DC-DC Converter Market by Product Type (Isolated, Non- isolated), Form Factor (SIP, DIP, DIN Rail, Box, Others), Input Voltage, Output Voltage, Output Power, Output Number, Isolation Working Voltage, Vertical and Region –Global Forecast to 2027

DC-DC Converter Market Size and Share

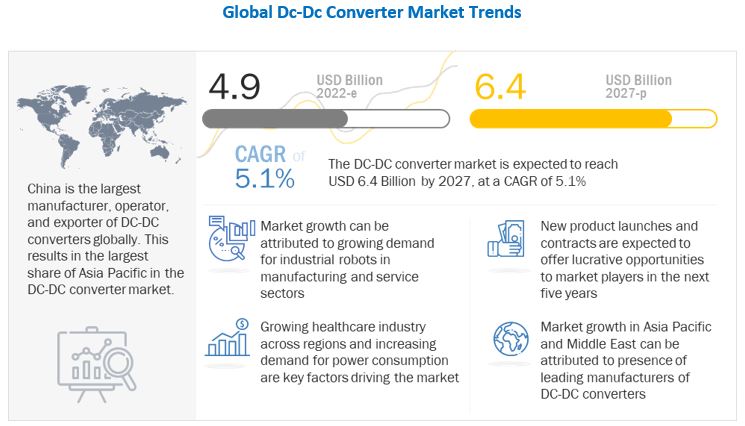

The Global DC-DC Converter Market Size was valued at USD 5,300 Million in 2023 and is estimated to reach USD 6,400 Million by 2027, growing at a CAGR of 5.1% during the forecast period. The market is driven by various factors, such as increasing power consumption and increasing industrial automation. Increasing power consumption throughout various industries and increasing applications in the industrial sector are most likely to drive the market for DC-DC converters. Asia Pacific, Europe, and North America are witnessing a thriving telecommunications industry, which will increase the demand for DC-DC Converters Industry. DC-DC converters are also turning out to be major electrical components in the automotive industry, which will rise with the rise in the electric vehicle market of the automotive industry across various regions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on DC-DC Converter Industry

Major competitors in the DC-DC converter industry are TDK Lambda Corporation (Japan), Murata Manufacturing Co. Texas Instruments Incorporated (US), Vicor Corporation (US), and Traco Power Ltd. (Switzerland). These companies have expanded their operations to North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. COVID-19 has also had an influence on their enterprises. According to industry analysts, COVID-19 will have an impact on power converter manufacturing and services internationally in 2020.

Global DC-DC Converter Market Trends

Driver: DC Converter in hybrid and electric vehicles

The growing adoption of electric/hybrid vehicles is driving up demand for DC-DC converters. The DC/DC converter is an essential component of hybrid electric vehicles as dDue to the automotive constraints, the power converter structure must be reliable, lightweight, small volume, with high efficiency, low electromagnetic interference, and low current/voltage ripple.

It is typically used in buck mode to provide electrical energy to the 12V system created by the 48V starter generator. It can also be used in boost mode for some functions, such as starting the vehicle and autonomous driving. In the various configurations of electric vehicles, DC-DC converters convert HV to 48V, HV to 12V, and 48V to 12V. Low losses, high efficiency, low volume, and light weight are the primary design requirements for DC-DC converters. Emerging technologies like high-power WBG semiconductors and bidirectional power supplies are assisting in the development of new DC-DC converters. STMicroelectronics (US) provides such bidirectional DC-DC converters for automotive applications.

Opportunity: Increasing military COTS applications

Commercial off-the-shelf (COTS) are products that are available and ready to use. They can be products related to hardware or software. These are generally aftermarket products made according to the needs of the consumer. Military COTS, according to the Federal Acquisition Regulation (FAR) of the US, is stated as commercial items or services that can be used under government contracts. With increasing military expenditure across countries of different regions, the demand for military COTS products will grow, which will drive the DC-DC converter market.

Restraint: Product manufacturing challenges

DC-DC converters and components related to them are some of the most critical components of integrated circuits used in power electronics equipment. Hence, manufacturing of these components is also a challenge for product manufacturers. These products have to be manufactured under the regulatory and safety requirements such as EN60950 and UL60950 for IT equipment, where they act as regulatory standards to prevent injury or damage due to any hazard. Thus, DC-DC converters have seen some evolution in manufacturing as the earlier designs used to be a bit bulky as compared to the newer technologies. Many manufacturing companies such as Murata and Delta Electronics have described the manufacturing and designing process for DC-DC converters as being tough. Texas Instruments has mentioned in an article that designing high-frequency, high input voltage DC-DC converters is one of the primary challenges faced by manufacturers of DC-DC converters.

Challenge: Global shortage of semiconductors

The global manufacturing sector has largely come to a halt with the ongoing disruptions in global supply chains. International travel restrictions and seismic shifts in demand and supply due to COVID-19 have dented the worldwide distribution network. Global shortages in integrated circuits have decimated the supply chain of various key industries. This has also affected the DC-DC converter market, as these converters are a vital part of IC boards. Hence, the global shortage faced by the power electronics industry has affected the manufacturing and supply chain of DC-DC converters as well.

DC-DC Converter Market Segments

Demand for isolated product type DC-DC converter system will drive the demand for product type segment

The isolated DC-DC converters market is predicted to expand the most in terms of value. An isolated DC-DC converter employs a transformer to separate the input supply channel from the output supply. With rising consumer electronics demand, the market for isolated DC-DC converters will expand throughout the anticipated year.

The telecommunication vertical is projected to witness a higher CAGR during the forecast period

Globally, the telecommunications sector is expanding. Given the worldwide epidemic, Statista predicts that by 2020, 1.4 billion cellphones would have been sold worldwide. As a result, the communications vertical for the DC-DC converter is expected to develop over the projection period, with a significant increase in the cellular phone market each year and the approaching 5G spectrum.

