Polymer Coated Fabrics Market by Product (Polyvinyl, Polyurethane, Polyethylene), Application (Transportation, Protective Clothing, Industrial, Awning, Roofing & Canopies, Furniture & Seating) - Global Forecast to 2024

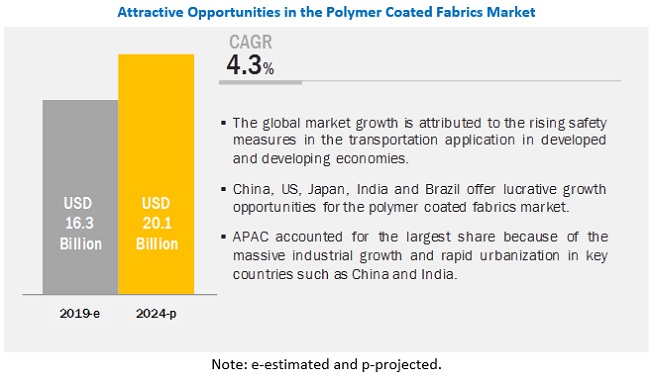

[282 Pages Report] The polymer coated fabrics market size is projected to reach USD 20.1 billion by 2024 from USD 16.3 billion in 2019, at a CAGR of 4.3%. The rising safety measures in the transportation application and stringent regulatory requirements for workers’ safety are expected to drive the polymer coated fabrics market. However, the availability of substitutes and environmental concerns are hampering the growth of this market.

Polyurethane coated fabrics to witness the fastest growth during the forecast period

Based on polymer type, the polymer coated fabrics market has been segmented into polyvinyl, polyurethane, polyethylene, and others. The polyurethane coated fabrics segment is estimated to register the highest growth in, terms of value and volume, of the global polymer coated fabrics market. PU coated fabrics have better properties such as transparency, elasticity, and resistance to oil, grease, and abrasion. They are especially preferred if there is a requirement for unusual impact and abrasion resistance. They are primarily used for applications such as rainwear, waterproof protective clothing, upholstery, luggage, footwear, glove, waterproof mattress cover, inflatable boats, and recreational items, among others Phosphites & phosphonites are among the most effective stabilizers, as they protect both primary antioxidants as well as the polymers during processing. Hydrolytically stable phosphites & phosphonites are generally the most frequently used polymer stabilizers.

Transportation is projected to be the largest application of polymer coated fabrics during the forecast period.

The transportation segment is projected to lead the polymer coated fabrics market, in terms of value, during the forecast period. This growth is attributed to the increasing use of polymer coated fabrics in various transportation applications. Polymer coated fabrics are majorly used for a wide range of automotive applications such as interior, exterior, airbags, seatbelt, and covers.

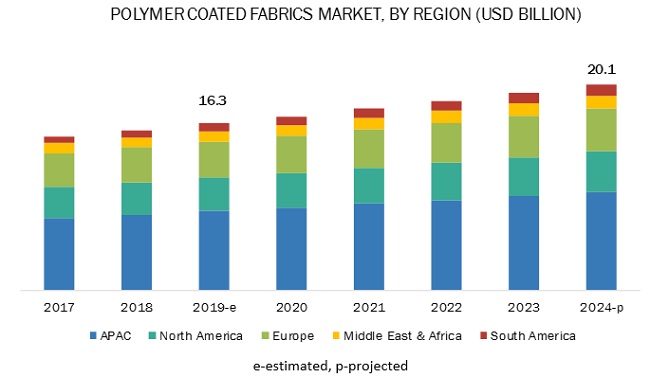

APAC to account for the largest share of the global polymer coated fabrics market during the forecast period

APAC is the largest polymer coated fabrics market, globally, due to massive industrial growth and rapid urbanization in key countries such as China and India. The increasing demand from the transportation, protective clothing, and industrial applications is driving the polymer coated fabrics market in APAC. China, Japan, and South Korea are the major countries driving the polymer coated fabrics market in APAC.

Key Market Players

The key market players profiled in the report include as Continental AG (Germany), Spradling International Inc. (US), Seaman Corporation (US), Saint-Gobain SA (France), Trelleborg AB (Sweden), Sioen Industries NV (Belgium), Serge Ferrari Group (France), Low & Bonar Plc (UK), and OMNOVO Solutions Inc. (US).

Continental AG (Germany) is a leading manufacturer of polymer coated fabrics, globally. The company produces various polymer coated fabrics mainly used in transportation, protective clothing, and industrial applications. It has good depth and breadth in its product offering, catering to most specific requirements of its customers. The company has been focusing on the strategies of expansion and new product launch to maintain its leadership in the market. For instance, in March 2017, the company opened a new plant for polymer coated fabrics in Changshu, China. The new center is expected to better serve Chinese customers’ demands in different industries.

