Polytetrafluoroethylene (PTFE) Films Market by Technology (Skived, Extruded, Cast), Application (Medical & Pharmaceuticals, Chemical Processing, Automotive, Aviation & Aerospace, Electrical & Electronics), and Region - Global Forecast to 2022

[117 Pages Report] Polytetrafluoroethylene (PTFE) Films Market size was valued at USD 420.6 Million in 2016 and is projected to reach USD 542.6 Million by 2022, at a CAGR of 4.4% during the forecast period. In this study, 2015 has been considered as the historical year, 2016 as the base year, and 20172022 as the forecast period for estimating the market size of PTFE films.

Objectives of the study:

- To define, describe, and forecast the PTFE films market on the basis of technology, application, and region

- To evaluate the PTFE films market in terms of value (USD) and volume (tons)

- To provide detailed information regarding major factors influencing the growth of the PTFE films market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for key players and provide details of the competitive landscape for market leaders

- To forecast the value of market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, in addition to key countries in each of these regions.

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and R&D activities in the PTFE films market

Research Methodology:

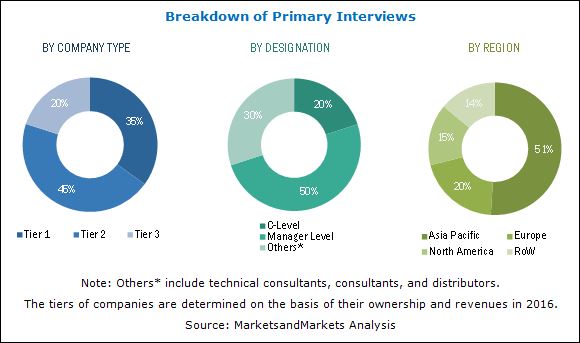

This research study involved the use of extensive secondary sources such as encyclopedia, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial study of the PTFE films market. Primary sources that include experts from related industries and suppliers were interviewed to obtain and verify important information as well as to assess growth prospects.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

Key manufacturers of PTFE films include Saint-Gobain (France), 3M (US), Nitto Denko (Japan), Rogers Corporation (US), Guarniflon (Italy), Technetics Group (US), Chukoh Chemical Industries (Japan), Lenzing Plastics (Austria), DUNMORE Corporation (US), and Markel Corporation (US). These companies are focused on increasing their regional presence by adopting key growth strategies, such as expansions, mergers & acquisitions, and new product developments.

Key Target Audience:

- Manufacturers of PTFE Films and Raw Materials

- Manufacturers in Application Industries

- Traders, Distributors, and Suppliers of PTFE Films

- Regional Manufacturer Associations and General PTFE Films Associations

- Government & Regional Agencies and Research Organizations

Scope of the report:

The PTFE films market has been segmented as follows:

On the basis of Technology:

- Skived

- Extruded

- Cast

On the basis of Application:

- Medical & Pharmaceuticals

- Chemical Processing

- Automotive

- Aviation & Aerospace

- Electrical & Electronics

- Others

On the basis of Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix that provides a detailed comparison of product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

The PTFE films market is expected to reach USD 542.6 Million by 2022, at a CAGR of 4.4% from 2017 to 2022. This growth can be attributed to the increasing use of PTFE films in the medical & pharmaceuticals and chemical processing industries. In addition, the rising demand for high-performance films from the electrical & electronics industry in China, Japan, South Korea, Malaysia, Thailand, Indonesia, and India is projected to drive the growth of the PTFE films market.

The PTFE films market has been segmented on the basis of technology, application, and region. Based on technology, the skived segment accounted for the largest share of the PTFE films market in 2016. Skived PTFE films are used in the packaging of ultra-pure chemicals to protect these fluids from contamination. Moreover, the cast technology segment of this market is projected to grow at the highest CAGR during the forecast period, both in terms of value and volume. Cast PTFE films are designed to sustain in extreme thermal and chemical conditions, and thus, these films are used in highly corrosive applications. They have a high elongation limit and do not fade or change color when stretched.

