Industrial Power Supply Market by Type (AC-DC and DC-DC Converter), Output Power (up to 500W, 500-1000W, 1000W-10kW, 10-75kW, 75-150kW), Vertical (Medical & Healthcare, Transportation, Military & Aerospace, Automobile), Region - Global Forecast to 2027

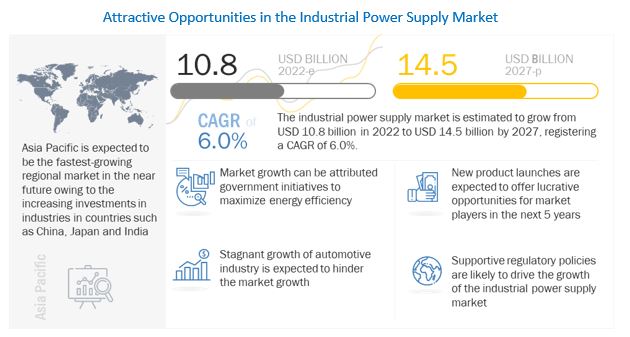

[269 Pages Report] The global industrial power supply market in terms of revenue was estimated to be worth $10.8 billion in 2022 and is poised to reach $14.5 billion by 2027, growing at a CAGR of 6.0% from 2022 to 2027. The growth of the market can be attributed to growing investments in the energy efficient devices in the industrial sectors and adoption of robots across several industries. The growing sales in electric vehicles is also an important driver for industrial power supply market.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Power Supply Market Dynamics

Driver: Growing sales of electric vehicles worldwide

A decade ago, the only real fuel choices were fossil fuels, diesel, or petrol. However, mild hybrid electric vehicles (MHEVs), hybrid electric vehicles (HEVs), and battery electric vehicles (BEVs) have recently been commercialized. The demand for electric vehicles is growing significantly across the world owing to the ambitious plans and initiatives by the governments of different countries, such as India, China, the US, France, and the UK, to reduce carbon emission levels by promoting the use of eco-friendly vehicles. These governments offer several incentives to promote the adoption of electric vehicles and are focused on developing public electric vehicle charging infrastructure. DC–DC converters are used in electric vehicles to increase or decrease voltage levels generated through attached batteries based on the power requirements of different automotive systems. These converters not only improve power flow and energy efficiency but also reduce the fuel consumption of vehicles and increase the vehicle output power per unit volume. For vehicles with limited space due to the deployment of excessive electronics, a DC–DC converter is a reliable option because it is lightweight, compact, highly efficient, and has low electromagnetic interference and fewer current/voltage ripples. These converters are crucial for electric vehicles to interface fuel cells/batteries or supercapacitor modules to the DC-link. Such application has the potential to act as a driver for the industrial power supply industry during the forecast period

Restraint: Increasing adoption of HVDC and renewable energy source

The conventional power transfer method, which includes AC–DC conversion, results in a 5–20% power loss. Many regions, such as the Americas, Asia, and Europe, are moving toward Ultrahigh-Voltage DC (UHV DC). The UHVDC transmission scheme is more cost-effective than an equivalent AC transmission scheme. The losses on the HVDC lines are roughly 3.5% per 1,000 km compared to 6.7% for AC lines at similar voltage levels. Hence, the adoption of DC power sources can be a better solution in the near future. Renewable energy resources are also being increasingly used. According to the International Energy Agency (IEA), the share of renewable energy in the global power generation mix increased from 22% in 2013 to 29% in 2020. China accounted for nearly 50% of the total renewable power capacity growth in 2020; this figure is expected to reach 58% by the end of 2022. Renewable sources such as solar and wind supply DC energy; the generated energy can be stored in batteries, thereby making a compatible interface with respect to renewable resources. The rising adoption of renewable energy sources and the increasing adoption of HVDC will hinder the growth of the AC–DC power supply market in the near future, which, in turn, will act as a restraint for the growth of the market.

Opportunities: Increasing demand for UAVs and growing adoption of IOT in various sectors

IoT has made its mark in mainstream businesses, with the number of entities that use it increasing significantly over the past three to four years. Industrial sectors that leverage IoT include manufacturing, mobility, energy, retail, and healthcare. The increasing application of IoT has led to Murata Manufacturing Co. Ltd. introducing compact and low-profile DC-DC converters, PoE IEEE 8.2.3bt, which enable the delivery of maximum power supply over LAN cables used to configure a network. This also provides higher data speed, allows the transfer of larger volumes of data in the fastest possible manner, and helps in better connectivity.

The aerospace industry is one of the fastest growing in the world. With the increase in operations related to unmanned aerial vehicles (UAVs) and satellites, applications related to the aerospace industry are also increasing. With rising military operations, the drone market is poised to expand across various regions; Chances of errors are greater in such remotely controlled aircraft, and a standardized flow of electricity toward various parts of the UAVs is imperative. Power DC-DC converters can be used to increase the efficiency of operations of UAVs. With increasing demand for drones in military, agriculture, logistics, and transportation, the demand for DC-DC converters will also rise during the forecast period. Power electronics companies are also focusing on manufacturing more efficient DC-DC converters for the aerospace industry. For instance, in January 2021, Vicor Power (US) announced its support to Boeing (US) for the manufacture of the O3b mPOWER satellite. The DC-DC converter used in the satellite is the first radiant fault-tolerant converter and has a form factor of SM-Chip, capable of working even in low-power mode.

