Polyphenylene Market by Type (PPS, PPO/PPE), Application (Engineering Plastics, Filter Bag, Composites, High Performance Lubricants), End-Use Industry (Automotive, Electronics & Electrical, Industrial, Coatings), and Region-Global Forecast to 2023

Polyphenylene market is projected to reach USD 4.99 Billion by 2023, at a CAGR of 8.2% during the forecast period. The polyphenylene market is driven by the growing use of polyphenylene in automotive and aerospace industries. The increase in the consumption of polyphenylene in the filter bag application will also drive the market.

The main objective of the study is to define, describe, and forecast the polyphenylene market on the basis of type, application, end-use industry, and region. The report includes detailed information about the major factors (drivers, restraints, opportunities) influencing the growth of the market. The report strategically analyzes market segments with respect to individual growth trends, growth prospects, and contribution to the total market. The report includes analysis of the polyphenylene market on the basis of type (polyphenylene sulfide, polyphenylene ether/oxide, others), end-use industry (automotive, electrical & electronics, industrial, coatings others), application (filter bag, composites, high performance lubricants, engineering plastics, others), and region (APAC, Europe, North America, Middle East & Africa, South America). The market for polyphenylene resin has been estimated in terms of value. The base year considered for the study is 2017 while the forecast period is between 2018 and 2023.

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global polyphenylene market and to estimate the size of various other dependent submarkets. Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Organization for Economic Co-operation and Development (OECD), World Bank, Securities and Exchange Commission (SEC), and other government and private websites have been referred to identify and collect information useful for this technical, market-oriented, and commercial study of the polyphenylene market.

To know about the assumptions considered for the study, download the pdf brochure

Some of the major market players in the global polyphenylene market include Toray Industries (Japan), Solvay (Belgium), Tosoh Corporation (Japan), DIC Corporation (Japan), Kureha Corporation (Japan), LG Chem (South Korea), Celanese Corporation (US), Saudi Arabia Basic Industries Corporation (Saudi Arabia), China Lumena New Material (China), and Ensigner (Germany).

Key Target Audience:

- Polyphenylene Manufacturers

- Raw Material Suppliers

- Manufacturing Technology Providers

- Traders, Distributors, and Suppliers of Polyphenylene

- Manufacturers in End-use Industries

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two-to-five years for prioritizing efforts and investments.

Scope of the Polyphenylene market report:

This research report categorizes the global polyphenylene market based on type, end-use industry, application, and region.

Based on Type:

- Polyphenylene Sulfide(PPS)

- Polyphenylene Ether/Oxide(PPE/PPO)

- Others

Based on End-use Industry:

- Automotive

- Electrical & Electronics

- Industrial

- Coatings

- Others

Based on Application:

- Composites

- Engineering Plastics

- High Performance Lubricants

- Filter Bags

- Others

Based on Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

The market has been further analyzed for key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

End-use industry analysis

- Product matrix that gives a detailed analysis of various types of polyphenylene in each end-use industry

Regional analysis

- Further breakdown of a region with respect to a country

Company information

- Detailed analysis and profiling of additional market players (up to 5)

The global polyphenylene market is estimated to be USD 3.37 Billion in 2018 and is projected to reach USD 4.99 Billion by 2023, at a CAGR of 8.2% during the forecast period.

The polyphenylene market has witnessed significant growth in recent years, owing to the growing use of polyphenylene resins in the automotive and aerospace industries, coupled with their increasing consumption in the filter bag application.

The main types of polyphenylene considered in the report are polyphenylene sulfide, polyphenylene ether/oxide, and others. Owing to their wide applicability and need for high thermal resistance, chemical resistance, flexibility, and high excellent electrical properties from various end-use industries, such as electrical & electronics and automotive, the polyphenylene sulfide type segment led the polyphenylene market in 2017, in terms of value.

Engineering plastics is the largest application of the polyphenylene market, in terms of value. The growing demand for flame retardancy, high heat deflection, and excellent dimensional stability is expected to drive the polyphenylene market in engineering plastic. Hence, this market is expected to witness continuous growth.

