Polyvinylidene Fluoride - PVDF Market by End User Industry (Chemical Processing, Construction, New Energies, and Oil & Gas), & by Application (Pipes, Coatings, Fittings, Sheets, Films, Tubes, Powder, Membranes, & Cables) - Trends Forecasts to 2019

[240 Slides Report] The global polyvinylidene fluoride market, along with its end products, has witnessed a linear growth in the past few years. This growth is estimated to increase in the coming years. The high purity, chemical inertness to most acids, aliphatic and aromatic organic compounds, chlorinated solvents, and an upsurge in the demand in coatings, Lithium-ion batteries, flexible flow lines and photovoltaic films will be the key influencing factors for the global PVDF market with the increased emphasis on its different applications and their end-users.

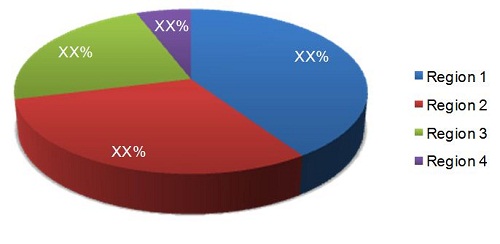

The polyvinylidene fluoride market is experiencing enormous growth which is expected to continue in the near future. This growth is mainly driven by the highly growing Asia-Pacific, North America, and Western European region. Considerable amount of investments and expansions are made by various market players to serve the end-user applications industry in the future. The North American region is the main PVDF market that accounted for about 38% market share of the total global demand in 2012.

Almost 35% of the total polyvinylidene fluoride demand was for the chemical processing industry in 2012, with the construction and new energies segment also being the fastest growing end-use segments, primarily due to high penetration across all the regions.

The drivers of the industry include growth in the end-user industries, strong demand for PVDF in Asia-Pacific especially China, Growth in Photovoltaic installations, and others.

This study basically aims to estimate the global polyvinylidene fluoride market for 2014 and to project its projected demand by 2019. This market research study provides a detailed qualitative and quantitative analysis of the global PVDF market. We have used various secondary sources such as encyclopedia, directories, industry journals, and databases to identify and collect information useful for this extensive commercial study of the PVDF market. The primary sources–experts from related industries and suppliers– have been interviewed to obtain and verify critical information as well as to assess the future prospects of the PVDF industry.

Competitive scenarios of the top players in the polyvinylidene fluoride market have been discussed in detail. We have also profiled leading players of this industry with their recent developments and other strategic industry activities. These include key PVDF manufacturers such as Arkema (France), Solvay S.A. (Belgium), Daikin Industries ltd (Japan), Dyneon GmbH (Germany), Kureha Corporation (Japan), Shanghai 3F New Materials Company Limited (China), Shanghai Ofluorine Chemical Technology Co. ltd. (China), Quadrant Engineering Plastics Products Inc. (Switzerland), Zhejiang Fotech International Co. Ltd. (China), Zhuzhou Hongda Polymer Materials Co. Ltd. (China), and others.

Scope of the report:

This research report categorizes the global market for polyvinylidene fluoride on the basis of applications, end-user industries, and geography along with forecasting volume, value, and analyzing trends in each of the submarkets.

On the basis of end-user industry:

- Chemical processing

- Construction

- New energies

- Oil and gas

- Others

Each end-user industry is further described in detail in the report with volume and revenue forecast.

On the basis of applications:

- Pipes

- Coatings

- Fittings

- Sheets

- Films

- Tubes

- Powder

- Membranes

- Cables

- Others

Each application is described in detail in the report with volume and revenue forecasts

On the basis of geography:

- North America

- Western Europe

- Asia-Pacific

- ROW

The market is further analyzed for key countries in each of these regions.

The polyvinylidene fluoride market is estimated to be 64,311.7 metric tons by volume by 2019 signifying a firm annualized growth rate of over 6.7% from 2014 to 2019.

