Dry Type Transformer Market

Dry Type Transformer Market by Technology (Cast Resin, Vacuum Pressure Impregnated), Voltage (Low (<1 kV), Medium (1–6 kV), High (Above 36 kV)), Phase (Single, Three), Application (Industrial, Commercial, Utility) and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

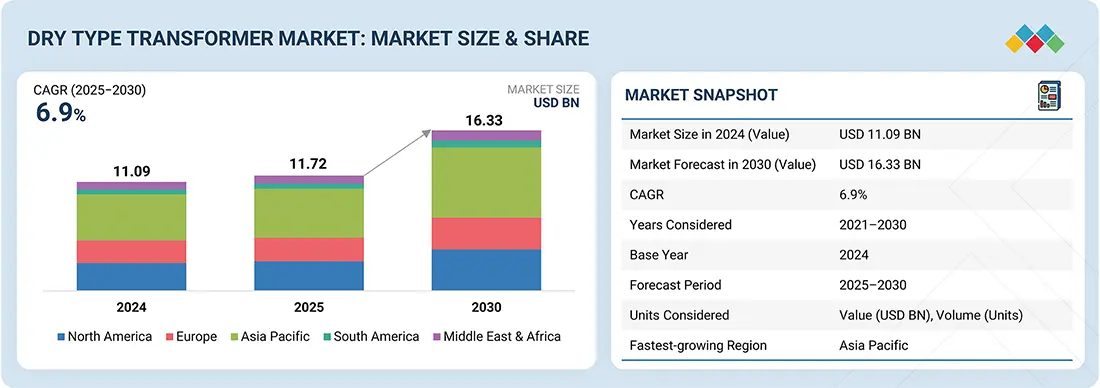

The global dry type transformer market is projected to reach USD 16.33 billion by 2030 from USD 11.72 billion in 2025, registering a CAGR of 6.9%. The market is witnessing strong growth, driven by the increasing adoption of eco-friendly and fire-safe solutions across industrial, utility, and commercial sectors. Rising investments in renewable energy integration, smart grids, and urban infrastructure projects are fueling demand for reliable and low-maintenance transformers. Supportive regulations, stricter safety standards, and advancements in cast resin and VPI technologies are further accelerating deployment worldwide.

KEY TAKEAWAYS

-

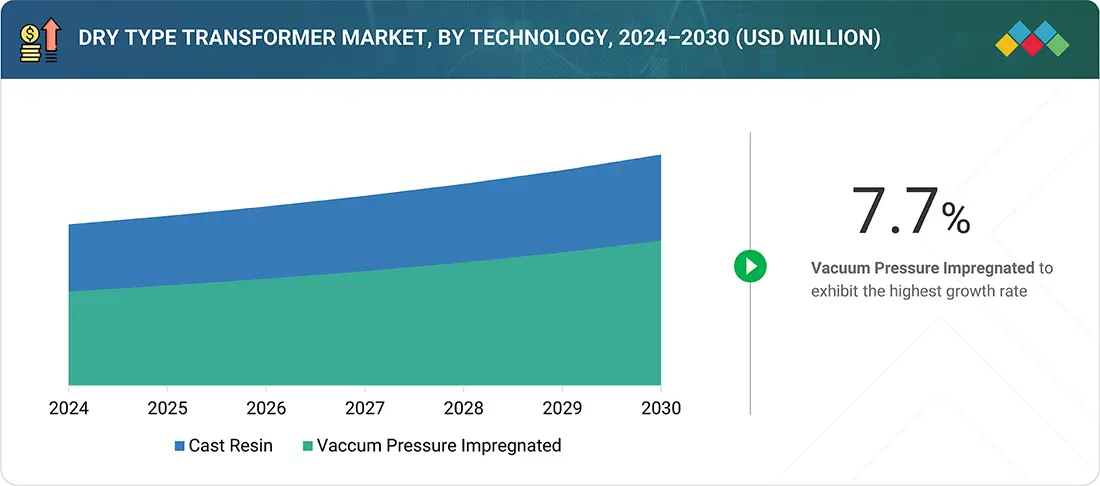

BY TECHNOLOGYThe technology segment includes cast resin and vacuum pressure impregnated. Cast resin transformers are gaining traction due to superior fire resistance, low maintenance, and eco-friendly insulation, meeting demand in sensitive and indoor applications.

