Proteases Market by Source (Microbial, Animal, Plant), Formulation (Liquid, Lyophilized Powder), Product (Renin, Papain, Alkaline), Application (Food & Beverages, Feed, Soaps & Detergents, Pharmaceutical), & by Region - Global Forecast to 2021

The proteases market is projected to reach USD 2.21 Billion in terms of value by 2021, at a CAGR of 6% from 2016 to 2021. The objectives of the study is to define, segment, and measure the global market with respect to sources, applications, methods of production, formulation, products, and key regional markets. They also include major factors influencing the growth of the market, strategically analyze the micromarkets, analyze opportunities for stakeholders, provide details of competitive landscape, and strategically profile the key players with respect to their market share and core competencies.

The years considered for the study are:

- Base year 2015

- Estimated year 2016

- Projected year 2021

- Forecast period 2016 to 2021

This report includes estimations of market sizes for value (USD billion). Both top-down and bottom-up approaches have been used to estimate and validate the size of the proteases market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The various contributors involved in the value chain of proteases include proteases manufacturers such as Novozymes A/S (Denmark), Chr. Hansen Holdings A/S (Denmark), E.I. du Pont de Nemours and Company (U.S.), Associated British Foods plc (U.K.), Koninklijke DSM N.V. (The Netherlands), government bodies & regulatory associations (United States Department of Agriculture (USDA), Food and Agriculture Organization (FAO), Association of Manufacturers & Formulators (AMFEP), Enzyme Technical Associations (ETA) and Environmental Protection Agency (EPA)), distributors such as AB Enzymes (Germany) and Novozymes A/S (Denmark), end users such as the food & beverages, livestock feed, soaps & detergent, pharmaceuticals, and other industries such as textile & leather, waste management, chemical industries, silver recovery, photography, and biofuel.

Target Audience

- Proteases manufacturers

- Proteases suppliers

- Research institutions

- Government bodies

- Distributors

- End user (industries)

The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report

On the basis of Source, the proteases market is segmented as follows:

- Animal

- Plant

- Microbial

- Fungal

- Bacterial

- Viral

On the basis of Application, the proteases market is segmented as follows:

- Food & beverages

- Livestock feed

- Soaps & detergent

- Pharmaceuticals

- Others (textile & leather, waste management, chemical industries, silver recovery, photography, biofuel)

On the basis of Method of production, the proteases market is segmented as follows:

- Fermentation

- Extraction

On the basis of Formulation, the proteases market is segmented as follows:

- Liquid formulation

- Lyophilized powder

- Others (granular and gel)

On the basis of Product, the proteases market is segmented as follows:

- Animal

- Trypsin

- Renin

- Pepsin

- Others (chymotrypsin, thrombin, elastase, cathepsin G)

- Plant

- Papain

- Bromelain

- Others (keratinases and ficin)

- Microbial

- Alkaline

- Acid stable

- Neutral

- Others (Proteinase K, Peptidase, Fungal acid protease)

On the basis of Region, the proteases market is segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of other applications of proteases

Regional Analysis

- Further breakdown of the Rest of World proteases market into Latin American countries (Brazil, Chile, Argentina)

- Further breakdown of the Rest of Asia-Pacific proteases market into other Asian countries

Company Information

- Detailed analysis and profiling of additional market players (up to 5)\

The market for proteases is projected to reach ~USD 2.21 Billion by 2021, at a CAGR of 6% from 2016 to 2021. The proteases market is fueled by growing industrialization, increasing incidence of diseases, growing environmental concern, and focus on cost reduction and resource optimization, which has led to a large-scale adoption of proteases for various applications.

The market is segmented on the basis of source into animal, plant, and microbial. The microbial segment is growing at the fastest rate in terms of value, due to the increasing producers demand as it is commercially viable & helps in yield improvement, and inability of plant and animal sources to meet the proteases demand globally.

Based on applications, the market is segmented into food & beverages, livestock feed, soaps & detergent, pharmaceuticals, and other applications. Soaps & detergents dominated the proteases market as proteases is cost-effective and safe to use. The changing cleaning habits, development of technology such as protein engineering to produce high performing products, and growing environmental concern are driving the market for proteases use in the soaps and detergents industry.

Based on the methods of production, the market is segmented into fermentation and extraction. Fermentation dominated the proteases market due to producers reliance on microbial sources and economic efficiency involved as the process is time and cost saving.

