1-Decene Market by Derivative (Polyalphaolefins (Synthetic Lubricants, and Others), Oxo Alcohols (Plasticizer and Detergent Alcohols)), and Region - Global Forecast to 2025

Updated on : August 25, 2025

1-Decene Market

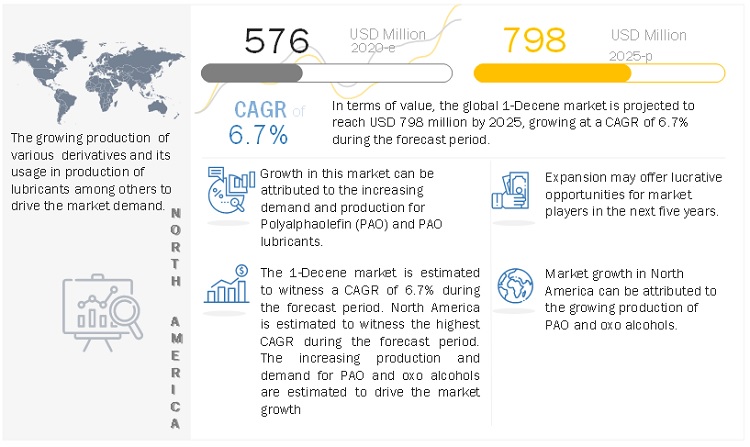

The global 1-Decene market was valued at USD 576 million in 2020 and is projected to reach USD 798 million by 2025, growing at 6.7% cagr from 2020 to 2025. A major driver of the 1-Decene market is the increasing demand for PAOs-based lubricants and the increase in the manufacturing of PAOs. The automobile industry is indirectly driving the 1-Decene market due to the increasing demand for PAOs-based synthetic lubricants. PAOs not only offer the advantage of technical performance but also preserve the environment in certain sensitive applications. In 2020, owing to the outbreak of the COVID-19 pandemic, there was a downfall in many industries across the globe. In addition, the petrochemical and oil & gas sectors were mainly impacted as these sectors had to stop their production due to overcapacity and less demand. The decrease in demand for lubricants during the lockdown period impacted the 1-Decene market.

Attractive Opportunities in the 1-Decene Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

1-Decene Market Dynamics

DRIVERS: Increasing demand for PAOs-based synthetic lubricants

The automobile industry is indirectly driving the 1-Decene market due to the increasing demand for PAOs-based synthetic lubricants. PAO consumption trends directly impact the demand for 1-Decene. Owing to the improving standards of living in developing countries, the number of vehicles is expected to continue to increase. The increased spending on vehicles by the middle-class population is expected to drive the market for automobiles, leading to an increased demand for lubricants, one of the important applications of 1-Decene derivatives. It offers various technical performance advantages that make it suitable for use in lubricant applications. The growth of the automotive industry can also be attributed to the growing population in developing nations such as China, India, and Brazil.

RESTRAINT : Growth of Group III base oils

Base oils are usually referred to as lubrication grade oils. Group I, II, and III base oils are refined from petroleum crude oil, while Group IV and V base oils are considered as synthetic oils. Earlier, PAOs and other synthetic oils were considered to have superior characteristics, such as viscosity index, pour point, volatility, and oxidation stability. However, with modern base oil manufacturing technology, all the characteristics of base oil can be independently controlled. Group III oils are witnessing the same trend, especially those which are manufactured by using modern hydroisomerization technology. These oils provide a performance similar to traditional PAO-based synthetic oils in a variety of applications. The rising demand for higher performance Group III base oils can be attributed to the demand within the automotive industry. This demand, along with increasing regulations on automotive manufacturers to achieve lower emission levels and overall carbon footprint, is also supporting the increase in demand for Group III base oils.

OPPORTUNITIES: Growing R&D investments for the development of alpha olefins from different sources

A new concept of producing alpha olefins from biomass is being practiced by various research laboratories and universities. In 2010, researchers at The Center for Biorenewable Chemicals (CBiRC), an NSF-funded Engineering Research Center (US), showcased that the medium chain length free fatty acids can be produced by E.coli using sugars as a source of carbon. The research makes use of codon-optimized eukaryotic and prokaryotic enzyme sources expressed in the microbial systems. The projects reported 35% to 40% of theoretical yields with 2.7 g/L being attained, which compares very favorably with the recent literature reports.

