Particulate Matter Monitoring Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Indoor Monitoring, Outdoor Monitoring), Technology (Light Scattering, Beta-Attenuation, Gravimetric, Opacity), Particle Size (PM1, PM2.5, PM4, PM10), Application and Region - Global Forecast to 2027

Updated on : October 22, 2024

The Particulate Matter Monitoring Market is experiencing significant growth, driven by the rising demand for air quality monitoring solutions amid increasing concerns over pollution and its health impacts. As urbanization and industrial activities intensify, regulatory bodies and governments are prioritizing the establishment of stringent air quality standards, leading to greater investment in monitoring technologies. Key trends in this market include the adoption of real-time monitoring systems, which utilize advanced sensors and data analytics to provide timely and accurate air quality assessments.

Additionally, the integration of IoT and cloud computing is enhancing data accessibility and enabling predictive analytics for better environmental management. Looking ahead, the future of the Particulate Matter Monitoring Market is promising, with continuous innovations in sensor technologies and an expanding emphasis on environmental sustainability expected to drive further growth and application across various sectors, including public health, agriculture, and urban planning.

Particulate Matter Monitoring Market Size & Growth

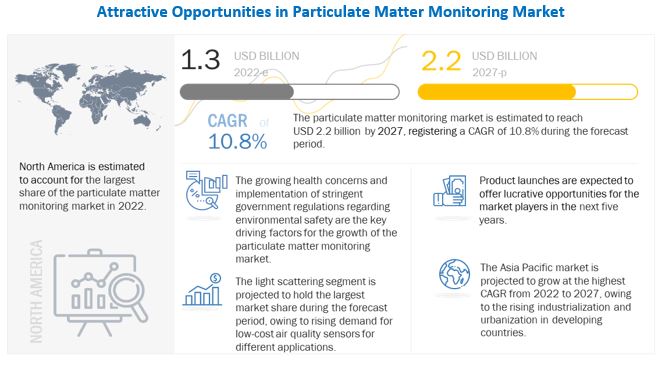

The Particulate Matter Monitoring Market Size is predicted to grow from USD 1.3 billion in 2022 to USD 2.2 billion by 2027, Growing at a CAGR of 10.8% from 2022 to 2027

The fast-growing semiconductor industry in Asia Pacific is expected to drive the demand for particulate matter monitoring solutions for use in cleanrooms and chip manufacturing facilities. For instance, the Chinese government has launched several initiatives to strengthen the semiconductor industry and it has invested into its domestic IC industry through the National Integrated Circuit Industry Investment Fund. Such investments are expected to drive the growth of semiconductor industry and manufacturing in China, which will drive the demand of particulate matter monitoring industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Particulate Matter Monitoring Market Segment Overview

The beta-attenuation technology for particulate matter monitoring market is projected to grow at a significant CAGR during the forecast period.

Beta-attenuation is the widely used air monitoring technology that absorbs beta radiation by solid particles extracted from airflow. It detects PM2.5 and PM10, which most air pollution regulatory agencies monitor.

However, compared to technologies such as light scattering and opacity, this technology is expensive. Hence, the rate of this segment is relatively slower in the global particulate matter monitoring market growth. Some major players integrating this technology into particulate matter sensors/devices/ instruments include Met One Instruments Inc. (now part of ACOEM Group), Thermo Fisher Scientific, Inc., and ACOEM Group.

The market for oil & gas application is expected to grow at the significant CAGR during the forecast period

Several processes in the oil & gas industry emit nitrogen oxides, carbon dioxide, sulfur dioxide, carbon monoxide, total volatile organic compounds (tVOCs), particulate matter, and hydrogen sulfide.

In the oil & gas industry, the production process releases pollutants into the environment. The air pollutant sources include the process heaters, tail gas units, Fluidized Catalytic Cracking (FCC) regenerators, flares and boilers, storage facility and equipment leaks, etc. The particles released are very small and come from various process units. The release of particulate matter depends on dust-catching equipment, burner design, fuel type, equipment maintenance, and oxygen concentration. Thus, the industry highly uses particulate matter monitoring instruments/sensors to identify particulate matter emissions and particle size.

To know about the assumptions considered for the study, download the pdf brochure

The market in Asia Pacific projected to grow at the highest CAGR from 2022 to 2027.

