Potato Starch Market Size, Share, Growth, Industry Trends Report by Type (Native, Modified), End-User (Food & Beverages, Feed, and Industrial), Nature (Conventional, Organic), and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2027

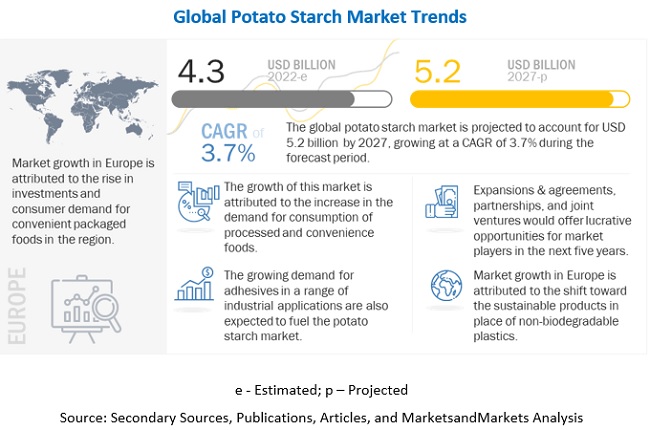

Potato starch market stood at USD 4.3 billion in 2022 and is expected to grow at a CAGR of 3.7% from 2022 to 2027 to reach USD 5.2 billion by the end of 2027. Potato starch is derived from a tuber-producing plant ‘potatoes’, which is a crop cultivated at a large scale worldwide. Potato starch contains less lipid, protein, and ash contents compared to starch derived from tapioca and corn. The granule size of potato starch is larger and pure, with long amylose and amylopectin chain length, compared to starched cereals, such as wheat, corn, and rice. However, certain properties, such as low thermal decomposition, thermal and shear resistance, and the high tendency of retrogradation, limit the use of potato starch in industrial applications. Potato starch is preferred over other starches, such as corn starch, due to its high consistency on pasting, excellent and flexible file formation, binding power, and low gelatinization temperature.

To know about the assumptions considered for the study, Request for Free Sample Report

Potato Starch Market Dynamics

Growth Drivers: Rising demand for processed and convenience food

In the food business, convenience is one of the biggest trends. It is a part of the daily diets of consumers in most developed countries. These foods require extensive processing and preparation, which is facilitated using technological innovations in preservation, packaging, freezing, artificial flavorings & ingredients, among others. Based on their annual consumption rates, it is evident that convenience foods are popular in North American and European countries. Globalization and the resultant changing lifestyles have also led to an increase in the consumption of convenience food in other countries around the world, especially in the developing markets of Asia, subsequently leading to an increased demand for potato starch. China and India are at the forefront of the growth of processed food across the Asia Pacific region. India’s processed food market is projected to be valued at USD 470 Bn by 2025, according to the Indian Brand Equity Foundation (IBEF).

Restraints: Availability of a range of alternatives to potato starch

The potato starch market faces high competition from alternative sources of starch, such as corn, wheat, rice, and arrowroot starch, among others. These starches have multiple similarities and differences based on their nutrient and chemical contents and can be substituted for potato starch depending on the requirements. Below is the list of starches alternatives to potato starch.

- Sweet rice flour: As an alternative to potato starch in gluten-free baking, sweet rice flour can be used. It is sticky and has higher starch content compared to regular rice. It also has a better binding capacity and helps in incorporating the ingredients between, as it is gluten-free.

- Corn starch: Potato starch can be replaced with corn starch in frying to make fried food crispier. Corn starch is also gluten-free, does not have a taste of its own, and can be used in the same amounts as potato starch.

- Arrowroot starch: Derived from the roots of various tropical plants, arrowroot starch has wide applications in the preparation of gluten-free bread. It holds only 3% fiber and does not have any protein, which is ideal for baking needs.

- Tapioca starch: This starch is derived from cassava roots and is lighter than potato starch. Due to the lighter nature of tapioca, the quantity used is double that of potato starch.

- Coconut flour: Coconut flour is an excellent alternative to potato starch and is largely adopted by vegans. However, the appearance of the dish changes due to the difference in the texture of potato starch and coconut flour.

- Rice flour: Rice flour has a grainy texture, but it can be used as an alternative to potato starch. It is also gluten-free and flavorless and used to replace potato starch as a thickening agent in stews and soups. Which is restraining the potato starch market.

Opportunities: Strong market potential for potato starch-based bioplastics

Bioplastics are plastics derived from biological materials and are biodegradable. These are made from renewable sources and are increasingly being preferred in packaging, food service, consumer electronics, agriculture/horticulture, consumer goods, automotive, and household applications. According to European Bioplastics, in 2020, the global production of bioplastics stood at 2.11 million tons, with packaging accounting for 47% of the application area for bioplastics. The global bioplastics market is set to register a growth of 36% between 2021-2026, driven by investments from countries, including China, the US, and European countries.

Challenges: Operational challenges associated with modern potato starch production processes

With the advancement in technologies and production processes across the manufacturing sector, the production of potato starch is a highly competitive market. Along with highly technical production processes, the consumer demand for quality products has risen tremendously. The demand is also high in terms of volume for various food, feed, and industrial applications.

Some of the key challenges in the potato starch market for production process are as follows:

- High raw material prices with maximum yield - Potatoes are subjected to various diseases caused by root-infecting pathogens. Two of the most common diseases are the soilborne fungi Verticillium dahliae and V. alboatrum. Moreover, due to temperature and climate changes, the production of potatoes has been impacted in some regions, thereby influencing the potato prices and the prices of potato starch.

- High energy costs with energy-efficient operations - Potatoes have high moisture content and require the drying process, which consumes large energy to form potato starch. Moreover, companies also have to abide by various energy regulations, which is challenging their business growth, impacting the potato starch business.

- Demand for high-value end-products with premium quality

- Requirement of robust and reliable process, maximum uptime, easy operations, and low maintenance

- Efficient water management because of high fresh-water and water discharge costs

- High initial investments demanding long equipment service life and optimal performance

- Need for maintaining a high quality consistently and ensuring compliance with the regulations that vary depending on end-use applications, such as food, feed, and industrial applications

- As potato starch production is based on the seasonality of the produce, it cannot be stored for long compared to cereals, thereby making optimal use of the invested capital a challenge. Thus, potato production facilities need to be multipurpose plants that can process other raw materials between the seasons.

Key Trends in the Global Potato Starch Market

- Growing Demand in Food Industry: Potato starch is widely used in the food industry as a thickening agent, stabilizer, and texture enhancer. The increasing demand for convenience foods, bakery products, and processed foods has been driving the growth of the potato starch market.

- Health and Wellness Trends: With the rising consumer awareness regarding health and wellness, there has been a shift towards natural and clean label ingredients. Potato starch, being a natural ingredient derived from potatoes, is perceived as healthier compared to synthetic thickeners and stabilizers. This trend has been boosting the demand for potato starch in various food applications.