CHALLENGES : Demand-supply gap

The 1-Decene market is characterized by the presence of very few players and their limited manufacturing capacities. A few players with comparatively large production capacity (than their peers) that exist in the 1-Decene market include Chevron Phillips Chemical Company LLC, Exxon Mobil Corporation, Royal Dutch Shell, and INEOS. The other players are smaller players when it comes to the manufacturing of linear alpha olefins and thereby 1-Decene. This becomes a major challenge for the PAO and oxo alcohols manufacturers as there is an increased demand for 1-Decene in all these derivative types. As the demand for 1-Decene is increasing, the manufacturers are unable to meet the demand due to their low production and production capacities.

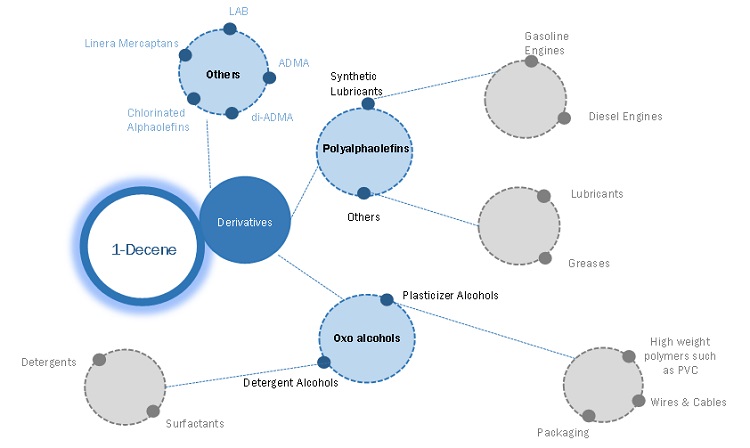

PAOs segment to dominate the market in 2019

PAOs are a class of polymers produced from 1-Decene, which act as a monomer. They are used in various synthetic products, such as lubricants, greases, and fluids. The demand for PAOs is majorly driven by their molecular stability and pureness. Greater oxidative stability, superior volatility, excellent low-temperature viscosities, high viscosity index, and excellent pour points drive the demand for PAOs in comparison to mineral oils. PAOs are used in a wide variety of industrial and automotive applications, including motor oils, wind turbine lubricants, heavy-duty diesel engine oils, fiber optic cable compounds, hydraulic oils, transmission fluids, compressor oils, and gear oils. PAO-based lubricants can also be used as components of food-grade lubricants.

To know about the assumptions considered for the study, download the pdf brochure

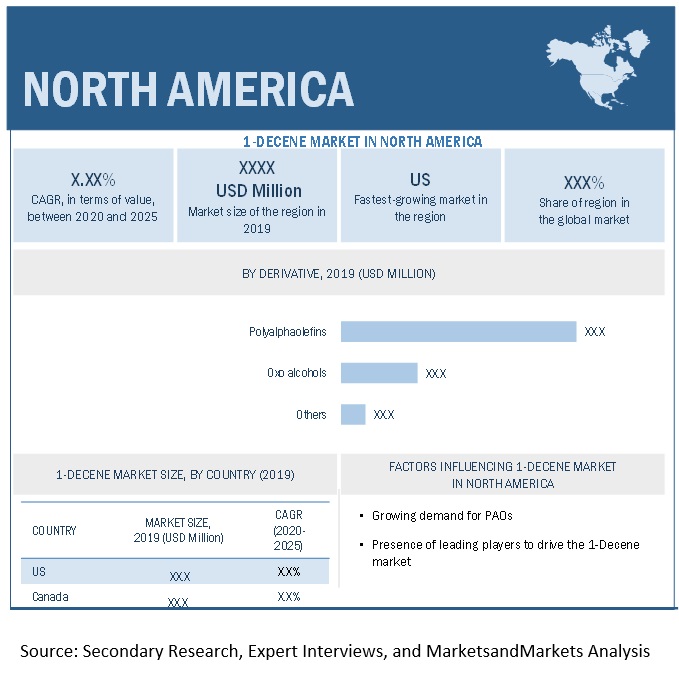

North America to account for the largest share of the global 1-Decene market during the forecast period