Polyphenylene are used in various end-use industries, such as automotive, electronics & electrical, industrial, coating, and others. On the basis of end-use industry, the automotive segment is projected to lead the polyphenylene market during the forecast period.

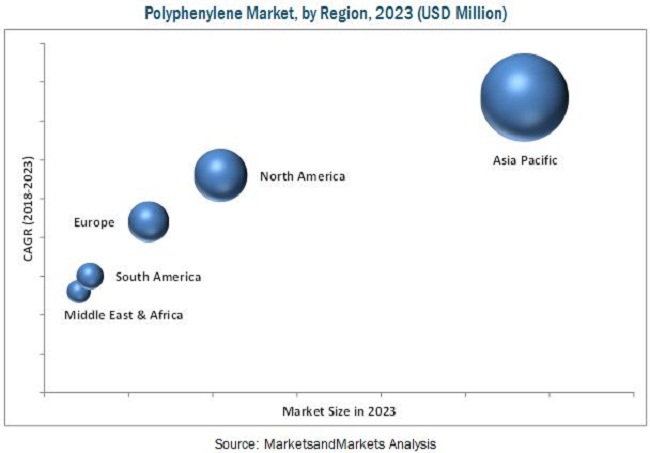

North America, Europe, APAC, the Middle East & Africa, and South America have been considered as key markets for polyphenylene in the report. APAC is estimated to be the fastest-growing polyphenylene resin market during the forecast period. This growth can be attributed to the rise in population, the increasing demand for polyphenylene from electronics & electrical and automotive industries. These factors are expected to encourage multinational companies to invest more in the region. Moreover, the region is witnessing economic growth.

The polyphenylene market is expected to witness significant growth in the coming years. However, the low heat resistance of separators and various safety issues related to batteries could hinder the growth of the market.

Toray Industries (Japan), Solvay (Belgium), Tosoh Corporation (Japan), DIC Corporation (Japan), Kureha Corporation (Japan), LG Chem (South Korea), Celanese Corporation (US), Saudi Arabia Basic Industries Corporation (Saudi Arabia), China Lumena New Material (China), and Ensigner (Germany) are the key companies operational in the polyphenylene market. Targeting new markets will enable manufacturers to cater to the rising demand for polyphenylene resins, hence reinforcing their position in the market.

Frequently Asked Questions (FAQ):

What is polyphenylene used for?

filter fabric for coal boilers, papermaking felts, electrical insulation, film capacitors, specialty membranes, gaskets, and packings.

Who leading market players in polyphenylene ?

The global polyphenylene market Toray Industries (Japan), Solvay (Belgium), Tosoh Corporation (Japan), DIC Corporation (Japan), Kureha Corporation (Japan), LG Chem (South Korea), Celanese Corporation (US), Saudi Arabia Basic Industries Corporation (Saudi Arabia), China Lumena New Material (China), and Ensigner (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for The Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities In The Polyphenylene Resin Market

4.2 Polyphenylene Resin Market, By Region

4.3 Polyphenylene Resin Market, By Region and End-Use Industry

4.4 Polyphenylene Resin Market, By Type

4.5 Polyphenylene Resin Market, By Country

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Use of Polyphenylene Resin In Automotive and Aerospace Industries

