Plasticizers Market by type (phthalate and Non-phthalate), Application (Floorings & Wall Coverings, Films & Sheets, Coated Fabrics, Wires & Cables, Consumer Goods) and Region (North America, Europe, Middle East and Africa) - Global Forecast to 2027

Updated on : September 17, 2025

Plasticizers Market

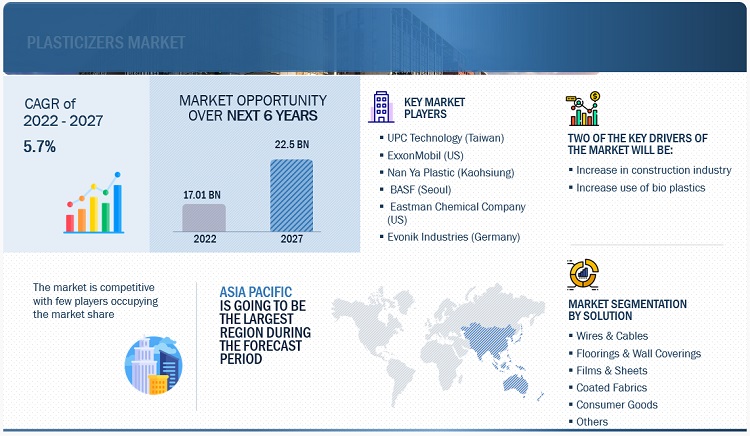

The global plasticizers market size was valued at USD 17.0 billion in 2022 and is projected to reach USD 22.5 billion by 2027, growing at 5.7% cagr from 2022 to 2027. Construction is one of the major end-use industries of plasticizers and offers market growth opportunities. The construction end-use industry is experiencing high growth rates in emerging regions such as Asia Pacific and South America.

Attractive Opportunities in the Plasticizers Market

To know about the assumptions considered for the study, Request for Free Sample Report

Plasticizers Market Dynamics

Driver: Rise in the construction sectors in the developing countries

Rising population, urbanization, and industrialization in developing economies will likely drive the plasticizers market. The growing infrastructure development in developing countries, such as China, India, and Brazil, is driving the demand for plasticizers, as these countries require a large amount of construction material and automotive parts. The construction of new roads, bridges, airports, ports, and other projects requires plastic products, such as pipes, wires, and cable insulation. Thus, the increasing need for more efficient and sustainable infrastructure drive the demand for plasticizers in the coming years.

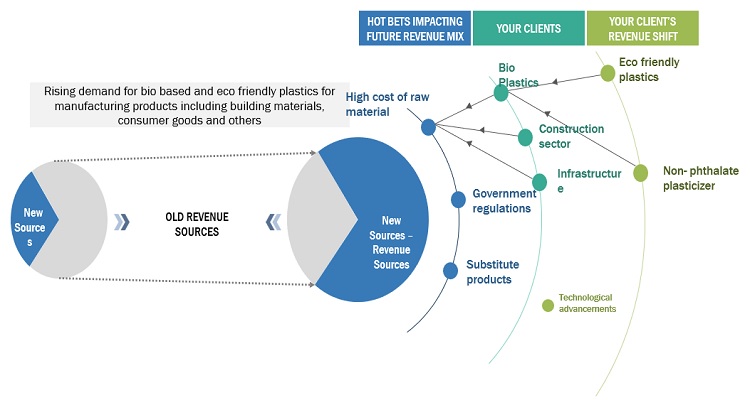

Restraint: Stringent government regulations pertaining to plastic products

Governments worldwide have imposed stringent regulations on the use of plasticizers to protect the environment and prevent health hazards. For example, some phthalate plasticizers have been banned or restricted in certain applications due to their adverse effects on health and environment. Besides, various governments aim to promote the use of bio-based and sustainable plasticizers and increase the demand for eco-friendly products.