The global polyvinylidene fluoride market, along with its applications , showed a significant growth in the past few years and is estimated to continue in the coming years. An increase in the demand in coatings, Lithium-ion batteries, flexible flow lines and photovoltaic films will be the key influencing factors for the global PVDF market.

Currently, the North American region is the largest consumer of PVDF with Asia-Pacific estimated to grow at the highest CAGR. The countries such as China, India, and Japan are anticipated to lead the Asia-Pacific polyvinylidene fluoride market, with China having the largest share in the regional volumetric consumption of PVDF. The market volume of PVDF is comparatively low in the ROW region, but is estimated to grow with a moderate CAGR from 2014 to 2019.

Almost 35% of the total PVDF demand was for the chemical processing industry in 2012, with the construction and new energies segment also being the fastest growing end-use segments, primarily due to high penetration in all the regions.

The Asia-Pacific and Western European regions are the most active markets in terms of strategic initiatives, owing to their emerging and mature market demands respectively. The New energies end-user industry led this rapid growth in the global polyvinylidene fluoride market.

The important PVDF manufacturers in Asia-Pacific include Daikin Industries ltd (Japan), Kureha Corporation (Japan), Shanghai 3F New Materials Company Limited (China), Shanghai Ofluorine Chemical Technology Co. ltd. (China), Zhejiang Fotech International Co. Ltd. (China), Zhuzhou Hongda Polymer Materials Co. Ltd. (China).

PVDF Market Size, by Geography, 2012 (Metric Tons)

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

This report covers the polyvinylidene fluoride market by key regions and important countries in each of these regions. It also provides a detailed segmentation of the market on the basis of key applications and end user industries up to 2019.

Table Of Contents

1 Introduction (Slide No. - 21)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 Key Data Points Taken From Primary Sources

