Flat Panel Antenna Market by Type (Electronically Steered, Mechanically Steered), Frequency (C and X, Ku, K, Ka), EndľUse Application (Aviation, Telecommunications, Military) and Region (2022-2027)

Updated on : Oct 23, 2024

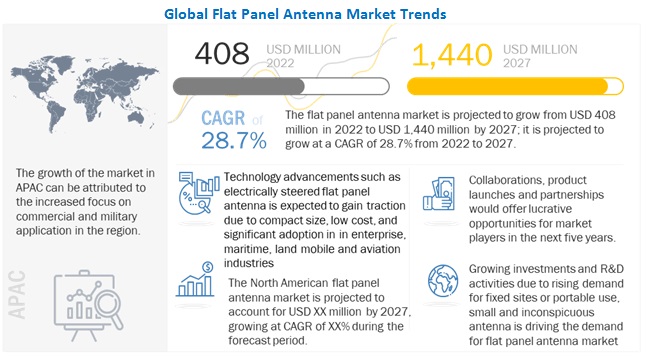

The global flat panel antenna market size is expected to grow from USD 408 million in 2022 to USD 1,440 million by 2027, growing at a CAGR of 28.7% during the forecast period.

Growing investments in space exploration and satellite launches, rising demand for electronically steered antennas worldwide, rising demand for innovative and compact antenna systems, and growing adoption of low cost, low profile antennas in various commercial and military applications will drive the demand for this market in the near future. The deployment of low earth orbit (LEO) satellites and constellations of satellites for communication applications has increased their demand across the globe. Other factors driving the market growth include growing demand for Ku- and Ka-band satellites, and the growing fleet of autonomous and connected vehicles used for various applications in the military and commercial sectors, which require customized flat panel antennas.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Flat panel antenna Market

COVID-19 had a significant impact on the flat panel antenna market due to the severe impact on the manufacturing sector in different regions due to the pandemic lockdown. Abruptions in manufacturing, production, and demand and supply in antenna components due to the sudden lockdown in 2020 has impacted the market of flat panel antennas. The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacturing of antenna equipment, including systems, subsystems, and components, has also been impacted. Although antenna equipment are critically important for a proper outcome from a satellite, disruptions in the supply chain have halted their manufacturing processes for the time being. Resuming manufacturing activities depends on the level of COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still be taking in orders, delivery schedules may not be fixed. However, with ease in lockdown in countries such as China, India, the US, and Germany, and vaccines being rolled out by numerous countries since December 2020, the manufacturing sector is expected to pick up the pace gradually in the coming months, and the flat panel antenna industry is expected to recover by mid 2022.

Flat Panel Antenna Market Dynamics

Driver: Rising demand for electronically steered phased array flat panel antennas

Electronically steered flat panel antennas are ultra-thin antennas and electronically acquire, steer, and lock a beam to any satellite. These antennas show great performance efficiency in a very thin, low-profile package, and are very rugged and completely weatherproof for extremely long life in harsh environments. Hence these has been a rising demand for these types of antennas in several critical environments Increased demand for communication on the move solutions for platforms such as commercial vehicles, military vehicles, trains, and boats has led to the greater use of electronically steered phased flat panel antennas (ESPA). These antennas can track and maintain satellite links even when platforms such as military vehicles, trains, or boats, are in motion. Hybrid beam steering is used in these phased array antennas for COTM, both electronically for elevation and mechanically for azimuth. An antenna terminal steering plays a major role in acquiring a satellite link. ESPA eliminates mechanical motion.

Restraint: High costs associated with development and maintenance of infrastructure to support flat panel antennas

The high cost incurred in the development and maintenance of earth station infrastructure is one of the major factors hindering market growth. Most of the required components are typically custom-fabricated or purchased from commercial off-the-shelf (COTS) vendors, which is expensive. Besides, the design, development, and construction of these antennas and their components require several hours of work by trained personnel. The level of skill required itself poses a significant barrier to entry. Significant investments are required in the R&D, manufacturing, system integration, and assembly stages of the value chains of these systems..

Opportunity: Development of ultra-compact, low profile flat panel antennas for advanced ground combat vehicles

Ultra-compact and low-profile flat panel satellite antennas are designed to operate with the new generation of Ka-band high-throughput satellites for any IP-based voice, video, or data Beyond-Line-of-Sight (BLoS) applications. These antennas provide full-duplex satellite communication, linking advanced ground combat vehicles to ground control stations. The forward link provides command and control capabilities, while the return link transfers sensor data. These integrated terminals comprise very small aperture terminal technologies. For instance, ThinKom solutions’ ThinPack flat-panel antennas combine the easy, fast setup of ultra-compact terminals with the power, throughput and performance of their bulkier counterparts so users can reap the most out of global satellite broadband.

Challenge: Lack of skilled workforce

Countries such as Morocco, South Africa, Nigeria, Somalia, Kenya, Bangladesh, Nepal, and Bhutan lack a skilled technical workforce in the space industry. Potential workforce issues affect the safety and effectiveness of space operations, which further limits the number of space exploration missions, thereby acting as a challenge to the growth of the flat panel antenna market. Critical space operations increasingly rely on well-qualified personnel for various tasks such as R&D, patent development, and software development & application, among others. Thus, the recruitment of a technical workforce forms a crucial part of ensuring innovation in business processes and products in the space industry.