Opportunities: Technological advancements such as production of bio plastics and its use in manufacturing plastic products

The market for bioplastics is expected to multiply in the coming years, providing an opportunity for plasticizer manufacturers to develop and market bioplastic-based products. Increasing concerns over plastic waste and the environmental impact of conventional petroleum-based plastics drive the growing demand for bioplastics. Bioplastics are made from renewable plant-based materials, such as corn starch, and have a lower carbon footprint than conventional plastics. Also, they biodegrade faster and are compostable, thereby reducing landfill waste. The rise in eco-conscious consumers and regulations promoting sustainable packaging solutions drives the growth of the bioplastics market.

Challenges: Highly volatile prices of raw materials

The volatility of raw material prices is a major challenge faced by the plasticizers industry. Plasticizers are primarily made from petroleum-based raw materials, with significantly fluctuating prices due to geopolitical tensions, natural disasters, and changes in global demand. This volatility can significantly increase production costs and negatively impact plasticizer manufacturers’ profitability. To mitigate the impact of raw material price volatility, companies in the plasticizers industry may implement hedging strategies, diversify their raw material sources, or adopt alternatives such as bio-based materials

Plasticizers Market Trends

Phthalate segment, by type, is expected to be the largest market during the forecast period

Phthalate plasticizers accounted for 80.6% market, in terms of volume, in 2021. This dominance is attributed to their low price and properties such as high durability, stability, and robust performance. The DINP type of phthalate plasticizers accounted for the largest market share (28.6%), in terms of volume, globally in 2021.

“Europe : The second fastest Plasticizers market”

The plasticizers market in Europe is driven by the electronics industry due to increased investment in research and innovations, thereby creating demand for plasticizers and PVCs that are widely used for building wires and cables.

To know about the assumptions considered for the study, download the pdf brochure

Plasticizers Market Players

The Plasticizers market is dominated by a few major players that have a wide regional presence. The key players in the Plasticizers market are UPC Technology (Taiwan), ExxonMobil (US), Nan Ya Plastic (Kaohsiung), BASF (Seoul), Eastman Chemical Company (US), Evonik Industries (Germany) , LG Chem ( South Korea), Shandong Hongxin Chemicals (China), Shandong Qilu Plasticizers (China), Aekyung Petrochemical (South Korea). In last few years, the companies have adopted growth strategies such as Acquisitions and expansions to capture a larger share of the Plasticizers market.

Read More: Plasticizers Companies

Plasticizers Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

application, type and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

UPC Technology (Taiwan), ExxonMobil (US), Nan Ya Plastic (Kaohsiung), BASF (Seoul), Eastman Chemical Company (US), Evonik Industries (Germany) , LG Chem ( South Korea), Shandong Hongxin Chemicals (China), Shandong Qilu Plasticizers (China), Aekyung Petrochemical (South Korea). |

|

|

This research report categorizes the plasticizers market by fuel, applications, product type, power rating, end user, and region.

Based on type, the plasticizers market has been segmented as follows:

- Phthalate

- Non-phthalate

Based on application, the plasticizers market has been segmented as follows:

- Wires & Cables

- Floorings & Wall Coverings

- Films & Sheets

- Coated Fabrics

- Consumer Goods

- Others

Based on region, the plasticizers market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- BASF (Germany) and StePac Ltd. (Israel) partnered in Decemebre 2022 to create next-generation sustainable packaging specifically for the fresh produce sector

- Eastman Chemical Company acquired 3F Feed & Food in April 2021 a European leader specializing in the technical and commercial development of additives for animal feed and human food.

- Evonik’s Coating Additives Business Line developed a new, multifunctional polymer additive for powder coating formulations in December 2022. It is versatile in formulations with inorganic fillers, pigments, and organic pigments, including carbon black.

Frequently Asked Questions (FAQ):

Which are the major companies in the C4ISR market? What are their major strategies to strengthen their market presence?

Some of the key players in the Plasticizers market are UPC Technology (Taiwan), ExxonMobil (US), Nan Ya Plastic (Kaohsiung), BASF (Seoul), Eastman Chemical Company (US), Evonik Industries (Germany) among others, are the key manufacturers that secured Plasticizers contracts in the last few years. Acquisition was the key strategies adopted by these companies to strengthen their Plasticizers market presence.

