Pet Food Processing Market by Type (Mixing & Blending Equipment, Forming Equipment, Baking & Drying Equipment, Cooling Equipment, Coating Equipment), Form (Dry, Wet), Application (Dog Food, Cat Food, Fish Food), and Region - Global Forecast to 2026

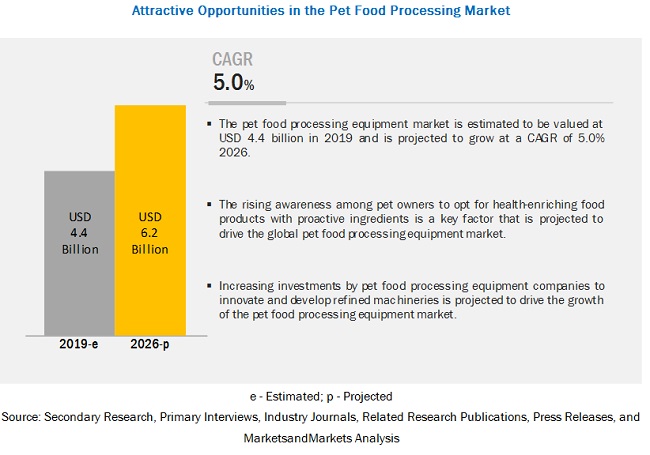

[168 Pages Report] The global pet food processing market size is valued to grow from USD 4.4 billion in 2019 to USD 6.2 billion by 2026, recording a CAGR of 5.0% during the forecast period. The increasing trend of product premiumization among pet food manufacturers and the rising acceptance of pets across regions are factors that are projected to contribute to the growth of the market during the forecast period. Furthermore, the increasing consumer trends related to pet food products, such as the increasing preference for high-quality commercial pet food products, are projected to encourage processing equipment manufacturers to opt for specialized and innovative machinery for pet food production. These factors are projected to drive the market growth.

The dog food segment is estimated to account for the largest share in 2019 in the market.

The dog food segment is estimated to dominate the pet food processing market, on the basis of application, in terms of value, in 2019. Dog food is witnessing increased demand due to the increasing dog population across regions. The increasing trend of pet humanization has also encouraged dog owners to accept them as companions due to their friendliness, which is projected to drive the demand for premium dog food products, thus contributing to the growth of the overall market.

The dry segment is projected to account for the largest share during the forecast period.

Dry pet food production is increasing, and its sales are projected to remain high in developing countries, such as China, Russia, and Poland. The demand for dry pet food products is increasing due to the cost-effectiveness of dry form, convenience in handling, and ease of purchasing in bulk. In addition, with the increase use of extrusion technologies, dry pet food production remains high. These factors are projected to drive the demand for pet food processing solutions.

The forming equipment segment in the pet food processing market is projected to dominate the market in 2019.

The forming equipment segment is estimated to dominate the pet food processing market in 2019. Pet food processors are shifting their focus toward extrusion-based manufacturing. The introduction of new extrusion technologies and its use in the pet food sector are factors that are projected to drive the demand for forming equipment in the market.

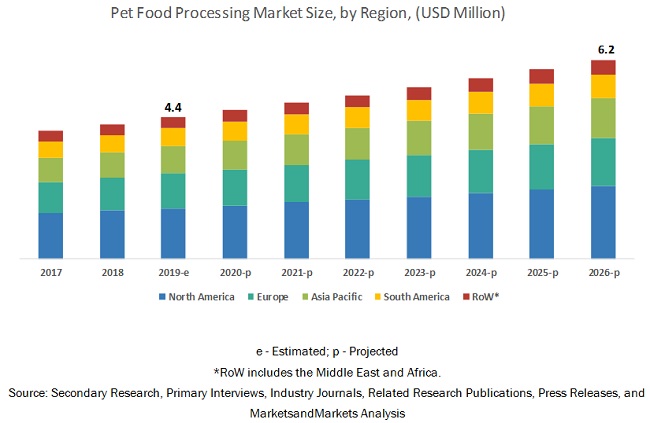

North America is projected to account for the largest share in the market during the forecast period.

