Osteoarthritis Therapeutics Market by Anatomy (Knee, Hand), Drug Type (NSAIDs, Analgesics, Corticosteroids), Route of Administration (Parenteral), Distribution Channel (Hospital Pharmacies), Purchasing Pattern (Prescription Drugs) - Global Forecasts to 2025

Market Growth Outlook Summary

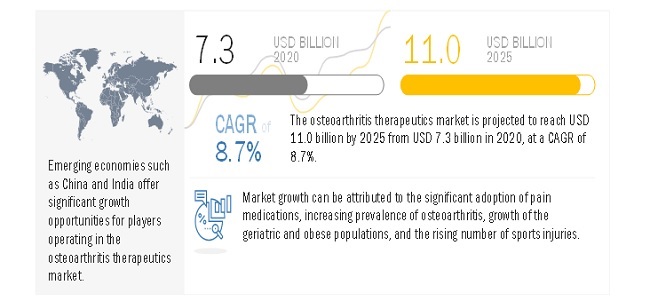

The global osteoarthritis therapeutics market growth forecasted to transform from USD 7.3 billion in 2020 to USD 11.0 million by 2025, driven by a CAGR of 8.7%. The presence of a large geriatric and target patient population and the improving healthcare infrastructure in several APAC countries are expected to offer growth opportunities in the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Osteoarthritis Therapeutics Market Dynamics

DRIVER: Rising government investments in cell-based research significant adoption of pain medications

Topical, oral, and parenteral pain medications are widely used to manage pain associated with osteoarthritis. Although alternatives such as orthopedic braces are used as part of a noninvasive approach for pain management, the adoption of pain medications for the condition is high owing to the ease of administration and the affordability of pain medications. Pain relievers such as oral analgesics (acetaminophen and NSAIDs such as ibuprofen, naproxen, tramadol, opiates, and duloxetine), topical agents (such as capsaicin and topical NSAIDs), intra-articular agents (such as corticosteroids and hyaluronic acid), and nutraceuticals (glucosamine and chondroitin) are widely used. Studies reveal that these medications offer a 30% reduction of chronic pain on administration.

The adoption of pain medications for the management of pain associated with osteoarthritis is expected to remain high over the coming decade, which is anticipated to propel the growth of the market during the study period.

RESTRAINT: Risk of adverse cardiovascular events associated with the use of NSAIDs in osteoarthritis treatment

OTC and prescription NSAIDs are widely used to relieve pain in osteoarthritis patients. As per a study published by the National Center for Biotechnology Information in 2019, more than 50% of osteoarthritis patients in the US are prescribed NSAIDs. Similarly, in Europe, of the total number of osteoarthritis patients using prescription medications (47%), 60% received NSAIDs.

The use of NSAIDs is associated with an increased risk of adverse cardiovascular events. Both cyclooxygenase (COX)-2 selective NSAIDs (coxibs) and non-selective NSAIDs increase CVD risk in patients. A study presented at the Annual European Congress of Rheumatology (EULAR 2018) stated that more than two-thirds of the increased cardiovascular risk associated with osteoarthritis is linked to NSAIDs. Such risks associated with the use of NSAIDs can potentially discourage doctors from prescribing these medications while driving patients using OTC NSAIDs to opt for alternative products.

OPPORTUNITY: Personalized medicine for osteoarthritis

Remarkable advances have been made in diagnosing, treating, and monitoring disease activity in patients with osteoarthritis, including the conceptualization of personalized OA medications. Essential features of biomarkers that will have clinical relevance for a personalized approach to therapy for RA include the ease of measurement, acceptable levels of sensitivity and specificity, and test methods that are accessible and interpretable by clinicians. The use of biomarkers to identify patients who are likely to respond to specific medical therapies may increase treatment response rates and reduce the risk of exposure to therapies that are unlikely to be effective or expose patients to serious treatment-related side-effects. The combination of unique biomarkers and baseline clinical characteristics such as sex and age may further enhance efforts to personalize treatment regimens for RA.

Knee osteoarthritis therapeutics is expected to hold the largest share of the osteoarthritis therapeutics market, by anatomy in 2020.