Trelleborg AB (Sweden) is another leading manufacturer of polymer coated fabrics. The company operates in the Americas, Europe, and Asia. It acquired Laminating Coating Technologies Inc. (Lamcotec) (US) in July 2018 as part of its strategy to strengthen its position in the US market. In February 2018, it also acquired Dartex Holdings (UK), a manufacturer of coated fabrics, primarily for the healthcare & medical industry. The acquired company is also a leading manufacturer of coated fabrics for pressure injury prevention. This acquisition is expected to broaden the company’s offering in the polymer coated fabrics market.

Scope of the Report

|

Report Metric |

Details | |

|

Years considered for the study |

| |

|

Base year considered |

2018 | |

| Forecast period | 2019–2024 | |

| Units considered | Value (USD Thousand), Volume (Kiloton) | |

| Segments covered | Polymer Type, Application, and Region | |

| Regions covered | APAC, North America, Europe, Middle East & Africa, and South America | |

| Companies profiled |

Takata Corporation (Japan), Trelleborg AB (Sweden), Spradling International Inc. (U.S.), Serge Ferrari Group (France), Saint-Gobain SA (Switzerland), Sioen Industries NV (Belgium), Continental AG (Germany), Takata Corporation (Japan), Cooley Group Holdings, Inc. (U.S.), Dickson Constant (France), Seaman Corporation (U.S.), and SRF Limited (India) Top 25 major players covered |

This report categorizes the global polymer coated fabrics market based on polymer type, application, and region.

On the basis of Polymer Type, the polymer coated fabrics market has been segmented as follows:

- Polyvinyl Coated Fabrics

- Polyurethane Coated Fabrics

- Polyethylene Coated Fabrics

- Others (acrylic, nylon 6, nylon 6-6, PA, PC, PEEK, PBT, and PET)

On the basis of Application, the polymer coated fabrics market has been segmented as follows:

- Transportation

- Protective Clothing

- Industrial

- Roofing, Awnings & Canopies

- Furniture & Seating

- Others (agriculture, geotextiles, medical, sports & leisure, and packaging)

On the basis of Region, the plastic antioxidants market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Key Questions Addressed by the Report

- What are the major developments impacting the market?

- Where will all the developments take the industry in the mid to long term?

- What are the upcoming types of polymer coated fabrics?

- What are the emerging applications of polymer coated fabrics?

- What are the major factors impacting market growth during the forecast period?

Frequently Asked Questions (FAQ):

What are the different types of polymer type and the most widely used type among them?

The different type of polymer types arevinyl coated fabrics, PU coated fabrics, PE coated fabrics, and others (acrylic, nylon 6, nylon 6-6, PA, PC, PEEK, PBT, and PET coated fabrics).Vinyl is the most used coating material in various applications due to its reduced cost, easy weldability, and availability of a wide range of colors.

What are the opportunities for the market?

High cost of using the recycled plastics and difficulty in managing the supply chain for post-consumer recycled plastic management is a big challenge for the market globally.

What are the factors supporting the growth of polymer coated fabrics market?

Factors such as surging demand from transportation, protective clothing, and industrial applications and increasing safety concerns and stringent government regulations for providing safety to workers are expected to augment the growth of the global polymer coated fabrics market.

What is the major restraint for polymer coated fabrics market?

The production of coated fabrics involves the use of solvents to adjust the viscosity of the coating material onto the fabric substrate. The Environmental Protection Agency (EPA) has determined that the principal source of hazardous air pollutants (HAPs) is the use of solvents in the manufacturing process of coated fabrics. The use of solvents in the manufacturing process is a restraint for the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Year Considered in the Report

1.4 Currency & Pricing

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Polymer Coated Fabrics Market

4.2 Polymer Coated Fabrics Market, By Application, 2019–2024

4.3 Polymer Coated Fabrics Market in APAC, By Application and Country

4.4 Polymer Coated Fabrics Market, By Region

4.5 Polymer Coated Fabrics Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Safety Measures in the Transportation Application

