Pea Processed Ingredients Market by Type (Pea protein (Isolates, Concentrates and Textured), Pea starch, Pea fiber, Pea Flour), Application (Food & Beverages), Source (Yellow split peas, chickpeas and lentils), and Region - Global Forecast to 2026

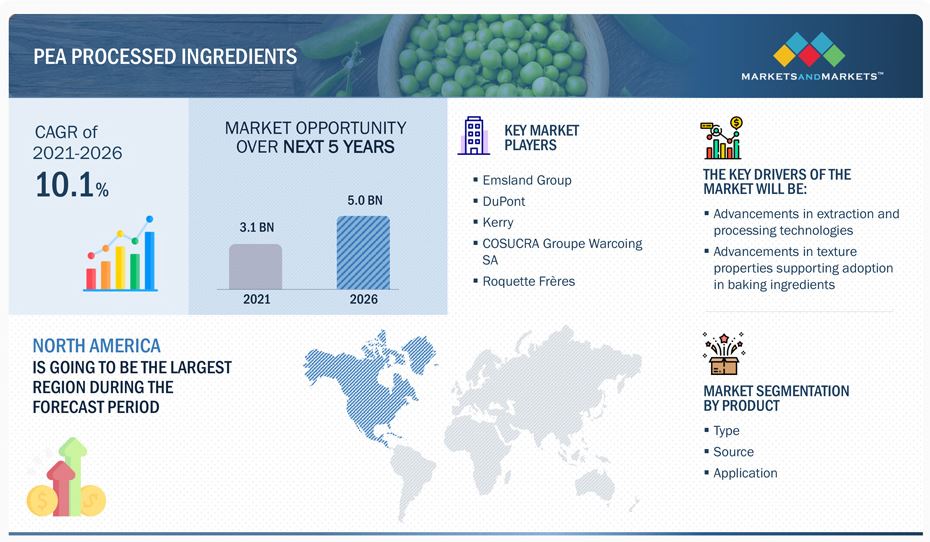

The Pea Processed Ingredients Market is projected to reach USD 5.0 billion by 2026 with a compound annual growth rate (CAGR) of 10.1%. The market value was estimated to be USD 3.1 billion in 2021. Growth in the demand for pea processed ingredients in the end-user application industries is driving the market growth of pea processed ingredients. Further, increase in the demand for gluten free products is also a major factor resulting to the rise in the demand for pea processed ingredients.

To know about the assumptions considered for the study, Request for Free Sample Report

Pea ingredients are experiencing a strong growth outlook in developed regions such as Europe and North America, where the growing vegan population continues to drive the demand for plant-based products. Industrial food manufacturers are focused on developing different product formats sourced from peas. Pea protein is among the most versatile ingredients and can be formulated into beverages, food products, snacks, and even functional foods in different forms. However, given the high prices of pea protein, their demands have remained popular in developed markets. However, industry participants are expanding their influence on developing markets in the Asia Pacific as a means to tap into the growing vegan population.

The pea processed ingredients market is primarily dominated by the North American and European markets that host a large production and consumer base. Consumers are often allergic to gluten and lactose, and as a result, pea processed ingredients are becoming an alternative option for a large population across the globe. With R&D efforts and technological advancements in the extraction and processing of different ingredients from peas, newer applications and developments are being incorporated in pea processed ingredients. Pea processed ingredients can be used as a substitute to flour, fiber, starch in the bakery industry, aiding toward healthy lifestyles. Thus their market is estimated to steadily grow in the near future.

Key Features of the Pea Processed Ingredients Market:

- High Protein Content: Pea processed ingredients are a rich source of protein and can be used as an alternative to animal-based protein sources.

- Gluten-free: Pea processed ingredients are gluten-free, making them suitable for individuals with celiac disease or gluten intolerance.

- Versatile: Pea processed ingredients can be used in a wide range of applications, including baked goods, snacks, soups, sauces, and meat alternatives.

- Sustainable: The pea plant is highly adaptable to different climatic conditions, making it a sustainable crop for processing into ingredients.

- Allergen-free: Pea processed ingredients are free from common allergens such as soy, dairy, and nuts, making them suitable for individuals with food allergies.

- Low Carb: Pea processed ingredients have a low glycemic index, making them a suitable ingredient for low-carb diets.

- High Fiber: Pea processed ingredients are a good source of dietary fiber, which helps to improve digestion and maintain healthy gut bacteria.

- Environmentally Friendly: The pea plant requires less water and fertilizer than other crops, making it a more environmentally friendly ingredient choice.

- Long Shelf Life: Pea processed ingredients have a long shelf life, making them a convenient and cost-effective ingredient for food manufacturers.

- Growing Demand: The demand for pea processed ingredients is increasing due to the growth of the plant-based and health food markets, providing opportunities for growth and innovation in the pea processed ingredients market.

Market Dynamics

Driver: Advancements in extraction and processing technologies

Pea processed ingredients such as pea protein, pea starch, pea fiber, and pea flour is extracted through the processing of various types of peas, such as split yellow peas, green peas, chickpeas, and lentils. It is obtained by implementing a process, which includes two phases, namely, dry and wet. The dry phase consists of two processes, dry milling and air classification. Pea flour is obtained after practicing dry milling and air classification processes. Later, it undergoes the wet milling process, which includes multi-step solubilization, followed by centrifugation. This is the process where pea protein, pea fiber, pea flour, and pea starch are separated.

Traditional technologies in pea processing could only extract protein flour comprising a maximal of 20% to 40% protein and concentrates comprising 45% to 60% proteins. Further the traditional techniques made pea processed ingredients less digestible and have low sensory properties. Hence, the constraints of the traditional techniques are leading to the evolution of newer and modern techniques of pea protein, starch, flour, and fiber extraction and processing. Modern techniques included wet milling and centrifugation process that aid in processing peas with high digestibility, and improved taste.

Restraint: High cost of extraction

Food & beverage manufacturers have been looking for more healthy and affordable alternatives for animal-based sources, thereby increasing investments in the plant-based ingredient market. Currently, soy ingredients has been dominating the plant-based ingredients space. Pea processed ingredients, due to its high extraction and processing costs and limited production, fails to lead the market for plant-based ingredients. Compared to pea, there is a greater consumer awareness about soy protein. Manufacturers have achieved economies of scale for soy-based ingredients due to their high production capacities and high demand.

On the other hand, pea is a comparatively newer product, which, due to the availability of low-cost products, such as soy, is finding it difficult to dominate the plant-based alternative industry. Manufacturers are finding it difficult to sell standalone pure pea processed ingredients that fetch lower margins, which is leading to the sales of blends of pea processed ingredients.

Opportunity: Advancements in texture properties supporting adoption in baking ingredients

Earlier, pea processed ingredients were majorly used as a meat & meat substitute alternative and in the nutraceutical industry. With R&D efforts and technological advancements in the extraction and processing of different ingredients from peas, newer applications and developments were incorporated in pea processed ingredients. Pea processed ingredients can be used as a substitute to flour, fiber, starch in the bakery industry, aiding toward healthy lifestyles.

Consumers constantly look for healthier food & beverage options, usually the ones that provide sustenance in hectic lives and daily routines. Bakery products never came in that category earlier. But now, with the inclusion of pea processed ingredients in the making of bakery products, the baking industry is ready to take the challenge.