North America is expected to account for the largest market share in 1-Decene during the forecast period, in terms of value. The market for 1-Decene is growing in North America because the region has a vast and varied industrial base of PAOs and oxo alcohols. The growth in North America is mainly attributed to the continuous expansion of oil & gas and petrochemical infrastructure in the US, Canada, and Mexico. North America is considered as a potential investment hub for 1-Decene production by several domestic as well as foreign players because of its vast reserves of natural resources. The US is expected to be the leading producer and consumer of 1-Decene in the region during the forecast period. The 1-Decene market in the US is driven by the demand for its derivatives from industries, such as automotive and packaging. 1-Decene manufacturers have planned various technological advances and expansions to cater to the increasing demand and gain enhanced profit margins

1-Decene Market Ecosystem

1-Decene Market Players

The key market players profiled in the report include as Royal Dutch Shell (Netherlands), INEOS (UK), Chevron Phillips Chemical Company LLC (US), SABIC (Saudi Arabia), Exxon Mobil Corporation (US), Qatar Chemical Company II Ltd. (Qatar), Idemitsu Kosan Co., Ltd. (Japan), PJSC Nizhnekamskneftekhim (Russia), Alfa Aesar (US), Merck Group (Germany), Toronto Chemical Industry Company Limited (Japan), Spectrum Chemical Mfg. Corp. (US), Agene Chemicals (UK), and Gelest Inc. (US), among others

1-Decene Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 576 million |

|

Revenue Forecast in 2025 |

USD 798 million |

|

Growth Rate |

CAGR of 6.7% from 2020 to 2025 |

|

Years considered for the study |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments covered |

Derivative, and Region |

|

Regions covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

|

This report categorizes the global 1-Decene market based on derivative, and region.

On the basis of derivative type, the 1-Decene market has been segmented as follows:

- Polyalphaolefins (PAOs)

- Oxo alcohols

- Others

On the basis of region, the 1-Decene market has been segmented as follows:

- North America

- Europe

- APAC

- Middle East & Arica

- South America

Royal Dutch Shell is one of the largest players in the 1-Decene market. Its well-established distribution network and brand value are the important factors for its future growth. The company has a strong R&D infrastructure and research centers in China, Germany, Japan, and the US. It is highly focused on its downstream business segment, which is a strong cash-generative segment with high return-on-investment. Its customer benefits include low maintenance costs, long equipment life, and reduced energy consumption. Shell has adopted expansions to meet the increasing demand from customers and strengthen its presence in the global alpha olefin market.

- In January, 2019, Royal Dutch Shell (Netherlands) started the production of its fourth alpha olefins (AO) unit at its Geismar, Louisiana, US chemical manufacturing site. Such developments make Royal Dutch Shell the largest producer of alpha olefins in the world.

Exxon Mobil Corporation is the another key player in the 1-Decene market. Exxon Mobil Corporation is a US-based oil & gas company. It markets its products globally under the brands: Exxon, Mobil, and Esso. It also owns hundreds of small subsidiaries, including Imperial Oil Limited (69.6% ownership) in Canada. The company operates under three main segments: upstream, downstream, and chemical. The upstream segment explores and produces crude oil and natural gas. The downstream segment manufactures and sells petroleum products. The chemical segment supplies olefins, polyolefins, and other petrochemical products. 1-Decene is produced under the chemical business segment and is commonly used as a raw material in the PAO industry to produce high-performance lubricants used in the oil & gas industry. The company focusses on expansion to meet the growing demand for 1-Decene.

-

In May 2019, Exxon Mobil planned to expand its Baytown, Texas, US chemical plant with an investment of USD 2 billion, which is expected to contribute a 15% return with respect to its investment. The investment is believed to maximize the production from the Permian basin and extra produce of 350,000 tons of linear alpha olefins a year.

Frequently Asked Questions (FAQ):

What are the high growth derivatives of 1-Decene?

The polyalphaolefin segment is projected to register the highest CAGR in terms of value during the forecast period. This is due to increasing usage of 1-Decene in the production of PAO. Moeover, the growing demand for PAO in the production of 1-Decene is leading to the growth of this market.

What are the major factors impacting market growth during the forecast period?

