Point-to-Point Antenna Market by Type (Parabolic, Flat Panel, Yagi), Polarization, Frequency Range (1.0 GHz to 9.9 GHz, 10.0 GHz to 29.9 GHz, 30.0 GHz to 86.0 GHz), Application, and Region - Global Forecast to 2025

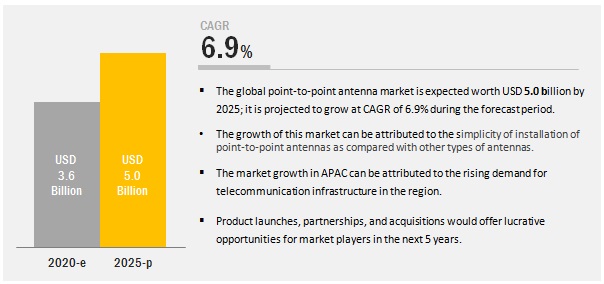

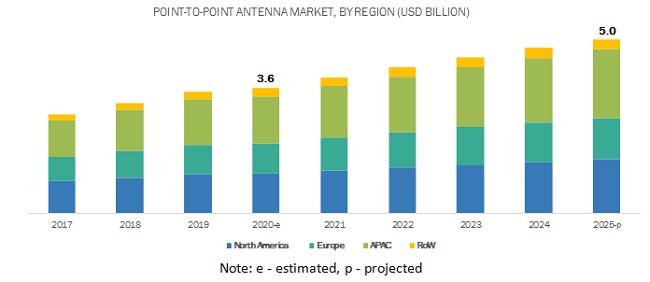

The point-to-point antenna market is projected to reach USD 5.0 billion by 2025; it is projected to grow at a CAGR of 6.9% during the forecast period.

This estimation factors in the impact of the COVID-19 pandemic on the market. The major driving factors are the simplicity of installation as compared with other antennas and the growing penetration of the Internet. The increasing number of M2M connections among various industry verticals is also expected to drive the point-to-point antenna market growth during the forecast period.

Impact of AI on Point-to-Point Antenna Market

Artificial Intelligence (AI) is significantly influencing the point-to-point antenna market by enhancing network performance, streamlining operations, and enabling intelligent decision-making. AI algorithms are being used to optimize antenna alignment, predict signal interference, and dynamically adjust transmission parameters in real time, resulting in more reliable and efficient wireless communication. In addition, AI facilitates proactive maintenance by analyzing system data to detect anomalies and predict equipment failures, thereby minimizing downtime and reducing operational costs. With the growing demand for high-capacity, low-latency communication links—especially in 5G, backhaul networks, and remote area connectivity—AI is helping operators maximize bandwidth utilization and ensure seamless connectivity. As a result, the integration of AI is not only improving the technical capabilities of point-to-point antenna systems but also expanding their applications across telecommunications, defense, and industrial automation sectors.

Flat panel antenna is projected to grow at highest CAGR in point-to-point antenna market during forecast period

The flat panel antenna segment is projected to grow at the highest CAGR in the point-to-point antenna market during the forecast period as it offers compact size, aesthetic look, and moderate gain. These antennas are gaining importance as the demand for Communication on the Move (COTM) continues to grow. As these antennas are flat, thin, and lightweight, they are often hung on walls or ceilings where they remain visually inconspicuous and blend easily into the background. These antennas are mostly used for covering single-floor small offices, small stores, and other indoor locations where access points cannot be placed centrally.

Dual-polarized held larger size of point-to-point antenna market in 2019

The dual-polarized antenna segment is expected to hold the larger share of the point-to-point antenna market owing to the ability of dual-polarized antennas to respond to both horizontally and vertically polarized radio waves simultaneously. The use of both polarizations increases the traffic handling capacity of the system.

