Coated Fabrics Market by Product Type (Polymer-coated Fabrics, Rubber-coated Fabrics and Fabric-backed Wall Coverings), Application (Transportation, Protective Clothing, Roofing, Awnings & Canopies), & Region – Global Forecast to 2028

Updated on : September 24, 2025

Coated Fabrics Market

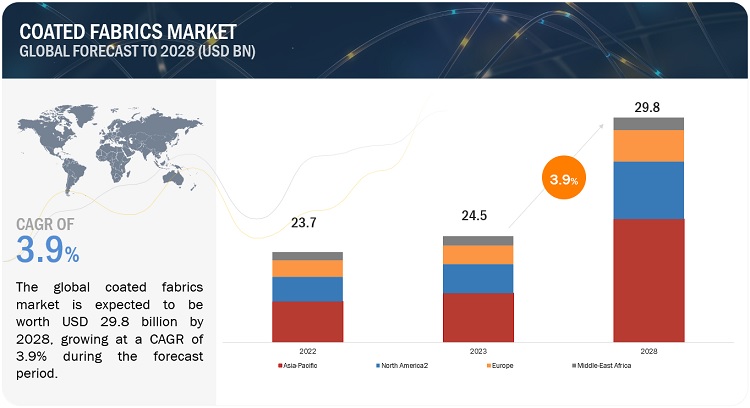

The coated fabrics market size was valued at USD 23.7 billion in 2022 and is projected to reach USD 29.8 billion by 2028, growing at 3.9% cagr from 2023 to 2028. A key factor contributing to the optimistic growth projection of the coated fabrics market is the increased focus on safety measures and rigorous regulations concerning worker safety in industries such as automotive, chemical, and oil & gas. Additionally, the rising demand for environmentally friendly materials is driving the coated fabrics market forward. Coated fabrics present a sustainable alternative, as they can be produced from various materials, including natural fibers like cotton and hemp, as well as recycled materials like plastic bottles. Owing to these factors, the coated fabrics market is well-positioned for steady and sustainable growth.

Coated Fabrics Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Coated Fabrics Market

Coated Fabrics Market Dynamics

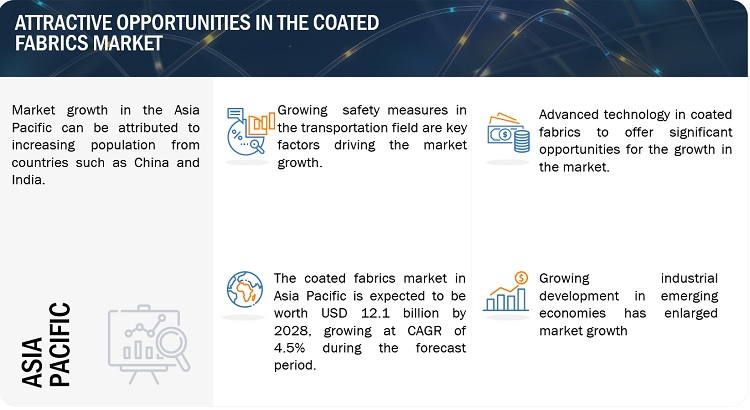

Driver: Growing demand for increased safety measures in vehicles, aircraft, and other forms of transportation

Due to rapid population growth in different regions, there has been a significant increase in the demand for transportation and automotive production. Coated fabrics are used as safety benefits in transportation applications to improve safety and performance. for example coated fabrics are effectively used in airbags, which offers safety features in vehicles and aircraft. In order to meet the rising demand from automotive industries there is a need to increase coated farbics production. This is a crucial driving factor behind the demand for coated farbics.

Restraints: substitutes available for coated fabrics.

Coated fabrics are employed in a variety of industries, including automotive, construction, healthcare, and defense due to their attributes of durability, water resistance, and UV protection, coated fabrics. For coated fabrics, a wide range of alternatives are available. Alternative materials, such as metals or ceramics, may be utilized in place of coated fabrics in some industrial applications. However, coated fabric is used for superior performance compared to its alternatives because it can display enhanced features like increased strength and water resistance.

Opportunities: growing development of new technologies

Coated fabrics can perform more effective, last for a longer period, and function better due to technological developments, which may increase their market value and attraction to consumers. Manufacturers are now able to create innovative products with better qualities including durability, resistance to chemicals and UV radiation, and improved aesthetics because of the development of new coating technologies and materials. Such factor can raise the demand for coated farbics.

Challenges: Dumping of coated fabrics

Coated fabrics are typically made of polymers, which poses a significant environmental hazard, given the low global recycling rate compared to production. As coated materials cannot be easily recycled, it poses a serious threat to the environment. Even with the use of high pressure and temperature, the waste produced after the use of coated fabrics cannot be recycled. This is due to the heterogeneous nature of the polymers employed in the production of coating and fiber compounds, making it difficult to properly mix them to recycle products.