Challenge: Supply constraints hampering growth prospects

The major challenge that pea processed ingredients manufacturers have to face is the shortage of supply. For instance, the ratio of conversion of pea protein extracted from peas differs from process to process and as per the type of pea used in the process. Ideally, 15% to 20% of peas are converted into proteins; the rest is converted into starch and fiber. Therefore, specific ingredients derived from the large processing of peas are limited, thereby resulting in supply constraints.

In recent times, the demand for pea processed ingredients has increased due to their health benefits, anti-allergen properties, and other functional properties. This increase in demand can be witnessed in the food & beverage industry.

However, suppose the supply of pea processed ingredients does not match up to the demand from food & beverage manufacturers. In that case, they may switch to alternatives of a pea, which may affect the growth of the market.

By type, the pea protein segment is estimated to hold the largest share in the pea processed ingredients market.

The pea protein segment dominated the market in 2020 and is expected to display similar trend in the coming years. Pea protein in food with neutral taste extracted mostly from yellow peas and split peas and has a typical legume amino acid profile. While its amino acid profile is similar to whey protein. Peas are particularly high in arginine, lysine, and phenylalanine.

Consumers concerned about current meat-producing processes and the trend of eating healthier are inclining consumers toward alternative proteins. Their well-balanced profile fulfills the essential amino acid requirements outlined by the World Health Organization for adults. It is highly used in smoothies and shakes in recent years and is also a great fit for almost any diet since it’s naturally vegan. It is also a great source of iron. It can aid muscle growth, weight loss, and heart health. Owing to it is functional properties, it is gaining popularity among consumers.

By application type, the functional food segment is expected to witness the fastest growth during the forecast period

The functional foods considered for the study include infant nutrition, nutritional supplements, dairy products, plant-based yogurt, plant-based creamers, plant-based butter, and other food products fortified with additional nutrients. The incorporation of pea processed ingredients adds to the shelf-life of the functional food products, along with the improvement of the textural and sensory characteristics, owing to their water-binding capacity, gel-forming ability, fat mimetic, anti-sticking, anti-clumping, texturizing, and thickening effects.

The manufacturers are looking into this opportunity to serve breakfast options fortified with healthy pea fibers. The inulin enhances the fiber content of the cereals and reduces sugar, making it a popular choice among consumers. The usage of pea processed ingredients food ingredients in the manufacturing of functional food products is expected to provide nutritive health benefits, prevent/resist chronic diseases, or act as energy boosters. The addition of functional food ingredients aids in the provision of nutritive benefits, over and above the basic nutritive capacities of traditional food products.

By source type, the yellow split peas segment is projected to grow at the fastest CAGR in the pea processed ingredients market until 2026.

The demand for yellow split peas is high owing to presence of high protein content and popularity among the food manufacturers. There is rising production of yellow peas over the years owing to the increasing demand of the same. For instance, according to the 2018 American Pulse Association Data, dry peas rank fourth in terms of the world production of food legumes below soybeans, peanuts, and dry beans. They have also reported that yellow peas and green peas, along with other minor classes, are the most commonly grown, with yellow peas accounting for approximately two-thirds of the US production. Yellow split peas are also regarded as high in fiber and is considered taste neutral thereby resulting to rising application of the same in the food and beverage products.

To know about the assumptions considered for the study, download the pdf brochure

The increasing demand for plant based food products, in the North America region is driving the market growth

In North America, Canada is the largest dry pea-producing nation and also the largest exporter for the same in the world. However, the highest consumption of pea protein in the US, and Canada together drives significant manufacturing potential in terms of processing technology and availability of raw materials, due to the high growth potential of the pea processed ingredients market in North America.

The use of meat and dairy substitutes from plants in burgers, nuggets, and many other foods is growing, which is driving the demand for pea ingredients, such as proteins, starch, and flours. According to a report published by Agri-Canada, for the year 2019-2020, dry pea production in Canada was estimated to rise by 30% to 4.7 million tones (Mt).

The US is one of the largest consumers of pea ingredients in the world and is also expected to hold a strong industry outlook over the forecast period. There has been a growing awareness of the consumption of healthy foods in the region, which has resulted in people shifting to lactose-free and gluten-free protein products. The country has recorded the highest number of obese and overweight people in the world. According to the National Centre for Health Statistics (NCHS), about one-third of the US adults aged 20 and older were found obese in the year 2019.

Key Market Players

The key players in this market include Emsland Group (Germany), DuPont (US), Kerry (Ireland), COSUCRA Groupe Warcoing SA (Belgium), Roquette Frères (France), Vestkorn Milling AS (Norway), Ingredion Incorporated (US), Axiom Foods, Inc (US), Felleskjøpet Rogaland Agder (Norway), AGT Food and Ingredients (Canada), Parrheim Foods (Canada), Puris Foods (US), Meelunie B.V (Netherlands) among others.

These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the report:

|

Report Metric |

Details |

|

Market size value in 2021 |

USD 3.1 billion |

|

Revenue forecast in 2026 |

USD 5.0 billion |

|

Growth Rate |

CAGR of 10.1% from 2021 to 2026 |

|

Base year for estimation |

2020 |

|

Historical data |

2019-2026 |

|

Forecast period |

2021-2026 |

|

Quantitative units |

Value (USD Million) and Volume (Tons) |

|

Segments covered |

Type, Source and Application |

|

Regional scope |

North America, Europe, Asia Pacific, South America and RoW (Middle East and Africa) |

|

Dominant Geography |

North America |

|

Key companies profiled |

Emsland Group (Germany), DuPont (US), Kerry (Ireland), COSUCRA Groupe Warcoing SA (Belgium), Roquette Frères (France) |

This research report categorizes the pea processed ingredients market based on type, application, source and region.

On the basis of type, the market has been segmented as follows:

- Protein

- Starch

- Flour

- Fiber

On the basis of application, the market has been segmented as follows:

-

Food

- Meat & Meat Substitutes

- Performance Nutrition

- Functional Foods

- Snacks

- Bakery

- Confectionery

- Others

- Beverage

- Others

On the basis of source, the market has been segmented as follows:

- Yellow split peas

- Chickpeas

- Lentils

On the basis of region, the market has been segmented as follows

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In November 2022, Global Food and Ingredients Ltd. launched the Pulsera ingredients brand (Canada). The product line initially consists of 85% pea protein isolate. This launch is in line with the company's goal of diversifying its portfolio with functional ingredients rich in plant-based protein and fiber.

- In October 2022, Roquette (France) has introduced a new line of organic pea ingredients, including organic pea starch and organic pea protein. This launch contributes to meeting consumer demand for natural, nutritious products.

- In September 2022, Lantmännen's (Sweden) invested USD 91 million in a new large-scale pea protein production facility in Sweden. This strengthens Lantmännen's food ingredient offering and its leadership position in the Northern European market for plant-based proteins.

- In September 2022, Equinom (Israel) has partnered with AGT Food and Ingredients Inc. (Canada) to market non-GMO ultra-high protein yellow pea protein ingredients and co-create a portfolio of functional plant-based ingredients. The co-branded ingredients will be marketed and sold by AGT to food manufacturers.

- In July 2022, Merit Functional Foods (Canada) launched Peazazz C, a pea protein for use in ready-to-drink (RTD) beverages. The protein has a smooth, grit-free texture that is suitable for RTD beverages without being chalky. This launch aided the company in providing pea protein to beverage manufacturers that is free of gritty texture and chalkiness, as well as having high solubility and low viscosity.