10.0 GHz to 29.9 GHz frequency range is projected to witness highest growth in point-to-point antenna market in coming years

The market for the frequency range of 10.0 GHz to 29.9 GHz is projected to witness the highest CAGR owing to the 5G cellular network. These are super-high-frequency (SHF) antennas with major applications in test equipment, industrial imaging, consumer and industrial VSAT, and cellular 5G

Telecommunication is expected to hold largest share of point-to-point antenna market in 2020

Point-to-point antennas are used for connectivity in the telecommunication sector. The main advantages of these antennas are that they offer high speed, high availability over a large connection distance, and can also be efficiently used for carrying voice and data traffic in several bandwidth-intensive applications. Since the 5G network is expected to widen the frequency application range for point-to-point antennas with the growing cellular network requirement, the telecommunication application is expected to hold the largest share of the point-to-point antenna market in 2020.

The COVID-19 pandemic will have a significant impact on the telecommunication sector. Owing to the increase in the number of countries imposing restrictions on movement, people are spending more time at home for work and leisure, using vast amounts of data. Telecom companies are focused on increasing network resiliency and planned investments in 5G. In March 2020, 3GPP, the global association developing the world’s 5G technology, announced a three-month delay in the timeline for the completion of 5G specifications: Releases 16 and 17. The stage 3 of Release 16 is now scheduled for June 2020. Also, the further work on Release 17 is shifted by three months, so the freezing of stage 3 will take place in September 2021.

APAC to have highest CAGR in point-to-point antenna market during forecast period

The point-to-point antenna market in APAC is foreseen to grow at a significant rate owing to the increasing number of 5G infrastructure development initiatives in the region. The rising demand for telecommunication infrastructure has also created a plethora of opportunities for the point-to-point antenna market in the region

In APAC, investments look promising as the majority of countries such as China, Japan, and South Korea have been more successful in containing the spread of COVID-19 than the US and European countries. China is easing the restrictions imposed on the operations of factories and the movement of workers. Major telecommunication equipment providers in the region, including ZTE (China) and Huawei Technologies (China), have signed more than 95 5G commercial deals with leading global telecom operators

Key Market Players

- The major players in the point-to-point antenna market are CommScope (US), Ericsson (Sweden), Comba Telecom Systems Holdings (Hong Kong), Amphenol (US), Cambium Networks (US), and Tongyu Communication (China).

- CommScope is a global provider of infrastructure solutions for communication and entertainment networks. It is one of the leading providers of wired and wireless networks. The company offers wired and wireless network solutions to cable and telephone service providers, as well as digital broadcast satellite operators and media programmers to deliver media, voice, Internet Protocol (IP) data services, and Wi-Fi connectivity to their subscribers. It also offers wireless and wired connectivity solutions for enterprises across complex and varied networking environments.

Scope of the Report:

|

Report Metric |

Details |

| Estimated Value | USD 3.6 Billion |

| Expected Value | USD 5.0 Billion |

| Growth Rate | CAGR of 6.9% |

|

Market size available for years |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units |

Value USD Million |

|

Segments covered |

Type, Polarization, Diameter, Frequency Range, and Application |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

CommScope (US), Ericsson (Sweden), Comba Telecom Systems Holdings (Hong Kong), Amphenol (US), Cambium Networks (US), Tongyu Communication (China), Laird (US), Radio Frequency Systems (Germany), Shenglu (China), Mobi Antenna Technologies (China), Rosenberger (Germany), Powerwave Technologies (US), LEAX Arkivator Telecom AB (Sweden), Xi'an Putian Antenna (China), PCTEL (US), Infinite Electronics International (US), mWave Industries (US), Kavveri Telecom (India), Wireless Excellence (UK), Trango Networks (US) |

This report categorizes the point-to-point antenna market based on type, polarization, frequency range, application, and region.

