PU sole (Footwear Polyurethane) Market by Raw Material (Methylene Diphenyl Diisocyanate, Toluene Diphenyl Diisocyanate, and Polyols), Application ( Casuals, Boots, Slippers & Sandals, Sports and Formals), and Region - Global Forecast to 2024

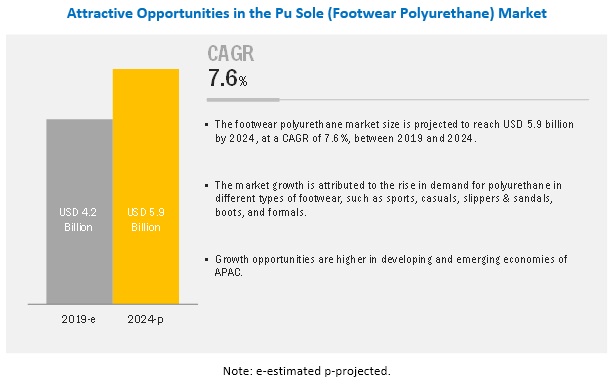

The PU sole (footwear polyurethane) market is projected to reach USD 5.9 billion by 2024, at a CAGR of 7.6%. Polyurethane is used in footwear to provide the perfect combination of ergonomics, microclimate, and comfort. The superior properties of polyurethane as shoe sole material, growth in footwear sales, and increasing production in the growing economies are expected to drive the PU sole (footwear polyurethane) market.

Casuals to be the fastest-growing segment of PU sole (footwear polyurethane) market between 2019 and 2024.

On the basis of application, the casuals segment is projected to register the highest CAGR during the forecast period. Casual footwear is defined as footwear that is worn on a daily basis for comfort and fashion. Such footwear also offers a wide range of performance for outdoor activities. Loafers, sneakers, and flat soles are a few types of casual footwear available commercially. The material selection for the soles is a key factor as the soles play a major role in providing comfort to users. The use of polyurethane in soles offers greater flexibility, durability, and comfort, which is driving the demand in this segment.

The methylene diphenyl diisocyanate (MDI) segment is projected to register highest CAGR during forecast period.

On the basis of raw material, the methylene diphenyl diisocyanate (MDI) segment is projected to register the highest CAGR during the forecast period. 4,4’-MDI isomer is used in shoe sole formulation. In order to make polyurethane soles for footwear, MDI is reacted with polyols in the presence of other additives. MDI-based polyurethanes have applications in compact outsoles and unit soles. They also provide a higher degree of stiffness and resilience. These properties are expected to drive the MDI-based PU sole (footwear polyurethane) market.

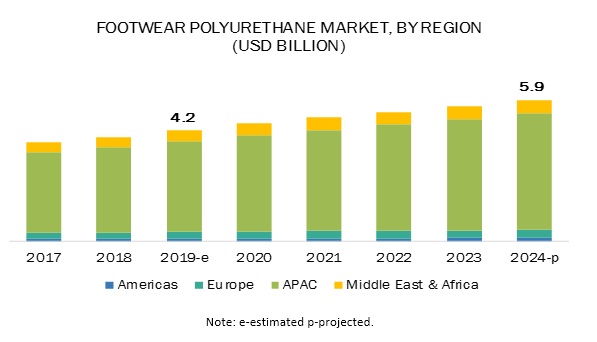

APAC is projected to be the largest PU sole (footwear polyurethane) market during the forecast period

The growth in the usage of PU sole (footwear polyurethane) in sports, casual, boots, formals, slippers & sandals footwear has increased the demand for PU sole (footwear polyurethane). APAC is the largest and the fastest-growing PU sole (footwear polyurethane) market. China is expected to account for the largest share of the market in APAC during the forecast period. The market in Indonesia is expected to register the fastest growth during the forecast period.