What are the drivers and opportunities for the plasticizers market?

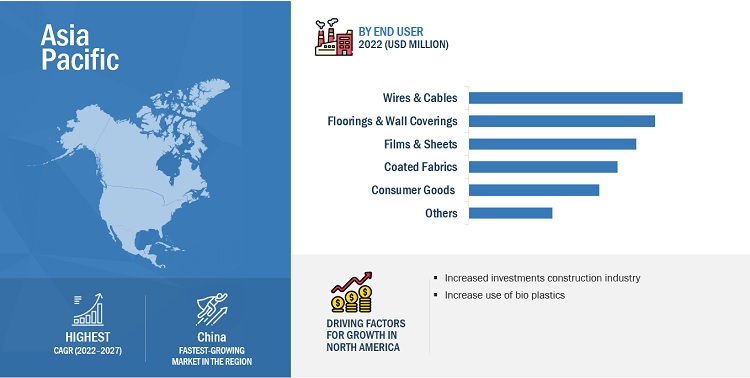

The need for plasticizers has increased significantly around the world, but particularly in Asia Pacific, where the development of new infrastructure and the use of bio plastics in countries like China, India, and South Korea will present several prospects for companies in the plasticizers industry. Rising R&D efforts to create plasticizers solutions are anticipated to accelerate market expansion globally.

Which region is expected to hold the highest market share?

The market in Asia Pacific will dominate the market share in 2022, showcasing strong demand from plasticizers in the region.

What is the total CAGR expected to be recorded for the plasticizers market during 2022-2027?

The CAGR is expected to record a CAGR of 5.7% from 2022-2027.

Which are the key development prevailing in the plasticizers market?

The main developments dominating the plasticizers industry are production of non phthalate plasticizers which are more eco friendly and sustainable than phthalate plasticizers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for plasticizers in construction industry- Increased use of bio-based plasticizers- Rise in infrastructure developmentRESTRAINTS- Stringent government regulations- High cost of bio-based plasticizers- Substitute productsOPPORTUNITIES- Increasing demand for bioplastics- Growing demand for sustainable and eco-friendly plasticizersCHALLENGES- Volatility of raw material prices- Health and environmental concerns

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISSUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE BASED ON REGION

-

5.6 ECOSYSTEM MAPPING

-

5.7 TRADE ANALYSISIMPORT–EXPORT SCENARIO

-

5.8 PATENT ANALYSISMETHODOLOGY- Document typeINSIGHTSLEGAL STATUSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.9 KEY FACTORS AFFECTING BUYING DECISIONQUALITYSERVICE

-

5.10 MACROECONOMIC INDICATORSECONOMIC GROWTHCONSTRUCTION ACTIVITYCONSUMER SPENDINGEXCHANGE RATESGOVERNMENT REGULATIONSPETROLEUM PRICES

- 6.1 INTRODUCTION

-

6.2 PHTHALATE PLASTICIZERSINCREASING DEMAND FROM VARIOUS END-USE APPLICATIONS TO PROPEL MARKETDOPDINP/DIDP/DPHPOTHER TYPES

-

6.3 NON-PHTHALATE PLASTICIZERSGROWING DEMAND FOR BIO-BASED PLASTICIZERS TO DRIVE MARKETADIPATESTRIMELLITATESEPOXIESBENZOATESOTHERS

- 7.1 INTRODUCTION

-

7.2 FLOORINGS & WALL COVERINGSRISE IN CONSTRUCTION ACTIVITY TO DRIVE SEGMENT

-

7.3 WIRES & CABLESELECTRONIC INDUSTRY TO FUEL DEMAND FOR WIRES & CABLES

-

7.4 COATED FABRICSINCREASING REQUIREMENT FOR FABRICS IN END-USE INDUSTRIES TO FUEL SEGMENT GROWTH

-

7.5 CONSUMER GOODSGROWING DEMAND FOR BIO-BASED PLASTICIZERS TO DRIVE SEGMENT

-

7.6 FILMS & SHEETSREQUIREMENT OF PVC SHEETS IN PACKAGING APPLICATIONS TO PROPEL SEGMENT

- 7.7 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 EUROPERECESSION IMPACTGERMANY- Easy availability of raw materials to drive marketITALY- Emergence of chemical industry to fuel market growthFRANCE- Industrial growth to propel marketRUSSIA- Evolving auto industry to fuel market growthPOLAND- Increased investments in construction sector to drive marketREST OF EUROPE