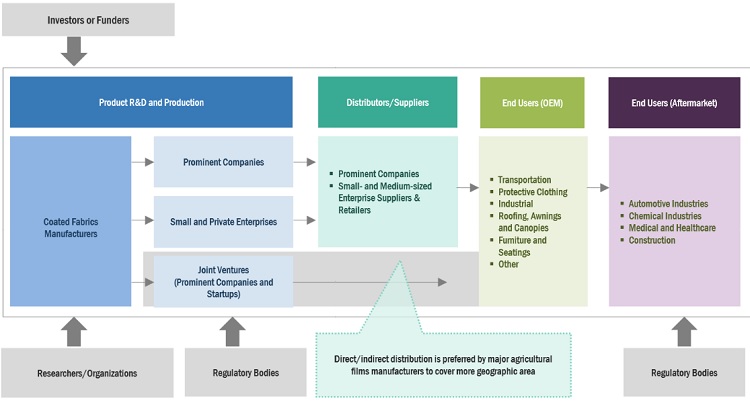

Coated Fabrics Market Ecosystem

Prominent companies in this market include well-established, financially stable coated fabrics. These businesses have been in business for a while and have a extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Continental AG (Germany), Trelleborg AB (Sweden), Serge Ferrari Group (France), Saint-Gobain S.A. (France), Freudenberg Group (Germany).

Based on application, Transportaion is projected to be the largest market for coated fabrics, in terms of value, during the forecast period.

Transportation is the largest application for coated fabrics due to high demand of polymer- and rubber-coated fabrics in automobiles, aircraft, railways, and marines. Coated fabrics helps to reduce the weight of vehicles, which leads to lower emissions of CO2.Coated farbics are mostly used in transpotation application for its propeties like rot-proof, dirt & oil-repellency, mildew, water and UV resistancy. Coated fabrics enhance the material duration and make it withstand with any weather conditions for automotive applications.

Based on Product type, Vinyl-coated fabrics was the largest segment in polymer-coated fabrics for coated fabrics market, in terms of value, in 2022.

Due to its qualities including adaptability, affordability, and durability, It is an ideal product for coated fabrics. However, the production of vinyl is also accompanied by environmental concerns. These fabrics are created by applying vinyl coatings to them. Polyvinyl chloride (PVC), usually known as vinyl, is a synthetic plastic substance created using fossil fuels. These type of fabrics are used in seat upholstery, protective clothing, aprons, and other industrial applications.

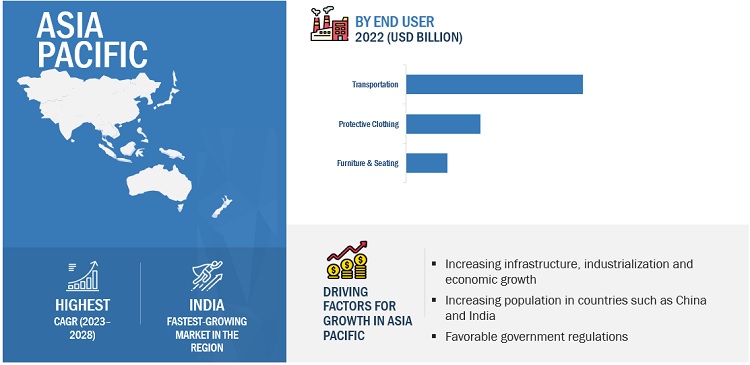

“Asia Pacific accounted for the largest market share for coated fabrics market, in terms of value, in 2022”

In terms of value, Asia Pacific was the largest market for coated fabrics in the year 2022, followed by Europe. This is due to the rise in population particularly in China and India. Significant growth in industrialization, infrastructures and high economic growth expected increase the utilization of coated fabrics in these countries. Also the stringent government regulations in Asia Pacific region gives boost to coated farbics market.

To know about the assumptions considered for the study, download the pdf brochure

Coating Fabrics Market Players

The key players profiled in the report include Continental AG (Germany), Trelleborg AB (Sweden), Serge Ferrari Group (France), Saint-Gobain S.A. (France), Freudenberg Group (Germany). and among others, are the key manufacturers that holds major market share in the last few years. Major focus was given to the acquisition, innovation and new product development due to the changing requirements of users across the world.

Coating Fabrics Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD Billion) |

|

Segments covered |

Product Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Berry Plastics Group, Inc. (US), Kuraray Co., Ltd. (Japan), The RKW Group (Germany), BASF SE (Germany), and The Dow Chemical Company (US). |

This report categorizes the global coated fabrics market based on product type, application, and region.

On the basis of Product type, the coated fabrics market has been segmented as follows:

- Polymer-coated Fabrics

- Vinyl-coated Fabrics

- PU-coated Fabrics

- PE-coated Fabrics

- Rubber-coated Fabrics

- Fabric-backed Wall Coverings

On the basis of application, the coated fabrics market has been segmented as follows:

- Transportation

- Protective Clothings

- Industrial

- Roofing, Awnings and Canopies

- Furniture & Seatings

- Others

On the basis of region, the coated fabrics market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In December 2021, Trelleborg AB has acquired a division of the US-based, privately owned company Alpha Engineered Composites. It is an operation in polymer coated fabrics used in niche applications.