-

BY PHASEThe phase segment includes single phase and three phase. The three-phase segment leads the market, driven by extensive use in industrial and utility projects and reinforced by growing investments in renewable integration.

-

BY VOLTAGEThe voltage segment includes low, medium, and high. Medium voltage transformers are preferred for urban infrastructure and renewables, valued for efficient, safe, and regulatory-compliant power delivery.

-

BY APPLICATIONThe application segment includes industrial, commerical, utilities, and others. The industrial sector dominates dry-type transformer adoption, with commercial segments like data centers and metro rail also showing strong growth due to safety and maintenance benefits.

-

BY REGIONAsia Pacific is the fastest growing region, propelled by rapid urbanization, renewable investments, and proactive grid modernization policies in countries such as China, India, and Japan.

-

COMPETITIVE LANDSCAPEThe market is moderately consolidated, with leading players such as ABB, Siemens, Schneider Electric, Eaton, and Hammond Power Solutions, focusing on organic and inorganic strategies. Strategic partnerships, local manufacturing expansions, and product innovations in eco-friendly insulation materials are being adopted to strengthen market presence and cater to evolving demand.

The dry type transformer market is witnessing strong growth due to the rising demand for safe, eco-friendly, and low-maintenance power distribution solutions. Stricter fire safety standards and environmental regulations are increasing adoption across industrial, utility, and commercial sectors. Advances in cast resin and vacuum pressure impregnated (VPI) technologies are enhancing efficiency, reliability, and thermal performance. Supportive government initiatives, renewable energy integration, and investments in smart grid and urban infrastructure are further accelerating the adoption of dry type transformers worldwide.

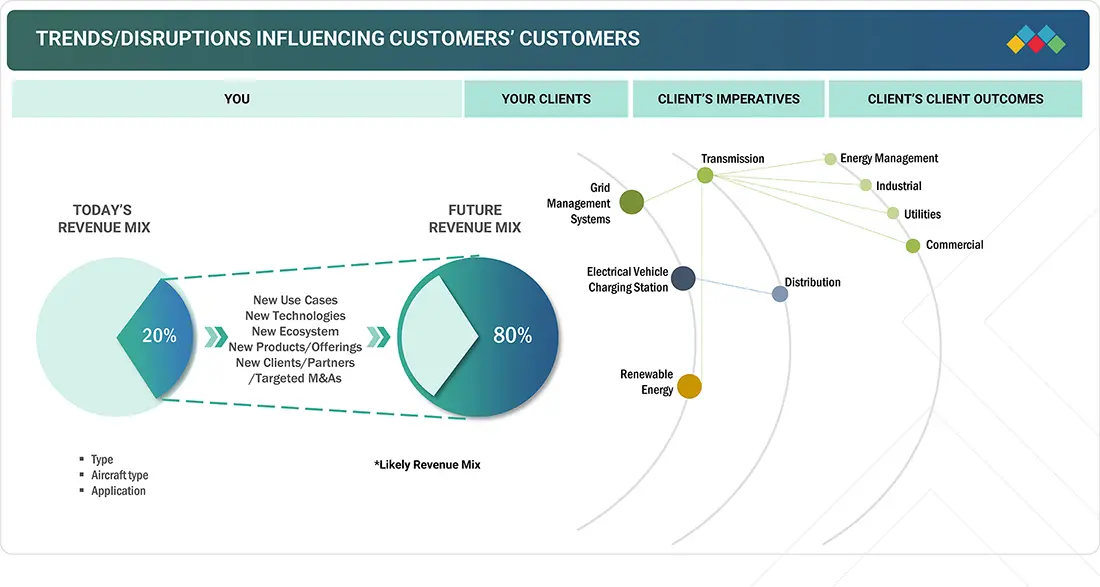

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hotbeds are the clients of dry-type transformer technology providers, and target applications are the clients of these hotbeds. Shifts in trends such as stricter safety regulations, renewable integration, and urban infrastructure growth will impact the revenues of end users. The revenue impact on end users will affect the revenues of hotbeds, which will further influence the revenues of dry type transformer technology providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising global demand for energy efficiency

