Industrial Starch Market by Type (Native, Starch Derivatives & Sweeteners), Source (Corn, Wheat, Cassava, Potato), Application (Food, Feed, Paper Making & Corrugation, Pharmaceutical), Form (Dry, Liquid), and Region - Global Forecast to 2022

[188 Pages Report] The global industrial starch market is projected to grow from USD 72.51 billion in 2016 to USD 106.64 billion by 2022, at a CAGR of 6.64% during the forecast period. Starch is a homopolysaccharide formed by glucose units and stored in the form of carbohydrates in plants. It is synthesized by parts of vegetable cells and is stored in seeds, tubers, and roots. Starch derived from sources in its original form is known as native starch; whereas, starch produced by physically, chemically, or enzymatically, treating native starch to change its properties and enhance its performance according to various applications is known as modified starch. Modified starch can be termed as an additive prepared by treating native starch or starch granules with chemicals and enzymes to partially degrade the starch. Derivatives are products obtained by reacting starch with a chemical compound, resulting in unique physical and functional properties. The scope of the global market for this report includes native starch and starch derivatives & sweeteners. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2022.

Market Dynamics

Drivers

- Growth in demand for convenience food

- Multiple functionalities of starch, starch derivatives, and sweeteners across end-user industries

Restraints

- High R&D costs

- Growth of the gum arabic market

Opportunities

- Rise in the potential of alternate sources of starch such as cassava

Challenges

- Requirement of consistency in raw material production

Multiple functionalities of starch, starch derivatives, and sweeteners in a diverse range of end-use industries to drive the global industrial starch market

Starch and starch derivatives have various functional characteristics including thickeners, stabilizers, sizing, fat replacers, and binding in various food and non-food applications. In addition, starch derivatives are used as an effective fermentation base for the bulk production of various biotechnological products such as organic acids, antibiotics, vitamins, and hormones. Although the food industry is projected to be the largest end user of starch and its derivatives, it is also increasingly used in various other end-use applications, such as paper, building materials, cosmetics, and pharmaceuticals. In addition, native starch is useful in a wide range of applications. However, it is restricted in some applications such as paper, building materials, cosmetics, and pharmaceuticals due to its structure. Modified starches, owing to their water absorbing and bulking agent features, improve the customer experience and offers enhanced mouthfeel in various food products. Due to these factors, it remains a preferred alternative for fats among manufacturers. In addition, various functional properties of starch and starch derivatives used in a range of end-use industries are driving the demand for industrial starch.

The following are the major objectives of the study.

- To define, segment, and forecast the size of the industrial starch market on the basis of source, form, application, type, function, and region.

- To project the market size, in terms of value (USD million) and volume (KT) for each of the segments, namely, source, form, type, and application.

- To forecast the size of the global market and its various submarkets with respect to four main regions, namely, North America, Asia-Pacific, Europe, and the Rest of the World (RoW).

- To provide detailed information about crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, industry-specific challenges).

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically profile key players and comprehensively analyze their market share and core competencies.

- To analyze competitive developments such as expansions, mergers & acquisitions, new product launches, and joint ventures & agreements in the industrial starch market.