- In November 2022, Trelleborg focused on innovation in healthcare & medical textiles. Dartex Zoned Coatings fabric was the one of its recent product launches. Its fabric allows different combinations of expand properties across its surface without switching the textile.

- In May 2020, Continental AG has innovated timing belts that are applicable in wind turbines in place of gearboxes. The fabric used in timing belts is effective in wear and tear propety ensuring a stable structure and reduces noise.

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

The demand for innovative coating technology in polymer-coated fabrics is expected to shift market trends.

Who are major players in coated fabrics market?

The key players profiled in the report include Continental AG (Germany), Trelleborg AB (Sweden), Serge Ferrari Group (France), Saint-Gobain S.A. (France), Freudenberg Group (Germany).

What is the emerging application of coated fabrics?

Transportation and protective clothing are the emerging applications for coated fabrics market during the forecast period.

What are the major factors restraining market growth during the forecast period?

Disposal of coated fabrics and presence of other substitutes is the major restraint for coated fabrics market growth.

What are the various strategies key players are focusing within coated fabrics market?

Key players are majorly focused on acquisitions, new product launch and Innovation with local or regional players within the market, in order to attract larger market share globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for eco-friendly materials- Increasing safety measures in transportation applications- Stringent regulatory requirements for workers’ safetyRESTRAINTS- Environmental concerns- Availability of substitutesOPPORTUNITIES- Technological advancements- Rapid industrialization in emerging economies- Innovative product development in protective clothing segmentCHALLENGES- Disposal and recycling of waste- Raw material price fluctuations- Lack of safety compliance

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

6.1 SUPPLY CHAIN ANALYSISRAW MATERIALMANUFACTURING OF COATED FABRICSDISTRIBUTION TO END USERS

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND REVENUE POCKETS FOR MANUFACTURERS OF COATED FABRICS

-

6.3 CONNECTED MARKETS: ECOSYSTEM MAPPING

-

6.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.5 PRICING ANALYSISAVERAGE SELLING PRICE, BY APPLICATIONAVERAGE SELLING PRICE, BY REGION

-

6.6 CASE STUDIESCASE STUDY ON COATED FABRICS FOR AUTOMOTIVE AIRBAGSCASE STUDY ON COATED FABRICS FOR INFLATABLE BOATS

-

6.7 TECHNOLOGY ANALYSISGROWING INFLUENCE OF NANOCOATING TECHNOLOGYUSE OF ELECTROSPINNING TECHNOLOGY TO DEVELOP HIGH-PERFORMANCE COATED FABRICS

-

6.8 TRADE DATAIMPORT SCENARIO OF COATED FABRICSEXPORT SCENARIO OF COATED FABRICS

-

6.9 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON COATED FABRICS MARKETREGULATIONS RELATED TO COATED FABRICSREGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS IN 2023

-

6.11 PATENT ANALYSISAPPROACHDOCUMENT TYPEJURISDICTION ANALYSISTOP APPLICANTS

- 7.1 INTRODUCTION

- 7.2 COATED FABRIC PRODUCTS, BY COMPANY

-

7.3 POLYMER-COATED FABRICSHIGH DEMAND DUE TO WATERPROOF AND WATER-RESISTANT PROPERTIES OF POLYMER-COATED FABRICSVINYL-COATED FABRICS- Properties such as high durability and resistant to wear and tear to drive marketPU-COATED FABRICS- Low weight and flexible nature of PU-coated fabrics to drive marketPE-COATED FABRICS- Resistance to UV radiation and moisture to drive demand

- 7.4 OTHER POLYMER-COATED FABRICS

-

7.5 RUBBER-COATED FABRICSHIGH RESISTANCE TO UV RADIATION AND FLEXIBILITY TO INCREASE DEMAND

-

7.6 FABRIC-BACKED WALL COVERINGSMOISTURE-RESISTANT PROPERTIES TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 TRANSPORTATIONGROWING AUTOMOTIVE INDUSTRY TO DRIVE MARKET

-

8.3 PROTECTIVE CLOTHINGINCREASING DEMAND FROM HEALTHCARE INDUSTRY TO DRIVE MARKET

-

8.4 INDUSTRIALGROWING DEMAND IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

-

8.5 ROOFING, AWNINGS & CANOPIESPROTECTION AGAINST UV RADIATION OUTDOOR SPACES TO DRIVE DEMAND

-

8.6 FURNITURE AND SEATING.GROWING DEMAND FROM RESIDENTIAL, HEALTHCARE, HOSPITALITY, AND COMMERCIAL SECTORS TO DRIVE MARKET

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICASIA PACIFIC COATED FABRICS MARKET, BY PRODUCTASIA PACIFIC COATED FABRICS MARKET, BY APPLICATIONASIA PACIFIC COATED FABRICS MARKET, BY COUNTRY- China- India- Japan- South Korea

-

9.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICANORTH AMERICA COATED FABRICS MARKET, BY PRODUCT TYPENORTH AMERICA COATED FABRICS MARKET, BY APPLICATIONNORTH AMERICA COATED FABRICS MARKET, BY COUNTRY- US- Canada- Mexico