The North American market is projected to account for the largest share in 2026. The dominance of the market in this region is attributed to factors such as the increasing trend of adopting pets as a family member, which leads to a significant rise in the pet population, thereby driving the demand for pet food products. Companies such as Middleby Corporation (US), Mepaco Group (US), and Reading Bakery Systems (US), are the key players operating in this market and focus on catering to the demands of pet food processors in North America. The rising awareness among pet owners has led to an increased inclination of manufacturers to comply with the highest food safety standards, thereby encouraging the growth of the market in North America.

Key Market Players

Key vendors operating in the global market include Andritz Group (Austria), Buhler Holding AG (Switzerland), The Middleby Corporation (US), GEA Group (Germany), Baker Perkins Ltd. (UK), Clextral SAS (France), Precision Food Innovations (US), Mepaco Group (US), Coperion GMBH (Germany), F.N. Smith Corporation (US), Reading Bakery Systems (US), and Selo (Netherlands). These players have broad industry coverage and high operational and financial strength.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Application, Form, Type, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered (20 companies) |

Andritz Group (Austria), Buhler Holding AG (Switzerland), The Middleby Corporation (US), GEA Group (Germany), Baker Perkins Ltd. (UK), Clextral SAS (France), Precision Food Innovations (US), Mepaco Group (US), Coperion GMBH (Germany), F.N. Smith Corporation (US), Reading Bakery Systems (US), Selo (Netherlands), Automated Process Equipment Corporation (APEC) (US), Gold Peg International (US), Probake Inc. (US), Jinan Darin Machinery Co. Ltd. (China), Jinan Qunlong Machinery Co. Ltd. (China), Probake Inc. (US), Fusion Tech Integrated, Inc. (US), Scansteel Foodtech (Denmark), and Jinan Bright Machinery Co. Ltd. (China) |

This research report categorizes the pet food processing market based on application, form, function, and region.

Based on Application, the market has been segmented as follows:

- Dog food

- Cat food

- Fish food

- Other applications (pet food for tortoises, rabbits, and ornamental birds)

Based on Form, the market has been segmented as follows:

- Dry

- Wet

Based on the Type, the market has been segmented as follows:

- Mixing & blending equipment

- Forming equipment

- Baking & drying equipment

- Coating equipment

- Cooling equipment

- Other types (vacuum pumping and stuffing machines)

Based on the Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East and Africa)

Key questions addressed by the report:

- Who are the major market players in the pet food processing equipment market?

- What are the regional growth trends and the largest revenue-generating regions for the pet food processing market?

- What are the major applications of pet food processing solutions that are projected to account for a major revenue share during the forecast period?

- What are the major forms in which pet food is being processed? Which form is projected to dominate the market during the forecast period?

- What are the major types of equipment used for production in the pet food industry, and which type is projected to account for the largest share during the forecast period?

Frequently Asked Questions (FAQ):

Does the market include the analysis for processed pet food products?

The scope of this study is confined to processing equipment only such as:

- Mixing & blending equipment

- Forming equipment

- Baking & drying equipment

- Coating equipment

- Cooling equipment

- Other types (vacuum pumping and stuffing machines)

- It does not cover processed products.

We need further bifurcation of the market by key countries in the South East Asian region.

MnM can offer you the required details. Please provide us details about your focused segments.

Can you explain the Competitive Leadership Mapping covered in the report?

The Competitive Leadership Mapping is positioning of market players in the micro quadrant based on strength of product offering and strength of business portfolio. It includes:

- Visionary Leaders

- Innovators

- Dynamic Differentiators

- Emerging Companies

Which companies have been included in this study?

The study comprises of top 20 companies operating in the pet food processing market. Following are the top 5 companies included:

- Buhler AG

- Andritz Group

- The Middleby Corporation

- GEA Group

- Baker Perkins LTD.