Based on anatomy, the market is segmented into knee, hip, hand, and small-joint osteoarthritis therapeutics. Knee osteoarthritis therapeutics is the largest and the fastest-growing segment in this market. This can primarily be attributed to the high incidence of knee osteoarthritis.

Viscosupplementation agents is expected to hold the largest share of the osteoarthritis therapeutics market, in 2020.

Based on drug type, the market is classified as, viscosupplementation agents, nonsteroidal anti-inflammatory drugs (NSAIDs), analgesics, and corticosteroids. The analgesics segment is subsegmented into duloxetine and acetaminophen, while the NSAIDs segment is subsegmented into naproxen, aspirin, diclofenac, ibuprofen, and other NSAIDs. The viscosupplementation agents segment accounted for the largest share of the global market in 2019. The rising incidence of knee osteoarthritis is the major factor driving the growth of this segment. Viscosupplementation effectively eases the pain of osteoarthritis through injections that fill up the joint’s synovial fluid, thus offering better lubrication of the joints.

Parental route is expected to hold the largest share of the osteoarthritis therapeutics market in 2020.

On the basis of route of administration, the market has been segmented into oral, topical, and parenteral routes. The parenteral route accounted for the largest share of this market in 2019 and is estimated to grow at the highest CAGR during the forecast period. This can be attributed to the wide adoption of the parenteral route for administering osteoarthritis therapeutics owing to the ease of administration and the better pharmacokinetics and pharmacodynamics, resulting in better patient compliance.

Hospital pharmacies segment commanded the largest share of the osteoarthritis therapeutics market in 2020.

Based on the distribution channel, the market is segmented into hospital pharmacies, online pharmacies, and retail pharmacies. In 2019, hospital pharmacies accounted for the largest share of this market because of the high volume of patients visiting hospitals for osteoarthritis treatments and the wide range of osteoarthritis therapeutics available in these pharmacies. Reimbursements can also be claimed easily on hospital pharmacy purchases, which is another important draw.

Prescription drugs segment commanded the largest share of the osteoarthritis therapeutics market in 2020.

Based on the purchasing pattern, the market is segmented into OTC and prescription drugs. In 2019, the prescription drugs segment accounted for a larger share of this market as most osteoarthritis therapeutics (viscosupplementation agents and corticosteroids) are only available on prescription.

To know about the assumptions considered for the study, download the pdf brochure

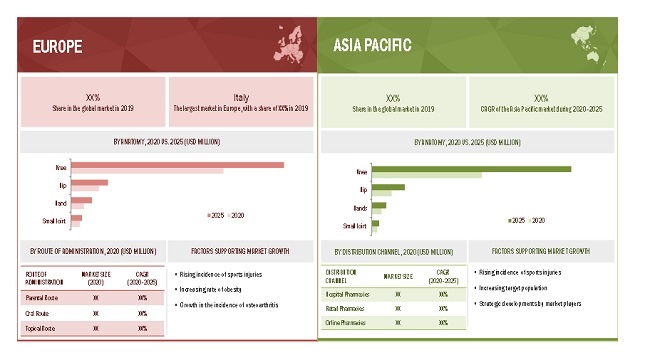

Europe commanded the largest share of the osteoarthritis therapeutics market in 2020.

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. In 2019, Europe commanded the largest share of the global market. The large share of this market segment can be attributed to the rising incidence of osteoarthritis, rising geriatric population, and increasing obesity rates in several European countries, coupled with the rising number of injuries due to sports and road accidents.

The major players operating in this market are Sanofi (France), Horizon Therapeutics PLC (Ireland), Johnson & Johnson (US), GlaxoSmithKline PLC (UK), Bayer AG (Germany), Abbott (US), Pfizer, Inc. (US), Eli Lilly (US), Anika Therapeutics, Inc. (US), Novartis AG (Switzerland), Ferring Pharmaceuticals (Switzerland), Bioventus (US), Zimmer Biomet Holdings, Inc. (US), Fidia Farmaceutici s.p.a. (Italy), Flexion Therapeutics, Inc. (US), Pharmed Limited (India), Virchow Biotech (India), Kitov Pharmaceuticals Ltd. (Israel), Assertio Therapeutics, Inc. (US), Atnahs (UK), Almatica Pharma LLC (US), OrthogenRx (US), LABRHA (France), Hanmi Pharm. Co., Ltd. (Korea), and Laboratorio Reig Jofre (Spain).

