Procurement as a Service Market by Component (Strategic Sourcing, Spend Management, Category Management, Process Management, Contract Management, and Transactions Management), Vertical, Organization Size, and Region - Global Forecast to 2024

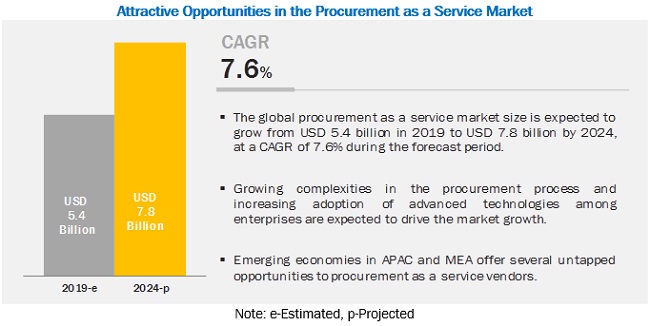

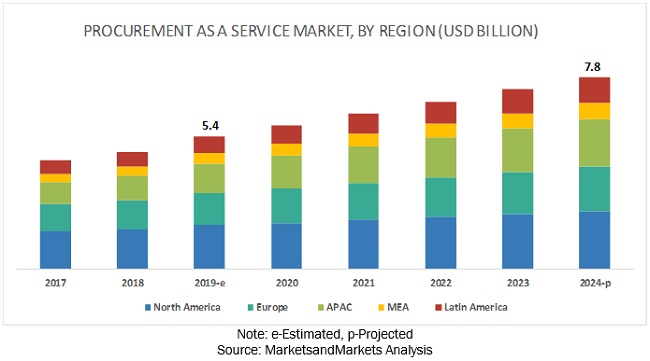

[117 Pages Report] The global Procurement as a Service Market size was valued USD 5.4 billion in 2019 and is projected to reach USD 7.8 billion by 2024, at a CAGR of 7.6%.The growing need among enterprises to reduce the costs associated with procurement operations and streamline procurement processes is expected to drive the growth of market across industry verticals globally.

By component, strategic sourcing segment to hold the largest market size during the forecast period

Strategic sourcing is an essential part of all businesses, regardless of the industry. Strategic sourcing includes the analysis of what an organization buys, from whom, at what price, and at what volume. Strategic sourcing involves various activities which includes identifying the companies external spend, conducting Request for Proposal (RFP)/Request for Quotation (RFQ) process, and negotiating prices with suppliers and setting up contracts. Strategic sourcing is all about finding the balance between the quality of goods and services, and its price. The strategic sourcing service providers have expertise in various sourcing activities and offer procurement as a service market to the enterprises for streamlining their sourcing operations.

Manufacturing industry vertical to hold the largest market size during the forecast period

Increasing global competition and rising consumer demand to drive companies to differentiate themselves from their competitors. Manufacturing companies must deliver higher quality at lower prices, newer features, and shorter production times while maintaining market presence and managing costs effectively. As a result, manufacturing companies are progressively adopting procurement outsourcing and technology driven solutions that enable them to streamline their manufacturing processes and achieve significant cost savings. This, in turn, enables them to focus on their competence areas, such as manufacturing skills, production, and on-time delivery. Procurement as a service in the manufacturing industry takes care of processes, such as spend analysis, sourcing and category management, supplier management, Procure-to-Pay (P2P) and Source-to-Pay (S2P) process management (while ensuring execution compliance), and planning and managing the supply chain costs.

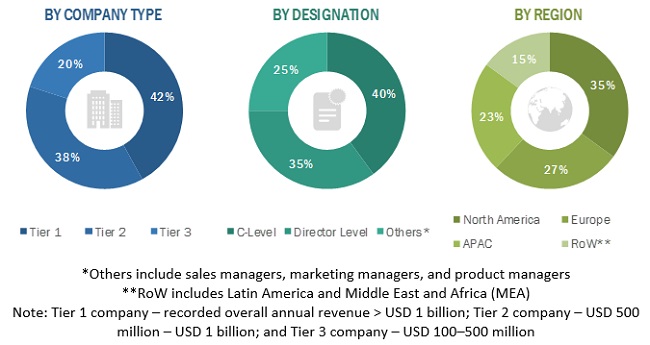

North America to account for the largest market size during the forecast period

North America is expected to have the largest market size in the procurement as a service market, as the region is a major hub for technological innovations and an early adopter of new technologies. The enterprises in the North American region are focusing on improving their procurement operations and implementing the best practices for procurement operations. Procurement outsourcing helps enterprises in increasing the efficiency of procurement processes. It also assists them in staying competitive in the market. The presence of major players in the region supports the demand for the adoption of procurement as a service.