-

8.3 NORTH AMERICARECESSION IMPACTUS- Investments in electronics and communication hubs to increase demand for plasticizersCANADA- Rise in construction sector to fuel demand for sustainable building materialsMEXICO- Infrastructure developments to propel market

-

8.4 ASIA PACIFICRECESSION IMPACTCHINA- Transition to low carbon economy to fuel demand for sustainable plasticizersINDIA- Growth of construction sector to propel marketJAPAN- International events to boost demand for plasticizersSOUTH KOREA- Rapid urbanization and industrialization to drive marketTAIWAN- Growth of chemical industry to propel marketREST OF ASIA PACIFIC

-

8.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Increase in large-scale infrastructure projects to fuel market growthARGENTINA- Government initiatives promoting sustainable plastic products to drive marketREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Emerging consumer electronics industry to drive demand for plasticizersUAE- Growth of electronics segment to propel marketQATAR- Digitalization to drive marketOMAN- Increasing demand for sustainable raw materials to fuel market growthISRAEL- Rise in industrialization to propel marketREST OF MIDDLE EAST & AFRICA

- 9.1 OVERVIEW

- 9.2 MARKET SHARE ANALYSIS, 2021

- 9.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

9.4 COMPANY EVALUATION MATRIX/QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

9.5 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.6 COMPETITIVE BENCHMARKING

- 9.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

- 9.8 COMPETITIVE SCENARIO

-

10.1 KEY PLAYERSUPC TECHNOLOGY CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEXXONMOBIL- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNAN YA PLASTICS- Business overview- Products/Solutions/Services offered- MnM viewBASF- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products/Services/Solutions offered- MnM viewEVONIK INDUSTRIES- Business overview- Products/Services/Solutions offeredLG CHEM- Business overview- Products/Services/Solutions offeredSHANDONG HONGXIN CHEMICALS- Business overview- Products/Services/Solutions offeredSHANDONG QILU PLASTICIZERS- Business overview- Products/Services/Solutions offeredAEKYUNG PETROCHEMICAL- Business overview- Products/Services/Solutions offered

-

10.2 OTHER PLAYERSDIC CORPORATIONJIANGSU ZHENGDAN CHEMICAL INDUSTRY CO., LTD.KAO CORPORATIONKLJ GROUPLANXESS AGOXEA CORPORATIONAVIENT CORPORATIONPOLYNT SPAVERTELLUS HOLDINGS LLCVELSICOL CHEMICAL, LLC