Challenges: Availability of inexpensive products of inferior quality in gray market

The market is highly fragmented, with many local and international players. Product quality is a primary parameter for any manufacturer to differentiate from others. The organized sector mainly targets industrial buyers and maintains superior product quality by adhering to various industrial standards. Players in the unorganized sector, mainly local Chinese manufacturers, offers cheaper alternatives of inferior quality to enter untapped local markets. Local manufacturers in most countries compete strongly with global suppliers in the respective markets by offering inexpensive and low-quality power supply products that emit toxic gases when heated or exposed to fire. These gray market players outperform the big players in terms of price competitiveness and local distribution network; this is a major challenge for the big players in the market.

Industrial Power Supply Market Size

The global industrial power supply market units used in industrial applications such as manufacturing, automation, and transportation is referred to as the industrial power supply market. Industrial power supply offer consistent and dependable electricity to industrial equipment, hence increasing efficiency, production, and safety. Factors such as the increasing adoption of automation and Industry 4.0 technologies, the need for efficient and dependable power solutions, and the growing need for renewable energy sources are driving the market for industrial power supply. A few large players dominate the global industrial power supply market, including Siemens AG, ABB Ltd., Delta Electronics, Inc., and Schneider Electric SE. The market is divided into four sections: type, output power, input voltage, and end-use industry.

Market Trends

Robotics segment, by vertical, is expected to grow at the highest CAGR during forecast period

The robotics segment is expected to register the highest CAGR of 7.9% during the forecast period. Robotics applications of industrial power supplies include factory and warehouse automation systems, goods handling and transportation systems, manufacturing and packaging systems, and automated assembly systems.

By output power, very low output (up to 500 W)segment is expected to be the most significant contributor to the global industrial power supply market during the forecast period

By output power, the industrial power system market has been segmented into very low output (up to 500 W), low output (500−1,000 W), medium output (1,000 W−10 kW), high output (10−75 kW), and very high output (75−150 kW). very low output (up to 500 W) is expected to be the largest segment during the forecast period. The rising use of automation solutions and digital technology by industries based in China, India, and Japan is the prime reason for the growth of this market.

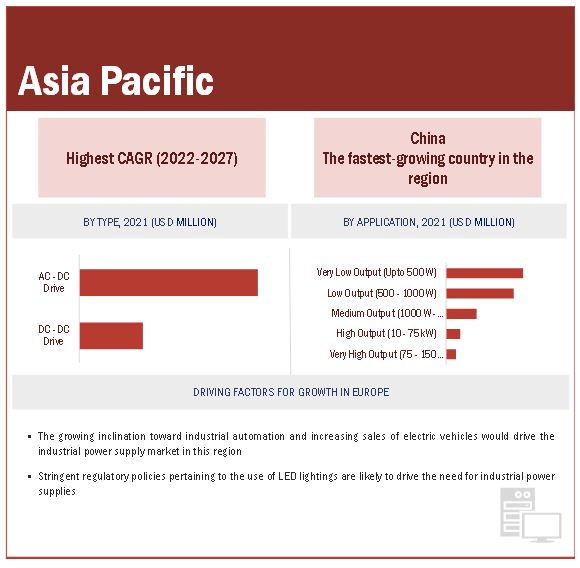

Asia Pacific: The largest and fastest industrial power supply market

Asia Pacific is expected to dominate the global industrial power supply market between 2022–2027, followed by North America and the Europe. The growing inclination of China and Japan toward industrial automation and the rising adoption of electric vehicles in the region are among the reasons for the region’s significant market size.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the industrial power supply market are TDK Lambda (Japan), Siemens (Germany), Delta Electronics (Taiwan), ABB (Switzerland), and Murata Power Solutions (US). Between 2018 and 2022, the companies adopted growth strategies such as sales contracts to capture a larger share of the market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Industrial power supply market by product type, output power, vertical, and region |

|

Geographies covered |

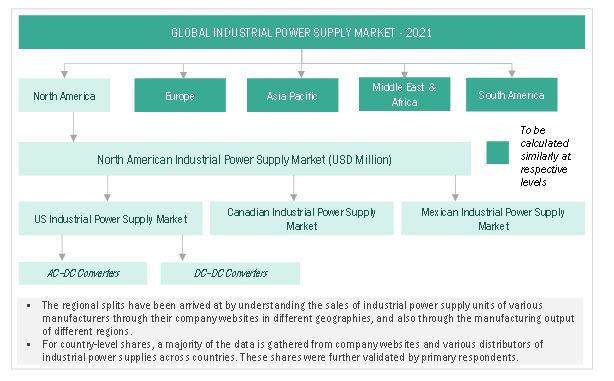

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

TDK Lambda (Japan), Siemens (Germany), Delta Electronics (Taiwan), ABB (Switzerland), Murata Power Solutions (US), Bel Fuse (US), Advanced Energy (US), SynQor (US), Astrodyne TDI (US), Traco Power (Switzerland), Vicor (US), RECOM (Austria), XP Power (Singapore), Mean Well (Taiwan), COSEL (Japan), MTM Power (Germany), PULS (Germany), Phoenix Contact (Germany), Amara Raja Power System (India), Inventus Power (US), and GlobTex (US). |

This research report categorizes the market by product type, output power, vertical, and region

On the basis of by type, the industrial power supply market has been segmented as follows:

- AC – DC Converter

- DC – DC Converter

On the basis of output power, the market has been segmented as follows:

- Very low output (up to 500 W)

- Low output (500−1,000 W)

- Medium output (1,000 W−10 kW)

- High output (10−75 kW)

- Very high output (75−150 kW)

On the basis of vertical, the industrial power supply market has been segmented as follows:

- Transportation

- Semiconductor

- Military & Aerospace

- Robotics

- Test & Measurement

- Industrial 3-D Printing

- Battery Charging & Test

- Laser

- Lighting

- Telecommunications

- Consumer Electronics

- Automotive

- Energy

- Food & Beverages

- Medical & Healthcare

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2022, ABB acquired electric vehicle (EV) commercial charging infrastructure solutions company, InCharge Energy. The addition of InCharge Energy will strengthen ABB’s E-mobility Division in the North American market by broadening its customer base and expanding its fleet electrification software and digital services offering.