- In June 2022, Roquette (France) launched its NUTRALYS range of organic proteins from pea for European markets. This launch enhances Roquette’s strong position in the overall protein market as a key leader for pea processed ingredients solutions.

- In April 2022, Cargill, Incorporated (US) expanded the distribution of its RadiPure pea protein in the Middle East, Turkey, Africa, and India. This was done to capitalize on the region's growing trend for plant-based food and to assist food and beverage manufacturers in responding to changing market trends.

- In February 2022, Ingredion (US) invested in InnovoPro (Israel), one of the leading Foodtech chickpea solutions companies. It will assist the company in unlocking huge consumer appeal for chickpea protein by capitalizing on food industry trends.

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the pea processed ingredients market and how intense is the competition?

The key players in this market include Emsland Group (Germany), DuPont (US), Kerry (Ireland), COSUCRA Groupe Warcoing SA (Belgium), Roquette Frères (France), Vestkorn Milling AS (Norway), Ingredion Incorporated (US), Axiom Foods, Inc (US), Felleskjøpet Rogaland Agder (Norway), AGT Food and Ingredients (Canada), Parrheim Foods (Canada), Puris Foods (US), Meelunie B.V (Netherlands) among others.The competition amongst the key players is strong in the growing regions such as Middle East and Asian countries wherein there is a changing mindset for processed foods along with growing inclination towards healthier alternatives. Heavy investments are being made for becoming self sufficient in terms of food demand. Thus the developing nations experience fierce competition amongst the start-ups and leading companies in the markets.

What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

Some direct and indirect stakeholders identified for the pea processed ingredients markets could be the food and beverage, pet food manufacturers, pea processed ingredients firms. Asia-Pacific and South America are attracting interests of the leading businesses and is expected to witness significant growth rate in the coming years.

What is the current size of the global pea processed ingredients market?

The pea processed ingredients market is expected to generate a revenue of USD 5.0 billion by 2026, at a CAGR of 10.1%. The global industry was expected to be valued at USD 3.1 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 PEA PROCESSED INGREDIENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 PEA PROCESSED INGREDIENTS MARKET SIZE ESTIMATION – APPROACH ONE

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.2.3 MARKET SIZE ESTIMATION NOTES

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 2 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 9 IMPACT OF COVID-19 ON THE GLOBAL MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 10 PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET SIZE, BY SOURCE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 13 MARKET SIZE, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 OVERVIEW OF THE GLOBAL MARKET

FIGURE 14 GROWING DEMAND FOR MEAT SUBSTITUTES AND ALLERGEN-FRIENDLY PRODUCTS TO DRIVE PROSPECTS FOR PEA INGREDIENTS

4.2 GLOBAL: MARKET FOR PEA PROCESSED INGREDIENTS, BY TYPE & COUNTRY

FIGURE 15 THE PROTEIN & US SUBSEGMENTS TO DOMINATE THE GLOBAL MARKET IN 2021

4.3 GLOBAL: MARKET FOR PEA PROCESSED INGREDIENTS, BY FOOD APPLICATION

FIGURE 16 THE MEAT & MEAT SUBSTITUTES SUBSEGMENT TO DOMINATE THE GLOBAL MARKET, BY FOOD APPLICATION, IN 2021

4.4 GLOBAL: MARKET FOR PEA PROCESSED INGREDIENTS, BY SOURCE & REGION

FIGURE 17 THE YELLOW SPLIT PEAS SUBSEGMENT TO DOMINATE THE GLOBAL MARKET, BY SOURCE, IN 2021

FIGURE 18 COVID-19 IMPACT ON THE GLOBAL MARKET: COMPARISON OF PRE AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

FIGURE 19 GREEN PEA PRODUCTION: TOP FIVE COUNTRIES, 2018 (METRIC TONNES)

5.2 MARKET DYNAMICS

FIGURE 20 MARKET DYNAMICS: PEA PROCESSED INGREDIENTS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing vegan population and popularity of plant-based products

FIGURE 21 UK’S FASTEST-GROWING TAKEAWAY CUISINES (2016–2019)

5.2.1.2 Advancements in extraction and processing technologies

5.2.1.3 Growing consumer awareness about nutritional benefits offered by pea and pea-based products

5.2.1.4 Increase in demand for gluten-free food products

5.2.2 RESTRAINTS

5.2.2.1 High cost of extraction and processing of pea processed ingredients

TABLE 3 ESTIMATION OF CAPITAL INVESTMENT FOR 2,000 KG/HECTARE OF YELLOW SPLIT PEAS

5.2.2.2 Low processing outputs resulting in limited supply to manufacturers

FIGURE 22 PEA EXTRACTION: INDUSTRIAL PROCESS

FIGURE 23 PEA EXTRACTION: PILOT PROCESS

5.2.2.3 Decrease in the production of dry pea

FIGURE 24 PRODUCTION QUANTITIES & HARVEST AREA OF DRY PEAS, 2014–2018 (MILLION HA & MILLION TONNE)

5.2.3 OPPORTUNITIES

5.2.3.1 Development and deployment of new application areas in pea processed ingredients

5.2.3.2 Lack of allergen properties helping acceptability against conventional plant-based proteins

5.2.3.3 Advancements in texture properties supporting adoption in baking ingredients

5.2.3.4 Rise in demand from the pet food industry

5.2.4 CHALLENGES

5.2.4.1 Supply constraints hampering growth prospects

5.2.4.2 Trade barriers due to COVID-19 outbreak

5.2.5 COVID-19 IMPACT ANALYSIS: (MARKET DYNAMICS)

6 INDUSTRY TRENDS (Page No. - 71)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 25 MANUFACTURING STEPS IN THE SUPPLY CHAIN OF PEA PROCESSED INGREDIENTS OF UTMOST IMPORTANCE DUE TO HIGH TECHNICALITIES

6.1.1 SMOOTH PROCUREMENT OF RAW MATERIALS

6.1.2 APT DISTRIBUTION CHANNEL TO REDUCE DEMAND-SUPPLY GAP

6.2 PATENT ANALYSIS

FIGURE 26 NUMBER OF PATENTS GRANTED BETWEEN 2011 AND 2020

FIGURE 27 TOP 10 INVESTORS WITH THE HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 28 TOP 10 APPLICANTS WITH HIGHEST NO. OF PATENT DOCUMENTS

TABLE 4 SOME PATENTS PERTAINING TO PEA PROCESSED INGREDIENTS, 2020-2021

6.3 REGULATORY FRAMEWORK

6.4 FOOD & BEVERAGE INGREDIENTS ECOSYSTEM/MARKET MAP

FIGURE 29 ECOSYSTEM VIEW

TABLE 5 MARKET FOR PEA PROCESSED INGREDIENTS: SUPPLY CHAIN (ECOSYSTEM)

6.5 YC YCC SHIFT

FIGURE 30 YC-YCC SHIFT FOR THE MARKET

6.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MARKET FOR PEA PROCESSED INGREDIENTS: PORTER’S FIVE FORCES ANALYSIS

6.6.1 THREAT OF NEW ENTRANTS

6.6.2 THREAT OF SUBSTITUTES

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.4 BARGAINING POWER OF BUYERS