Electronically Steerd type is expected to witness the highest market share and growth rate during the forecast period

Based on different types, the market has been segmented into two categories: electronically steered and mechanically steered. Electronically steered antenna is the leading type in the flat panel antenna market in terms of CAGR and marker size. This is mainly because of its low cost and high market acceptance. Electrically steered flat panel antenna is expected to gain traction due to compact size, low cost, and significant adoption in enterprise, maritime, land mobile and aviation industries. AlCAN Systems (Canada), C-COM Satellite Systems Inc (Canada), Hanwha Phasor (UK), and ThinKom Solutions (US) are some of the players providing electronically steered FPA systems.

Commercial application is expected to have the largest market share during the forecast period

The commercial application is expected to grow at the highest CAGR in the flat panel antenna market. The commercial segment cater to a variety of applications, especially commercial shipping, boating, super yachts, passenger vehicles and other applications. The flat panel antennas used for such applications are smaller and more discreet than the large radomes generally used on bigger vessels for broadband satellite communication. These flat panel antennas include ESA OR phased array antennas which track satellites electronically while the units themselves are stationary, so there are no moving parts to wear out and potentially fail. Thus, rising demand for such antennas in different commercial applications is driving the growth of flat panel antenna market.

Asia Pacific is the leading flat panel antenna market in terms of CAGR, globally.

APAC is expected to contribute to the highest CAGR during the forecast period in the flat panel antenna market. APAC is the major market for consumer and commercial segment due to its growing population. Key countries in APAC include China, Japan, India, and South Korea. Rapid developments related to flat panel antenna in telecommunication applications also provide growth opportunities for the market in APAC as trend for 5G in APAC is growing at a fast pace. Other factors contributing to the rising demand for flat panel antennas in APAC include technological advancements in antenna technology, increased awareness of the benefits of using flat panel antennas among the masses, and the cost-effectiveness of these antennas. Electronically steered flat panel antenna type is famous and reliable way initiate satellite communications and retrieve data and information in telecommunications and commercial sectors in Asia and other continents

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The flat panel antenna companies are such as Kymeta Corporation (US), ThinKom Solutions(US), Hanwha Phasor (England), TTI Norte (Spain), and L3Harria Technologies (US).

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year |

2021 |

|

Forecast period |

2021–2027 |

|

Units |

Value USD Million |

|

Segments covered |

Type, Frequency, End-use application and region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

The companies covered in the flat panel antenna market are Kymeta Corporation(US), ThinKom Solutions(US), Hanwha Phasor (England), TTI Norte (Spain), and L3Harria Technologies (US), Ball Aerospace (US), RadioWaves(US), SatPro Tech (China), NXT Communications (US), ALCAN Systems (UK), C-COM Satellites(US), Gilat Satellite Networks (Israel), Isotropic Systems (England), China Starwin (China), OneWeb (UK), and ST Engineering. (US), Inmarsat (UK), Cobham Aerospace Communications (France), MTI Wireless Edge(Israel). |

This report categorizes the flat panel antenna market based on type, frequency, end-use applications and region

Flat panel antenna market, By Type

- Electronically steered

- Mechanically steered

Flat panel antenna market, By Frequency

- C and X band

- Ku, K and Ka band

Flat panel antenna market, By End-Use Application

- Aviation

- Telecommunications

- Military

- Commercial

- Others

Geographic Analysis

- Introduction

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

- Rest of APAC (RoAPAC)

-

Rest of the World (RoW)

- South America

- Middle East and Africa

Recent Developments

- In November 2021, ThinKom Solutions has delivered its ThinAir Ka2517 phased-array antenna system to Leidos for installation on its new high-accuracy electronic intelligence aircraft for the U.S. Army. The ThinKom Ka2517 low-profile Ka-band aero satellite antenna system, which is being integrated with a U.S. military-compliant modem, provides real-time, reliable and resilient broadband transmission to and from the aircraft in flight.

- In September 2021, Kymeta Corporation announced a launch of the Kymeta u8 MIL hybrid terminal, providing military users with a camouflaged, flexible, and more robust connectivity solution for communications-on-the-move (COTM) and networks-on-the-move (NOTM). The new terminal adds to the growing number of solutions offered by Kymeta based on the innovative u8 antenna technology.

- In August 2021, Hanwha Systems has announced a USD $300m equity investment in OneWeb, the Low Earth Orbit (LEO) satellite communications company. Hanwha Systems brings further defense capabilities and the latest antenna technologies to OneWeb, alongside relationships to new government customers and expanded geographical reach.

Frequently Asked Questions (FAQ):

What is the size of the global flat panel antenna market?

The global Flat panel antenna market is expected to value USD 3.6 billion in 2022 and is projected to reach USD 4.8 billion by 2027, at a CAGR of 6.0%.

