Packaging Testing Market by Type (Physical, Chemical, Microbiological), Material (Glass, Plastic, Paper, Metals), Technology (Physical tests, Spectroscopy & Photometric-based, Chromatography-based), Industry, and Region - Global Forecast to 2022

[183 Pages Report] Packaging Testing Market report categorizes the global market by Type (Physical, Chemical, Microbiological), Material (Glass, Plastic, Paper, Metals), Technology (Physical tests, Spectroscopy & Photometric-based, Chromatography-based), Industry, and Region. The global market, in terms of value, is projected to reach USD 14.64 Billion by 2022, at a CAGR of 12.0% from 2017. Packaging testing includes the testing of various materials such as glass, plastic, paper & paperboard, metal, and others. Growing demand for safe products with a longer shelf-life is driving the demand for packaging testing. This has attributed to the growth of this market. The market players are responding to these new opportunities by expanding their global presence and service offerings.

The objectives of the study are:

- To define, segment, and forecast the size of this market with respect to type, material type, technology, end-use industry, and region

- To analyze the market structure by identifying the various subsegments of the packaging testing market

- To forecast the size of the packaging testing market and its various submarkets with respect to four main regions, namely, North America, Asia-Pacific, Europe, and the Rest of the World (RoW)

- To provide detailed information about the crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide the details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies1

- To analyze the competitive developments such as expansions & investments, acquisitions, new service & technology launches, agreements, collaborations, and partnerships in the packaging testing market

The years considered for the study are as follows:

- Base Year – 2016

- Estimated Year – 2017

- Projected Year – 2022

- Forecast Period – 2017 to 2022

This report includes estimations of the market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the packaging testing market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research through various sources such as the Centers for Disease Control and Prevention (CDC), U.S. Environmental Protection Agency (EPA), the European Federation of National Associations of Measurement, Testing and Analytical Laboratories (EUROLAB), the World Health Organization (WHO), the Industrial Packaging Alliance of North America (IPANA), the Food Packaging Forum Foundation (IPFF), and I.E. Canada (Canadian Association of Importers and Exporters), and their market share in the respective regions have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The packaging testing ecosystem comprises packaging testing service providers such as SGS S.A. (Switzerland), Bureau Veritas SA (France), Intertek Group Plc. (U.K.), Eurofins Scientific SE (Luxembourg), TÜV SÜD AG (Germany), and Mérieux NutriSciences Corporation (U.S.) as the major players. Other players such as ALS Limited (Australia), National Technical Systems, Inc. (U.S.), Microbac Laboratories, Inc. (U.S.), EMSL Analytical Inc. (U.S.), and Campden BRI (U.K.) also have a significant presence in this market.

Target Audience:

- R&D institutes

- Technology providers

- Packaging testing service providers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers

Scope of the report

This research report categorizes the packaging testing market based on type, material type, technology, end-use industry, and region.

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Based on Type, the market has been segmented as follows:

- Physical

- Chemical

- Microbiological

Based on Material Type, the market has been segmented as follows:

- Glass

- Plastic

- Paper & paperboard

- Metal

- Others

Based on Technology, the market has been segmented as follows:

- Physical tests

- Spectroscopy & photometric-based

- Chromatography-based

- Others

Based on end-use Industry, the market has been segmented as follows:

- Food & beverage

- Agrochemicals

- Pharmaceuticals

- Personal care

- Others

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (South America and the Middle East & Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Segmental Analysis

- Segmental analysis, which provides a further breakdown of the physical, chemical, and microbiological test methods in the test type segment

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific packaging testing market, by country

- Further breakdown of other countries in the Rest of the World packaging testing market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The global packaging testing market has grown exponentially in the last few years. The market size is projected to reach USD 14.64 Billion by 2022, growing at a CAGR of around 12.0% from 2017. Emerging countries such as India, China, Japan, Brazil, and Argentina are the potential primary markets of the industry. Factors such as rising awareness and demand for sustainable packaging, increasing retail industry with increasing demand for packed products, stringent regulatory environment, and the emergence of new technologies are the major driving factors for this market. Moreover, the requirement for longer shelf-life of products helps to drive the growth of the packaging testing industry.

The global market, based on type, is segmented into physical, chemical, and microbiological. The physical segment dominated the market with the largest share in 2016 since the determination of physical properties of a product is an essential application for packaging testing. This is followed by chemical testing of packaging which is conducted for the determination of chemical properties such as corrosion level and overall composition of the material, monitoring product quality, toxic detection, contaminants detection, and to meet other regulatory standards.