The particulate matter monitoring market share in the Asia Pacific comprises of key countries like China, India, Japan, and South Korea among others. The demand for particulate matter monitoring solutions is expected to grow at a fast pace in developing countries of Asia Pacific.

For instance, India is considered one of the fastest-growing economies worldwide. Like other countries, India is also working towards reducing particulate matter and monitoring control, which is generated through industries and other factors. The National Clean Air Programme (NCAP) identifies several industries, such as mining, construction, and the raw materials used in stone refining, crushing, and cement industries responsible for generating dust particles. For instance, activities like drilling, crushing, and sand filtering cause dust generation and are considered the major sources of dust pollution, leading to an increase in the number of dust monitors across the country. The demand for particulate matter monitoring is growing in India. For instance, in September 2019, a pilot emissions trading scheme (ETS) to measure particulate matter pollution was implemented in Surat city (India).

Top 5 Key Market Players in Particulate Matter Monitoring Market

Major vendors in the Particulate Matter Monitoring Companies include

-

Thermo Fisher Scientific, Inc. (US),

-

AMETEK (US),

-

Spectris plc (UK),

-

ACOEM Group (France),

-

Siemens (Germany)

Particulate Matter Monitoring Market Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.3 billion |

|

Revenue Forecast in 2027 |

USD 2.2 billion |

|

Growth Rate |

10.8%. |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Particle Size, Type, Technology, and Application |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Thermo Fisher Scientific, Inc. (US), AMETEK (US), Spectris plc (UK), ACOEM Group (France), and Siemens (Germany) and Others- (Total 22 players have been covered) |

Particulate Matter Monitoring Market Dynamics

DRIVERS: Increasing focus on ambient air quality monitoring

Air quality monitoring for outdoor environments is considered critical in several countries worldwide. Several cities across the world, which have an advanced civic technology environment, or those that are planning major infrastructure upgrades in their existing ones, should consider integrating air quality sensors into their infrastructures.

Cities with “Smart City” agendas and advanced data management capabilities can measure the ambient air quality, weather, traffic, noise, and other factors using multi-purpose sensors. People living in high-polluted towns and cities are realizing the impact of these particles. For instance, a city like London faces high air pollution in which PM2.5 is considered the most concerning and proven fatal in numerous cases. Thus, it is becoming necessary to monitor the ambient air quality in major cities to maintain environmental and human health. Furthermore, the environmental effects include visibility impairment, environmental damage, and material damage. Fine particle PM2.5 is the main cause of reduced visibility (haze) in various countries. Hence, it is required to monitor the ambient air quality periodically. Moreover, environmental damage due to particulate matter includes damaging sensitive forests and farm crops, making lakes and streams acidic, and more. In addition, wood burning, open fires, and coal-fueled stoves are considered the large contributors to particulate matter emissions in countries such as the UK and across Europe. Hence, all these factors are likely to fuel the demand for particulate matter sensors in ambient air monitoring, creating lucrative opportunities for the market players

RESTRAINTS: High technology cost and lack of real-time monitoring using traditional particulate matter monitoring solutions

Particulate matter sensors can monitor the particle density by assessing all the changes in the properties of air passing through the sensor unit. Unlike gas sensors that can detect different pollutants, particulate matter sensors cannot identify the exact composition of pollutants.

However, they can recognize particles of varied sizes. The existing low-cost particulate matter sensing mainly uses light scattering technology; however, other traditional laboratory-grade instruments offer more accuracy but are expensive. For instance, gravimetric methods are considered the most accurate way of determining mass concentration, but they have some practical limitations of installation in everyday applications as these instruments are bulky and expensive. Hence, they are rarely used in low-cost air quality sensing applications and are mostly deployed by government organizations. Beta-attenuation technology provides the mass concentration of particulate matter. But the primary drawback of this technology-based instrument is that it is a non-continuous monitoring technology and can collect only limited readings. Moreover, this technology is also costly, limiting its market acceptance.

OPPORTUNITIES: Growing indoor air quality monitoring worldwide

Due to the particulate matter, there are chances of numerous health effects, such as premature death in people with heart or lung diseases, aggravated asthma, nonfatal heart attacks, decreased lung function, irregular heartbeats, and irritation of airways.