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 IMPORT TRADE DATA FOR PHTHALATE PLASTICIZERS

- TABLE 2 EXPORT TRADE DATA FOR PHTHALATE PLASTICIZERS

- TABLE 3 GRANTED PATENTS ACCOUNTED FOR 18% OF TOTAL PATENTS IN LAST 10 YEARS

- TABLE 4 PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 5 PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 6 PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 7 PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 8 NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 9 NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 10 PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 11 PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 12 PLASTICIZERS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 13 PLASTICIZERS MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 14 EUROPE: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 15 EUROPE: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 16 EUROPE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 17 EUROPE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 18 EUROPE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 19 EUROPE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 20 EUROPE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 21 EUROPE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 22 EUROPE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 23 EUROPE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 24 GERMANY: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 25 GERMANY: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 26 GERMANY: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 27 GERMANY: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 28 GERMANY: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 29 GERMANY: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 30 GERMANY: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 31 GERMANY: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 32 ITALY: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 33 ITALY: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 34 ITALY: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 35 ITALY: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 36 ITALY: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 37 ITALY: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 38 ITALY: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 39 ITALY: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 40 FRANCE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 41 FRANCE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 42 FRANCE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 43 FRANCE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 44 FRANCE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 45 FRANCE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 46 FRANCE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 47 FRANCE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 48 RUSSIA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 49 RUSSIA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 50 RUSSIA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 51 RUSSIA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 52 RUSSIA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 53 RUSSIA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 54 RUSSIA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 55 RUSSIA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 56 POLAND: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 57 POLAND: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 58 POLAND: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 59 POLAND: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 60 POLAND: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 61 POLAND: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 62 POLAND: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 63 POLAND: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 64 REST OF EUROPE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 65 REST OF EUROPE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 66 REST OF EUROPE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 67 REST OF EUROPE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 68 REST OF EUROPE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 69 REST OF EUROPE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 70 REST OF EUROPE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 71 REST OF EUROPE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 72 NORTH AMERICA: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 74 NORTH AMERICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 76 NORTH AMERICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 78 NORTH AMERICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 80 NORTH AMERICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 82 US: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 83 US: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 84 CANADA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 85 CANADA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 86 MEXICO: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 87 MEXICO: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 88 ASIA PACIFIC: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 90 ASIA PACIFIC: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 92 ASIA PACIFIC: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 94 ASIA PACIFIC: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 96 ASIA PACIFIC: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 98 CHINA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 99 CHINA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 100 INDIA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 101 INDIA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 102 JAPAN: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 103 JAPAN: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 104 SOUTH KOREA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 105 SOUTH KOREA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 106 TAIWAN: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 107 TAIWAN: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 108 REST OF ASIA PACIFIC: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 110 SOUTH AMERICA: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 111 SOUTH AMERICA: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 112 SOUTH AMERICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 113 SOUTH AMERICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 114 SOUTH AMERICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 115 SOUTH AMERICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 116 SOUTH AMERICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 117 SOUTH AMERICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 118 SOUTH AMERICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 119 SOUTH AMERICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 120 BRAZIL: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 121 BRAZIL: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 122 ARGENTINA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 123 ARGENTINA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 124 REST OF SOUTH AMERICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 125 REST OF SOUTH AMERICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 130 MIDDLE EAST & AFRICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 134 MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 136 SAUDI ARABIA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 137 SAUDI ARABIA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 138 SAUDI ARABIA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 139 SAUDI ARABIA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 140 SAUDI ARABIA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 141 SAUDI ARABIA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 142 SAUDI ARABIA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 143 SAUDI ARABIA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 144 UAE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 145 UAE: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 146 UAE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 147 UAE: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 148 UAE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 149 UAE: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 150 UAE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 151 UAE: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 152 QATAR: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 153 QATAR: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 154 QATAR: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 155 QATAR: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 156 QATAR: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 157 QATAR: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 158 QATAR: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 159 QATAR: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 160 OMAN: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 161 OMAN: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 162 OMAN: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 163 OMAN: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 164 OMAN: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 165 OMAN: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 166 OMAN: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 167 OMAN: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 168 ISRAEL: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 169 ISRAEL: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 170 ISRAEL: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 171 ISRAEL: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 172 ISRAEL: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 173 ISRAEL: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 174 ISRAEL: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 175 ISRAEL: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 181 REST OF MIDDLE EAST & AFRICA: NON-PHTHALATE PLASTICIZERS MARKET, BY TYPE, 2020–2027 (KILOTON)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: PLASTICIZERS MARKET, BY APPLICATION, 2020–2027 (KILOTON)

- TABLE 184 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 185 PLASTICIZERS MARKET: DEGREE OF COMPETITION

- TABLE 186 PLASTICIZERS MARKET: KEY STARTUPS/SMES

- TABLE 187 PLASTICIZERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 188 COMPANY APPLICATION FOOTPRINT

- TABLE 189 COMPANY TYPE FOOTPRINT

- TABLE 190 COMPANY REGION FOOTPRINT

- TABLE 191 COMPANY FOOTPRINT

- TABLE 192 PLASTICIZERS MARKET: PRODUCT LAUNCHES, 2020–2022

- TABLE 193 PLASTICIZERS MARKET: DEALS, 2020–2022

- TABLE 194 UPC TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 195 UPC TECHNOLOGY CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 UPC TECHNOLOGY CORPORATION: EXPANSIONS/MERGERS/ACQUISITIONS