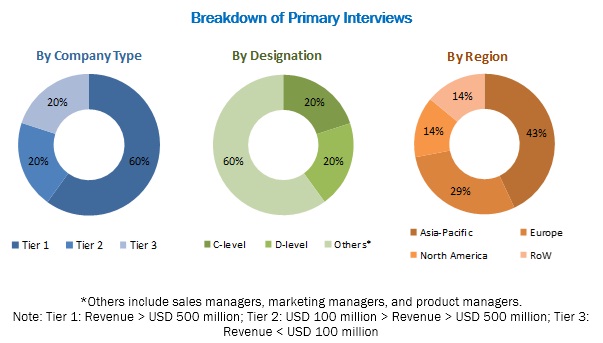

During this research study, major players operating in the industrial starch market in various regions were identified, and their offerings, regional presence, and distribution channels were analyzed through in-depth discussions. Top-down and bottom-up approaches were used to determine the overall market size. Sizes of the other individual markets were estimated using percentage splits obtained through secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The contributors involved in the value chain of industrial starch include industrial starch manufacturers such as Cargill (US), Archer Daniels Midland Company (US), Ingredion Incorporated (US), and Tate & Lyle PLC (UK); government bodies & regulatory associations such as the USDA (United States Department of Agriculture), the FDA (Food and Drug Administration), and the EFSA (European Food Safety Authority); and end uses such as food, feed, pharmaceutical, cosmetics, and corrugation & paper making.

Major Market Developments

- In August 2016, Ingredion, Incorporated (US) acquired the rice starch and rice flour business of Sun Flour Industry Co, Ltd. (Thailand) to support the company’s global strategy of increasing its high-value specialty ingredients business.

- In July 2016, Archer Daniels Midland Company (US) expanded its portfolio of starches by introducing a new line of starch–DM Confectionery Molding Starch. This is projected to help the company in expanding its customer base in the confectionery industry.

- In January 2016, Cargill, Incorporated (US) set up a new corn milling plant in Davangere, Karnataka (India), which cost the company nearly USD 100 million. This helped the company in meeting with the growing demands for modified starch and its derivatives in the food and pharmaceutical industries.

Target Audience

- Raw material suppliers

- Traders, distributors, and manufacturers & suppliers of industrial starch

- Food processors & food manufacturers

- Government and research organizations

- Trade associations and industry bodies

- Regulatory bodies such as the Food and Drugs Organization (FDA), the European Commission, the European Food Safety Authority (EFSA), and Food Standards Australia New Zealand

Report Scope

By Type

- Native starch

- Starch derivatives & sweeteners

By Source

- Corn

- Wheat

- Cassava

- Potato

- Other sources

By Application:

- Food & beverage

- Feed

- Other applications

By Form:

- Dry

- Liquid

By Geography

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Critical questions answered by the report

- What are the new application areas, which the industrial starch companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Segmental Analysis

Segmental analysis, which provides further breakdown of the ‘Others’ category in the application segment into mining & drilling, construction & building, adhesive, and chemical industries

Segmental analysis, which provides further breakdown of the ‘Others’ category in the type segment into maltodextrin, cyclodextrin, glucose syrup, hydrolysate and others

Regulatory Framework

- Regulations pertaining to each of the starch or starch derivatives across regions/countries.

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific industrial starch market, by country

- Further breakdown of Rest of Europe industrial starch market, by key country

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global industrial starch market is projected to grow from USD 72.51 billion in 2016 to USD 106.64 billion by 2022, at a CAGR of 6.64% during the forecast period. The increasing demand for convenience food and multiple functionalities of starch, starch derivatives, and sweeteners in a diverse range of end-use industries are the key factors driving the growth of this market.

Starch is a carbohydrate that is extracted from agricultural raw materials, such as corn, wheat, potato, and cassava and is used in numerous food and non-food applications. It is used as a major ingredient in food & beverage, feed, and other end-user industries such as corrugating & paper making, textile, pharmaceutical, personal care, and construction & building materials due to various functionalities such as thickening, binding, sizing, film forming, coating, and stabilizing. Starch is divided into three types, namely, native starch and starch derivatives & sweeteners.

The industrial starch market is segmented on the basis of type, into native starch and starch derivatives & sweeteners. The market for starch derivatives & sweeteners is projected to grow at the highest CAGR between 2016 and 2022. Unlike native starch, starch derivatives and sweeteners have better and application specific functionalities, due to which they are used in a wide range of industrial applications.

The global market in Asia-Pacific is projected to be the largest market during the forecast period. The market in Asia-Pacific is driven by the use of starch in various applications in emerging Asian markets such as China and India. For instance, the consumption of starch in China is nearly half of the global starch consumption.