The market growth is primarily due to the demand for PAO-based lubricants and increasing industrialization in APAC and Middle East & Africa. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 1-DECENE MARKET: INCLUSIONS & EXCLUSIONS

1.2.2 1-DECENE: MARKET DEFINITION AND INCLUSIONS, BY DERIVATIVES

1.3 SCOPE OF THE MARKET

FIGURE 1 1-DECENE: MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 1-DECENE MARKET: STUDY APPROACH

2.1.1 DEMAND-SIDE APPROACH

2.1.2 SUPPLY-SIDE APPROACH

2.1.3 PARENT MARKET APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 DEMAND SIDE

2.2.2 SUPPLY SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – Demand and Supply Side

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 1-DECENE MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS ASSOCIATED WITH 1-DECENE MARKET

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 5 1-DECENE MARKET TO BE DRIVEN BY THE POLYALPHAOLEFINS SEGMENT

FIGURE 6 NORTH AMERICA TO BE THE FASTEST-GROWING 1-DECENE MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 GROWTH OPPORTUNITIES FOR THE 1-DECENE MANUFACTURERS BETWEEN 2020 AND 2025

FIGURE 7 ATTRACTIVE GROWTH OPPORTUNITIES IN THE 1-DECENE MARKET

4.2 GLOBAL 1-DECENE MARKET, BY REGION, 2020-2025

FIGURE 8 NORTH AMERICA TO BE THE FASTEST-GROWING REGION DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: 1-DECENE MARKET, BY COUNTRY AND DERIVATIVE

FIGURE 9 US ACCOUNTED FOR THE LARGEST MARKET SHARE IN THE 1-DECENE MARKET IN NORTH AMERICA

4.4 1-DECENE MARKET IN 2019, BY REGION AND DERIVATIVE

FIGURE 10 POLYALPHAOLEFIN DERIVATIVES LED THE 1-DECENE MARKET

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS OF 1-DECENE MARKET

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE 1-DECENE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for PAOs-based synthetic lubricants

5.2.1.2 Growing industrial activities in the Middle East & Africa and APAC

TABLE 1 INDUSTRIAL GROWTH RATE, 2019

5.2.2 RESTRAINTS

5.2.2.1 Growth of Group III base oils

5.2.2.2 Volatile raw material prices

FIGURE 12 NATURAL GAS HISTORICAL PRICE TREND (2010–2020)

5.2.2.3 Growth in demand for hybrid vehicles and increasing battery price parity

5.2.3 OPPORTUNITIES

5.2.3.1 Growing R&D investments for the development of alpha olefins from different sources

5.2.3.2 Growth of wind energy sector

TABLE 2 GLOBAL INSTALLED WIND POWER CAPACITY (MW)

TABLE 3 PAO VS. OTHER BASE OILS: PERFORMANCE CHARACTERISTICS

5.2.4 CHALLENGES

5.2.4.1 Demand-supply gap

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 OIL & GAS INDUSTRY

TABLE 4 OIL PRODUCTION STATISTICS: TOP 15 COUNTRIES, 2015–2025 (MILLION TONS)

TABLE 5 NATURAL GAS PRODUCTION STATISTICS: TOP 15 COUNTRIES, 2015–2025 (BILLION CUBIC METER)

5.4.2 AUTOMOTIVE INDUSTRY

TABLE 6 SALE OF NEW VEHICLES IN KEY COUNTRIES OF APAC, 2019 (UNITS)

TABLE 7 SALE OF NEW VEHICLES IN KEY COUNTRIES OF NORTH AMERICA, 2019 (UNITS)

TABLE 8 SALE OF NEW VEHICLES IN KEY COUNTRIES OF EUROPE, 2019 (UNITS)

TABLE 9 SALE OF NEW VEHICLES IN KEY COUNTRIES OF SOUTH AMERICA, 2019 (UNITS)

TABLE 10 SALE OF NEW VEHICLES IN KEY COUNTRIES OF MIDDLE EAST & AFRICA, 2019 (UNITS)

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 14 SUPPLY CHAIN OF 1-DECENE MARKET

5.5.1 RAW MATERIAL

5.5.2 PRODUCTION PROCESS

5.5.3 DERIVATIVES

5.5.4 END-USE

5.6 TECHNOLOGY ANALYSIS

5.7 SHIFT IN REVENUE STREAMS DUE TO MEGATRENDS IN END-USE INDUSTRIES

FIGURE 15 1-DECENE MARKET: CHANGING REVENUE MIX

5.8 CONNECTED MARKETS: ECOSYSTEM

FIGURE 16 1-DECENE MARKET: ECOSYSTEM

5.9 CASE STUDIES

5.10 1-DECENE MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 17 MARKET SIZE IN TERMS OF REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

5.10.1 NON-COVID-19 SCENARIO

5.10.2 OPTIMISTIC SCENARIO

5.10.3 PESSIMISTIC SCENARIO

5.10.4 REALISTIC SCENARIO

5.11 AVERAGE SELLING PRICE TREND

TABLE 11 AVERAGE PRICES OF 1-DECENE, BY REGION, 2018-2025 (USD/KG)