Based on application, the chemical processing segment accounted for the largest share of the PTFE films market in 2016, in terms of value. Chemical inertness, the ability to withstand high temperatures, and good mechanical properties make PTFE a suitable material for chemical processing applications. The medical & pharmaceuticals application segment of this market is expected to grow at the highest CAGR from 2017 to 2022, in terms of value. Superior properties of PTFE such as biocompatibility, lubricity, and chemical inertness have enhanced the applicability of PTFE films as compared to other polymeric materials in the medical & pharmaceuticals industry.

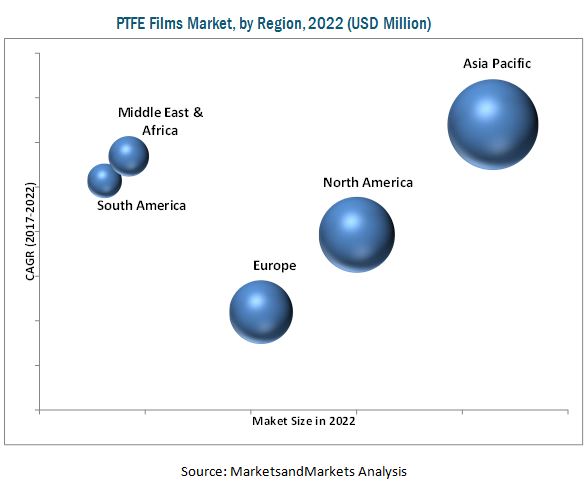

Asia Pacific accounted for the largest share of the PTFE films market in 2016; this market in the Asia Pacific region is projected to grow at the highest CAGR during the forecast period. The increased demand for PTFE films in chemical processing and electrical & electronics industries are expected to offer lucrative growth opportunities to manufacturers of PTFE films. Several international players have set up their manufacturing facilities in the Asia Pacific region, owing to easy availability of raw materials, cheap labor, and favorable government policies. This, in turn, has contributed to the growth of the PTFE films market in this region.

The PTFE films market is highly competitive, with a large number of small and medium-sized players, especially in China and India. New product developments, expansions, and mergers & acquisitions are key growth strategies adopted by leading players operating in the PTFE films market.

The cost of PTFE films is directly proportional to the cost of raw materials and the cost involved in their manufacturing process. Fluorspar is a major raw material used in the production of PTFE films. The limited supply of fluorspar is resulting in the high prices of PTFE films. The high cost of PTFE films as compared to conventional plastic films acts as a restraint to the growth of the PTFE films market.

3M, a key player in the PTFE films market, offers PTFE films for electrical, thermal protection, packaging, and other applications. As a part of its key growth strategy, the company is focused on expanding its regional presence. For instance, in March 2015, Dyneon, a subsidiary of 3M, established a fluoropolymer upcycling facility in Germany. The facility can recycle up to 500 tons of fluoropolymer waste, annually. This development strategy helped the company strengthen its foothold in the PTFE films market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the PTFE Films Market

4.2 PTFE Films Market Growth, By Region

4.3 PTFE Films Market Share, By Technology and Country

4.4 PTFE Films Market Attractiveness

4.5 PTFE Films Market Size, By Technology

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Preference for PTFE Films in the Medical & Pharmaceuticals Applications