-

Implementation of stringent environmental regulations

Level

-

High CAPEX due to usage of advanced materials

-

Susceptibility to moisture and insulation

Level

-

Expansion of industrial infrastructure

Level

-

Lack of liquid-based cooling

-

Preference for oil-filled transformers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising Global Demand for Energy Efficiency

The global push toward higher energy efficiency is a major driver for dry type transformers. These transformers offer superior safety, reduced losses, and eco-friendly performance compared to oil-filled units, making them ideal for installations in densely populated urban areas, renewable projects, and commercial facilities. With industries and utilities under increasing regulatory pressure to minimize energy waste and carbon emissions, dry type transformers are gaining strong adoption as part of modern grid infrastructure.

Restraint: High CAPEX Due to Usage of Advanced Materials

One of the primary restraints for dry type transformers is their high upfront capital expenditure. Advanced insulation materials such as epoxy resin, cast resin, and vacuum pressure impregnated (VPI) technologies contribute to higher manufacturing costs than oil-filled designs. This creates adoption challenges in cost-sensitive markets, particularly in large-scale power and utility projects where initial investment is critical in procurement decisions.

Opportunity: Expansion of Industrial Infrastructure

The ongoing expansion of industrial infrastructure worldwide is creating significant opportunities for dry type transformer adoption. Rapid growth in sectors such as manufacturing, data centers, metro rail systems, and EV charging infrastructure requires safe, low-maintenance, and environmentally sustainable power distribution solutions. Government initiatives supporting industrial growth and renewable energy integration further strengthen the business case for dry type transformers, particularly in Asia Pacific, North America, and Europe.

Challenge: Lack of Liquid-based Cooling

A major challenge for dry type transformers is the absence of liquid-based cooling, which limits their efficiency and overload capacity in high-power applications. They are highly suitable for medium-voltage indoor installations. They can handle extremely high voltages and heavy loads as effectively as oil-filled transformers, which restrict their use in utility-scale outdoor projects. As a result, oil-filled units continue to be the preferred choice in many high-capacity and cost-sensitive applications, posing a challenge for wider dry type adoption.

Dry Type Transformer Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Addressing failure analysis of distribution transformers at Ughelli Business Unit; solution targeted overloads and improper copper wiring | Improved transformer reliability, technical guidelines for wire dimensioning, safer electrical distribution without dependency on HRC fuses |

|

Wind Power Projects (Iran Grid Operators) | Tackling grid integration for wind power in the Abhar and Kahak regions through policy-oriented collaboration and stakeholder engagement |

|

Long Island Power Authority (LIPA), New York | Expansion of smart energy corridor with enhanced cybersecurity; advanced metering and control systems supplemented by dry type transformers |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