-

9.4 EUROPERECESSION IMPACT ON EUROPEEUROPE COATED FABRICS MARKET, BY PRODUCTEUROPE COATED FABRICS MARKET, BY APPLICATIONEUROPE COATED FABRICS MARKET, BY COUNTRY- Germany- Italy- UK- France- Spain

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA COATED FABRICS MARKET, BY PRODUCTMIDDLE EAST & AFRICA COATED FABRICS MARKET, BY APPLICATIONMIDDLE EAST & AFRICA COATED FABRICS MARKET, BY COUNTRY- Turkey- Saudi Arabia- UAE

-

9.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICASOUTH AMERICA COATED FABRICS MARKET, BY PRODUCTSOUTH AMERICA COATED FABRICS MARKET, BY APPLICATIONSOUTH AMERICA COATED FABRICS MARKET, BY COUNTRY- Brazil- Argentina

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET RANKING OF KEY PLAYERS

-

10.4 MARKET SHARE OF KEY PLAYERSCONTINENTAL AGTRELLEBORG ABSERGE FERRARI GROUPSAINT-GOBAIN S.A.FREUDENBERG GROUP

- 10.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.6 COMPANY EVALUATION QUADRANT (TIER 1)STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

10.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewTRELLEBORG AB- Business overview- Products offered- Recent developments- MnM viewSERGE FERRARI GROUP- Business overview- Products offered- Recent developments- MnM viewSAINT-GOBAIN S.A.- Business overview- Products offered- Recent developments- MnM viewFREUDENBERG GROUP- Business overview- Products offered- Recent developments- MnM viewSEAMAN CORPORATION- Business overview- Products offeredSRF LIMITED- Business overview- Products offeredSIOEN INDUSTRIES NV- Business overview- Products offeredSPRADLING INTERNATIONAL INC.- Business overview- Products offeredOMNOVA SOLUTIONS INC.- Business overview- Products offered

-

11.2 OTHER KEY MARKET PLAYERSCOOLEY GROUP HOLDINGS, INC.ENDUTEX COATED TECHNICAL TEXTILESHAARTZ CORPORATIONHEYTEX TECHNICAL TEXTILESMORBERN INC.OBEIKAN TECHNICAL FABRICS CO LTD.UNIROYAL GLOBAL LIMITEDCGTDICKSON CONSTANTBROOKWOOD COMPANIES, INC.ALBANY INTERNATIONAL CORPORATIONINTERNATIONAL TEXTILE GROUP, INC.MOUNT VERNON MILLS, INC.INDUSTRIAL SEDO S.L.NANTONG TAYHUI NEW MATERIAL TECHNOLOGY CO. LTD.DONGGUAN UOO SPORT PRODUCTS CO. LTD.YAW LIAMY ENTERPRISE CO. LTD.SHENZHEN SHUNYIDA TEXTILE CO. LTD.

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 PROTECTIVE CLOTHING MARKETMARKET DEFINITIONMARKET OVERVIEW

-

12.4 PROTECTIVE CLOTHING MARKET, BY REGIONNORTH AMERICA- North America protective clothing market, by countryEUROPE- Europe protective clothing market, by countryASIA PACIFIC- Asia Pacific protective clothing market, by country

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 COATED FABRICS MARKET: ASSUMPTIONS

- TABLE 2 COATED FABRICS MARKET: LIMITATIONS

- TABLE 3 COATED FABRICS MARKET: RISK ASSESSMENT

- TABLE 4 US: PPE PROVISIONS AND STANDARDS

- TABLE 5 DIRECT AND HIDDEN COSTS OF WORKPLACE ACCIDENTS

- TABLE 6 COATED FABRICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020–2027 (USD BILLION)

- TABLE 8 COATED FABRICS MARKET: ECOSYSTEM

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 11 AVERAGE SELLING PRICES FOR TOP THREE APPLICATIONS (USD/KG)

- TABLE 12 AVERAGE SELLING PRICES OF COATED FABRICS, BY REGION, 2021–2028 (USD/KG)

- TABLE 13 COATED FABRIC IMPORTS, BY REGION, 2013–2021 (USD MILLION)

- TABLE 14 COATED FABRIC EXPORTS, BY REGION, 2013–2021 (USD MILLION)

- TABLE 15 COATED FABRICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023

- TABLE 16 PATENT STATUS AND COUNT

- TABLE 17 PATENTS BY TORAY INDUSTRIES, INC.

- TABLE 18 PATENTS BY ZHEJIANG JINYU TEXTILE SCIENCE AND TECHNOLOGY CO., LTD.

- TABLE 19 PATENTS BY NANTONG TONGZHOU JIANGHUA TEXTILE CO., LTD.