Key Players in PU sole (Footwear Polyurethane) Market

The key companies profiled in the PU sole (footwear polyurethane) market research report are BASF SE (Germany), Covestro (Germany), DuPont (US), Huntsman (US), Wanhua Chemical Group (China), Coim Group (Italy), Lubrizol (US), Lanxess (Germany), Manali Petrochemical (India), and INOAC (Japan)

PU sole (Footwear Polyurethane) Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units Considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments |

Application, Raw material, and Region |

|

Regions |

APAC, Europe, the Americas, and the Middle East & Africa |

|

Companies |

BASF SE (Germany), Covestro (Germany), Dow (US), Huntsman (US), Wanhua Chemical Group (China), Coim Group (Italy), Lubrizol (US), Lanxess (Germany), Manali Petrochemical (India), and INOAC (Japan) are the 10 key players covered. |

This research report categorizes the global PU sole (footwear polyurethane) market on the basis of application, raw material, and region.

On the basis of application:

- Casuals

- Boots

- Slippers & Sandals

- Sports

- Formals

On the basis of raw material:

- Methylene Diphenyl Diisocyanate (MDI)

- Toluene Diphenyl Diisocyanate (TDI)

- Polyols

On the basis of region:

- APAC

- Europe

- Americas

- Middle East & Africa

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- In October 2019, the Wanhua Chemical Group launched new 3D-printed shoe material solution that will integrate high-quality and highly-flexible materials, which include WANFAB TPU (filament and powder) and Adwel waterborne adhesive

- In January 2018, BASF established a new MDI synthesis unit in Geismar, Louisiana. MDI is a basic raw material which is used for the production of polyurethanes. The annual capacity of MDI production will increase from 300,000 metric tons to 600,000 metric tons. This expansion enabled the company to enhance its presence in North America.

- In June 2018, Covestro increased its TPU (Thermoplastic Polyurethane) production capacity at its West Virginia (US) plant. This expansion will increase Covestro's annual production capacity of TPU by 25.0%, which in turn, will help the company to expand its footprint, globally.

Key questions addressed by the report

- What was the PU sole (footwear polyurethane) market size in 2018?

- What are the global PU sole (footwear polyurethane) market trends in demand for polyurethane?

- Will the market witness an increase or decline in demand for polyurethane in the near future?

- What were the revenue pockets of PU sole (footwear polyurethane) in 2018?

- Who are the key players in the global PU sole (footwear polyurethane) market?

Frequently Asked Questions (FAQ):

What are the types of footwear that uses polyurethane (PU) sole?

There are generally five categories of footwear that uses PU sole namely sports, casuals, boots, slippers & sandals and formals. Polyurethane is used in outsole, midsole and insoles of footwear depending upon the applications.

What are the factors driving the growth of PU sole?

With the growing number of footwear production and sales coupled with the use of polyurethane as a shoe material due to its properties such as comfort, durability, good fit, and affordability is driving the growth of PU sole in the market.

What are the challenges faced by the market players?

Major challenges in the market are the volatility in the crude oil prices as it is used for the production of raw materials for PU, andthe other is the difficulty in the processing of thermoplastic polyurethane faced by the manufacturers.

Who are the major players in the PU sole market?

Some of the major players in the market are BASF SE (Germany), Covestro (Germany), DuPont (US), Huntsman (US), Wanhua Chemical Group (China), Coim Group (Italy), Lubrizol (US), Lanxess (Germany), Manali Petrochemical (India), and INOAC (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table Of Contents

1 Introduction

1.1 Market Scope

1.1.1 Market Definition

1.1.2 Market Covered

1.1.2.1 PU Sole (Footwear Polyurethane) Market, By Raw Materials

1.1.2.2 PU Sole (Footwear Polyurethane) Market, By End-Use

1.1.2.3 PU Sole (Footwear Polyurethane) Market, By Region

1.1.3 Estimation Years Considered for The Study

1.1.4 Currency

1.1.5 Package size

1.1.6 Limitations

1.2 Stakeholders

2 Research Methodology

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Key Data from Secondary Sources

