PEEK Market

PEEK Market by Reinforcement Type (Glass Filled, Carbon Filled, Unfilled), Processing Method (Extrusion, Injection Molding), End User (Electrical & Electronics, Aerospace, Automotive, Oil & Gas, Medical), and Region - Global Forecast to 2030

Updated on : December 11, 2025

POLYETHER ETHER KETONE MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global PEEK market is projected to grow from USD 1.50 billion in 2025 to USD 2.14 billion by 2030, at a CAGR of 7.5% during the forecast period. Polyether ether ketone (PEEK) is a type of thermoplastic polymer that is high in performance and, semi-crystalline. One of the significant features one can find in this polymer is incredible mechanical strength, chemical resistance, and thermal stability. PEEK is mainly found in applications where heavy functionality is most highly required. PEEK is available in different reinforcement types including Unfilled PEEK, Glass-filled PEEK, and Carbon-filled PEEK. The unfilled version of PEEK gives the best purity and flexibility while an additional glass-filling enhances mechanical strength and dimensional stability for structural components. The carbon-filling improves stiffness, thermal conductivity, and wear resistance, making it suitable for use under high load and high-temperature conditions. PEEK is processed using two major methods including extrusion and injection molding. The end-use industries use this material for various applications. In the electrical and electronics industries, PEEK is highly valued due to its properties in insulation and resistance to high temperature. In addition, it is used in the aerospace application where it yields weight-efficient and high-strength components. It is also used in the automotive industry for parts requiring chemical resistance and durability. The oil and gas industry currently uses it due to its capability to withstand a harsh environment under high pressure. Moreover, PEEK is also used in the medical field for implants and surgical devices because of its biocompatibility and radiolucency. The rising demands for lightweight and high-performance materials in strategic industries, in conjunction with improvements in medical technology and innovations in automotive, is expected to drive the PEEK market.

KEY TAKEAWAYS

-

BY END-USERThe PEEK market, by end-user, has been segmented into electrical & electronics, automotive, aerospace, oil & gas, medical, and other end-users. The demand for PEEK in the electrical & electronics industry is rising due to its excellent insulating properties, heat resistance, and durability. The demand for PEEK in the aerospace industry is growing due to its lightweight, high strength, and resistance to extreme temperatures and chemicals. It helps improve fuel efficiency and performance by replacing heavier metal parts.

-

BY PROCESSING METHODThe PEEK market, by processing method, has been segmented into extrusion, injection molding, and other processing methods. Extrusion is commonly used to produce continuous PEEK profiles such as pipes, rods, and sheets. This method involves melting PEEK granules and forcing the material through a die to form long, consistent shapes, making it ideal for applications in chemical, food processing, and medical industries due to its efficiency, flexibility, and cost-effectiveness. Meanwhile, injection molding is suited for high-volume production of complex PEEK components. These diverse processing techniques significantly expand the scope of PEEK across high-performance industries.

-

BY REINFORCEMENT TYPEThe PEEK market, by reinforcement type, has been segmented into glass-filled, carbon-filled, unfilled, and other reinforcement types. The growth of glass-filled PEEK is driven by its enhanced mechanical strength and thermal stability, making it suitable for aerospace, automotive, and electronics applications. The growth of carbon-filled PEEK is fueled by its superior strength-to-weight ratio, stiffness, and electrical conductivity.

-

BY REGIONThe PEEK market has been segmented into Asia Pacific, Europe, North America, the Middle East & Africa, and South America. It is witnessing robust growth due to technological advancements, elevated demand for high-performance materials, and diverse applications across key industries.