Industrial starch applications in food & beverage, feed, and other applications to drive the growth of the industrial starch market

Food & beverage

Starch and its derivatives find application in various food applications such as confectionery, processed food, beverages, and others. Native starches are generally used for providing food products the required consistency, texture, and stability. However, these starches are chemically treated to create modified starches for application in a range of food products. Modified starches find increasing applications in food systems, where native starches have not been able to deliver the desired performance.

Feed

In comparison to the food and non-food markets for starch, the feed market for starch is relatively small. While modified and native starches are used as thickeners and binders in feed, other starch derivatives act as a source of fiber and for coloring and sweetening applications in pet food. Pregelatinized and high-amylose starch has useful binding properties and is used in pelletizing and extrusion processes. The use of starch derivatives remains high as it provides features such as enhanced digestibility of feed and protecting the liver functions of livestock.

Other Applications

Besides food and feed industries, the starch, its derivatives, and sweeteners find application in various other industries such as corrugation & paper making, pharmaceutical, textile, cosmetics, mining & drilling, construction & building materials, and chemical. The use of starch in these industrial applications is based on the need for specific functionality and properties among final products.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for industrial starch?

High R&D costs associated with the extraction and manufacture of starch derivatives are restraining the market growth. The extraction of starch derivatives from new natural sources for physical and chemical applications in various industries, such as food & beverage, paper, and pharmaceutical has become a challenge for manufacturers. Further, advancements in research have resulted in clinical recommendations with regards to the safe use of starch derivatives in various industrial applications. The use of starch in processed and convenience foods can contribute positively to the health and wellness of the general population in terms of fat substitution and replacing synthetic additives such as emulsifiers. Starch derivatives and their benefits have gained recognition in Europe and North America; hence, manufacturers and marketers are producing and distributing a wide range of starch derivatives & sweeteners for food and non-food applications, with an increased emphasis on the R&D activities. However, more investments are required to support the R&D activities, restraining the growth of this market.

The key players in this market are Cargill, Incorporated (US), Archer Daniels Midland Company (US), Ingredion Incorporated (US), Tate & Lyle PLC (UK), Agrana Beteiligungs-AG (Austria), Grain Processing Corporation (US), Roquette Frères (France), Tereos Group (France), Royal Cosun (Netherlands), and Altia Industrial Services (Finland). These companies have predominantly adopted new product launches as a growth strategy. In addition, other strategies adopted by these companies include expansions & investments, mergers & acquisitions, and joint ventures & agreements to increase their market share.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Covered

1.4 Periodization Considered for the Study

1.5 Currency

1.6 Stakeholders

1.7 Scope Limitations

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Opportunities in this Market

4.2 Key Industrial Starch Markets

4.3 Asia-Pacific Industrial Starch Market, By Source and Country

4.4 Dry vs Liquid Form, 2016 vs 2022

4.5 Market, By Application & Region

4.6 Life Cycle Analysis: Market, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Source

5.2.2 Application

5.2.3 Form

5.2.4 Type

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth in Demand for Convenience Food