-

Expansion of Application Areas: Potato starch is not only used in the food industry but also finds applications in industries such as pharmaceuticals, textiles, paper, and adhesives. The versatility of potato starch and its eco-friendly nature have led to its adoption in various non-food applications, thus expanding the market opportunities.

-

Technological Advancements: Technological advancements in potato starch processing have led to improved extraction methods, resulting in higher yields and better quality starch. These advancements have helped potato starch manufacturers to meet the increasing demand efficiently and sustainably.

-

Regional Market Dynamics: The global potato starch market is influenced by regional dynamics such as potato production, consumption patterns, and regulatory frameworks. Countries with significant potato cultivation, such as China, India, the United States, and European nations, play a crucial role in the global potato starch market.

-

Sustainability Initiatives: Sustainability has become a key focus area for both consumers and businesses. Potato starch, being a renewable and biodegradable resource, aligns well with sustainability objectives. Companies in the potato starch market are increasingly investing in sustainable sourcing practices and eco-friendly production processes to meet consumer preferences and regulatory requirements.

-

Market Consolidation and Innovation: The potato starch market is witnessing consolidation through mergers, acquisitions, and strategic partnerships as companies aim to strengthen their market presence and expand their product portfolios. Additionally, there is a continued emphasis on product innovation to cater to evolving consumer preferences and differentiate offerings in a competitive market landscape.

Native Potato Starch Is Suitable For Use In Pet Foods And Animal Nutrition

Native potato starch is used for a wide range of practical purposes in food products. Its high water-binding capacity is helpful in noodles, soups and sauces, canned vegetables, meat and bakery products, snacks and confectionaries, dry mixes, and a variety of extruded food products. It provides high viscosity and heightens the taste, odor, and color of the food in which it is used due to the low protein and fat/lipid content. It is a flexible ingredient in various foods, providing good organoleptic properties.

Native potato starch is also suitable for use in pet foods and animal nutrition. It serves as a digestible energy source for animals and allows adapting and/or improving the texture of the finished product during palletization and extrusion processes. Among the major industrially produced native starches, potato starch stands out with distinct characteristics that make it a choice ingredient in food manufacturing, which is driving the potato starch market, Native potato starch also has the highest viscosity among all the major native starches. It reaches a peak viscosity of 3000 BU at 60 degrees Celsius–65 degrees Celsius. It also exhibits the highest swelling power and solubility at 95 degrees Celsius compared to other native starches.

Increased Production In Lesser Time Boosting The Industrial Usage Of Microbial Enzymes

Microbial enzymes play a major role in the industrial enzymes market because they are more stable than plant and animal enzymes. They can be produced through fermentation techniques in a cost-effective manner with less time and space requirement, and because of their high consistency, process modification and optimization are easily done. Novel enzymes that cannot be extracted from plants and animals are derived from microorganisms and can be easily used. Enzymes are biocatalysts that play an important role in metabolic and biochemical reactions. Microbial enzymes are mainly produced by submerged fermentation and solid-state fermentation. The enormous diversity of microbial enzymes makes them an important source of raw materials for industrial applications, such as bioethanol, Paper & pulp, textile & leather, detergents, feed, and wastewater treatment. For example, the use of microbial enzymes in the Paper & pulp industry allows the secondary fiber structure to loosen up, releasing the embedded ink with reduced usage of alkali, chemicals, and detergents.

The Post Use Material Of Biodegradable Plastics Can Be Treated Biologically

A unique feature of biodegradable plastics is that, unlike most conventional plastics, the post-use materials may be treated biologically, for instance, via aerobic composting, to generate carbon and nutrient-rich compost as a soil improver. Compost can be used as soil enhancer to enhance water retention and increase the availability of water to plants. This has led to the establishment of different standards and certification systems to regulate composting practices.

Kompuestos, one of the leading producers of sustainable compounds in Europe, have developed bioplastic based on potato starch market that will degrade within four weeks. They joined Biokomp's range of biodegradable resins made from different starches derived from corn, potato, and various types of cereals.

To know about the assumptions considered for the study, download the pdf brochure

Potato Starch Industry: Regional Landscape

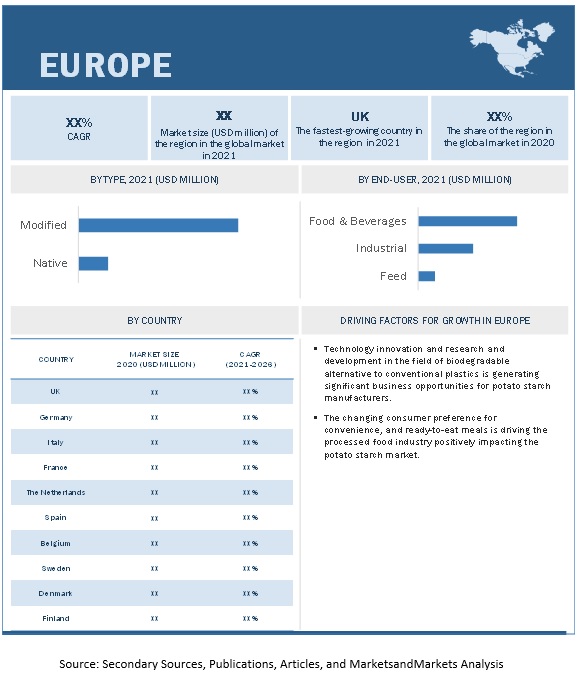

Europe dominated the potato starch market, with a value of USD 1.9 billion in 2021; it is projected to reach USD 2.4 billion by 2027, at a CAGR of 3.7% during the forecast period.

Today Europe is the world’s leading producer of potato starch, with European potato starch being exported to all corners of the globe. Europe accounted for a market share of 60.7% in the global modified starch market, in 2021. The European starch industry has a range of starch offerings, ranging from native to modified (chemically and physically) and liquid and solid sweeteners. The versatility of potato starches enables their application as ingredients and functional supplements in the food, non-food, and feed industries.

In terms of the end-use application industry, there is no stand-out trend. However, the food industry is projected to witness the fastest growth with the newer variations of modified starch, new products, and a range of applications.

Potato Starch Market Key Players

The key players in the market include Tate & Lyle (UK), Emsland (Germany), Ingredion Incorporated (US), and Avebe (Netherlands).

Potato Starch Market Report Scope

|

Report Metric |

Details |

|

Market size estimation |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Market size valuation in 2022 |

USD 4.3 billion |

|

Revenue prediction in 2027 |

USD 5.2 billion |

|

Progress rate |

CAGR of 3.7% from 2022 to 2027 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By type, end-user, nature and region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies studied |

|

Potato Starch Market Segmentation:

This research report categorizes the market, based on type, end-user, nature and region

|

Aspect |

Details |

|

By Type |

|

|

By End User |

|

|

By Nature |

|

|

By Region |

|

Recent Developments in the Potato Starch Market:

- In March 2021, Ingredion Incorporated launched a new ULTRA-TEX 1311 potato starch range for the US and Canadian markets. It helps to leverage waxy potato starch’s unique benefits for thickening and texturizing across a variety of use.

