Protein Sequencing Market by Product (Sample Preparation, MS, Sequencer, Reagent, Consumable), Service, Technology (MS, Edman), Application (Biotherapeutics, Genetic Engineering), Enduser (Academia, Pharma, Biotechnology, CROs) - Global Forecasts to 2023

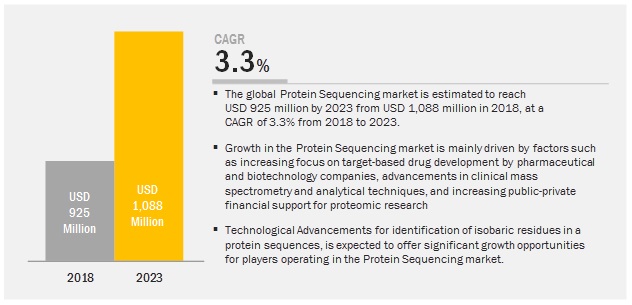

The protein sequencing market is projected to reach USD 1,088 million by 2023, growing at a CAGR of 3.3%. The study involved four major activities to estimate the current market size for protein sequencing. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

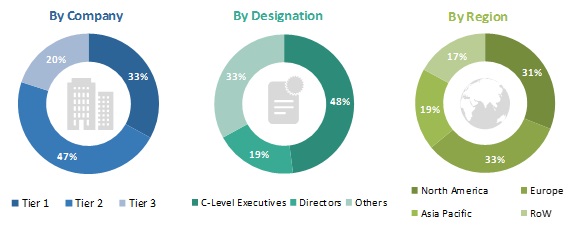

The protein sequencing market comprises several stakeholders such as protein sequencing equipment manufacturers, vendors, and distributors; protein sequencing service companies; protein sequencing bioinformatics/data analysis companies; research laboratories and academic institutes; venture capitalists and other government funding organizations; research and consulting firms; pharmaceutical and biotechnology companies; contract manufacturing organizations (CMOs); and contract research organizations (CROs).

The demand side of this market is characterized by increasing use of proteomic research in drug discovery (cell line development, verification of correct protein expressions, and protein degradation analysis), increasing R&D expenditure of major pharmaceutical and biotechnology companies, and patent expiry of major blockbuster drugs. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the protein sequencing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the protein sequencing industry.

Report Objectives

- To define, describe, and forecast the protein sequencing market based on product & service, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges) along with the current trends

- To strategically analyze micromarkets1 with respect to their individual growth trends, prospects, and contributions to the total market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the protein sequencing market in North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- To track and analyze competitive developments such as product launches, agreements, partnerships, collaborations, mergers & acquisitions, and research & development activities in the protein sequencing market

- Micromarkets are defined as the further segments and subsegments of the protein sequencing market included in the report.

- 2. Core competencies of the companies are captured in terms of their key developments and key strategies adopted to maintain their position in the market.

Protein Sequencing Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product & service, technology, application, end user, and region |

|

Geographies covered |

North America (US & Canada), Europe (Germany, France, UK, and RoE), APAC (Japan, China, India, and RoAPAC), and the RoW |

|

Companies covered |

Major 10 players covered, including Thermo Fisher Scientific, Inc. (US), Shimadzu Corporation (Japan), Agilent Technologies (US), SGS S.A. (Switzerland), Rapid Novor (Canada), Charles River Laboratories (US), Bioinformatics Solutions (Canada), Proteome Factory (Germany), and Selvita (Poland) |

This research report categorizes the protein sequencing market based on product & service, technology, application, end user, and region

By Product & Service

- Sample Preparation Products & Services

-

Protein Sequencing Products

- Reagents & Consumables

-

Instruments

- Mass Spectrometry Instruments

- Edman Degradation Sequencers

- Analysis Products/Software

- Protein Sequencing Services

By Technology

- Edman Degradation

- Mass Spectrometry

By Application

- Biotherapeutics

- Genetic Engineering

- Other Applications

By End User

- Academic Institutes & Research Centers

- Pharmaceutical & Biotechnology Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth in the protein sequencing market is mainly driven by the increasing focus on target-based drug development by pharmaceutical and biotechnology companies, advancements in clinical Mass Spectrometry and analytical techniques, and increasing public-private financial support for proteomic research.