- In December 2021, Delta Electronics acquired Universal Instruments, an automation solution company. Taking over the precision automation solutions company was expected to boost Delta Electronics smart manufacturing and industrial automation capabilities and generate substantial research and development and customer base synergies.

- In January 2019, TDK Lambda acquired Nextys, a company that designs and manufactures DIN rail power supplies and accessories. Through the acquisition, TDK Lambda hoped to strengthen its market position in DIN rail power supplies.

- In August 2018, Murata Power Solutions acquired Calex Manufacturing, Inc., located in Concord, California. Through this acquisition Murata Power Solutions expanded its product line

Frequently Asked Questions (FAQs):

What is the current size of the industrial power supply market?

The current market size of global Industrial power supply market is USD 10.3 billion in 2021.

What are the major drivers for industrial power supply market?

The growth of the industrial power supply market can be attributed to growing investments in the energy efficient devices in the industrial sectors and adoption of robots across several industries. The growing sales in electric vehicles in also an important driver for industrial power supply market.

Which is the fastest-growing region during the forecasted period in the industrial power supply market?

Asia Pacific is the fastest growing region in the global industrial power supply market between 2022–2027, followed by North America and the Europe. The growing inclination of China and Japan toward industrial automation and the rising adoption of electric vehicles in the region are among the reasons for the region’s significant market size

Which is the fastest-growing segment, by output power during the forecasted period in the industrial power supply market?

The very low output (up to 500 W) is expected to be the largest segment during the forecast period. The rising use of automation solutions and digital technology by industries based in China, India, and Japan is the prime reason for the growth of this market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 MARKET, BY PRODUCT TYPE: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET, BY OUTPUT POWER: INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL POWER SUPPLY MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Break-up of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH (DEMAND-SIDE)

FIGURE 3 MARKET: TOP-DOWN APPROACH

2.4 DEMAND-SIDE ANALYSIS

FIGURE 4 PARAMETERS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR INDUSTRIAL POWER SUPPLIES

2.4.1 CALCULATION OF DEMAND-SIDE ANALYSIS OF MARKET

2.4.2 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.5 SUPPLY-SIDE ANALYSIS

FIGURE 5 REVENUES OF MAJOR MANUFACTURERS FROM SALES OF INDUSTRIAL POWER SUPPLIES ACROSS GLOBAL REGIONS DETERMINED TO IDENTIFY MARKET SIZE

2.5.1 CALCULATION OF SUPPLY-SIDE ANALYSIS OF MARKET

FIGURE 6 MARKET: STEPS FOR SUPPLY-SIDE ANALYSIS

2.5.2 KEY PRIMARY INSIGHTS FOR SUPPLY-SIDE

2.6 GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 1 INDUSTRIAL POWER SUPPLY MARKET SNAPSHOT

FIGURE 7 ASIA PACIFIC DOMINATED MARKET IN 2021

FIGURE 8 AC−DC CONVERTERS TO HOLD LARGER MARKET SHARE IN 2027

FIGURE 9 VERY LOW OUTPUT (UP TO 500 W) SEGMENT TO HOLD LARGEST SIZE OF MARKET, BY OUTPUT POWER, DURING FORECAST PERIOD

FIGURE 10 MEDICAL & HEALTHCARE AND TRANSPORTATION VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL POWER SUPPLY MARKET

FIGURE 11 GROWING REQUIREMENT FOR ENERGY-EFFICIENT POWER SUPPLIES AND INCREASING ADOPTION OF ELECTRIC VEHICLES EXPECTED TO DRIVE MARKET GROWTH DURING 2022–2027

4.2 INDUSTRIAL POWER SUPPLY MARKET, BY REGION

FIGURE 12 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY PRODUCT TYPE

FIGURE 13 AC−DC CONVERTERS DOMINATED MARKET, BY PRODUCT TYPE, IN 2021

4.4 MARKET, BY OUTPUT POWER

FIGURE 14 INDUSTRIAL POWER SUPPLIES WITH VERY LOW OUTPUT (UP TO 500 W) ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.5 MARKET, BY VERTICAL

FIGURE 15 TRANSPORTATION VERTICAL HELD LARGEST SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 INDUSTRIAL POWER SUPPLY MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for energy-efficient devices in industrial sector

FIGURE 17 INDUSTRY ENERGY PRODUCTIVITY BY REGION

5.2.1.2 Growing sales of electric vehicles worldwide

FIGURE 18 ELECTRIC CAR SALES (2021)

5.2.1.3 Rising adoption of robots across several industries

5.2.2 RESTRAINTS

5.2.2.1 Increasing adoption of HVDC and renewable energy sources

5.2.2.2 Complexities associated with power supply equipment manufacturing

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for UAVs and growing adoption of IoT in various sectors