- In July 2020, Emsland Group entered into a strategic partnership with the Brenntag Group (Russia). This strategic decision has reorganized the sales structure of the Emsland Group in Russia. Brenntag took over the distribution of Emsland’s product portfolio for the food industry. The product portfolio also includes technical specialty products, such as native starches, modified starches, proteins, and fibers from peas and potatoes.

- In October 2018, The Avebe and Hanze Universities partnered to increase social prosperity in the northern region. The initiative also promotes regional cooperation.

- In September 2018, SiccaDania started the manufacturing of VIMAL’s third state-of-the-art manufacturing facility in Chernihiv, Ukraine, in September 2018. The new facility aims at increasing the total revenues of potato producers across the country.

Frequently Asked Questions (FAQ):

What are the major revenue pockets in the potato starch market currently?

Europe dominated the potato starch market, with a value of USD 1,923 million in 2021; it is projected to reach USD 2,384 million by 2027, at a CAGR of 3.7% during the forecast period. The European Starch Industry Association, Starch Europe, is the trade association that represents the interests of the European starch industry. Major players present in the European modified starch market are Roquette Frères (France) and Avebe U.A (Netherlands).

How big is the potato starch market?

The global potato starch market is estimated to be valued at USD 4.3 billion in 2022. It is projected to reach USD 5.2 billion by 2027, recording a CAGR of 3.7% during the forecast period.

Which players are involved in manufacturing of potato starch?

Key players in this market include Tate & Lyle, Emsland, Ingredion Incorporated, and Avebe. Since potato starch is a fast-growing market, the existing players are fixated upon improving their market shares, while startups are being established rapidly. The potato starch market can be classified as a fragmented market as it has a large number of organized players, accounting for a major part of the market share, present at the global level, and unorganized players present at the local level in several countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 POTATO STARCH MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2015–2020

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGNCHART

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

TABLE 3 KEY DATA FROM PRIMARY SOURCES

2.1.2.1 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

2.2 POTATO STARCH MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE (BASED ON END USER, BY REGION)

2.2.2 APPROACH TWO (BASED ON THE GLOBAL MARKET)C

2.3 DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDYCHART

2.6 SCENARIO-BASED MODELING

2.7 INTRODUCTION TO COVID-19

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 5 COVID-19: GLOBAL PROPAGATION

FIGURE 6 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 7 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 8 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 9 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 4 MARKET SHARE SNAPSHOT, 2022 VS. 2027, BY VALUE

TABLE 5 MARKET SHARE SNAPSHOT, 2022 VS. 2027, BY VOLUME

FIGURE 10 IMPACT OF COVID-19 ON THE MARKET SIZE, BY SCENARIO, 2020-2021 (USD MILLION)

FIGURE 11 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY FOOD & BEVERAGES SUB-APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY NATURE, 2022 VS. 2027 (KT)

FIGURE 15 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN THIS MARKET

FIGURE 16 GROWING DEMAND FOR THE USE OF SUSTAINABLE PRODUCTS TO REDUCE THE CARBON EMISSION RESULTED IN THE USE OF POTATO STARCH

4.2 MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 17 EUROPE WAS THE LARGEST MARKET GLOBALLY FOR POTATO STARCH IN 2021

4.3 ASIA PACIFIC: POTATO STARCH MARKET, BY KEY APPLICATION & COUNTRY

FIGURE 18 CHINA ACCOUNTED FOR THE LARGEST SHARE IN THE ASIA PACIFIC MARKET IN 2021

4.4 MARKET, BY END USER SUB-SEGMENTS

FIGURE 19 FOOD & BEVERAGES TO DOMINATE THE MARKET FOR POTATO STARCH DURING THE FORECAST PERIOD

4.5 MARKET, BY END USER

FIGURE 20 FOOD & BEVERAGES SEGMENT TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.6 MARKET FOR POTATO STARCH, BY NATURE

FIGURE 21 EUROPE DOMINATED BOTH NATURE OF POTATO STARCH IN 2021

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising demand for processed and convenience foods

FIGURE 23 PATTERN OF PROCESSED FOOD TRADE (AVERAGE PERCENTAGE SHARE), 2016-2018

FIGURE 24 PASTA PRODUCTION SHARE, BY REGION, 2019

5.2.1.2 Growing demand for adhesives in a range of industrial applications

FIGURE 25 TRADE FLOWS OF PAPER FOR RECYCLING, 2020 (MILLION TONS)

FIGURE 26 NON-FIBROUS MATERIALS CONSUMPTION IN THE PAPER AND PULP INDUSTRIES, 1991–2020 (MILLION TONS)

5.2.1.3 Investments in research and development and increasing production capacities accelerating the potato starch market

5.2.2 RESTRAINTS

5.2.2.1 Availability of a range of alternatives to potato starch

TABLE 6 CHARACTERISTICS COMPARISON CHART FOR STARCHES DERIVED FROM VARIOUS SOURCES

5.2.2.2 Lack of potato starch processing equipment and technologies in developing countries

5.2.3 OPPORTUNITIES

5.2.3.1 Strong market potential for potato starch-based bioplastics

FIGURE 27 GLOBAL PRODUCTION CAPACITIES OF BIOPLASTICS, BY MARKET SEGMENT, 2020

FIGURE 28 GLOBAL PRODUCTION CAPACITIES OF BIOPLASTICS, BY MATERIAL TYPE, 2020

5.2.3.2 Untapped potential of potato starch in the cosmetic industry

5.2.4 CHALLENGES

5.2.4.1 Operational challenges associated with modern potato starch production processes

5.2.4.2 Regulatory policies impacting the overall potato starch industry

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

6 INDUSTRY TRENDS (Page No. - 74)

6.1 INTRODUCTION

6.2 COVID-19 IMPACT ON THE POTATO STARCH MARKET

6.3 VALUE CHAIN

FIGURE 29 MARKET: VALUE CHAIN

6.3.1 RESEARCH & DEVELOPMENT

6.3.2 SOURCING OF RAW MATERIALS

6.3.3 PRODUCTION & PROCESSING

6.3.4 DISTRIBUTION, MARKETING, & SALES

6.4 SUPPLY CHAIN

FIGURE 30 PRODUCT DEVELOPMENT AND MANUFACTURING PLAY A VITAL ROLE IN THE SUPPLY CHAIN FOR THE MARKET

6.5 TECHNOLOGY ANALYSIS

6.5.1 POTATO STARCH MODIFICATION USING OZONE TECHNOLOGY

6.5.2 PREDICTING MECHANICAL PROPERTIES OF THERMOPLASTIC STARCH FILMS USING AI

6.6 PRICING ANALYSIS: MARKET, BY REGION

FIGURE 31 PRICING TRENDS OF THE POTATO STARCH, 2017–2019 (USD/TONS)