The market is also segmented on the basis of formulations into liquid, lyophilized powder, and others. Lyophilized powder dominated the global market in terms of formulation due to its functional properties as it increases the shelf life of the product and also due to the development & advancement of technology such as encapsulation.

On the basis of products, renin dominated the animal product segment for proteases owing to its physiological benefits and its major use in the food & beverages industry such as cheese making. Papain dominated the plant product segment of proteases due to its health benefits such as boosting digestion, supporting the immune system, acting as an antioxidant, and others, along with its functional properties such as relatively heat-resistant enzyme makes it more preferable. Alkaline is the largest microbial product in the proteases market owing to its functional properties as it is more stable at high temperatures and it also finds its application majorly in the soaps and detergent industry which is the largest industry for enzyme application.

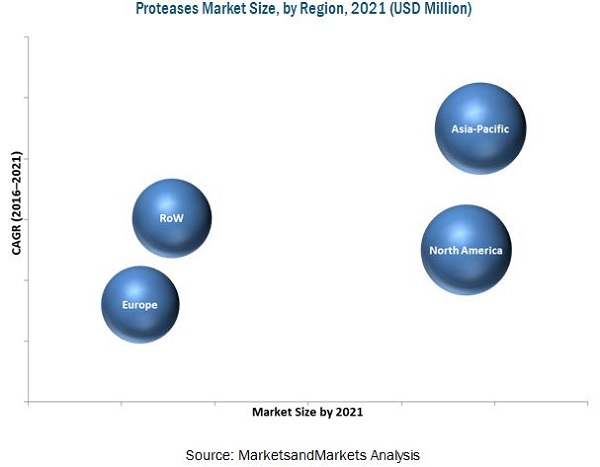

On the basis of region, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America dominated the global market due to the developed industries in this region. Asia-Pacific is the fastest growing region in the proteases market due to continuous increase in demand for proteases owing to the economic and operational benefits from proteases along with increasing industrialization, ease of doing business, and broad application spectrum.

Increasing raw material cost, lack of transparency in patent protection, and stringent government regulations laws along with price war among different proteases manufacturers are restraining the market.

The proteases market is fragmented and competitive, with a large number of players operating at regional and local levels. The key players in the market adopted expansions and investments as their preferred growth strategy. Key players such as Chr. Hansen Holdings A/S (Denmark), E.I. du Pont de Nemours and Company (U.S.), Associated British Foods plc (U.K.), Koninklijke DSM N.V. (The Netherlands), Novozymes A/S (Denmark), Dyadic International Incorporated (U.S.), Advanced Enzyme Technologies Ltd. (India), Biocatalysts Limited (U.K.), Amano Enzyme Inc. (Japan), and Specialty Enzymes and Biotechnologies (U.S.). have been profiled in the report.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered for the Study

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

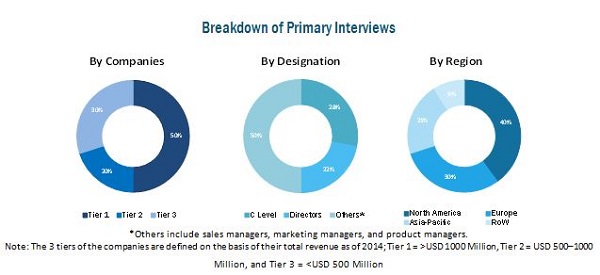

2.1.2.2 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Adoption of Biofuels and Growing Textile & Leather Industries

2.2.2.2 Increasing Per Capita Global GDP Over the Years

2.2.2.3 Emerging and Developing Economies With Higher GDP (PPP)

2.2.3 Supply-Side Analysis

2.2.3.1 Research & Development of Proteases

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Opportunities in the Proteases Market