-

COMPETITIVE LANDSCAPEVictrex plc. (UK), Syensqo (Belgium), Evonik Industries AG (Germany), SurloIndia (India), Caledonian Industries Limited (UK), Jilin Joinature Polymer Co., Ltd. (China), Mitsubishi Chemical Group (Japan), RTP Company (US), Westlake Plastics (US), Drake Plastics (US), Avient Corporation (US), Americhem (US), JUNHUA (China), Lehmann&Voss&Co. (Germany), and Polymer Industries (US) are some the leading manufacturers of PEEK. They focus on expanding their geographic reach to meet consumer demand. These companies have adopted agreements, expansions, and product launches to acquire new projects, strengthen their product & service portfolios, and tap into untapped markets.

The PEEK market is expanding steadily as its adoption widens across diverse end-use industries such as automotive, aerospace, electronics, and healthcare. Its superior properties—high thermal stability, chemical resistance, and mechanical strength—make it a preferred replacement for metals and conventional polymers in demanding applications. Additionally, continuous industry developments such as strategic agreements, capacity expansions, and new product launches are enhancing material availability, improving performance characteristics, and broadening application potential. These initiatives are enabling manufacturers to meet sector-specific requirements more effectively, thereby accelerating the overall growth of the PEEK market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The PEEK market is undergoing rapid expansion, driven by the increased adoption in diverse end-use industries. The growth of end-use industries, such as electrical & electronics, aerospace, automotive, oil & gas, and medical, increases the demand for PEEK, including glass-filled, carbon-filled, and unfilled. At the same time, PEEK's ability to act as a potential substitute for metals is further boosting the market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased adoption in diverse end-use industries

Level

-

Availability of substitute polymers

Level

-

Expanding applications in healthcare

-

Potential substitute for metals

Level

-

Manufacturing and processing complexities

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased adoption in diverse end-use industries

The rise in demand for lightweight and high-performance materials is driving the polyether ether ketone (PEEK) market. Due to its exceptional mechanical strength, chemical resistance, and thermal stability, PEEK is preferred by industries that value durability and efficiency, especially where weight reduction of components is essential. In fields like aerospace, automotive, and medical, there's a strong demand for components that can handle extreme conditions without adding extra weight, which has led to a rise in PEEK usage. For example, in the automotive sector, PEEK is utilized in engine parts and fuel systems to lighten the load and enhance performance. Furthermore, the growing usage and demand in various end-use industries, including oil and gas, electrical and electronics, , and medical, is further fueling the growth of PEEK's market. As the demand for advanced, high-quality materials rises in these sectors, PEEK stands out for its ability to perform exceptionally well in tough environments, making it a top choice. The growth of manufacturing capabilities and technological innovations in these areas has only solidified PEEK's status as a go-to material, providing the perfect mix of strength, lightweight characteristics, and performance that modern applications demand. This trend is set to keep propelling the PEEK market forward, with expanding uses in numerous high-tech industries.

Restraints: Availability of substitute polymers

The availability of substitute polymers acts as a significant restraint to the growth of polyether ether ketone market. Despite being a high-performance polymer that has good mechanical strength, chemical resistance, and high thermal stability, PEEK is an expensive polymer when compared to some of the other high-performance polymers including polytetrafluoroethylene (PTFE), polyimides, polyphenylene sulfide (PPS), and liquid crystal polymers (LCPs). These polymers often provide an inferior alternative for some applications, but they usually fulfill the requirements for a lower price, making them highly attractive in the case of budget constraints in applications. For commercial sectors, such as automotive, electronics, and industrial manufacturing, these alternative polymers can be used so as not to sacrifice too much on performance while also being cost-effective. Advances in material science lead to further manufactured new polymers that would be mimicking or improving some of PEEK's properties, thus opening competition in the market. The plethora of material options available to customers form a challenging environment for PEEK to develop especially in the price-sensitive regions. Always, industries are looking forward to optimizing production costs while ensuring that quality is maintained. Thus, substitute polymers remain key factors in slowing the increased adoption and expansion of PEEK in many applications.