5.3.1.2 Multiple Functionalities of Starch, Starch Derivatives & Sweeteners in Diverse Range of End-Use Industries

5.3.2 Restraints

5.3.2.1 High R&D Costs

5.3.2.2 Growth in the Gum Arabic Market

5.3.3 Opportunities

5.3.3.1 Rise in Potential of Alternate Sources of Starch Such as Cassava and Others

5.3.4 Challenges

5.3.4.1 Required Level of Consistency in Raw Material Production

6 Industry Outlook (Page No. - 47)

6.1 Supply Chain

6.2 Raw Material Analysis

6.3 Trade Statistics By Key Countries

6.3.1 U.S.

6.3.2 Canada

6.3.3 Mexico

6.3.4 Germany

6.3.5 France

6.3.6 Italy

6.3.7 U.K.

6.3.8 Spain

6.3.9 China

6.3.10 Japan

6.3.11 India

6.3.12 Australia

6.3.13 Thailand

6.3.14 Indonesia

6.3.15 Brazil

6.3.16 South Africa

7 Industrial Starch Market, By Type (Page No. - 65)

7.1 Introduction

7.2 Native Starch

7.3 Starch Derivatives & Sweeteners

7.3.1 Modified Starch

7.3.2 Other Derivatives & Sweeteners

7.3.2.1 Maltodextrin

7.3.2.2 Cyclodextrin

7.3.2.3 Glucose Syrups

7.3.2.4 Hydrolysates

8 Industrial Starch Market, By Source (Page No. - 77)

8.1 Introduction

8.2 Corn

8.3 Wheat

8.4 Cassava

8.5 Potato

8.6 Other Sources

9 Industrial Starch Market, By Application (Page No. - 84)

9.1 Introduction

9.2 Food & Beverage

9.2.1 Confectionery

9.2.2 Processed Foods

9.2.3 Beverages

9.2.4 Others

9.3 Feed

9.4 Other Applications

9.4.1 Corrugation & Paper Making

9.4.2 Pharmaceutical

9.4.3 Textile

9.4.4 Cosmetics

9.4.5 Others

9.4.5.1 Mining & Drilling

9.4.5.2 Construction & Building

9.4.5.3 Adhesive

9.4.5.4 Chemical

10 Industrial Starch Market, By Form (Page No. - 93)

10.1 Introduction

10.2 Dry Form

10.3 Liquid

11 Industrial Starch Market, By Function (Page No. - 96)

11.1 Introduction

11.2 Stabilizing

11.3 Thickening

11.4 Film Forming Agents

11.5 Gelling Agent

11.6 Texturizing

11.7 Binding

11.8 Emulsifying

11.9 Sizing

11.10 Mositure Retention

11.11 Coating

12 Industrial Starch Market, By Region (Page No. - 99)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 U.K.

12.3.4 Italy

12.3.5 Spain

12.3.6 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Australia

12.4.5 Rest of Asia-Pacific

12.5 Rest of the World

12.5.1 Latin America

12.5.2 Africa

12.5.3 Middle East

13 Brand Overview (Page No. - 136)

13.1 Introduction

13.2 Cargill, Incorporated

13.3 Archer Daniels Midland Company

13.4 Ingredion, Incorporated

13.5 Tate & Lyle PLC

13.6 Agrana Beteiligungs-AG

14 Competitive Landscape (Page No. - 140)

14.1 Overview

14.2 Market Share Analysis

14.3 Competitive Situations & Trends

14.4 New Product Launches

14.5 Expansions & Investments

14.6 Mergers & Acquisitions

14.7 Joint Ventures & Agreements

15 Company Profiles (Page No. - 145)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

15.1 Introduction

15.2 Cargill, Incorporated

15.3 Archer Daniels Midland Company

15.4 Ingredion Incorporated

15.5 Tate & Lyle PLC

15.6 Agrana Beteiligungs-AG

15.7 Grain Processing Corporation

15.8 Roquette Frères

15.9 The Tereos Group

15.10 Royal Cosun

15.11 Altia Industrial Services

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 175)

16.1 Industry Insights

16.2 Discussion Guide

16.3 More Company Developments

16.3.1 New Product Launches

16.3.2 Expansions & Investments

16.3.3 Mergers & Acquisitions

16.3.4 Joint Ventures & Agreements

16.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.5 Introducing RT: Real-Time Market Intelligence

16.6 Available Customizations

16.7 Related Reports

16.8 Author Details

List of Tables (128 Tables)

Table 1 Global Industrial Starch Market Snapshot, By Value

Table 2 Canada: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 3 Spain: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 4 Japan: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 5 India: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 6 Australia: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 7 Thailand: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 8 Brazil: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 9 South Africa: Starch Import-Export, By Source, 2011-2015 (Kg)

Table 10 Industrial Starch Market Size, By Type, 2014–2022 (KT)

Table 11 Market Size, By Type, 2014–2022 (USD Billion)

Table 12 Native Starch Market Size, By Region, 2014–2022 (USD Billion)