5.2.3.2 Rising need for high-frequency switching power supplies

5.2.4 CHALLENGES

5.2.4.1 Availability of inexpensive products of inferior quality in gray market

5.2.4.2 Varying frequency-specific standards across countries

TABLE 2 COUNTRY-WISE SINGLE-PHASE VOLTAGE AND FREQUENCY SPECIFICATIONS

5.2.4.3 Global shortage of semiconductors

5.3 COVID-19 IMPACT ANALYSIS

5.3.1 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COVID-19 GLOBAL PROPAGATION

FIGURE 20 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 3 INDUSTRIAL POWER SUPPLY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF SUBSTITUTES

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 THREAT OF NEW ENTRANTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP VERTICALS

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP VERTICALS (%)

5.5.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR TOP VERTICALS

TABLE 5 KEY BUYING CRITERIA, BY END USER

5.6 AVERAGE SELLING PRICE TREND

FIGURE 25 AVERAGE SELLING PRICES OF INDUSTRIAL POWER SUPPLY OF VARYING OUTPUT POWER

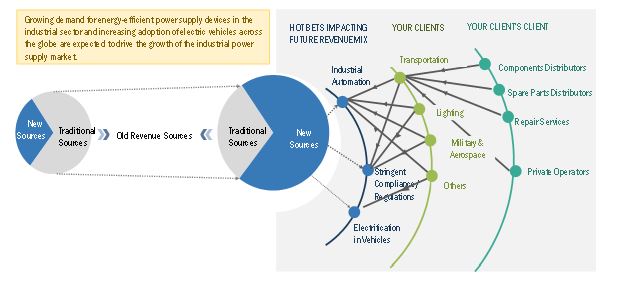

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

FIGURE 26 REVENUE SHIFT FOR MARKET PLAYERS

5.8 TRADE DATA STATISTICS

TABLE 6 REGION-WISE IMPORT DATA, 2019–2021 (USD MILLION)

TABLE 7 REGION-WISE EXPORT DATA, 2019–2021 (USD MILLION)

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 27 SUPPLY CHAIN OF MARKET

TABLE 8 MARKET: ECOSYSTEM

5.9.1 KEY INFLUENCERS

5.9.2 RAW MATERIAL/COMPONENT PROVIDERS

5.9.3 ASSEMBLERS/MANUFACTURERS

5.9.4 DISTRIBUTORS

5.9.5 END USERS

5.10 TECHNOLOGY ANALYSIS

5.10.1 ADOPTION OF METAL-OXIDE-SEMICONDUCTOR FIELD-EFFECT TRANSISTOR (MOSFET) TECHNOLOGY

5.11 MARKET MAP

FIGURE 28 INDUSTRIAL POWER SUPPLY MARKET MAP

5.12 KEY CONFERENCES AND EVENTS BETWEEN 2022 AND 2023

TABLE 9 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TARIFFS, CODES, AND REGULATIONS

5.13.1 TARIFFS RELATED TO MARKET

TABLE 10 IMPORT TARIFFS FOR HS 854231, ELECTRICAL STATIC CONVERTERS

5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.3 CODES AND REGULATIONS RELATED TO INDUSTRIAL POWER SUPPLY

TABLE 16 GLOBAL: CODES AND REGULATIONS

5.14 CASE STUDY ANALYSIS

5.14.1 AUTONOMOUS WAREHOUSE ROBOT MANUFACTURER USES ADVANCED POWER SUPPLY DEVICE TO INCREASE EFFICIENCY (2021)

5.14.1.1 Problem statement

5.14.1.2 Solution

5.14.2 ALLIANCE TECHNICAL SOLUTIONS (ATS) PROVIDES POWER SUPPLY SOLUTION FOR MOBILE TACTICAL RADAR

5.14.2.1 Problem statement

5.14.2.2 Solution

5.14.3 AUTOMOTIVE DC–DC CONVERTER MANUFACTURER SLASHES TEST TIME BY 95% (2018)

5.14.3.1 Problem statement

5.14.3.2 Solution

5.15 INDUSTRIAL POWER SUPPLY: PATENT ANALYSIS

5.15.1 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 17 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS, 2015–2021

6 INDUSTRIAL POWER SUPPLY MARKET, BY TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 29 INDUSTRIAL POWER SUPPLY MARKET SHARE, BY TYPE, 2021

TABLE 18 MARKET, BY PRODUCT TYPE, 2020–2027(USD MILLION)

TABLE 19 MARKET, BY PRODUCT TYPE, 2020–2027 (THOUSAND UNITS)

6.2 AC–DC CONVERTERS

6.2.1 RISING DEMAND FOR DC POWER SOURCES IN RAILWAYS AND AUTOMOTIVE CHARGING TO PROPEL MARKET GROWTH

TABLE 20 MARKET FOR AC–DC CONVERTERS, BY REGION, 2020–2027(USD MILLION)

6.2.1.1 Enclosed/encapsulated

6.2.1.2 DIN rail

6.2.1.3 Open frame

6.2.1.4 PCB mount

6.2.1.5 Configurable type

6.3 DC–DC CONVERTERS

6.3.1 INCREASING USE IN DIFFERENT TYPES OF ROBOTS TO DRIVE MARKET

TABLE 21 MARKET FOR DC–DC CONVERTERS, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1 Isolated

6.3.1.2 Non-isolated

7 INDUSTRIAL POWER SUPPLY MARKET, BY OUTPUT POWER (Page No. - 90)

7.1 INTRODUCTION

FIGURE 30 MARKET, BY OUTPUT POWER, 2021

TABLE 22 MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

7.2 VERY LOW OUTPUT (UP TO 500 W)

7.2.1 GROWING USE OF LED TO BOOST DEMAND FOR SUCH INDUSTRIAL SUPPLIES

TABLE 23 MARKET FOR VERY LOW OUTPUT (UP TO 500 W), BY REGION, 2020–2027 (USD MILLION)