6.6.5 DEGREE OF COMPETITION

6.7 TRADE DATA ANALYSIS

FIGURE 31 TRADE DATA ANALYSIS

6.8 PRICING ANALYSIS

6.8.1 INTRODUCTION

6.8.2 PEA STARCH PRICING ANALYSIS, BY TYPE (USD/TONS)

FIGURE 32 PRICING ANALYSIS: PEA STARCH MARKET, BY TYPE, 2018-2021

6.9 PRICING FACTORS IMPACTING THE PEA PROCESSED INGREDIENTS MARKET

6.9.1 RAW MATERIAL VARIETIES AND CLIMATE CONDITIONS

6.9.2 FAVOURABLE CLIMATIC CONDITIONS TO PRODUCE BASE MATERIAL

6.9.3 DEMAND AND SUPPLY FACTORS

6.9.4 MANUFACTURING COST

6.9.5 LOGISTIC COST

6.9.6 REGULATORY REFORMS

6.9.7 NATURE OF COMPETITION IN THE MARKET

6.9.8 ECONOMIC CONDITION

6.9.9 PRODUCT LIFE CYCLE

6.10 CASE STUDY ANALYSIS: THE PEA PROCESSED INGREDIENTS MARKET

TABLE 7 ROQUETTE FRERES: CONSTRUCTING NEW PROTEIN PLANT

TABLE 8 INGREDION INCORPORATED: DEVELOPING INGREDIENTS FOR NEW RECIPES

6.11 CUSTOMER ANALYSIS

TABLE 9 LIST OF KEY CUSTOMER COMPANIES USING PEA PROCESSED INGREDIENTS, BY APPLICATION & BY REGION (2020)

7 PEA PROCESSED INGREDIENTS MARKET, BY TYPE (Page No. - 93)

7.1 INTRODUCTION

FIGURE 33 GLOBAL OBESITY PREVALENCE RATES, 2014-2021

7.2 COVID-19 IMPACT ANALYSIS-TYPE

TABLE 10 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 11 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 12 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY TYPE, 2019–2022 (USD MILLION)

FIGURE 34 PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 13 MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 14 MARKET SIZE, BY TYPE, 2019–2026 (TONS)

7.3 PROTEIN

7.3.1 SHIFTING CONSUMER PREFERENCES TOWARD PLANT-BASED FOODS TO DRIVE THE DEMAND FOR PEA PROTEINS

FIGURE 35 COUNTRY AND CATEGORY-WISE PEA PROTEIN PATENTS APPLIED BETWEEN 2017-2021

TABLE 15 PEA PROCESSED INGREDIENTS MARKET SIZE FOR PROTEIN, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 PEA PROCESSING INGREDIENTS MARKET SIZE, BY PROTEIN TYPE, 2019–2026 (USD MILLION)

7.3.2 ISOLATES

TABLE 17 PEA PROCESSED INGREDIENTS MARKET SIZE FOR ISOLATES, BY REGION, 2019–2026 (USD MILLION)

7.3.3 CONCENTRATES

TABLE 18 PEA PROCESSED INGREDIENTS MARKET SIZE FOR CONCENTRATES, BY REGION, 2019–2026 (USD MILLION)

7.3.4 TEXTURED

TABLE 19 PEA PROCESSED INGREDIENTS MARKET SIZE FOR TEXTURED, BY REGION, 2019–2026 (USD MILLION)

7.4 FLOUR

7.4.1 INCREASING USAGE IN BAKERY AND SNACKS END-USE INDUSTRIES TO DRIVE THE MARKET GROWTH

TABLE 20 PEA PROCESSED INGREDIENTS MARKET SIZE FOR FLOUR, BY REGION, 2019–2026 (USD MILLION)

7.5 STARCH

7.5.1 INCREASING AWARENESS REGARDING GLUTEN-FREE FOODS TO PROPEL THE DEMAND FOR QUALITY PEA STARCHES

TABLE 21 PEA PROCESSED INGREDIENTS MARKET SIZE FOR STARCH, BY REGION, 2019–2026 (USD MILLION)

7.6 FIBERS

7.6.1 HEALTH BENEFITS OF PEA FIBERS TO INCREASE THEIR USE IN VARIOUS FOOD AND FEED APPLICATIONS

TABLE 22 PEA PROCESSED INGREDIENTS MARKET SIZE FOR FIBER, BY REGION, 2019–2026 (USD MILLION)

8 PEA PROCESSED INGREDIENTS MARKET, BY APPLICATION (Page No. - 105)

8.1 INTRODUCTION

8.2 COVID-19 IMPACT ANALYSIS-APPLICATION

TABLE 23 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 24 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 25 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

FIGURE 36 PEA PROCESSED INGREDIENTS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

TABLE 26 MARKET SIZE, BY PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 27 MARKET SIZE, BY PROTEIN FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 28 MARKET SIZE, BY PROTEIN PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 29 MARKET SIZE, BY ISOLATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 30 MARKET SIZE, BY ISOLATE PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 31 MARKET SIZE, BY CONCENTRATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 32 MARKET SIZE, BY CONCENTRATE PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 33 MARKET SIZE, BY TEXTURED FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 MARKET SIZE, BY TEXTURED PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 35 MARKET SIZE, BY STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 36 MARKET SIZE, BY STARCH FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 37 MARKET SIZE, BY STARCH PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 38 PEA PROCESSED INGREDIENTS MARKET SIZE, BY FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 39 MARKET SIZE, BY FOOD FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 40 MARKET SIZE, BY FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 41 MARKET SIZE, BY FOOD FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 42 MARKET SIZE, BY FIBER PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

8.3 FOOD

TABLE 43 MARKET SIZE FOR FOOD, BY REGION, 2019–2026 (USD MILLION)

8.3.1 MEAT AND MEAT SUBSTITUTES

8.3.1.1 Globally rising vegan populations to drive the demand for plant-based meat substitutes

TABLE 44 PEA PROCESSED INGREDIENTS MARKET SIZE FOR MEAT & MEAT SUBSTITUTES, BY REGION, 2019–2026 (USD MILLION)

TABLE 45 MARKET SIZE FOR MEAT & MEAT SUBSTITUTES, BY TYPE, 2019–2026 (USD MILLION)

8.3.2 PERFORMANCE NUTRITION

8.3.2.1 Increasing cases of lactose intolerance and growing adoption in supplements to drive the adoption of pea protein in performance nutrition

TABLE 46 PEA PROCESSED INGREDIENTS MARKET SIZE FOR PERFORMANCE NUTRITION, BY REGION, 2019–2026 (USD MILLION)

TABLE 47 MARKET SIZE FOR PERFORMANCE NUTRITION, BY TYPE, 2019–2026 (USD MILLION)

8.3.2.2 Protein powders

8.3.2.3 Sports/Protein drinks

8.3.2.4 Protein Bars/Meal replacement bars

TABLE 48 PEA PROCESSED INGREDIENTS MARKET SIZE, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

8.3.3 FUNCTIONAL FOODS

8.3.3.1 Growing awareness toward the functional benefits of pea ingredients to support the growth in functional foods

TABLE 49 PEA PROCESSED INGREDIENTS MARKET SIZE FOR FUNCTIONAL FOODS, BY REGION, 2019–2026 (USD MILLION)

TABLE 50 MARKET SIZE FOR FUNCTIONAL FOODS, BY TYPE, 2019–2026 (USD MILLION)