Table 13 North America: Native Starch Market Size, By Country, 2014–2022 (USD Billion)

Table 14 Europe: Native Starch Market Size, By Country, 2014–2022 (USD Billion)

Table 15 Asia-Pacific: Native Starch Market Size, By Country, 2014–2022 (USD Billion)

Table 16 RoW: Native Starch Market Size, By Region, 2014–2022 (USD Billion)

Table 17 Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (KT)

Table 18 Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 19 Starch Derivatives & Sweeteners Market Size, By Region, 2014–2022 (USD Billion)

Table 20 North America: Starch Derivatives & Sweeteners Market Size, By Country, 2014–2022 (USD Billion)

Table 21 Europe: Starch Derivatives & Sweeteners Market Size, By Country, 2014–2022 (USD Billion)

Table 22 Asia-Pacific: Starch Derivatives & Sweeteners Market Size, By Country, 2014–2022 (USD Billion)

Table 23 RoW: Starch Derivatives & Sweeteners Market Size, By Region, 2014–2022 (USD Billion)

Table 24 Modified Starch Market Size, By Region, 2014–2022 (USD Billion)

Table 25 Other Derivatives & Sweeteners Market Size, By Region, 2014–2022 (USD Billion)

Table 26 Industrial Starch Market Size, By Source, 2014–2022 (KT)

Table 27 Market Size, By Source, 2014–2022 (USD Billion)

Table 28 Corn: Market Size for Industrial Starch, By Region, 2014–2022 (USD Billion)

Table 29 Wheat: Market Size, By Region, 2014–2022 (USD Billion)

Table 30 Cassava: Industrial Starch Market Size, By Region, 2014–2022 (USD Billion)

Table 31 Potato:Market Size, By Region, 2014–2022 (USD Billion)

Table 32 Other Sources: Market Size, By Region, 2014–2022 (USD Billion)

Table 33 Market Size for Industrial Starch, By Application, 2014–2022 (KT)

Table 34 Market Size, By Application, 2014–2022 (USD Billion)

Table 35 Industrial Starch Market Size for Food & Beverage, By Application, 2014–2022 (KT)

Table 36 Market Size for Food & Beverage, By Application, 2014–2022 (USD Billion)

Table 37 Industrial Starch Market Size for Food & Beverage, By Region, 2014–2022 (USD Billion)

Table 38 Market Size for Feed, By Region, 2014–2022 (USD Billion)

Table 39 Industrial Starch Market Size for Other Applications , By Type, 2014–2022 (KT)

Table 40 Market Size for Other Applications , By Type, 2014–2022 (USD Billion)

Table 41 Industrial Starch Market Size for Other Applications, By Region, 2014–2022 (USD Billion)

Table 42 Market Size, By Form, 2014–2022 (KT)

Table 43 Market Size, By Form, 2014–2022 (USD Billion)

Table 44 Dry Industrial Starch Market Size, By Region, 2014–2022 (USD Billion)

Table 45 Liquid Industrial Starch Market Size, By Region, 2014–2022 (USD Billion)

Table 46 Functions of Industrial Starch, By Type

Table 47 Industrial Starch Market Size, By Region, 2014–2022 (KT)

Table 48 Market Size, By Region, 2014–2022 (USD Billion)

Table 49 North America: Industrial Starch Market Size, By Country, 2014–2022 (USD Billion)

Table 50 North America: Market Size, By Type, 2014–2022 (USD Billion)

Table 51 North America: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 52 North America: Market Size, By Source, 2014–2022 (USD Billion)

Table 53 North America: Market Size, By Application, 2014–2022 (USD Billion)

Table 54 North America: Market Size, By Form, 2014–2022 (USD Billion)

Table 55 U.S.: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 56 U.S.: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 57 Canada: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 58 Canada: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 59 Mexico: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 60 Mexico: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 61 Europe: Industrial Starch Market Size, By Country, 2014–2022 (USD Billion)