- TABLE 197 EXXONMOBIL: COMPANY OVERVIEW

- TABLE 198 EXXONMOBIL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 EXXONMOBIL: DEALS

- TABLE 200 NAN YA PLASTICS: COMPANY OVERVIEW

- TABLE 201 NAN YA PLASTICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 202 BASF: COMPANY OVERVIEW

- TABLE 203 BASF: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 BASF: EXPANSIONS/MERGERS/ACQUISITIONS

- TABLE 205 BASF: PRODUCT LAUNCH

- TABLE 206 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 207 EASTMAN CHEMICAL COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 208 EASTMAN CHEMICAL COMPANY: EXPANSIONS/MERGERS/ACQUISITIONS

- TABLE 209 EVONIK INDUSTRIES: COMPANY OVERVIEW

- TABLE 210 EVONIK INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 EVONIK INDUSTRIES: PRODUCT LAUNCH

- TABLE 212 LG CHEM: COMPANY OVERVIEW

- TABLE 213 LG CHEM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 214 SHANDONG HONGXIN CHEMICALS: COMPANY OVERVIEW

- TABLE 215 SHANDONG HONGXIN CHEMICALS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 216 SHANGDONG QILU PLASTICIZERS: BUSINESS OVERVIEW

- TABLE 217 SHANGDONG QILU PLASTICIZERS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 218 AEKYUNG PETROCHEMICAL: COMPANY OVERVIEW

- TABLE 219 AEKYUNG PETROCHEMICALS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 1 PLASTICIZERS MARKET: RESEARCH DESIGN

- FIGURE 2 PLASTICIZERS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 3 TOP-DOWN APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 PLASTICIZERS MARKET: DATA TRIANGULATION

- FIGURE 6 PHTHALATES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 7 WIRES & CABLES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- FIGURE 9 INCREASING DEMAND FROM VARIOUS APPLICATIONS TO DRIVE MARKET

- FIGURE 10 WIRES & CABLES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 FLOORINGS & WALL COVERINGS TO GROW DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 PHTHALATES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PLASTICIZERS MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS: PLASTICIZERS MARKET

- FIGURE 16 VALUE CHAIN ANALYSIS: PLASTICIZERS MARKET

- FIGURE 17 AVERAGE SELLING PRICE, BY REGION (USD/KILOTON)

- FIGURE 18 PUBLICATION TRENDS (LAST TEN YEARS)

- FIGURE 19 TOP JURISDICTION, BY DOCUMENT

- FIGURE 20 SUPPLIER SELECTION CRITERION

- FIGURE 21 PHTHALATES TO DOMINATE PLASTICIZERS MARKET DURING FORECAST PERIOD

- FIGURE 22 WIRES & CABLES TO DOMINATE PLASTICIZERS MARKET DURING FORECAST PERIOD

- FIGURE 23 ASIA PACIFIC ACCOUNTED FOR LARGEST CAGR IN PLASTICIZERS MARKET

- FIGURE 24 EUROPE: PLASTICIZERS MARKET SNAPSHOT

- FIGURE 25 ASIA PACIFIC: PLASTICIZERS MARKET SNAPSHOT

- FIGURE 26 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS IN PLASTICIZERS MARKET, 2021

- FIGURE 27 PLASTICIZERS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2021

- FIGURE 28 PLASTICIZERS MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

- FIGURE 29 UPC TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

- FIGURE 30 EXXONMOBIL: COMPANY SNAPSHOT

- FIGURE 31 BASF: COMPANY SNAPSHOT

- FIGURE 32 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 33 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 34 LG CHEM: COMPANY SNAPSHOT