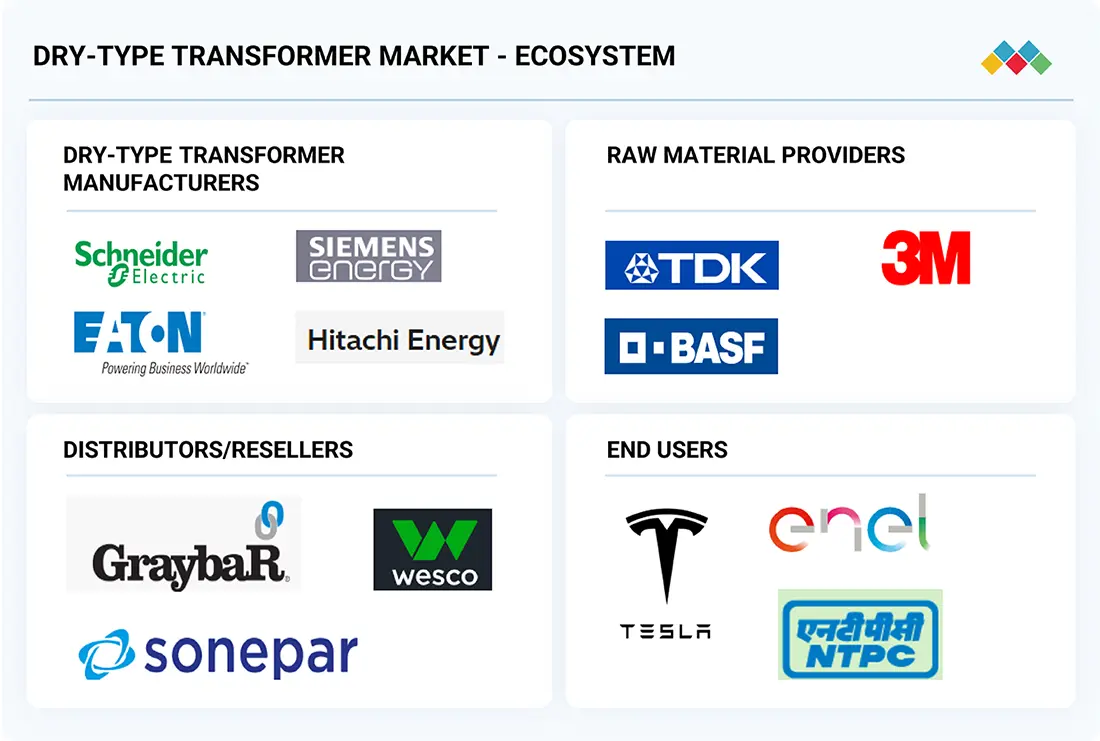

MARKET ECOSYSTEM

The dry type transformer market ecosystem is characterized by robust collaboration among raw material suppliers, manufacturers, distributors, and end users to ensure safe, efficient, and sustainable transformer deployment. Raw material providers such as DuPont, Elantas, and 3M supply essential epoxy resins, insulation materials, and advanced composites that enhance fire resistance, thermal stability, and overall reliability. Manufacturers such as Siemens Energy, Schneider Electric, and Hammond Power Solutions use these materials to design dry type transformers with cast resin and vacuum pressure impregnated (VPI) technologies, ensuring operational safety, compactness, and low maintenance. Distributors, including Ritz and Acme Electric, facilitate market reach and customer support, acting as bridges between manufacturers and niche markets. End users such as Data4 (data centers), Enel (renewables), and Duke Energy (utilities) rely on dry type transformers for reliable, eco-friendly, and fire-safe power distribution, supporting critical areas like digital infrastructure, renewable integration, and grid modernization. This collaboration underlines the market's crucial role in advancing safe and sustainable power distribution solutions worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Dry Type Transformer Market, By Technology

The Cast Resin segment accounted for the largest market revenue share in 2024. This segment is growing as cast resin transformers offer superior fire safety, low maintenance, and enhanced resistance to moisture and dust, making them highly suitable for indoor and urban installations. Their compact design and eco-friendly insulation materials align with stricter safety regulations and sustainability targets, driving wide adoption across industrial and commercial sectors.

Dry Type Transformer Market, By Phase

The Three-phase segment dominated the dry type transformer market in 2024. Three-phase transformers are increasingly preferred due to their efficiency in handling higher power loads and suitability for large-scale applications such as data centers, industrial plants, and utility grids. Their ability to provide stable voltage and reliable performance under heavy load conditions is fueling demand. Ongoing electrification and industrial expansion further support their growth.

Dry Type Transformer Market, By Voltage

The Medium Voltage segment accounted for the largest share in 2024. Medium-voltage dry-type transformers are widely deployed in infrastructure, commercial buildings, and renewable energy projects due to their balance of safety, efficiency, and cost-effectiveness. Their ability to meet grid integration requirements and ensure reliable distribution makes them a preferred choice. Rapid urbanization and increasing investments in smart grid projects are accelerating adoption.