By product & service, the protein sequencing services segment is expected to grow at the highest rate during the forecast period

Growth in the protein sequencing services segment can be attributed to factors such as the launch of technologically advanced instruments, software, and services for protein sequencing; the high cost of sequencing infrastructure; complexities associated with protein sequencing procedures; and the availability of cutting-edge sequencing infrastructure among service providers.

By technology, mass spectrometry is expected to be the largest contributor to the protein sequencing market

The large share of the mass spectrometry segment can be attributed to its advantages, such as high-throughput sequencing capabilities, cost efficiency, and identification of blocked or modified proteins. Market growth is also due to the increasing focus of market players on launching technologically advanced mass spectrometry instruments and increasing application of mass spectrometry in Proteomics research.

By end user, the academic institutes and research centers segment is expected to be the largest contributor to the protein sequencing market

The increase in funding for proteomic research by public and private institutes is a major factor driving the growth of the academic institutes and research centers segment. Academic institutes and research centers use protein sequencing for proteomic research. These facilities rely on protein sequencing providers to carry out proteomic research due to lack of infrastructure, a limited number of samples, and budget constraints to procure protein sequencing consumables. Also, various academic institutes and research centers provide various protein sequencing services, such as mass spectrometry and Edman degradation.

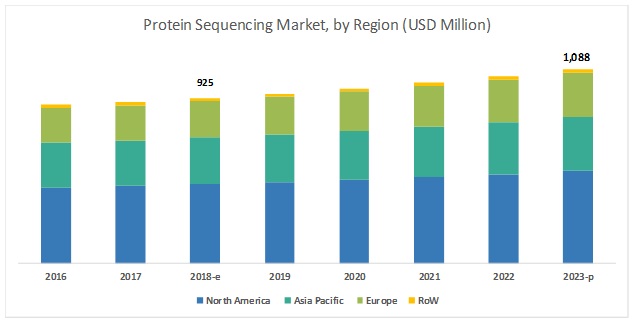

North America is expected to account for the largest share of the market during the forecast period

North America is one of the major revenue-generating regions in the protein sequencing market. The large share of this regional segment can mainly be attributed to the availability of funds from public and private organizations for carrying out proteomic research, growing focus on structure-based drug design, the presence of leading protein sequencing stakeholders, and the increasing number of drug development activities in the region.

Thermo Fisher Scientific (US), SGS S.A. (Switzerland), and Shimadzu (Japan) are the major players operating in the protein sequencing market. Other players in this market include Waters Corporation (US), Rapid Novor (Canada), Agilent Technologies (US), Charles River Laboratories (US), and Selvita (Poland).

Thermo Fisher Scientific has a strong global presence with more than 48% of its revenue generated from the US and around 9% from China. It led the market with its flagship mass spectrometry platforms Q Exactive UHMR Hybrid Quadrupole - Orbitrap (launched in June 2018), Thermo Scientific TSQ 9000 Triple Quadrupole GC-MS/MS system (launched in April 2018), and Orbitrap Fusion Lumos Tribrid Mass Spectrometer (launched in June 2017). The company also provides reagents and consumables for protein sequencing. The company’s growth in consumables sales also contributed to maintaining its position in the protein sequencing market.

SGS S.A. is a leading provider of protein sequencing services. The company adopted acquisitions as a key inorganic growth strategy to expand its geographic coverage and enhance its service capabilities. The company utilizes its subsidiary’s technologies and resources to provide advanced services, including protein sequencing solutions, to its customers across the globe. This strategy helps the company to enhance its innovative protein sequencing service offerings.

Recent developments:

- In June 2018, Shimadzu (Japan) launched the Quadrupole time-of-flight (Q-TOF) LCMS-9030 System. This helped the company to expand its product offerings.

- In January 2018, SGS S.A. (Switzerland) acquired Vanguard Sciences Inc. (US), a Food Safety Testing service provider. This helped the company to improve its protein sequencing offering for food safety.

- In March 2018, Charles River Laboratories (US) started its Biologics Testing Solutions facility in Pennsylvania (US) to support the characterization, development, and release of biologics & biosimilars.

Key questions addressed in the report:

- What are the growth opportunities related to protein sequencing across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of protein sequencing products and services. Will this scenario continue in the next five years?

- Where will all the advancements in products offered by various companies take the industry in the mid- to long-term?

- What are the various applications where protein sequencing finds a high adoption rate?

- What are the new trends and advancements in the protein sequencing market?

Frequently Asked Questions (FAQs):

What is the size of Protein Sequencing Market?