5.2.1.2 Increasing Consumption In The Filter Bag Application

5.2.1.3 Replacement of Conventional Materials

5.2.2 Restraints

5.2.2.1 CAPACity Build and Oversupply

5.2.2.2 High Cost of Polyphenylene Resin In Comparison With Other Conventional Materials

5.2.3 Opportunities

5.2.3.1 Development of Advanced Products

5.2.3.2 Preference In Various Applications Due to Special Properties

5.2.4 Challenges

5.2.4.1 Development of Halogen-Free and Eco-Friendly Polyphenylene Resin

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview

5.4.1 Gdp Growth Rate Forecast of Major Economies

5.4.2 Trends In The Automotive Industry

6 Polyphenylene Resin Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Polyphenylene Sulfide (PPS)

6.3 Polyphenylene Oxide/Polyphenylene Ether (PPO)/(PPE)

6.4 Others

7 Polyphenylene Resin Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Composites

7.3 Filter Bag

7.4 Engineering Plastics

7.5 High Performance Lubricants

7.6 Others

8 Polyphenylene Resin Market, By End-Use Industry (Page No. - 52)

8.1 Introduction

8.2 Automotive

8.3 Industrial

8.4 Electrical & Electronics

8.5 Coatings

8.6 Others

9 Polyphenylene Resin Market, By Region (Page No. - 59)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Taiwan

9.2.6 Rest of APAC

9.3 North America

9.3.1 US

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Italy

9.4.3 France

9.4.4 UK

9.4.5 Spain

9.4.6 Netherlands

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 South Africa

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 91)

10.1 Introduction

10.2 Market Ranking

10.3 Competitive Scenario

10.3.1 Expansion

10.3.2 Acquisition

10.3.3 New Product Launch

11 Company Profiles (Page No. - 95)

11.1 Toray Industries

11.2 Solvay

11.3 Tosoh Corporation

11.4 DIC Corporation

11.5 Kureha Corporation

11.6 LG Chem

11.7 Celanese Corporation

11.8 Saudi Arabia Basic Industries Corporation (SABIC)

11.9 China Lumena New Material

11.10 Ensigner

11.11 Other Players

11.11.1 Lion Idemitsu Composites

11.11.2 Initz

11.11.3 Zhejiang Nhu Special Materials

11.11.4 Asahi Kasei

11.11.5 Chevron Phillips Chemical

11.11.6 Ryan Plastics

11.11.7 RTP Company

11.11.8 Teijin Limited

11.11.9 Daicel Corporation

11.11.10 Polyplastic

12 APPEndix (Page No. - 116)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (97 Tables)

Table 1 Trends and Forecast of Gdp Growth Rates Between 2016 and 2021

Table 2 Motor Vehicle Production Between 2015 and 2016

Table 3 Polyphenylene Resin Market Size, By Type, 2016–2023 (USD Million)

Table 4 Polyphenylene Resin Market Size, By Type, 2016–2023 (Kiloton)

Table 5 PPS Market Size, By Region, 2016–2023 (USD Million)

Table 6 PPS Market Size, By Region, 2016–2023 (Kiloton)

Table 7 (PPO)/(PPE) Market Size, By Region, 2016–2023 (USD Million)

Table 8 (PPO)/(PPE) Market Size, By Region, 2016–2023 (Kiloton)

Table 9 Other Polyphenylene Resin Market Size, By Region, 2016–2023, (USD Million)

Table 10 Other Polyphenylene Resin Market Size, By Region, 2016–2023 (Kiloton)

Table 11 Polyphenylene Resin Market Size, By Application, 2016–2023 (USD Million)

Table 12 Polyphenylene Resin Market Size, By Application, 2016–2023 (Kiloton)

Table 13 Polyphenylene Resin Market Size In Composites, By Region, 2016–2023 (USD Million)

Table 14 Polyphenylene Resin Market Size In Composites, By Region, 2016–2023 (Kiloton)

Table 15 Polyphenylene Resin Market Size In Filter Bag, By Region, 2016–2023 (USD Million)

Table 16 Polyphenylene Resin Market Size In Filter Bag, By Region, 2016–2023 (Kiloton)

Table 17 Polyphenylene Resin Market Size In Engineering Plastics, By Region, 2016–2023 (USD Million)

Table 18 Market Size In Engineering Plastics, By Region, 2016–2023 (Kiloton)

Table 19 Market Size In High Performance Lubricants, By Region, 2016–2023 (USD Million)

Table 20 Market Size In High Performance Lubricants, By Region, 2016–2023 (Kiloton)