Power 1000W output power DC-DC converter projected to witness highest CAGR during the forecast period

The DC-DC converter market is anticipated to expand at the greatest CAGR throughout the forecast period for the >1000W output power category. These can work with a variety of industrial applications because to their wide input voltage range. They are among the finest converters for providing correct output voltage under a variety of input supplies since they can operate at greater working temperatures.

The DIN Rail form type DC-DC converter is projected to witness the highest CAGR during the forecast period

During the anticipated period, the market for DC-DC converters is expected to develop at the highest CAGR for DIN Rail DC-DC converters. A standard metal rail known as a DIN rail is most frequently and extensively used for attaching circuit breakers and industrial control devices. These DC-DC converters' wide input voltage range and adjustable specifications make it possible to incorporate equipment with inconsistent voltages into industrial systems with ease.

The Multiple output number DC-DC converter is projected to witness the highest CAGR during the forecast period

The DC-DC converter market is anticipated to expand at the highest CAGR throughout the forecast period for multiple output DC-DC converters. The need for DC-DC converters is rising along with the demand for power application products in the industry. To function effectively, electrical equipment must operate in a controlled setting with a range of input voltage. As a result, DC-DC converters with multiple outputs have a range of input voltage levels and effectively generate several correct outputs.

“40-160v: The fastest-growing segment of the DC-DC converter market, by Input Voltage.“

Based on the input voltage, the 40-160v segment is projected to grow at the highest CAGR rate for the DC-DC converter market during the forecast period. With the rising industrial and aerospace application the demand for high input voltage DC-DC converter is also increasing. DC-DC converters with high input voltages have efficiency up to 92% and are available in various form type such as DIN Rail, Chassis mount, Brick and others.

DC-DC Converter Market Regional Analysis

The Asia Pacific market is projected to contribute the largest share from 2022 to 2027

During the projection period, Asia Pacific is expected to have the biggest regional market share for DC-DC converters worldwide. Due to the fast expansion of technologically superior power converters in the area, Asia Pacific is the region driving the worldwide DC-DC converter market. Manufacturers of DC-DC converters are being encouraged by the expansion of the manufacturing sector as well as the aerospace and military sectors in Asia Pacific to produce cutting-edge and effective products across a variety of product categories.

To know about the assumptions considered for the study, download the pdf brochure

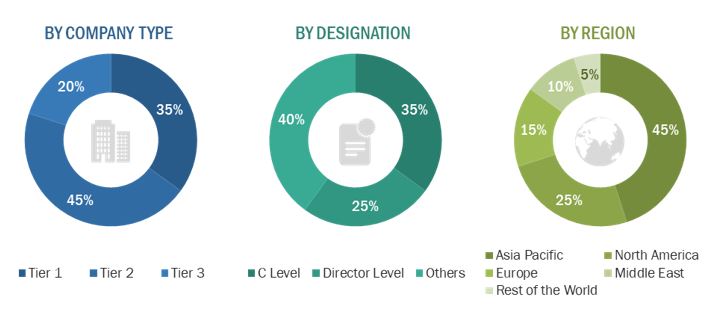

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1–39%; Tier 2–45%; and Tier 3–20%

- By Designation: C Level–35%; Directors–25%; and Others–40%

- By Region: North America–25%; Europe–15%; Asia Pacific–45%; and Rest of the World–15%

DC-DC Converter Companies: Top Key Market Players

The DC-DC Converter Companies is dominated by globally established players such as

- TDK Lambda Corporation (Japan)

- Texas Instruments Incorporated (US)

- Delta Electronics (Taipei)

- Flex Ltd. (Singapore)

- Infineon Tecnologies AG (Germany)

DC-DC Converter Market Report Scope:

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 4.9 Billion |

|

Revenue Forecast in 2027 |

USD 6.4 Billion |

|

Growth Rate |

5.1% |

| Forecast Period |

2022-2027 |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Vertical, By Form Factor, By Input Voltage, By output Voltage, By output Power, By Output Number, By Product Type, By Isolation Working Voltage, By Region |

|

Geographies Covered |

|

|

Companies Covered |

TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Delta Electronics (Taipei), Flex Ltd. (Singapore) and Infineon Technologies AG (Germany) |

The study categorizes the DC-DC converter market based on Vertical, Form Factor, Input Voltage, Output Voltage, Output Power, Output Number, Product Type, Isolation Working Voltage, and Region.

By Vertical

- Telecommunication

- Automotive

- Industrial Robots

- Service Robots

- Aerospace and Defense

- Medical

- Railway

- Server, Storage and Network

- Consumer Electronics

- Energy and Power

- Marine

By Form Factor

- SIP

- DIP

- DIN Rail

- Box

- Chassis Mount

- Discrete

- Brick

By Input Voltage

- <12v

- 9-36v

- 18-75v

- 40-160v

- >200v

By Output Voltage

- <2v

- 3.3v

- 5v

- 12v

- 15v

- 24v

- >24v

By Output Power

- 0.5-9W

- 10-29W

- 30-99W

- 100-250W

- 250-500W

- 500-1000W

- >1000W

By Output Number

- Single

- Dual

- Triple

- Multiple

By Product Type

- Isolated DC-DC Converter

- Non-Isolated DC-DC Converter

By Isolation Working Voltage

- 50-150V

- 150-250V

- 200-1000V

- 1000-2500V

- >2500V

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In September 2021, Murata introduced MYRNP PicoBK™ DC-DC Converter which are small coil-integrated negative voltage DC-to-DC converter IC. This solution offers the switching methods of the MYRNP series to maintain a stable output voltage even when the input voltage fluctuates while also supporting a larger output current.