TABLE 12 AVERAGE PRICES OF 1-DECENE, BY DERIVATIVE AND REGION, 2019 (USD/KG)

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATIONS RELATED TO 1-DECENE

5.13 TRADE DATA STATISTICS

5.13.1 IMPORT OF 1-DECENE: INDIA

5.13.2 IMPORT OF 1-DECENE: RUSSIA

5.14 PATENT ANALYSIS

5.14.1 APPROACH

5.14.2 DOCUMENT TYPE

FIGURE 18 PATENTS REGISTERED FOR 1-DECENE, 2015-2020

FIGURE 19 PATENTS PUBLICATION TRENDS FOR 1-DECENE, 2015-2020

5.14.3 JURISDICTION ANALYSIS

FIGURE 20 MAXIMUM PATENTS FILED BY COMPANIES IN THE US BETWEEN 2015 AND 2020

5.14.4 TOP APPLICANTS

FIGURE 21 LG CHEMICAL LTD. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2015 AND 2020

5.15 COVID-19 IMPACT

5.15.1 INTRODUCTION

5.15.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COUNTRY-WISE SPREAD OF COVID-19

5.15.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.15.3.1 Impact of COVID-19 on the Economy: Scenario Assessment

FIGURE 24 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 25 SCENARIOS OF COVID-19 IMPACT

5.16 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 1-DECENE MARKET, BY DERIVATIVE (Page No. - 81)

6.1 INTRODUCTION

FIGURE 26 POLYALPHAOLEFINS TO CONTINUE LEADING 1-DECENE MARKET DURING FORECAST PERIOD

TABLE 13 MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 14 MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 15 MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 16 MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

6.1.1 POLYALPHAOLEFINS

TABLE 17 POLYALPHAOLEFINS: 1-DECENE MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 18 POLYALPHAOLEFINS: MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 19 POLYALPHAOLEFINS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 POLYALPHAOLEFINS: MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

6.1.1.1 Synthetic Lubricants

6.1.1.2 Others

6.1.2 OXO ALCOHOLS

TABLE 21 OXO ALCOHOLS: 1-DECENE MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 22 OXO ALCOHOLS: SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 23 OXO ALCOHOLS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 OXO ALCOHOLS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

6.1.2.1 Detergent alcohols

6.1.2.2 Plasticizer alcohols

6.1.3 OTHERS

TABLE 25 OTHERS: 1-DECENE MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 26 OTHERS: MARKET SIZE, BY REGION, 2020-2025 (KILOTON)

TABLE 27 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 OTHERS: MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7 1-DECENE MARKET, BY REGION (Page No. - 91)

7.1 INTRODUCTION

TABLE 29 1-DECENE MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 30 MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 31 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

7.2 NORTH AMERICA

FIGURE 27 NORTH AMERICAN 1-DECENE MARKET: SNAPSHOT

7.2.1 BY DERIVATIVE

7.2.1.1 PAOs to be the largest derivative of 1-Decene in North America

TABLE 33 NORTH AMERICA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.2.2 BY COUNTRY

7.2.2.1 US to be the largest 1-Decene market in North America

TABLE 37 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

7.2.2.2 US

7.2.2.2.1 Presence of leading players and increasing production of PAOs to propel market growth

TABLE 41 US: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 42 US: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 43 US: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 44 US: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.2.2.3 Canada

7.2.2.3.1 Growing automotive and industrial sectors along with oil & gas sectors to increase demand for 1-Decene

TABLE 45 CANADA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 46 CANADA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 47 CANADA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 48 CANADA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.2.2.4 Mexico

7.2.2.4.1 Growing demand for oxo alcohols to boost 1-Decene market

TABLE 49 MEXICO: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 50 MEXICO: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 51 MEXICO: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 52 MEXICO: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3 EUROPE

FIGURE 28 EUROPE: 1-DECENE MARKET SNAPSHOT

7.3.1 BY DERIVATIVE

7.3.1.1 PAOs to be the largest derivative of 1-Decene

TABLE 53 EUROPE: MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 54 EUROPE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 55 EUROPE: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 56 EUROPE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3.2 BY COUNTRY

7.3.2.1 France to lead the 1-Decene market in Europe

TABLE 57 EUROPE: 1-DECENE MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 58 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 59 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