2.2.2 Key Data from Primary Sources

2.2.2.1 Key Industry Insights

2.2.3 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Porter’s Five Forces Analysis

5.4 Innovation (Patent Analysis)

5.5 Value Chain Analysis

5.6 Pricing Analysis

5.7 YC, YCC shift

5.8 Macroeconomic Overview

6 PU Sole (Footwear Polyurethane) Market, By Raw Material – Forecast till 2024 (in USD Million and KT)

6.1 Methylene Diisocyanate (MDI)

6.2 Toluene Diisocyanate (TDI)

6.3 Polyols

7 PU Sole (Footwear Polyurethane) Market, By Application – Forecast till 2024 (in USD Million and KT)

7.1 Casuals

7.2 Boots

7.3 Slippers & Sandals

7.4 Sports

7.5 Formals

8 PU Sole (Footwear Polyurethane) Market, By Region – Forecast till 2024 (in USD Million and KT)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Spain

8.3.5 Italy

8.3.6 Rest of the Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Thailand

8.4.6 Rest of APAC

8.5 Rest of the World (RoW)

8.5.1 Middle East & Africa

8.5.2 South America

9 Competitive Landscape

9.1 Introduction

9.2 New Product Launches

9.3 Expansion Activities

9.4 Partnerships, Agreements and Collaborations

9.5 Mergers and Acquisitions

9.6 Industry structure

9.6.1 Market share / capacities of key players / operational growth drivers

9.6.2 Industry consolidation / fragmentation

10 Company Profiles

(Business Overview, Financials^, Products & Services, Key Strategy, and Recent Developments. Winning Imperatives, Current focus on strategies, Threat from competition and Right to win)

10.1 Huntsman Corporation

10.2 BASF

10.3 Dow Inc

10.4 COIM

10.5 Wanhua Chemical Company

10.6 Lubrizol

10.7 LANXESS

10.8 Covestro

10.9 Manali Petrochemical

10.1 INOAC Corporation

10.11 Eurofoam Group

10.12 Asahi Kasei Corporation

10.13 Trelleborg

10.14 Headway Group

10.15 Cellular Mouldings

10.16 ERA Polymers

10.17 Perstorp

10.18 Kasodur

10.19 VCM Polyurethanes

10.2 Rogers Corporation

Note: The above list of suppliers is tentative. We will identify top ten and 10 other key players and profile them during the study.^ Financials will be available for companies provided they have annual reports

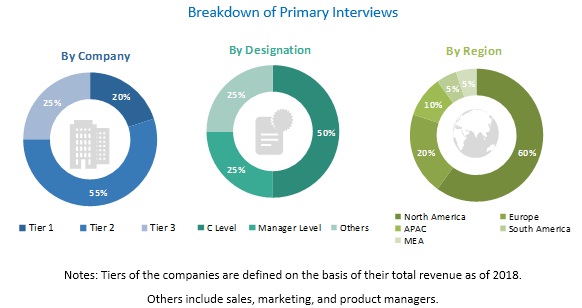

The study involves four major activities in estimating the current market size of footwear polyurethane. Exhaustive secondary research was done to collect information related to the PU sole (footwear polyurethane) market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The PU sole (footwear polyurethane) market comprises several stakeholders, such as raw material suppliers, technology developers, derivative manufacturers, and regulatory organizations in the supply chain. The development of application usage characterizes the demand side of this market. The supply side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global PU sole (footwear polyurethane) market and estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size included the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable. In order to complete the overall market estimation process and arrive at the exact statistics for all segments and subsegments, the data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market size of footwear polyurethane, in terms of value and volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the PU sole (footwear polyurethane) market size based on application and raw material

- To forecast the market size of different segments with respect to four regions, namely, APAC, Europe, the Americas, and the Middle East and Africa.

- To forecast the PU sole (footwear polyurethane) market size of different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying its high-growth segments

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the PU sole (footwear polyurethane) market

Company Information:

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in PU sole (Footwear Polyurethane) Market