The protein sequencing market is projected to reach USD 1,088 million by 2023, growing at a CAGR of 3.3%.

What are the major growth factors of Protein Sequencing Market?

The study involved four major activities to estimate the current market size for protein sequencing. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Who all are the prominent players of Protein Sequencing Market?

Major 10 players covered, including Thermo Fisher Scientific, Inc. (US), Shimadzu Corporation (Japan), Agilent Technologies (US), SGS S.A. (Switzerland), Rapid Novor (Canada), Charles River Laboratories (US), Bioinformatics Solutions (Canada), Proteome Factory (Germany), and Selvita (Poland)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.1.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Revenue-Based Market Estimation

2.2.2 End-User-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Protein Sequencing Market Overview

4.2 Protein Sequencing Market, By Product & Service (2018 vs 2023)

4.3 Protein Sequencing Market, By Technology, 2018 vs 2023

4.4 Protein Sequencing Market, By Application, 2018 vs 2023

4.5 Protein Sequencing Market, By End User, 2018 vs 2023

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Focus on Target-Based Drug Development By Pharmaceutical and Biotechnology Companies

5.2.1.2 Advancements in Clinical Mass Spectrometry and Analytical Techniques

5.2.1.3 Increasing Public-Private Financial Support for Proteomic Research

5.2.2 Restraints

5.2.2.1 High Infrastructure Costs

5.2.3 Opportunities

5.2.3.1 Technological Advancements for the Identification of Isobaric Residues in Protein Sequences

5.2.4 Challenges

5.2.4.1 Preparation of Pure Protein Samples

5.2.4.2 Need for Skilled Researchers and Laboratory Professionals

6 Protein Sequencing Market, By Product & Service (Page No. - 37)

6.1 Introduction

6.2 Sample Preparation Products & Services

6.2.1 Growing Need for Standardized Sample Preparation Solutions is A Major Driver for the Sample Preparation Products & Services Market

6.3 Protein Sequencing Products

6.3.1 Reagents & Consumables

6.3.1.1 Growing Number of Sequencing Procedures to Drive the Demand for Protein Sequencing Reagents & Consumables

6.3.2 Instruments

6.3.2.1 Mass Spectrometry Instruments

6.3.2.1.1 Technological Advancements to Drive the Adoption of Mass Spectrometry Instruments

6.3.2.2 Edman Degradation Sequencers

6.3.2.2.1 High Accuracy of Edman Degradation Method to Drive the Adoption of These Products

6.3.3 Analysis Products/Software

6.3.3.1 Protein Sequencing Analysis Products/Software to Witness the Highest Growth Rate During the Forecast Period

6.4 Protein Sequencing Services

6.4.1 Protein Sequencing Services to Register the Highest Growth Between 2018 & 2023

7 Protein Sequencing Market, By Technology (Page No. - 46)

7.1 Introduction

7.2 Mass Spectrometry

7.2.1 High-Throughput Sequencing Capabilities and Cost Efficiency to Drive the Adoption of Mass Spectrometry Protein Sequencing

7.3 Edman Degradation

7.3.1 High Accuracy of the Edman Degradation Method is the Key Factor Driving Its Adoption in the Market

8 Protein Sequencing Market, By Application (Page No. - 50)

8.1 Introduction

8.2 Biotherapeutics

8.2.1 Biotherapeutics Segment to Witness the Highest Growth During the Forecast Period

8.3 Genetic Engineering

8.3.1 Large Number of Research Projects Focused on Genetically Modified Organisms & Technological Advancements—Key Factors Driving Market Growth

8.4 Other Applications

9 Protein Sequencing Market, By End User (Page No. - 56)

9.1 Introduction

9.2 Academic Institutes & Research Centers

9.2.1 Academic Institutes & Research Centers to Account for the Largest Share of the Market Owing to the Increasing Funding for Proteomics Research

9.3 Pharmaceutical & Biotechnology Companies

9.3.1 Increasing R&D Expenditure of Major Pharmaceutical and Biotechnology Companies to Drive Market Growth

9.4 Other End Users

10 Protein Sequencing Market, By Region (Page No. - 62)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Launch of Advanced Protein Sequencing Products & the Strong Presence of Leading Players are Driving the Growth of the Protein Sequencing Market in the Us

10.2.2 Canada

10.2.2.1 Financial Support From Government and Private Organizations for R&D in the Proteomics Field—Major Factor Supporting Market Growth