The packaging testing market, based on material type, is segmented into glass, plastic, paper & paperboard, metal, and others which include wood, polystyrene, bioplastic, cloth, and other flexible packaging. The plastic segment accounted for the largest share of this market in 2016. The paper & paperboard segment is projected to grow at the highest CAGR from 2017 to 2022. The market for paper packaging testing is growing with an increase in the use of paper & paperboard due to their easy and abundant availability, lower cost, and environment-friendly nature.

The global market, based on technology, is segmented into physical tests, spectroscopy & photometric-based, chromatography-based, and others which include chemical test, molecular, and isotope methods. The physical tests segment dominated the market in 2016. The spectroscopy & photometric-based segment is projected to grow at the highest CAGR from 2017 to 2022. Physical tests not only assure reliability, quality, and performance of packaging products but also help improve the efficiency of product performance, thereby resulting in cost savings.

The global market, based on end-use industry, is segmented into food & beverage, agrochemicals, pharmaceuticals, personal care, and others which include various industries such as textile, automobile, transportation, environmental, and other consumer goods. The pharmaceutical segment dominated the market in 2016. The food & beverage segment is projected to grow at the highest CAGR due to an increase in food safety awareness among consumers and growth in the number of packaging and labeling mandates in various regions.

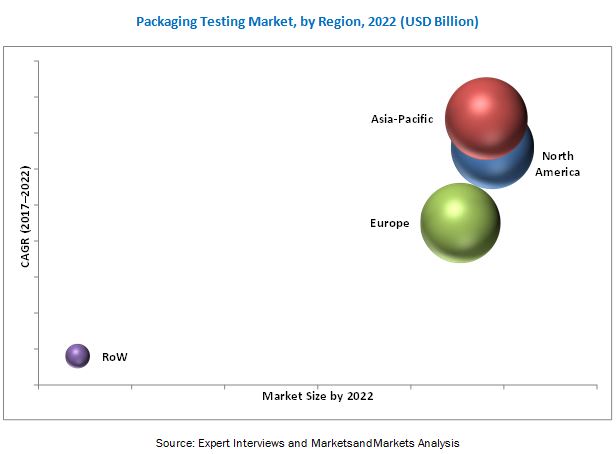

The North American region is projected to dominate the packaging testing market by 2022. The Asia-Pacific region is projected to be the fastest-growing market during the forecast period since the demand from the food & beverage industry is projected to increase in the coming years. The other factors responsible for the growth of the Asia-Pacific market are the emerging countries, globalization of trade, and rapid industrialization in the region.

The cost of packaging testing is very high due to the high cost of testing equipment. Automated instruments provide reliable and faster test results. However, due to the high cost of instruments, the testing cost also increases.

Expansions & investments, acquisitions, new service & technology launches, and agreements, collaborations, and partnerships are the key strategies adopted by market players to ensure their growth in the market. The market is dominated by players such as SGS S.A. (Switzerland), Bureau Veritas SA (France), Intertek Group Plc. (U.K.), Eurofins Scientific SE (Luxembourg), TÜV SÜD AG (Germany), and ALS Limited (Australia). Other major players in the market include Mérieux NutriSciences Corporation (U.S.), National Technical Systems, Inc. (U.S.), Microbac Laboratories, Inc. (U.S.), EMSL Analytical Inc. (U.S.), Campden BRI (U.K.), and Institut fur Produktqualitat GmbH (Germany).

What is market size for food packaging TIC in the global market?

Can you provide the market analysis for food contact material testing and packaging TIC for raw material suppliers, machinery manufacturers, distributors, retailers, and food manufacturers?

End user might have a question with regards to NIAS, can you provide more details?

- Packaging testing is part of NIAS

- NIAS can also be studied separately from regulatory perspective.

Split that market sizing as: Sizing by product type (Oils, Edibles, etc.)

- Regulatory services

- Testing services

- Compliance consulting service,

- Audit

What is the competition status for the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

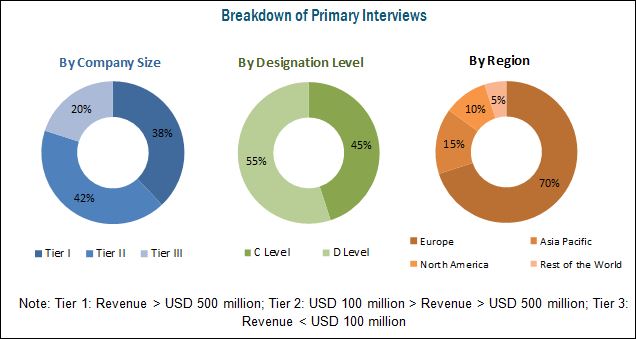

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumption

2.4.2 Limitation

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Opportunities in this Market