7.3 LOW OUTPUT (500−1,000 W)

7.3.1 INCREASING DEMAND FOR USE IN TRANSPORTATION APPLICATIONS TO DRIVE MARKET

TABLE 24 MARKET FOR LOW OUTPUT (500−1,000 W), BY REGION, 2020–2027(USD MILLION)

7.4 MEDIUM OUTPUT (1,000 W−10 KW)

7.4.1 NEED FOR MEDIUM-OUTPUT POWER SUPPLIES IN BATTERY CHARGING & TESTING APPLICATIONS TO PROPEL MARKET GROWTH

TABLE 25 MARKET FOR MEDIUM OUTPUT (1,000 W−10 KW), BY REGION, 2020–2027 (USD MILLION)

7.5 HIGH OUTPUT (10−75 KW)

7.5.1 SURGING ADOPTION OF POWER SUPPLIES FOR AVIONICS & MILITARY APPLICATIONS TO FOSTER MARKET GROWTH

TABLE 26 MARKET FOR HIGH OUTPUT (10−75 KW), BY REGION, 2020–2027 (USD MILLION)

7.6 VERY HIGH OUTPUT (75−150 KW)

7.6.1 MOUNTING DEMAND FOR PROGRAMMABLE POWER SUPPLIES TO PROPEL MARKET

TABLE 27 MARKET FOR VERY HIGH OUTPUT (75−150 KW), BY REGION, 2020–2027 (USD MILLION)

8 INDUSTRIAL POWER SUPPLY MARKET, BY VERTICAL (Page No. - 96)

8.1 INTRODUCTION

FIGURE 31 MARKET, BY VERTICAL, 2021

TABLE 28 MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

8.2 TRANSPORTATION

8.2.1 SURGING DEMAND FOR AC–DC OR DC–DC POWER SUPPLIES IN RAIL APPLICATIONS TO PROPEL MARKET GROWTH

TABLE 29 MARKET FOR TRANSPORTATION, BY REGION, 2020–2027 (USD MILLION)

8.3 SEMICONDUCTOR

8.3.1 INCREASING ADOPTION OF DIGITALIZATION TO PROVIDE OPPORTUNITIES FOR MARKET

TABLE 30 MARKET FOR SEMICONDUCTOR, BY REGION, 2020–2027 (USD MILLION)

8.4 MILITARY & AEROSPACE

8.4.1 GROWING DEMAND FOR AC-DC AND DC–DC CONVERTERS FOR VARIOUS COMPONENTS TO STIMULATE MARKET GROWTH

TABLE 31 MARKET FOR MILITARY & AEROSPACE, BY REGION, 2020–2027(USD MILLION)

8.5 ROBOTICS

8.5.1 INCREASING ADOPTION OF ROBOTS TO PROMOTE DEMAND FOR INDUSTRIAL POWER SUPPLIES

TABLE 32 INDUSTRIAL POWER SUPPLY MARKET FOR ROBOTICS, BY REGION, 2020–2027 (USD MILLION)

8.6 TEST & MEASUREMENT

8.6.1 INCREASING DEMAND FOR TEST AND MEASUREMENT EQUIPMENT IN INDUSTRIAL LABORATORIES TO SPUR MARKET GROWTH

TABLE 33 MARKET FOR TEST & MEASUREMENT, BY REGION, 2020–2027 (USD MILLION)

8.7 INDUSTRIAL 3D PRINTING

8.7.1 INCREASING APPLICATIONS OF 3D PRINTED PROTOTYPES TO GENERATE DEMAND FOR INDUSTRIAL POWER SUPPLY PRODUCTS

TABLE 34 MARKET FOR INDUSTRIAL 3D PRINTING, BY REGION, 2020–2027 (USD MILLION)

8.8 BATTERY CHARGING & TEST

8.8.1 RISING ADOPTION OF ELECTRIC VEHICLES TO BOOST MARKET

TABLE 35 MARKET BATTERY CHARGING & TEST, BY REGION, 2020–2027 (USD MILLION)

8.9 LASER

8.9.1 INCREASING USE OF LASER TECHNOLOGY TO PROMOTE MARKET GROWTH

TABLE 36 MARKET FOR LASER, BY REGION, 2020–2027 (USD MILLION)

8.10 LIGHTING

8.10.1 GOVERNMENT INITIATIVES TO PROMOTE LED LIGHTING TO BOOST DEMAND FOR POWER SUPPLIES

TABLE 37 MARKET FOR LIGHTING, BY REGION, 2020–2027 (USD MILLION)

8.11 TELECOMMUNICATION

8.11.1 INCREASING PREVALENCE OF CELLULAR TOWERS TO DRIVE MARKET

TABLE 38 MARKET FOR TELECOMMUNICATION, BY REGION, 2020–2027 (USD MILLION)

8.12 CONSUMER ELECTRONICS

8.12.1 GROWING NUMBER OF ELECTRONIC INSTRUMENTS TO PROPEL MARKET

TABLE 39 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2020–2027 (USD MILLION)

8.13 AUTOMOTIVE

8.13.1 SURGING DEMAND FOR POWER SUPPLIES IN EV VEHICLES TO BOOST MARKET GROWTH

TABLE 40 MARKET FOR AUTOMOTIVE, BY REGION, 2020–2027 (USD MILLION)