7.3.2.2 France

7.3.2.2.1 Increasing production and demand for PAOs in the country to drive market

TABLE 61 FRANCE: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 62 FRANCE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 63 FRANCE: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 64 FRANCE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3.2.3 Belgium

7.3.2.3.1 Presence of Chevron Phillips Chemical and INEOS to increase demand for 1-Decene

TABLE 65 BELGIUM: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 66 BELGIUM: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 67 BELGIUM: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 68 BELGIUM: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3.2.4 Germany

7.3.2.4.1 Growing demand for oxo alcohols in the country to drive demand for 1-Decene

TABLE 69 GERMANY: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 70 GERMANY: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 71 GERMANY: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 72 GERMANY: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3.2.5 Netherlands

7.3.2.5.1 Increasing demand for PAO-based lubricants to propel market growth

TABLE 73 NETHERLANDS: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 74 NETHERLANDS: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 75 NETHERLANDS: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 76 NETHERLANDS: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3.2.6 UK

7.3.2.6.1 Increasing demand for oxo alcohols to drive the demand for 1-Decene

TABLE 77 UK: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 78 UK: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 79 UK: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 80 UK: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3.2.7 Russia

7.3.2.7.1 Strong oil & gas sector to support 1-Decene market growth

TABLE 81 RUSSIA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 82 RUSSIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 83 RUSSIA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 84 RUSSIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.3.2.8 Rest of Europe

TABLE 85 REST OF EUROPE: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 86 REST OF EUROPE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 87 REST OF EUROPE: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 88 REST OF EUROPE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4 APAC

7.4.1 BY DERIVATIVE

7.4.1.1 PAOs to be the largest derivative of 1-Decene in APAC

TABLE 89 APAC: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 90 APAC: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 91 APAC: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 92 APAC: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4.2 BY COUNTRY

7.4.2.1 China to lead the 1-Decene market in APAC

TABLE 93 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 94 APAC: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 95 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 96 APAC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

7.4.2.2 China

7.4.2.2.1 Strong automotive and manufacturing sectors to increase demand for 1-Decene

TABLE 97 CHINA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 98 CHINA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 99 CHINA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 100 CHINA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4.2.3 Japan

7.4.2.3.1 Large automotive sector to drive the market

TABLE 101 JAPAN: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 102 JAPAN: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 103 JAPAN: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 104 JAPAN: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4.2.4 Malaysia

7.4.2.4.1 Increasing demand for plasticizers to boost market growth

TABLE 105 MALAYSIA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 106 MALAYSIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 107 MALAYSIA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 108 MALAYSIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4.2.5 India

7.4.2.5.1 Growing demand for plasticizers and surfactants to drive market

TABLE 109 INDIA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 110 INDIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 111 INDIA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 112 INDIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4.2.6 Indonesia

7.4.2.6.1 Growing oxo alcohol segment to propel market growth

TABLE 113 INDONESIA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 114 INDONESIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 115 INDONESIA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 116 INDONESIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4.2.7 Singapore

7.4.2.7.1 Powerful mix of refining, olefins production, and chemicals manufacturing to drive market

TABLE 117 SINGAPORE: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 118 SINGAPORE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 119 SINGAPORE: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 120 SINGAPORE: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.4.2.8 Rest of APAC

TABLE 121 REST OF APAC: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 122 REST OF APAC: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 123 REST OF APAC: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 124 REST OF APAC: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.5 MIDDLE EAST & AFRICA

7.5.1 BY DERIVATIVE

7.5.1.1 Oxo alcohols to be the largest derivative of 1-Decene in Middle East & Africa

TABLE 125 MIDDLE EAST & AFRICA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 126 MIDDLE EAST & AFRICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 127 MIDDLE EAST & AFRICA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.5.2 BY COUNTRY

7.5.2.1 Saudi Arabia to be the largest market for 1-Decene in Middle East & Africa

TABLE 129 MIDDLE EAST & AFRICA: 1-DECENE MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 130 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

7.5.2.2 Saudi Arabia

7.5.2.2.1 Increasing demand for detergent alcohols and plasticizer alcohols to drive market

TABLE 133 SAUDI ARABIA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 134 SAUDI ARABIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 135 SAUDI ARABIA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 136 SAUDI ARABIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.5.2.3 South Africa

7.5.2.3.1 Growing petrochemical production in the country to increase demand for 1-Decene

TABLE 137 SOUTH AFRICA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 138 SOUTH AFRICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 139 SOUTH AFRICA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 140 SOUTH AFRICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.5.2.4 Turkey