Point-to-Point Antenna Market, by Type:

- Parabolic Antenna

- Flat Panel Antenna

- Yagi Antenna

Point-to-Point Antenna Market, by Polarization:

- Single-polarized Antenna

- Dual-polarized Antenna

Point-to-Point Antenna Market, by Diameter:

- 0.2m to 0.9m

- 1.0m to 3.0m

- 3.1m to 4.6m

Point-to-Point Antenna Market, by Frequency Range:

- 1.0 GHz to 9.9 GHz

- 10.0 GHz to 29.9 GHz

- 30.0 GHz to 86.0 GHz

Point-to-Point Antenna Market, by Applications:

- Telecommunication

- Commercial/Industrial

- Military and Defense

- Satellite

- Others

Point-to-Point Antenna Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

RoW

- South America

- Middle East

- Africa

Recent Developments

- In March 2020, Comba Telecom Systems launched 5G sub-6 outdoor CPE and hybrid beam antennas.

- In February 2020, CommScope launched several antenna solutions, connectors, and power options to make it simple and fast for wireless operators to develop their networks to support the surge of 5G rollouts across the world.

- In October 2019, Ericsson acquired the Antenna and Filter division of Germany-based Kathrein, which is a world-leading provider of antenna and filter technologies.

- In February 2019, Amphenol Antenna Solutions (AAS) launched the NodeLine multiband antenna family in the market. This NodeLine family is a perfect solution for carriers willing to prepare their networks to carry out 4.5G and 5G operations.

Key questions addressed by the report

- Which are the major products of the point-to-point antenna market? How big is the opportunity for their growth in the developing economies in the next 5 years?

- Which are the major companies in the point-to-point antenna market? What are their major strategies to strengthen their market presence?

- Which are the leading countries in the point-to-point antenna market? What would be the share of North America and APAC in this market for the next 5 years?

- Where will all these developments in the point-to-point antenna market take the industry in the mid to long term?

- What are the upcoming solutions of point-to-point antennas?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

3.1 OPTIMISTIC SCENARIO

3.2 REALISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 ATTRACTIVE OPPORTUNITIES IN POINT-TO-POINT ANTENNA MARKET

4.2 POINT-TO-POINT ANTENNA MARKET, BY TYPE

4.3 MARKET, BY POLARIZATION

4.4 MARKET, BY FREQUENCY RANGE

4.5 MARKET, BY APPLICATION

4.6 MARKET, BY REGION

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Simplicity of installation as compared with other antennas

5.2.1.2 Rise in penetration of Internet

5.2.1.3 Increase number of M2M connections among various industry verticals

5.2.2 RESTRAINTS

5.2.2.1 Growing consumer demand for extended network coverage

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand from smart cities

5.2.3.2 Increasing deployment of Wi-Fi by businesses

5.2.4 CHALLENGES

5.2.4.1 Lack of consistency in point-to-point antennas and variance in operating frequencies for different applications across the world