Some particles such as smog, smoke, and soot are visible, but some of the most harmful particles, which are smaller and invisible, can easily get into the lungs and bloodstream. These particulate matters can lead to acute and chronic ill-health effects. The health impacts of particulate matter depend on the pre-existing conditions, type of particulate matter, and other environmental factors. Exposure to particulate matter can also lead to several unpleasant symptoms and conditions. In addition, it also causes nose, eyes and throat irritation, fatigue, dizziness, cardiovascular diseases, and even some cancers. Hence, it is necessary to measure and monitor the levels of particulate matter in commercial and residential buildings. For this, indoor air quality sensors are being used for different particle sizes such as PM1, PM2.5, PM4, and PM10, because these indoor air quality sensors or particulate matter sensors provide clear insights into the building’s indoor air quality.

CHALLENGES: Delay in implementation of particulate matter monitoring solutions in developing countries

With ongoing technological advancements in particulate matter monitoring instruments and technologies, governments worldwide are increasingly focusing on controlling this pollutant and deploying particulate matter monitors/dust monitors according to the requirement of industries.

This is expected to boost the growth prospects for particulate matter monitoring products during the next decade. Although the implementation of particulate matter monitors in European and North American countries is growing owing to government regulations, developing countries in regions such as Asia Pacific, South America, and Africa are not aggressively focusing on monitoring pollutant levels. This is due to the absence/delay in the implementation of stringent government regulations.

Particulate Matter Monitoring Market Categorization

This research report categorizes the particulate matter monitoring market by particle size, type, technology, application and region.

Based on Particle Size, the Particulate Matter Monitoring Market been Segmented as follows:

- PM1

- PM2.5

- PM5

- PM10

Based on Type, the Particulate Matter Monitoring Market been Segmented as follows:

- Indoor Monitoring

- Outdoor Monitoring

Based on Technology, the Particulate Matter Monitoring Market been Segmented as follows:

- Light Scattering

- Beta-Attenuation

- Gravimetric

- Opacity

- Others

Based on Application, the Particulate Matter Monitoring Market been Segmented as follows:

-

Process Industries

- Power Generation

- Oil & Gas

- Chemical & Petrochemical

- Ambient Air Monitoring

- Indoor Air Monitoring

- Healthcare

- Others

Based on Region, the Particulate Matter Monitoring Market been Segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

-

Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- South America

Recent Developments in Particulate Matter Monitoring Industry

- In May 2022, TSI Incorporated has launched the SidePak AM520 Personal Aerosol Monitor, with real-time benefits such as dual display and data logging of mass concentration of respirable silica and Diesel Particulate Monitoring (DPM) applications.

- In September 2021, Particle Measuring Systems launched the new PRO Series, a portfolio of complete contamination monitoring instruments, which includes particle counters, microbial monitors, and more.

- In November 2020, Honeywell International Inc. announced to expand its Healthy Buildings Air Quality offering to improve and measure commercial building indoor air quality. For this, the company introduced the Honeywell Electronic Air Cleaners (EACs) with UV Systems and a new line of indoor air quality (IAQ) sensors.

Frequently Asked Questions (FAQs):

What is the CAGR expected to be recorded for the particulate matter monitoring market during 2022-2027?

The global particulate matter monitoring market is expected to record a CAGR of 10.8% from 2022–2027.

What are the driving factors for the particulate matter monitoring market?

Increasing focus on ambient air quality monitoring and stringent government regulations are the key driving factors for this particulate matter monitoring market.

Which are the significant players operating in the particulate matter monitoring market?

Thermo Fisher Scientific, Inc. (US), AMETEK (US), Spectris plc (UK), ACOEM Group (France), and Siemens (Germany) are among a few key players in the particulate matter monitoring market.

Which region will grow at a fast rate in the future?