What are the major driving factors and opportunities in the Flat panel antenna market?

Growing investments in space exploration and satellite launches, rising demand for electronically steered antennas worldwide, rising demand for innovative and compact antenna systems, and growing adoption of low cost, low profile antennas in various commercial and military applications will drive the demand for this market in the near future.

Who are the star players in the global Flat panel antenna market?

Companies such as Kymeta Corporation (US), ThinKom Solutions(US), Hanwha Phasor (England), TTI Norte (Spain), and L3Harria Technologies (US) fall under the star category. These companies cater to the requirements of their customers by providing customized products. Such advantages give these companies an edge over other companies in the market.

What are the major strategies adopted by the key players?

Product launches and deals such as collaborations, partnerships and agreements are the major strategies adopted by the key players of the flat panel antenna market.

Which region contributes to the largest market share in Flat panel antenna market during the forecast period?

North America contributes the largest market share in Flat panel antenna market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SEGMENTATION OF FLAT PANEL ANTENNA MARKET

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 FLAT PANEL ANTENNA MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primary interviews

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE—REVENUE GENERATED BY COMPANIES FROM SALES OF FLAT PANEL ANTENNAS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size using bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size using top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.6 FORECASTING ASSUMPTIONS

2.7 COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

TABLE 2 EVALUATION CRITERIA

2.7.1 VENDOR INCLUSION CRITERIA

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 COMMERCIAL APPLICATION TO WITNESS HIGHEST CAGR IN FLAT PANEL ANTENNA MARKET DURING FORECAST PERIOD

FIGURE 9 ELECTRONICALLY STEERED ANTENNA SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE AND GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 10 KU, K, AND KA BAND FREQUENCY SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE AND HIGHER CAGR DURING FORECAST PERIOD

FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF OVERALL FLAT PANEL ANTENNA MARKET IN 2027

3.1 IMPACT ANALYSIS OF COVID-19 ON FLAT PANEL ANTENNA MARKET

FIGURE 12 FLAT PANEL ANTENNA MARKET SIZE IN PRE-COVID-19 AND POST-COVID-19 SCENARIOS

TABLE 3 FLAT PANEL ANTENNA MARKET: PRE-COVID-19 AND POST-COVID-19 SCENARIOS, 2018–2027 (USD MILLION)

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN FLAT PANEL ANTENNA MARKET

FIGURE 13 COLLABORATIONS AMONG KEY PLAYERS AND ADOPTION OF FLAT PANEL ANTENNAS IN VARIOUS END-USE APPLICATIONS ARE DRIVING MARKET GROWTH

4.2 FLAT PANEL ANTENNA MARKET, BY TYPE

FIGURE 14 ELECTRONICALLY STEERED FLAT PANEL ANTENNA TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

4.3 FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION

FIGURE 15 COMMERCIAL EXPECTED TO LEAD IN TERMS OF SIZE DURING FORECAST PERIOD

4.4 REGION-WISE FLAT PANEL ANTENNA MARKET GROWTH RATE

FIGURE 16 FLAT PANEL ANTENNA MARKET IN APAC TO GROW AT HIGHEST CAGR WHILE NORTH AMERICA TO HOLD MAJOR MARKET SHARE BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 RISING DEMAND FOR ELECTRONICALLY STEERED ANTENNAS TO DRIVE GROWTH OF FLAT PANEL ANTENNA MARKET

5.2.1 DRIVERS

FIGURE 18 IMPACT OF DRIVERS ON FLAT PANEL ANTENNA MARKET

5.2.1.1 Rising demand for electronically steered phased array flat panel antennas

5.2.1.2 Rising focus on space exploration missions and satellite launches

FIGURE 19 NUMBER OF SATELLITE LAUNCHES (2017–2021)

5.2.1.3 Increasing demand for VSAT-based flat panel antennas for maritime as well as commercial applications

5.2.1.4 Increasing demand for UAVs and focus on development of compact antenna systems for UAV platforms

5.2.2 RESTRAINTS

FIGURE 20 IMPACT OF RESTRAINTS ON FLAT PANEL ANTENNA MARKET

5.2.2.1 High costs associated with development and maintenance of infrastructure to support flat panel antennas

5.2.3 OPPORTUNITIES

FIGURE 21 IMPACT OF OPPORTUNITIES ON FLAT PANEL ANTENNA MARKET

5.2.3.1 Development of ultra-compact, low profile flat panel antennas for advanced ground combat vehicles

5.2.3.2 Demand for flat panel antennas in commercial applications, especially passenger vehicles

5.2.3.3 Demand for high data rate transmission

5.2.4 CHALLENGES

FIGURE 22 IMPACT OF CHALLENGES ON FLAT PANEL ANTENNA MARKET

5.2.4.1 Electromagnetic compatibility-related challenges of flat panel satellite antennas

5.2.4.2 Lack of skilled workforce

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS OF FLAT PANEL ANTENNA ECOSYSTEM: R&D AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