5.3 IMPACT OF COVID-19 ON DRIVERS

5.3.1 SIMPLICITY OF INSTALLATION AS COMPARED WITH OTHER ANTENNAS

5.4 IMPACT OF COVID-19 ON RESTRAINTS

5.4.1 GROWING CONSUMER DEMAND FOR EXTENDED NETWORK COVERAGE

6 POINT-TO-POINT ANTENNA MARKET, BY TYPE (Page No. - 45)

6.1 INTRODUCTION

6.2 PARABOLIC ANTENNA

6.2.1 INCREASE IN USE OF PARABOLIC ANTENNAS IN RADIO AND WIRELESS APPLICATIONS

6.3 FLAT PANEL ANTENNA

6.3.1 RISE IN IMPORTANCE OF FLAT PANEL ANTENNAS OWING TO GROWING DEMAND FOR COMMUNICATION ON THE MOVE (COTM)

6.4 YAGI ANTENNA

6.4.1 INCREASE IN ADOPTION OF YAGI ANTENNA IN POINT-TO-POINT COMMUNICATIONS AS THEY RADIATE IN ONLY ONE

7 POINT-TO-POINT ANTENNA MARKET, BY POLARIZATION (Page No. - 51)

7.1 INTRODUCTION

7.2 SINGLE-POLARIZED ANTENNA

7.2.1 SINGLE-POLARIZED ANTENNAS RESPOND ONLY TO ONE ORIENTATION OF POLARIZATION

7.3 DUAL-POLARIZED ANTENNA

7.3.1 DUAL-POLARIZED ANTENNAS CAN RESPOND TO BOTH HORIZONTALLY AND VERTICALLY POLARIZED RADIO WAVES SIMULTANEOUSLY

8 POINT-TO-POINT ANTENNA MARKET, BY DIAMETER (Page No. - 55)

8.1 INTRODUCTION

8.2 0.2 METERS TO 0.9 METERS

8.2.1 INCREASE IN USE OF ANTENNAS WITH DIAMETER RANGING FROM 0.2 METERS TO 0.9 METERS IN COMMERCIAL AND INDUSTRIAL APPLICATIONS

8.3 1.0 METERS TO 3.0 METERS

8.3.1 SURGE IN USE OF ANTENNAS WITH DIAMETER RANGING FROM 1.0 METERS TO 3.0 METERS IN CIVIL, MILITARY, AND GOVERNMENT RADAR APPLICATIONS

8.4 3.1 METERS TO 4.6 METERS

8.4.1 RISE IN ADOPTION OF ANTENNAS WITH DIAMETER RANGING FROM 3.1 METERS TO 4.6 METERS IN SATELLITE COMMUNICATIONS OR RAW SATELLITE FEEDS

9 POINT-TO-POINT ANTENNA MARKET, BY FREQUENCY RANGE (Page No. - 56)

9.1 INTRODUCTION

9.2 1.0 GHZ TO 9.9 GHZ

9.2.1 INDUSTRIAL, COMMERCIAL, AND CELLULAR APPLICATIONS OPERATE IN THIS FREQUENCY RANGE

9.3 10.0 GHZ TO 29.9 GHZ

9.3.1 SUPER-HIGH-FREQUENCY (SHF) ANTENNAS OPERATE ON THIS FREQUENCY RANGE

9.4 30.0 GHZ TO 86.0 GHZ

9.4.1 ANTENNAS IN THIS FREQUENCY RANGE ARE ALSO KNOWN AS EXTREMELY HIGH-FREQUENCY (EHF) ANTENNAS

10 POINT-TO-POINT ANTENNA MARKET, BY APPLICATION (Page No. - 59)

10.1 INTRODUCTION

10.2 TELECOMMUNICATION

10.2.1 5G NETWORK EXPECTED TO WIDEN FREQUENCY APPLICATION RANGE FOR POINT-TO-POINT ANTENNAS IN TELECOMMUNICATION SECTOR

10.2.2 IMPACT OF COVID-19

10.2.3 URBAN

10.2.3.1 Integral linking of urbanization with advancements in communication technology

10.2.4 RURAL

10.2.4.1 Rise in use of point-to-point antennas in for connecting utility networks and areas having poor broadband connectivity

10.3 COMMERCIAL/INDUSTRIAL

10.3.1 COMMERCIAL/INDUSTRIAL SEGMENT OF POINT-TO-POINT ANTENNA MARKET INCLUDES OFFICES, SERVICE PROVIDERS, AND MANUFACTURING

10.3.2 IMPACT OF COVID-19

10.4 SATELLITE

10.4.1 ADVANCEMENTS IN SATELLITE TECHNOLOGIES RESULTED IN GROWTH OF SATELLITE SERVICES SECTOR

10.5 MILITARY & DEFENSE

10.5.1 MILITARY AND DEFENSE SECTOR REQUIRES CONTINUOUS MONITORING OF COMMUNICATION FOR PRIVACY AND SECURITY ISSUES

10.6 OTHERS

11 GEOGRAPHIC ANALYSIS (Page No. - 78)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 IMPACT OF COVID-19 ON NORTH AMERICA

