Power Supply Market by Output Power, Product Type, Vertical (Lighting, Consumer Electronics, Telecommunications, Transportation, Food & Beverages, Medical & Healthcare, Military & Aerospace, Industrial), and Geography - Global Forecast to 2023

[152 Pages Report] The global power supply market is expected to grow from an estimated USD 25.20 billion in 2018 to USD 34.92 billion by 2023, at a CAGR of 6.7% during the forecast period. Power supplies are being used in many verticals such as lighting, telecommunications, consumer electronics, medical & healthcare, industrial, food & beverages, transportation, and military & aerospace. The base year considered for the study is 2017, and the forecast has been provided for the period from 2018 to 2023.

Market Dynamics

Drivers

- Growing adoption of home and building automation systems

- Emerging telecommunications sector

- Increasing demand for energy-efficient devices/appliances

Restraints

- Increase in adoption of high-voltage direct current (HVDC) and renewable energy sources may affect growth of AC-DC market

- Various regional/country-wise regulatory and safety standards

Opportunities

- Growing use of data centers

- Increasing requirement of power supply in medical and healthcare devices

Challenges

- Stringent design considerations for input power/nonstandard AC & DC inputs

Lighting vertical to drive global power supply market during forecast period

In the lighting industry, LED lighting has a significant growth potential owing to the increasing consumer demand for energy-efficient lighting systems, declining prices of LEDs, and growing penetration of LEDs as a light source in several lighting applications. LED lighting is a significant consumer of power supplies, thereby driving the growth of the market in the near future.

Moreover, the power supply types, such as enclosed and open frame, as well as special purpose AC-DC, led lighting power supplies to be used for various lighting applications (such as architectural lighting, medical lighting, transportation lighting, entertainment lighting, safety and security lighting, street lighting, lit signage and moving signs boards, displays) and commercial applications (such as refrigerator lighting and outdoor area lightings). Such huge usage of power supplies for lighting applications is likely to upsurge the growth of power supply market in the near future.

The following are the major Objectives of the Study.

- To describe and forecast the market, in terms of value, by output power, product type, and vertical

- To describe and forecast the market, in terms of value, by regionNorth America, Asia Pacific (APAC), Europe, Rest of the World (RoW)

- To provide detailed information regarding major factors influencing growth (drivers, restraints, opportunities, and challenges)

- To study complete value chain of power supplies and analyze current and future market trends

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the power supply ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, collaborations, contracts, agreements, expansions and partnerships in

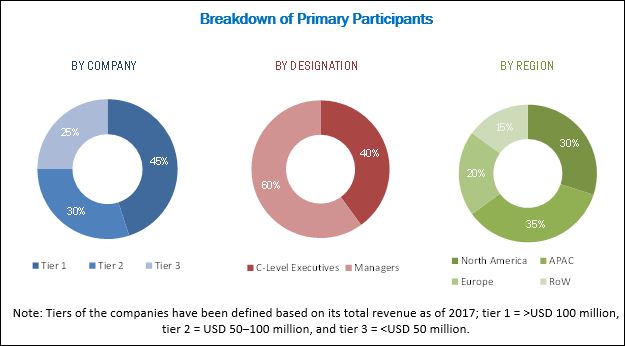

During this research study, major players operating in the power supply market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in the power supply market include MEAN WELL (Taiwan), TDK Lambda (Japan), Siemens (Germany), General Electric (US), XP Power (US), Murata Power Solutions (Japan), Artesyn (US), Phoenix Contact (Germany), Delta Electronics (Taiwan), Cosel (Japan), PULS (Germany), CUI (US), Acbel Polytech (Taiwan), Salcom (Finland), LITE-ON Power System Solutions (US), FSP (Taiwan), Power Innovation (Germany), MTM Power (Germany), and Power Systems & Controls (US).

Critical questions which the report answers

- Which technological disruptions will impact the market in the next 5 years?

- Which are the key players in the market and how intense is the competition?

Target Audience:

- Raw material and manufacturing equipment suppliers

- Power supply product manufacturers

- Power supply original equipment manufacturers (OEMs)

- Distributors and traders

- Research organizations

- Organizations, forums, alliances, and associations

Report Scope:

Market by Output Power

- Low

- Medium

- High

Market by Type

- AC-DC

- DC-DC

Market by Vertical

- Telecommunications

- Consumer Electronics

- Medical & Healthcare

- Military & Aerospace

- Transportation

- Lighting

- Food & Beverages

- Industrial

Market by Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

Country-Wise Breakup for RoW

- Country-wise split of the market in RoW

The overall power supply market is expected to grow from USD 25.20 billion in 2018 to USD 34.92 billion by 2023, at a CAGR of 6.7%. Growing adoption of home and building automation systems, emerging telecommunications sector, increasing demand for energy-efficient devices/appliances are the key factors driving the growth of this market.