8.3.4 SNACKS

8.3.4.1 Demand for healthy snacking alternatives to drive the demand for pea ingredients in snacks

TABLE 51 PEA PROCESSED INGREDIENTS MARKET SIZE FOR SNACKS, BY REGION, 2019–2026 (USD MILLION)

TABLE 52 MARKET SIZE FOR SNACKS, BY TYPE, 2019–2026 (USD MILLION)

8.3.5 BAKERY PRODUCTS

8.3.5.1 Demand for healthy alternatives to drive the use of pea protein in baking applications

FIGURE 37 STEADY INCREASE IN GLOBAL TRADE OF BAKERY FOODS, 2016-2020

TABLE 53 PEA PROCESSED INGREDIENTS MARKET SIZE FOR BAKERY, BY REGION, 2019–2026 (USD MILLION)

TABLE 54 MARKET SIZE FOR BAKERY, BY TYPE, 2019–2026 (USD MILLION)

8.3.6 CONFECTIONERY

8.3.6.1 Consumer demand for healthier confectionery products to lead to the introduction of newer pea ingredients

FIGURE 38 GLOBAL INCREASE IN CONFECTIONERY EXPORTS, 2004-2019

TABLE 55 PEA PROCESSED INGREDIENTS MARKET SIZE FOR CONFECTIONERY, BY REGION, 2019–2026 (USD MILLION)

TABLE 56 MARKET SIZE FOR CONFECTIONERY, BY TYPE, 2019–2026 (USD MILLION)

8.3.7 OTHER FOOD APPLICATIONS

TABLE 57 PEA PROCESSED INGREDIENTS MARKET SIZE FOR OTHER FOOD APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 58 MARKET SIZE FOR OTHER FOOD APPLICATIONS, BY TYPE, 2019–2026 (USD MILLION)

8.4 BEVERAGES

8.4.1 EASY SOLUBILITY AND ADOPTION IN PLANT-BASED BEVERAGES TO SUPPORT PEA INGREDIENTS GROWTH

TABLE 59 PEA PROCESSED INGREDIENTS MARKET SIZE FOR BEVERAGE, BY REGION, 2019–2026 (USD MILLION)

TABLE 60 MARKET SIZE FOR BEVERAGE, BY TYPE, 2019–2026 (USD MILLION)

8.5 OTHER APPLICATIONS

8.5.1 BENEFITS OF PEA INGREDIENTS ON ANIMAL HEALTH AND WELLBEING TO DRIVE THE DEMAND

TABLE 61 PEA PROCESSED INGREDIENTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 62 MARKET SIZE FOR OTHER APPLICATIONS, BY TYPE, 2019–2026 (USD MILLION)

9 PEA PROCESSED INGREDIENTS MARKET, BY SOURCE (Page No. - 130)

9.1 INTRODUCTION

FIGURE 39 GLOBAL DRIED LEGUMINOUS VEGETABLE EXPORTS, INCLUDING DRIED PEAS AND CHICKPEAS, 2016-2020 (USD MILLION)

9.2 COVID-19 IMPACT ANALYSIS-SOURCE TYPE

TABLE 63 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY SOURCE, 2019–2022 (USD MILLION)

TABLE 64 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY SOURCE, 2019–2022 (USD MILLION)

TABLE 65 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY SOURCE, 2019–2022 (USD MILLION)

FIGURE 40 PEA PROCESSED INGREDIENTS MARKET SIZE, BY SOURCE, 2021 VS. 2026 (USD MILLION)

TABLE 66 MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

9.3 YELLOW SPLIT PEAS

9.3.1 HIGH PRODUCTION RATES AND PROTEIN CONTENT FAVOR DEMAND FOR YELLOW SPLIT PEAS

TABLE 67 PEA PROCESSED INGREDIENTS MARKET SIZE FOR YELLOW SPLIT PEAS, BY REGION, 2019–2026 (USD MILLION)

9.4 CHICKPEAS

9.4.1 IMPROVEMENTS IN TECHNOLOGICAL CAPABILITIES AND INNOVATION TO DRIVE GROWTH FOR CHICKPEAS IN PEA PROTEIN

TABLE 68 PEA PROCESSED INGREDIENTS MARKET SIZE FOR CHICKPEAS, BY REGION, 2019–2026 (USD MILLION)

9.5 LENTILS

9.5.1 EASY AVAILABILITY AND LOWER COSTS TO DRIVE GLOBAL DEMAND FOR LENTILS

TABLE 69 PEA PROCESSED INGREDIENTS MARKET SIZE FOR LENTILS, BY REGION, 2019–2026 (USD MILLION)

10 PEA PROCESSED INGREDIENTS MARKET, BY FUNCTION (Page No. - 137)

10.1 INTRODUCTION

10.2 BINDING & THICKENING

10.2.1 MAJOR USE OF PEA STARCH & FLOURS AS A BINDING & THICKENING AGENT FOR MANUFACTURING SNACKS

10.3 GELLING

10.3.1 USE OF PEA PROTEINS AND STARCHES AS A GELLING AGENT IN CONFECTIONERY PRODUCTS

10.4 TEXTURIZING

10.4.1 PEA INGREDIENTS USED IN ENHANCING THE TEXTURE OF MEAT PRODUCTS

10.5 FILM FORMING

10.5.1 PEA INGREDIENTS USED AS FILM-FORMING AGENTS IN THE MANUFACTURING OF TABLETS

10.6 OTHER FUNCTIONS

11 PEA PROCESSED INGREDIENTS MARKET, BY REGION (Page No. - 140)

11.1 INTRODUCTION

FIGURE 41 US TO ACCOUNT FOR THE LARGEST MARKET SHARE IN THE GLOBAL MARKET

TABLE 70 PEA PROCESSED INGREDIENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 71 MARKET SIZE, BY REGION, 2019–2026 (TONS)

11.1.1 COVID-19 IMPACT ANALYSIS- REGION

TABLE 72 OPTIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 73 REALISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 74 PESSIMISTIC SCENARIO: COVID-19 IMPACT ANALYSIS OF THE GLOBAL MARKET, BY REGION, 2019–2022 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 42 PREVALENCE OF OBESITY AND SEVERE OBESITY AMONG ADULTS: US, 2017–2018

FIGURE 43 NORTH AMERICA: REGIONAL SNAPSHOT

TABLE 75 NORTH AMERICA: PEA PROCESSED INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (TONS)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY PROTEIN SUBTYPE, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY ISOLATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY ISOLATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY CONCENTRATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY CONCENTRATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY TEXTURED PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY TEXTURED APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY FOOD PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY PROTEIN PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY FOOD STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY STARCH PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY FOOD FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY FOOD FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY FIBER PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.2.1 US

11.2.1.1 Adoption of healthy food habits for weight management to cause the pea processed ingredients market to flourish

TABLE 97 US: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 US: MARKET SIZE, BY PEA PROTEIN SUBTYPE, 2019–2026 (USD MILLION)

TABLE 99 US: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 100 US: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 US: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 102 US: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Canada experiencing significant growth and expansion in the pea processed ingredients market, driven by high production volumes of dry pea

FIGURE 44 AREA HARVESTED FOR PEA PRODUCTION IN CANADA, 2019–2020 (THOUSAND HECTARES)