1.5.4 Assumptions Made For This Report

1.6 Key Questions Answered

2 Executive Summary (Slide No. - 37)

2.1 Introduction

2.2 Industry Snapshot

3 Premium Insights (Slide No. - 40)

3.1 Polyvinylidene Fluoride : Market Share, 2012

3.2 PVDF: Market Trend & Forecast, By Geography

3.3 Polyvinylidene Fluoride : Market Attractiveness, By Geography

3.4 PVDF Market Attractiveness: PVDF

3.5 PVDF Market Attractiveness: PVDF

3.6 PVDF Market Share: Polyvinylidene Fluoride End-User Industry

3.7 PVDF Market Trend

4 Market Overview (Slide No. - 48)

4.1 Introduction

4.2 Value Chain Analysis

4.3 Drivers & Restraints

4.4 Porter’s Five Forces Analysis

5 Market Players: Product Specifications (Slide No. - 60)

5.1 Arkema

5.1.1 Kynar PVDF Ranges

5.1.1.1 Kynar PVDF Resins

5.1.1.2 Kynar Film

5.2 Solvay

5.2.1 Hylar PVDF

5.2.2 Solef PVDF

5.2.2.1 Solef PVDF Grades

6 Market Assessment, By End-User Industry (Slide No. - 86)

6.1 Global Polyvinylidene Fluoride (PVDF) Market, By End-User Industry

6.1.1 Chemical Processing Industry

6.1.2 Construction

6.1.3 New Energy

6.1.4 Oil &Gas

6.1.5 Other Applications: Market Trend, By Geography

7 Market Assessment, By Application (Slide No. - 102)

7.1 Introduction

7.2 PVDF (Polyvinylidene Fluoride): Global Market Trend, By Application

7.2.1 Pipes

7.2.2 Coatings

7.2.2.1 Advantages

7.2.3 Fittings

7.2.4 Sheets

7.2.5 Films

7.2.6 Tubes

7.2.7 Powder

7.2.8 Membranes

7.2.9 Cables

7.2.10 Other Applications: Market Trend, By Geography

8 Market Assessment, By Geography (Slide No. - 134)

8.1 Polyvinylidene Fluoride : Global Market Size, By Geography

8.2 North America: Polyvinylidene Fluoride Market Size, By Country

8.2.1 U.S.: Polyvinylidene Fluoride Market Size, By End-User Industry

8.2.2 Others: PVDF Market Size, By End-User Industry

8.2.3 North America: Polyvinylidene Fluoride Market Size, By End-User Industry

8.2.4 North America: PVDF Market Size, By Application

8.3 Western Europe: PVDF Market Size, By Country

8.3.1 Germany: PVDF Market Size, By End-User Industry

8.3.2 France: PVDF Market Size, By End-User Industry

8.3.3 Others: PVDF Market Size, By End-User Industry

8.3.4 Western Europe: Polyvinylidene Fluoride Market Size, By End-User Industry

8.3.5 Western Europe: PVDF Market Size, By Application

8.4 Asia-Pacific: Market Size, By Country

8.4.1 China: PVDF Market Size, By End-User Industry

8.4.2 India: PVDF Market Size, By End-User Industry

8.4.3 Others: PVDF Market Size, By End-User Industry

8.4.4 Asia-Pacific: Market Size, By End-User Industry

8.4.5 Asia-Pacific: PVDF Market Size, By Application

8.5 ROW: PVDF Market Size, By Country

8.5.1 Brazil: PVDF Market Size, By End-User Industry

8.5.2 Others: PVDF Market Size, By End-User Industry

8.5.3 ROW: PVDF Market Size, By End-User Industry

8.5.4 ROW: PVDF Market Size, By Application

9 PVDF Customer: Existing & Potential (Slide No. - 181)

10 PVDF Equipment Manufacturers (Slide No. - 185)

11 Competitive Landscape (Slide No. - 191)

11.1 Introduction

11.2 Competitor Product Mapping

11.3 Major Developments in The Global PVDF Market

12 Company Profiles (Slide No. - 201)

12.1 Arkema

12.2 Daikin Industries Ltd.

12.3 Dyneon Gmbh

12.4 Kureha Corporation

12.5 Shanghai 3f New Materials Company Limited

12.6 Shanghai Ofluorine Chemical Technology Co. Ltd

12.7 Solvay S.A.

12.8 Quadrant Engineering Plastics Products Inc.

12.9 Zhejiang Fotech International Co. Ltd.

12.1 Zhuzhouhongda Polymer Materials Co. Ltd.

List of Tables (99 Tables)

Table 1 Detailed Research Methodology For PVDF Market Size

Table 2 Data From Secondary Sources

Table 3 Data From Secondary Sources

Table 4 PVDF: Industry Snapshot

Table 5 Properties of PVDF

Table 6 Comparison of Various Properties of PVDF With Other Fluorinated Polymers

Table 7 PVDF Resins Properties: Homopolymervs Copolymer

Table 8 PVDF: Regulatory Listings and Approvals

Table 9 Kynar PVDF Standards

Table 10 Hylar PVDF Standards

Table 11 PVDF: Physical Properties

Table 12 PVDF Market Size, By End-User Industry, 2014-2019 (Metric Tons)

Table 13 PVDF Market Size, By End-User Industry, 2014-2019 ('000$)

Table 14 Global Chemical Processing Market Size, By Geography, 2012-2019 (Metric Tons)

Table 15 Global PVDF Chemical Processing Market Size, By Geography, 2012-2019 ('000$)

Table 16 Construction PVDF Market Size, By Geography, 2012-2019 (Metric Tons)

Table 17 PVDF Construction Market Size, By Geography, 2012-2019 ('000$)

Table 18 Polyvinylidene Fluoride Market Size in New Energy, By Geography, 2012-2019 (Metric Tons)

Table 19 PVDF Market Size in New Energy, By Geography, 2012-2019 ('000$)

Table 20 Polyvinylidene Fluoride Market Size in Oil & Gas, By Geography, 2012-2019 (Metric Tons)