Dry Type Transformer Market, By Application

The Industrial segment held the largest market revenue share in 2024. Industries such as chemicals, oil & gas, and manufacturing rely heavily on dry-type transformers due to their robustness, safety, and ability to operate in challenging environments. Their fire-resistant and low-maintenance design ensures operational reliability, making them ideal for critical industrial processes. Expanding industrialization and stricter safety norms are driving the growth of this segment.

REGION

Europe to be the largest region in the global Pad-Mounted Switchgear market during the forecast period

Asia Pacific accounted for the largest market share and is also projected to record the highest CAGR in the dry type transformer market. The region’s dominance is fueled by rapid industrialization, urbanization, and large-scale infrastructure development in China, India, Japan, and South Korea. Strong investments in renewable energy projects, including solar and wind, are creating significant demand for dry-type transformers that ensure safe and reliable power distribution. Government initiatives promoting energy efficiency and stricter environmental regulations are further accelerating adoption. Additionally, the growing need for transformers in railways, metros, smart cities, and data centers positions the Asia Pacific as the largest and fastest-growing hub for dry-type transformer deployment.

Dry Type Transformer Market: COMPANY EVALUATION MATRIX

In the dry type transformer market matrix, Hitachi Energy (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across utilities, renewables, and data centers. Hyosung Heavy Industries (Emerging Leader) is gaining traction with innovative medium- and high-voltage dry-type solutions, supported by growing demand in Asia and the Middle East.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.09 Billion |

| Market Forecast in 2030 (value) | USD 16.33 Billion |

| Growth Rate | CAGR of 6.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Dry Type Transformer Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- July 2025 : Toyota's restructuring project in Brazil includes the expansion of its existing manufacturing facility in Sorocaba (SP), reaching a total area equivalent to 40 football fields. As part of this growth strategy, WEG supplied TOYOTA with dry-type transformers totaling over 45 MVA of power. The supply is part of Project ON 09400 – TOYOTA DO BRASIL LTDA, one of the largest investments in Brazil, focused on consolidating the production of hybrid flex-fuel vehicles in the country.

- April 2025 : Hitachi Energy announced a USD 22.5 million investment to expand and modernize its dry-type transformer manufacturing operations in Southwest Virginia, supporting the opening of a newly purchased 75,000-square-foot facility in Atkins, Virginia, and upgrading the company’s existing facility in Bland, Virginia.

- April 2023 : Eaton acquired 49% of its stake in Jiangsu Ryan Electrical Co. Ltd., a power distribution and dry-type transformer manufacturer. This acquisition will help the company to serve its customers better globally.

- August 2023 : Eaton is investing over USD 500 million to expand its North American manufacturing capacity, focusing on transformers and essential electrical technologies to meet rising demand across utility, commercial, healthcare, industrial, and residential sectors. The investments aim to enhance supply and operational resilience, with most projects set for completion by 2024 and 2025.

- October 2021 : Hitachi Energy Ltd. completed the expansion of its Bland, Virginia, manufacturing facility, the leading producer of dry type transformers in North America. This expansion provides the additional production capacity to support new manufacturing capabilities.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the dry-type transformer market. Exhaustive secondary research was done to collect information on the peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The primary research for this report involved interviews with sources from both the supply and demand sides to gather qualitative and quantitative insights. Supply-side sources included industry experts such as CEOs, VPs, and marketing directors from companies in the dry-type transformer market.

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. The following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2024: Tier

1 = >USD 1 billion, Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the dry-type transformer market. These methods were also used extensively to estimate the size of various subsegments in the market.

Dry Type Transformer Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

A dry-type transformer is an electrical device that transfers power between two or more circuits without using liquid for cooling or insulation. Unlike oil-immersed transformers, dry-type transformers rely on air or other solid insulation materials, such as epoxy resin or varnish, to cool and insulate the windings. These transformers are typically self-extinguishing, non-flammable, and environmentally safe, making them well-suited for indoor installations or locations with fire risk, environmental restrictions, or ventilation limitations. Their design ensures safety, reliability, and minimal maintenance, which has led to widespread use in commercial buildings, hospitals, metro and railway systems, data centers, industrial facilities, and renewable energy infrastructure. Key technologies within this market include cast resin transformers (CRT) and vacuum pressure-impregnated (VPI) transformers. These are engineered to meet the demands of modern electrical systems, which are increasingly moving toward decentralized, automated, and digitalized grid environments. As global energy consumption grows and infrastructure becomes more urbanized and electrified, the dry-type transformer market is witnessing strong demand due to its alignment with sustainability goals, safety standards, and operational efficiency requirements.