6.7 ECOSYSTEM

TABLE 7 MARKET FOR POTATO STARCH: ECOSYSTEM

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 32 YC-YCC: REVENUE SHIFT FOR THE POTATO STARCH MARKET

6.9 PATENT ANALYSIS

TABLE 8 KEY PATENTS PERTAINING TO POTATO STARCH, 2020–2021

6.10 TRADE ANALYSIS

TABLE 9 KEY EXPORTING COUNTRIES WITH EXPORT AND IMPORT VALUE OF POTATO STARCH, 2019 (USD MILLION)

6.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET FOR POTATO STARCH: PORTER’S FIVE FORCES ANALYSIS

6.11.1 INTENSITY OF COMPETITIVE RIVALRY

6.11.2 BARGAINING POWER OF SUPPLIERS

6.11.3 BARGAINING POWER OF BUYERS

6.11.4 THREAT OF NEW ENTRANTS

6.11.5 THREAT OF SUBSTITUTES

6.12 CASE STUDIES ANALYSIS

6.12.1 USE CASE 1: INGREDION INCORPORATED USES POTATO STARCH TO MAINTAIN THE PULPY GOODNESS

7 REGULATORY FRAMEWORK (Page No. - 86)

7.1 INTRODUCTION

7.2 POTATO STARCH REGULATIONS IN THE US 21 CFR 173

TABLE 11 REFERENCE AMOUNTS CUSTOMARILY CONSUMED PER EATING OCCASION

TABLE 12 POTATO STARCH PREPARATION APPROVED-FOOD ADDITIVES LISTED IN 21 CFR

7.3 POTATO STARCH REGULATIONS IN EUROPE

TABLE 13 EU AND UK IMPORT TARIFF RATES FOR POTATOES AND DERIVED PRODUCTS

TABLE 14 RISK ASSESSMENT FOR POTATO STARCH MANUFACTURING

7.4 POTATO STARCH REGULATIONS IN ASIA-PACIFIC

TABLE 15 PRODUCTS AND SERVICES LISTED FOR COMPULSORY HALAL CERTIFICATION IN INDONESIA

8 POTATO STARCH MARKET, BY NATURE (Page No. - 89)

8.1 INTRODUCTION

FIGURE 33 CONVENTIONAL SEGMENT TO DOMINATE THE GLOBAL MARKET 2021, IN TERMS OF VOLUME

TABLE 16 MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 17 MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 18 MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 19 MARKET SIZE, BY NATURE, 2022–2027 (KT)

8.2 ORGANIC

TABLE 20 ORGANIC MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 21 ORGANIC MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 ORGANIC MARKET SIZE, BY REGION, 2019–2021 (KT)

TABLE 23 ORGANIC MARKET SIZE, BY REGION, 2022–2027 (KT)

8.3 CONVENTIONAL

TABLE 24 CONVENTIONAL MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 25 CONVENTIONAL MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 CONVENTIONAL MARKET SIZE, BY REGION, 2019–2021 (KT)

TABLE 27 CONVENTIONAL MARKET SIZE, BY REGION, 2022–2027 (KT)

9 POTATO STARCH MARKET, BY TYPE (Page No. - 95)

9.1 INTRODUCTION

FIGURE 34 MODIFIED POTATO STARCH DOMINATED THE TYPE MARKET IN 2021, IN TERMS OF VOLUME

TABLE 28 MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 29 MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 30 MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 31 MARKET SIZE, BY TYPE, 2022–2027 (KT)

9.2 NATIVE

9.2.1 NATIVE POTATO STARCH CAN ALSO BE PRODUCED AS A SIDE STREAM PRODUCT

TABLE 32 NATIVE MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 33 NATIVE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 NATIVE MARKET SIZE, BY REGION, 2019–2021 (KT)

TABLE 35 NATIVE MARKET SIZE, BY REGION, 2022–2027 (KT)

9.3 MODIFIED

9.3.1 MODIFIED STARCHES ARE USED TO REMOVE THE CONSTRAINTS OF FOOD APPLICATIONS

TABLE 36 MODIFIED MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 MODIFIED MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 MODIFIED MARKET SIZE, BY REGION, 2019–2021 (KT)

TABLE 39 MODIFIED MARKET SIZE, BY REGION, 2022–2027 (KT)

10 POTATO STARCH MARKET, BY END USER (Page No. - 102)

10.1 INTRODUCTION

FIGURE 35 FOOD & BEVERAGES SEGMENT TO DOMINATE THE MARKET FROM 2022 TO 2027 (USD MILLION)

TABLE 40 MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 41 MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 42 MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 43 MARKET SIZE, BY END USER, 2022–2027 (KT)

10.2 FOOD & BEVERAGES

TABLE 44 FOOD & BEVERAGES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 45 FOOD & BEVERAGES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 FOOD & BEVERAGES MARKET SIZE, BY REGION, 2019–2021 (KT)

TABLE 47 FOOD & BEVERAGES MARKET SIZE, BY REGION, 2022–2027 (KT)

10.2.1 BAKERY & CONFECTIONERY PRODUCTS

10.2.1.1 Potato starch improves the texture and quality of bakery products

TABLE 48 MARKET SIZE IN BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 MARKET SIZE IN BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 MARKET SIZE IN BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2019–2021 (KT)

TABLE 51 MARKET SIZE IN BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2022–2027 (KT)

10.2.2 BEVERAGES

10.2.2.1 Starches stabilizing beverages and providing them with viscosity for mouthfeel

TABLE 52 POTATO STARCH MARKET SIZE IN BEVERAGES, BY REGION, 2019–2021 (USD MILLION)

TABLE 53 MARKET SIZE IN BEVERAGES, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 MARKET SIZE IN BEVERAGES, BY REGION, 2019–2021 (KT)

TABLE 55 MARKET SIZE IN BEVERAGES, BY REGION, 2022–2027 (KT)

10.2.3 PROCESSED FOODS

10.2.3.1 Potato starch acts as a stabilizer and provide the freeze-thaw ability to processed foods

TABLE 56 MARKET SIZE IN PROCESSED FOODS, BY REGION, 2019–2021 (USD MILLION)

TABLE 57 MARKET SIZE IN PROCESSED FOODS, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 MARKET SIZE IN PROCESSED FOODS, BY REGION, 2019–2021 (KT)

TABLE 59 MARKET SIZE IN PROCESSED FOODS, BY REGION, 2022–2027 (KT)

10.2.4 OTHER FOOD & BEVERAGES APPLICATIONS

10.2.4.1 They provide crispiness to snacks and cereals

TABLE 60 MARKET SIZE IN OTHER FOOD & BEVERAGES APPLICATIONS, BY REGION, 2019–2021 (USD MILLION)