What is the leading application in the pet food processing market?

The dog food segment was the highest revenue contributor to the market, with USD 2,290.2 million in 2019, and is estimated to reach USD 3,319.4 million by 2026, with a CAGR of 5.4%. The cat food segment is estimated to reach USD 2,057.5 million by 2026, at a significant CAGR of 4.8% during the forecast period.

What is the estimated industry size of pet food processing?

The global pet food processing market was valued at USD 4,379.9 million in 2019, and is projected to reach USD 6,150.6 million by 2026, registering a CAGR of 5.0% from 2019 to 2026.

What is the CAGR of pet food processing market?

The global pet food processing market registered a CAGR of 5.0% from 2019 to 2026. The forming equipment segment was the highest revenue contributor to the market, with USD 1,678.0 million in 2019, and is estimated to reach USD 2,438.3 million by 2026, with a CAGR of 5.5%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Pet Food Processing Equipment Market Size Estimation - Method 1

2.2.2 Pet Food Processing Equipment Market Size Estimation - Method 2

2.2.3 Pet Food Processing Equipment Market Size Estimation Notes

2.3 Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Growth Opportunities in the Pet Food Processing Equipment Market

4.2 Pet Food Processing Equipment Market, By Form, 2018

4.3 North America: Pet Food Processing Equipment Market, By Key Application and Country

4.4 Pet Food Processing Equipment Market, By Type and Region, 2018

4.5 Pet Food Processing Equipment Market, By Key Country, 2018

5 Pet Food Processing Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Premiumization Across the Pet Food Category

5.2.1.2 Rising Acceptance of Pets

5.2.1.3 Rising Awareness Among Pet Owners to Use Healthy Food With Proactive Ingredients

5.2.1.4 Growing Investments By Pet Food Processing Equipment Companies

5.2.1.5 Growing Demand for Extruded Products

5.2.2 Restraints

5.2.2.1 Depreciating Processing Capability of Equipment Used for Pet Food Processing

5.2.3 Opportunities

5.2.3.1 New Technologies Being Used in the Pet Food Processing Industry

5.2.3.2 Reintroducing the Concept of Convenience Food Through Supermarkets and Hypermarkets Will Help Boost the Pet Food Processing and Equipment Industry

5.2.4 Challenges

5.2.4.1 Presence of Various Regulations in the Pet Food Processing Industry

5.3 Pet Food Processing Flowchart

5.4 Patent Analysis

5.5 Regulations

5.6 YC and YCC Shift

6 Pet Food Processing Market, By Type (Page No. - 48)

6.1 Introduction

6.2 Mixing & Blending Equipment

6.2.1 Application of New and Innovative Ingredients Will Promote the Usage of Mixing & Blending Equipment

6.3 Forming Equipment

6.3.1 New Extrusion Technologies in Pet Food Processing Driving the Market for Forming Equipment

6.4 Baking & Drying Equipment

6.4.1 Necessity of Baking Pet Food Treats to Enhance the Taste Will Drive the Market Growth of Baking & Drying Equipment

6.5 Coating Equipment

6.5.1 Application of New Colorants to Enhance the Attractiveness of Pet Food

6.6 Cooling Equipment

6.6.1 Application of Animal-Based Products for the Formation of Pet Food Makes Cooling Equipment Essential for the Market

6.7 Other Types

6.7.1 Proper Processing of Pet Food is Required to Deliver the Desired Results, Which Help the Usage of Stuffing Or Pumping Equipment in Pet Food Processing