Key Market Players

The major procurement as a service market vendors includes Accenture (Ireland), Infosys (India), GEP (US), Genpact (US), Proxima (UK), WNS (India), Capgemini (France), IBM (US), Wipro (India), HCL Technologies (India), TCS (India), Xchanging (UK), Aegis (India), Corbus (India), and CA Technologies (US).

Accenture is one of the leading vendors in the procurement as a service market with robust services, to help organizations save cost and enhance their business performance. With more than 16,000 skilled professionals, supplementary Source-to-Contract (S2C) or P2P services, operational support, and procurement operations, Accenture manages more than 35,000 projects annually. Accenture’s capability to offer industry-specific professional and management consulting services is its core competency. The company has alliances with many technologies, and sales and delivery companies to offer its own customers with more enhanced and extended services. Accenture’s strong financial growth in comparison with the other service providers is a significant strategic factor that attracts numerous investors and partners to invest in the company, thereby increasing its overall market value.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Market Value in 2024 |

USD 7.8 billion |

|

CAGR |

7.6% |

|

Segments covered |

Component, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Accenture (Ireland), Infosys (India), GEP (US), Genpact (US), Proxima (UK), WNS (India), Capgemini (France), IBM (US), Wipro (India), HCL Technologies (India), TCS (India), Xchanging (UK), Aegis (India), Corbus (India), and CA Technologies (US) |

This research report categorizes the market to forecast revenues and analyze trends in each of the following submarkets:

By Component, the procurement as a service market has been segmented as follows:

-

- Strategic Sourcing

- Spend Management

- Contract Management

- Category Management

- Process Management

- Transactions Management

By Organization Size, the market has been segmented as follows:

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Industry Vertical, the market has been segmented as follows:

- Manufacturing

- Retail and consumer packaged goods

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Energy and Utilities

- Healthcare

- Travel and Hospitality

- Others (government, and media and entertainment)

By Region, the procurement as a service market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- Australia and New Zealand (ANZ)

- China

- India

- Rest of APAC

-

MEA

- United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2019, Accenture launched SynOps, a human-machine operated engine that leverages data, advanced analytics, and Artificial Intelligence (AI) to help organizations achieve intelligent operations across key business functions. These functions include finance and accounting, marketing, and procurement.

Frequently Asked Questions (FAQ):

What are the top solutions category in the procurement as a service market?

What are the drivers and opportunities present in the procurement as a service marker?

Drivers:

- Growing Demand Among Enterprises to Streamline the Procurement Processes

- Imminent Need to Handle Compliance Polices and Contracts

Opportunities:

- Advent of Artificial Intelligence and Machine Learning in the Procurement Process

- High Adoption of Analytics Solutions to Improve the Procurement Process

What are major vendors in Procurement as a Service Market?

How big is the Procurement as a service market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Participants’ Profiles

2.2 Market Breakup and Data Triangulation

2.3 Competitive Leadership Mapping Research Methodology

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.4.2 Bottom-Up Approach

2.5 Market Forecast

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Procurement as a Service Market

4.2 Market in North America, By Vertical and Country

4.3 Market: Major Countries

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand Among Enterprises to Streamline the Procurement Processes

5.2.1.2 Imminent Need to Handle Compliance Polices and Contracts

5.2.2 Restraints

5.2.2.1 Growing Concerns for Data Security and Privacy Across Enterprises

5.2.3 Opportunities

5.2.3.1 Advent of Artificial Intelligence and Machine Learning in the Procurement Process

5.2.3.2 High Adoption of Analytics Solutions to Improve the Procurement Process

5.2.4 Challenges

5.2.4.1 Integration Issues With the Legacy Systems

5.2.4.2 Outages and Third-Party Dependence

5.3 Industry Trends

6 Procurement as a Service Market, By Component (Page No. - 37)

6.1 Introduction

6.2 Strategic Sourcing

6.2.1 Increasing Need to Manage the Network of Global Suppliers Among Enterprises to Draw the Demand for Strategic Sourcing