5.3.1 RESEARCH & DEVELOPMENT (R&D)

5.3.2 MANUFACTURING

5.3.3 ASSEMBLERS AND INTEGRATORS

5.3.4 DISTRIBUTION/RESELLERS

5.3.5 END USERS

5.3.6 AFTER-SALES SERVICES

5.4 ECOSYSTEM/MARKET MAP

FIGURE 24 FLAT PANEL ANTENNA MARKET ECOSYSTEM

FIGURE 25 KEY PARTICIPANTS IN FLAT PANEL ANTENNA ECOSYSTEM

5.4.1 R&D INSTITUTES

5.4.2 FLAT PANEL ANTENNA PROVIDERS

5.4.3 END USERS

TABLE 4 FLAT PANEL ANTENNA MARKET: SUPPLY CHAIN

5.5 TECHNOLOGY AND INDUSTRY TRENDS ANALYSIS

5.5.1 KEY TECHNOLOGIES AND TRENDS

5.5.1.1 Use of Wide V Band for satellite communication

5.5.1.2 New advanced antenna designs

5.5.1.3 Development of active electronically scanned array (AESA)

5.5.1.4 Development of small satellite constellations to enhance communication

5.5.1.5 3D printing of RF equipment

5.5.1.6 Active Direct Radiating Array Technologies

5.5.1.7 Multi-Band, Multi-Mission (MBMM) antenna

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS (YC-YCC SHIFT)

FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS (YC-YCC SHIFT): FLAT PANEL ANTENNA MARKET

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES IMPACT ON FLAT PANEL ANTENNA MARKET (2021)

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS: FLAT PANEL ANTENNA MARKET (2021)

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 CASE STUDIES

5.8.1 LEIDOS UTILIZED THINKOM SOLUTIONS’ THINAIR KA2517 PHASED ARRAY ANTENNA SYSTEM FOR US ARMY MODEM

5.8.2 ONEWEB UTILIZED KYMETA’S U8 BASED LEO TERMINAL WITH ITS LEO SATELLITE CONSTELLATION

5.8.3 US ARMY UTILIZED KYMETA’A U8 TERMINAL FOR ITS ARMORED BRIGADE COMBAT TEAM (ABCT) SATELLITE COMMUNICATIONS ON MOVE (SOTM) PILOT PROGRAM

5.8.4 CHINESE GOVERNMENT INSTALLED CHINA STARWIN'S FL60P-E HIGH INTEGRATED FLAT PANEL TERMINAL IN ITS HEILONGJIANG PROVINCE FOR EMERGENCY RESCUE AND DISASTER MANAGEMENT SITUATIONS

5.8.5 INTELSAT UTILIZED GILAT SATELLITE NETWORKS’ FLAT PANEL ANTENNA FOR NON-MOBILE APPLICATIONS

5.9 PRICING ANALYSIS

FIGURE 28 AVERAGE SELLING PRICE (ASP) ANALYSIS

5.10 PATENT ANALYSIS

FIGURE 29 NUMBER OF PATENTS GRANTED FOR FLAT PANEL ANTENNAS IN A YEAR OVER LAST 11 YEARS (2011–2021)

5.11 LIST OF MAJOR PATENTS

TABLE 6 LIST OF MAJOR PATENTS GRANTED FOR FLAT PANEL ANTENNAS, 2021

5.12 TRADE DATA ANALYSIS

5.12.1 IMPORTS DATA

FIGURE 30 IMPORTS DATA FOR HS CODE 8529, BY COUNTRY, 2016–2020

TABLE 7 IMPORTS DATA FOR HS CODE 8529, BY COUNTRY, 2016–2020 (USD BILLION)

5.12.2 EXPORTS DATA

FIGURE 31 EXPORTS DATA FOR HS CODE 8529, BY COUNTRY, 2016–2020

TABLE 8 EXPORTS DATA FOR HS CODE 8542, BY COUNTRY, 2016–2020 (USD BILLION)

5.13 STANDARDS & REGULATIONS

5.13.1 NORTH AMERICA

5.13.2 EUROPE

5.13.3 GLOBAL

6 FLAT PANEL ANTENNA MARKET, BY TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 32 FLAT PANEL ANTENNA MARKET, BY TYPE

FIGURE 33 MECHANICALLY STEERED FLAT PANEL ANTENNA TO ACCOUNT FOR LARGER MARKET SHARE

TABLE 9 FLAT PANEL ANTENNA MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 10 FLAT PANEL ANTENNA MARKET, BY TYPE, 2021–2027 (USD MILLION)

6.2 MECHANICALLY STEERED FLAT PANEL ANTENNA

6.2.1 MECHANICALLY STEERED ANTENNAS CAN PROVIDE BETTER BROADBAND SERVICE AT HIGHER LATITUDES

TABLE 11 MECHANICALLY STEERED FLAT PANEL ANTENNA MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 12 MECHANICALLY STEERED FLAT PANEL ANTENNA MARKET, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 13 MECHANICALLY STEERED FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2018–2020 (USD MILLION)