Table 62 Europe: Market Size, By Type, 2014–2022 (USD Billion)

Table 63 Europe: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 64 Europe: Market Size, By Source, 2014–2022 (USD Billion)

Table 65 Europe: Market Size, By Application, 2014–2022 (USD Billion)

Table 66 Europe: Market Size, By Form, 2014–2022 (USD Billion)

Table 67 Germany: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 68 Germany: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 69 France: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 70 France: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 71 U.K.: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 72 U.K.: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 73 Italy: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 74 Italy: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 75 Spain: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 76 Spain: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 77 Rest of Europe: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 78 Rest of Europe: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 79 Asia-Pacific: Market Size for Industrial Starch, By Country, 2014–2022 (USD Billion)

Table 80 Asia-Pacific: Market Size, By Type, 2014–2022 (USD Billion)

Table 81 Asia-Pacific: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 82 Asia-Pacific: Industrial Starch Market Size, By Source, 2014–2022 (USD Billion)

Table 83 Asia-Pacific: Market Size, By Application, 2014–2022 (USD Billion)

Table 84 Asia-Pacific: Market Size, By Form, 2014–2022 (USD Billion)

Table 85 China: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 86 China: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 87 Japan: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 88 Japan: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 89 India: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 90 India: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 91 Australia: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 92 Australia: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 93 Rest of Asia-Pacific: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 94 Rest of Asia-Pacific: Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 95 RoW: Industrial Starch Market Size, By Region, 2014–2022 (USD Billion)

Table 96 RoW: Market Size, By Type, 2014–2022 (USD Billion)

Table 97 RoW: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 98 RoW: Market Size for Industrial Starch, By Source, 2014–2022 (USD Billion)

Table 99 RoW: Market Size, By Application, 2014–2022 (USD Billion)

Table 100 RoW: Market Size, By Form, 2014–2022 (USD Billion)

Table 101 Latin America: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 102 Latin America: Industrial Starch Derivatives & Sweeteners Market Size, By Type, 2014–2022 (USD Billion)

Table 103 Africa: Market Size for Industrial Starch, By Type, 2014–2022 (USD Billion)

Table 104 Africa: Industrial Starch Derivatives & Sweeteners Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 105 Middle East: Industrial Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 106 Middle East: Industrial Starch Derivatives & Sweeteners Starch Market Size, By Type, 2014–2022 (USD Billion)

Table 107 Cargill, Incorporated: List of Brands, By Application

Table 108 Archer Daniels Midland Company: List of Brands, By Application

Table 109 Tate & Lyle: List of Brands of feed, By Application

Table 110 Agrana Beteiligungs-AG: List of Brands, By Application

Table 111 New Product Launches, 2011–2016

Table 112 Expansions & Investments, 2011–2016

Table 113 Acquisitions, 2011–2016

Table 114 Joint Ventures & Agreements, 2011–2016

Table 115 Cargill, Incorporatd: Products Offered

Table 116 Archer Daniels Midland Company: Products Offered

Table 117 Ingredion Incorporated: Products Offered

Table 118 Tate & Lyle PLC: Products Offered

Table 119 Agrana Beteiligungs-AG: Products Offered

Table 120 Grain Processing Corporation: Products Offered

Table 121 Roquette Frères: Products Offered

Table 122 The Tereos Group: Products Offered

Table 123 Royal Cosun: Products Offered

Table 124 Altia Industrial Services: Products Offered

Table 125 New Product Launches, 2011–2016

Table 126 Expansions & Investments, 2011–2016

Table 127 Mergers & Acquisitions, 2011–2016

Table 128 Joint Ventures, 2011–2016

List of Figures (85 Figures)

Figure 1 Market Segmentation

Figure 2 Geographic Scope

Figure 3 Industrial Starch Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market Size for Industrial Starch, By Application, 2016 vs 2022 (USD Billion)

Figure 8 Market Snapshot, By Source, 2016 vs 2022 (KT)

Figure 9 Market Size, By Form, 2016 vs 2022 (KT)