- TDK-Lambda introduced 250-Watt RGA series of ruggedized non-isolated DC-DC converter for harsh-environment applications such as robotics, automated guided vehicles, communications, and industrial and portable battery-powered equipment.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the DC-DC convereter market?

Response: The DC-DC converter market is expected to grow substantially owing to the technological development in DC-DC converter IC and component.

What are the key sustainability strategies adopted by leading players operating in the DC-DC converter market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the DC-DC converter market. The major players include TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Delta Electronics (Taipei), Flex Ltd. (Singapore) and Infineon Tecnologies AG (Germany), these players have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the DC-DC converter market?

Response: Some of the major emerging technologies and use cases disrupting the market include Compact size, low power and low noise DC-DC converters

Who are the key players and innovators in the ecosystem of the DC-DC converter market?

Response: The key players in the DC-DC converter market include TDK Lambda Corporation (Japan), Texas Instruments Incorporated (US), Delta Electronics (Taipei), Flex Ltd. (Singapore) and Infineon Tecnologies AG (Germany).

Which region is expected to hold the highest market share in the DC-DC converter market?

Response: DC-DC converter market in Asia Pacific is projected to hold the highest market share during the forecast period. . The key factor responsible for Asia Pacific, leading the global DC-DC converter market owing to the rapid growth of the technologically advanced power converter in the region. This region consist of major countries such as India, China and Japan which are rapidly growing economical countries. In Asia Pacific, the rise in manufacturing industries and growing aerospace and defence industry is encouraging manufacturers of DC-DC converters to introduce technologically advanced and efficient products cross avrious product type. The increasing demand for DC-DC converter and the presence of some of the leading players operating in the market, such as TDK Lambda Corporation, Murata Manufacturing Co. Ltd, FDK Corporation, are expected to drive the global DC-DC converter market in Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DC-DC CONVERTERS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN DC-DC CONVERTERS MARKET

1.5 CURRENCY CONSIDERED

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET DEFINITION AND SCOPE

TABLE 2 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH AND METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

TABLE 3 DC-DC CONVERTERS MARKET FOR VERTICALS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION AND VALIDATION

FIGURE 6 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 RESEARCH ASSUMPTIONS

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 7 18-75 V SEGMENT TO ACCOUNT FOR LARGEST SHARE OF DC-DC CONVERTERS MARKET IN 2022

FIGURE 8 DC-DC CONVERTERS MARKET, BY PRODUCT TYPE, 2022

FIGURE 9 BRICK SEGMENT TO DOMINATE DC-DC CONVERTERS MARKET IN 2022

FIGURE 10 MIDDLE EAST TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DC-DC CONVERTERS MARKET

FIGURE 11 RISE IN DEMAND FOR INDUSTRIAL ROBOTS EXPECTED TO DRIVE MARKET

4.2 DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER

FIGURE 12 DUAL SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.3 DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE

FIGURE 13 18–75 V SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.4 DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE

FIGURE 14 12 V SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.5 DC-DC CONVERTERS MARKET, BY COUNTRY

FIGURE 15 INDIA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DC-DC CONVERTERS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing demand for industrial robots in manufacturing and service sectors

5.2.1.2 Growing healthcare industry across regions

5.2.1.3 Rising adoption of DC-DC converters in hybrid and electric vehicles

FIGURE 17 GLOBAL EV SALES, BY TYPE, 2011–2030, IN THOUSANDS OF UNITS

5.2.1.4 Increasing demand for power consumption

5.2.2 RESTRAINTS

5.2.2.1 Functionality of DC-DC converters in low-power mode

5.2.2.2 Product manufacturing challenges

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing IoT applications in various industries

5.2.3.2 Increasing demand for UAVs and satellites

5.2.3.3 Increasing military COTS applications

5.2.3.4 High power demand for 5G base stations

TABLE 4 5G CELL TYPES

5.2.3.4.1 5G communications use cases, by region

TABLE 5 5G USE CASES, BY REGION

5.2.4 CHALLENGES

5.2.4.1 Global shortage of semiconductors

5.2.4.2 Maintaining high performance with compact size

5.3 RANGES AND SCENARIOS

FIGURE 18 RANGES AND SCENARIOS

5.4 TECHNOLOGY ANALYSIS

5.4.1 RISING HEALTHCARE APPLICATIONS

5.4.2 GROWING COMMUNICATION INDUSTRY

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DC-DC CONVERTERS MARKET

FIGURE 19 REVENUE SHIFT IN DC-DC CONVERTERS MARKET

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 20 MARKET ECOSYSTEM MAP: DC-DC CONVERTERS MARKET

TABLE 6 DC-DC CONVERTERS MARKET ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: DC-DC CONVERTERS MARKET

5.8 TRADE DATA ANALYSIS

TABLE 7 TRADE DATA FOR DC-DC CONVERTERS MARKET

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

5.10 CASE STUDY ANALYSIS

5.10.1 LOW NOISE AND COMPACT DESIGN

5.11 TARIFF AND REGULATORY LANDSCAPE

6 INDUSTRY TRENDS (Page No. - 74)

6.1 INTRODUCTION

6.2 EMERGING TRENDS

FIGURE 23 EMERGING TRENDS

6.2.1 DEVELOPMENT IN ROBOTICS

6.2.2 INCREASING INDUSTRIAL APPLICATIONS

6.2.3 INCREASING DEMAND FOR HIGH-POWER DC-DC CONVERTERS

6.2.4 LOW-POWER DC-DC CONVERTERS

6.2.5 RISING AUTOMOTIVE APPLICATIONS

6.2.6 COMPACT DC-DC CONVERTERS

6.2.7 TECHNOLOGICAL ADVANCEMENTS AND CONTINUOUS IMPROVEMENT

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.5 INNOVATIONS AND PATENT REGISTRATIONS, 2012-2020

