving the adoption of broadband-based multimedia applications, remote surveillance, and robotic technologies such as unmanned aerial vehicles (UAVs). As a result, public safety agencies are replacing their narrowband public safety networks with LTE-based networks.

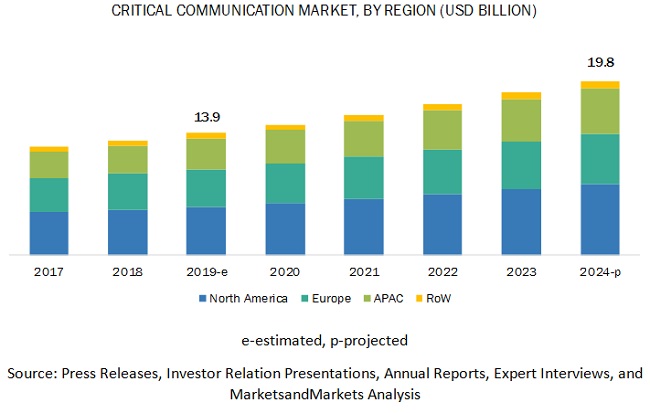

North America to hold a major share of the critical communication market during the forecast period

North America is currently leading the global critical communication industry, followed by Europe and Asia Pacific, mainly due to ongoing technological advancements and rising adoption of digital LMR products by government and commercial sectors. The US government made the interoperability standard available to ensure efficient use of LMR technology products and fast and uninterrupted communication in case of catastrophic situations, such as the September 11 attack or Hurricane Katrina. North America is considered to be the most advanced region with regard to the adoption of critical communication technology and infrastructure. The protection of critical infrastructure is considered to be the most severe economic and national security challenge by the government of these countries.

Critical Communication Market Key Players

Key players in the market include Motorola Solutions (US), Ericsson (Sweden), Nokia (Finland), Huawei (China), AT&T (US), Hariss (US), ZTE (China), Cobham Wireless (UK), Inmarsat (UK), Hytera (China), JVCKENWOOD Corporation (Japan), Mentura Group (Finland), Tait Communications (New Zealand), Telestra (Australia), Ascom (Switzerland), Zenitel (Belgium), Leonardo (Italy), Secure Land Communications (France), and Simoco Wireless Solutions (UK).

Motorola Solutions (US), one of the global leaders, has a broad product portfolio in the critical communication market. The company has the infrastructure and its technology platforms in critical communications, video security solutions, command center software, and support services help to make cities safer and businesses to grow. The company’s critical communication solutions, such as land mobile radio (LMR), keep people connected and help them to stay safe. Motorola Solutions operates through the following segments: Products and Systems Integration, and Services and Software. The company has a global footprint in more than 100 countries and has over 12,500 systems deployed across the world. Motorola has formed alliances with players such as Ericsson, Telstra, and Qualcomm to innovate its first LTE Broadcast-enabled PTT calls. It addresses the communication requirements of government agencies, state and local public safety and first-responder agencies, and commercial and industrial customers that use private communications networks and manage mobile workforces.

Critical Communication Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2019 |

USD 13.9 Billion |

| Revenue Forecast in 2024 | USD 19.8 Billion |

| Growth Rate | 7.4% |

| Base Year Considered | 2018 |

| Historical Data Available for Years | 2016–2024 |

|

Forecast Period |

2019–2024 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | North America |

| Largest Market Share Segment | Land Mobile Radio (LMR) Segment |

| Highest CAGR Segment | Transportation vertical Segment |

| Largest Application Market Share | Multimedia Application |

Critical communication Market Segmentation:

In this report, the critical communication market has been segmented into the following categories:

Critical Communication Market, by Offering:

- Hardware

- Command and Control Systems

- Infrastructure Equipment

- End-use Devices

- Services

- Consulting Services

- Integration Services

- Maintenance and Support Services

Critical Communication Market, by Technology:

- Land Mobile Radio (LMR)

- Long-Term Evolution (LTE)

Critical Communication Market, by End-use Vertical:

- Public Safety

- Transportation

- Utilities

- Mining

- Others

Critical communication Market, by Geography:

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

- Rest of APAC

- Rest of the World (RoW)

- Middle East & Africa

- South America

Key Developments

- In April 2019, Nokia, together with Nordic Telecom, launched the mission-critical communication-ready LTE network in the 410–430 MHz band. With this launch of Nokia’s advanced and future-proof mobile broadband solution, Nordic Telecom is likely to stimulate public protection and disaster relief efforts with innovation services possible by mobile broadband networks.