Table 21 PVDF Market Size in Oil & Gas, By Geography, 2012-2019 ('000$)

Table 22 PVDF Market Size in Others, By Geography, 2012-2019 (Metric Tons)

Table 23 PVDF Market Size in Others, By Geography, 2012-2019 ('000$)

Table 24 PVDF Application and Its Description

Table 25 PVDF Market Size, By Application, 2012-2019 (Metric Tons)

Table 26 PVDF Market Size, By Application, 2014-2019 ('000$)

Table 27 PVDF Fabrication Technique

Table 28 Properties of Pipe Lining Thermoplastics

Table 29 PVDF Pipes Market Size, By Region, 2014-2019 (Metric Tons)

Table 30 Polyvinylidene Fluoride Pipes Market Size, By Region, 2014-2019 ('000$)

Table 31 PVDF Coatings Market Size, By Region 2014-2019 (Metric Tons)

Table 32 PVDF Coatings Market Size, By Region 2014-2019 ('000$)

Table 33 PVDF Fittings Market Size, By Region 2014-2019 (Metric Tons)

Table 34 PVDF Fittings Market Size, By Region 2014-2019 ('000$)

Table 35 PVDF Sheet Specifications

Table 36 PVDF Sheets Market Size, By Region, 2014-2019 (Metric Tons)

Table 37 PVDF Sheets Market Size, By Region, 2014-2019 ('000$)

Table 38 PVDF Films Market Size, By Region, 2014-2019 (Metric Tons)

Table 39 PVDF Films Market Size, By Region, 2014-2019 ('000$)

Table 40 PVDF Tubes Market Size, By Region, 2014-2019 (Metric Tons)

Table 41 PVDF Tubes Market Size, By Region, 2014-2019 ('000$)

Table 42 PVDF Powder Market Size, By Region, 2014-2019 (Metric Tons)

Table 43 PVDF Powder Market Size, By Region, 2014-2019 ('000$)

Table 44 PVDF Membrane Market Size, By Region, 2014-2019 (Metric Tons)

Table 45 PVDF Membrane Market Size, By Region, 2014-2019 ('000$)

Table 46 PVDF Cable: Physical Properties

Table 47 PVDF Cables Market Size, By Region, 2014-2019 (Metric Tons)

Table 48 PVDF Cables Market Size, By Region, 2014-2019 ('000$)

Table 49 Others PVDF Market Size, By Region, 2014-2019 (Metric Tons)

Table 50 Others PVDF Market Size, By Region, 2014-2019 ('000$)

Table 51 Polyvinylidene Fluoride Market Size, By Geography, 2012-2019 (Metric Tons)

Table 52 PVDF Market Size, By Geography, 2012-2019 ('000$)

Table 53 North America: PVDF Market Size, By Country, 2012-2019 (Metric Tons)

Table 54 North America: PVDF Market Size, By Country, 2012-2019 ('000$)

Table 55 U.S.: PVDF Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 56 U.S.: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 57 Others: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 58 Others: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 59 North America: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 60 North America: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 61 North America: PVDF Market Size, By Application, 2012-2019 (Metric Tons)

Table 62 North America: PVDF Market Size, By Application, 2012-2019 ('000$)

Table 63 Western Europe: Polyvinylidene Fluoride Market Size, By Country, 2012-2019 (Metric Tons)

Table 64 Western Europe: Market Size, By Country, 2012-2019 ('000$)

Table 65 Germany: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 66 Germany: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 ('000$)

Table 67 France: PVDF Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 68 France: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 69 Others: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 70 Others: Market Size, By End-User Industry, 2012-2019 ('000$)

Table 71 Western Europe: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 72 Western Europe: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 ('000$)

Table 73 Western Europe: Polyvinylidene Fluoride Market Size, By Application, 2012-2019 (Metric Tons)

Table 74 Western Europe: Polyvinylidene Fluoride Market Size, By Application, 2012-2019 ('000$)