The particulate matter monitoring market in Asia pacific is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 PARTICULATE MATTER MONITORING MARKET: SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH APPROACH

FIGURE 2 PARTICULATE MATTER MONITORING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 MARKET: RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for deriving market size by bottom-up analysis (demand side)

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for deriving market size by top-down analysis (supply side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

TABLE 1 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 9 PARTICULATE MATTER MONITORING MARKET, 2018–2027 (USD MILLION)

FIGURE 10 LIGHT SCATTERING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 11 AMBIENT AIR MONITORING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 13 GROWING HEALTH CONCERNS AND INCREASING ENVIRONMENTAL REGULATIONS

4.2 MARKET, BY TYPE

FIGURE 14 OUTDOOR MONITORING SEGMENT TO HOLD LARGER MARKET SHARE FROM 2022 TO 2027

4.3 MARKET, BY TECHNOLOGY

FIGURE 15 LIGHT SCATTERING SEGMENT TO REGISTER HIGHER CAGR FROM 2022 TO 2027

4.4 MARKET, BY APPLICATION

FIGURE 16 AMBIENT AIR MONITORING SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2027

4.5 NORTH AMERICAN MARKET, BY APPLICATION AND COUNTRY

FIGURE 17 AMBIENT AIR MONITORING SEGMENT AND US TO BE LARGEST SHAREHOLDERS OF NORTH AMERICAN MARKET IN 2027

4.6 MARKET, BY COUNTRY

FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 PARTICULATE MATTER MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing government regulations and standards related to air quality monitoring

5.2.1.2 Growing need for monitoring emissions and particulate matter levels in automotive and transportation sectors

5.2.1.3 Increasing focus on ambient air quality monitoring

FIGURE 20 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High technology cost and lack of real-time monitoring using traditional particulate matter monitoring solutions

FIGURE 21 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing indoor air quality monitoring worldwide

FIGURE 22 HARMFUL EFFECTS ASSOCIATED WITH EXPOSURE TO PARTICULATE MATTER

5.2.3.2 Expanding semiconductor and healthcare industries in Asia Pacific

FIGURE 23 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Delay in implementation of particulate matter monitoring solutions in developing countries

FIGURE 24 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

TABLE 2 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 3 INDICATIVE PRICE OF PARTICULATE MATTER MONITORING PRODUCTS, BY KEY PLAYER

5.5.1 AVERAGE SELLING PRICE OF PARTICULATE MATTER MONITORING PRODUCTS OFFERED BY KEY PLAYERS

FIGURE 27 AVERAGE SELLING PRICE OF PARTICULATE MATTER MONITORING PRODUCTS OFFERED BY THREE KEY PLAYERS

TABLE 4 AVERAGE SELLING PRICE OF PARTICULATE MATTER MONITORING PRODUCTS OFFERED BY THREE KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE (AI)

5.7.2 INTERNET OF THINGS (IOT)

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.9.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR 3 KEY APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR 3 KEY APPLICATIONS

5.10 CASE STUDY ANALYSIS

TABLE 8 WORLD CLASS CRUSHER QUARRY USES PM MONITORING TO MEET REGULATORY COMPLIANCE

TABLE 9 SISK GROUP USES DUST SENTRY PARTICULATE MATTER MONITORS TO REDUCE CONSTRUCTION DUST EMISSIONS AT WEMBLEY CITY REGENERATION PROJECT

TABLE 10 GAS AND DUST MONITORS OF AMETEK HELP JELD-WEN TO ACHIEVE EMISSION COMPLIANCE

5.11 TRADE ANALYSIS

FIGURE 31 IMPORT SCENARIO OF MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES, BY KEY COUNTRY, 2017−2021 (USD MILLION)

FIGURE 32 EXPORT DATA FOR MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES, BY KEY COUNTRY, 2017−2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 11 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 34 NUMBER OF PATENTS GRANTED PER YEAR, 2012–2021

TABLE 12 LIST OF PATENTS IN MARKET, 2020–2021

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 13 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 STANDARDS

TABLE 18 STANDARDS FOR MARKET

6 PARTICULATE MATTER MONITORING MARKET, BY PARTICLE SIZE (Page No. - 74)

6.1 INTRODUCTION

FIGURE 35 MARKET, BY PARTICLE SIZE

FIGURE 36 PARTICULATE MATTER: COMMON EXAMPLES BASED ON TYPE AND SIZE

6.2 PM1

6.3 PM2.5

6.4 PM4

6.5 PM10

TABLE 19 KEY DIFFERENCES: PM2.5 VS. PM10

7 PARTICULATE MATTER MONITORING MARKET, BY TYPE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 37 MARKET, BY TYPE

FIGURE 38 OUTDOOR MONITORING SEGMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 20 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 21 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 INDOOR MONITORING