Opportunity: Expanding applications in healthcare, and potential substitute for metals

PEEK (polyether ether ketone) has found ever-broader applications in health care, while slowly evolving into a substitute for metals, giving ample opportunity for market growth. PEEK has excellent biocompatibility, chemical resistance, and mechanical properties, thus making an ideal candidate for medical implants as well as surgical and dental instruments. It has been used in orthopedic implants such as spinal cages, hip replacements, and trauma fixation devices owing to its unique mixture of properties: strength, flexibility, and radiolucency, thus allowing somebody to image without distortion. Due to its durability against repeated sterilization cycles, it becomes an invaluable asset within surgical settings. Apart from the health care industry, polyether ether ketone is increasingly used in multiple industries due to its ability to substitute metal in some key applications in various industries like oil and gas, automotive, and aerospace. Its properties like its lightweight nature along with thermal stability allow it to be used as a replacement for metals such as aluminum and stainless steel in critical applications, which thus helps to reduce component weight, boost corrosion resistance, and enhance fuel efficiency. Such a trend is gaining ground with more focus on energy efficiency, sustainability, and miniaturization. The demand for PEEK is likely to further strengthen its value as a material for the future in so many high-value applications as the medical and industrial sectors find priority on materials that offer performance without the negative impact of metal.

Challenge: Manufacturing and processing complexities

Complicated manufacturing and processing procedures of polyether ether ketone (PEEK) pose a significant challenge to the growth of the market. As a high-performance polymer, PEEK requires very precise and controlled production conditions during the various stages of polymerization and thereafter processing. The material is synthesized under very high temperatures requiring the use of specialized equipment capable of handling such extreme conditions. Besides, the very high melt viscosity of PEEK makes its extrusion and injection-molding processes more difficult compared to standard polymers. As such, serious investments into advanced machinery and highly skilled labor, as well as a stringent quality-control system, would need to be made to manufacture pure defect-free PEEK components. These high capital and operation costs act as barriers to entry to new entrants and sometimes limit the scalability for small manufacturers. Any minor changes in the processing of polyether ether ketone can lead to significant drawbacks for demanding end-use industries like medical, automotive, and aerospace. Moreover, the processing of both glass-filled or carbon-filled PEEK customized reinforced grades requires exact formulation and dispersion techniques, thus adding to the complexity of manufacturing. Overall, these factors lead to an increase in the production costs of polyether ether ketone, and restrict its adoption in cost-sensitive markets.

PEEK Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides PEEK for aerospace, automotive, electronics, energy, industrial, and medical industries, supporting demanding applications that require high performance and reliability. | Enables the development of lightweight, durable components with outstanding resistance to high temperatures and harsh chemicals, leading to improved longevity and overall system performance. |

|

Delivers PEEK for additive manufacturing, aerospace, automotive, healthcare, oil & gas, and semiconductor industries, supporting advanced engineering needs. | Ensures high-quality part performance by providing excellent chemical resistance, long-term dimensional stability, and superior wear and dielectric properties in aggressive environments. |

|

Manufactures PEEK that finds usage in medical devices, especially for improving osteoconductive properties and bone healing in healthcare. | Offers superior strength and mechanical resilience, allowing for lighter, biocompatible implants that often outperform metals, thus supporting better medical outcomes and patient safety. |

|

Serves mechanical engineering, aerospace, automotive, medical, electronics, pharmaceutical, and food processing sectors with multiple PEEK grades for manufacturing. | Offers versatile PEEK material options tailored for various production processes, enabling manufacturers to achieve components with high durability, reliability, and process efficiency. Its PEEK products are available as coarse powder (P series), fine powder (PF series), and granules (G series) with different fluidity grades. These are suitable for various processing techniques like compounding, injection molding, extrusion, compression molding, and coating. |

|

Provides a range of PEEK extruded and compression-molded forms for aerospace, food, medical, oil & gas, and semiconductor applications. | Provides a wide array of product forms and reinforcement options, ensuring reliable performance under mechanical and chemical stress, and suitability for specialized and high-purity uses. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The PEEK market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of polyether ether ketone. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Victrex Plc. (UK), Syensqo (Belgium), Evonik Industries AG (Germany), Jilin Joinature Polymer Co., Ltd. (China), and Junhua (China).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PEEK Market, By End-user