10.3 Europe

10.3.1 Germany

10.3.1.1 Favorable Funding Scenario for Life Science Research to Drive the Growth of the Protein Sequencing Market in Germany

10.3.2 France

10.3.2.1 Rising Demand for Biotherapeutics and Biotechnology in the Country to Drive the Adoption of Protein Sequencing

10.3.3 UK

10.3.3.1 Presence of A Large Life Sciences Industry and the Continued Growth of the Biopharmaceuticals Sector are the Major Factors Driving Market Growth

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 China to Register the Highest Growth in the Asia Pacific Protein Sequencing Market During the Forecast Period

10.4.2 Japan

10.4.2.1 Strong Life Sciences R&D Infrastructure and A Favorable Government Funding Scenario are Key Factors Driving Market Growth

10.4.3 India

10.4.3.1 Implementation of Favorable Government Initiatives to Support Life Sciences Research to Support the Growth of the Protein Sequencing Market in India

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 84)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation and Trends

11.3.1 Product Launches and Services

11.3.2 Partnerships

11.3.3 Acquisitions

11.3.4 Expansions

12 Company Profiles (Page No. - 89)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Agilent Technologies, Inc.

12.2 Bioinformatics Solutions

12.3 Charles River Laboratories

12.4 Proteome Factory

12.5 Rapid Novor Inc.

12.6 Selvita

12.7 SGS

12.8 Shimadzu Corporation

12.9 Thermo Fisher Scientific Inc.

12.10 Waters

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 111)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (58 Tables)

Table 1 Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 2 Sample Preparation Products & Services Market, By Region, 2016–2023 (USD Million)

Table 3 Protein Sequencing Products Market, By Type, 2016–2023 (USD Million)

Table 4 Protein Sequencing Products Market, By Region, 2016–2023 (USD Million)

Table 5 Reagents & Consumables Market, By Region, 2016–2023 (USD Million)

Table 6 Instruments Market, By Type, 2016–2023 (USD Million)

Table 7 Instruments Market, By Region, 2016–2023 (USD Million)

Table 8 Analysis Products/Software Market, By Region, 2016–2023 (USD Million)

Table 9 Protein Sequencing Services Market, By Region, 2016–2023 (USD Million)

Table 10 Protein Sequencing Market, By Technology, 2016–2023 (USD Million)

Table 11 Mass Spectrometry Protein Sequencing Market, By Region, 2016–2023 (USD Million)

Table 12 Edman Degradation Protein Sequencing Market, By Region, 2016–2023 (USD Million)

Table 13 Protein Sequencing Market, By Application, 2016–2023 (USD Million)

Table 14 Protein Sequencing Market for Biotherapeutics, By Region, 2016–2023 (USD Million)

Table 15 Protein Sequencing Market for Genetic Engineering, By Region, 2016–2023 (USD Million)

Table 16 Protein Sequencing Market for Other Applications, By Region, 2016–2023 (USD Million)

Table 17 Protein Sequencing Market, By End User, 2016–2023 (USD Million)

Table 18 Protein Sequencing Market for Academic Institutes & Research Centers, By Region, 2016–2023 (USD Million)

Table 19 Protein Sequencing Market for Pharmaceutical & Biotechnology Companies, By Region, 2016–2023 (USD Million)

Table 20 Protein Sequencing Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 21 Protein Sequencing Market, By Region, 2016–2023 (USD Million)

Table 22 North America: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 23 North America: Protein Sequencing Products Market, By Type, 2016–2023 (USD Million)

Table 24 North America: Protein Sequencing Market, By Technology, 2016–2023 (USD Million)

Table 25 North America: Protein Sequencing Market, By Application, 2016–2023 (USD Million)

Table 26 North America: Protein Sequencing Market, By End User, 2016–2023 (USD Million)

Table 27 North America: Protein Sequencing Market, By Country, 2016–2023 (USD Million)

Table 28 US: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 29 Canada: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 30 Europe: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 31 Europe: Protein Sequencing Products Market, By Type, 2016–2023 (USD Million)

Table 32 Europe: Protein Sequencing Market, By Technology, 2016–2023 (USD Million)

Table 33 Europe: Protein Sequencing Market, By Application, 2016–2023 (USD Million)

Table 34 Europe: Protein Sequencing Market, By End User, 2016–2023 (USD Million)

Table 35 Europe: Protein Sequencing Market, By Country, 2016–2023 (USD Million)