- In March 2019, Motorola Solutions launched a new digital convenience radio called MiT5000 for Japan. The product provides outstanding sound and functionality for a wide range of professional needs of industries such as hospitality, manufacturing, construction, logistics, and security. MiT5000 features high quality, easy-to-hear audio, and a volume adjuster to automatically filter out background noise.

- In March 2019, Ohio City selected mission-critical technologies from Motorola Solutions to take incoming emergency calls, share and manage critical incident information, and communicate across agencies to coordinate a response and share information seamlessly.

- In March 2018, Harris received a 5-year, single-award Indefinite Delivery Indefinite Quantity (IDIQ) contract from the U.S. Navy in the fiscal year 2018 for HF and multiband handheld and manpack radio systems and accessories.

- In March 2018, Motorola acquired Plant Holdings (Plant), from its parent company Airbus DS Communications, for USD 237 million. This acquisition is likely to boost Motorola’s command center software portfolio and its software enterprise.

Key questions addressed by the report:

- What are the opportunities for critical communication system providers?

- How much growth is expected from hardware and services in the market

- Who are the major current and potential competitors in the market, and what are their top priorities, strategies, and developments?

- What are the major end-use verticals of the critical communication market?

- What are the major technologies used for critical communication and its impact on the critical communication market and growth trends in the respective technology?

Frequently Asked Questions (FAQ):

Which products are expected to drive the growth of the market in the next 5 years?

High demand for critical communication solutions from diverse industries such as public safety, transportation, and medical, advanced features of critical communication networks, and increased need to modernize old equipment is expected to drive the growth of the critical communication market. Owing to factors such as the critical communication infrastructure includes group calling, rapid voice call setup, and high-quality audio and video. Complex systems incorporating trunking and digital capabilities enable multiple features, such as video conferencing and real-time HD videos. Also, modern critical communication networks have state-of-the-art features such as multi-network operation with spectrum sharing techniques, network security capabilities, temporary deployable systems, and quality of services.

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

Motorola Solutions, Nokia, Harris, AT&T, Hytera, Ericsson, ZTE, Huawei, Cobham Wireless, and Ascom dominated the critical communication market. Leading companies in the critical communication market adopted strategies of product launches and developments to strengthen their market presence and enter new application areas.

Which region is expected to witness significant demand for critical communication in the coming years?

North America to hold a major share of the critical communication market during the forecast period. North America is currently leading the global critical communication industry, followed by Europe and Asia Pacific, mainly due to ongoing technological advancements and rising adoption of digital LMR products by government and commercial sectors. The US government made the interoperability standard available to ensure efficient use of LMR technology products and fast and uninterrupted communication in case of catastrophic situations, such as the September 11 attack or Hurricane Katrina. North America is considered to be the most advanced region with regard to the adoption of critical communication technology and infrastructure. The protection of critical infrastructure is considered to be the most severe economic and national security challenge by the government of these countries.

Which technology expected to lead growth of market market?

LTE technology to account for the highest demand in the critical communication market during the forecast Factors such as the adoption of LTE by FirstNet by public safety organizations in the US, the inclination of the UK Home Office toward LTE, and plans of South Korea to build a nationwide LTE network for public safety are driving the development of LTE for critical communications. The requirements of public safety communications are rapidly changing, involving the adoption of broadband-based multimedia applications, remote surveillance, and robotic technologies such as unmanned aerial vehicles (UAVs). As a result, public safety agencies are replacing their narrowband public safety networks with LTE-based networks.

Which are the major opportunities in the critical communication market?