A power supply is a device that accepts an AC power input, rectifies and filters it and then applies the resulting DC voltage to a regulator circuit that provides a constant DC output voltage. There are a wide variety of AC-DC and DC-DC power supplies that can have an output voltage from less than 1 V to thousands of volts and output power ranging from 0.1 W to thousands of watts. AC-DC and DC-DC power supply applications from verticals such as lighting, industrial, consumer electronics, and medical are driving the market by integrating it in various devices such as street lighting, home lighting, wearable bands, smartphones, and patient-monitoring devices.

The power supply market has been segmented by output power into low, medium, and high. The market for power supply with low output power is expected to grow at the highest CAGR from 2018 to 2023. The high adoption of power supply with low output power in the telecommunications and consumer electronics applications contribute to the rapid growth of the said market.

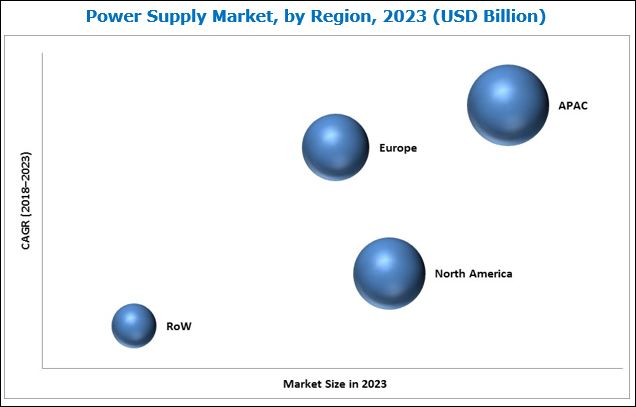

The power supply market in APAC is expected to grow at the highest CAGR during the forecast period. Moreover, APAC is expected to dominate the overall power supply during the forecast period. This growth can be attributed to the strong demand for consumer equipment, including portable healthcare electronics and white goods. Increasing digitization and automation in various sectors is likely to generate demand for power supplies in APAC.

Lighting, industrial, and consumer electronics verticals drive growth of power supply market

Lighting

In the lighting industry, LED lighting has significant growth potential owing to the increasing consumer demand for energy-efficient lighting systems, declining prices of LEDs, and growing penetration of LEDs as a light source in several lighting applications. LED lighting is a significant consumer of power supplies, thereby driving the growth of the market in the near future.

Moreover, the power supply types, such as enclosed and open frame, as well as special purpose AC-DC, led lighting power supplies to be used for various lighting applications (such as architectural lighting, medical lighting, transportation lighting, entertainment lighting, safety and security lighting, street lighting, lit signage and moving signs boards, displays) and commercial applications (such as refrigerator lighting and outdoor area lightings). Such huge usage of power supplies for lighting applications is likely to upsurge the growth of power supply market in the near future.

Industrial

The industrial vertical consists of various industries such as building and industrial automation, warehousing, process automation, semiconductor, automotive, wastewater treatment, and renewable energy. The aforementioned industries require/utilize AC-DC and DC-DC power supplies in a number of industrial applications such as test and measurement instruments, industrial electric equipment, factory automation equipment, home and building automation systems, and among others.

Consumer Electronics

Consumer electronics holds a major share of the power supply market. With increasing digitization and miniaturization, consumer electronics products, such as PCs, laptops, game consoles, DVD players, printers, scanners, hard disk drives, and cameras, are becoming portable, compact, and power- and cost-efficient. With the introduction of new and innovative technologies, such as IoT, more devices are getting connected, e.g., wireless printers. These devices require low DC power for efficient functioning. Therefore, AC-DC and DC-DC power supplies are among the essential components for consumer electronics devices/equipment. The introduction of new technologies is expected to drive the growth of the market for consumer electronics devices/equipment. Security systems, electronics equipment and instruments, lighting control systems, LED display applications, household appliances, gaming devices, information technology equipment, and consumer electronics products are among the various consumer systems and devices that require AC-DC and DC-DC power supplies.