6.3 Spend Management

6.3.1 Growing Need Among Enterprises for Effectively Managing the Spending Expenditure to Boost the Demand for Spend Management

6.4 Category Management

6.4.1 Growing Need to Effectively Manage Various Categories and Ensuring Compliance With Contracts to Drive the Demand for Category Management

6.5 Process Management

6.5.1 Increasing Complexities of Procurement Processes to Drive the Demand for Process Management

6.6 Contract Management

6.6.1 Growing Demand Among Enterprises to Comply With the Financial Compliances to Boost the Demand for Contract Management

6.7 Transactions Management

6.7.1 Need for Simplifying Transactional Processes Across Verticals to Fuel the Demand for Transactions Management

7 Market, By Organization Size (Page No. - 45)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Need to Manage Complex Procurement Contracts to Drive the Adoption of Procurement as a Service Among Large Enterprises

7.3 Small and Medium-Sized Enterprises

7.3.1 Need for Eliminating Expenditures Associated With Staff Contracting and Technology Deployment to Boost the Demand for Procurement as a Service Among Small and Medium-Sized Enterprises

8 Market, By Vertical (Page No. - 49)

8.1 Introduction

8.2 Manufacturing

8.2.1 Achieving Shorter Production Time and Reducing Supply Chain Costs to Drive the Adoption of Procurement as a Service in the Manufacturing Vertical

8.3 Retail and Consumer Packaged Goods

8.3.1 Developing a Strong Procurement Infrastructure and Maintaining Ethical and Sustainable Business Practices to Drive the Growth of Procurement as a Service in Retail and Consumer Packaged Goods Vertical

8.4 Banking, Financial Services, and Insurance

8.4.1 Capabilities, Such as Spend Analytics, Market Intelligence, and Supplier Performance Management, to Accelerate the Growth of Procurement as a Service in BFSI Vertical

8.5 IT and Telecom

8.5.1 Improving Total Cost of Ownership and Achieving Success in Mergers and Acquisitions to Boost the Market Growth in the IT and Telecom Vertical

8.6 Energy and Utilities

8.6.1 Understanding Global and Regional Markets for Sourcing, Improving Protection Requirements, and Meeting Warranty Obligations to Drive the Growth of the Market in Energy and Utilities Vertical

8.7 Travel and Hospitality

8.7.1 Managing Suppliers and Contracts, and Enabling Strategic Sourcing to Bolster the Adoption of Procurement as a Service in Travel and Hospitality Vertical

8.8 Healthcare

8.8.1 Need for Increasing R&D and Business Efficiencies to Accelerate the Growth of Market in Healthcare Vertical

8.9 Others

9 Procurement as a Service Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.1.1 Presence of a Large Number of Multinational Companies and Managed Service Providers, and High Adoption of Advanced Solutions to Boost the Growth of Procurement as a Service in the US

9.2.2 Canada

9.2.2.1 Increasing Awareness About the Benefits of Procurement as a Service to Propel the Adoption of Procurement as a Service in Canada

9.3 Europe

9.3.1 United Kingdom

9.3.1.1 Growing Demand to Comply With the Procurement Regulations to Drive the Market Growth in the UK

9.3.2 Germany

9.3.2.1 Presence of a High Number of Manufacturing and Retail Companies and Need for Delivering Sustainable Business to Result in the Increase in the Adoption of Procurement as a Service in Germany

9.3.3 France

9.3.3.1 Technological Advancements and Rising Dependencies on Process Automation to Propel the Demand for Procurement as a Service in France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Need for Easy Raw Material Procurement and Finest Suppliers’ Selection to Drive the Growth of the Procurement as a Service Market in China

9.4.2 India

9.4.2.1 Corporate and Consumer Favoring Government Regulations and Inclination Toward Automation Solutions to Propel the Demand for Procurement as a Service in India

9.4.3 Australia and New Zealand

9.4.3.1 Government Purchasing Initiatives and Maximizing Opportunities for Competitive Suppliers to Fuel the Growth of the Market in Australia and New Zealand