- TABLE 20 TOP 10 PATENT OWNERS IN US, 2011–2022

- TABLE 21 COATED FABRICS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 22 COATED FABRICS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 23 COATED FABRICS MARKET, BY PRODUCT, 2018–2022 (KILOTON)

- TABLE 24 COATED FABRICS MARKET, BY PRODUCT, 2023–2028 (KILOTON)

- TABLE 25 POLYMER-COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 POLYMER-COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 POLYMER-COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 28 POLYMER-COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 29 VINYL-COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 VINYL-COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 VINYL-COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 32 VINYL-COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 33 APPLICATIONS OF VINYL-COATED FABRICS

- TABLE 34 ADVANTAGES AND DISADVANTAGES OF PVC AS COATING MATERIAL

- TABLE 35 PU-COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 PU-COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 PU-COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 38 PU- COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 39 APPLICATIONS OF PU-COATED FABRICS

- TABLE 40 ADVANTAGES AND DISADVANTAGES OF PU AS COATING MATERIAL

- TABLE 41 PE-COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 PE-COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 PE-COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 44 PE-COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 45 APPLICATIONS OF PE-COATED FABRICS

- TABLE 46 ADVANTAGES AND DISADVANTAGES OF PE AS COATING MATERIAL

- TABLE 47 OTHER POLYMER-COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 OTHER POLYMER-COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 OTHER POLYMER-COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 50 OTHER POLYMER-COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 51 APPLICATIONS OF OTHER POLYMER-COATED FABRICS

- TABLE 52 RUBBER-COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 RUBBER-COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 RUBBER-COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 55 RUBBER-COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 56 APPLICATIONS OF RUBBER-COATED FABRICS

- TABLE 57 ADVANTAGES AND DISADVANTAGES OF RUBBER AS COATING MATERIAL

- TABLE 58 FABRIC-BACKED WALL COVERING-COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 FABRIC-BACKED WALL COVERING -COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 FABRIC-BACKED WALL COVERING-COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 61 FABRIC-BACKED WALL COVERING-COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 62 FACTORS CONTRIBUTING TO DEMAND FOR COATED FABRICS

- TABLE 63 COMPANIES, BY APPLICATION

- TABLE 64 COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 65 COATED FABRICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 67 COATED FABRICS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 68 TRANSPORTATION: COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 TRANSPORTATION: COATED FABRIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 TRANSPORTATION: COATED FABRIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 71 TRANSPORTATION: COATED FABRIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 72 TRANSPORTATION: END-USE APPLICATIONS OF COATED FABRICS

- TABLE 73 PROTECTIVE CLOTHING: COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 PROTECTIVE CLOTHING: COATED FABRIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 PROTECTIVE CLOTHING: COATED FABRIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 76 PROTECTIVE CLOTHING: COATED FABRIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 77 PROTECTIVE CLOTHING: END-USE APPLICATIONS OF COATED FABRICS

- TABLE 78 INDUSTRIAL: COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 79 INDUSTRIAL: COATED FABRIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 INDUSTRIAL: COATED FABRIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 81 INDUSTRIAL: COATED FABRIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 82 INDUSTRIAL: END-USE APPLICATION OF COATED FABRICS

- TABLE 83 ROOFING, AWNINGS & CANOPIES: COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 ROOFING, AWNINGS & CANOPIES: COATED FABRIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 ROOFING, AWNINGS & CANOPIES: COATED FABRIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 86 ROOFING, AWNINGS & CANOPIES: COATED FABRIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 87 ROOFING, AWNINGS & CANOPIES: END-USE APPLICATIONS OF COATED FABRICS

- TABLE 88 FURNITURE & SEATING: COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 89 FURNITURE & SEATING: COATED FABRIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 FURNITURE & SEATING: COATED FABRIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 91 FURNITURE & SEATING: COATED FABRIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 92 FURNITURE & SEATING: END-USE APPLICATIONS OF COATED FABRICS

- TABLE 93 OTHERS: COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 OTHERS: COATED FABRIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 OTHERS: COATED FABRIC MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 96 OTHERS: COATED FABRIC MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 97 OTHER END-USE APPLICATIONS OF COATED FABRICS

- TABLE 98 COATED FABRICS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 99 COATED FABRICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 COATED FABRICS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 101 COATED FABRICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 102 ASIA PACIFIC: COATED FABRICS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: COATED FABRIC MARKET, BY PRODUCT, 2018–2022 (KILOTON)

- TABLE 105 ASIA PACIFIC: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (KILOTON)

- TABLE 106 ASIA PACIFIC: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 109 ASIA PACIFIC: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 110 ASIA PACIFIC: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 113 ASIA PACIFIC: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 114 CHINA: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 115 CHINA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 CHINA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 117 CHINA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 118 INDIA: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 119 INDIA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 INDIA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 121 INDIA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 122 JAPAN: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 123 JAPAN: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 JAPAN: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 125 JAPAN: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 126 SOUTH KOREA: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 127 SOUTH KOREA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 SOUTH KOREA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 129 SOUTH KOREA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 130 NORTH AMERICA: COATED FABRICS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: COATED FABRIC MARKET, BY PRODUCT, 2018–2022 (KILOTON)