Critical questions the report answers:

- Which technological disruptions will impact the power supply market in the next 5 years?

- Which are the key players in the market and how intense is the competition?

A number of regulatory international and domestic standards are imposed by governments to standardize products/end-item equipment. These standards vary from one country to another; therefore, to achieve significant sales, power supply and end-item equipment manufacturers must adhere to standards that are specific to a country or a region. Moreover, the sales of power supplies, either as inbuilt or external types, depends on meeting the relevant safety standards applicable to specific territories. These standards are defined and administered by national or international agencies, with various government-recognized testing laboratories certifying statutory regulation compliances. The designers of such products or power supplies need to understand these standards even though they may not perform standards certification.

Major players operating in the power supply market include MEAN WELL (Taiwan), TDK Lambda (Japan), Siemens (Germany), General Electric (US), XP Power (US), Murata Power Solutions (Japan), Artesyn (US), Phoenix Contact (Germany), Delta Electronics (Taiwan), Cosel (Japan), PULS (Germany), CUI (US), Acopian (US), Acbel Polytech (Taiwan), Salcom (Finland), LITE-ON Power System Solutions (US), FSP (Taiwan), Power Innovation (Germany), MTM Power (Germany), and Power Systems & Controls (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Market Share Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Growth Opportunities in Power Supply Market

4.2 Market, By Vertical

4.3 Market, By Region and Output Power

4.4 Market, By Country (2018)

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Adoption of Home and Building Automation Systems

5.2.1.2 Emerging Telecommunications Sector

5.2.1.3 Increasing Demand for Energy-Efficient Devices/Appliances

5.2.2 Restraints

5.2.2.1 Increase in Adoption of High-Voltage Direct Current (HVDC) and Renewable Energy Sources May Affect Growth of AC-DC Market

5.2.2.2 Various Regional/Country-Wise Regulatory and Safety Standards

5.2.3 Opportunities

5.2.3.1 Growing Use of Data Centers

5.2.3.2 Increasing Requirement of Power Supply in Medical and Healthcare Devices

5.2.4 Challenges

5.2.4.1 Stringent Design Considerations for Input Power/Nonstandard AC & DC Inputs

5.3 Value Chain Analysis

6 Power Supply Market, By Output Power (Page No. - 39)

6.1 Introduction

6.2 Power Supply With Low Output (500 W and Below)

6.3 Power Supply With Medium Output (5001,000 W)

6.4 Power Supply With High Output (More Than 1,000 W)

7 Power Supply Market, By Product Type (Page No. - 43)

7.1 Introduction

7.2 AC-DC Power Supply

7.2.1 Enclosed/Encapsulated

7.2.2 Din Rail

7.2.3 Open Frame

7.2.4 PCB Mount

7.2.5 Configurable Type AC-DC Power Supply

7.2.6 Others

7.3 DC-DC Converter

7.3.1 Isolated

7.3.2 Non-Isolated

8 Power Supply Market, By Vertical (Page No. - 50)

8.1 Introduction

8.2 Telecommunications

8.3 Consumer Electronics

8.4 Medical & Healthcare

8.5 Military & Aerospace

8.6 Transportation

8.7 Lighting

8.8 Food & Beverages

8.9 Industrial

9 Geographic Analysis (Page No. - 82)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 APAC

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.2 South America

9.5.3 Africa

10 Competitive Landscape (Page No. - 102)

10.1 Overview

10.2 Competitive Scenario

10.3 Competitive Situation and Trend

10.3.1 Product Launches/Developments

10.3.2 Others

11 Company Profiles (Page No. - 107)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Key Players

11.1.1 Mean Well

11.1.2 TDK Lambda

11.1.3 Siemens

11.1.4 General Electric

11.1.5 XP Power

11.1.6 Murata Power Solutions

11.1.7 Artesyn

11.1.8 Phoenix Contact

11.1.9 Delta Electronics

11.1.10 Cosel

11.1.11 Puls

11.2 Other Key Players

11.2.1 CUI

11.2.2 Acopian

11.2.3 Acbel Polytech

11.2.4 Salcomp

11.2.5 Lite-On Power Sysytem Solutions

11.2.6 FSP

11.2.7 Power Innovation

11.2.8 MTM Power

11.2.9 Power Systems & Controls

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 146)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (85 Tables)