TABLE 103 CANADA: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 107 CANADA: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 108 CANADA: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Evolving consumer preferences to drive the pea processed ingredients market in Mexico

TABLE 109 MEXICO: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 MEXICO: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 111 MEXICO: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 112 MEXICO: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 113 MEXICO: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 114 MEXICO: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3 EUROPE

FIGURE 45 TOP 10 COUNTRIES WITH THE LARGEST SHARES OF GLOBAL VEGAN NEW PRODUCT LAUNCHES, 2018

FIGURE 46 GREENHOUSE GAS EMISSIONS FROM AVERAGE FOOD CONSUMPTION

FIGURE 47 EUROPE: REGIONAL SNAPSHOT

TABLE 115 EUROPE: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (TONS)

TABLE 118 EUROPE: MARKET SIZE, BY PROTEIN SUBTYPE, 2019–2026 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY ISOLATE APPLICATION, 2019–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY ISOLATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY CONCENTRATE APPLICATION, 2019–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY CONCENTRATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY TEXTURED APPLICATION, 2019–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY TEXTURED APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY FOOD PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY PROTEIN PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY FOOD STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY STARCH PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY FOOD FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY FOOD FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY FIBER PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.3.1 FRANCE

11.3.1.1 Strong demands from food, beverage, and feed sectors to drive the market growth in the country

TABLE 137 FRANCE: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 FRANCE: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 139 FRANCE: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 140 FRANCE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 141 FRANCE: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 142 FRANCE: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3.2 DENMARK

11.3.2.1 Investments and production facilities to contribute to pea protein growth in Denmark

TABLE 143 DENMARK: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 DENMARK: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 145 DENMARK: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 146 DENMARK: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 147 DENMARK: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 148 DENMARK: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 High rise in the number of vegan products in the local markets to drive the demands for pea ingredients

TABLE 149 GERMANY: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 GERMANY: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 151 GERMANY: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 152 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 153 GERMANY: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 154 GERMANY: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3.4 UK

11.3.4.1 Strong demands from pet food and vegan food manufacturing industries to drive the pea processed ingredients market

TABLE 155 UK: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 UK: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 157 UK: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 158 UK: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 159 UK: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 160 UK: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Strong agricultural outputs and changing consumer preferences to drive pea protein consumption in Spain

TABLE 161 SPAIN: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 SPAIN: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 163 SPAIN: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 164 SPAIN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 165 SPAIN: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 166 SPAIN: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3.6 NETHERLANDS

11.3.6.1 Changing consumer preferences due to decreasing population health to drive the growth of the pea ingredients market in the Netherlands

TABLE 167 NETHERLANDS: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 168 NETHERLANDS: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 169 NETHERLANDS: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 170 NETHERLANDS: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 171 NETHERLANDS: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 172 NETHERLANDS: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3.7 ITALY

11.3.7.1 Growing conventional foods market to drive the demands in the country

TABLE 173 ITALY: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 ITALY: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 175 ITALY: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 176 ITALY: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 177 ITALY: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 178 ITALY: MARKET, 2019–2026 (USD MILLION)

TABLE 182 FINLAND: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 183 FINLAND: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 184 FINLAND: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.3.9 REST OF EUROPE

11.3.9.1 Rising influence of veganism is expected to drive the demands

TABLE 185 REST OF EUROPE: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 186 REST OF EUROPE: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 187 REST OF EUROPE: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 188 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 189 REST OF EUROPE: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 190 REST OF EUROPE: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 191 ASIA PACIFIC: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 192 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 193 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2019–2026 (TONS)

TABLE 194 ASIA PACIFIC: MARKET SIZE, BY PROTEIN SUBTYPE, 2019–2026 (USD MILLION)

TABLE 195 ASIA PACIFIC: MARKET SIZE, BY ISOLATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 196 ASIA PACIFIC: MARKET SIZE, BY ISOLATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 197 ASIA PACIFIC: MARKET SIZE, BY CONCENTRATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 198 ASIA PACIFIC: MARKET SIZE, BY CONCENTRATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 199 ASIA PACIFIC: MARKET SIZE, BY TEXTURED FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 200 ASIA PACIFIC: MARKET, BY TEXTURED APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 201 ASIA PACIFIC: MARKET SIZE, BY PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 202 ASIA PACIFIC: MARKET SIZE, BY FOOD PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 203 ASIA PACIFIC: MARKET SIZE, BY PROTEIN PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 204 ASIA PACIFIC: MARKET SIZE, BY STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 205 ASIA PACIFIC: MARKET SIZE, BY FOOD STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 206 ASIA PACIFIC: MARKET SIZE, BY STARCH PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 207 ASIA PACIFIC: MARKET SIZE, BY FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 208 ASIA PACIFIC: MARKET SIZE, BY FOOD FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 209 ASIA PACIFIC: MARKET SIZE, BY FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 210 ASIA PACIFIC: MARKET SIZE, BY FOOD FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 211 ASIA PACIFIC: MARKET SIZE, BY FIBER PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 212 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Rising demand for meat protein substitutes and conventional foods to drive the global market in China

TABLE 213 CHINA: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 214 CHINA: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 215 CHINA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 216 CHINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 217 CHINA: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 218 CHINA: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Preference for fitness among the youth to propel the market for pea protein

TABLE 219 INDIA: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 220 INDIA: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 221 INDIA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 222 INDIA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 223 INDIA: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 224 INDIA: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.4.3 JAPAN

11a.4.3.1 The increasing vegan culture to lead the country to be a lucrative market for pea protein

TABLE 225 JAPAN: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 226 JAPAN: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 227 JAPAN: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 228 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 229 JAPAN: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 230 JAPAN: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Rising environmental concerns to make the plant-based food segment in Australia & New Zealand grow at a faster speed

TABLE 231 AUSTRALIA & NEW ZEALAND: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 232 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 233 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 234 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 235 AUSTRALIA & NEW ZEALAND: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 236 AUSTRALIA & NEW ZEALAND: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

11.4.5.1 Changing consumer lifestyle and demand for sports nutrition to drive the market growth

TABLE 237 REST OF ASIA PACIFIC: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 238 REST OF ASIA PACIFIC: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 239 REST OF ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 240 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 241 REST OF ASIA PACIFIC: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 242 REST OF ASIA PACIFIC: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 243 SOUTH AMERICA: PEA PROCESSED INGREDIENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 244 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 245 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (TONS)

TABLE 246 SOUTH AMERICA: MARKET SIZE, BY PROTEIN SUBTYPE, 2019–2026 (USD MILLION)

TABLE 247 SOUTH AMERICA: MARKET SIZE, BY ISOLATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 248 SOUTH AMERICA: PEA PROCESSED INGREDIENTS MARKET, BY ISOLATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 249 SOUTH AMERICA: MARKET SIZE, BY CONCENTRATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 250 SOUTH AMERICA: MARKET, BY CONCENTRATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 251 SOUTH AMERICA: MARKET SIZE, BY TEXTURED FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 252 SOUTH AMERICA: MARKET, BY TEXTURED APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 253 SOUTH AMERICA: MARKET SIZE, BY PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 254 SOUTH AMERICA: MARKET SIZE, BY FOOD PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 255 SOUTH AMERICA: MARKET SIZE, BY PROTEIN PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 256 SOUTH AMERICA: MARKET SIZE, BY STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 257 SOUTH AMERICA: MARKET SIZE, BY FOOD STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 258 SOUTH AMERICA: MARKET SIZE, BY STARCH PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 259 SOUTH AMERICA: MARKET SIZE, BY FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 260 SOUTH AMERICA: MARKET SIZE, BY FOOD FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 261 SOUTH AMERICA: MARKET SIZE, BY FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 262 SOUTH AMERICA: MARKET SIZE, BY FOOD FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 263 SOUTH AMERICA: MARKET SIZE, BY FIBER PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 264 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increase in demand for meat alternatives and sports nutrition to drive the market