5.2.1.2 Excellent Physical Properties Fueling the Consumption of PTFE Films in Various Applications

5.2.2 Restraints

5.2.2.1 Higher Price of PTFE Films Than That of Conventional Plastic Films

5.2.3 Opportunities

5.2.3.1 Growing Demand for PTFE Films in Emerging Countries

5.2.4 Challenges

5.2.4.1 Raw Material Shortage

6 Industry Trends (Page No. - 35)

6.1 Porters Five Forces Analysis

6.1.1 Threat of New Entrants

6.1.2 Threat of Substitutes

6.1.3 Bargaining Power of Suppliers

6.1.4 Bargaining Power of Buyers

6.1.5 Intensity of Competitive Rivalry

6.2 Macroeconomic Overview

6.2.1 Introduction

6.2.2 GDP Growth Rate and Forecasts of Major Economies

6.2.3 Global Automotive Industry and Its Impact on the PTFE Films Market

7 PTFE Films Market, By Technology (Page No. - 41)

7.1 Introduction

7.2 Extruded Technology

7.3 Cast Technology

7.4 Skived Technology

8 PTFE Films Market, By Application (Page No. - 44)

8.1 Introduction

8.2 Medical & Pharmaceuticals

8.3 Chemical Processing

8.4 Automotive

8.5 Aviation & Aerospace

8.6 Electrical & Electronics

8.7 Other Applications

9 PTFE Films Market, By Region (Page No. - 48)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 Italy

9.3.3 France

9.3.4 U.K.

9.3.5 Spain

9.3.6 Russia

9.3.7 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.4.5 Indonesia

9.4.6 Vietnam

9.4.7 Malaysia

9.4.8 Thailand

9.4.9 Rest of Asia-Pacific

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 Egypt

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 88)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 New Product Developments

10.2.2 Mergers & Acquisitions

10.2.3 Expansions

10.3 Market Ranking

11 Company Profiles (Page No. - 92)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 3M

11.2 Nitto Denko Corporation

11.3 Rogers Corporation

11.4 Saint-Gobain

11.5 Guarniflon S.P.A

11.6 Technetics Group

11.7 Chukoh Chemical Industries

11.8 Lenzing Plastics

11.9 Dunmore Corporation

11.10 Markel Corporation

11.11 Other Market Players

11.11.1 Plasticut

11.11.2 Jiangxi Aidmer Seal and Packing

11.11.3 Jiangsu Taifulong Technology

11.11.4 Poly Fluoro

11.11.5 Cixi Rylion PTFE

11.11.6 J. V. Corporation

11.11.7 Merefsa

11.11.8 Enflo

11.11.9 Dalau

11.11.10 Textiles Coated International

11.11.11 Ningbo Taifno PTFE Plastic Products Co.

11.11.12 PTFE Industries

11.11.13 Polyflon Technology

11.11.14 Fluoro-Plastics

11.11.15 Hubei Everflon Polymer

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 110)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (83 Tables)

Table 1 Trends and Forecast of Nominal GDP, By Country, 20152022 (GDP Pencentage)

Table 2 PTFE Films Market Size, By Technology, 20152022 (Ton)

Table 3 PTFE Films Market Size, By Technology, 20152022 (USD Million)

Table 4 PTFE Films Market Size, By Application, 20152022 (Ton)

Table 5 PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 6 PTFE Films Market Size, By Region, 20152022 (Ton)

Table 7 PTFE Films Market Size, By Region, 20152022 (USD Million)

Table 8 North America: PTFE Films Market Size, By Country, 20152022 (Ton)

Table 9 North America: PTFE Films Market Size, By Country, 20152022 (USD Million)

Table 10 North America: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 11 North America: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 12 U.S.: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 13 U.S.: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 14 Canada: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 15 Canada: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 16 Mexico: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 17 Mexico: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 18 Europe: PTFE Films Market Size, By Country, 20152022 (Ton)

Table 19 Europe: PTFE Films Market Size, By Country, 20152022 (USD Million)

Table 20 Europe: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 21 Europe: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 22 Germany: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 23 Germany: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 24 Italy: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 25 Italy: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 26 France: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 27 France: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 28 U.K.: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 29 U.K.: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 30 Spain: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 31 Spain: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 32 Russia: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 33 Russia: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 34 Rest of Europe: PTFE Films Market Size, By Application, 20152022 (Ton)