Electrical & Electronics is estimated to be the fastest-growing segment of the global polyether ether ketone market during the forecast period. During the forecast period under consideration, the electrical and electronics segment is anticipated to showcase the highest CAGR in the polyether ether ketone (PEEK) market on account of the increasing demand for high-performance materials to meet the increasingly complex requirements of modern electronics. Indeed, outstanding electrical insulating properties combined with high thermal stability and chemical resistance make PEEK an optimal material for the manufacture of important electronic components such as connectors, cable insulation, semiconductor parts, and microchip sockets. Due to an ongoing trend toward miniaturization in electronics and the growing need for lightweight, durable, and high-temperature-resistant materials, PEEK has emerged as the preferred material amongst manufacturers. Furthermore, the demands for PEEK-based components are rising due to the advent of 5G technology, rapid growth of smart devices, and increase in electric vehicles, all of which demand electronic systems with high technology. The other factor that accentuates the applicability of PEEK in this industry is its resistance in maintaining both mechanical and dielectric properties in extreme conditions-withstands high voltage and high-temperature situations. Therefore, this rising demand from the electrical and electronics sector indeed contributes significantly to the overall growth of the polyether ether ketone market, which in turn challenges the manufacturers to be innovative and increase production capacity in order to meet the needs of the emerging technology.

PEEK Market, By Reinforcement Type

Glass-filled PEEK is estimated to be the fastest-growing segment of the global polyether ether ketone market during the review period. The segment of glass-filled PEEK in the category of reinforcement types is anticipated to grow with the highest CAGR during the forecast period due to its outstanding mechanical characteristics and wide range of applications. Comparatively, glass-filled PEEK is substantially stronger, stiffer, and better than unfilled PEEK, while also being excellently chemically resistant and thermally performing. That is what makes them particularly applicable in any industry, including aerospace, automotive, electrical and electronics, and oil and gas, where they have demanding applications. Therefore, the increasing focus on lightweight and durable materials to improve fuel efficiency and performance is accelerating the use of glass-filled PEEK components such as structural parts, gears, and seals by the aerospace and automotive markets, and the electrical and electronics industries also appreciate these advancements for insulation as well as much better heat and wear resistance-in the use of connectors, switches, and housings. Meanwhile, industries operating in harsh environments prefer glass-filled PEEK due to its good resilience to load and temperature variations. As the requirement for high-performance materials that offer strength as well as lightweight nature continues to drive industries, the subsequent increase in preference for glass-filled PEEK largely propels overall business growth in the polyether ether ketone market, instigating further material innovation and expanded production capabilities.

REGION

Asia Pacific is to be the fastest-growing region in global PEEK market during forecast period

The polyether ether ketone (PEEK) market in the Asia Pacific region, is anticipated to grow at the highest CAGR during the forecast period. The growth in the PEEK market can be attributed to strong industrial growth, expanding end-use industries, and increase in investment in high-performance materials. The increasing urbanization and disposable incomes of households along with rapid advancement in technology are driving growth in sectors such as automotive, aerospace, electronics, and health care in major economies in the region including China, India, Japan, South Korea, and Southeast Asian countries. The establishing trend of increased demand for lightweight, durable, and high strength materials in these end-use industries is driving materials providers to adopt PEEK as its adoption will help global manufacturers reduce operating costs, improve sustainability goals, improve performance of their product, and comply with regulations. For example, in the automotive, stricter emissions norms and the shift towards electric vehicles will increase use of PEEK in components in applications that require thermal management and lightweight materials. The electronics sector will see growth from the excellent thermal and electrical properties of PEEK that are essential for electronic devices that are miniaturized and high in performance. In addition, government policies, including "Make in India" have also resulted in numerous manufacturing and innovation programs that are tied to increase in demand for new and advanced materials such as PEEK in the said region.