7.2.1 GROWING AWARENESS REGARDING ADVERSE EFFECTS OF PARTICULATE MATTER ON HUMAN HEALTH

TABLE 22 INDOOR MONITORING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 INDOOR MONITORING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 OUTDOOR MONITORING

7.3.1 RISING TREND OF PARTICULATE MATTER MONITORING IN VARIOUS INDUSTRIES

TABLE 24 OUTDOOR MONITORING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 OUTDOOR MONITORING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 PARTICULATE MATTER MONITORING MARKET, BY TECHNOLOGY (Page No. - 83)

8.1 INTRODUCTION

FIGURE 39 MARKET, BY TECHNOLOGY

FIGURE 40 LIGHT SCATTERING SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 26 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.2 LIGHT SCATTERING

8.2.1 RISING USE OF LIGHT SCATTERING TECHNOLOGY DUE TO COST-EFFECTIVENESS

TABLE 28 LIGHT SCATTERING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 LIGHT SCATTERING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 BETA-ATTENUATION

8.3.1 INCREASING APPLICATION OF BETA-ATTENUATION TECHNOLOGY IN PARTICULATE MONITORS TO ACHIEVE HIGH-ACCURACY MEASUREMENTS

TABLE 30 BETA-ATTENUATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 BETA-ATTENUATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 GRAVIMETRIC

8.4.1 HIGH DEMAND FOR GRAVIMETRIC TECHNOLOGY-BASED EQUIPMENT FROM GOVERNMENT AGENCIES TO RECORD RELIABLE READINGS

TABLE 32 GRAVIMETRIC: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 GRAVIMETRIC: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 OPACITY

8.5.1 HIGH USE OF OPACITY MONITORS IN PROCESS INDUSTRIES FOR CONTINUOUS PARTICULATE MATTER MONITORING

TABLE 34 OPACITY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 OPACITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 OTHER TECHNOLOGIES

TABLE 36 OTHER TECHNOLOGIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 OTHER TECHNOLOGIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 PARTICULATE MATTER MONITORING MARKET, BY APPLICATION (Page No. - 92)

9.1 INTRODUCTION

FIGURE 41 MARKET, BY APPLICATION

FIGURE 42 AMBIENT AIR MONITORING SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2027

TABLE 38 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 39 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 PROCESS INDUSTRIES

9.2.1 POWER GENERATION

9.2.1.1 High use of particle sensors in power generation industry for particulate matter monitoring

TABLE 40 POWER GENERATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 POWER GENERATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.2 OIL & GAS

9.2.2.1 Growing demand for advanced particulate matter monitoring solutions in oil & gas industry

TABLE 42 OIL & GAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 OIL & GAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.3 CHEMICAL & PETROCHEMICAL

9.2.3.1 Stringent quality and production requirements in chemical industry

TABLE 44 CHEMICAL & PETROCHEMICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 CHEMICAL & PETROCHEMICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 AMBIENT AIR MONITORING

9.3.1 RISING DEMAND FOR PARTICULATE MATTER MONITORING SOLUTIONS IN CONSTRUCTION AND MINING INDUSTRIES

TABLE 46 AMBIENT AIR MONITORING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 AMBIENT AIR MONITORING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 INDOOR AIR MONITORING

9.4.1 INCREASING DEMAND FOR INDOOR PARTICULATE MATTER MONITORS WITH RISING INVESTMENTS IN SEMICONDUCTOR INDUSTRY

TABLE 48 INDOOR AIR MONITORING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 INDOOR AIR MONITORING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 HEALTHCARE

9.5.1 IMPLEMENTATION OF STRINGENT SAFETY AND QUALITY REGULATIONS

TABLE 50 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 OTHER APPLICATIONS

TABLE 52 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 PARTICULATE MATTER MONITORING MARKET, BY REGION (Page No. - 103)

10.1 INTRODUCTION

FIGURE 43 MARKET, BY REGION

FIGURE 44 CHINA TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2022 TO 2027

TABLE 54 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 46 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN MARKET DURING FORECAST PERIOD

TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 High industrial growth and presence of major market players

10.2.2 CANADA

10.2.2.1 Expanding oil & gas industry

10.2.3 MEXICO

10.2.3.1 Growing process industries

10.3 EUROPE

FIGURE 47 EUROPE: SNAPSHOT OF MARKET

FIGURE 48 UK TO REGISTER HIGHEST CAGR IN EUROPEAN MARKET DURING FORECAST PERIOD

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing government-led investments and initiatives to monitor air quality