Need for reliable and high-quality public safety communication systems and standardization of infrastructure platforms are some of the opportunities in the critical communication market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach to Capture Market Size By Bottom-Up Analysis

2.2.2 Top-Down Approach

2.2.2.1 Approach to Capture Market Size By Top-Down Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Overall Critical Communication Market

4.2 Market, By Technology

4.3 Market, By Vertical

4.4 Market in APAC, By Vertical and Country

4.5 Market, By Geography

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for Critical Communication Solutions From Diverse Industries Such as Public Safety, Transportation, and Medical

5.2.1.2 Advanced Features of Critical Communication Networks

5.2.1.3 Increased Need to Modernize Old Equipment

5.2.2 Restraints

5.2.2.1 Limited Availability of Bandwidth

5.2.2.2 Increased Complexity of Networks and Systems Due to Multiple Communication Standards

5.2.3 Opportunities

5.2.3.1 Need for Reliable and High-Quality Public Safety Communication Systems

5.2.3.2 Standardization of Infrastructure Platforms

5.2.4 Challenges

5.2.4.1 Budget Constraints Toward Procurement

5.2.4.2 Interoperability Issues

6 Critical Communication Market, By Offering (Page No. - 40)

6.1 Introduction

6.2 Hardware

6.2.1 Command and Control Systems

6.2.1.1 APAC to Be Fastest-Growing Region in Critical Communication Market for Command and Control Systems During Forecast Period

6.2.2 Infrastructure Equipment

6.2.2.1 North America to Hold Substantial Share of Critical Communication Market for Infrastructure Equipment During Forecast Period

6.2.3 End-Use Devices

6.2.3.1 Critical Communication Market for End-Use Devices to Grow at Highest Growth Rate During Forecast Period

6.3 Services

6.3.1 Consulting Services

6.3.1.1 Consulting Services to Witness Significant Growth in Critical Communication Market During Forecast Period

6.3.2 Integration Services

6.3.2.1 Technological Advancements to Boost Demand for Integration Services During Forecast Period

6.3.3 Maintenance and Support Services

6.3.3.1 Maintenance and Support Services to Dominate the Critical Communication Market During Forecast Period

7 Critical Communication Market, By Technology (Page No. - 50)

7.1 Introduction

7.2 Land Mobile Radio (LMR)

7.2.1 LMR Technology-Based Critical Communication Solutions to Account for Larger Market Share During 2019–2024

7.2.2 Tetra/P25

7.2.2.1 Tera/P25 LMR Technology to Record Highest CAGR in Critical Communication Market During Forecast Period

7.2.3 Analog

7.2.3.1 Analog Technology Accounted for Largest Share of Market for LMR in 2018

7.2.4 Others

7.3 Long-Term Evolution (LTE)

7.3.1 LTE Technology to Witness Highest CAGR in Market During Forecast Period

8 Critical Communication Market, By Vertical (Page No. - 56)

8.1 Introduction

8.2 Public Safety

8.2.1 Public Safety Vertical to Witness Highest Demand for Critical Communication Solutions During Forecast Period

8.3 Transportation

8.3.1 Transportation Vertical to Witness Highest CAGR in Market From 2019 to 2024

8.4 Utilities

8.4.1 Need for Robust Communication in Utilities Vertical to Propel Market Growth During Forecast Period

8.5 Mining

8.5.1 APAC to Record Highest CAGR in Market for Mining Vertical During Forecast Period

8.6 Others

9 Geographic Analysis (Page No. - 62)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US to Hold Major Share of Critical Communication Market in North America During Forecast Period

9.2.2 Canada

9.2.2.1 Canadian Critical Communication Market Growth is Accelerated By Huge Investments By Government

9.2.3 Mexico

9.2.3.1 LMR Technology to Capture Major Share of Critical Communication Market in Mexico During Forecast Period

9.3 Europe

9.3.1 UK

9.3.1.1 UK to Lead European Critical Communication Market During Forecast Period

9.3.2 Germany

9.3.2.1 Germany to Record Highest CAGR in Critical Communication Market in Europe During Forecast Period

9.3.3 France

9.3.3.1 LTE Technology to Witness Higher CAGR in French Critical Communication Market During 2019–2024

9.3.4 Spain

9.3.4.1 Technological Advancements and Concerns of Safety and Security to Surge Demand for Critical Communication Solutions in Spain in Coming Years

9.3.5 Rest of Europe

9.3.5.1 Strong Government Support for Development of Advanced Critical Communication Systems Boost Critical Communication Market Growth in Rest of Europe