Table 1 Single-Phase Voltage and Frequency Specification for Different Countries

Table 2 Power Supply Market, By Output Power, 20162023 (USD Billion)

Table 3 Market, By Product Type, 20162023 (USD Billion)

Table 4 AC-DC Market, By Vertical, 20162023 (USD Million)

Table 5 DC-DC Market, By Vertical, 20162023 (USD Million)

Table 6 Market, By Vertical, 20162023 (USD Billion)

Table 7 Market for Telecommunications, By Product Type, 20162023 (USD Million)

Table 8 Market for Telecommunications, By Output Power, 20162023 (USD Million)

Table 9 Market for Telecommunications, By Region, 20162023 (USD Million)

Table 10 Market in North America for Telecommunications, By Country, 20162023 (USD Million)

Table 11 Market in Europe for Telecommunications, By Country, 20162023 (USD Million)

Table 12 Market in APAC for Telecommunications, By Country, 20162023 (USD Million)

Table 13 Market in RoW for Telecommunications, By Country, 20162023 (USD Million)

Table 14 Market for Consumer Electronics, By Product Type, 20162023 (USD Million)

Table 15 Market for Consumer Electronics, By Output Power, 20162023 (USD Million)

Table 16 Market for Consumer Electronics, By Region, 20162023 (USD Million)

Table 17 Market in North America for Consumer Electronics, By Country, 20162023 (USD Million)

Table 18 Market in Europe for Consumer Electronics, By Country, 20162023 (USD Million)

Table 19 Market in APAC for Consumer Electronics, By Country, 20162023 (USD Million)

Table 20 Market in RoW for Consumer Electronics, By Country, 20162023 (USD Million)

Table 21 Medical & Healthcare Applications

Table 22 Market for Medical, By Product Type, 20162023 (USD Million)

Table 23 Market for Medical, By Output Power, 20162023 (USD Million)

Table 24 Market for Medical, By Region, 20162023 (USD Million)

Table 25 Market in North America for Medical, By Country, 20162023 (USD Million)

Table 26 Market in Europe for Medical, By Country, 20162023 (USD Million)

Table 27 Market in APAC for Medical, By Country, 20162023 (USD Million)

Table 28 Market in RoW for Medical, By Country, 20162023 (USD Million)

Table 29 Market for Military, By Product Type, 20162023 (USD Million)

Table 30 Market for Military, By Output Power, 20162023 (USD Million)

Table 31 Market for Military, By Region, 20162023 (USD Million)

Table 32 Market in North America for Military, By Country, 20162023 (USD Million)

Table 33 Market in Europe for Military, By Country, 20162023 (USD Million)

Table 34 Market in APAC for Military, By Country, 20162023 (USD Million)

Table 35 Market in RoW for Military, By Country, 20162023 (USD Million)

Table 36 Market for Transportation, By Product Type, 20162023 (USD Million)

Table 37 Market for Transportation, By Output Power, 20162023 (USD Million)

Table 38 Market for Transportation, By Region, 20162023 (USD Million)

Table 39 Market in North America for Transportation, By Country, 20162023 (USD Million)

Table 40 Market in Europe for Transportation, By Country, 20162023 (USD Million)

Table 41 Market in APAC for Transportation, By Country, 20162023 (USD Million)

Table 42 Market in RoW for Transportation, By Country, 20162023 (USD Million)

Table 43 Market for Lighting, By Product Type, 20162023 (USD Million)

Table 44 Market for Lighting, By Output Power, 20162023 (USD Million)

Table 45 Market for Lighting, By Region, 20162023 (USD Million)

Table 46 Market in North America for Lighting, By Country, 20162023 (USD Million)

Table 47 Market in Europe for Lighting, By Country, 20162023 (USD Million)

Table 48 Market in APAC for Lighting, By Country, 20162023 (USD Million)

Table 49 Market in RoW for Lighting, By Country, 20162023 (USD Million)

Table 50 Market for Food & Beverages, By Product Type, 20162023 (USD Million)

Table 51 Market for Food & Beverages, By Output Power, 20162023 (USD Million)

Table 52 Market for Food & Beverages, By Region, 20162023 (USD Million)

Table 53 Market in North America for Food & Beverages, By Country, 20162023 (USD Million)

Table 54 Market in Europe for Food & Beverages, By Country, 20162023 (USD Million)

Table 55 Market in APAC for Food & Beverages, By Country, 20162023 (USD Million)

Table 56 Market in RoW for Food & Beverages, By Country, 20162023 (USD Million)