Stakeholders

- Energy regulators

- Consulting companies in the energy & power industry

- Distributors of dry-type transformers

- Governments and research organizations

- Power equipment and garden tool manufacturers

- Dry-type transformer manufacturers

- Spare parts and component suppliers

Report Objectives

- To describe and forecast the dry-type transformer market, in terms of value, based on technology, voltage, phase, application, and region, in terms of value

- To forecast the dry-type transformer market, by region, in terms of volume

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the dry-type transformer market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments, and perform a value chain analysis of the dry-type transformer market

- To analyze the opportunities for various stakeholders by identifying the high-growth segments of the dry-type transformer market

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as contracts, agreements, expansions, product launches, investments, and acquisitions, in the dry-type transformer market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What was the size of the dry-type transformer market in 2024?

The dry-type transformer market was valued at USD 11.09 billion in 2024.

What are the major drivers for the dry-type transformer market?

The major drivers for the dry-type transformer market include the growing demand for safe, reliable, and environmentally sustainable power distribution solutions, especially in urban, commercial, and industrial applications. As global electricity consumption rises due to rapid urbanization, digitalization, and the electrification of transportation and infrastructure, there is an increasing need for medium-voltage transformers that can be safely installed indoors or in densely populated areas. Dry-type transformers, which are oil-free and fire-resistant, offer a safer alternative to traditional oil-immersed units, making them ideal for critical environments such as hospitals, data centers, metro systems, and renewable energy facilities.

Which region will be the largest dry-type transformer market during the forecast period?

Asia Pacific is expected to be the largest dry-type transformer market during the forecast period, driven by rapid industrialization, urban development, and large-scale investments in power infrastructure across key countries such as China, India, Japan, and South Korea. The region’s growing electricity demand, fueled by rising populations, increasing adoption of electric vehicles, renewable energy integration, and expanding commercial and residential infrastructure, has led to a surge in the need for safe, efficient, and compact power distribution systems. Dry-type transformers, with their oil-free, fire-resistant, and low-maintenance characteristics, are increasingly favored for deployment in high-rise buildings, transport hubs, hospitals, and solar and wind power plants.

Which segment of the dry-type transformer market, by voltage, is expected to hold the largest market share during the forecast period, and why?

During the forecast period, the medium voltage segment is expected to hold the largest market share in the dry-type transformer market, primarily due to its extensive use across a wide range of industrial, commercial, and utility applications. Typically operating between 1 and 36 kV, medium-voltage dry-type transformers are crucial for decreasing power from high-voltage transmission lines to levels suitable for end-use applications in manufacturing plants, commercial complexes, hospitals, data centers, renewable energy systems, and public infrastructure. Their compact, oil-free, and fire-safe design makes them ideal for indoor and densely populated environments, where traditional oil-filled transformers pose fire and environmental risks. Additionally, the ongoing shift toward smart grids, decentralized energy systems, and urban electrification has heightened the demand for safe, reliable, and low-maintenance power distribution solutions, further strengthening the position of medium-voltage transformers.

Which application will account for the majority of market share in the coming years?

The industrial application is expected to account for the largest share of the dry-type transformer market in the coming years, driven by the rising demand for safe, efficient, and reliable power distribution in heavy-duty environments. Industries such as manufacturing, oil & gas, chemicals, mining, steel, and automotive require a continuous and stable power supply for operations involving high loads and sensitive equipment. Dry-type transformers are designed for these applications due to their oil-free, fire-resistant design, which reduces the risk of fire hazards and environmental contamination, which is especially important in hazardous or confined industrial settings.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Dry Type Transformer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Dry Type Transformer Market