9.4 Asia Pacific (APAC)

9.4.1 China

9.4.1.1 China to Hold Major Share of Critical Communication Market in APAC During Forecast Period

9.4.2 Japan

9.4.2.1 Critical Communication Market in Japan is Driven By Increasing Preference for Smart Home Technologies

9.4.3 India

9.4.3.1 India to Witness Highest CAGR in Market in APAC During Forecast Period

9.4.4 South Korea

9.4.4.1 LTE Technology to Register Highest CAGR in Market in South Korea During Forecast Period

9.4.5 Rest of APAC

9.4.5.1 LMR Technology to Hold Significant Share of Market in Rest of APAC During Forecast Period

9.5 Rest of the World (RoW)

9.5.1 South America

9.5.1.1 South America to Register Higher CAGR in Market in RoW During Forecast Period

9.5.2 Middle East and Africa

9.5.2.1 Middle East and Africa to Hold Major Share of Market in RoW During Forecast Period

10 Competitive Landscape (Page No. - 90)

10.1 Overview

10.2 Ranking Analysis of Key Players in Critical Communication Market

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Strength of Product Portfolio (25 Companies)

10.5 Business Strategy Excellence (25 Companies)

10.6 Competitive Situations and Trends

10.6.1 Product Launches and Developments

10.6.2 Agreements, Partnerships, Contracts, Collaborations

10.6.3 Acquisitions

10.6.4 Expansions

11 Company Profiles (Page No. - 101)

(Business Overview, Products, Solutions, and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Introduction

11.2 Key Players

11.2.1 MotoRoLA Solutions

11.2.2 Nokia

11.2.3 Harris

11.2.4 AT&T

11.2.5 Hytera

11.2.6 Ericsson

11.2.7 ZTE

11.2.8 Huawei

11.2.9 Cobham Wireless

11.2.10 Ascom

11.3 Other Key Players

11.3.1 Leonardo

11.3.2 Mentura Group

11.3.3 Inmarsat

11.3.4 Zenitel

11.3.5 Telstra

11.3.6 Jvckenwood Corporation

11.3.7 Tait Communications

11.3.8 Secure Land Communications (Airbus)

11.3.9 Simoco Wireless Solutions

*Details on Business Overview, Products, Solutions, and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 141)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Related Reports

12.4 Author Details

List of Tables (62 Tables)

Table 1 List of Frequency Bands

Table 2 Critical Communication Market, By Offering, 2016–2024 (USD Billion)

Table 3 Market for Hardware Offerings, By Type, 2016–2024 (USD Billion)

Table 4 Market for Hardware Offerings, By Region, 2016–2024 (USD Million)

Table 5 Market for Command and Control Systems, By Region, 2016–2024 (USD Million)

Table 6 Market for Infrastructure Equipment, By Region, 2016–2024 (USD Million)

Table 7 Market for End-Use Devices, By Region, 2016–2024 (USD Million)

Table 8 Market for Service Offerings, By Type, 2016–2024 (USD Million)

Table 9 Market for Service Offerings, By Region, 2016–2024 (USD Million)

Table 10 Market for Consulting Services, By Region, 2016–2024 (USD Million)

Table 11 Market for Integration Services, By Region, 2016–2024 (USD Million)

Table 12 Market for Maintenance and Support Services, By Region, 2016–2024 (USD Million)

Table 13 Critical Communication Market, By Technology, 2016–2024 (USD Billion)

Table 14 Market for LMR Technology, By Type, 2016–2024 (USD Million)

Table 15 Market for LMR Technology, By Region, 2016–2024 (USD Million)

Table 16 Market for LTE Technology, By Region, 2016–2024 (USD Million)

Table 17 Market, By Vertical, 2016–2024 (USD Million)

Table 18 Market for Public Safety Vertical, By Region, 2016–2024 (USD Million)

Table 19 Market for Transportation Vertical, By Region, 2016–2024 (USD Million)

Table 20 Market for Utilities Vertical, By Region, 2016–2024 (USD Million)

Table 21 Market for Mining Vertical, By Region, 2016–2024 (USD Million)

Table 22 for Other Verticals, By Region, 2016–2024 (USD Million)

Table 23 Market, By Region, 2016–2024 (USD Million)

Table 24 Market in North America, By Technology, 2016–2024 (USD Million)