TABLE 14 MECHANICALLY STEERED FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 15 MECHANICALLY STEERED FLAT PANEL ANTENNA MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 16 MECHANICALLY STEERED FLAT PANEL ANTENNA MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 ELECTRONICALLY STEERED FLAT PANEL ANTENNA

6.3.1 ELECTRONICALLY STEERED FPAS ARE EXPECTED TO GAIN TRACTION DUE TO COMPACT SIZE, LOW COST, AND SIGNIFICANT ADOPTION IN ENTERPRISE, MARITIME, LAND MOBILE, AND AVIATION APPLICATIONS

TABLE 17 ELECTRONICALLY STEERED FLAT PANEL ANTENNA MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 18 ELECTRONICALLY STEERED FLAT PANEL ANTENNA MARKET, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 19 ELECTRONICALLY STEERED FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2018–2020 (USD MILLION)

TABLE 20 ELECTRONICALLY STEERED FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 21 ELECTRONICALLY STEERED FLAT PANEL ANTENNA MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 22 ELECTRONICALLY STEERED FLAT PANEL ANTENNA MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3.1.1 Passive electronically scanned array (PESA)

6.3.1.2 Active electronically scanned arrays (AESA)

7 FLAT PANEL ANTENNA MARKET, BY FREQUENCY (Page No. - 90)

7.1 INTRODUCTION

FIGURE 34 FLAT PANEL ANTENNA MARKET, BY FREQUENCY

FIGURE 35 KU, K, AND KA FREQUENCY BAND (13 GHZ–40 GHZ) TO LEAD FLAT PANEL ANTENNA MARKET

TABLE 23 FLAT PANEL ANTENNA MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 24 FLAT PANEL ANTENNA MARKET, BY FREQUENCY, 2021–2027 (USD MILLION)

7.2 C AND X BAND (4 GHZ–12 GHZ)

7.2.1 C AND X BAND FLAT PANEL ANTENNAS CAN BE USED WIDELY FOR GROUND SURVEILLANCE, ENVIRONMENTAL MONITORING, AND SECURITY PURPOSES

TABLE 25 C AND X BAND FLAT PANEL ANTENNA MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 26 C AND X BAND FLAT PANEL ANTENNA MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 27 C AND X BAND FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2018–2020 (USD MILLION)

TABLE 28 C AND X BAND FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 29 C AND X BAND FLAT PANEL ANTENNA MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 C AND X BAND FLAT PANEL ANTENNA MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 KU, K, AND KA BAND (13 GHZ–40 GHZ)

7.3.1 KU, K, AND KA BAND FLAT PANEL ANTENNAS ARE EXPECTED TO BE WIDELY ADOPTED FOR LEO SATELLITE BROADBAND SYSTEMS

TABLE 31 KU, K, AND KA BAND FLAT PANEL ANTENNA MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 32 KU, K, AND KA BAND FLAT PANEL ANTENNA MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 33 KU, K, AND KA BAND FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2018–2020 (USD MILLION)

TABLE 34 KU, K, AND KA BAND FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

TABLE 35 KU, K, AND KA BAND FLAT PANEL ANTENNA MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 KU, K, AND KA BAND FLAT PANEL ANTENNA MARKET, BY REGION, 2021–2027 (USD MILLION)

8 FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION (Page No. - 97)

8.1 INTRODUCTION

FIGURE 36 COMMERCIAL APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 37 FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2018–2020 (USD MILLION)

TABLE 38 FLAT PANEL ANTENNA MARKET, BY END-USE APPLICATION, 2021–2027 (USD MILLION)

8.2 AVIATION

8.2.1 FLAT PANEL SATELLITE ANTENNA TECHNOLOGY OFFERS LIGHTWEIGHT, LOW PROFILE, AND LOW MAINTENANCE SOLUTION FOR AIRCRAFT

TABLE 39 FLAT PANEL ANTENNA MARKET IN AVIATION, BY TYPE, 2018–2020 (USD MILLION)

TABLE 40 FLAT PANEL ANTENNA MARKET IN AVIATION, BY TYPE, 2021–2027 (USD MILLION)

TABLE 41 FLAT PANEL ANTENNA MARKET IN AVIATION, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 42 FLAT PANEL ANTENNA MARKET IN AVIATION, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 43 FLAT PANEL ANTENNA MARKET IN AVIATION, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 FLAT PANEL ANTENNA MARKET IN AVIATION, BY REGION, 2021–2027 (USD MILLION)

8.3 TELECOMMUNICATION

8.3.1 RISING TRENDS OF SEAMLESS CONNECTIVITY FOR CONSUMER APPLICATIONS TO BOOST FLAT PANEL ANTENNA MARKET

TABLE 45 FLAT PANEL ANTENNA MARKET IN TELECOMMUNICATIONS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 46 FLAT PANEL ANTENNA MARKET IN TELECOMMUNICATIONS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 47 FLAT PANEL ANTENNA MARKET IN TELECOMMUNICATIONS, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 48 FLAT PANEL ANTENNA MARKET IN TELECOMMUNICATIONS, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 49 FLAT PANEL ANTENNA MARKET IN TELECOMMUNICATIONS, BY REGION, 2018–2020 (USD MILLION)