7 Pet Food Processing Market, By Form (Page No. - 57)

7.1 Introduction

7.2 Dry

7.2.1 Consumer Preferences have Evolved Owing to the Convenience and Cost-Effectiveness of Dry Food

7.3 Wet

7.3.1 Growing Demand for Premium Pet Food Will Drive the Overall Pet Food Processing Equipment Market

8 Pet Food Processing Market, By Application (Page No. - 61)

8.1 Introduction

8.2 Dog Food

8.2.1 Growing Pet Humanization Will Drive the Market

8.3 Cat Food

8.3.1 Increasing Trend of Premiumization of Pet Food Will Drive the Market Growth

8.4 Fish Food

8.4.1 Cost-Effectiveness of Fish Food Will Drive Its Growth in the Coming Years

8.5 Other Applications

8.5.1 Changing Consumer Lifestyles and Rising Disposable Income Will Drive Market Growth

9 Pet Food Processing Market, By Region (Page No. - 67)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Large Export Base and the Growing Consumer Demand for Innovative Pet Products to Create Growth Opportunities for Pet Food Processing Equipment Manufacturers

9.2.2 Canada

9.2.2.1 Increase in Demand for Premium Pet Food Products to Drive the Growth of the Market in Canada

9.2.3 Mexico

9.2.3.1 Increasing Disposable Income in Mexico to Drive the Market Positively

9.3 Europe

9.3.1 Germany

9.3.1.1 Increasing Pet Food Sales have Contributed to the Growth of the Pet Food Processing Equipment Market in Europe

9.3.2 France

9.3.2.1 Product Premiumization Trend to Drive the Market Growth for Pet Food Processing Equipment in the Country

9.3.3 UK

9.3.3.1 Increasing Demand for Pet Treats With New Ingredients to Drive the Market Growth for Pet Food Processing Equipment in the UK

9.3.4 Italy

9.3.4.1 Increasing Consumer Trend of Treating Pets as A Family Member to Drive the Growth of the Pet Food Category and the Related Processing Equipment Industry

9.3.5 Spain

9.3.5.1 Introduction of New Ingredients in the Pet Food Category to Drive the Demand for Pet Food Processing Equipment in the Country

9.3.6 Russia

9.3.6.1 The Increasing Need for New Processing Solutions in the Specialty Pet Food Category to Drive the Demand for Pet Food Equipment in the Country

9.3.7 Rest of Europe

9.3.7.1 Changing Consumer Preference for High-Quality Pet Food Variety to Drive the Market for Pet Food Processing Equipment

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Increasing Investments and the Expansion of Pet Food Processing and Equipment Companies to Drive the Market Growth

9.4.2 India

9.4.2.1 Cost-Effectiveness and the High Demand for Dry Pet Food Products to Drive the Growth of Dry Pet Food Processing Equipment

9.4.3 Japan

9.4.3.1 The Usage of Premium and Specialized Ingredients for Producing Pet Food and Treats to Drive the Growth of the Pet Food Processing Equipment Market

9.4.4 Thailand

9.4.4.1 The Growth of the Retail Sector to Drive the Growth of the Pet Food Processing Equipment Market Due to the Increasing Demand for Pet Food

9.4.5 Philippines

9.4.5.1 The Increase in Pet Ownership and the Need for Improved Pet Diets to Drive the Growth of the Pet Food Processing Equipment Market

9.4.6 Australia & New Zealand

9.4.6.1 The Demand for Specialized Products With A Low Environmental Impact to Drive the Demand for Customized Pet Food Equipment

9.4.7 Rest of Asia Pacific

9.4.7.1 The Growth of the Pet Food Sector to Drive the Growth of the Pet Food Processing Equipment Market

9.5 South America

9.5.1 Brazil

9.5.1.1 Increase in Pet Food Sales to Drive the Pet Food Processing Equipment Market in Brazil

9.5.2 Argentina

9.5.2.1 The Increasing Trend of Opting for Premium-Quality Products to Drive the Market Growth for Pet Food Processing Equipment in the Country

9.5.3 Chile

9.5.3.1 Increasing Demand for Pet Treats With New Ingredients to Drive the Market Growth for Pet Food Processing Equipment in Chile