8.14 ENERGY

8.14.1 DEMAND FOR ALTERNATIVE ENERGY SOURCES TO BOLSTER MARKET

TABLE 41 INDUSTRIAL POWER SUPPLY MARKET FOR ENERGY, BY REGION, 2020–2027 (USD MILLION)

8.15 FOOD & BEVERAGE

8.15.1 CAPACITY ENHANCEMENT OF EXISTING PLANTS EXPECTED TO DRIVE MARKET

TABLE 42 MARKET FOR FOOD & BEVERAGE, BY REGION, 2020–2027 (USD MILLION)

8.16 MEDICAL & HEALTHCARE

8.16.1 EXPANSION OF HEALTHCARE SYSTEMS TO DRIVE MARKET

TABLE 43 MARKET FOR MEDICAL & HEALTHCARE, BY REGION, 2020–2027 (USD MILLION)

9 INDUSTRIAL POWER SUPPLY MARKET, BY REGION (Page No. - 110)

9.1 INTRODUCTION

FIGURE 32 REGIONAL SNAPSHOT: EUROPE AND ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 33 MARKET SHARE (VALUE), BY REGION, 2021

TABLE 44 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 45 MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9.2 ASIA PACIFIC

FIGURE 34 SNAPSHOT: MARKET IN ASIA PACIFIC, 2021

9.2.1 BY PRODUCT TYPE

TABLE 46 ASIA PACIFIC: INDUSTRIAL POWER SUPPLY MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

9.2.2 BY OUTPUT POWER

TABLE 47 ASIA PACIFIC: MARKET, BY OUTPUT POWER 2020–2027 (USD MILLION)

9.2.3 BY VERTICAL

TABLE 48 ASIA PACIFIC: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET, BY TELECOMMUNICATION VERTICAL, 2020–2027 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.4.1 China

9.2.4.1.1 Expanding manufacturing industry to accelerate market growth

TABLE 51 CHINA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 52 CHINA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.2.4.2 Japan

9.2.4.2.1 High adoption of automation devices in lighting and industrial applications to support market growth

TABLE 53 JAPAN: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 54 JAPAN: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.2.4.3 India

9.2.4.3.1 Increasing inclination of manufacturers toward automation to spur market growth

TABLE 55 INDIA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 56 INDIA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.2.4.4 Indonesia

9.2.4.4.1 Thriving automotive and petroleum industries to boost market

TABLE 57 INDONESIA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 58 INDONESIA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.2.4.5 Malaysia

9.2.4.5.1 Booming automotive sector to accelerate market growth

TABLE 59 MALAYSIA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 60 MALAYSIA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.2.4.6 Thailand

9.2.4.6.1 High investment in defense sector to foster market growth

TABLE 61 THAILAND: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 62 THAILAND: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.2.4.7 Vietnam

9.2.4.7.1 High adoption of Industry 4.0 and flourishing semiconductors industry expected to drive demand for power supplies

TABLE 63 VIETNAM: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 64 VIETNAM: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.2.4.8 Rest of Asia Pacific

TABLE 65 REST OF ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 66 REST OF ASIA PACIFIC: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 35 SNAPSHOT: NORTH AMERICAN MARKET

9.3.1 BY PRODUCT TYPE

TABLE 67 NORTH AMERICA: INDUSTRIAL POWER SUPPLY MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

9.3.2 BY OUTPUT POWER

TABLE 68 NORTH AMERICA: MARKET, BY OUTPUT POWER 2020–2027 (USD MILLION)

9.3.3 BY VERTICAL

TABLE 69 NORTH AMERICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 70 MARKET, BY TELECOMMUNICATION VERTICAL, 2020–2027 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.4.1 US

9.3.4.1.1 Increasing focus on military spending and industrial automation to boost demand for industrial power supplies

TABLE 72 US: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 73 US: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.3.4.2 Canada

9.3.4.2.1 Government investments in renewable energy projects to drive market

TABLE 74 CANADA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 75 CANADA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.3.4.3 Mexico

9.3.4.3.1 High demand for renewable energy and electric vehicles to fuel market

TABLE 76 MEXICO: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 77 MEXICO: MARKET, BY END-USER INDUSTRY, 2020–2027 (USD MILLION)

9.4 EUROPE

9.4.1 BY PRODUCT TYPE

TABLE 78 EUROPE: INDUSTRIAL POWER SUPPLY MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

9.4.2 BY OUTPUT POWER

TABLE 79 EUROPE: MARKET, BY OUTPUT POWER 2020–2027 (USD MILLION)

9.4.3 BY VERTICAL

TABLE 80 EUROPE: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY TELECOMMUNICATION VERTICAL, 2020–2027 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 82 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

9.4.4.1 UK

9.4.4.1.1 Increasing investments in renewable energy and aerospace & defense to boost market

TABLE 83 UK: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 84 UK: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.4.4.2 Germany

9.4.4.2.1 Growing industrial automation and rapid rise in automotive sector to drive market

TABLE 85 GERMANY: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.4.4.3 Italy

9.4.4.3.1 Increasing government investments in medical devices to bolster market

TABLE 87 ITALY: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 88 ITALY: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.4.4.4 France

9.4.4.4.1 Government initiatives in transportation and healthcare to boost demand for industrial power supplies

TABLE 89 FRANCE: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.4.4.5 Spain

9.4.4.5.1 Growth of renewables sector to drive market

TABLE 91 SPAIN: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 92 SPAIN: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.4.4.6 Rest of Europe