Figure 10 Market Size, By Type, 2016 vs 2022 (USD Billion)

Figure 11 Industrial Starch Market Share (Volume), By Region, 2016

Figure 12 Growing Demand for Convenience Foods Drives the Demand for Industrial Starch

Figure 13 Geographic Snapshot: New Hotspots Emerging in Asia-Pacific, 2016–2022

Figure 14 Corn Held the Largest Share in 2015

Figure 15 Liquid Form Dominated the Global Market

Figure 16 Food & Beverage Segment Accounted for the Largest Share and is Projected to Be the Fastest-Growing During the Forecast Period

Figure 17 Asia-Pacific Region Poised for Robust Growth, 2016–2022

Figure 18 Industrial Starch Market, By Source

Figure 19 Market, By Application

Figure 20 Market, By Form

Figure 21 Market, By Type

Figure 22 Market, By Region

Figure 23 Market Dynamics: Industrial Starch

Figure 24 Food Consumption Data, By Type, 2016

Figure 25 Supply Chain: Industrial Starch Market

Figure 26 Source By Key Starch Producing Regions (Million Tones)

Figure 27 Starch Production, By Region

Figure 28 U.S.: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 29 U.S.: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 30 Canada: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 31 Canada: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 32 Mexico: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 33 Germany: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 34 Germany: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 35 France: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 36 France: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 37 Italy: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 38 Italy: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 39 U.K.: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 40 U.K.: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 41 Spain: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 42 Spain: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 43 China: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 44 China: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 45 Japan: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 46 Japan: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 47 India: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 48 India: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 49 Australia: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 50 Australia: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 51 Thailand: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 52 Thailand: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 53 Indonesia: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 54 Indonesia: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 55 Brazil: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 56 Brazil: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 57 South Africa: Starch Import-Export, By Source, 2011-2015 (KT)

Figure 58 South Africa: Dextrins & Other Modified Starch, Import-Export, 2011-2015 (KT)

Figure 59 Industrial Starch Market Share, By Type, 2015 (KT)

Figure 60 Industrial Market Share (Value), By Source, 2016–2022

Figure 61 Industrial Starch Market Share (Volume), By Application, 2016–2022

Figure 62 Industrial Market Share (Volume), By Form, 2015 (KT)

Figure 63 Starch Production, By Region, 2010

Figure 64 Starch & Sweeteners Consumption, Per Capita vs GDP Per Capita

Figure 65 China Accounted for the Largest Share in this Market in 2015

Figure 66 U.S. Exports of Products From Corn, 2010-2014

Figure 67 North American Industrial Starch Market: U.S. is Estimated to Lead the Market in 2016

Figure 68 Starch Production in EU, 2004–2015

Figure 69 Asia-Pacific Industrial Starch Market: China is Estimated to Lead the Market in North America in 2016

Figure 70 New Product Launches and Expansions & Investments: Leading Approaches of Key Companies, 2011–2016

Figure 71 Expanding Revenue Base Through New Product Launches, 2014–2016

Figure 72 New Product Launches: the Key Strategy, 2011–2016

Figure 73 Geographic Revenue Mix of Top Market Players

Figure 74 Cargill, Incorporated: Company Snapshot

Figure 75 Cargill, Incorporated: SWOT Analysis

Figure 76 Archer Daniels Midland Company: Company Snapshot

Figure 77 Archer Daniels Midland Company: SWOT Analysis

Figure 78 Ingredion Incorporated: Company Snapshot

Figure 79 Ingredion Incorporated: SWOT Analysis

Figure 80 Tate & Lyle PLC: Company Snapshot

Figure 81 Tate& Lyle PLC: SWOT Analysis

Figure 82 Agrana Beteiligungs-AG: Company Snapshot

Figure 83 Agrana Beteiligungs-AG: SWOT Analysis

Figure 84 The Tereos Group: Company Snapshot

Figure 85 Royal Cosun: Company Snapshot

Growth opportunities and latent adjacency in Industrial Starch Market