Table 21 Polyphenylene Resin Market Size In Others, By Region, 2016–2023 (USD Million)

Table 22 Polyphenylene Resin Market Size In Others, By Region, 2016–2023 (Kiloton)

Table 23 Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 24 Market Size, By End-Use Industry, 2016–2028 (Kiloton)

Table 25 Market Size In Automotive, By Region, 2016–2023 (USD Million)

Table 26 Polyphenylene Resin Market Size In Automotive, By Region, 2016–2023 (Kiloton)

Table 27 Polyphenylene Resin Market Size In Industrial, By Region, 2016–2023 (USD Million)

Table 28 Polyphenylene Resin Market Size In Industrial, By Region, 2016–2023 (Kiloton)

Table 29 Market Size In Electrical & Electronics, By Region, 2016–2023 (USD Million)

Table 30 Market Size In Electrical & Electronics, By Region, 2016–2023 (Kiloton)

Table 31 Market Size In Coatings, By Region, 2016–2023 (USD Million)

Table 32 Polyphenylene Resin Market Size In Coatings, By Region, 2016–2023 (Kiloton)

Table 33 Polyphenylene Resin Market Size In Other Industries, By Region, 2016–2023 (USD Million)

Table 34 Polyphenylene Resin Market Size In Other Industries, By Region, 2016–2023 (Kiloton)

Table 35 Polyphenylene Resin Market Size, By Region, 2016–2023 (USD Million)

Table 36 Polyphenylene Resin Market Size, By Region, 2016–2023 (Kiloton)

Table 37 APAC: Market Size, By Country, 2016–2023 (USD Million)

Table 38 APAC: Market Size, By Country, 2016–2023 (Kiloton)

Table 39 APAC: Market Size, By Application, 2016–2023 (USD Million)

Table 40 APAC: Market Size, By Application, 2016–2023 (Kiloton)

Table 41 APAC: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 42 APAC: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 43 China: Market, By End-Use Industry, 2016–2023 (USD Million)

Table 44 Japan: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 45 India: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 46 South Korea: Polyphenylene Resin Market, By End-Use Industry, 2016–2023 (USD Million)

Table 47 Taiwan: Polyphenylene Resin Market, By End-Use Industry, 2016–2023 (USD Million)

Table 48 Rest of APAC: Polyphenylene Resin Market, By End-Use Industry, 2016–2023 (USD Million)

Table 49 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 50 North America: Market Size, By Country, 2016–2023 (Kiloton)

Table 51 North America: Market Size, By Application, 2016–2023 (USD Million)

Table 52 North America: Market Size, By Application, 2016–2023 (Kiloton)

Table 53 North America: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 54 North America: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 55 North America: Polyphenylene Resin Market Size, By Type, 2016–2023 (USD Million)

Table 56 North America: Polyphenylene Resin Market Size, By Type, 2016–2023 (Kiloton)

Table 57 US: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 58 Canada: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 59 Mexico: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 60 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 61 Europe: Market Size, By Country, 2016–2023 (Kiloton)

Table 62 Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 63 Europe: Market Size, By Application, 2016–2023 (Kiloton)

Table 64 Europe: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 65 Europe: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 66 Germany: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 67 Italy: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Millions)

Table 68 France: Polyphenylene Resin Market, By End-Use Industry, 2016–2023 (USD Million)

Table 69 UK: Polyphenylene Resin Market, By End-Use Industry, 2016–2023 (USD Million)

Table 70 Spain: Polyphenylene Resin Market, By End-Use Industry, 2016–2023 (USD Million)

Table 71 Netherlands: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 72 Rest of Europe: Polyphenylene Resin Market, By End-Use Industry, 2016–2023 (USD Million)

Table 73 Middle East & Africa: Market Size, By Country, 2016–2023 (USD Million)

Table 74 Middle East & Africa: Market Size, By Country, 2016–2023 (Kiloton)