9.5.4 Rest of South America

9.5.4.1 Changing Consumer Expectations to Drive the Market for Pet Food Processing Equipment

9.6 Rest of the World

9.6.1 Middle East

9.6.1.1 Rising Demand for Customized Food Products for Different Breeds of Pets is Projected to Drive the Demand for Pet Food Processing Equipment

9.6.2 Africa

9.6.2.1 Increasing Trend of Pet Humanization is Projected to Drive the Growth of the Pet Food Processing Equipment Market in Africa

10 Competitive Landscape (Page No. - 115)

10.1 Overview

10.2 Competitive Leadership Mapping

10.2.1 Dynamic Differentiators

10.2.2 Innovators

10.2.3 Visionary Leaders

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio

10.3.2 Business Strategy Excellence

10.4 Competitive Scenario

10.4.1 Expansions & Investments

10.4.2 New Product Launches

10.4.3 Mergers & Acquisitions

10.4.4 Agreements, Joint Ventures, and Partnerships

10.5 Competitive Leadership Mapping (Startup/SME)

10.5.1 Progressive Companies

10.5.2 Starting Blocks

10.5.3 Responsive Companies

10.5.4 Dynamic Companies

10.6 Competitive Benchmarking

10.6.1 Strength of Product Portfolio

10.6.2 Business Strategy Excellence

11 Company Profiles (Page No. - 126)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & Right to Win)*

11.1 Andritz Group

11.2 Buhler Holding AG

11.3 The Middleby Corporation

11.4 GEA Group

11.5 Baker Perkins LTD.

11.6 Clextral SAS

11.7 Precision Food Innovations

11.8 Mepaco Group

11.9 Coperion GmbH

11.10 F.N. Smith Corporation

11.11 Reading Bakery Systems

11.12 Selo

11.13 Gold Peg International Pty LTD.

11.14 Jinan Darin Machinery Co. LTD.

11.15 Probake

11.16 Fusion Tech Integrated, Inc.

11.17 Automated Process Equipment Corporation (APEC)

11.18 Scansteel Foodtech

11.19 Jinan Bright Machinery Co. LTD.

11.20 Jinan Qunlong Machinery Co. LTD.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & Right to Win Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 161)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (111 Tables)

Table 1 USD Exchange Rates, 2014–2018

Table 2 Pet Food Processing Market Snapshot, 2019 vs 2026

Table 3 List of Important Patents for Pet Food Processing, 2013–2018

Table 4 Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 5 Mixing & Blending Equipment: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 6 Forming Equipment: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 7 Baking & Drying Equipment: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 8 Coating Equipment: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 9 Cooling Equipment: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 10 Other Types: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 11 Pet Food Processing Market Size, By Form, 2017–2026 (USD Million)

Table 12 Dry: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 13 Wet: Market for Pet Food Processing Size, By Region, 2017–2026 (USD Million)

Table 14 Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 15 Dog Food: Market for Pet Food Processing Size, By Region, 2017–2026 (USD Million)

Table 16 Cat Food: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 17 Fish Food: Market for Pet Food Processing Size, By Region, 2017–2026 (USD Million)

Table 18 Other Applications: Pet Food Processing Equipment Market Size, By Region, 2017–2026 (USD Million)

Table 19 North America: Market for Pet Food Processing Size, By Country, 2017–2026 (USD Million)

Table 20 North America: Market for Pet Food Processing Size, By Type, 2017–2026 (USD Million)

Table 21 North America: Pet Food Processing Market Size, By Form, 2017–2026 (USD Million)

Table 22 North America: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 23 US: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 24 US: Market for Pet Food Processing Size, By Form, 2017–2026 (USD Million)

Table 25 US: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 26 Canada: Pet Food Processing Market Size, By Type, 2017–2026 (USD Million)

Table 27 Canada: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 28 Canada: Market for Pet Food Processing Size, By Application, 2017–2026 (USD Million)

Table 29 Mexico: Market for Pet Food Processing Size, By Type, 2017–2026 (USD Million)

Table 30 Mexico: Market for Pet Food Processing Size, By Form, 2017–2026 (USD Million)