9.4.4 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 United Arab Emirates

9.5.1.1 Increasing Adoption of Technologies to Drive the Growth of Procurement as a Service in the UAE

9.5.2 Saudi Arabia

9.5.2.1 Procurement to be the Next Step of Advancement for Improving Operations and Services in the Middle East

9.5.3 South Africa

9.5.3.1 Growth of the Manufacturing Vertical, Coupled With the Retail and Consumer Goods Vertical, to Boost Procurement as a Service Adoption

9.5.4 Rest of Middle East and Africa

9.6 Latin America

9.6.1 Brazil

9.6.1.1 Growing Adoption of Cloud-Based Supply Chain Solutions to Boost the Demand for Procurement as a Service

9.6.2 Mexico

9.6.2.1 Increasing Focus Among Enterprises to Streamline the Procurement Processes to Draw the Demand for Procurement as a Service

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 79)

10.1 Overview

10.2 Competitive Scenario

10.2.1 Product/Solution Launches and Enhancements

10.2.2 Business Expansions

10.2.3 Partnerships, Agreements, Collaborations, and Acquisitions

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

11 Company Profiles (Page No. - 84)

11.1 Introduction

(Business Overview, Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.2 Accenture

11.3 Infosys

11.4 GEP

11.5 Genpact

11.6 Proxima

11.7 WNS

11.8 Capgemini

11.9 IBM

11.10 Wipro

11.11 HCL

11.12 TCS

11.13 Xchanging

11.14 Aegis

11.15 Corbus

11.16 CA Technologies

*Details on Business Overview, Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 110)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (49 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 use Case 1: Improved Savings Through Procurement Process Transformation

Table 4 use Case 2: Attaining Cost Reduction and Faster Project Delivery By Gaining Holistic Visibility Into Procurement Processes

Table 5 use Case 3: Consolidating Transactional Procurement and Eliminating Regional Inconsistencies and Inefficiencies

Table 6 Procurement as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 7 Strategic Sourcing: Market Size, By Region, 2017–2024 (USD Million)

Table 8 Spend Management: Market Size, By Region, 2017–2024 (USD Million)

Table 9 Category Management: Market Size, By Region, 2017–2024 (USD Million)

Table 10 Process Management: Market Size, By Region, 2017–2024 (USD Million)

Table 11 Contract Management: Market Size, By Region, 2017–2024 (USD Million)

Table 12 Transactions Management: Market Size, By Region, 2017–2024 (USD Million)

Table 13 Procurement as a Service Market Size, By Organization Size, 2017–2024 (USD Million)

Table 14 Large Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 15 Small and Medium-Sized Enterprises: Market Size, By Region, 2017–2024 (USD Million)

Table 16 Market, By Vertical, 2017–2024 (USD Million)

Table 17 Manufacturing: Market Size, By Region, 2017–2024 (USD Million)

Table 18 Retail and Consumer Packaged Goods: Market Size, By Region, 2017–2024 (USD Million)

Table 19 Banking, Financial Services, and Insurance: Market Size, By Region, 2017–2024 (USD Million)

Table 20 IT and Telecom: Market Size, By Region, 2017–2024 (USD Million)

Table 21 Energy and Utilities: Market Size, By Region, 2017–2024 (USD Million)

Table 22 Travel and Hospitality: Market Size, By Region, 2017–2024 (USD Million)

Table 23 Healthcare: Market Size, By Region, 2017–2024 (USD Million)

Table 24 Others: Market Size, By Region, 2017–2024 (USD Million)

Table 25 Market Size, By Region, 2017–2024 (USD Million)

Table 26 North America: Procurement as a Service Market Size, By Component, 2017–2024 (USD Million)

Table 27 North America: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 28 North America: Market Size, By Vertical, 2017–2024 (USD Million)

Table 29 North America: Market Size, By Country, 2017–2024 (USD Million)

Table 30 Europe: Market Size, By Component, 2017–2024 (USD Million)

Table 31 Europe: Procurement as a Service Market Size, By Organization Size, 2017–2024 (USD Million)

Table 32 Europe: Market Size, By Vertical, 2017–2024 (USD Million)

Table 33 Europe: Market Size, By Country, 2017–2024 (USD Million)

Table 34 Asia Pacific: Market Size, By Component, 2017–2024 (USD Million)

Table 35 Asia Pacific: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 36 Asia Pacific: Market Size, By Vertical, 2017–2024 (USD Million)

Table 37 Asia Pacific: Market Size, By Country, 2017–2024 (USD Million)

Table 38 Middle East and Africa: Market Size, By Component, 2017–2024 (USD Million)