7.5.2.4.1 Combination of large-scale investments and an increase in manufacturing and infrastructure activities

TABLE 141 TURKEY: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 142 TURKEY: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 143 TURKEY: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 144 TURKEY: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.5.2.5 Iran

7.5.2.5.1 Growing manufacturing, construction, energy, and petrochemicals sectors

TABLE 145 IRAN: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 146 IRAN: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 147 IRAN: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 148 IRAN: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.5.2.6 Rest of the Middle East & Africa

TABLE 149 REST OF MIDDLE EAST & AFRICA: 1-DECENE MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 150 REST OF MIDDLE EAST & AFRICA: SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 151 REST OF MIDDLE EAST & AFRICA: SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 152 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.6 SOUTH AMERICA

7.6.1 BY DERIVATIVE

7.6.1.1 Oxo alcohols to be the largest derivative of 1-Decene in South America

TABLE 153 SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 154 SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 155 SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 156 SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.6.2 BY COUNTRY

7.6.2.1 Brazil to be the largest market for 1-Decene in South America

TABLE 157 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 158 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

7.6.2.2 Brazil

7.6.2.2.1 Investments in the building & construction, manufacturing, and oil & gas sectors

TABLE 161 BRAZIL: MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 162 BRAZIL: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 163 BRAZIL: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 164 BRAZIL: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.6.2.3 Argentina

7.6.2.3.1 Growing industrial sector to drive the demand for 1-Decene

TABLE 165 ARGENTINA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 166 ARGENTINA: MARKET SIZE, BY DERIVATIVE,2020–2025 (KILOTON)

TABLE 167 ARGENTINA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 168 ARGENTINA: MARKET SIZE, BY DERIVATIVE,2020–2025 (USD MILLION)

7.6.2.4 Colombia

7.6.2.4.1 Rising demand for oxo alcohols to boost demand for 1-Decene

TABLE 169 COLOMBIA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 170 COLOMBIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 171 COLOMBIA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 172 COLOMBIA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

7.6.2.5 Rest of South America

TABLE 173 REST OF SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (KILOTON)

TABLE 174 REST OF SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (KILOTON)

TABLE 175 REST OF SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2016–2019 (USD MILLION)

TABLE 176 REST OF SOUTH AMERICA: MARKET SIZE, BY DERIVATIVE, 2020–2025 (USD MILLION)

8 COMPETITIVE LANDSCAPE (Page No. - 160)

8.1 OVERVIEW

FIGURE 29 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY, 2016–2020

8.2 MARKET SHARE OF MAJOR PLAYERS

FIGURE 30 MARKET SHARE ANALYSIS, KEY PLAYERS, 2019

8.2.1 ROYAL DUTCH SHELL

8.2.2 CHEVRON PHILLIPS CHEMICAL COMPANY

8.2.3 INEOS

8.2.4 EXXON MOBIL CORPORATION

8.3 RANKING OF KEY MARKET PLAYERS, 2019

FIGURE 31 RANKING OF TOP FIVE PLAYERS IN THE 1-DECENE MARKET, 2019

8.4 COMPETITIVE BENCHMARKING

TABLE 177 BRAND INFLUENCE ON 1-DECENE MARKET

8.5 COMPANY EVALUATION MATRIX, 2019

8.5.1 STARS

8.5.2 EMERGING LEADERS

FIGURE 32 1-DECENE MARKET: COMPANY EVALUATION MATRIX, 2019

8.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 33 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN 1-DECENE MARKET

8.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 34 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN 1-DECENE MARKET

8.8 STARTUP AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2019

8.8.1 RESPONSIVE COMPANIES

8.8.2 STARTING BLOCKS

FIGURE 35 1-DECENE MARKET: START-UP AND SMES EVALUATION MATRIX, 2019

8.9 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 36 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN 1-DECENE MARKET (START-UP)

8.10 BUSINESS STRATEGY EXCELLENCE

FIGURE 37 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN IN 1-DECENE MARKET (START-UP)