Table 75 Middle East & Africa: Market Size, By Application, 2016–2023 (USD Million)

Table 76 Middle East & Africa: Market Size, By Application, 2016–2023 (Kiloton)

Table 77 Middle East & Africa: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 78 Middle East & Africa: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 79 Middle East & Africa: Market Size, By Type, 2016–2023 (USD Million)

Table 80 Middle East & Africa: Market Size, By Type, 2016–2023 (Kiloton)

Table 81 Saudi Arabia: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 82 South Africa: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 83 Rest of Middle East & Africa: Polyphenylene Resin Market Size, End-Use Industry, 2016–2023 (USD Million)

Table 84 South America: Market Size, By Country, 2016–2023 (USD Million)

Table 85 South America: Market Size, By Country, 2016–2023 (Kiloton)

Table 86 South America: Market Size, By Application, 2016–2023 (USD Million)

Table 87 South America: Market Size, By Application, 2016–2023 (Kiloton)

Table 88 South America: Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 89 South America: Market Size, By End-Use Industry, 2016–2023 (Kiloton)

Table 90 South America: Market Size, By Type, 2016–2023 (USD Million)

Table 91 South America: Market Size, By Type, 2016–2023 (Kiloton)

Table 92 Brazil: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 93 Argentina: Polyphenylene Resin Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 94 Rest of South America: Polyphenylene Resin Market Size, By Application, 2016–2023 (USD Million)

Table 95 Expansion, 2014–2017

Table 96 Acquisition, 2014–2017

Table 97 New Product Launch, 2014–2017

List of Figures (34 Figures)

Figure 1 Polyphenylene Resin Market Segmentation

Figure 2 Polyphenylene Resin Market, By Region

Figure 3 Polyphenylene Resin Market: Research Design

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Polyphenylene Resin Market: Data Triangulation

Figure 7 PPS to Be The Largest Type

Figure 8 Automotive to Be The Largest End-Use Industry

Figure 9 Engineering Plastics to Be The Largest Application

Figure 10 APAC to Be The Fastest-Growing Market During The Forecast Period

Figure 11 Polyphenylene Resin Market to Witness Rapid Growth Between 2018 and 2023

Figure 12 APAC to Be The Fastest-Growing Polyphenylene Resin Market

Figure 13 Automotive Industry Accounted for The Largest Market Share

Figure 14 PPS to Account for The Largest Market Share

Figure 15 China to Be The Fastest-Growing Polyphenylene Resin Market

Figure 16 Overview of The Factors Governing The Polyphenylene Resin Market

Figure 17 Polyphenylene Resin Market: Porter’s Five Forces Analysis

Figure 18 PPS to Be The Largest Type During The Forecast Period

Figure 19 Properties of PPS

Figure 20 Engineering Plastics to Be The Largest Application During The Forecast Period

Figure 21 Automotive to Be The Largest End-Use Industry

Figure 22 China to Register The Highest Cagr During The Forecast Period

Figure 23 APAC: Polyphenylene Resin Market Snapshot

Figure 24 North America: Polyphenylene Resin Market Snapshot

Figure 25 Companies Adopted Expansion as The Key Growth Strategy Between 2014 and 2017

Figure 26 Toray Was The Leading Player In The Market In 2016

Figure 27 Toray Industries: Company Snapshot

Figure 28 Solvay: Company Snapshot

Figure 29 Tosoh Corporation: Company Snapshot

Figure 30 DIC Corporation: Company Snapshot

Figure 31 Kureha Corporation: Company Snapshot

Figure 32 LG Chem: Company Snapshot

Figure 33 Celanese Corporation: Company Snapshot

Figure 34 SABIC:Company Snapshot

Growth opportunities and latent adjacency in Polyphenylene Market

i am doing my thesis work on polyphenylenevinylene and iwant to know the price availability of it .please send me details as soon as possible

PLEASE GIVE ME A COMPANY ADDRESSES WHICH IS MANUFACTURING OF PPO RESINS IF POSSIBLE