Table 57 Market for Industrial, By Product Type, 20162023 (USD Million)

Table 58 Market for Industrial, By Output Power, 20162023 (USD Million)

Table 59 Market for Industrial, By Region, 20162023 (USD Million)

Table 60 Market in North America for Industrial, By Country, 20162023 (USD Million)

Table 61 Market in Europe for Industrial, By Country, 20162023 (USD Million)

Table 62 Market in APAC for Industrial, By Country, 20162023 (USD Million)

Table 63 Market in RoW for Industrial, By Country, 20162023 (USD Million)

Table 64 Market, By Region, 20162023 (USD Billion)

Table 65 Market in North America, By Country, 20162023 (USD Million)

Table 66 Market in US, By Vertical, 20162023 (USD Million)

Table 67 Market in Canada, By Vertical, 20162023 (USD Million)

Table 68 Market in Mexico, By Vertical, 20162023 (USD Million)

Table 69 Market in Europe, By Country, 20162023 (USD Million)

Table 70 Market in UK, By Vertical, 20162023 (USD Million)

Table 71 Market in Germany, By Vertical, 20162023 (USD Million)

Table 72 Market in France, By Vertical, 20162023 (USD Million)

Table 73 Market in Rest of Europe, By Vertical, 20162023 (USD Million)

Table 74 Market in APAC, By Country, 20162023 (USD Billion)

Table 75 Market in China, By Vertical, 20162023 (USD Million)

Table 76 Market in Japan, By Vertical, 20162023 (USD Million)

Table 77 Market in India, By Vertical, 20162023 (USD Million)

Table 78 Market in Rest of APAC, By Vertical, 20162023 (USD Million)

Table 79 Market in RoW, By Region, 20162023 (USD Million)

Table 80 Market in Middle East, By Vertical, 20162023 (USD Million)

Table 81 Market in South America, By Vertical, 20162023 (USD Million)

Table 82 Market in Africa, By Vertical, 20162023 (USD Million)

Table 83 Key Product Launches/Developments (20152018)

Table 84 Key Acquisitions and Expansions, and Partnerships/Agreements (20152018)

Table 85 Prominent Player in the Power Supply Market

List of Figures (38 Figures)

Figure 1 Power Supply Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of Research Study

Figure 8 AC-DC to Dominate Market During Forecast Period

Figure 9 China to Dominate Market in APAC During Forecast Period

Figure 10 APAC to Be Fastest-Growing Market for Power Supplies During Forecast Period

Figure 11 Increasing Adoption of Power Supply in Lighting, Consumer Electronics and Telecommunications Devices in APAC Drives Power Supply Market

Figure 12 Market for Lighting to Grow at Highest CAGR During Forecast Period

Figure 13 APAC Held Largest Share of Market for Lighting Vertical in 2017

Figure 14 APAC to Grow at Highest CAGR in Market From 2018 to 2023

Figure 15 Market Dynamics of Market

Figure 16 Value Chain Analysis: Major Value Added During Original Equipment Manufacturing Phase

Figure 17 Power Supply Market, By Output Power

Figure 18 Low Output Power Supplies to Dominate Market During Forecast Period

Figure 19 Power Supply Market, By Product Type

Figure 20 Lighting to Dominate AC-DC Market During Forecast Period

Figure 21 Market, By Vertical

Figure 22 Lighting to Dominate Market During Forecast Period

Figure 23 APAC to Dominate Market for Telecommunication During the Forecast Period

Figure 24 Market: Geography Snapshot

Figure 25 North America: Snapshot of Power Supply Market

Figure 26 Europe: Snapshot of Power Supply Market

Figure 27 APAC: Snapshot of Power Supply Market

Figure 28 RoW: Snapshot of Power Supply Market

Figure 29 Companies in the Market Adopted Product Launches/ Developments as Key Growth Strategy From 2015 to 2018

Figure 30 Power Supply Market Evaluation Framework

Figure 31 Mean Well: Company Snapshot

Figure 32 TDK Lambda: Company Snapshot

Figure 33 Siemens: Company Snapshot

Figure 34 General Electric: Company Snapshot

Figure 35 XP Power: Company Snapshot

Figure 36 Murata Power Solutions: Company Snapshot

Figure 37 Delta Electronics: Company Snapshot

Figure 38 Cosel: Company Snapshot

Growth opportunities and latent adjacency in Power Supply Market