TABLE 265 BRAZIL: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 266 BRAZIL: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 267 BRAZIL: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 268 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 269 BRAZIL: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 270 BRAZIL: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Growing vegan lifestyle in Argentina to influence the market growth

TABLE 271 ARGENTINA: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 272 ARGENTINA: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 273 ARGENTINA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 274 ARGENTINA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 275 ARGENTINA: MARKET SIZE, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 276 ARGENTINA: MARKET SIZE, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

11.5.3.1 Slowly rising health awareness and adoption of healthy eating habits estimated to drive the market

TABLE 277 REST OF SOUTH AMERICA: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 278 REST OF SOUTH AMERICA: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 279 REST OF SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 280 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 281 REST OF SOUTH AMERICA: MARKET SIZE, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 282 REST OF SOUTH AMERICA: MARKET SIZE, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.6 REST OF THE WORLD (ROW)

TABLE 283 REST OF THE WORLD: MARKET SIZE FOR PEA PROCESSED INGREDIENTS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 284 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 285 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2019–2026 (TONS)

TABLE 286 REST OF THE WORLD: MARKET SIZE, BY PROTEIN SUBTYPE, 2019–2026 (USD MILLION)

TABLE 287 REST OF THE WORLD: MARKET SIZE, BY ISOLATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 288 REST OF THE WORLD: MARKET, BY ISOLATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 289 REST OF THE WORLD: MARKET SIZE, BY CONCENTRATE FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 290 REST OF THE WORLD: MARKET, BY CONCENTRATE APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 291 REST OF THE WORLD: MARKET SIZE, BY TEXTURED FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 292 REST OF THE WORLD: MARKET, BY TEXTURED APPLICATION FOR PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 293 REST OF THE WORLD: MARKET SIZE, BY PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 294 REST OF THE WORLD: MARKET SIZE, BY FOOD PROTEIN APPLICATION, 2019–2026 (USD MILLION)

TABLE 295 REST OF THE WORLD: MARKET SIZE, BY PROTEIN PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 296 REST OF THE WORLD: MARKET SIZE, BY STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 297 REST OF THE WORLD: MARKET SIZE, BY FOOD STARCH APPLICATION, 2019–2026 (USD MILLION)

TABLE 298 REST OF THE WORLD: MARKET SIZE, BY STARCH PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 299 REST OF THE WORLD: MARKET SIZE, BY FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 300 REST OF THE WORLD: MARKET SIZE, BY FOOD FLOUR APPLICATION, 2019–2026 (USD MILLION)

TABLE 301 REST OF THE WORLD: MARKET SIZE, BY FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 302 REST OF THE WORLD: MARKET SIZE, BY FOOD FIBER APPLICATION, 2019–2026 (USD MILLION)

TABLE 303 REST OF THE WORLD: MARKET SIZE, BY FIBER PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

TABLE 304 REST OF THE WORLD: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

11.6.1 MIDDLE EAST

11.6.1.1 Increasing sports activities and a positive outlook toward vegan lifestyles of customers to propel the market

TABLE 305 MIDDLE EAST: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 306 MIDDLE EAST: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 307 MIDDLE EAST: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 308 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 309 MIDDLE EAST: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 310 MIDDLE EAST: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

11.6.2 AFRICA

11.6.2.1 Easy availability of raw material and increase in awareness about health benefits associated with a plant-based diet to drive the market

TABLE 311 AFRICA: PEA PROCESSED INGREDIENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 312 AFRICA: MARKET SIZE, BY PEA PROTEIN SUB TYPE, 2019–2026 (USD MILLION)

TABLE 313 AFRICA: MARKET SIZE, BY SOURCE, 2019–2026 (USD MILLION)

TABLE 314 AFRICA: MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 315 AFRICA: MARKET, BY FOOD APPLICATION, 2019–2026 (USD MILLION)

TABLE 316 AFRICA: MARKET, BY PERFORMANCE NUTRITION, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 250)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS

TABLE 317 PEA PROCESSED INGREDIENTS MARKET: DEGREE OF COMPETITION

12.3 KEY PLAYER STRATEGIES

FIGURE 48 MAJOR STRATEGIES ADOPTED BY THE KEY PLAYERS

12.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 49 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

12.5 COVID-19-SPECIFIC COMPANY RESPONSE

12.5.1 INGREDION INCORPORATED

12.5.2 ROQUETTE FRÈRES

12.5.3 EMSLAND GROUP

12.5.4 DUPONT

12.5.5 KERRY

12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 50 PEA PROCESSED INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

12.7 PRODUCT FOOTPRINT

TABLE 318 COMPANY TYPE FOOTPRINT

TABLE 319 COMPANY REGION FOOTPRINT

TABLE 320 COMPANY SOURCE FOOTPRINT

12.8 COMPETITIVE EVALUATION QUADRANT (OTHER PLAYERS)

12.8.1 PROGRESSIVE COMPANIES

12.8.2 STARTING BLOCKS

12.8.3 RESPONSIVE COMPANIES

12.8.4 DYNAMIC COMPANIES

FIGURE 51 PEA PROCESSED INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHER PLAYERS)