TABLE 9 INNOVATIONS AND PATENT REGISTRATIONS

7 DC-DC CONVERTERS MARKET, BY VERTICAL (Page No. - 80)

7.1 INTRODUCTION

FIGURE 25 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

TABLE 10 DC-DC CONVERTERS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 11 DC-DC CONVERTERS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

7.2 TELECOMMUNICATION

TABLE 12 TELECOMMUNICATION DC-DC CONVERTERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 13 TELECOMMUNICATION DC-DC CONVERTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 14 TELECOMMUNICATION DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2018–2021 (USD MILLION)

TABLE 15 TELECOMMUNICATION DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2022–2027 (USD MILLION)

7.2.1 CELLULAR PHONE

7.2.1.1 5G to increase smartphone usage

7.2.2 COMMUNICATION TOWERS

7.2.2.1 Increasing signal strength to provide 5G services

7.2.3 DATA CENTERS

7.2.3.1 Rising infrastructure and data security laws

7.3 AUTOMOTIVE

TABLE 16 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 18 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2018–2021 (USD MILLION)

TABLE 19 AUTOMOTIVE DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2022–2027 (USD MILLION)

7.3.1 NON-ELECTRIC VEHICLES

TABLE 20 NON-ELECTRIC VEHICLE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 21 NON-ELECTRIC VEHICLE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

7.3.1.1 Passenger vehicles

7.3.1.1.1 Improving standards of living and increase in disposable income

7.3.1.2 Commercial vehicles

7.3.1.2.1 Increasing demand from logistics and transportation industry

7.3.1.3 Construction vehicles

7.3.1.3.1 Advanced DC/DC converters based on latest semiconductor technology to displace alternators powering auxiliary components

7.3.2 ELECTRIC VEHICLES

TABLE 22 ELECTRIC VEHICLE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 23 ELECTRIC VEHICLE DC-DC CONVERTERS MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

7.3.2.1 Passenger vehicles

7.3.2.1.1 Fuel-cell vehicles

7.3.2.1.1.1 Increasing need for emission-free vehicles

7.3.2.1.2 Hybrid electric vehicles

7.3.2.1.2.1 Need for better performance eco-friendly vehicles

7.3.2.1.3 Battery electric vehicles

7.3.2.1.3.1 Government support for zero-emission vehicles

7.3.2.1.4 Plug-in hybrid electric vehicles

7.3.2.1.4.1 Increasing need for long-range electric vehicles

7.3.3 COMMERCIAL VEHICLES

7.3.3.1 Rising demand for electric vehicles from logistics industry

7.3.4 E-MOBILITY CHARGING STATIONS

7.3.4.1 Rising usage of electric vehicles

7.4 INDUSTRIAL ROBOTS

TABLE 24 INDUSTRIAL ROBOTS DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2018–2021 (USD MILLION)

TABLE 25 INDUSTRIAL ROBOTS DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2022–2027 (USD MILLION)

7.4.1 MANUFACTURING ROBOTS

TABLE 26 MANUFACTURING ROBOTS DC-DC CONVERTERS MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 27 MANUFACTURING ROBOTS DC-DC CONVERTERS MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

7.4.1.1 Metals

7.4.1.1.1 Requirement of robust actuators in mining industry

7.4.1.2 Chemicals, paper, and plastics

7.4.1.2.1 Increasing industrialization and stringent environmental regulations to drive segment

7.4.1.3 Automotive

7.4.1.3.1 Increased demand for industrial robots in automotive sector to drive market

7.4.1.4 Electronics & electricals

7.4.1.4.1 Increasing demand for batteries, chips, and displays to drive market

7.4.1.5 Food & beverages

7.4.1.5.1 Need to increase automation and enhance capacity of existing plants to drive segment

7.4.2 SERVICE ROBOTS

7.4.2.1 Automated guided vehicles

7.4.2.1.1 Increased demand for automated handling in industrial facilities

7.4.2.2 Cleaning robots

7.4.2.2.1 Requirement for automated cleaning services in commercial spaces

7.4.2.3 Inspection robots

7.4.2.3.1 Rising need for automated inspection in difficult-to-reach areas

7.4.2.4 Humanoid robots

7.4.2.4.1 Need to replicate human touch for various sectors

7.4.2.5 Warehousing robots

7.4.2.5.1 Robotics arms

7.4.2.5.1.1 Robotic arms generally used to handle huge payloads at arm wrist

7.4.2.5.2 Collaborative robots

7.4.2.5.2.1 Introduction of 5G technology projected to accelerate deployment of collaborative robots in manufacturing industry

7.4.2.5.3 Articulated robots

7.4.2.5.3.1 Manufacturers in countries such as Brazil, Indonesia, and Malaysia expected to integrate robotic automation into their operations

7.5 AEROSPACE & DEFENSE

TABLE 28 AEROSPACE & DEFENSE DC-DC CONVERTERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 AEROSPACE & DEFENSE DC-DC CONVERTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 AEROSPACE & DEFENSE DC-DC CONVERTERS MARKET, BY PLATFORM TYPE, 2018–2021 (USD MILLION)

TABLE 31 AEROSPACE & DEFENSE DC-DC CONVERTERS MARKET, BY PLATFORM TYPE, 2022–2027 (USD MILLION)

7.5.1 AIRCRAFT

7.5.1.1 More electric aircraft expected to drive demand for DC-DC converters

TABLE 32 AIRCRAFT DC-DC CONVERTERS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 33 AIRCRAFT DC-DC CONVERTERS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