8.11 COMPETITIVE SITUATION AND TRENDS

8.11.1 EXPANSION

TABLE 178 EXPANSION, 2016–2020

8.11.2 JOINT VENTURE

TABLE 179 JOINT VENTURE, 2016–2020

8.11.3 INVESTMENT

TABLE 180 INVESTMENT, 2016–2020

8.11.4 AGREEMENT

TABLE 181 AGREEMENT, 2016–2020

8.11.5 MERGER

TABLE 182 MERGER, 2016–2020

8.11.6 CONTRACT

TABLE 183 CONTRACT, 2016–2020

9 COMPANY PROFILES (Page No. - 172)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

9.1 ROYAL DUTCH SHELL

FIGURE 38 ROYAL DUTCH SHELL: COMPANY SNAPSHOT

FIGURE 39 ROYAL DUTCH SHELL: WINNING IMPERATIVES

9.2 INEOS

FIGURE 40 INEOS: COMPANY SNAPSHOT

FIGURE 41 INEOS: WINNING IMPERATIVES

9.3 CHEVRON PHILLIPS CHEMICAL COMPANY LLC

FIGURE 42 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: COMPANY SNAPSHOT

FIGURE 43 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: WINNING IMPERATIVES

9.4 SABIC

FIGURE 44 SABIC: COMPANY SNAPSHOT

FIGURE 45 SABIC: WINNING IMPERATIVES

9.5 EXXON MOBIL CORPORATION

FIGURE 46 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

FIGURE 47 EXXON MOBIL CORPORATION: WINNING IMPERATIVES

9.6 QATAR CHEMICAL COMPANY II LTD.

9.7 IDEMITSU KOSAN CO., LTD.

FIGURE 48 IDEMITSU KOSAN CO., LTD.: COMPANY SNAPSHOT

9.8 PJSC NIZHNEKAMSKNEFTEKHIM

FIGURE 49 PJSC NIZHNEKAMSKNEFTEKHIM: COMPANY SNAPSHOT

9.9 ALFA AESAR

9.1 MERCK GROUP

FIGURE 50 MERCK GROUP: COMPANY SNAPSHOT

9.11 OTHER KEY MARKET PLAYERS

9.11.1 GELEST INC.

9.11.2 ANGENE CHEMICALS

9.11.3 SPECTRUM CHEMICAL MFG. CORP.

9.11.4 TOKYO CHEMICAL INDUSTRY COMPANY LIMITED

9.11.5 TORONTO RESEARCH CHEMICALS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

10 ADJACENT & RELATED MARKETS (Page No. - 195)

10.1 INTRODUCTION

10.2 LIMITATIONS

10.3 ALPHA OLEFINS MARKET

10.3.1 MARKET DEFINITION

10.3.2 MARKET OVERVIEW

10.3.3 ALPHA OLEFINS MARKET, BY TYPE

TABLE 184 ALPHA OLEFINS MARKET, BY TYPE, 2015–2022 (KILOTON)

TABLE 185 ALPHA OLEFINS MARKET, BY TYPE, 2015–2022 (USD MILLION)

10.3.4 1-DECENE MARKET, BY APPLICATION

TABLE 186 ALPHA OLEFINS MARKET, BY APPLICATION, 2015–2022 (KILOTON)

TABLE 187 ALPHA OLEFINS MARKET, BY APPLICATION, 2015–2022 (USD MILLION)

10.3.5 1-DECENE MARKET, BY REGION

TABLE 188 ALPHA OLEFINS MARKET, BY REGION, 2015–2022 (KILOTON)

TABLE 189 ALPHA OLEFINS MARKET, BY REGION, 2015–2022 (USD MILLION)

11 APPENDIX (Page No. - 200)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

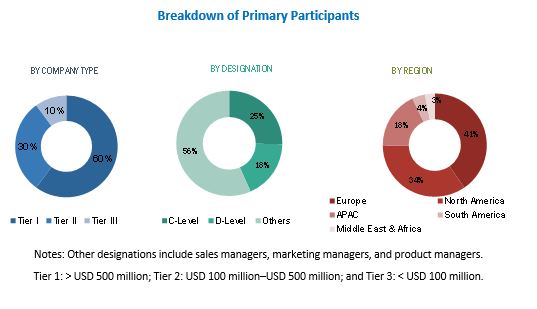

The study involved four major activities in estimating the market size for 1-Decene market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The 1-Decene market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in lubricants, and plasticizers industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the 1-Decene market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of both value and volume , were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the 1-Decene.

Report Objectives

- To analyze and forecast the size of the 1-Decene market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges and opportunities influencing the growth of the market

- To define, describe, and segment the 1-Decene market based on derivative

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional derivative type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 1-Decene Market