TABLE 93 REST OF EUROPE: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.5 SOUTH AMERICA

9.5.1 BY PRODUCT TYPE

TABLE 95 SOUTH AMERICA: INDUSTRIAL POWER SUPPLY MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

9.5.2 BY OUTPUT POWER

TABLE 96 SOUTH AMERICA: MARKET, BY OUTPUT POWER 2020–2027 (USD MILLION)

9.5.3 BY VERTICAL

TABLE 97 SOUTH AMERICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 98 SOUTH AMERICA: MARKET, BY TELECOMMUNICATION VERTICAL, 2020–2027 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 99 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

9.5.4.1 Brazil

9.5.4.1.1 Emerging automotive sales and increasing investment in healthcare to drive market

TABLE 100 BRAZIL: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 101 BRAZIL: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.5.4.2 Argentina

9.5.4.2.1 Favorable government policies and investments in renewable energy and automotive to fuel market

TABLE 102 ARGENTINA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 103 ARGENTINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.4.3 Rest of South America

TABLE 104 REST OF SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 105 REST OF SOUTH AMERICA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 BY PRODUCT TYPE

TABLE 106 MIDDLE EAST & AFRICA: INDUSTRIAL POWER SUPPLY MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

9.6.2 BY OUTPUT POWER

TABLE 107 MIDDLE EAST & AFRICA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6.3 BY VERTICAL

TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2020–2027 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY TELECOMMUNICATION VERTICAL, 2020–2027 (USD MILLION)

9.6.4 BY COUNTRY

TABLE 110 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

9.6.4.1 Saudi Arabia

9.6.4.1.1 Investment in electric vehicles and renewable energy to drive market

TABLE 111 SAUDI ARABIA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 112 SAUDI ARABIA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6.4.2 UAE

9.6.4.2.1 Increasing number of EV charging stations and growing healthcare sector to drive market

TABLE 113 UAE: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 114 UAE: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6.4.3 Qatar

9.6.4.3.1 High demand from petroleum industry for AC–DC converters to spur market

TABLE 115 QATAR: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 116 QATAR: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6.4.4 OMAN

9.6.4.4.1 Efforts to reduce carbon footprint expected to drive market

TABLE 117 OMAN: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 118 OMAN: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6.4.5 Kuwait

9.6.4.5.1 Adoption of robotic technology in oil industry to increase demand for industrial power supply solutions

TABLE 119 KUWAIT: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 120 KUWAIT: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6.4.6 South Africa

9.6.4.6.1 Growing telecommunications and renewable energy sectors to boost market

TABLE 121 SOUTH AFRICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 122 SOUTH AFRICA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

9.6.4.7 Rest of Middle East & Africa

TABLE 123 REST OF MIDDLE EAST & AFRICA: MARKET, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 124 REST OF MIDDLE EAST & AFRICA: MARKET, BY OUTPUT POWER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 160)

10.1 KEY PLAYERS STRATEGIES

TABLE 125 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2022

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 126 MARKET: DEGREE OF COMPETITION

FIGURE 36 INDUSTRIAL POWER SUPPLY MARKET SHARE ANALYSIS, 2021

10.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 37 TOP PLAYERS IN MARKET FROM 2017 TO 2021

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 38 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

10.5 START-UP/SME EVALUATION QUADRANT, 2021

10.5.1 PROGRESSIVE COMPANY

10.5.2 RESPONSIVE COMPANY

10.5.3 DYNAMIC COMPANY

10.5.4 STARTING BLOCK

FIGURE 39 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

10.5.5 COMPETITIVE BENCHMARKING

TABLE 127 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 128 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

10.6 MARKET: COMPANY FOOTPRINT

TABLE 129 OUTPUT POWER: COMPANY POWER RATING FOOTPRINT

TABLE 130 BY PRODUCT TYPE: COMPANY BY TYPE FOOTPRINT

TABLE 131 END USER: COMPANY END USER FOOTPRINT

TABLE 132 END USER: COMPANY END USER FOOTPRINT

TABLE 133 REGION: COMPANY REGION FOOTPRINT

TABLE 134 COMPANY FOOTPRINT

10.7 COMPETITIVE SCENARIO

TABLE 135 MARKET: NEW PRODUCT LAUNCHES, JANUARY 2018–MAY 2022

TABLE 136 MARKET: DEALS, JANUARY 2018–MAY 2022

TABLE 137 MARKET: OTHERS, JANUARY 2018–MAY 2022

11 COMPANY PROFILES (Page No. - 179)

11.1 KEY PLAYERS

(Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view)*

11.1.1 TDK LAMBDA

TABLE 138 TDK LAMBDA: BUSINESS OVERVIEW

FIGURE 40 TDK LAMBDA: COMPANY SNAPSHOT, 2021

TABLE 139 TDK LAMBDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 140 TDK LAMBDA: PRODUCT LAUNCHES

TABLE 141 TDK LAMBDA: DEALS

TABLE 142 TDK LAMBDA: OTHERS

11.1.2 SIEMENS

TABLE 143 SIEMENS: BUSINESS OVERVIEW

FIGURE 41 SIEMENS: COMPANY SNAPSHOT, 2021

TABLE 144 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 145 SIEMENS: PRODUCT LAUNCHES