7.5.1.2 Civil

7.5.1.2.1 Commercial

7.5.1.2.1.1 Increasing narrow-body aircraft to drive market for commercial aircraft

7.5.1.2.2 Business aviation

7.5.1.2.2.1 Increase in corporate activities globally

7.5.1.2.3 Helicopters

7.5.1.2.3.1 Expanding applications of commercial helicopters

7.5.1.3 Military

7.5.1.3.1 Growing national security and special mission aircraft to drive market

7.5.1.3.2 Fighter aircraft

7.5.1.3.3 Special mission aircraft

7.5.1.3.4 Transport aircraft

7.5.1.3.5 Rotorcraft

7.5.1.4 Unmanned aerial vehicles

7.5.1.4.1 Fixed-wing UAVs

7.5.1.4.1.1 Increase in flying hours to drive market

7.5.1.4.2 Rotary wing UAVs

7.5.1.4.2.1 Increasing application of rotary-wing UAVs for commercial and military purposes

7.5.2 LAND VEHICLES

7.5.2.1 Armored vehicles

7.5.2.1.1 Rising demand for AVs for use in cross-border conflicts

7.5.2.2 Ground support equipment (GSE)

7.5.2.2.1 Rising number of airports

7.5.3 SATELLITES

7.5.3.1 Rising demand for high output voltage for satellite communication

7.5.3.2 Small satellites

7.5.3.2.1 Growing national security concerns along with geographic operations

7.5.3.3 Medium satellites

7.5.3.3.1 Increasing demand for LEO-based services

7.5.3.4 Large satellites

7.5.3.4.1 Rising demand for telecom services

7.6 MEDICAL

7.6.1 HEALTHCARE SYSTEMS THROUGHOUT REGIONS EXPANDING AT HIGH PACE

7.6.2 COMPUTED TOMOGRAPHY SCANNERS

7.6.3 MAMMOGRAPHY SYSTEMS

7.6.4 POSITRON EMISSION TOMOGRAPHY SYSTEMS

7.6.5 MAGNETIC RESONANCE IMAGING SYSTEMS

7.7 RAILWAY

7.7.1 GROWING TRANSPORT INFRASTRUCTURE TO DRIVE MARKET

7.7.2 LOCOMOTIVE

7.7.3 RAPID TRANSIT

7.8 ENERGY AND POWER

7.8.1 OIL AND GAS

7.8.1.1 Rising Middle East oil and gas industry

7.8.2 RENEWABLE ENERGY

7.8.2.1 Increasing demand for alternative sources of energy

7.8.3 LOW VOLTAGE DIRECT CURRENT (LVDC)

7.8.3.1 Increasing urbanization to drive segment

7.9 CONSUMER ELECTRONICS

7.9.1 INCREASING NUMBER OF NEW ELECTRONIC GADGETS AND DIFFERENT ELECTRONIC INSTRUMENTS

TABLE 34 CONSUMER ELECTRONICS DC-DC CONVERTERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 CONSUMER ELECTRONICS DC-DC CONVERTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.9.2 AR & VR DEVICES

7.9.3 WEARABLE DEVICES

7.9.4 HOUSEHOLD APPLIANCES

7.1 SERVER, STORAGE, AND NETWORK

7.10.1 RISE IN DATA CENTERS EXPECTED TO BOOST GROWTH

TABLE 36 SERVER, STORAGE, AND NETWORK DC-DC CONVERTERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 SERVER, STORAGE, AND NETWORK DC-DC CONVERTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.11 MARINE

TABLE 38 MARINE DC-DC CONVERTERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 MARINE DC-DC CONVERTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 40 MARINE DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2018–2021 (USD MILLION)

TABLE 41 MARINE DC-DC CONVERTERS MARKET, BY SUBSEGMENT, 2022–2027 (USD MILLION)

7.11.1 SHIPS

7.11.1.1 Commercial

7.11.1.2 Military

7.11.2 PORT EQUIPMENT

7.11.2.1 Growing demand for advanced cargo handling

8 DC-DC CONVERTERS MARKET, BY PRODUCT TYPE (Page No. - 113)

8.1 INTRODUCTION

FIGURE 26 ISOLATED SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

TABLE 42 DC-DC CONVERTERS MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 43 DC-DC CONVERTERS MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

8.2 ISOLATED DC-DC CONVERTER

8.2.1 ISOLATION WORKING VOLTAGE

8.2.1.1 50–150 V

8.2.1.2 150–250 V

8.2.1.3 250–1,000 V

8.2.1.4 1,001–2,500 V

8.2.1.5 >2,500 V

8.3 NON-ISOLATED DC-DC CONVERTER

8.3.1 <10 A

8.3.2 10-20 A

8.3.3 20-50 A

8.3.4 50-100 A

9 DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE (Page No. - 117)

9.1 INTRODUCTION

FIGURE 27 12 V SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

TABLE 44 DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE, 2018–2021 (USD MILLION)

TABLE 45 DC-DC CONVERTERS MARKET, BY OUTPUT VOLTAGE, 2022–2027 (USD MILLION)

9.2 <2 V

9.3 3.3 V

9.4 5 V

9.5 12 V

9.6 15 V

9.7 24 V

9.8 >24 V

10 DC-DC CONVERTERS MARKET, BY OUTPUT POWER (Page No. - 121)

10.1 INTRODUCTION

FIGURE 28 30-99 W SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

TABLE 46 DC-DC CONVERTERS MARKET, BY OUTPUT POWER, 2018–2021 (USD MILLION)

TABLE 47 DC-DC CONVERTERS MARKET, BY OUTPUT POWER, 2022–2027 (USD MILLION)

10.2 0.5–9 W

10.3 10–29 W

10.4 30–99 W

10.5 100–250 W

10.6 250–500 W

10.7 500–1,000 W

10.8 >1,000 W

11 DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE (Page No. - 125)

11.1 INTRODUCTION

FIGURE 29 18-75 V SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

TABLE 48 DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE, 2018–2021 (USD MILLION)