TABLE 61 MARKET SIZE IN OTHER FOOD & BEVERAGES APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 62 MARKET SIZE IN OTHER FOOD & BEVERAGES APPLICATIONS, BY REGION, 2019–2021 (KT)

TABLE 63 MARKET SIZE IN OTHER FOOD & BEVERAGES APPLICATIONS, BY REGION, 2022–2027 (KT)

10.2.4.2 Noodles

10.2.4.3 RTE snacks

10.3 FEED

TABLE 64 POTATO STARCH MARKET SIZE IN FEED, BY REGION, 2019–2021 (USD MILLION)

TABLE 65 MARKET SIZE IN FEED, BY REGION, 2022–2027 (USD MILLION)

TABLE 66 MARKET SIZE IN FEED, BY REGION, 2019–2021 (KT)

TABLE 67 MARKET SIZE IN FEED, BY REGION, 2022–2027 (KT)

10.4 INDUSTRIAL

TABLE 68 MARKET SIZE IN INDUSTRIAL, BY REGION, 2019–2021 (USD MILLION)

TABLE 69 MARKET SIZE IN INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

TABLE 70 MARKET SIZE IN INDUSTRIAL, BY REGION, 2019–2021 (KT)

TABLE 71 MARKET SIZE IN INDUSTRIAL, BY REGION, 2022–2027 (KT)

10.4.1 PAPER INDUSTRY

10.4.1.1 Modified starch provides internal strength to paper

TABLE 72 MARKET SIZE IN PAPER INDUSTRY, BY REGION, 2019–2021 (USD MILLION)

TABLE 73 MARKET SIZE IN PAPER INDUSTRY, BY REGION, 2022–2027 (USD MILLION)

TABLE 74 MARKET SIZE IN PAPER INDUSTRY, BY REGION, 2019–2021 (KT)

TABLE 75 MARKET SIZE IN PAPER INDUSTRY, BY REGION, 2022–2027 (KT)

10.4.2 PHARMACEUTICALS

10.4.2.1 Potato starch performs crucial functions in various pharmaceutical applications

TABLE 76 MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 77 MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 78 POTATO STARCH MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2019–2021 (KT)

TABLE 79 MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2022–2027 (KT)

10.4.3 COSMETICS

10.4.3.1 Potato starch provides smoothness to cosmetics

TABLE 80 MARKET SIZE IN COSMETICS, BY REGION, 2019–2021 (USD MILLION)

TABLE 81 MARKET SIZE IN COSMETICS, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 MARKET SIZE IN COSMETICS, BY REGION, 2019–2021 (KT)

TABLE 83 MARKET SIZE IN COSMETICS, BY REGION, 2022–2027 (KT)

10.4.4 BIODEGRADABLE PLASTICS

10.4.4.1 Starch constitutes a rich resource of fermen TABLE sugars

FIGURE 36 BIODEGRADABLE PLASTIC PROCESS CURVE

TABLE 84 MARKET SIZE IN BIODEGRADABLE PLASTIC, BY REGION, 2019–2021 (USD MILLION)

TABLE 85 MARKET SIZE IN BIODEGRADABLE PLASTIC, BY REGION, 2022–2027 (USD MILLION)

TABLE 86 MARKET SIZE IN BIODEGRADABLE PLASTIC, BY REGION, 2019–2021 (KT)

TABLE 87 MARKET SIZE IN BIODEGRADABLE PLASTIC, BY REGION, 2022–2027 (KT)

10.4.5 OTHER INDUSTRIAL APPLICATIONS

10.4.5.1 Potato starch is primarily used for textile sizing in the textile industry

TABLE 88 MARKET SIZE IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2019–2021 (USD MILLION)

TABLE 89 MARKET SIZE IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

TABLE 90 MARKET SIZE IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2019–2021 (KT)

TABLE 91 MARKET SIZE IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2022–2027 (KT)

11 POTATO STARCH MARKET, BY REGION (Page No. - 126)

11.1 INTRODUCTION

FIGURE 37 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2022–2027

TABLE 92 MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 93 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 94 MARKET SIZE, BY REGION, 2019–2021 (KT)

TABLE 95 MARKET SIZE, BY REGION, 2022–2027 (KT)

11.2 NORTH AMERICA

TABLE 96 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2021 (KT)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (KT)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2019–2021 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2022–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: POTATO STARCH MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2019–2021 (KT)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2022–2027 (KT)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2019–2021 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2022–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2019–2021 (KT)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2022–2027 (KT)

11.2.1 UNITED STATES

11.2.1.1 Potato starch is used in various food applications to improve their texture

TABLE 120 US: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 121 US: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 122 US: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 123 US: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 124 US: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 125 US: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 126 US: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 127 US: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 128 US: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 129 US: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 130 US: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 131 US: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.2.2 CANADA

11.2.2.1 Government agencies are working toward incorporating potato starch in various industrial applications

TABLE 132 CANADA: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 133 CANADA: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 134 CANADA: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 135 CANADA: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 136 CANADA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 137 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 138 CANADA: POTATO STARCH MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 139 CANADA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 140 CANADA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 141 CANADA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 142 CANADA: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 143 CANADA: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.2.3 MEXICO

11.2.3.1 Growth in the paper & packaging industry demanding potato starch

TABLE 144 MEXICO: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 145 MEXICO: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 146 MEXICO: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 147 MEXICO: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 148 MEXICO: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 149 MEXICO: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 150 MEXICO: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 151 MEXICO: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 152 MEXICO: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 153 MEXICO: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 154 MEXICO: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 155 MEXICO: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3 EUROPE

FIGURE 38 EUROPE: MARKET SNAPSHOT

TABLE 156 EUROPE: POTATO STARCH MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 157 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 158 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2021 (KT)

TABLE 159 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 160 EUROPE: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 161 EUROPE: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 162 EUROPE: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 163 EUROPE: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 164 EUROPE: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 165 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 166 EUROPE: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 167 EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 168 EUROPE: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 169 EUROPE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 170 EUROPE: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 171 EUROPE: MARKET SIZE, BY END USER, 2022–2027 (KT)

TABLE 172 EUROPE: MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2019–2021 (USD MILLION)

TABLE 173 EUROPE: MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2022–2027 (USD MILLION)

TABLE 174 EUROPE: MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2019–2021 (KT)

TABLE 175 EUROPE: MARKET SIZE, BY FOOD & BEVERAGES SUB SEGMENT, 2022–2027 (KT)

TABLE 176 EUROPE: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2019–2021 (USD MILLION)

TABLE 177 EUROPE: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2022–2027 (USD MILLION)

TABLE 178 EUROPE: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2019–2021 (KT)

TABLE 179 EUROPE: MARKET SIZE, BY INDUSTRIAL SUB SEGMENT, 2022–2027 (KT)