5.2.1.2 Stringent Regulatory Requirement for Worker’s Safety Driving the Protective Clothing Segment

5.2.2 Restraints

5.2.2.1 Environmental Concerns

5.2.2.2 Availability of Substitutes

5.2.3 Opportunities

5.2.3.1 Rapid Industrialization in Emerging Economies

5.2.3.2 Innovative Product Development in Protective Clothing Segment

5.2.4 Challenges

5.2.4.1 Disposal/Recycling of Waste

5.2.5 Burning Issue

5.2.5.1 Lack of Safety Compliance

5.3 Porter’s Five Forces Analysis

5.3.1 Threat 0f New Entrants

5.3.2 Threat of Substitutes

5.3.3 Barganing Power of Buyers

5.3.4 Barganing Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

6 Polymer Coated Fabrics Market, By Product (Page No. - 45)

6.1 Introduction

6.2 Polymer Coated Fabrics Companies, By Product

6.2.1 Polymer Polymer Coated Fabrics

6.2.1.1 Vinyl Polymer Coated Fabrics

6.2.1.2 Pu Polymer Coated Fabrics

6.2.1.3 Pe Polymer Coated Fabrics

6.2.1.4 Other Polymer Polymer Coated Fabrics

7 Polymer Coated Fabrics Market, By Application (Page No. - 63)

7.1 Introduction

7.1.1 Transportation

7.1.2 Protective Clothing

7.1.3 Industrial

7.1.4 Roofing, Awnings & Canopies

7.1.5 Furniture & Seating

7.1.6 Others

8 Polymer Coated Fabrics Market, By Region (Page No. - 79)

8.1 Introduction

8.2 APAC

8.2.1 Introduction

8.2.1.1 China

8.2.1.2 India

8.2.1.3 Japan

8.2.1.4 South Korea

8.3 North America

8.3.1 Introduction

8.3.1.1 US

8.3.1.2 Canada

8.3.1.3 Mexico

8.4 Europe

8.4.1 Introduction

8.4.1.1 Germany

8.4.1.2 Italy

8.4.1.3 UK

8.4.1.4 France

8.4.1.5 Spain

8.5 Middle East & Africa

8.5.1 Introduction

8.5.1.1 Turkey

8.5.1.2 Saudi Arabia

8.5.1.3 UAE

8.6 South America

8.6.1 Introduction

8.6.1.1 Brazil

8.6.1.2 Argentina

9 Competitive Landscape (Page No. - 128)

9.1 Overview

9.2 Market Share Analysis, 2017

9.2.1 Continental AG

9.2.2 Trelleborg AB

9.2.3 Saint-Gobain S.A.

9.2.4 Sieon Industries N.V.

9.2.5 Serge Ferrari Group

9.3 Competitive Situations and Trends

9.3.1 New Product Launches

9.3.2 Expansions

9.3.3 Acquisitions

9.3.4 Agreements

9.3.5 Partnerships

10 Company Profiles (Page No. - 137)

10.1 Continental AG

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Developments

10.1.4 SWOT Analysis

10.1.5 MnM View

10.2 Sioen Industries NV

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.2.4 SWOT Analysis

10.2.5 MnM View

10.3 Saint-Gobain S.A.

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.3.4 SWOT Analysis

10.3.5 MnM View

10.4 Trelleborg AB

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 SWOT Analysis

10.4.5 MnM View

10.5 Serge Ferrari Group

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.5.5 MnM View

10.6 Low & Bonar (Mehler Texnologies)

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.6.4 SWOT Analysis

10.6.5 MnM View

10.7 SRF Limited

10.7.1 Business Overview

10.7.2 Products Offered

10.8 Omnova Solutions Inc.

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 Recent Developments

10.9 Seaman Corporation

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 Recent Developments

10.10 Spradling International, Inc.

10.10.1 Business Overview

10.10.2 Products Offered

10.10.3 Recent Developments

10.11 Other Market Players

10.11.1 Dickson Constast

10.11.2 Cooley Group Holdings, Inc.

10.11.3 Endutex Coated Technical Textiles

10.11.4 Haartz Corporation

10.11.5 Heytex Bramsche GmbH (Earlier Julius Heywinkel GmbH)

10.11.6 Industrial Sedo S.L.

10.11.7 Morbern Inc

10.11.8 Mount Vernon Mills, Inc.

10.11.9 Obeikan Technical Fabrics Co. Ltd.

10.11.10 Uniroyal Engineered Products LLC.

11 Appendix (Page No. - 167)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.1 Knowledge Store: Marketsandmarkets Subscription Portal

11.2 Author Details

The study involved four major activities in estimating the market size for polymer coated fabrics. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

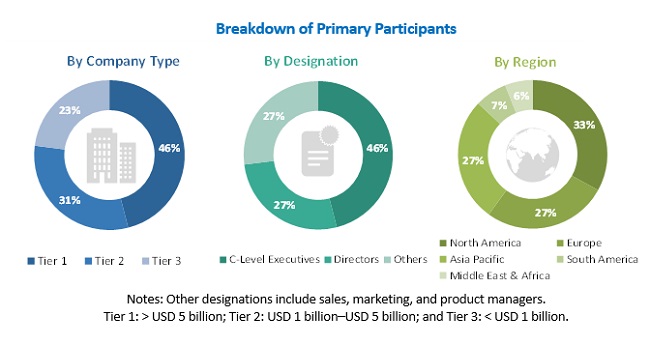

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials, such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The polymer coated fabrics market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the textile industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the polymer coated fabrics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors, and trends from both the demand and supply sides in the polymer coated fabrics industry.

Report Objectives

- To analyze and forecast the size of the polymer coated fabrics market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the polymer coated fabrics market based on polymer type and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the market segments with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional source type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Polymer Coated Fabrics Market