Table 39 Middle East and Africa: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 40 Middle East and Africa: Procurement as a Service Market Size, By Vertical, 2017–2024 (USD Million)

Table 41 Middle East and Africa: Market Size, By Country, 2017–2024 (USD Million)

Table 42 Latin America: Market Size, By Component, 2017–2024 (USD Million)

Table 43 Latin America: Market Size, By Organization Size, 2017–2024 (USD Million)

Table 44 Latin America: Market Size, By Vertical, 2017–2024 (USD Million)

Table 45 Latin America: Procurement as a Service Market Size, By Country, 2017–2024 (USD Million)

Table 46 Product/Solution Launches and Enhancements, 2017–2019

Table 47 Business Expansions, 2018–2019

Table 48 Partnerships, Agreements, Collaborations, and Acquisitions, 2018–2019

Table 49 Evaluation Criteria

List of Figures (31 Figures)

Figure 1 Procurement as a Service Market: Research Design

Figure 2 Competitive Leadership Mapping: Criteria Weightage

Figure 3 Market: Bottom-Up and Top-Down Approaches

Figure 4 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 5 Strategic Sourcing Segment to Hold the Highest Market Share in 2019

Figure 6 Manufacturing Vertical to Account for the Highest Market Share in 2019

Figure 7 Growing Need for Optimizing the Procurement Process and Improving Its Efficiency to Drive the Market During the Forecast Period

Figure 8 Manufacturing Vertical and United States Region to Dominate the Procurement as a Service Market in North America in 2019

Figure 9 India to Grow at the Highest CAGR in the Market During the Forecast Period

Figure 10 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 11 Spend Management Segment to Grow at the Highest CAGR During the Forecast Period

Figure 12 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 13 Retail and Consumer Packaged Goods Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia Pacific to Witness Significant Growth During the Forecast Period

Figure 15 North America: Market Snapshot

Figure 16 Asia Pacific: Market Snapshot

Figure 17 Key Developments in the Market, 2017–2019

Figure 18 Procurement as a Service Market (Global), Competitive Leadership Mapping, 2019

Figure 19 Accenture: Company Snapshot

Figure 20 Accenture: SWOT Analysis

Figure 21 Infosys: Company Snapshot

Figure 22 Infosys: SWOT Analysis

Figure 23 GEP: SWOT Analysis

Figure 24 Genpact: Company Snapshot

Figure 25 Genpact: SWOT Analysis

Figure 26 WNS: Company Snapshot

Figure 27 WNS: SWOT Analysis

Figure 28 Capgemini: Company Snapshot

Figure 29 IBM: Company Snapshot

Figure 30 Wipro: Company Snapshot

Figure 31 HCL: Company Snapshot

The study involved 4 major activities in estimating the current market size of the procurement as a service market. An exhaustive secondary research was done to collect information about the market. The next step was to validate the findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The procurement as a service market comprises several stakeholders, such as procurement as a service provider, Business Process Outsourcing (BPO) vendors, procurement solution providers, cloud solution providers, cloud service brokers, system integrators, consulting service providers, managed service providers, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the procurement as a service market consists of enterprises from different industry verticals, such as Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) and telecom, retail and consumer packaged goods, energy and utilities, healthcare, travel and hospitality, manufacturing, travel and hospitality, and others (government and media and entertainment). The supply side includes procurement outsourcing providers offering procurement as a service. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the procurement as a service market. The methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To define, describe, and forecast the procurement as a service market by component, vertical, organization size, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regional segments, namely, North America, Europe, Asia Pacific (APAC), MEA, and Latin America

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze the competitive developments, such as agreements, alliances, joint ventures, and mergers and acquisitions, in the procurement as a service market

Key Questions Addressed by the Report

- How is the adoption trend of procurement as a service across major economies?

- What are the challenges faced by procurement as a service vendor in the global market?

- What is the potential of the emerging application areas of procurement as a service?

- What are various developments happened in the global procurement as a service market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Procurement as a Service Market

what is the growth rate from 2022 to 2028?

Understand the Procurement as a service Market.

Need insight into the Procurement as a Service market around the Globe, in Africa and South Africa.

Gather insights into Global Procurement as a Service market, its opportunity areas, market size and also the market size captured by leading firms like Deloitte, Accenture in this space.