11.3.1 GERMANY

11.3.1.1 Increase in consumption of convenience food driving the demand

TABLE 180 GERMANY: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 181 GERMANY: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 182 GERMANY: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 183 GERMANY: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 184 GERMANY: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 185 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 186 GERMANY: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 187 GERMANY: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 188 GERMANY: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 189 GERMANY: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 190 GERMANY: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 191 GERMANY: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.2 FRANCE

11.3.2.1 High consumption of dairy products fueling the demand for potato starch

TABLE 192 FRANCE: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 193 FRANCE: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 194 FRANCE: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 195 FRANCE: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 196 FRANCE: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 197 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 198 FRANCE: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 199 FRANCE: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 200 FRANCE: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 201 FRANCE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 202 FRANCE: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 203 FRANCE: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.3 UNITED KINGDOM

11.3.3.1 Growth of the feed industry contributing to the global market

TABLE 204 UK: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 205 UK: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 206 UK: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 207 UK: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 208 UK: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 209 UK: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 210 UK: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 211 UK: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 212 UK: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 213 UK: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 214 UK: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 215 UK: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.4 SPAIN

11.3.4.1 Developed food processing industry propelling the market growth

TABLE 216 SPAIN: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 217 SPAIN: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 218 SPAIN: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 219 SPAIN: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 220 SPAIN: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 221 SPAIN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 222 SPAIN: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 223 SPAIN: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 224 SPAIN: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 225 SPAIN: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 226 SPAIN: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 227 SPAIN: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.5 ITALY

11.3.5.1 Widespread baker & confectionery industry in the country to drive demand

TABLE 228 ITALY: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 229 ITALY: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 230 ITALY: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 231 ITALY: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 232 ITALY: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 233 ITALY: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 234 ITALY: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 235 ITALY: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 236 ITALY: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 237 ITALY: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 238 ITALY: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 239 ITALY: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.6 BELGIUM

11.3.6.1 Modified potato starch is used for analog screen-painting

TABLE 240 BELGIUM: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 241 BELGIUM: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 242 BELGIUM: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 243 BELGIUM: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 244 BELGIUM: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 245 BELGIUM: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 246 BELGIUM: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 247 BELGIUM: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 248 BELGIUM: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 249 BELGIUM: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 250 BELGIUM: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 251 BELGIUM: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.7 THE NETHERLANDS

11.3.7.1 The Netherlands grows over 500 different varieties of potatoes

TABLE 252 THE NETHERLANDS: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 253 THE NETHERLANDS: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 254 THE NETHERLANDS: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 255 THE NETHERLANDS: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 256 THE NETHERLANDS: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 257 THE NETHERLANDS: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 258 THE NETHERLANDS: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 259 THE NETHERLANDS: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 260 THE NETHERLANDS: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 261 THE NETHERLANDS: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 262 THE NETHERLANDS: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 263 THE NETHERLANDS: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.8 SWEDEN

11.3.8.1 Sweden uses GM potatoes for the paper production industry

TABLE 264 SWEDEN: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 265 SWEDEN: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 266 SWEDEN: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 267 SWEDEN: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 268 SWEDEN: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 269 SWEDEN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 270 SWEDEN: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 271 SWEDEN: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 272 SWEDEN: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 273 SWEDEN: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 274 SWEDEN: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 275 SWEDEN: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.9 DENMARK

11.3.9.1 Potato starch produced in Denmark are exceptionally pure

TABLE 276 DENMARK: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 277 DENMARK: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 278 DENMARK: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 279 DENMARK: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 280 DENMARK: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 281 DENMARK: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 282 DENMARK: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 283 DENMARK: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 284 DENMARK: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 285 DENMARK: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 286 DENMARK: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 287 DENMARK: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.10 FINLAND

11.3.10.1 Best known sago delicacy is made by using potato starch

TABLE 288 FINLAND: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 289 FINLAND: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 290 FINLAND: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 291 FINLAND: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 292 FINLAND: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 293 FINLAND: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 294 FINLAND: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 295 FINLAND: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 296 FINLAND: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 297 FINLAND: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 298 FINLAND: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 299 FINLAND: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.3.11 REST OF EUROPE

11.3.11.1 Growing industries will increase the demand for potato starch

TABLE 300 REST OF EUROPE: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 301 REST OF EUROPE: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 302 REST OF EUROPE: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 303 REST OF EUROPE: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 304 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 305 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 306 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 307 REST OF EUROPE: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 308 REST OF EUROPE: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 309 REST OF EUROPE: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 310 REST OF EUROPE: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 311 REST OF EUROPE: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.4 ASIA PACIFIC

TABLE 312 ASIA PACIFIC: MARKET SIZE FOR POTATO STARCH, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 313 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 314 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2021 (KT)

TABLE 315 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 316 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 317 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 318 ASIA PACIFIC: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 319 ASIA PACIFIC: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 320 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 321 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 322 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 323 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 324 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 325 ASIA PACIFIC: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 326 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 327 ASIA PACIFIC: MARKET SIZE, BY END USER, 2022–2027 (KT)

TABLE 328 ASIA PACIFIC: MARKET SIZE, BY FOOD & BEVERAGES SUBSEGMENT, 2019–2021 (USD MILLION)

TABLE 329 ASIA PACIFIC: MARKET SIZE, BY FOOD & BEVERAGES SUBSEGMENT, 2022–2027 (USD MILLION)

TABLE 330 ASIA PACIFIC: MARKET SIZE FOR POTATO STARCH, BY FOOD & BEVERAGES SUBSEGMENT, 2019–2021 (KT)

TABLE 331 ASIA PACIFIC: MARKET SIZE, BY FOOD & BEVERAGES SUBSEGMENT, 2022–2027 (KT)

TABLE 332 ASIA PACIFIC: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2019–2021 (USD MILLION)

TABLE 333 ASIA PACIFIC: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2022–2027 (USD MILLION)

TABLE 334 ASIA PACIFIC: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2019–2021 (KT)

TABLE 335 ASIA PACIFIC: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2022–2027 (KT)

11.4.1 CHINA

11.4.1.1 China dominates the Asia Pacific potato starch market

TABLE 336 CHINA: MARKET SIZE FOR POTATO STARCH, BY NATURE, 2019–2021 (USD MILLION)

TABLE 337 CHINA: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 338 CHINA: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 339 CHINA: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 340 CHINA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 341 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 342 CHINA: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 343 CHINA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 344 CHINA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 345 CHINA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 346 CHINA: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 347 CHINA: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.4.2 JAPAN

11.4.2.1 Rise in the processed food industry in Japan driving the market

TABLE 348 JAPAN: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 349 JAPAN: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 350 JAPAN: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 351 JAPAN: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 352 JAPAN: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 353 JAPAN: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 354 JAPAN: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 355 JAPAN: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 356 JAPAN: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 357 JAPAN: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 358 JAPAN: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 359 JAPAN: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.4.3 INDIA