4.2 Packaging Testing Market: Key Countries

4.3 Packaging Testing Market, By Material Type and Region

4.4 Developed vs Developing Markets for Packaging Testing

4.5 Market, By Industry & Region

4.6 Market, By Technology

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Products With Longer Shelf Under Various Conditions

5.2.1.2 Stringent Regulatory Environment

5.2.1.2.1 Increasing Recalls Due to Packaging and Labeling

5.2.1.3 Growing Demand for Packaged Products

5.2.1.3.1 Growing FMCG Industries

5.2.1.4 Increasing Awareness and Demand for Sustainable Packaging

5.2.1.4.1 Unauthorized Usage of Recycled Materials

5.2.1.5 Technological Advancements in the Market

5.2.1.5.1 Increasing R&D Investments By Companies

5.2.2 Restraints

5.2.2.1 High Cost of Packaging Testing

5.2.2.1.1 Adoption of Advanced Testing Methods Proportional to the Price of Sample Testing

5.2.2.2 Lack of Standard Regulations

5.2.3 Opportunities

5.2.3.1 Portable & Automated Testing Techniques to Enhance the Testing Availability With Less Turnaround Time

5.2.3.2 Emerging Countries Have High Growth Opportunities

5.2.3.3 Growing Consumer Awareness About the Importance of Safe Packaging for Products

5.2.4 Challenges

5.2.4.1 High Turnaround Time for A Majority of the Tests

5.2.4.2 High Capital Investments

6 Regulatory Framework (Page No. - 51)

6.1 Introduction

6.2 U.S.

6.2.1 U.S. Food-Contact Regulations

6.2.2 U.S. Food Package Labeling Requirements

6.3 Canada

6.4 Eu Regulations

6.4.1 Germany

6.4.2 France

6.4.3 Italy

6.4.4 U.K.

6.5 Eu Food Contact and Package Labeling Regulations

6.6 Food Contact Regulations: Asia-Pacific

6.6.1 Food Packaging Regulations in China

6.6.2 Food Contact Material Regulations in South Korea

6.6.3 Food Contact Material Regulations in Australia & New Zealand

6.6.4 Food Contact Material Regulations in Japan

6.7 Regulatory Standards for Pet (Polyethylene Terephthalate) Pharmaceutical Packaging

6.7.1 U.S. Food and Drug Administration (FDA)

6.7.2 U.S. Pharmacopoeia (USP)

6.7.3 The European Pharmacopoeia (EP)

6.7.4 Bureau of Indian Standards (BIS)

7 Packaging Testing Market, By Type (Page No. - 59)

7.1 Introduction

7.2 Physical

7.3 Chemical

7.4 Microbiological

8 Packaging Testing Market, By Material Type (Page No. - 65)

8.1 Introduction

8.2 Glass

8.3 Plastic

8.4 Paper & Paperboard

8.5 Metal

8.6 Others

9 Packaging Testing Market, By Technology (Page No. - 74)

9.1 Introduction

9.2 Physical Test Methods

9.3 Spectroscopy & Photometric-Based

9.4 Chromatography-Based

9.5 Others

10 Packaging Testing Market, By Industry (Page No. - 81)

10.1 Introduction

10.2 Food & Beverage

10.3 Agrochemicals

10.4 Pharmaceuticals

10.5 Personal Care

10.6 Others

11 Packaging Testing Market, By Region (Page No. - 88)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Australia & New Zealand

11.4.5 Rest of Asia-Pacific

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Middle East

11.5.4 Others in RoW

12 Competitive Landscape (Page No. - 124)

12.1 Introduction

12.2 Competitive Leadership Mapping

12.2.1 Visionary Leaders

12.2.2 Innovators

12.2.3 Dynamic Differentiators

12.2.4 Emerging Companies

12.3 Competitive Benchmarking

12.3.1 Strength of Service Offering (For 26 Companies)

12.3.2 Business Strategy Excellence (For 26 Companies)

12.4 Market Share Analysis, By Key Players, 2016

13 Company Profiles (Page No. - 129)

(Business Overview, Strength of service offering, Services offered, Business strategy excellence, Recent developments)*