4.2 Proteases Market: Major Countries

4.3 Life Cycle Analysis: Proteases Market, By Region

4.4 Asia-Pacific Proteases Market, By Application & Region

4.5 Developed vs Emerging Proteases Markets

4.6 Proteases Market Size, By Methods of Production

4.7 Proteases Formulation Market, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Evolution of Enzymes

5.4 Market Dynamics

5.4.1 Market Drivers

5.4.1.1 Diverse Functionality in Food

5.4.1.2 Importance in Laundry and Detergent Application

5.4.1.3 Reduction in Feed Costs and Optimization of Nutritional Value in Feed

5.4.1.4 Proteases Functionality in Feed to Drive Its Demand in Livestock Industry

5.4.1.5 Increasing Production & Consumption of Meat to Fuel Demand for Proteases in Feed and Food Industry

5.4.1.6 Wide Use in Infant Food Formulas

5.4.1.7 Sustainability as A Result of Various Sources

5.4.1.8 Advancements in R&D Activities for Proteases

5.4.2 Restraints

5.4.2.1 Government Restraints & Regulations

5.4.2.2 Lack of Transparency in Patent Protection Laws

5.4.3 Opportunities

5.4.3.1 Proteases as A Class of Therapeutic Agents

5.4.3.2 Increase in Demand for Environmental and Health-Friendly Products

5.4.3.3 Emerging Economies With High Growth Potential

5.4.4 Challenges

5.4.4.1 Effective Storage

5.4.4.2 Concerns Over Cost, Quality, Safety, and Consumer Perception About Enzymes

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain

6.4 Industry Insights

6.5 Porters Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Regulatory Framework

7 Proteases Market, By Source (Page No. - 55)

7.1 Introduction

7.2 Animal Sources

7.3 Plant Sources

7.4 Microbial Sources

8 Proteases Enzymes Market, By Product (Page No. - 63)

8.1 Animal Product

8.1.1 Trypsin

8.1.2 Pepsin

8.1.3 Renin

8.1.4 Others

8.2 Plant

8.2.1 Papain

8.2.2 Bromelain

8.2.3 Others (Keratinases and Ficin)

8.3 Microbial

8.3.1 Alkaline Protease

8.3.2 Acid Protease

8.3.3 Neutral Protease

9 Proteases Market, By Method of Production (Page No. - 68)

9.1 Introduction

9.2 Fermentation

9.3 Extraction

10 Proteases Market, By Formulation (Page No. - 72)

10.1 Introduction

10.2 Liquid Formulations

10.3 Lyophilized Powder

10.4 Others

11 Proteases Market, By Application (Page No. - 77)

11.1 Introduction

11.2 Food & Beverages

11.2.1 Dairy Industry

11.2.2 Bakery Enzymes

11.2.3 Processed Foods

11.2.4 Meat

11.2.5 Beverages

11.3 Feed

11.4 Soap & Detergent Industry

11.5 Pharmaceuticals

11.6 Others

12 Proteases Market, By Region (Page No. - 88)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 U.K.

12.3.2 Germany

12.3.3 France

12.3.4 Italy

12.3.5 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Rest of Asia-Pacific

12.5 Rest of the World (RoW)

12.5.1 Latin America

12.5.2 Africa

12.5.3 Middle East

13 Competitive Landscape (Page No. - 109)

13.1 Overview

13.2 Market Share Analysis

13.3 Competitive Situation & Trends

13.3.1 Expansions & Investments

13.3.2 New Product Launches

13.3.3 Acquisitions

13.3.4 Collaborations, Agreements, Joint Ventures, and Partnerships

14 Company Profiles (Page No. - 115)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

14.1 Introduction

14.2 Novozymes A/S

14.3 Chr. Hansen Holdings A/S

14.4 E. I. Du Pont De Nemours and Company

14.5 Associated British Foods PLC

14.6 Koninklijke DSM N.V.

14.7 Advanced Enzyme Technologies Ltd.

14.8 Dyadic International Incorporated

14.9 Amano Enzyme Inc.

14.10 Biocatalysts Limited

14.11 Specialty Enzymes & Biotechnologies

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 143)

15.1 Discussion Guide

15.2 More Company Developments

15.2.1 Expansions & Investments

15.2.2 New Product Launches & Approvals

15.2.3 Collaborations, Agreements, Joint Ventures, and Partnerships

15.2.4 Acquisitions & Strategic Alliance

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing Rt: Real Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (70 Tables)

Table 1 Per Capita Consumption of Livestock Products

Table 2 Industry Insights: Leading Trends Among Key Players

Table 3 List of Regulatory Bodies

Table 4 Types of Proteases Along With Functional Groups and Their Sources

Table 5 Proteases Market Size, By Source, 20142021 (USD Million)

Table 6 Types of Proteases and Their Sources

Table 7 Animal-Sourced Proteases Market Size, By Region, 20142021 (USD Million)

Table 8 Plant-Sourced Proteases Market Size, By Region, 20142021 (USD Million)

Table 9 Types of Proteases and Microbial Sources

Table 10 Proteases Market Size, By Microbial Source, 20142021 (USD Million)

Table 11 Microbial-Sourced Proteases Market Size, By Region, 20142021 (USD Million)

Table 12 Proteases Market Size, By Animal Product, 20142021 (USD Million)