PEEK Market: COMPANY EVALUATION MATRIX

In the PEEK market matrix, Victrex plc. is one of the leading companies providing polyether ether ketone (PEEK) and polyaryle ether ketone (PAEK)-based polymer solutions. Specializing in high-performance polymers, PEEK films, lightweight metal replacement solutions, and gear solutions, the company serves six core markets, including aerospace, automotive, energy, electronics, industrial, and medical. Not only does the company have an extended product range when it comes to PEEK, but it is also lancing new PEEK products, which further strengthen its market presence. Similarly, RTP Company is another major player in this market. RTP Company specializes in custom-engineered thermoplastics. With over 20 manufacturing plants across the US, Mexico, Europe, Singapore, and China, the company develops high-performance thermoplastic compounds tailored to meet the specific needs of end-use industries. The company serves automotive, electrical & electronics, energy, healthcare, and industrial applications, providing thermoplastic solutions in pellet, sheet, and film formats. These materials are designed for various processing methods, including injection molding, extrusion, and compression molding, ensuring adaptability to various manufacturing needs. RTP also provides custom extrusion services, including sheet sizing, surface texturing, protective masking, and film laminating.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.41 BN |

| Market Forecast in 2030 (value) | USD 2.14 BN |

| Growth Rate | CAGR 7.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD MN), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: PEEK Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Aerospace & Defense OEMs |

|

|

| Automotive Manufacturers |

|

|

| Medical Device Companies |

|

|

| Electronics & Semiconductor Firms |

|

|

| Industrial Machinery Manufacturers |

|

|

| Oil & Gas / Chemical Industry Clients |

|

|

| 3D Printing / Additive Manufacturing Providers |

|

|

| Renewable Energy / Battery Industry Players |

|

|

RECENT DEVELOPMENTS

- March 2025 : Syensqo and Politubes Srl announced a strategic partnership to develop slot liner spiral-wound tubes using Ajedium polyether ether ketone (PEEK) and polyphenylsulfone (PPSU) film. These spiral-wound slot liner tubes leverage the high-performance properties of Ajedium PEEK films, providing superior insulation for electric motors.

- March 2024 : DEMGY Group and Drake Plastics formed the "Liberty Alliance," a partnership to expand high-performance polymer solutions. DEMGY becomes the preferred distributor in France for Drake’s machinable semi-finished shapes, offering turnkey solutions. The product portfolio includes extruded bars, sheets, Seamless Tube and near-net-shapes from special formulations of PEEK and polyketone, as well as Torlon polyamide-imide and other high-performance polymers. The partnership strengthens both companies’ market reach in aerospace, mobility, and semiconductors, providing high-quality, cost-effective technical solutions globally.

- October 2023 : Victrex plc. launched a new product grade developed exclusively for Drug Delivery and Pharmaceutical Contact applications. The new product grade, VICTREX PC 101, is a PEEK-based material ideally suited to non-implantable pharmaceutical contact and drug delivery applications for less than 24-hour tissue contact duration.

- October 2023 : Evonik introduced a new carbon-fiber reinforced PEEK filament, for use in 3D printed medical implants. This smart biomaterial can be processed in common extrusion-based 3D printing technologies such as fused filament fabrication (FFF).

- May 2020 : Evonik launched a 3D-printable PEEK (polyether ether ketone) filament as an implant-grade material for medical applications. This PEEK filament is an implant-grade material based on VESTAKEEP i4 G, a highly viscous, high-performance polymer from Evonik.