Table 36 Germany: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 37 France: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 38 UK: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 39 Rest of Europe: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 40 Asia Pacific: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 41 Asia Pacific: Protein Sequencing Products Market, By Type, 2016–2023 (USD Million)

Table 42 Asia Pacific: Protein Sequencing Market, By Technology, 2016–2023 (USD Million)

Table 43 Asia Pacific: Protein Sequencing Market, By Application, 2016–2023 (USD Million)

Table 44 Asia Pacific: Protein Sequencing Market, By End User, 2016–2023 (USD Million)

Table 45 Asia Pacific: Protein Sequencing Market, By Country, 2016–2023 (USD Million)

Table 46 China: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 47 Japan: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 48 India: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 49 Rest of Asia Pacific: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 50 RoW: Protein Sequencing Market, By Product & Service, 2016–2023 (USD Million)

Table 51 RoW: Protein Sequencing Products Market, By Type, 2016–2023 (USD Million)

Table 52 RoW: Protein Sequencing Market, By Technology, 2016–2023 (USD Million)

Table 53 RoW: Protein Sequencing Market, By Application, 2016–2023 (USD Million)

Table 54 RoW: Protein Sequencing Market, By End User, 2016–2023 (USD Million)

Table 55 Key Product and Service Launches 2017–2018 (October)

Table 56 Key Partnerships, 2017–2018 (October)

Table 57 Key Acquisitions, 2017–2018 (October)

Table 58 Key Geographic Expansions, 2017–2018 (October)

List of Figures (37 Figures)

Figure 1 Protein Sequencing Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 Market Size Estimation: Protein Sequencing Market

Figure 4 Data Triangulation Methodology

Figure 5 Protein Sequencing Market Share, By Application, 2018 vs 2023

Figure 6 Protein Sequencing Market Share, By Product & Service, 2018 vs 2023

Figure 7 Protein Sequencing Market, By Technology, 2018 vs 2023 (USD Million)

Figure 8 Protein Sequencing Market, By End User, 2018 vs 2023 (USD Million)

Figure 9 Protein Sequencing Market: Geographical Snapshot

Figure 10 Significant Adoption of Target-Based Drug Development Approaches to Drive Market Growth

Figure 11 Protein Sequencing Services Segment is Expected to Account for the Major Share During Forecast Period

Figure 12 Mass Spectrometry Will Continue to Dominate the Protein Sequencing Market in 2023

Figure 13 Biotherapeutics Segment is Expected to Grow at the Highest Rate During the Study Period

Figure 14 Academic Institutes and Research Centers to Dominate the Protein Sequencing Market in the Forecast Period

Figure 15 Protein Sequencing Market: Drivers, Restraints, Opportunities, & Challenges

Figure 16 NIH Research Grants for Research in Life Sciences, 2013–2017 (USD Billion)

Figure 17 Protein Sequencing Services are Expected to Register Highest Growth During the Forecast Period

Figure 18 Mass Spectrometry to Dominate the Protein Sequencing Market During the Forecast Period

Figure 19 Biotherapeutics is Expected to Grow at the Highest Rate During the Forecast Period

Figure 20 Number of Research Publications on Genetically Modified Organisms (2007-2017)

Figure 21 Growth in the Number of Known Protein Structures Available in Protein Data Bank Database

Figure 22 Academic Institutes & Research Centers to Register the Highest Growth During the Forecast Period (2018–2023)

Figure 23 Key Academic Protein Sequencing Service Providers

Figure 24 Funding for Proteomic Research, 1987–2017 (USD Million)

Figure 25 North America: Protein Sequencing Market Snapshot

Figure 26 Europe: Protein Sequencing Market Snapshot

Figure 27 Asia Pacific: Protein Sequencing Market Snapshot

Figure 28 RoW: Protein Sequencing Market Snapshot

Figure 29 Key Developments in the Protein Sequencing Market From Jan 2015 to October 2018

Figure 30 Protein Sequencing Market Share Analysis, By Key Player, 2017

Figure 31 Agilent Technologies: Company Snapshot (2017)

Figure 32 Charles River Laboratories: Company Snapshot (2017)

Figure 33 Selvita: Company Snapshot (2017)

Figure 34 SGS: Company Snapshot (2017)

Figure 35 Shimadzu Corporation: Company Snapshot (2017)

Figure 36 Thermo Fisher Scientific: Company Snapshot (2017)

Figure 37 Waters: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protein Sequencing Market