Table 13 Market Size, By Plant Product, 20142021 (USD Million)

Table 14 Proteases Market Size, By Microbial Product, 20142021 (USD Million)

Table 15 Proteases Market Size, By Method of Production, 20142021 (USD Million)

Table 16 Use of Proteases in Brewing

Table 17 Fermentation: Proteases Market Size, By Region, 20142021 (USD Million)

Table 18 Extraction: Proteases Market Size, By Region, 20142021 (USD Million)

Table 19 Proteases Market Size, By Formulation, 20142021 (USD Million)

Table 20 Liquid Formulation Market Size, By Region, 20142021 (USD Million)

Table 21 Lyophilized Powder Market Size, By Region, 20142021 (USD Million)

Table 22 Other Formulations Market Size, By Region, 20142021 (USD Million)

Table 23 Proteases Market Size, By Application, 20142021 (USD Million)

Table 24 Application Area of Various Types of Proteases in the Food Industry

Table 25 Food & Beverages Market Size, By Region, 20142021 (USD Million)

Table 26 Proteases in Food & Beverages Market Size, By Sub-Applications, 20142021 (USD Million)

Table 27 Feed Market Size, By Region, 20142021 (USD Million)

Table 28 Soaps & Detergents Market Size, By Region, 20142021 (USD Million)

Table 29 Pharmaceuticals Market Size, By Region, 20142021 (USD Million)

Table 30 Proteases Market Size for Other Applications, By Region, 20142021 (USD Million)

Table 31 Proteases Market Size, By Region, 20142021 (USD Million)

Table 32 North America: Proteases Market Size, By Country, 20142021 (USD Million)

Table 33 North America: Proteases Market Size, By Source, 20142021 (USD Million)

Table 34 North America: Proteases Market Size, By Formulation, 20142021 (USD Million)

Table 35 North America: Proteases Market Size, By Method of Production, 20142021 (USD Million)

Table 36 U.S.: Proteases Market Size, By Source, 20142021 (USD Million)

Table 37 Canada: Proteases Market Size, By Source, 20142021 (USD Million)

Table 38 Mexico: Proteases Market Size, By Source, 20142021 (USD Million)

Table 39 Europe: Proteases Market Size, By Country, 20142021 (USD Million)

Table 40 Europe: Proteases Market Size, By Source, 20142021 (USD Million)

Table 41 Europe: Proteases Market Size, By Formulation, 20142021 (USD Million)

Table 42 Europe: Proteases Market Size, By Method of Production, 20142021 (USD Million)

Table 43 U.K.: Proteases Market Size, By Source, 20142021 (USD Million)

Table 44 Germany: Proteases Market Size, By Source, 20142021 (USD Million)

Table 45 France: Proteases Market Size, By Source, 20142021 (USD Million)

Table 46 Italy: Proteases Market Size, By Source, 20142021 (USD Million)

Table 47 Rest of Europe: Proteases Market Size, By Source, 20142021 (USD Million)

Table 48 Asia-Pacific: Proteases Market Size, By Country, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Source, 20142021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Formulation, 20142021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Method of Production, 20142021 (USD Million)

Table 52 China: Proteases Market Size, By Source, 20142021 (USD Million)

Table 53 Japan: Proteases Market Size, By Source, 20142021 (USD Million)

Table 54 India: Proteases Market Size, By Source, 20142021 (USD Million)

Table 55 Rest of Asia-Pacific: Proteases Market Size, By Source, 20142021 (USD Million)

Table 56 RoW: Proteases Market Size, By Region, 20142021 (USD Million)

Table 57 RoW: Market Size, By Source, 20142021 (USD Million)

Table 58 RoW: Market Size, By Formulation, 20142021 (USD Million)

Table 59 RoW: Market Size, By Method of Production, 20142021 (USD Million)

Table 60 Latin America: Proteases Market Size, By Source, 20142021 (USD Million)

Table 61 Africa: Proteases Market Size, By Source, 20142021 (USD Million)

Table 62 Middle East: Proteases Market Size, By Source, 20142021 (USD Million)

Table 63 Expansions & Investments, 20102015

Table 64 New Product Launches, 20102015

Table 65 Acquisitions, 20102015

Table 66 Collaborations, Agreements, Joint Ventures, and Partnerships, 20102015

Table 67 Expansions & Investments, 20112016

Table 68 New Product Launches & Approvals, 20112016

Table 69 Collaborations, Agreements, Joint Ventures, and Partnerships, 20102015

Table 70 Acquisitions & Strategic Alliance, 20112015

List of Figures (58 Figures)