Table 25 Market in North America, By Offering, 2016–2024 (USD Million)

Table 26 Market in North America, By Vertical, 2016–2024 (USD Million)

Table 27 Market in North America, By Country, 2016–2024 (USD Million)

Table 28 Market in North America for Hardware Offerings, By Type, 2016–2024 (USD Million)

Table 29 Market in North America for Service Offerings, By Type, 2016–2024 (USD Million)

Table 30 Market in US, By Technology, 2016–2024 (USD Million)

Table 31 Market in Canada, By Technology, 2016–2024 (USD Million)

Table 32 Market in Mexico, By Technology, 2016–2024 (USD Million)

Table 33 Market in Europe, By Technology, 2016–2024 (USD Million)

Table 34 Market in Europe, By Offering, 2016–2024 (USD Million)

Table 35 Market in Europe, By Vertical, 2016–2024 (USD Million)

Table 36 Market in Europe, By Country, 2016–2024 (USD Million)

Table 37 Market in Europe for Hardware Offerings, By Type, 2016–2024 (USD Million)

Table 38 Market in Europe for Service Offerings, By Type, 2016–2024 (USD Million)

Table 39 Market in UK, By Technology, 2016–2024 (USD Million)

Table 40 Market in Germany, By Technology, 2016–2024 (USD Million)

Table 41 Market in France, By Technology, 2016–2024 (USD Million)

Table 42 Market in Spain, By Technology, 2016–2024 (USD Million)

Table 43 Market in Rest of Europe, By Technology, 2016–2024 (USD Million)

Table 44 Market in APAC, By Technology, 2016–2024 (USD Million)

Table 45 Market in APAC, By Offering, 2016–2024 (USD Million)

Table 46 Market in APAC, By Vertical, 2016–2024 (USD Million)

Table 47 Market in APAC, By Country, 2016–2024 (USD Million)

Table 48 Market in APAC for Hardware Offerings, By Type, 2016–2024 (USD Million)

Table 49 Market in APAC for Service Offerings, By Type, 2016–2024 (USD Million)

Table 50 Market in China, By Technology, 2016–2024 (USD Million)

Table 51 Market in Japan, By Technology, 2016–2024 (USD Million)

Table 52 Market in India, By Technology, 2016–2024 (USD Million)

Table 53 Market in South Korea, By Technology, 2016–2024 (USD Million)

Table 54 Market in Rest of APAC, By Technology, 2016–2024 (USD Million)

Table 55 Market in RoW, By Technology, 2016–2024 (USD Million)

Table 56 Market in RoW, By Offering, 2016–2024 (USD Million)

Table 57 Market in RoW, By Vertical, 2016–2024 (USD Million)

Table 58 Market in RoW, By Region, 2016–2024 (USD Million)

Table 59 Market in RoW for Hardware Offerings, By Type, 2016–2024 (USD Million)

Table 60 Market in RoW for Service Offerings, By Type, 2016–2024 (USD Million)

Table 61 Market in South America, By Technology, 2016–2024 (USD Million)

Table 62 Market in Middle East and Africa, By Technology, 2016–2024 (USD Thousand)

List of Figures (43 Figures)

Figure 1 Markets Covered

Figure 2 Critical Communication Market: Process Flow of Market Size Estimation

Figure 3 Critical Communication Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 Public Safety Vertical to Account for Largest Share of Market By 2024

Figure 9 Services Segment to Witness Higher CAGR in Market During Forecast Period

Figure 10 LMR Technology to Hold Larger Size of Market During Forecast Period

Figure 11 APAC to Be Fastest-Growing Region in Market During Forecast Period

Figure 12 High Demand for Critical Communication Solutions From Diverse Verticals Such as Public Safety, Transportation, and Medical is Fueling Market Growth

Figure 13 LMR Technology to Hold Major Market Size During Forecast Period

Figure 14 Transportation Vertical to Record Highest CAGR in Market During Forecast Period

Figure 15 Public Safety and China to Hold Largest Share of Market, By Vertical and Country, Respectively, in APAC By 2024

Figure 16 India to Witness Highest CAGR in Market During 2019–2024

Figure 17 Critical Communication Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Hardware Offerings to Hold A Larger Size of Market During Forecast Period

Figure 19 Infrastructure Equipment to Account for Largest Size of Market for Hardware Offerings By 2024