TABLE 49 DC-DC CONVERTERS MARKET, BY INPUT VOLTAGE, 2022–2027 (USD MILLION)

11.2 <12 V

11.3 9–36 V

11.4 18–75 V

11.5 40–160 V

11.6 >200 V

12 DC-DC CONVERTERS MARKET, BY FORM FACTOR (Page No. - 128)

12.1 INTRODUCTION

FIGURE 30 DIN RAIL SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

TABLE 50 DC-DC CONVERTERS MARKET, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 51 DC-DC CONVERTERS MARKET, BY FORM FACTOR, 2022–2027 (USD MILLION)

12.2 SIP

12.3 DIP

12.4 DIN RAIL

12.5 BOX TYPE

12.6 CHASSIS MOUNT

12.7 DISCRETE

12.8 BRICK

12.8.1 FULL BRICK

12.8.2 HALF BRICK

12.8.3 QUARTER BRICK

12.8.4 EIGHTH BRICK

12.8.5 SIXTEENTH BRICK

13 DC-DC CONVERTERS MARKET, BY REGION (Page No. - 133)

13.1 INTRODUCTION

FIGURE 31 DC-DC CONVERTERS MARKET: REGIONAL SNAPSHOT

13.1.1 IMPACT OF COVID-19 ON DC-DC CONVERTERS MARKET, BY REGION

TABLE 52 DC-DC CONVERTERS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 DC-DC CONVERTERS MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: DC-DC CONVERTERS MARKET SNAPSHOT

TABLE 54 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: DC-DC CONVERTERS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Growing industrial automation and expanding defense sector

13.2.1.2 Increasing demand for hybrid and electric cars

FIGURE 33 US: EV CARS SALES PROJECTION

TABLE 62 US: DC-DC CONVERTERS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 63 US: DC-DC CONVERTERS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 64 US: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 65 US: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Investments in alternate energy sources

TABLE 66 CANADA: DC-DC CONVERTERS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 67 CANADA: DC-DC CONVERTERS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 68 CANADA: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 69 CANADA: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.3 EUROPE

FIGURE 34 EUROPE: DC-DC CONVERTERS MARKET SNAPSHOT

TABLE 70 EUROPE: DC-DC CONVERTERS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: DC-DC CONVERTERS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 72 EUROPE: DC-DC CONVERTERS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 EUROPE: DC-DC CONVERTERS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: DC-DC CONVERTERS MARKET, BY ISOLATION WORKING VOLTAGE, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: DC-DC CONVERTERS MARKET, BY ISOLATION WORKING VOLTAGE, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 77 EUROPE: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: DC-DC CONVERTERS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 79 EUROPE: DC-DC CONVERTERS MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Growing industrial automation with rapid rise in manufacturing robotics

TABLE 80 GERMANY: DC-DC CONVERTERS MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 81 GERMANY: DC-DC CONVERTERS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 82 GERMANY: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 83 GERMANY: DC-DC CONVERTERS MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.3.2 RUSSIA

13.3.2.1 Growing telecommunications industry

TABLE 84 RUSSIA: DC DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 85 RUSSIA: DC DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 86 RUSSIA: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 87 RUSSIA: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.3.3 NORWAY

13.3.3.1 Expanding transportation industry

TABLE 88 NORWAY: DC DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 89 NORWAY: DC DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 90 NORWAY: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 91 NORWAY: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.3.4 ITALY

13.3.4.1 Growing automotive industry

TABLE 92 ITALY: DC DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 93 ITALY: DC DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 94 ITALY: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 95 ITALY: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.3.5 FRANCE

13.3.5.1 Investments in transportation and growing healthcare sector

TABLE 96 FRANCE: DC DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 97 FRANCE: DC DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 98 FRANCE: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 99 FRANCE: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.3.6 REST OF EUROPE

13.3.6.1 Telecom market to push demand for DC-DC converters

TABLE 100 REST OF EUROPE: DC DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 101 REST OF EUROPE: DC DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 102 REST OF EUROPE: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 103 REST OF EUROPE: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: DC DC CONVERTER MARKET SNAPSHOT

TABLE 104 ASIA PACIFIC: DC DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: DC DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: DC DC CONVERTER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: DC DC CONVERTER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: DC DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Expanding manufacturing industry and regular investments in renewable energy

FIGURE 36 CHINA: EV SALES PER UNIT

TABLE 110 CHINA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 111 CHINA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 112 CHINA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 113 CHINA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.4.2 INDIA

13.4.2.1 Growing IT and 5G infrastructure

FIGURE 37 INDIA: EV SALES PER UNIT

TABLE 114 INDIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 115 INDIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 116 INDIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 117 INDIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.4.3 TAIWAN

13.4.3.1 Growing semiconductor industry and rise in demand for power electronics

TABLE 118 TAIWAN: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 119 TAIWAN: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 120 TAIWAN: DC-DC CONVERTER MARKET, BY ISOLATION WORKING VOLTAGE, 2018–2021 (USD MILLION)

TABLE 121 TAIWAN: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 122 TAIWAN: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.4.4 AUSTRALIA

13.4.4.1 Growing healthcare industry and strict emission standards

TABLE 123 AUSTRALIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 124 AUSTRALIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 125 AUSTRALIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 126 AUSTRALIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.4.5 SINGAPORE

13.4.5.1 Growing industrial, automobile, and telecommunications sectors

TABLE 127 SINGAPORE: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 128 SINGAPORE: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 129 SINGAPORE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 130 SINGAPORE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.4.6 REST OF ASIA PACIFIC

TABLE 131 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 132 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 133 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.5 MIDDLE EAST