- TABLE 133 NORTH AMERICA: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (KILOTON)

- TABLE 134 NORTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 137 NORTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 138 NORTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 141 NORTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 142 US: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 143 US: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 US: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 145 US: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 146 CANADA: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 147 CANADA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 CANADA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 149 CANADA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 150 MEXICO: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 151 MEXICO: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 MEXICO: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 153 MEXICO: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 154 EUROPE: COATED FABRICS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 155 EUROPE: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 156 EUROPE: COATED FABRIC MARKET, BY PRODUCT, 2018–2022 (KILOTON)

- TABLE 157 EUROPE: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (KILOTON)

- TABLE 158 EUROPE: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 159 EUROPE: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 161 EUROPE: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 162 EUROPE: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 163 EUROPE: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 164 EUROPE: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 165 EUROPE: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 166 GERMANY: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 167 GERMANY: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 168 GERMANY: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 169 GERMANY: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 170 ITALY: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 171 ITALY: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 172 ITALY: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 173 ITALY: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 174 UK: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 175 UK: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 UK: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 177 UK: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 178 FRANCE: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 179 FRANCE: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 180 FRANCE: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 181 FRANCE: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 182 SPAIN: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 183 SPAIN: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 184 SPAIN: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 185 SPAIN: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: COATED FABRICS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY PRODUCT, 2018–2022 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (KILOTON)

- TABLE 190 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 193 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 197 MIDDLE EAST & AFRICA: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 198 TURKEY: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 199 TURKEY: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 200 TURKEY: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 201 TURKEY: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 202 SAUDI ARABIA: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 203 SAUDI ARABIA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 204 SAUDI ARABIA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 205 SAUDI ARABIA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 206 UAE: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 207 UAE: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 208 UAE: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 209 UAE: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 210 SOUTH AMERICA: COATED FABRICS MARKET, BY PRODUCT, 2018–2022 (USD MILLION)

- TABLE 211 SOUTH AMERICA: COATED FABRICS MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 212 SOUTH AMERICA: COATED FABRIC MARKET, BY PRODUCT, 2018–2022 (KILOTON)

- TABLE 213 SOUTH AMERICA: COATED FABRIC MARKET, BY PRODUCT, 2023–2028 (KILOTON)

- TABLE 214 SOUTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 215 SOUTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 216 SOUTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 217 SOUTH AMERICA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 218 SOUTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 219 SOUTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 220 SOUTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 221 SOUTH AMERICA: COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 222 BRAZIL: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 223 BRAZIL: COATED FABRIC MARKET, BY APPLICATION ,2023–2028 (USD MILLION)

- TABLE 224 BRAZIL: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 225 BRAZIL: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 226 ARGENTINA: COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 227 ARGENTINA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 228 ARGENTINA: COATED FABRIC MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 229 ARGENTINA: COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 230 STRATEGIES ADOPTED BY KEY COATED FABRIC MANUFACTURERS

- TABLE 231 COATED FABRICS MARKET: DEGREE OF COMPETITION

- TABLE 232 COATED FABRICS MARKET: TYPE FOOTPRINT

- TABLE 233 COATED FABRICS MARKET: APPLICATION FOOTPRINT

- TABLE 234 COATED FABRICS MARKET: REGION FOOTPRINT

- TABLE 235 COATED FABRICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 236 COATED FABRICS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 237 COATED FABRICS MARKET: PRODUCT LAUNCHES (2019–2022)

- TABLE 238 COATED FABRICS MARKET: DEALS (2019–2022)

- TABLE 239 COATED FABRICS MARKET: OTHER DEVELOPMENTS (2019–2022)

- TABLE 240 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 241 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 242 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 243 TRELLEBORG AB: COMPANY OVERVIEW

- TABLE 244 TRELLEBORG AB: PRODUCTS OFFERED

- TABLE 245 TRELLEBORG AB: DEALS

- TABLE 246 TRELLEBORG AB: OTHER DEVELOPMENTS

- TABLE 247 SERGE FERRARI GROUP: COMPANY OVERVIEW

- TABLE 248 SERGE FERRARI GROUP: PRODUCTS OFFERED

- TABLE 249 SERGE FERRARI GROUP: PRODUCT LAUNCHES

- TABLE 250 SERGE FERRARI GROUP: DEALS

- TABLE 251 SAINT-GOBAIN S.A.: COMPANY OVERVIEW

- TABLE 252 SAINT-GOBAIN S.A.: PRODUCTS OFFERED

- TABLE 253 SAINT-GOBAIN S.A.: OTHER DEVELOPMENTS

- TABLE 254 FREUDENBERG GROUP: COMPANY OVERVIEW

- TABLE 255 FREUDENBERG GROUP: PRODUCTS OFFERED

- TABLE 256 FREUDENBERG GROUP: DEALS

- TABLE 257 SEAMAN CORPORATION: COMPANY OVERVIEW

- TABLE 258 SEAMAN CORPORATION: PRODUCTS OFFERED

- TABLE 259 SRF LIMITED: COMPANY OVERVIEW

- TABLE 260 SRF LIMITED: PRODUCTS OFFERED

- TABLE 261 SIOEN INDUSTRIES NV: COMPANY OVERVIEW

- TABLE 262 SIOEN INDUSTRIES NV: PRODUCTS OFFERED

- TABLE 263 SPRADLING INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 264 SPRADLING INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 265 OMNOVA SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 266 OMNOVA SOLUTIONS INC.: PRODUCTS OFFERED