TABLE 50 FLAT PANEL ANTENNA MARKET IN TELECOMMUNICATIONS, BY REGION, 2021–2027 (USD MILLION)

8.4 MILITARY

8.4.1 MARINE AND DEFENSE APPLICATIONS TO FUEL GROWTH OF FLAT PANEL PHASED ARRAY ANTENNAS

TABLE 51 FLAT PANEL ANTENNA MARKET IN MILITARY, BY TYPE, 2018–2020 (USD MILLION)

TABLE 52 FLAT PANEL ANTENNA MARKET IN MILITARY, BY TYPE, 2021–2027 (USD MILLION)

TABLE 53 FLAT PANEL ANTENNA MARKET IN MILITARY, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 54 FLAT PANEL ANTENNA MARKET IN MILITARY, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 55 FLAT PANEL ANTENNA MARKET IN MILITARY, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 FLAT PANEL ANTENNA MARKET IN MILITARY, BY REGION, 2021–2027 (USD MILLION)

8.5 COMMERCIAL

TABLE 57 FLAT PANEL ANTENNA MARKET IN COMMERCIAL, BY TYPE, 2018–2020 (USD MILLION)

TABLE 58 FLAT PANEL ANTENNA MARKET IN COMMERCIAL, BY TYPE, 2021–2027 (USD MILLION)

TABLE 59 FLAT PANEL ANTENNA MARKET IN COMMERCIAL, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 60 FLAT PANEL ANTENNA MARKET IN COMMERCIAL, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 61 FLAT PANEL ANTENNA MARKET IN COMMERCIAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 62 FLAT PANEL ANTENNA MARKET IN COMMERCIAL, BY REGION, 2021–2027 (USD MILLION)

8.6 OTHERS

TABLE 63 FLAT PANEL ANTENNA MARKET IN OTHERS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 64 FLAT PANEL ANTENNA MARKET IN OTHERS, BY TYPE, 2021–2027 (USD MILLION)

TABLE 65 FLAT PANEL ANTENNA MARKET IN OTHERS, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 66 FLAT PANEL ANTENNA MARKET IN OTHERS, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 67 FLAT PANEL ANTENNA MARKET IN OTHERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 68 FLAT PANEL ANTENNA MARKET IN OTHERS, BY REGION, 2021–2027 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 111)

9.1 INTRODUCTION

FIGURE 37 FLAT PANEL ANTENNA MARKET IN APAC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 69 FLAT PANEL ANTENNA MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 70 FLAT PANEL ANTENNA MARKET, BY REGION, 2021–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: FLAT PANEL ANTENNA MARKET SNAPSHOT

TABLE 71 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY TYPE, 2018–2020 (USD MILLION)

TABLE 72 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY TYPE, 2021–2027 (USD MILLION)

TABLE 73 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 74 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 75 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY END-USER APPLICATION, 2018–2020 (USD MILLION)

TABLE 76 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY END-USER APPLICATION, 2021–2027 (USD MILLION)

TABLE 77 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 78 FLAT PANEL ANTENNA MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing spending by US defense organizations and private players drives market

9.2.2 CANADA

9.2.2.1 Market growth in Canada is subjected to government-backed initiatives for satellite communications

9.2.3 MEXICO

9.2.3.1 Use of flat panel antennas in commercial applications to augment market growth in Mexico

9.3 EUROPE

FIGURE 39 EUROPE: FLAT PANEL ANTENNA MARKET SNAPSHOT

TABLE 79 FLAT PANEL ANTENNA MARKET IN EUROPE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 80 FLAT PANEL ANTENNA MARKET IN EUROPE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 81 FLAT PANEL ANTENNA MARKET IN EUROPE, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 82 FLAT PANEL ANTENNA MARKET IN EUROPE, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 83 FLAT PANEL ANTENNA MARKET IN EUROPE, BY END-USER APPLICATION, 2018–2020 (USD MILLION)

TABLE 84 FLAT PANEL ANTENNA MARKET IN EUROPE, BY END-USER APPLICATION, 2021–2027 (USD MILLION)

TABLE 85 FLAT PANEL ANTENNA MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 86 FLAT PANEL ANTENNA MARKET IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany held second-largest market share in Europe in 2021 due to increasing popularity of multimedia applications, internet access, and mobile and fixed services

9.3.2 UK

9.3.2.1 Increasing number of LEO constellations and high-throughput satellites boost UK market

9.3.3 FRANCE

9.3.3.1 Deployment of advanced ground satellite communication systems fuels market in France

9.3.4 SPAIN

9.3.4.1 Space industry expected to propel market growth in Spain

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC (APAC)

FIGURE 40 APAC: FLAT PANEL ANTENNA MARKET SNAPSHOT

TABLE 87 FLAT PANEL ANTENNA MARKET IN APAC, BY TYPE, 2018–2020 (USD MILLION)

TABLE 88 FLAT PANEL ANTENNA MARKET IN APAC, BY TYPE, 2021–2027 (USD MILLION)