Figure 20 Maintenance and Support Services to Lead Critical Communication Market During Forecast Period

Figure 21 LMR Network Technology to Capture Significantly Larger Size of Market During Forecast Period

Figure 22 Public Safety Vertical to Account for Largest Size of Market During Forecast Period

Figure 23 North America to Account for Largest Size of Market By 2024

Figure 24 Geographic Snapshot of Critical Communication Market (2019–2024)

Figure 25 Snapshot of Critical Communication Market in North America

Figure 26 US to Dominate Market in North America During Forecast Period

Figure 27 Snapshot of Critical Communication Market in Europe

Figure 28 UK to Command Market in Europe During Forecast Period

Figure 29 Snapshot of Critical Communication Market in APAC

Figure 30 China to Hold Largest Size of Market in APAC During Forecast Period

Figure 31 Middle East and Africa to Hold Largest Size of Market in RoW During Forecast Period

Figure 32 Key Developments By Leading Players in Market From 2016 to 2018

Figure 33 Ranking of Key Players in Critical Communication Market (2018)

Figure 34 Critical Communication Market (Global) Competitive Leadership Mapping, 2018

Figure 35 Agreements, Contracts, Collaborations, and Partnerships Were Key Strategies Adopted By Major Players From 2016 to 2018

Figure 36 MotoRoLA Solutions: Company Snapshot

Figure 37 Nokia: Company Snapshot

Figure 38 Harris: Company Snapshot

Figure 39 AT&T: Company Snapshot

Figure 40 Ericsson: Company Snapshot

Figure 41 ZTE: Company Snapshot

Figure 42 Huawei: Company Snapshot

Figure 43 Ascom: Company Snapshot

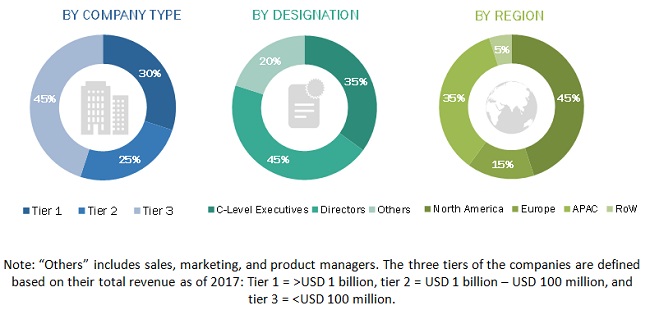

The study involved four major activities for estimating the size of the critical communication market. Exhaustive secondary research was done to collect information on the market, including its peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations; white papers, critical communication-based marketing-related journals, certified publications, and articles from recognized authors; gold and silver standard websites; directories; and databases.

Secondary research has been conducted to obtain key information about the industry’s supply chain, market’s monetary chain, the total pool of key players, and market segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both market and technology oriented perspectives. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include key industry participants, subject matter experts (SMEs), C-level executives of key companies, and consultants from various key companies and organizations operating in the critical communication market.

After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to verify and validate critical market numbers.

Primary research has also been conducted to identify segmentation types and key players, as well as analyze the competitive landscape, key market dynamics (drivers, restraints, opportunities, and challenges), and major growth strategies adopted by market players. During market engineering, both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to estimate and forecast the market, including the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed during the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the overall market and other dependent submarkets listed in this report. Extensive qualitative and quantitative analyses have been performed during market engineering to list key information/insights.

Major players in the market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This involved studying the annual and financial reports of top market players, and interviews with industry experts (such as CEOs, vice presidents, directors, and marketing executives) for key insights—both quantitative and qualitative.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size through the process explained above, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives

- To define and describe the critical communication market, in terms of value, by offering, technology, end-use vertical, and Geography

- To forecast the critical communication market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To identify the opportunities for various stakeholders such as critical communication system manufacturers, component suppliers, and brand product manufacturers by identifying high-growth segments and emerging use cases of the critical communication market

- To strategically analyze micro-markets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in

terms of ranking and core competencies, along with detailing competitive landscape for market leaders - To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the critical communication market

Available Customization

With the given market data, MarketsandMarkets offers customizations according to companies’ specific needs. The following customization options are available for the report.

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Critical Communication Market