13.1 Introduction

13.2 SGS SA

13.3 Bureau Veritas SA

13.4 Intertek Group PLC

13.5 Eurofins Scientific SE

13.6 Tüv Süd AG

13.7 ALS Limited

13.8 Mérieux Nutrisciences Corporation

13.9 Microbac Laboratories, Inc.

13.10 EMSL Analytical, Inc.

13.11 Campden Bri

13.12 Institut Fur Produktqualitat GmbH

13.13 OMIC USA Inc.

*Details on Business Overview, Strength of service offering, Services offered, Business strategy excellence, Recent developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 171)

14.1 Discussion Guide

14.2 Key Industry Insights

14.3 More Company Developments

14.3.1 New Service Launches

14.3.2 Expansions

14.3.3 Acquisitions

14.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.5 Introducing RT: Real Time Market Intelligence

14.6 Available Customizations

14.7 Related Reports

14.8 Author Details

List of Tables (68 Tables)

Table 1 Properties, Environmental Issues, and Cost Factor for Packaging Materials

Table 2 Food Packaging Safety Regulations Across the World

Table 3 Packaging Testing Market Size, By Type, 2015–2022 (USD Million)

Table 4 Packaging Physical Testing Market Size, By Region, 2015–2022 (USD Million)

Table 5 Packaging Chemical Testing Market Size, By Region, 2015–2022 (USD Million)

Table 6 Packaging Microbiological Testing Market Size, By Region, 2015–2022 (USD Million)

Table 7 Materials Used in Packaging

Table 8 Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 9 Glass Packaging Testing Market Size, By Region, 2015–2022 (USD Million)

Table 10 Market Size for Plastic Packaging Testing, By Region, 2015–2022 (USD Million)

Table 11 Paper & Paperboard Packaging Testing Market Size, By Region, 2015–2022 (USD Million)

Table 12 Market Size for Metal Packaging Testing, By Region, 2015–2022 (USD Million)

Table 13 Other Packaging Testing Market Size, By Region, 2015–2022 (USD Million)

Table 14 Market Size for Packaging Testing, By Technology, 2015–2022 (USD Million)

Table 15 Physical Tests Market Size, By Region, 2015–2022 (USD Million)

Table 16 Spectroscopy- & Photometric-Based Market Size, By Region, 2015–2022 (USD Million)

Table 17 Chromatography-Based Market Size, By Region, 2015–2022 (USD Million)

Table 18 Other Technologies Market Size, By Region, 2015–2022 (USD Million)

Table 19 Packaging Testing Market Size, By Industry, 2015–2022 (USD Million)

Table 20 Food & Beverage Packaging Testing Market Size, By Region, 2015–2022 (USD Million)

Table 21 Agrochemicals Packaging Testing Market Size, By Region, 2015–2022 (USD Million)

Table 22 Pharmaceuticals Packaging Testing Market Size, By Region, 2015–2022 (USD Million)

Table 23 Personal Care Packaging Testing Market Size, By Region, 2015–2022 (USD Million)

Table 24 Packaging Testing Market Size for Other Industries, By Region, 2015–2022 (USD Million)

Table 25 Market Size for Packaging Testing, By Region, 2015–2022 (USD Million)

Table 26 North America: Packaging Testing Market Size, By Country, 2015–2022 (USD Million)

Table 27 North America: Market Size, By Material Type, 2015–2022 (USD Million)

Table 28 North America: Market Size, By Type, 2015–2022 (USD Million)

Table 29 North America: Market Size, By Technology, 2015–2022 (USD Million)

Table 30 North America: Market Size, By Industry, 2015–2022 (USD Million)

Table 31 U.S.: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 32 Lists of Acceptable Polymers for Use in Food Packaging Applications in Canada

Table 33 Canada: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 34 Mexico: Market Size, By Material Type, 2015–2022 (USD Million)

Table 35 Europe: Packaging Testing Market Size, By Country, 2015–2022 (USD Million)

Table 36 Europe: Market Size, By Material Type, 2015–2022 (USD Million)

Table 37 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 38 Europe: Market Size, By Technology, 2015–2022 (USD Million)

Table 39 Europe: Market Size, By Industry, 2015–2022 (USD Million)

Table 40 Germany: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 41 U.K.: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 42 France: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 43 Italy: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 44 Spain: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 45 Rest of Europe: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 46 Asia-Pacific: Packaging Testing Market Size, By Country, 2015–2022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Material Type, 2015–2022 (USD Million)

Table 48 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Technology, 2015–2022 (USD Million)

Table 50 Asia-Pacific: Market Size, By Industry, 2015–2022 (USD Million)

Table 51 China: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 52 Shift in Indian Packaging Trend