Table 31 Mexico: Pet Food Processing Market Size, By Application, 2017–2026 (USD Million)

Table 32 Europe: Pet Food Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 33 Europe: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 34 Europe: Market for Pet Food Processing Size, By Form, 2017–2026 (USD Million)

Table 35 Europe: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 36 Germany: Pet Food Processing Market Size, By Type, 2017–2026 (USD Million)

Table 37 Germany: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 38 Germany: Market for Pet Food Processing Size, By Application, 2017–2026 (USD Million)

Table 39 France: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 40 France: Market for Pet Food Processing Size, By Form, 2017–2026 (USD Million)

Table 41 France: Market for Pet Food Processing Size, By Application, 2017–2026 (USD Million)

Table 42 UK: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 43 UK: Pet Food Processing Market Size, By Form, 2017–2026 (USD Million)

Table 44 UK: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 45 Italy: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 46 Italy: Market for Pet Food Processing Size, By Form, 2017–2026 (USD Million)

Table 47 Italy: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 48 Spain: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 49 Spain: Pet Food Processing Market Size, By Form, 2017–2026 (USD Million)

Table 50 Spain: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 51 Russia: Market for Pet Food Processing Size, By Type, 2017–2026 (USD Million)

Table 52 Russia: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 53 Russia: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 54 Rest of Europe: Market for Pet Food Processing Size, By Type, 2017–2026 (USD Million)

Table 55 Rest of Europe: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 56 Rest of Europe: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 57 Asia Pacific: Pet Food Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 58 Asia Pacific: Pet Food Processing Market Size, By Type, 2017–2026 (USD Million)

Table 59 Asia Pacific: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 60 Asia Pacific: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 61 China: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 62 China: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 63 China: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 64 India: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 65 India: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 66 India: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 67 Japan: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 68 Japan: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 69 Japan: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 70 Thailand: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 71 Thailand: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 72 Thailand: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 73 Philippines: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 74 Philippines: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 75 Philippines: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 76 Australia & New Zealand: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 77 Australia & New Zealand: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 78 Australia & New Zealand: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 79 Rest of Asia Pacific: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 80 Rest of Asia Pacific: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 81 Rest of Asia Pacific: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 82 South America: Pet Food Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 83 South America: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 84 South America: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 85 South America: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 86 Brazil: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 87 Brazil: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 88 Brazil: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 89 Argentina: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 90 Argentina: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 91 Argentina: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 92 Chile: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 93 Chile: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 94 Chile: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 95 Rest of South America: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 96 Rest of South America: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 97 Rest of South America: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 98 Rest of the World: Pet Food Processing Equipment Market Size, By Country, 2017–2026 (USD Million)

Table 99 Rest of the World: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 100 Rest of the World: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 101 Rest of the World: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 102 Middle East: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 103 Middle East: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 104 Middle East: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 105 Africa: Pet Food Processing Equipment Market Size, By Type, 2017–2026 (USD Million)

Table 106 Africa: Pet Food Processing Equipment Market Size, By Form, 2017–2026 (USD Million)

Table 107 Africa: Pet Food Processing Equipment Market Size, By Application, 2017–2026 (USD Million)

Table 108 Expansions & Investments, 2016–2019

Table 109 New Product Launches, 2016–2019

Table 110 Mergers & Acquisitions, 2016–2019

Table 111 Agreements, Joint Ventures, and Partnerships, 2016–2019

List of Figures (36 Figures)

Figure 1 Pet Food Processing Equipment: Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Pet Food Processing Equipment Market: Research Design

Figure 4 Data Triangulation Methodology

Figure 5 Pet Food Processing Equipment Market Size, By Type, 2019 vs 2026 (USD Million)

Figure 6 Pet Food Processing Equipment Market Size, By Form, 2019 vs 2026 (USD Million)

Figure 7 Pet Food Processing Equipment Market Size, By Application, 2019 vs 2026 (USD Million)