10.3.2 UK

10.3.2.1 Rising funding by local authorities to improve air quality

10.3.3 FRANCE

10.3.3.1 Increasing installation of particulate matter monitors with rising focus on improving air quality

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 49 ASIA PACIFIC: SNAPSHOT OF MARKET

FIGURE 50 CHINA TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC MARKET DURING FORECAST PERIOD

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Government initiatives to reduce air pollution

10.4.2 JAPAN

10.4.2.1 High air pollution in urban areas

10.4.3 INDIA

10.4.3.1 Rising demand for ambient air monitoring solutions to curb air pollution

10.4.4 SOUTH KOREA

10.4.4.1 Increasing industrialization and urbanization

10.4.5 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 51 MIDDLE EAST TO HOLD LARGEST SHARE OF ROW MARKET DURING FORECAST PERIOD

TABLE 80 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 MIDDLE EAST: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 ROW: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 86 ROW: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 87 ROW: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 88 ROW: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 89 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Rising industrialization

10.5.2 AFRICA

10.5.2.1 Rising initiatives by international organizations and local authorities

10.5.3 SOUTH AMERICA

10.5.3.1 Increasing government emphasis on reducing black carbon levels

11 COMPETITIVE LANDSCAPE (Page No. - 130)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 90 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

11.3 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 52 MARKET: REVENUE ANALYSIS OF 5 KEY PLAYERS, 2017–2021

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 91 MARKET: MARKET SHARE ANALYSIS (2021)

11.5 COMPANY EVALUATION QUADRANT, 2021

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 53 MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 54 MARKET: SME EVALUATION QUADRANT, 2021

11.7 PARTICULATE MATTER MONITORING MARKET: COMPANY FOOTPRINT

TABLE 92 COMPANY FOOTPRINT

TABLE 93 APPLICATION: COMPANY FOOTPRINT

TABLE 94 REGION: COMPANY FOOTPRINT

11.8 COMPETITIVE BENCHMARKING

TABLE 95 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 96 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.9 COMPETITIVE SCENARIOS AND TRENDS

11.9.1 MARKET: PRODUCT LAUNCHES

11.9.2 MARKET: DEALS

12 COMPANY PROFILES (Page No. - 146)

12.1 KEY PLAYERS

(Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

12.1.1 AMETEK

TABLE 97 AMETEK: COMPANY OVERVIEW

FIGURE 55 AMETEK: COMPANY SNAPSHOT

TABLE 98 AMETEK: PRODUCT OFFERINGS

TABLE 99 AMETEK: PRODUCT LAUNCHES

TABLE 100 AMETEK: DEALS

12.1.2 SIEMENS

TABLE 101 SIEMENS: COMPANY OVERVIEW

FIGURE 56 SIEMENS: COMPANY SNAPSHOT

TABLE 102 SIEMENS: PRODUCT OFFERINGS

12.1.3 THERMO FISHER SCIENTIFIC, INC.

TABLE 103 THERMO FISHER SCIENTIFIC, INC.: COMPANY OVERVIEW

FIGURE 57 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

TABLE 104 THERMO FISHER SCIENTIFIC, INC.: PRODUCT OFFERINGS

12.1.4 HONEYWELL INTERNATIONAL INC.

TABLE 105 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 106 HONEYWELL INTERNATIONAL INC.: PRODUCT OFFERINGS

TABLE 107 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

12.1.5 HORIBA, LTD.

TABLE 108 HORIBA, LTD.: COMPANY OVERVIEW

FIGURE 59 HORIBA, LTD.: COMPANY SNAPSHOT

TABLE 109 HORIBA, LTD.: PRODUCT OFFERINGS

12.1.6 ROBERT BOSCH GMBH

TABLE 110 ROBERT BOSCH GMBH: COMPANY OVERVIEW

FIGURE 60 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 111 ROBERT BOSCH GMBH: PRODUCT OFFERINGS

12.1.7 SICK AG

TABLE 112 SICK AG: COMPANY OVERVIEW

FIGURE 61 SICK AG: COMPANY SNAPSHOT

TABLE 113 SICK AG: PRODUCT OFFERINGS

12.1.8 SPECTRIS PLC

TABLE 114 SPECTRIS PLC: COMPANY OVERVIEW

FIGURE 62 SPECTRIS PLC: COMPANY SNAPSHOT

TABLE 115 SPECTRIS PLC: PRODUCT OFFERINGS

TABLE 116 SPECTRIS PLC: PRODUCT LAUNCHES

12.1.9 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 117 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