- TABLE 267 COOLEY GROUP HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 268 ENDUTEX COATED TECHNICAL TEXTILES: COMPANY OVERVIEW

- TABLE 269 HAARTZ CORPORATION: COMPANY OVERVIEW

- TABLE 270 HEYTEX TECHNICAL TEXTILES: COMPANY OVERVIEW

- TABLE 271 MORBERN INC.: COMPANY OVERVIEW

- TABLE 272 OBEIKAN TECHNICAL FABRICS CO LTD: COMPANY OVERVIEW

- TABLE 273 UNIROYAL GLOBAL LIMITED: COMPANY OVERVIEW

- TABLE 274 CGT: COMPANY OVERVIEW

- TABLE 275 DICKSON CONSTANT: COMPANY OVERVIEW

- TABLE 276 BROOKWOOD COMPANIES, INC.: COMPANY OVERVIEW

- TABLE 277 ALBANY INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 278 INTERNATIONAL TEXTILE GROUP, INC.: COMPANY OVERVIEW

- TABLE 279 MOUNT VERNON MILLS, INC.: COMPANY OVERVIEW

- TABLE 280 INDUSTRIAL SEDO S.L.: COMPANY OVERVIEW

- TABLE 281 NANTONG TAYHUI NEW MATERIAL TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

- TABLE 282 DONGGUAN UOO SPORT PRODUCTS CO. LTD.: COMPANY OVERVIEW

- TABLE 283 YAW LIAMY ENTERPRISE CO. LTD.: COMPANY OVERVIEW

- TABLE 284 SHENZHEN SHUNYIDA TEXTILE CO. LTD.: COMPANY OVERVIEW

- TABLE 285 NORTH AMERICA: PROTECTIVE CLOTHING MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 286 NORTH AMERICA: PROTECTIVE CLOTHING MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 287 EUROPE: PROTECTIVE CLOTHING MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 288 EUROPE: PROTECTIVE CLOTHING MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- TABLE 289 ASIA PACIFIC: PROTECTIVE CLOTHING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 290 ASIA PACIFIC: PROTECTIVE CLOTHING MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

- FIGURE 1 COATED FABRICS MARKET: RESEARCH DESIGN

- FIGURE 2 COATED FABRICS MARKET: PRIMARY DESIGN

- FIGURE 3 COATED FABRICS MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1, SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2, BOTTOM-UP—SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3—BOTTOM-UP (DEMAND SIDE)

- FIGURE 8 COATED FABRICS MARKET: DATA TRIANGULATION

- FIGURE 9 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- FIGURE 11 POLYMER-COATED FABRICS WAS LARGEST PRODUCT SEGMENT OF COATED FABRICS IN 2022

- FIGURE 12 TRANSPORTATION TO BE LARGEST APPLICATION OF COATED FABRICS DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 14 GROWING DEMAND FOR PROTECTIVE CLOTHING TO DRIVE COATED FABRICS MARKET BETWEEN 2023 AND 2028

- FIGURE 15 ASIA PACIFIC TO BE LARGEST COATED FABRICS MARKET DURING FORECAST PERIOD

- FIGURE 16 CHINA AND POLYMER-COATED FABRICS ACCOUNTED FOR LARGEST MARKET SHARE

- FIGURE 17 TRANSPORTATION TO BE LEADING SEGMENT OF COATED FABRICS ACROSS REGIONS

- FIGURE 18 SAUDI ARABIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 19 OVERVIEW OF FACTORS GOVERNING COATED FABRICS MARKET

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS OF COATED FABRICS MARKET

- FIGURE 21 COATED FABRICS MARKET: SUPPLY CHAIN

- FIGURE 22 REVENUE SHIFT FOR COATED FABRICS MARKET

- FIGURE 23 COATED FABRICS MARKET: ECOSYSTEM

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 26 AVERAGE SELLING PRICES FOR TOP THREE APPLICATIONS

- FIGURE 27 AVERAGE SELLING PRICE OF COATED FABRICS, BY REGION, 2021–2028

- FIGURE 28 COATED FABRIC IMPORTS, BY KEY COUNTRIES, 2013–2021

- FIGURE 29 COATED FABRIC EXPORTS, BY KEY COUNTRIES, 2013–2021

- FIGURE 30 PATENTS REGISTERED IN COATED FABRICS MARKET, 2011–2022

- FIGURE 31 PATENT PUBLICATION TRENDS, 2011–2022

- FIGURE 32 LEGAL STATUS OF PATENTS FILED IN COATED FABRICS MARKET

- FIGURE 33 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 34 THE PROCTER & GAMBLE COMPANY REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2022