Figure 8 Pet Food Processing Equipment Market Share & Growth (Value), By Region, 2018

Figure 9 Product Premiumization in the Pet Food Category to Drive the Pet Food Processing Equipment Market

Figure 10 Dry Segment Accounted for A Larger Share in the Pet Food Processing Equipment Market

Figure 11 North America: High Adoption of Innovative Pet Food Processing Equipment in the Us

Figure 12 North America Accounted for the Largest Share in the Pet Food Processing Equipment Market in 2018

Figure 13 US Accounted for the Largest Market Share in 2018

Figure 14 Pet Food Processing Equipment Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Number of US Households That Own A Pet, By Animal, 2019 (USD Million)

Figure 16 Number of Patents Approved for Pet Food Processing, By Applicant, 2018–2019

Figure 17 Pet Food Processing Equipment Market Size, By Type, 2019 vs 2026 (USD Million)

Figure 18 Pet Food Processing Equipment Market Size, By Form, 2019 vs 2026 (USD Million)

Figure 19 Pet Food Processing Equipment Market Size, By Application, 2019 vs 2026 (USD Million)

Figure 20 Number of US Households That Own Pets

Figure 21 China and India to Witness Significant Growth in the Pet Food Processing Equipment Market (2019–2026)

Figure 22 North America: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Pet Food Processing Equipment Market: Competitive Leadership Mapping, 2018

Figure 25 Key Developments of Leading Players in the Pet Food Processing Equipment Market, 2016–2019

Figure 26 Pet Food Processing Equipment Market: Competitive Leadership Mapping, 2018

Figure 27 Andritz Group: Company Snapshot

Figure 28 Andritz Group: SWOT Analysis

Figure 29 Buhler Holding AG: Company Snapshot

Figure 30 Buhler Holding AG: SWOT Analysis

Figure 31 The Middleby Corporation: Company Snapshot

Figure 32 The Middleby Corporation: SWOT Analysis

Figure 33 GEA: Company Snapshot

Figure 34 GEA Group: SWOT Analysis

Figure 35 Baker Perkins LTD.: SWOT Analysis

Figure 36 Clextral Sas: SWOT Analysis

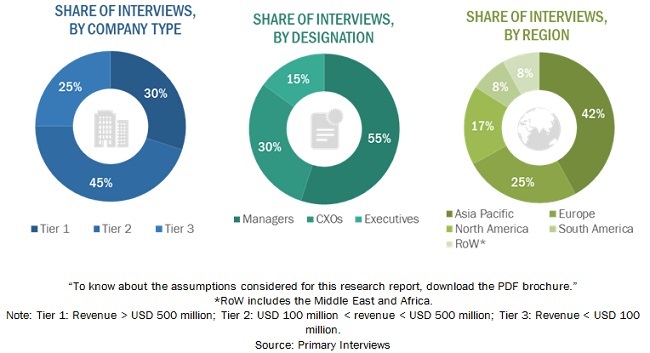

The study involved four major steps in estimating the size of the pet food processing market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. These secondary sources included reports from the AEM (Association of Equipment Manufacturers), PMMI (The Association of Packaging and Processing Technologies), PFMA (Pet Food Manufacturing Association) and PEMA (Process Equipment Manufacturers' Association). The secondary sources also included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The overall pet food processing market comprises several stakeholders in the supply chain, which include global and regional pet food product dealers, pet food processors, and pet food suppliers. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, regional pet food products dealers and manufacturers, and pet food equipment manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the pet food processing market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The pet food processing market size, in terms of value, was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to estimate the global pet food processing market and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- Determining and projecting the size of the pet food processing market, with respect to application, form, type, and regional markets, over a seven-year period, ranging from 2019 to 2026

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the pet food processing market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the pet food processing market

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe pet food processing market, by key country

- Further breakdown of the Rest of Asia Pacific pet food processing market, by key country

Company Information

- Analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Pet Food Processing Market