Table 35 Rest of Europe: PTFE Films Market Size, By Application, 20152022 (USD Million)

Table 36 Asia-Pacific: PTFE Films Market Size, By Country, 20152022 (Ton)

Table 37 Asia-Pacific: PTFE Films Market Size, By Country, 20152022 (USD Million)

Table 38 Asia-Pacific: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 39 Asia-Pacific: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 40 China: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 41 China: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 42 Japan: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 43 Japan: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 44 South Korea: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 45 South Korea: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 46 India: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 47 India: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 48 Indonesia: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 49 Indonesia: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 50 Vietnam: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 51 Vietnam: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 52 Malaysia: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 53 Malaysia: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 54 Thailand: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 55 Thailand: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 56 Rest of Asia-Pacific: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 57 Rest of Asia-Pacific: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 58 Middle East & Africa: Polytetrafluoroethylene Films Market Size, By Country, 20152022 (Ton)

Table 59 Middle East & Africa: Polytetrafluoroethylene Films Market Size, By Country, 20152022 (USD Million)

Table 60 Middle East & Africa: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 61 Middle East & Africa: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 62 Saudi Arabia: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 63 Saudi Arabia: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 64 UAE: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 65 UAE: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 66 Egypt: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 67 Egypt: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 68 Rest of Middle East & Africa: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 69 Rest of Middle East & Africa: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 70 South America: Polytetrafluoroethylene Films Market Size, By Country, 20152022 (Ton)

Table 71 South America: Polytetrafluoroethylene Films Market Size, By Country, 20152022 (USD Million)

Table 72 South America: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 73 South America: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 74 Brazil: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 75 Brazil: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 76 Argentina: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 77 Argentina: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 78 Rest of South America: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (Ton)

Table 79 Rest of South America: Polytetrafluoroethylene Films Market Size, By Application, 20152022 (USD Million)

Table 80 New Product Developments, 20152017

Table 81 Mergers & Acquisitions, 20152017

Table 82 Expansions, 20152017

Table 83 Company Ranking

List of Figures (25 Figures)

Figure 1 PTFE Films Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 PTFE Films Market: Data Triangulation

Figure 5 Cast PTFE Films to Register the Highest CAGR During the Forecast Period

Figure 6 Chemical Processing Application to Lead the PTFE Films Market, During the Forecast Period

Figure 7 Asia-Pacific Led the PTFE Films Market in 2016

Figure 8 PTFE Films Market to Witness Rapid Growth Between 2017 and 2022

Figure 9 Asia-Pacific to Lead the PTFE Films Market, 20172022

Figure 10 U.S. Accounted for the Largest Share of the PTFE Films Market in 2016

Figure 11 Asia-Pacific to Be the Fastest-Growing PTFE Films Market, 20172022

Figure 12 Skived Technology to Account for the Largest Share in the PTFE Films Market, 20172022

Figure 13 Factors Governing the PTFE Films Market

Figure 14 China Was the Largest Producer of Cars and Commercial Vehicles in 2016

Figure 15 Skived PTFE Films to Be the Largest Segment of the PTFE Films Market in 2017

Figure 16 Medical & Pharmaceuticals to Register Highest CAGR During the Forecast Period

Figure 17 China, India, and South Korea to Witness High Growth During the Forecast Period

Figure 18 North America Market Snapshot: Mexico to Be the Fastest-Growing Market Between 2017 and 2022

Figure 19 Asia-Pacific Market Snapshot: China to Be the Largest Consumer of PTFE Films

Figure 20 Key Developments By Leading Players in Market Between 2015 and 2017

Figure 21 3M: Company Snapshot

Figure 22 Nitto Denko Corporation: Company Snapshot

Figure 23 Rogers Corporation: Company Snapshot

Figure 24 Saint-Gobain: Company Snapshot

Figure 25 Technetics Group: Company Snapshot

Growth opportunities and latent adjacency in Polytetrafluoroethylene (PTFE) Films Market