Table of Contents

Methodology

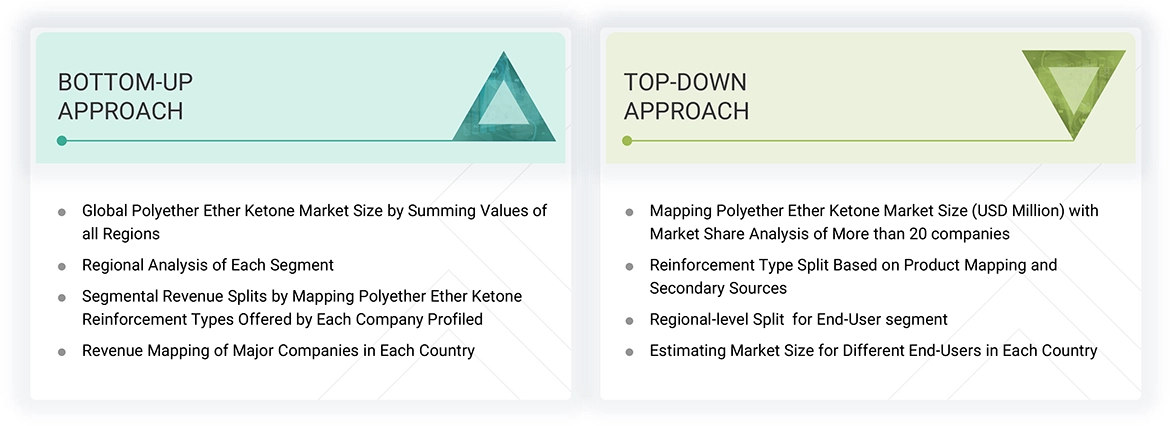

The research encompassed four primary actions in assessing the present market size of PEEK. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the PEEK value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to determine the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the access control market is initiated by collecting revenue data from prominent suppliers using secondary research. During the secondary research, sources such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The PEEK market comprises several stakeholders in the supply chain, such as manufacturers, suppliers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of electrical & electronics, automotive, oil & gas, medical, aerospace, and other applications. Advancements in technology characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the PEEK market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the PEEK market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global PEEK Market Size: Bottom-Up and Top-Down Approaches

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Polyether ether ketone (PEEK) is a high-performance, semi-crystalline thermoplastic polymer known for its excellent mechanical strength, thermal stability, chemical resistance, and flame retardancy. It is widely utilized in demanding engineering applications due to its ability to maintain performance under extreme conditions. PEEK is available in several reinforcement types, including unfilled polyether ether ketone (pure PEEK), glass-filled polyether ether ketone for improved rigidity and dimensional stability, and carbon-filled polyether ether ketone for enhanced strength, stiffness, and thermal conductivity. The polymer is processed through advanced methods such as injection molding and extrusion, which allow for the production of complex components with high precision. Owing to its superior properties, PEEK finds extensive applications across various end-use industries, including electrical and electronics, aerospace, automotive, oil and gas, and medical. These industries leverage PEEK’s performance benefits for parts such as insulators, connectors, engine components, implants, and seals, making it a critical material in high-reliability environments.

Stakeholders

- Polyether ether ketone manufacturers

- Polyether ether ketone suppliers

- Polyether ether ketone traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global PEEK market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global PEEK market

- To analyze and forecast the size of various segments (end-use and type) of the PEEK market based on five major regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the PEEK Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in PEEK Market

Shelby

Apr, 2014

Looking for information on PEEK polymers market.

Erin

Jul, 2019

Specific interest on compression and spin moulded PEEK..

Dieter

Dec, 2014

Polyether Ether Ketone (PEEK) Market .

Johannes

Dec, 2018

Help on PEEK market for Europe and mainly Germany.

Wolfgang

Sep, 2013

Information on Market overview of Polyether Ether Ketone (PEEK) and its applications. Also, a deep dive into competitive intelligence on top producers..

Amir

Nov, 2019

Information on raw material for polyether ether ketones (peak) and a carbonless peak for the compressor industry and the piston ring in Turkey and wants help on the same.

Nick

Sep, 2016

PEEK application areas..

Daisuke

Jul, 2019

General information on the PEEK market .

Matt

Mar, 2016

PEEK market for medical application.