11.2.2 US

11.2.2.1 US held largest market size of point-to-point antenna market in North America

11.2.3 CANADA

11.2.3.1 Adoption of advanced technologies and proliferation of IoT expected to fuel demand for point-to-point antennas in Canada

11.2.4 MEXICO

11.2.4.1 market in Mexico to grow at highest CAGR from 2020 to 2025

11.3 EUROPE

11.3.1 IMPACT OF COVID-19 ON EUROPE

11.3.2 UK

11.3.2.1 Increased UK government investments for development of antenna infrastructure for quick deployment of 5G networks

11.3.3 GERMANY

11.3.3.1 Emergence of Germany as powerhouse for industrial and automobile electronics manufacturing lead to requirements for improved connectivity

11.3.4 SPAIN

11.3.4.1 Adoption of smart cities in Spain to catalyze growth of point-to-point antenna market in country

11.3.5 FRANCE

11.3.5.1 Increased investments for development of high-speed and robust networks in France

11.3.6 REST OF EUROPE (ROE)

11.4 ASIA PACIFIC (APAC)

11.4.1 IMPACT OF COVID-19 ON APAC

11.4.2 JAPAN

11.4.2.1 Significant investments in research and development activities related to wireless communication technologies in Japan

11.4.3 CHINA

11.4.3.1 Increased involvement of China in development of 5G network infrastructure

11.4.4 INDIA

11.4.4.1 Widespread proliferation of broadband connectivity and penetration of advanced technologies to drive demand for point-to-point antennas in India

11.4.5 SOUTH KOREA

11.4.5.1 Presence of large-scale manufacturing companies in semiconductor displays, transportation, and logistics verticals of South Korea

11.4.6 REST OF APAC (ROAPAC)

11.5 REST OF THE WORLD (ROW)

11.5.1 IMPACT OF COVID-19 ON ROW

11.5.2 SOUTH AMERICA

11.5.2.1 Increased deployment of wireless communication equipment to drive growth of network infrastructures in South America

11.5.3 MIDDLE EAST

11.5.3.1 Growth in installation of point-to-point antennas by building owners in Middle East

11.5.4 AFRICA

11.5.4.1 Increased investments being made across communication sector to fuel growth of point-to-point antenna market in Africa

12 COMPETITIVE LANDSCAPE (Page No. - 107)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS, 2019

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 VISIONARY LEADERS

12.3.2 INNOVATORS

12.3.3 DYNAMIC DIFFERENTIATORS

12.3.4 EMERGING COMPANIES

12.4 COMPETITIVE SCENARIO

12.5 COMPETITIVE SITUATIONS AND TRENDS

12.5.1 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS

12.5.2 NEW PRODUCT LAUNCHES/DEVELOPMENTS

12.5.3 ACQUISITIONS

13 COMPANY PROFILES (Page No. - 114)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.2.1 COMMSCOPE

13.2.2 ERICSSON

13.2.3 COMBA TELECOM SYSTEMS HOLDINGS

13.2.4 AMPHENOL

13.2.5 CAMBIUM NETWORKS

13.2.6 TONGYU COMMUNICATION

13.2.7 LAIRD TECHNOLOGIES

13.2.8 RADIO FREQUENCY SYSTEMS

13.2.9 ROSENBERGER

13.2.10 SHENGLU

13.2.11 MOBI ANTENNA TECHNOLOGIES

13.2.12 INFINITE ELECTRONICS INTERNATIONAL

13.2.13 TRANGO NETWORKS

13.2.14 MWAVE INDUSTRIES

13.2.15 KAVVERI TELECOM

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13.3 RIGHT TO WIN

13.4 OTHER PLAYERS

13.4.1 XI’AN PUTIAN ANTENNA

13.4.2 LEAX ARKIVATOR TELECOM AB

13.4.3 WIRELESS EXCELLENCE LIMITED

13.4.4 POWERWAVE TECHNOLOGIES

13.4.5 PCTEL

14 APPENDIX (Page No. - 148)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (103 Tables)

TABLE 1 POINT-TO-POINT ANTENNA MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 2 MARKET, BY TYPE, 2017–2025 (MILLION UNITS)