11.4.3.1 Growing demand for potato starch in India’s industrial sector

TABLE 360 INDIA: MARKET SIZE FOR POTATO STARCH, BY NATURE, 2019–2021 (USD MILLION)

TABLE 361 INDIA: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 362 INDIA: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 363 INDIA: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 364 INDIA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 365 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 366 INDIA: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 367 INDIA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 368 INDIA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 369 INDIA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 370 INDIA: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 371 INDIA: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.4.4 SOUTH KOREA

11.4.4.1 Growth in the demand for packaged food is driving the demand for potato starch

TABLE 372 SOUTH KOREA: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 373 SOUTH KOREA: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 374 SOUTH KOREA: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 375 SOUTH KOREA: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 376 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 377 SOUTH KOREA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 378 SOUTH KOREA: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 379 SOUTH KOREA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 380 SOUTH KOREA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 381 SOUTH KOREA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 382 SOUTH KOREA: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 383 SOUTH KOREA: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.4.5 THAILAND

11.4.5.1 Food exports and production of ready-to-eat meals to drive the potato starch industry

TABLE 384 THAILAND: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 385 THAILAND: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 386 THAILAND: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 387 THAILAND: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 388 THAILAND: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 389 THAILAND: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 390 THAILAND: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 391 THAILAND: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 392 THAILAND: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 393 THAILAND: POTATO STARCH MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 394 THAILAND: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 395 THAILAND: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.4.6 REST OF ASIA PACIFIC

11.4.6.1 Growth in industries will increase the demand for potato starch

TABLE 396 REST OF ASIA PACIFIC: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 397 REST OF ASIA PACIFIC: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 398 REST OF ASIA PACIFIC: MARKET SIZE FOR POTATO STARCH, BY NATURE, 2019–2021 (KT)

TABLE 399 REST OF ASIA PACIFIC: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 400 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 401 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 402 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 403 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 404 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 405 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 406 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 407 REST OF ASIA PACIFIC: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.5 REST OF THE WORLD (ROW)

TABLE 408 ROW: POTATO STARCH MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 409 ROW: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 410 ROW: MARKET SIZE, BY COUNTRY, 2019–2021 (KT)

TABLE 411 ROW: MARKET SIZE, BY COUNTRY, 2022–2027 (KT)

TABLE 412 ROW: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 413 ROW: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 414 ROW: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 415 ROW: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 416 ROW: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 417 ROW: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 418 ROW: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 419 ROW: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 420 ROW: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 421 ROW: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 422 ROW: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 423 ROW: MARKET SIZE, BY END USER, 2022–2027 (KT)

TABLE 424 ROW: MARKET SIZE, BY FOOD & BEVERAGES SUBSEGMENT, 2019–2021 (USD MILLION)

TABLE 425 ROW: MARKET SIZE, BY FOOD & BEVERAGES SUBSEGMENT, 2022–2027 (USD MILLION)

TABLE 426 ROW: MARKET SIZE, BY FOOD & BEVERAGES SUBSEGMENT, 2019–2021 (KT)

TABLE 427 ROW: MARKET SIZE, BY FOOD & BEVERAGES SUBSEGMENT, 2022–2027 (KT)

TABLE 428 ROW: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2019–2021 (USD MILLION)

TABLE 429 ROW: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2022–2027 (USD MILLION)

TABLE 430 ROW: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2019–2021 (KT)

TABLE 431 ROW: MARKET SIZE, BY INDUSTRIAL SUBSEGMENT, 2022–2027 (KT)

11.5.1 SOUTH AMERICA

TABLE 432 SOUTH AMERICA: POTATO STARCH MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 433 SOUTH AMERICA: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 434 SOUTH AMERICA: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 435 SOUTH AMERICA: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 436 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 437 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 438 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 439 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 440 SOUTH AMERICA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 441 SOUTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 442 SOUTH AMERICA: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 443 SOUTH AMERICA: MARKET SIZE, BY END USER, 2022–2027 (KT)

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Potential of potato starch in bioplastics industrial application

TABLE 444 MIDDLE EAST & AFRICA: MARKET SIZE, BY NATURE, 2019–2021 (USD MILLION)

TABLE 445 MIDDLE EAST & AFRICA: MARKET SIZE, BY NATURE, 2022–2027 (USD MILLION)

TABLE 446 MIDDLE EAST & AFRICA: MARKET SIZE, BY NATURE, 2019–2021 (KT)

TABLE 447 MIDDLE EAST & AFRICA: MARKET SIZE, BY NATURE, 2022–2027 (KT)

TABLE 448 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 449 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 450 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2021 (KT)

TABLE 451 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2022–2027 (KT)

TABLE 452 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2019–2021 (USD MILLION)

TABLE 453 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

TABLE 454 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2019–2021 (KT)

TABLE 455 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2022–2027 (KT)

12 COMPETITIVE LANDSCAPE (Page No. - 236)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2020

TABLE 456 POTATO STARCH MARKET: DEGREE OF COMPETITION

12.3 KEY PLAYER STRATEGIES

12.4 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2020

FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 40 MARKET, COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.5.5 PRODUCT FOOTPRINT

TABLE 457 POTATO STARCH: COMPANY PRODUCT APPLICATION FOOTPRINT

TABLE 458 POTATO STARCH: COMPANY REGION FOOTPRINT

12.6 MARKET, STARTUP/SME EVALUATION QUADRANT, 2020

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 41 MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHERS)

12.7 NEW PRODUCT LAUNCHES AND DEALS

12.7.1 NEW PRODUCT LAUNCHES

TABLE 459 MARKET: PRODUCT LAUNCHES, APRIL 2017–MARCH 2021

12.7.2 DEALS

TABLE 460 POTATO STARCH MARKET: DEALS, SEPTEMBER 2017–JULY 2021

13 COMPANY PROFILES (Page No. - 248)

13.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 PEPEES S.A.