TABLE 135 MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 136 MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 137 MIDDLE EAST: DC-DC CONVERTER MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 138 MIDDLE EAST: DC-DC CONVERTER MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 139 MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 140 MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.5.1 UAE

13.5.1.1 Growing industrial and healthcare sectors

TABLE 141 UAE: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 142 UAE: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 143 UAE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 144 UAE: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.5.2 SAUDI ARABIA

13.5.2.1 Growing IT and energy & power sectors

TABLE 145 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 146 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 147 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 148 SAUDI ARABIA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.5.3 TURKEY

13.5.3.1 Growing defense investments

TABLE 149 TURKEY: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 150 TURKEY: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 151 TURKEY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 152 TURKEY: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.5.4 REST OF MIDDLE EAST

TABLE 153 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 155 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 156 REST OF MIDDLE EAST: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.6 REST OF THE WORLD

TABLE 157 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 158 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 159 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 160 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 161 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 162 REST OF THE WORLD: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.6.1 LATIN AMERICA

13.6.1.1 Growing investments in alternative energy sources

TABLE 163 LATIN AMERICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 164 LATIN AMERICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 165 LATIN AMERICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 166 LATIN AMERICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

13.6.2 AFRICA

13.6.2.1 Growing industrial and telecommunications sectors

TABLE 167 AFRICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 168 AFRICA: DC-DC CONVERTER MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 169 AFRICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2018–2021 (USD MILLION)

TABLE 170 AFRICA: DC-DC CONVERTER MARKET, BY OUTPUT NUMBER, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 189)

14.1 INTRODUCTION

14.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2021

TABLE 171 DEGREE OF COMPETITION

14.3 REVENUE ANALYSIS, 2019–2021

FIGURE 38 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

14.4 RANK ANALYSIS, 2021

FIGURE 39 REVENUE GENERATED BY TOP FIVE PLAYERS, 2021

14.5 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

FIGURE 40 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

14.6 COMPANY EVALUATION QUADRANT

14.6.1 STARS

14.6.2 EMERGING LEADERS

14.6.3 PERVASIVE PLAYERS

14.6.4 PARTICIPANTS

FIGURE 41 DC-DC CONVERTER MARKET COMPANY EVALUATION QUADRANT, 2021

TABLE 172 COMPANY FOOTPRINT

TABLE 173 COMPANY VERTICAL FOOTPRINT (1/2)

TABLE 174 COMPANY VERTICAL FOOTPRINT (2/2)

TABLE 175 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 176 COMPANY REGION FOOTPRINT

14.7 COMPETITIVE BENCHMARKING

FIGURE 42 DC-DC CONVERTER MARKET COMPETITIVE LEADERSHIP MAPPING (SME), 2021

14.7.1 PROGRESSIVE COMPANIES

14.7.2 RESPONSIVE COMPANIES

14.7.3 STARTING BLOCKS

14.7.4 DYNAMIC COMPANIES

14.8 COMPETITIVE SCENARIO

14.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 177 PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2022

15 COMPANY PROFILES (Page No. - 206)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

15.1 KEY PLAYERS

15.1.1 TDK-LAMBDA CORPORATION

TABLE 178 TDK-LAMBDA CORPORATION: BUSINESS OVERVIEW

FIGURE 43 TDK-LAMBDA CORPORATION: COMPANY SNAPSHOT

TABLE 179 TDK-LAMBDA CORPORATION: NEW PRODUCT DEVELOPMENTS

15.1.2 TRACO ELECTRONIC AG

TABLE 180 TRACO ELECTRONIC AG: BUSINESS OVERVIEW

TABLE 181 TRACO ELECTRONIC AG: NEW PRODUCT DEVELOPMENTS

15.1.3 MURATA MANUFACTURING CO., LTD.

TABLE 182 MURATA MANUFACTURING CO., LTD.: BUSINESS OVERVIEW

FIGURE 44 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

TABLE 183 MURATA MANUFACTURING CO., LTD.: NEW PRODUCT DEVELOPMENTS

15.1.4 INFINEON TECHNOLOGIES AG

TABLE 184 INFINEON TECHNOLOGIES AG: BUSINESS OVERVIEW

FIGURE 45 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

TABLE 185 INFINEON TECHNOLOGIES AG: NEW PRODUCT DEVELOPMENTS

15.1.5 ADVANCED ENERGY INDUSTRIES INC.

TABLE 186 ADVANCED ENERGY INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 46 ADVANCED ENERGY INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 187 ADVANCED ENERGY INDUSTRIES INC.: NEW PRODUCT DEVELOPMENTS