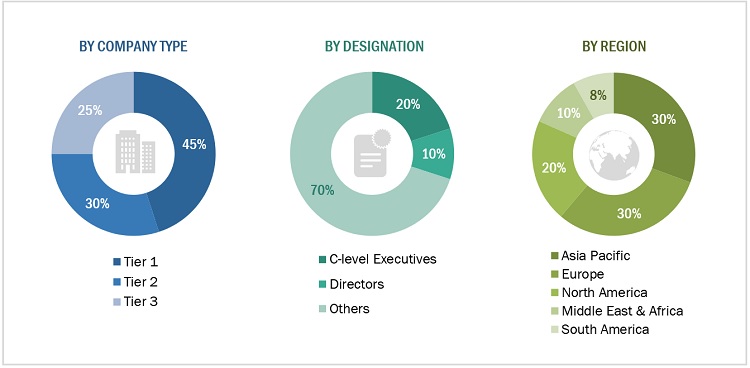

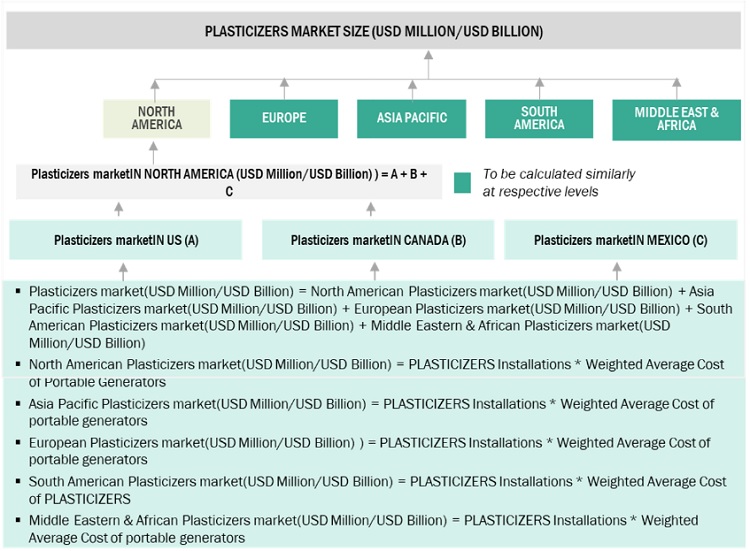

The study involved major activities in estimating the current size of the Plasticizers market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases, were considered for identifying and collecting information for this study. Secondary research was mainly conducted to obtain key information about the supply chain of the industry, monetary chain of the market, the total number of market players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, consultants, and related key executives from major companies and organizations operating in the market. Primary sources from the demand side include lab technicians, technologists, and sales/purchase managers in the industry. Following is the breakdown of primary respondents:

Note: Others include product engineers and product specialists.

The tier of the companies is defined on the basis of their total revenue; as of 2018: Tier 1 = > USD 1 billion, Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Plasticizers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Plasticizers Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Definition

Plasticizers are low molecular weight compounds added to other polymeric substances to aid polymer processing and impart flexibility, plasticity, softness, and reduce brittleness. They are primarily used in PVC cables, PVC resins, wire jacketing, vinyl flooring, medical equipment, automobile parts, and others. Plasticizers make the polymer solution more suitable for various applications such as films & coatings.

The key stakeholders of the plasticizers market include Raw Material Suppliers, Manufacturers (Plasticizer Manufacturers), Plasticizer Traders, Distributors, and Suppliers, End-use Industry Participants, Government and Research Organizations, Associations and Industrial Bodies, Research and Consulting Firms, Research & Development (R&D) Institutions, Environmental Support Agencies.

Objectives of the Study

- To define, describe, segment, and forecast the Plasticizers market size, by technology, meter type, component, and application

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the Plasticizers market

- To strategically analyze the Plasticizers market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five main regions (along with countries), namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product developments, contracts & agreements, investments & expansions, and mergers & acquisitions in the Plasticizers market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plasticizers Market

India and Global plasticizer demand and market forecast upto 2020 and key growth drivers for next coming years

Need the plasticizer demand and consumption market forecast up to 2020 for Iran and the globe, along with key growth drivers for the next coming years.

The growth of the plasticizer market in Indonesia in 2019?

Interested in market of plasticizer

PVC industry market trends