TABLE 3 PARABOLIC POINT-TO-POINT ANTENNA MARKET, BY POLARIZATION, 2017–2025 (USD MILLION)

TABLE 4 PARABOLIC POINT-TO-POINT ANTENNA MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 5 FLAT PANEL POINT-TO-POINT ANTENNA MARKET, BY POLARIZATION, 2017–2025 (USD MILLION)

TABLE 6 FLAT PANEL POINT-TO-POINT ANTENNA MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 7 YAGI POINT-TO-POINT ANTENNA MARKET, BY POLARIZATION, 2017–2025 (USD MILLION)

TABLE 8 YAGI POINT-TO-POINT ANTENNA MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 9 POINT-TO-POINT ANTENNA MARKET, BY POLARIZATION, 2017–2025 (USD MILLION)

TABLE 10 SINGLE-POLARIZED POINT-TO-POINT ANTENNA MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 11 DUAL-POLARIZED POINT-TO-POINT ANTENNA MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 12 POINT-TO-POINT ANTENNA MARKET, BY FREQUENCY RANGE, 2017–2025 (USD MILLION)

TABLE 13 5G FREQUENCY BAND BASED ON GEOGRAPHICAL AREA

TABLE 14 POINT-TO-POINT ANTENNA MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 15 MARKET FOR TELECOMMUNICATION, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR TELECOMMUNICATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 17 MARKET FOR TELECOMMUNICATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 18 MARKET IN NORTH AMERICA FOR TELECOMMUNICATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 19 MARKET IN EUROPE FOR TELECOMMUNICATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 20 MARKET IN APAC FOR TELECOMMUNICATION, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 21 MARKET IN ROW FOR TELECOMMUNICATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET FOR URBAN AREAS, BY REGION, 2017–2025 (USD MILLION)

TABLE 23 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN NORTH AMERICA FOR URBAN AREAS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 24 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN EUROPE FOR URBAN AREAS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 25 MARKET IN APAC FOR URBAN AREAS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 26 MARKET IN ROW FOR URBAN AREAS, BY REGION, 2017–2025 (USD MILLION)

TABLE 27 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET FOR RURAL AREAS, BY REGION, 2017–2025 (USD MILLION)

TABLE 28 MARKET IN NORTH AMERICA FOR RURAL AREAS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 29 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN EUROPE FOR RURAL AREAS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 30 MARKET IN APAC FOR RURAL AREAS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 31 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN ROW FOR RURAL AREAS, BY REGION, 2017–2025 (USD MILLION)

TABLE 32 POINT-TO-POINT ANTENNA MARKET FOR COMMERCIAL/INDUSTRIAL, BY TYPE, 2017–2025 (USD MILLION)

TABLE 33 MARKET FOR COMMERCIAL/INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

TABLE 34 MARKET IN NORTH AMERICA FOR COMMERCIAL/INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 35 MARKET IN EUROPE FOR COMMERCIAL/INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 36 MARKET IN APAC FOR COMMERCIAL/INDUSTRIAL, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 37 MARKET IN ROW FOR COMMERCIAL/INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

TABLE 38 MARKET FOR SATELLITE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 39 MARKET FOR SATELLITE, BY REGION, 2017–2025 (USD MILLION)

TABLE 40 MARKET IN NORTH AMERICA FOR SATELLITE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 41 MARKET IN EUROPE FOR SATELLITE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 42 MARKET IN APAC FOR SATELLITE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 43 MARKET IN ROW FOR SATELLITE, BY REGION, 2017–2025 (USD MILLION)

TABLE 44 MARKET FOR MILITARY AND DEFENSE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 45 MARKET FOR MILITARY AND DEFENSE, BY REGION, 2017–2025 (USD MILLION)