FIGURE 63 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

TABLE 118 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT OFFERINGS

12.1.10 TESTO SE & CO. KGAA

TABLE 119 TESTO SE & CO. KGAA: COMPANY OVERVIEW

TABLE 120 TESTO SE & CO. KGAA: PRODUCT OFFERINGS

12.1.11 TSI INCORPORATED

TABLE 121 TSI INCORPORATED: COMPANY OVERVIEW

TABLE 122 TSI INCORPORATED: PRODUCT OFFERINGS

TABLE 123 TSI INCORPORATED: PRODUCT LAUNCHES

*Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 ACOEM GROUP

12.2.2 AEROQUAL LIMITED

12.2.3 AIRMODUS OY

12.2.4 DEKATI LTD.

12.2.5 DURAG HOLDING AG (GRIMM)

12.2.6 NANEOS

12.2.7 OPSIS AB

12.2.8 PALAS GMBH

12.2.9 SENSIDYNE, LP

12.2.10 SENSIRION AG

12.2.11 TERA GROUP

13 ADJACENT AND RELATED MARKETS (Page No. - 190)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 SMART SENSORS MARKET, BY TECHNOLOGY

13.3.1 INTRODUCTION

TABLE 124 SMART SENSORS MARKET, BY TECHNOLOGY, 2018–2021 (USD BILLION)

TABLE 125 SMART SENSORS MARKET, BY TECHNOLOGY, 2022–2027 (USD BILLION)

13.3.2 MAJOR PACKAGING TYPES CONSIDERED IN SMART SENSORS MARKET

TABLE 126 TECHNICAL FEATURES OF SYSTEM-IN-PACKAGE (SIP) AND SYSTEM-ON-CHIP (SOC)

13.3.3 MEMS TECHNOLOGY

13.3.3.1 Increasing adoption of MEMS technology-based smart sensors in various process industries to boost market growth

TABLE 127 SMART SENSORS MARKET FOR MEMS TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 128 SMART SENSORS MARKET FOR MEMS TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

13.3.4 CMOS TECHNOLOGY

13.3.4.1 Characteristics such as low static power consumption and high noise immunity driving demand for CMOS technology

TABLE 129 SMART SENSORS MARKET FOR CMOS TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 130 SMART SENSORS MARKET FOR CMOS TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 198)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the particulate matter monitoring market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information-secondary and primary-have been used to identify and collect information for an extensive technical and commercial study of the particulate matter monitoring market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred particulate matter monitoring providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

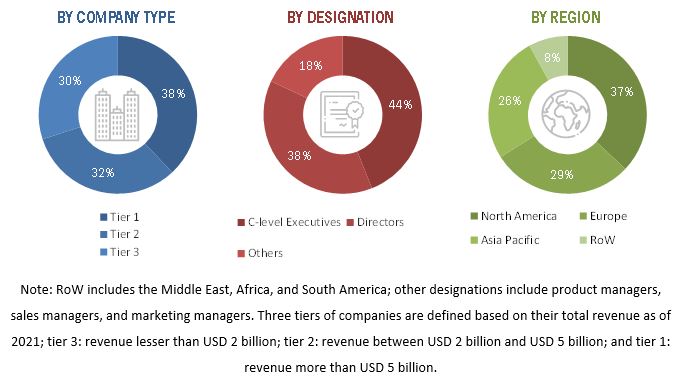

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from particulate matter monitoring instrument providers, such as Thermo Fisher Scientific, Inc. (US), AMETEK (US), Spectris plc (UK), ACOEM Group (France), and Siemens (Germany); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the particulate matter monitoring market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the particulate matter monitoring market based on particle size, technology, and type

- To define, describe, and forecast the particulate matter monitoring market based on application

- To describe and forecast the size of the particulate matter monitoring market based on four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the particulate matter monitoring market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Particulate Matter Monitoring Market