Table 75 Asia-Pacific: Polyvinylidene Fluoride Market Size, By Country, 2012-2019 (Metric Tons)

Table 76 Asia-Pacific: Polyvinylidene Fluoride Market Size, By Country, 2012-2019 ('000$)

Table 77 China: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 78 China: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 79 India: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 80 India: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 81 Others: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 82 Others: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 83 Asia-Pacific: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 84 Asia-Pacific: Polyvinylidene Fluoride Market Value, By End-User Industry, 2012-2019 ('000$)

Table 85 Asia-Pacific: Polyvinylidene Fluoride Market Size, By Application, 2012-2019 (Metric Tons)

Table 86 Asia-Pacific: Polyvinylidene Fluoride Market Size, By Application, 2012-2019 ('000$)

Table 87 ROW: Polyvinylidene Fluoride Market Size, By Country, 2012-2019 (Metric Tons)

Table 88 ROW: Polyvinylidene Fluoride Market Size, By Country, 2012-2019 ('000$)

Table 89 Brazil: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 90 Brazil: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 91 Others: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 92 Others: PVDF Market Size, By End-User Industry, 2012-2019 ('000$)

Table 93 ROW: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 (Metric Tons)

Table 94 ROW: Polyvinylidene Fluoride Market Size, By End-User Industry, 2012-2019 ('000$)

Table 95 ROW: Polyvinylidene Fluoride Market Size, By Application, 2012-2019 (Metric Tons)

Table 96 ROW: Polyvinylidene Fluoride Market Size, By Application, 2012-2019 ('000$)

Table 97 Polyvinylidene Fluoride Customers

Table 98 PVDF Equipment Manufacturers

Table 99 Polyvinylidene Fluoride Market Share, By Key Players, 2012

List of Figures (31 Figures)

Figure 1 Polyvinylidene Fluoride Market Segmentation

Figure 2 Research Methodology: Supply Market

Figure 3 Research Methodology: Demand Side

Figure 4 Research Methodology: Triangulation

Figure 5 Research Methodology: Forecasting Model

Figure 6 Market Share (Volume), By End-User & Application, 2012

Figure 7 Market Share (Volume), By Geography, 2014-2019 & Market Share (Volume), By Geography, 2012

Figure 8 Market Attractiveness, By Geography, 2014-2019

Figure 9 PVDF Market Attractiveness, By Application, 2014-2019

Figure 10 Market Attractiveness, By End-User Industry, 2014-2019

Figure 11 Market Share (Volume), By End-User Industry, 2014-2019

Figure 12 Market Trend (Value), By Geography, 2014-2019

Figure 13 Polyvinylidene Fluoride : Raw Material Requirements

Figure 14 PVDF: Market Value Chain Analysis

Figure 15 Market Drivers & Restraints

Figure 16 Porter’s Five Forces Analysis

Figure 17 Kynar PVDF Resin: Brands

Figure 18 End-User Industries, Using PVDF

Figure 19 PVDF Applications & End-User Industries

Figure 20 Applications of PVDF

Figure 21 PVDF Coating Comparison: Color Change

Figure 22 PVDF Coating Comparison: Gloss Retention

Figure 23 PVDF Coating Performance

Figure 24 Polyvinylidene Fluoride Piezoelectric Films Applications

Figure 25 PVDF: Competitor Product Mapping

Figure 26 Polyvinylidene Fluoride Market Development Share, By Growth Strategy, 2011-2013*

Figure 27 PVDF Market Developments’ Trend, By Growth Strategy, 2011-2013*

Figure 28 Polyvinylidene Fluoride Market Developments, By Key Players, 2011-2013*

Figure 29 Growth Strategies of Major Companies, 2011–2013*

Figure 30 Patent Analysis, By Region, 2010-2014*

Figure 31 Patent Analysis, By Key Players, 2010-2014*

Growth opportunities and latent adjacency in Polyvinylidene Fluoride - PVDF Market