12.9 COMPETITIVE SCENARIO

12.9.1 NEW PRODUCT LAUNCHES

TABLE 321 PEA PROCESSED INGREDIENTS MARKET: NEW PRODUCT LAUNCHES, JANUARY 2017–DECEMBER 2019

12.9.2 DEALS

TABLE 322 PEA PROCESSED INGREDIENTS MARKET: DEALS, JUNE 2017–JULY 2020

12.9.3 OTHERS

TABLE 323 PEA PROCESSED INGREDIENTS MARKET: EXPANSIONS, SEPTEMBER 2017-SEPTEMBER 2020

13 COMPANY PROFILES (Page No. - 262)

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

13.1 KEY PLAYERS

13.1.1 EMSLAND GROUP

TABLE 324 EMSLAND GROUP: BUSINESS OVERVIEW

TABLE 325 EMSLAND GROUP: PRODUCTS OFFERED

TABLE 326 EMSLAND GROUP: NEW PRODUCT LAUNCHES

TABLE 327 EMSLAND GROUP: DEALS

13.1.2 DUPONT

TABLE 328 DUPONT: BUSINESS OVERVIEW

FIGURE 52 DUPONT: COMPANY SNAPSHOT

TABLE 329 DUPONT: PRODUCTS OFFERED

TABLE 330 DUPONT: NEW PRODUCT LAUNCHES

13.1.3 ROQUETTE FRÈRES

TABLE 331 ROQUETTE FRÈRES: BUSINESS OVERVIEW

TABLE 332 ROQUETTE FRÈRES: PRODUCTS OFFERED

TABLE 333 ROQUETTE FRÈRES: NEW PRODUCT LAUNCHES

TABLE 334 ROQUETTE FRÈRES: OTHERS

13.1.4 KERRY

TABLE 335 KERRY: BUSINESS OVERVIEW

FIGURE 53 KERRY: COMPANY SNAPSHOT

TABLE 336 KERRY: PRODUCTS OFFERED

TABLE 337 KERRY: DEALS

TABLE 338 KERRY: OTHERS

13.1.5 VESTKORN MILLING AS

TABLE 339 VESTKORN MILLING AS: BUSINESS OVERVIEW

TABLE 340 VESTKORN MILLING AS: PRODUCTS OFFERED

TABLE 341 VESTKORN MILLING AS: NEW PRODUCT LAUNCHES

13.1.6 INGREDION INCORPORATED

TABLE 342 INGREDION INCORPORATED: BUSINESS OVERVIEW

FIGURE 54 INGREDION INCORPORATED: COMPANY SNAPSHOT

TABLE 343 INGREDION INCORPORATION: PRODUCTS OFFERED

TABLE 344 INGREDION INCORPORATION: NEW PRODUCT LAUNCHES

TABLE 345 INGREDION INCORPORATION: DEALS

TABLE 346 INGREDION INCORPORATION: OTHERS

13.1.7 COSUCRA GROUPE WARCOING SA

TABLE 347 COSUCRA GROUPE WARCOING SA: BUSINESS OVERVIEW

TABLE 348 COSUCRA GROUPE WARCOING SA: PRODUCTS OFFERED

TABLE 349 COSUCRA GROUPE WARCOING SA: OTHERS

13.1.8 AXIOM FOODS INC.

TABLE 350 AXIOM FOODS INC.: BUSINESS OVERVIEW

TABLE 351 AXIOM FOODS INC.: PRODUCTS OFFERED

TABLE 352 AXIOM FOODS INC.: NEW PRODUCT LAUNCHES

TABLE 353 AXIOM FOODS INC.: DEALS

13.1.9 FELLESKJØPET ROGALAND AGDER

TABLE 354 FELLESKJØPET ROGALAND AGDER: BUSINESS OVERVIEW

TABLE 355 FELLESKJØPET ROGALAND AGDER: PRODUCTS OFFERED

TABLE 356 FELLESKJØPET ROGALAND AGDER: NEW PRODUCT LAUNCHES

13.1.10 AGT FOOD AND INGREDIENTS

TABLE 357 AGT FOOD AND INGREDIENTS: BUSINESS OVERVIEW

TABLE 358 AGT FOOD AND INGREDIENTS: PRODUCTS OFFERED

13.1.11 PARRHEIM FOODS

TABLE 359 PARRHEIM FOODS: BUSINESS OVERVIEW

TABLE 360 PARRHEIM FOODS: PRODUCTS OFFERED

13.1.12 PURIS FOODS

TABLE 361 PURIS FOODS: BUSINESS OVERVIEW

TABLE 362 PURIS FOODS: PRODUCTS OFFERED

TABLE 363 PURIS FOODS: NEW PRODUCT LAUNCHES

TABLE 364 PURIS FOODS: DEALS

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 MEELUNIE B.V.

TABLE 365 MEELUNIE B.V.: BUSINESS OVERVIEW

TABLE 366 MEELUNIE B.V: PRODUCTS OFFERED

13.2.2 BATORY FOODS

TABLE 367 BATORY FOODS: BUSINESS OVERVIEW

TABLE 368 BATORY FOODS: PRODUCTS OFFERED

TABLE 369 BATORY FOODS: DEALS

TABLE 370 BATORY FOODS: OTHERS

13.2.3 SHANDONG JIANYUAN GROUP

TABLE 371 SHANDONG JIANYUAN GROUP: BUSINESS OVERVIEW

TABLE 372 SHANDONG JIANYUAN GROUP: PRODUCTS OFFERED

13.2.4 YANTAI SHUANGTA FOOD CO., LTD.

TABLE 373 YANTAI SHUANGTA FOOD CO., LTD.: BUSINESS OVERVIEW

TABLE 374 YANTAI SHUANGTA FOOD CO., LTD.: PRODUCTS OFFERED

13.2.5 A&B INGREDIENTS INC.

TABLE 375 A&B INGREDIENTS INC.: BUSINESS OVERVIEW

TABLE 376 A&B INGREDIENTS INC.: PRODUCTS OFFERED

13.2.6 YANTAI ORIENTAL PROTEIN TECH CO., LTD.

13.2.7 AMERICAN KEY FOOD PRODUCTS

13.2.8 THE SCOULAR COMPANY

13.2.9 BURCON NUTRASCIENCE CORP

13.2.10 AGRIDIENT B.V.

13.2.11 LONG LIST OF COMPANIES

14 ADJACENT AND RELATED MARKETS (Page No. - 309)

14.1 INTRODUCTION

TABLE 377 ADJACENT MARKETS TO PEA PROCESSED INGREDIENTS

14.2 LIMITATIONS

14.3 PEA STARCH MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 378 PEA STARCH MARKET SIZE, BY GRADE, 2018–2026 (USD MILLION)

14.4 PLANT-BASED PROTEIN MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 379 PLANT-BASED PROTEIN MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

15 APPENDIX (Page No. - 312)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involves four major activities to estimate the current size for pea processed ingredients market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. These findings, assumptions, and market size was validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

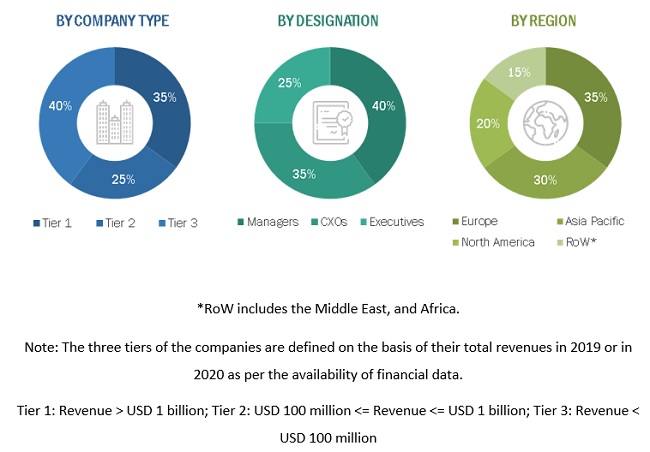

The pea processed ingredients market comprises several stakeholders such as manufacturers, importers & exporters, traders, distributors, suppliers of pea processed ingredients; food safety authorities; food technologists; food product manufacturers; raw material suppliers; and regulatory bodies such as the Food and Agriculture Organization (FAO), the Environmental Protection Agency (EPA), the Food Safety Council (FSC), government and research organizations, and trade associations and industry bodies. The demand-side of this market is characterized by the rising awareness of shelf life extension among pea processed ingredients manufacturers. The supply-side is characterized by advancements in technology in processing peas and increasing the production of pea processed ingredients. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents—

The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the pea processed ingredient market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The value chain and market size of the pea processed ingredient market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for key opinions from leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives:

- To define, segment, and project the global market size for pea processed ingredients

- To understand the structure of the pea processed ingredients market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client's specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe, Rest of Asia Pacific, and Rest of South America.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pea Processed Ingredients Market