15.1.6 ABB LTD.

TABLE 188 ABB LTD.: BUSINESS OVERVIEW

FIGURE 47 ABB LTD.: COMPANY SNAPSHOT

TABLE 189 ABB LTD.: NEW PRODUCT DEVELOPMENTS

15.1.7 TEXAS INSTRUMENTS INCORPORATED

TABLE 190 TEXAS INSTRUMENTS INCORPORATED: BUSINESS OVERVIEW

FIGURE 48 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

TABLE 191 TEXAS INSTRUMENTS INCORPORATED: NEW PRODUCT DEVELOPMENTS

15.1.8 FLEX LTD.

TABLE 192 FLEX LTD.: BUSINESS OVERVIEW

FIGURE 49 FLEX LTD.: COMPANY SNAPSHOT

TABLE 193 FLEX LTD.: NEW PRODUCT DEVELOPMENTS

15.1.9 VICOR CORPORATION

TABLE 194 VICOR CORPORATION: BUSINESS OVERVIEW

FIGURE 50 VICOR CORPORATION: COMPANY SNAPSHOT

TABLE 195 VICOR CORPORATION: NEW PRODUCT DEVELOPMENTS

15.1.10 FDK CORPORATION

TABLE 196 FDK CORPORATION: BUSINESS OVERVIEW

FIGURE 51 FDK CORPORATION: COMPANY SNAPSHOT

15.1.11 RECOM POWER GMBH

TABLE 197 RECOM POWER GMBH: BUSINESS OVERVIEW

15.1.12 CRANE CO.

TABLE 198 CRANE CO.: BUSINESS OVERVIEW

FIGURE 52 CRANE CO.: COMPANY SNAPSHOT

TABLE 199 CRANE CO.: NEW PRODUCT DEVELOPMENTS

15.1.13 STMICROELECTRONICS

TABLE 200 STMICROELECTRONICS: BUSINESS OVERVIEW

FIGURE 53 STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 201 STMICROELECTRONICS: NEW PRODUCT DEVELOPMENTS

15.1.14 CINCON ELECTRONICS

TABLE 202 CINCON ELECTRONICS: BUSINESS OVERVIEW

TABLE 203 CINCON ELECTRONICS: NEW PRODUCT DEVELOPMENTS

15.1.15 MEAN WELL ENTERPRISES

TABLE 204 MEAN WELL ENTERPRISES: BUSINESS OVERVIEW

15.1.16 DELTA ELECTRONICS

TABLE 205 DELTA ELECTRONICS: BUSINESS OVERVIEW

FIGURE 54 DELTA ELECTRONICS: COMPANY SNAPSHOT

15.1.17 XP POWER

TABLE 206 XP POWER: BUSINESS OVERVIEW

FIGURE 55 XP POWER: COMPANY SNAPSHOT

TABLE 207 XP POWER: NEW PRODUCT DEVELOPMENTS

15.1.18 BEL FUSE INC.

TABLE 208 BEL FUSE INC.: BUSINESS OVERVIEW

FIGURE 56 BEL FUSE INC.: COMPANY SNAPSHOT

TABLE 209 BEL FUSE INC.: NEW PRODUCT DEVELOPMENTS

15.1.19 KGS ELECTRONICS

TABLE 210 KGS ELECTRONICS: BUSINESS OVERVIEW

15.1.20 ASTRONICS CORPORATION

TABLE 211 ASTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 57 ASTRONICS CORPORATION: COMPANY SNAPSHOT

TABLE 212 ASTRONICS CORPORATION: NEW PRODUCT DEVELOPMENTS

15.1.21 MEGGITT PLC

TABLE 213 MEGGITT PLC: BUSINESS OVERVIEW

FIGURE 58 MEGGITT PLC: COMPANY SNAPSHOT

15.2 OTHER PLAYERS

15.2.1 SYNQOR

TABLE 214 SYNQOR: BUSINESS OVERVIEW

15.2.2 AIMTEC

TABLE 215 AIMTEC: BUSINESS OVERVIEW

15.2.3 COSEL

TABLE 216 COSEL: BUSINESS OVERVIEW

15.2.4 AJ’S POWER SOURCE

TABLE 217 AJ’S POWER SOURCE: BUSINESS OVERVIEW

15.2.5 VPT POWER

TABLE 218 VPT POWER: BUSINESS OVERVIEW

15.2.6 SG MICRO CORP.

TABLE 219 SG MICRO CORP.: BUSINESS OVERVIEW

15.2.7 POWER PRODUCTS INTERNATIONAL

TABLE 220 POWER PRODUCTS INTERNATIONAL: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 266)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

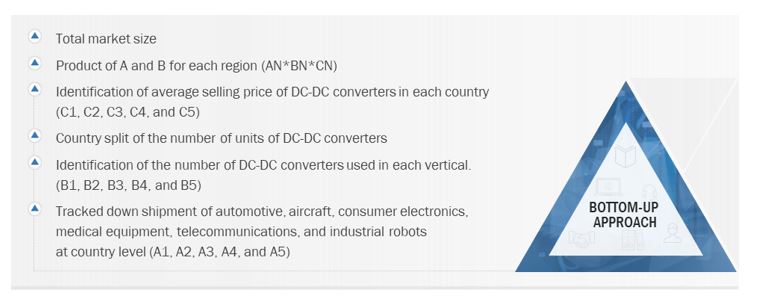

The study involved four major activities in estimating the current size of the DC-DC Converter market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market share of companies offering DC-DC Converter was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, sources such as government sources; SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases were used to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry’s value and supply chain and to identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to DC-DC Converter components, platforms, and regions, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from defense equipment manufacturers, electric car manufacturers, marine vessel manufacturers; aircraft manufacturers; DC-DC Converter manufacturers; integrators; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using DC-DC converter were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of DC-DC converter and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the DC-DC converter market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global DC-DC Converter Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the DC-DC Converter Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the DC-DC converter market.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Report Objectives

- To define, describe, segment, and forecast the size of the DC-DC converter market based on vertical, input voltage, form factor, output power, output voltage, output number, product type, isolation working voltage and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the DC-DC converter market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the DC-DC converter market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the DC-DC converter Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DC-DC Converter Market

1) I wonder if I can purchase parts of the report "DC-DC Converter Market by Vertical, Form Factor, Product Type, Output Power, Input Voltage, Output Voltage, Sales Channel, Output Number and Region - Forecast to 2025" (For example, chapters such as 3, 4, 5, 6, 8, 9, 10, 13, 14, 15, and 16 of the report). 2) I'd like to know what would be the probable cost.

I would like to know about the market for new DC-DC bi-directional converters, major players, testing request (majority research lack of). Since I am in testing equipment, I cannot find any research on the testing of DC-DC converter that was collected from customer's (market) view.

We are a design and development company in the area of power supplies. I am looking for an opportunity to introduce standard products for target segment/s.

I am interested in knowing how our current research on DC-DC converters fits with future market demands.