TABLE 146 SIEMENS: DEALS

TABLE 147 SIEMENS: OTHERS

11.1.3 DELTA ELECTRONICS

FIGURE 42 DELTA ELECTRONICS: COMPANY SNAPSHOT, 2021

TABLE 149 DELTA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 150 DELTA ELECTRONICS: PRODUCT LAUNCHES

TABLE 151 DELTA ELECTRONICS: DEALS

TABLE 152 DELTA ELECTRONICS: OTHERS

11.1.4 ABB

TABLE 153 ABB: BUSINESS OVERVIEW

FIGURE 43 ABB: COMPANY SNAPSHOT, 2021

TABLE 154 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 155 ABB: DEALS

TABLE 156 ABB: OTHERS

11.1.5 MURATA POWER SOLUTIONS

TABLE 157 MURATA POWER SOLUTIONS: COMPANY OVERVIEW

FIGURE 44 MURATA POWER SOLUTIONS COMPANY SNAPSHOT, 2021

TABLE 158 MURATA POWER SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 159 MURATA POWER SOLUTIONS: PRODUCT LAUNCHES

TABLE 160 MURATA POWER SOLUTIONS: DEALS

TABLE 161 MURATA POWER SOLUTIONS: OTHERS

11.1.6 BEL FUSE

TABLE 162 BEL FUSE: COMPANY OVERVIEW

FIGURE 45 BEL FUSE COMPANY SNAPSHOT, 2021

TABLE 163 BEL FUSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 BEL FUSE: PRODUCT LAUNCHES

TABLE 165 BEL FUSE: DEALS

11.1.7 ADVANCED ENERGY

TABLE 166 ADVANCED ENERGY: COMPANY OVERVIEW

FIGURE 46 ADVANCED ENERGY COMPANY SNAPSHOT, 2021

TABLE 167 ADVANCED ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 168 ADVANCED ENERGY: PRODUCT LAUNCHES

TABLE 169 ADVANCED ENERGY: DEALS

TABLE 170 ADVANCED ENERGY: OTHERS

11.1.8 SYNQOR

TABLE 171 SYNQOR: COMPANY OVERVIEW

TABLE 172 SYNQOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 173 SYNQOR: PRODUCT LAUNCHES

11.1.9 ASTRODYNE TDI

TABLE 174 ASTRODYNE TDI: COMPANY OVERVIEW

TABLE 175 ASTRODYNE TDI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 176 ASTRODYNE TDI: PRODUCT LAUNCHES

TABLE 177 ASTRODYNE TDI: DEALS

TABLE 178 ASTRODYNE TDI: OTHERS

11.1.10 TRACO POWER

TABLE 179 TRACO POWER: COMPANY OVERVIEW

TABLE 180 TRACO POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 181 TRACO POWER: PRODUCT LAUNCHES

11.1.11 VICOR

TABLE 182 VICOR: COMPANY OVERVIEW

FIGURE 47 VICOR COMPANY SNAPSHOT, 2020

TABLE 183 VICOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 184 VICOR: PRODUCT LAUNCHES

TABLE 185 VICOR: DEALS

11.1.12 RECOM

TABLE 186 RECOM: COMPANY OVERVIEW

TABLE 187 RECOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 188 RECOM: PRODUCT LAUNCHES

TABLE 189 RECOM: DEALS

11.1.13 XP POWER

TABLE 190 XP POWER: COMPANY OVERVIEW

FIGURE 48 XP POWER COMPANY SNAPSHOT, 2021

TABLE 191 XP POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 XP POWER: PRODUCT LAUNCHES

11.1.14 MEAN WELL

TABLE 193 MEAN WELL: COMPANY OVERVIEW

TABLE 194 MEAN WELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 MEAN WELL: PRODUCT LAUNCHES

11.1.15 COSEL

TABLE 196 COSEL: COMPANY OVERVIEW

FIGURE 49 COSEL COMPANY SNAPSHOT, 2021

TABLE 197 COSEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 198 COSEL: PRODUCT LAUNCHES

*Details on Business and financial overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 MTM POWER

11.2.2 PULS

11.2.3 PHOENIX CONTACT

11.2.4 AMARA RAJA POWER SYSTEMS

11.2.5 INVENTUS POWER

11.2.6 GLOBTEK

12 APPENDIX (Page No. - 259)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

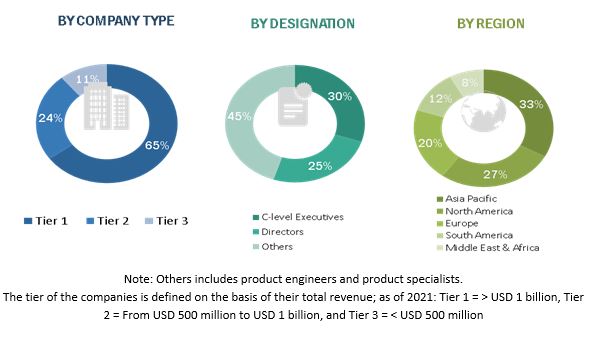

The study involved major activities in estimating the current size of the global industrial power supply market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The market `comprises several stakeholders such as industrial power supply manufacturers, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for industrial power supplies in, automotive, transportation, medical & healthcare, and utility end users. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global industrial power supply market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Industrial power supply Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the market based on by output power, product type, vertical, and region

- To describe and forecast the market, in terms of value, for five key regions- North America, Europe, Asia Pacific, South America, and the Middle East & Africa-along with their respective countries

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide details about the competitive landscape of the market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market

- To analyze the impact of COVID-19 on the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments in the market, such as contracts & agreements, investments & expansions, new product launches, and mergers & acquisitions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Power Supply Market