TABLE 89 FLAT PANEL ANTENNA MARKET IN APAC, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 90 FLAT PANEL ANTENNA MARKET IN APAC, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 91 FLAT PANEL ANTENNA MARKET IN APAC, BY END-USER APPLICATION, 2018–2020 (USD MILLION)

TABLE 92 FLAT PANEL ANTENNA MARKET IN APAC, BY END-USER APPLICATION, 2021–2027 (USD MILLION)

TABLE 93 FLAT PANEL ANTENNA MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 94 FLAT PANEL ANTENNA MARKET IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increasing use of SATCOM terminals in military applications drives market in China

9.4.2 JAPAN

9.4.2.1 Increased use of satellites and antennas for surveillance in Japan

9.4.3 INDIA

9.4.3.1 Increasing demand for satellite broadcast systems and telecommunication fuels market in India

9.4.4 SOUTH KOREA

9.4.4.1 Government support for domestic production provides market growth opportunities in South Korea

9.4.5 REST OF APAC

9.5 REST OF WORLD (ROW)

TABLE 95 FLAT PANEL ANTENNA MARKET IN ROW, BY TYPE, 2018–2020 (USD MILLION)

TABLE 96 FLAT PANEL ANTENNA MARKET IN ROW, BY TYPE, 2021–2027 (USD MILLION)

TABLE 97 FLAT PANEL ANTENNA MARKET IN ROW, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 98 FLAT PANEL ANTENNA MARKET IN ROW, BY FREQUENCY, 2021–2027 (USD MILLION)

TABLE 99 FLAT PANEL ANTENNA MARKET IN ROW, BY END-USER APPLICATION, 2018–2020 (USD MILLION)

TABLE 100 FLAT PANEL ANTENNA MARKET IN ROW, BY END-USER APPLICATION, 2021–2027 (USD MILLION)

TABLE 101 FLAT PANEL ANTENNA MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 102 FLAT PANEL ANTENNA MARKET IN ROW, BY REGION, 2021–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 133)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 103 OVERVIEW OF STRATEGIES DEPLOYED BY FLAT PANEL ANTENNA MARKET ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

10.3 MARKET SHARE ANALYSIS, 2021

FIGURE 41 SHARE OF MAJOR PLAYERS IN FLAT PANEL ANTENNA MARKET, 2021

TABLE 104 FLAT PANEL ANTENNA MARKET: DEGREE OF COMPETITION

10.4 RANKING OF KEY PLAYERS IN FLAT PANEL ANTENNA MARKET

FIGURE 42 FLAT PANEL ANTENNA MARKET: RANKING OF KEY PLAYERS, 2021

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 PERVASIVE

10.5.3 EMERGING LEADER

10.5.4 PARTICIPANT

FIGURE 43 FLAT PANEL ANTENNA MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.6 START-UP/SME EVALUATION MATRIX

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 44 FLAT PANEL ANTENNA MARKET: STARTUP/SME EVALUATION MATRIX, 2021

10.7 COMPETITIVE BENCHMARKING

TABLE 105 FLAT PANEL ANTENNA MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 106 FLAT PANEL ANTENNA MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

10.8 FLAT PANEL ANTENNA MARKET: COMPANY FOOTPRINT

TABLE 107 FOOTPRINT OF COMPANIES

TABLE 108 APPLICATION FOOTPRINT OF COMPANIES

TABLE 109 PRODUCT FOOTPRINT OF COMPANIES

TABLE 110 REGIONAL FOOTPRINT OF COMPANIES

10.9 COMPETITIVE SCENARIO AND TRENDS

FIGURE 45 MARKET EVOLUTION FRAMEWORK: PRODUCT LAUNCHES AND DEVELOPMENTS, COLLABORATIONS, AND PARTNERSHIPS WERE MAJORLY ADOPTED STRATEGIES BY MARKET PLAYERS FROM 2019 TO 2022

10.9.1 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 111 FLAT PANEL ANTENNA MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, 2019–2021

10.9.2 DEALS

TABLE 112 FLAT PANEL ANTENNA MARKET: DEALS, 2019–2021

10.9.3 OTHERS

TABLE 113 FLAT PANEL ANTENNA MARKET: OTHERS, 2019–2021

11 COMPANY PROFILES (Page No. - 151)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 KYMETA CORPORATION

TABLE 114 KYMETA CORPORATION: BUSINESS OVERVIEW

TABLE 115 KYMETA CORPORATION: PRODUCTS OFFERED

TABLE 116 KYMETA CORPORATION: PRODUCT LAUNCHES

TABLE 117 KYMETA CORPORATION: DEALS

11.1.2 HANWHA-PHASOR

TABLE 118 HANWHA-PHASOR: BUSINESS OVERVIEW

TABLE 119 HANWHA-PHASOR: PRODUCTS OFFERED

TABLE 120 HANWHA-PHASOR: DEALS

11.1.3 TTI NORTE

TABLE 121 TTI NORTE: BUSINESS OVERVIEW

TABLE 122 TTI NORTE: PRODUCTS OFFERED

TABLE 123 TTI NORTE: OTHERS

11.1.4 THINKOM SOLUTIONS

TABLE 124 THINKOM SOLUTIONS: BUSINESS OVERVIEW

TABLE 125 THINKOM SOLUTIONS: PRODUCTS OFFERED

TABLE 126 THINKOM SOLUTIONS: PRODUCT LAUNCHES

TABLE 127 THINKOM SOLUTIONS: DEALS

TABLE 128 THINKOM SOLUTIONS: OTHERS

11.1.5 L3HARRIS TECHNOLOGIES

TABLE 129 L3HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 46 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 130 L3HARRIS TECHNOLOGIES: PRODUCTS OFFERED