Figure 1 Market Segmentation

Figure 2 Proteases Market, By Region

Figure 3 Research Design: Proteases Market

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Global Carbon Emissions From Fossil Fuels, 1970-2010

Figure 6 Global Apparel Retail Industry to Continue an Upward Trend

Figure 7 Global Per Capita GDP, 2008-2014

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Market Size Estimation Methodology: Top-Down Approach

Figure 10 Data Triangulation

Figure 11 Assumptions of the Study

Figure 12 Proteases Market Snapshot, By Source, 2016 vs 2021

Figure 13 Market Size, By Application, 20162021

Figure 14 Market Size, By Production Method, 20162021

Figure 15 Market Size, By Formulation, 20162021

Figure 16 Market Share (Value), By Region, 2016

Figure 17 Growing Adoption of Proteases in the Meat Industry and Upsurge in the Usage of Proteases in Infant Food Formulation Will Drive Growth of the Proteases Market

Figure 18 Emerging Markets in Asia-Pacific Poised for High Growth From 2016

Figure 19 Asia-Pacific Market Poised for Robust Growth, 2016 to 2021

Figure 20 Pharmaceuticals Segment Dominated the Asia-Pacific Market in 2015

Figure 21 Emerging Economies are Projected to Drive the Consumption of Proteases During the Forecast Period (2016-2021)

Figure 22 Fermentation Segment is Expected to Hold the Largest Share in the Proteases Market Throughout the Forecast Period (2016-2021)

Figure 23 Lyophilized Powder Segment Poised for Significant Growth in the Proteases Market, 20162021

Figure 24 Proteases Market: Market Segmentation

Figure 25 Evolution of Enzymes

Figure 26 Proteases Enzymes Market: Market Dynamics

Figure 27 Research and Enzyme Development Contributes Maximum Value to the Overall Worth of the Proteases Market

Figure 28 Enzyme Development and Production Plays A Vital Role in the Supply Chain of the Proteases Market

Figure 29 Porters Five Forces Analysis: Proteases Market

Figure 30 Asia-Pacific is Projected to Grow at the Highest Rate During the Forecast Period (2016-2021)

Figure 31 Asia-Pacific is Projected to Dominate the Proteases Market Throughout the Forecast Period (2016-2021)

Figure 32 Proteases Market Share, By Method of Production, 2016

Figure 33 Market Share, By Formulation, 20162021

Figure 34 Soaps & Detergents is Estimated to Dominate the Proteases Enzymes Market, 2016

Figure 35 Proteolytic Hydrolysis Process in Cheese Making

Figure 36 Food & Beverages Market Size, By Region, 2016 vs 2021

Figure 37 Soaps & Detergents Market Size, By Region, 2016 vs 2021

Figure 38 Geographic Snapshot (20162021): Asia-Pacific Markets are Emerging as New Hot Spots

Figure 39 North American Proteases Market Snapshot: U.S. Dominated the Market With the Largest Share in 2015

Figure 40 European Proteases Market: Germany Dominated the Market With the Largest Share in 2015

Figure 41 Asia-Pacific Proteases Market: China & India to Drive Regional Market Growth

Figure 42 RoW Proteases Market: Latin America to Drive Regional Market Growth

Figure 43 Key Companies Preferred Expansion & Investment Over Other Strategies Between 2010 & 2015

Figure 44 Market Share Analysis. 2015

Figure 45 Key Players Extensively Adopted Expansions & Investments, New Product Launches, and Acquisitions Strategies to Fuel Growth of the Proteases Market Between 2010 & 2015

Figure 46 Annual Developments in the Global Proteases Market, 20102015

Figure 47 Geographic Revenue Mix of Top Five Market Players

Figure 48 Novozymes A/S: Company Snapshot

Figure 49 Novozymes A/S: SWOT Analysis

Figure 50 Company Snapshot: Chr. Hansen Holdings A/S

Figure 51 Chr. Hansen Holdings A/S: SWOT Analysis

Figure 52 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 53 E. I Du Pont De Nemours and Company: SWOT Analysis

Figure 54 Associated British Food PLC: Company Snapshot

Figure 55 Associated British Food PLC: SWOT Analysis

Figure 56 Koninklijke DSM N.V.: Company Snapshot

Figure 57 Koninklijke DSM N.V.: SWOT Analysis

Figure 58 Dyadic International Incorporated: Company Snapshot

Growth opportunities and latent adjacency in Proteases Market