TABLE 461 PEPEES S.A.: BUSINESS OVERVIEW

FIGURE 42 PEPEES S.A.: COMPANY SNAPSHOT

TABLE 462 PEPEES S.A.: PRODUCTS OFFERED

13.1.2 AGRANA BETEILIGUNGS-AG

TABLE 463 AGRANA BETEILIGUNGS-AG: BUSINESS OVERVIEW

FIGURE 43 AGRANA BETEILIGUNGS-AG: COMPANY SNAPSHOT

TABLE 464 AGRANA BETEILIGUNGS-AG: PRODUCTS OFFERED

TABLE 465 MARKET: OTHERS, MARCH 2021

13.1.3 KMC

TABLE 466 KMC: BUSINESS OVERVIEW

FIGURE 44 KMC: COMPANY SNAPSHOT

TABLE 467 KMC: PRODUCTS OFFERED

TABLE 468 MARKET: OTHERS, MAY 2018–SEPTEMBER 2019

13.1.4 TATE & LYLE

TABLE 469 TATE & LYLE: BUSINESS OVERVIEW

FIGURE 45 TATE & LYLE: COMPANY SNAPSHOT

TABLE 470 TATE & LYLE: PRODUCTS OFFERED

TABLE 471 MARKET: DEALS, FEBRUARY 2021–JULY 2021

13.1.5 VIMAL PPCE

TABLE 472 VIMAL PPCE: BUSINESS OVERVIEW

TABLE 473 VIMAL PPCE: PRODUCTS OFFERED

TABLE 474 POTATO STARCH MARKET: OTHERS, SEPTEMBER 2017

13.1.6 AVEBE

TABLE 475 AVEBE: BUSINESS OVERVIEW

FIGURE 46 AVEBE: COMPANY SNAPSHOT

TABLE 476 AVEBE: PRODUCTS OFFERED

TABLE 477 MARKET: DEALS, OCTOBER 2018–APRIL 2021

13.1.7 TEREOS

TABLE 478 TEREOS: BUSINESS OVERVIEW

FIGURE 47 TEREOS: COMPANY SNAPSHOT

TABLE 479 TEREOS: PRODUCTS OFFERED

13.1.8 LYCKEBY

TABLE 480 LYCKEBY: BUSINESS OVERVIEW

TABLE 481 LYCKEBY: PRODUCTS OFFERED

13.1.9 RÄDCHEN USA INC

TABLE 482 RÄDCHEN USA INC: BUSINESS OVERVIEW

TABLE 483 RADCHEN USA INC: PRODUCTS OFFERED

13.1.10 ROYAL INGREDIENTS GROUP

TABLE 484 ROYAL INGREDIENTS GROUP: BUSINESS OVERVIEW

TABLE 485 ROYAL INGREDIENTS GROUP: PRODUCTS OFFERED

13.1.11 ROQUETTE FRÈRES

TABLE 486 ROQUETTE FRÈRES: BUSINESS OVERVIEW

FIGURE 48 ROQUETTE FRÈRES: COMPANY SNAPSHOT

TABLE 487 ROQUETTE FRÈRES: PRODUCTS OFFERED

13.1.12 EMSLAND GROUP

TABLE 488 EMSLAND GROUP: BUSINESS OVERVIEW

TABLE 489 EMSLAND GROUP: PRODUCTS OFFERED

TABLE 490 POTATO STARCH MARKET: PRODUCT LAUNCHES, DECEMBER 2020

TABLE 491 MARKET FOR POTATO STARCH: DEALS, JULY 2020

13.1.13 SÜDSTÄRKE GMBH

TABLE 492 SÜDSTÄRKE GMBH: BUSINESS OVERVIEW

FIGURE 49 SÜDSTÄRKE GMBH: COMPANY SNAPSHOT

TABLE 493 SÜDSTÄRKE GMBH: PRODUCTS OFFERED

13.1.14 INGREDION INCORPORATED

TABLE 494 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 50 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 495 INGREDION INCORPORATED: PRODUCTS OFFERED

TABLE 496 MARKET: PRODUCT LAUNCHES, APRIL 2017–MARCH 2021

13.1.15 AKV LANGHOLT AMBA

TABLE 497 AKV LANGHOLT AMBA: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS TO POTATO STARCH MARKET (Page No. - 282)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 PEA STARCH MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 PEA STARCH MARKET, BY GRADE

TABLE 498 PEA STARCH MARKET SIZE, BY GRADE, 2018–2026 (USD MILLION)

TABLE 499 PEA STARCH MARKET SIZE, BY GRADE, 2018–2026 ( TON)

14.3.4 PEA STARCH MARKET, BY REGION

TABLE 500 PEA STARCH MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 501 PEA STARCH MARKET SIZE, BY REGION, 2018–2026 (TON)

14.4 MODIFIED STARCH MARKET

14.4.1 LIMITATIONS

14.4.2 MARKET DEFINITION

14.4.3 MARKET OVERVIEW

14.4.4 MODIFIED STARCH MARKET, BY FUNCTION

14.4.4.1 INTRODUCTION

14.4.5 MODIFIED STARCH MARKET, BY REGION

14.4.5.1 INTRODUCTION

TABLE 502 MODIFIED STARCH MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 503 MODIFIED STARCH MARKET SIZE, BY REGION, 2018–2025 (KT)

14.5 INDUSTRIAL STARCH MARKET

14.5.1 LIMITATIONS

14.5.2 MARKET DEFINITION

14.5.3 MARKET OVERVIEW

14.5.4 INDUSTRIAL STARCH MARKET, BY TYPE

TABLE 504 INDUSTRIAL STARCH MARKET SIZE, BY TYPE, 2014–2022 (KT)

14.5.5 INDUSTRIAL STARCH MARKET, BY REGION

14.5.5.1 Introduction

TABLE 505 INDUSTRIAL STARCH MARKET SIZE, BY REGION, 2014–2022 (KT)

15 APPENDIX (Page No. - 292)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

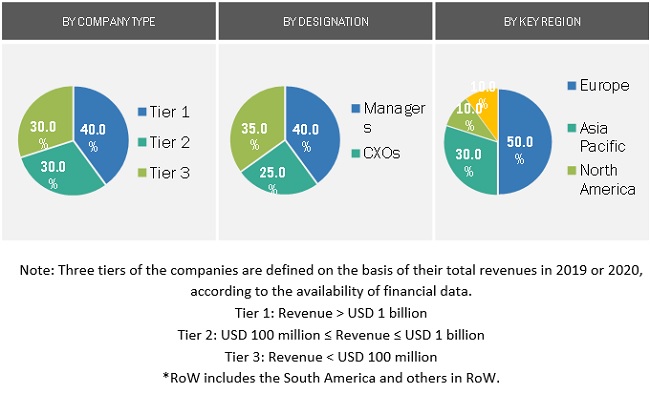

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the potato starch market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the market.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Potato Starch Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major potato starch manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Potato Starch Market Report Objectives

- To define, segment, and project the global market for potato starch on the basis of type, end-user, nature, and region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the market

Target Audience

- Potato starch raw material suppliers

- Potato starch manufacturers

- Intermediate suppliers, such as traders and distributors of potato starch

- Manufacturers of food & beverages, feed, paper industry, pharma, and cosmetics

- Government and research organizations

- Associations, regulatory bodies, and other industry-related bodies:

- Starch Europe

- World Health Organization (WHO)

- Food Industry Association of Austria (FIAA)

- International Federation of Starch Associations (IFSA)

- NISAD Starch Industrialists Association

- United States Department of Agriculture (USDA)

- Association of Enterprises of Deep Processing of Grains

- International Potato Center (CIP)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the potato starch market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for potato starch into the Greece

- Further breakdown of the Rest of South America market for potato starch into Chile, Peru, and Ecuador

- Further breakdown of other countries in the RoW market for potato starch into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Potato Starch Market

Interested to know more about the bioplastic based on potato starch. Kindly provide more information about biodegradable plastics as well.