- FIGURE 35 RUBBER-COATED FABRICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 PROTECTIVE CLOTHING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO DRIVE COATED FABRICS MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: COATED FABRICS MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: COATED FABRICS MARKET SNAPSHOT

- FIGURE 40 EUROPE: COATED FABRICS MARKET SNAPSHOT

- FIGURE 41 RANKING OF TOP FIVE PLAYERS IN COATED FABRICS MARKET, 2022

- FIGURE 42 CONTINENTAL AG ACCOUNTED FOR LARGEST SHARE OF COATED FABRICS MARKET IN 2022

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES DURING LAST FIVE YEARS

- FIGURE 44 COATED FABRICS MARKET: COMPANY FOOTPRINT

- FIGURE 45 COMPANY EVALUATION QUADRANT FOR COATED FABRICS MARKET (TIER 1)

- FIGURE 46 STARTUP/SME EVALUATION QUADRANT FOR COATED FABRICS MARKET

- FIGURE 47 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 48 TRELLEBORG AB: COMPANY SNAPSHOT

- FIGURE 49 SERGE FERRARI GROUP: COMPANY SNAPSHOT

- FIGURE 50 SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

- FIGURE 51 FREUDENBERG GROUP: COMPANY SNAPSHOT

- FIGURE 52 SRF LIMITED: COMPANY SNAPSHOT

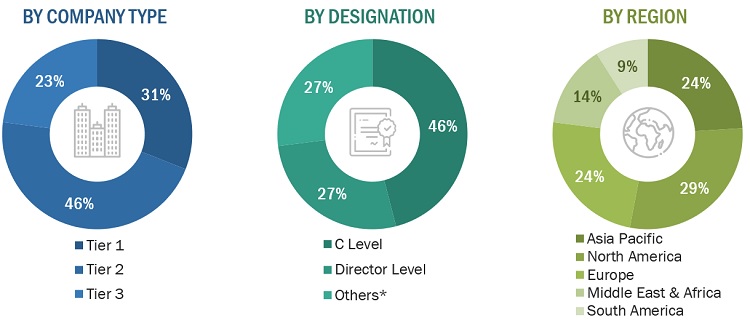

The study involved four major activities in estimating the market size for coated fabrics. Intensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The coated fabrics market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the coated fabrics market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Continental AG |

Global Strategy & Innovation Manager |

|

Trelleborg AB |

Technical Sales Manager |

|

Serge Ferrari Group |

Senior Supervisor |

|

Saint-Gobain S.A. |

Production Supervisor |

|

Freudenberg Group |

Vice-Precident |

Market Size Estimation

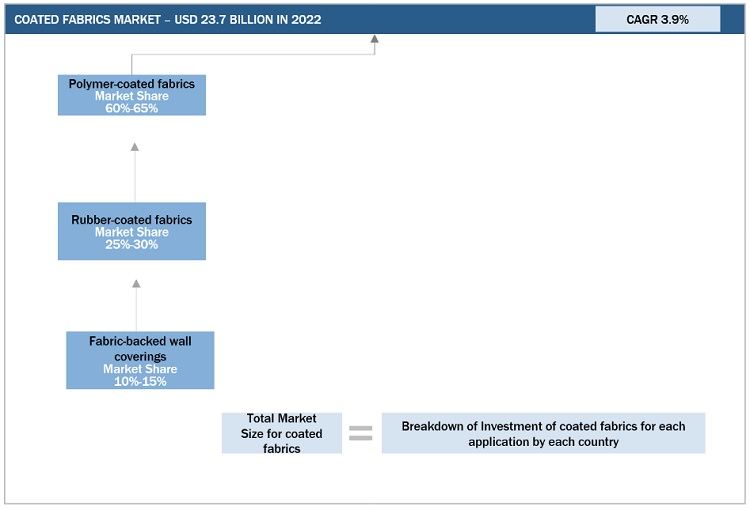

Both top-down and bottom-up approaches were used to estimate and validate the total size of the coated fabrics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Coated Fabrics Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Coated Fabrics Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the coated fabrics industry.

Market Definition

The coated fabrics market refers to the key industries involved in the production, distribution, and sale of fabrics that have been treated or coated with various materials to enhance their performance characteristics. Coated fabrics are typically made by applying a coating or lamination to a base fabric, which can be made of natural or synthetic fibers. The coatings applied to these fabrics can serve a variety of purposes, including improving the fabrics durability. Coated fabrics are used in the various industries, including automotive, transportation, aerospace, marine, healthcare, sports and leisure, industrial, and construction.

Key Stake Holders

- Coated fabrics manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the coated fabrics market in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the coated fabrics market based on product type and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Coated Fabrics Market

Need contacts of Coates fabric industries who need fabric. I am fabric manufacturer.

Specific information on coated fabrics market along with opportunites

Polyurethane Coating Market

General information required on global coating industry

Coated fabrics market report

Interested in coated fabric industry

Coated Fabrics Market