Table 53 India: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 54 Japan: Market Size, By Material Type, 2015–2022 (USD Million)

Table 55 Australia & New Zealand: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 56 Rest of Asia-Pacific: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 57 RoW: Packaging Testing Market Size, By Country, 2015–2022 (USD Million)

Table 58 RoW: Market Size, By Material Type, 2015–2022 (USD Million)

Table 59 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 60 RoW: Market Size, By Technology, 2015–2022 (USD Million)

Table 61 RoW: Market Size, By Industry, 2015–2022 (USD Million)

Table 62 Brazil: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 63 Argentina: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 64 Middle East: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 65 Others in RoW: Market Size for Packaging Testing, By Material Type, 2015–2022 (USD Million)

Table 66 New Service Launches, 2017

Table 67 Expansions, 2012

Table 68 Acquisitions, 2017

List of Figures (54 Figures)

Figure 1 Market Segmentation

Figure 2 Regional Segmentation: Packaging Testing Market

Figure 3 Research Design: Packaging Testing

Figure 4 Breakdown of Primaries: By Company, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Packaging Testing Market Snapshot, By Material Type, 2017 vs 2022

Figure 9 Asia-Pacific is the Fastest-Growing Region for the Packaging Testing Market, 2017–2022

Figure 10 Market Size for Packaging Testing, By Type, 2017–2022

Figure 11 Market Size, By Technology, 2017–2022

Figure 12 Market Size, By Industry, 2017–2022

Figure 13 Packaging Testing Market Share, By Region

Figure 14 Growing Retail Industry and Regulatory Mandates to Drive the Growth of this Market

Figure 15 China is Projected to Be the Fastest-Growing Country in the Packaging Testing Market By 2022

Figure 16 Plastic Segment is Projected to Dominate the Market Through 2022

Figure 17 Developing Countries Projected to Emerge at Higher Growth Rates During the Forecast Period

Figure 18 Europe Dominated the Global Market Across All Industries in 2016

Figure 19 Spectroscopy & Photometric-Based Segment is Projected to Be the Fastest-Growing During the Forecast Period

Figure 20 North American Packaging Testing Market, By Type (USD Million)

Figure 21 Market Dynamics:Packaging Testing Market

Figure 22 Top 10 Packaging Types in World, 2014

Figure 23 Medical Device Labeling/Packaging Recalls By FDA, 2010-2014

Figure 24 Per Capita Consumption of Packaged Products, 2015 (Kg)

Figure 25 Total MSW (Municipal Solid Waste) Generation in the U.S., By Material, 2013

Figure 26 Recycling Rates of Selected Products in the U.S., 2013

Figure 27 Indian Packaging Industry, 2015 vs 2022 (USD Billion)

Figure 28 Indian Packaging By Market Sector, 2015

Figure 29 U.S. Legislation on Food Contact Material

Figure 30 Eu Legislation on Food Contact Material

Figure 31 Packaging Testing Market Size, By Type, 2017 vs 2022 (USD Million)

Figure 32 Packaging Physical Testing Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 33 Market Size for Packaging Testing, By Material Type, 2017 vs 2022 (USD Million)

Figure 34 Plastic Packaging Testing Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 35 Market Size for Packaging Testing, By Technology, 2017 vs 2022 (USD Million)

Figure 36 Physical Tests Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 37 Market Size for Packaging Testing, By Industry, 2017 vs 2022 (USD Million)

Figure 38 Pharmaceuticals Packaging Testing Market Size, By Region, 2017 vs 2022 (USD Million)

Figure 39 U.S. Accounted for the Largest Share in this Market, 2016

Figure 40 North American Market Snapshot

Figure 41 Canada’s Retail Landscape, 2016

Figure 42 European Market Snapshot

Figure 43 Organic and Regular Packaged Food Retail Sales in Spain, 2007-2015 (USD Million)

Figure 44 Asia-Pacific Market Snapshot

Figure 45 Consumption of Flexible Packaging in India, 2009

Figure 46 Packaging Materials Used in Australia, 2010

Figure 47 Packaging Testing Market (Global) Competitive Leadership Mapping, 2017

Figure 48 SGS SA Led the Packaging Testing Market, 2016

Figure 49 SGS SA: Company Snapshot

Figure 50 Bureau Veritas SA: Company Snapshot

Figure 51 Intertek Group PLC.: Company Snapshot

Figure 52 Eurofins Scientific SE: Company Snapshot

Figure 53 Tüv Süd AG: Company Snapshot

Figure 54 ALS Limited: Company Snapshot

Growth opportunities and latent adjacency in Packaging Testing Market