TABLE 131 L3HARRIS TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 132 L3HARRIS TECHNOLOGIES: DEALS

TABLE 133 L3HARRIS TECHNOLOGIES: OTHERS

11.1.6 ISOTROPIC SYSTEMS

TABLE 134 ISOTROPIC SYSTEMS: BUSINESS OVERVIEW

TABLE 135 ISOTROPIC SYSTEMS: PRODUCTS OFFERED

TABLE 136 ISOTROPIC SYSTEMS: PRODUCT LAUNCHES

TABLE 137 ISOTROPIC SYSTEMS: DEALS

TABLE 138 ISOTROPIC SYSTEMS: OTHERS

11.1.7 L-COM GLOBAL CONNECTIVITY

TABLE 139 L-COM GLOBAL CONNECTIVITY: BUSINESS OVERVIEW

TABLE 140 L-COM GLOBAL CONNECTIVITY: PRODUCTS OFFERED

TABLE 141 L-COM GLOBAL CONNECTIVITY: PRODUCT LAUNCHES

11.1.8 ONEWEB

TABLE 142 ONEWEB: BUSINESS OVERVIEW

TABLE 143 ONEWEB: PRODUCTS OFFERED

TABLE 144 ONEWEB: DEALS

11.1.9 ST ENGINEERING IDIRECT

TABLE 145 ST ENGINEERING IDIRECT: BUSINESS OVERVIEW

TABLE 146 ST ENGINEERING IDIRECT: PRODUCTS OFFERED

TABLE 147 ST ENGINEERING IDIRECT: PRODUCT LAUNCHES

TABLE 148 ST ENGINEERING IDIRECT: DEALS

TABLE 149 ST ENGINEERING IDIRECT: OTHERS

11.1.10 CHINA STARWIN SCIENCE&TECHNOLOGY

TABLE 150 CHINA STARWIN SCIENCE&TECHNOLOGY: BUSINESS OVERVIEW

TABLE 151 CHINA STARWIN SCIENCE&TECHNOLOGY: PRODUCTS OFFERED

TABLE 152 CHINA STARWIN SCIENCE&TECHNOLOGY: PRODUCT LAUNCHES

TABLE 153 CHINA STARWIN SCIENCE&TECHNOLOGY: OTHERS

11.2 OTHER PLAYERS

11.2.1 SATPRO TECH

11.2.2 GILAT SATELLITE NETWORKS

11.2.3 RADIOWAVES, AN INFINITE ELECTRONICS COMPANY

11.2.4 BALL AEROSPACE

11.2.5 NXT COMMUNICATIONS CORPORATION

11.2.6 AICAN SYSTEMS

11.2.7 C-COM SATELLITE SYSTEMS INC.

11.2.8 INMARSAT

11.2.9 COBHAM AEROSPACE COMMUNICATION

11.2.10 MTI WIRELESS EDGE LIMITED

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 214)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

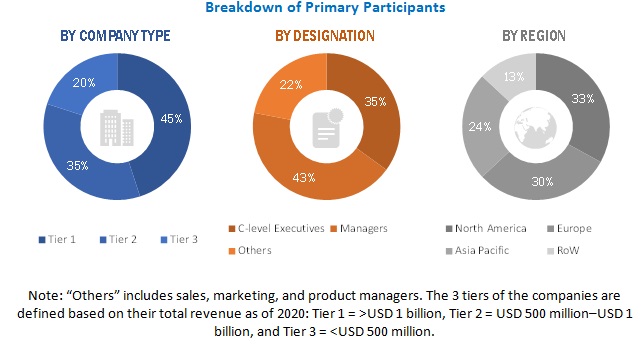

The study involved 4 major activities in estimating the current size of flat panel antenna market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the flat panel antenna market begins with capturing the data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the technical and commercial study of the flat panel antenna market. Secondary sources also include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, market’s value chain, total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the flat panel antenna market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the flat panel antenna market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the flat panel antenna market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the flat panel antenna market based on type, frequency and end-use application

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To explain the different materials used in flat panel antennas and the various products that use flat panel antennas

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research & development (R&D) in the market

- To analyze the impact of COVID-19 on the flat panel antenna market and provide market estimates for both pre-and post-COVID-19 scenarios

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flat Panel Antenna Market

Hello. Please let me ask three things. 1. Does it contains the market used in Space X? Space X was not contained in "Companies covered". 2. I am looking for the information of print circuit used in flat panel antenna. Do you have the information for each part?