TABLE 46 MARKET IN NORTH AMERICA FOR MILITARY AND DEFENSE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 47 MARKET IN EUROPE FOR MILITARY AND DEFENSE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 48 MARKET IN APAC FOR MILITARY AND DEFENSE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 49 MARKET IN ROW FOR MILITARY AND DEFENSE, BY REGION, 2017–2025 (USD MILLION)

TABLE 50 MARKET FOR OTHERS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 51 MARKET FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA FOR OTHERS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 53 MARKET IN EUROPE FOR OTHERS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 54 MARKET IN APAC FOR OTHERS, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 55 MARKET IN ROW FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 56 POINT-TO-POINT ANTENNA MARKET, BY REGION 2017–2025 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 59 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN NORTH AMERICA, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 60 MARKET IN US, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 61 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN US, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 62 MARKET IN CANADA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 63 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN CANADA, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 64 MARKET IN MEXICO, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 65 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN MEXICO, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 66 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 67 MARKET IN EUROPE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 68 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN EUROPE, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 69 MARKET IN UK, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 70 POINT-TO-POINT TELECOMM UNCTION ANTENNA MARKET IN UK, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 71 MARKET IN GERMANY, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 72 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN GERMANY, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 73 MARKET IN SPAIN, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 74 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN SPAIN, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 75 MARKET IN FRANCE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 76 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN FRANCE, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 77 MARKET IN REST OF EUROPE, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 78 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN REST OF EUROPE, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 79 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 80 MARKET IN APAC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 81 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN APAC, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 82 MARKET IN JAPAN, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 83 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN JAPAN, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 84 MARKET IN CHINA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 85 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN CHINA, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 86 MARKET IN INDIA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 87 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN INDIA, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 88 MARKET IN SOUTH KOREA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 89 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN SOUTH KOREA, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 90 MARKET IN REST OF APAC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 91 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN REST OF APAC, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 92 MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 93 MARKET IN ROW, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 94 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN ROW, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 95 MARKET IN SOUTH AMERICA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 96 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN SOUTH AMERICA, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 97 MARKET IN MIDDLE EAST, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 98 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN MIDDLE EAST, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 99 MARKET IN AFRICA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 100 POINT-TO-POINT TELECOMMUNICATION ANTENNA MARKET IN AFRICA, BY DEPLOYMENT, 2017–2025 (USD MILLION)

TABLE 101 PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS, MARCH 2017–APRIL 2020

TABLE 102 NEW PRODUCT LAUNCHES/DEVELOPMENTS, MARCH 2017–APRIL 2020

TABLE 103 ACQUISITIONS, MARCH 2017–APRIL 2020

LIST OF FIGURES (43 Figures)

FIGURE 1 POINT-TO-POINT ANTENNA MARKET SEGMENTATION

FIGURE 2 POINT-TO-POINT ANTENNA MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

FIGURE 4 POINT-TO-POINT ANTENNA MARKET: BOTTOM-UP APPROACH

FIGURE 5 POINT-TO-POINT ANTENNA MARKET: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 IMPACT OF COVID-19 ON POINT-TO-POINT ANTENNA MARKET

FIGURE 8 MARKET, BY TYPE, 2019 VS. 2025 (USD MILLION)

FIGURE 9 MARKET, BY POLARIZATION, 2019 VS. 2025 (USD MILLION)

FIGURE 10 MARKET, BY FREQUENCY RANGE, 2019 VS. 2025 (USD MILLION)

FIGURE 11 MARKET, BY APPLICATION, 2019 VS. 2025 (USD MILLION)

FIGURE 12 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 SIMPLICITY OF INSTALLATION DRIVES GROWTH OF MARKET

FIGURE 14 PARABOLIC ANTENNA SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2020

FIGURE 15 DUAL-POLARIZED ANTENNA SEGMENT TO WITNESS GROW AT HIGH CAGR DURING FORECAST PERIOD

FIGURE 16 1.0 GHZ TO 9.9 GHZ SEGMENT TO HOLD LARGEST SIZE OF MARKET IN 2020

FIGURE 17 MARKET FOR COMMERCIAL/INDUSTRIAL TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

FIGURE 18 MARKET IN APAC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 19 POINT-TO-POINT ANTENNA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 20 MARKET DRIVERS AND THEIR IMPACT

FIGURE 21 NUMBER OF INTERNET USERS, BY REGION, 2019

FIGURE 22 INTERNET PENETRATION RATE, BY REGION, 2019

FIGURE 23 MARKET RESTRAINTS AND THEIR IMPACT

FIGURE 24 MARKET OPPORTUNITIES AND THEIR IMPACT

FIGURE 25 MARKET CHALLENGES AND THEIR IMPACT

FIGURE 26 MARKET, BY TYPE

FIGURE 27 MARKET, BY POLARIZATION

FIGURE 28 1.0 GHZ TO 9.9 GHZ SEGMENT EXPECTED TO HOLD LARGEST SIZE OF MARKET IN 2019

FIGURE 29 MARKET, BY APPLICATION

FIGURE 30 MARKET, BY GEOGRAPHY

FIGURE 31 NORTH AMERICA: POINT-TO-POINT ANTENNA MARKET SNAPSHOT

FIGURE 32 EUROPE: MARKET SNAPSHOT

FIGURE 33 APAC: MARKET SNAPSHOT

FIGURE 34 ROW: MARKET SNAPSHOT

FIGURE 35 COMPANIES ADOPTED NEW PRODUCT LAUNCHES/DEVELOPMENTS, PARTNERSHIPS, AND ACQUISITIONS AS KEY GROWTH STRATEGIES FROM MARCH 2017 TO APRIL 2020

FIGURE 36 RANKING OF KEY PLAYERS IN POINT-TO-POINT ANTENNA MARKET, 2019

FIGURE 37 POINT-TO-POINT ANTENNA MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 38 MARKET EVALUATION FRAMEWORK: NEW PRODUCT LAUNCHES/ DEVELOPMENTS, PARTNERSHIPS, AND ACQUISITIONS HAVE BEEN ADOPTED BY MARKET PLAYERS FROM 2017 TO 2020

FIGURE 39 COMMSCOPE: COMPANY SNAPSHOT

FIGURE 40 ERICSSON: COMPANY SNAPSHOT

FIGURE 41 COMBA TELECOM SYSTEMS HOLDINGS: COMPANY SNAPSHOT

FIGURE 42 AMPHENOL: COMPANY SNAPSHOT

FIGURE 43 CAMBIUM NETWORKS: COMPANY SNAPSHOT

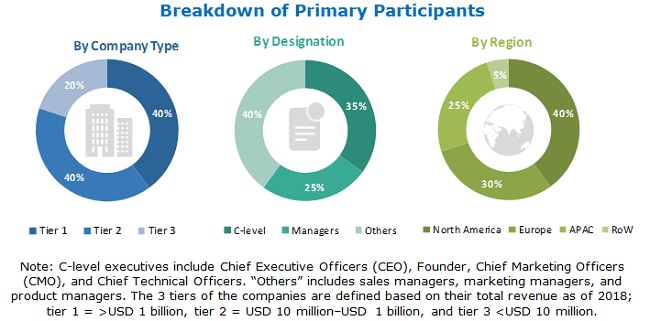

The study involved 4 major activities in estimating the current size of the point-to-point antenna market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the point-to-point antenna market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the point-to-point antenna market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the point-to-point antenna market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the point-to-point antenna market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the point-to-point antenna market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the point-to-point antenna market, in terms of value, by type, polarization, diameter, frequency range, and application

- To describe and forecast the market size for four regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the market’s growth (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the point-to-point antenna market for stakeholders and provide the competitive landscape of the market

- To map competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product launches, partnerships, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Point-to-Point Antenna Market