Scope of the Osteoarthritis Therapeutics Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$7.3 billion |

|

Projected Revenue Size by 2025 |

$11.0 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.7% |

|

Market Driver |

Rising government investments in cell-based research significant adoption of pain medications |

|

Market Opportunity |

Personalized medicine for osteoarthritis |

This research report categorizes the osteoarthritis therapeutics market to forecast revenue and analyze trends in each of the following submarkets:

By Anatomy

- Knee Osteoarthritis

- Hip Osteoarthritis

- Hand Osteoarthritis

- Small Joint Osteoarthritis

By Drug Type

- Viscosupplementation Agents

-

Nonsteroidal Anti-inflammatory Drugs

- Naproxen

- Aspirin

- Diclofenac

- Ibuprofen

- Other NSAIDs

-

Analgesics

- Duloxetine

- Acetaminophen

- Corticosteroids

By Route of Administration

- Parenteral Route

- Topical Route

- Oral Route

By Purchasing Pattern

- Prescription Drugs

- Over-the-Counter Drugs

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Africa

Key Developments:

- In 2020, GlaxoSmithKline Plc (UK) launched Voltaren in the US.

- In 2020, Horizon Therapeutics Plc (Ireland) expanded its presence in the US.

- In 2019, Kitov Pharma Ltd. (Israel) entered into an agreement with Coeptis Pharmaceuticals which has helped in the efficient distribution and commercialization of Consensi.

- In 2018, Atnahs established a sales office in Dubai, UAE.

- In 2017, Flexion Therapeutics, Inc. (US) received FDA Approval for ZILRETTA

Frequently Asked Questions (FAQ):

What are the growth opportunities in the osteoarthritis therapeutics market across major regions in the future?

Emerging markets, personalized medicines for osteoarthritis and collaborations for product development are anticipated to offer growth opportunities in the osteoarthritis therapeutics market during the forecast period.

Which type of drug is expected to hold the largest share in the osteoarthritis therapeutics market?

Based on drug type, the market is classified as, viscosupplementation agents, nonsteroidal anti-inflammatory drugs (NSAIDs), analgesics, and corticosteroids. The viscosupplementation agents segment accounted for the largest share of the osteoarthritis therapeutics market in 2019. The rising incidence of knee osteoarthritis is the major factor driving the growth of this segment. Viscosupplementation effectively eases the pain of osteoarthritis through injections that fill up the joint’s synovial fluid, thus offering better lubrication of the joints.

Which is the most preferred route of administration of osteoarthritis medications?

Among the route of administration, parental route is highly preferred owing to the ease of administration and the better pharmacokinetics and pharmacodynamics, resulting in better patient compliance.

Which region has a well-developed osteoarthritis therapeutics market?

Among the regions, Europe has a well established osteoarthritis therapeutics market. The growth of the European market is attributed to the rising incidence of osteoarthritis, rising geriatric population, and increasing obesity rates in several European countries, coupled with the rising number of injuries due to sports and road accidents.

What is the impact of COVID-19 on osteoarthritis therapeutics market?

The market of osteoarthritis therapeutics market is affected marginally by the outbreak of COVID-19. Among drug types, the use of corticosteroids has reduced. Although there is no evidence to suggest that corticosteroid injections lead to a substantial increase in the risk of infection, there is a possible reduction in the immune response for up to a few weeks following the procedure. While this risk is extremely low, it needs to be considered when deciding to proceed with the procedure. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

1.8 LIMITATIONS OF THE CURRENT EDITION

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.1 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 GLOBAL MARKET: BOTTOM-UP APPROACH

2.2.2 GROWTH FORECAST

2.2.3 TOP-DOWN APPROACH

FIGURE 5 GLOBAL MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 7 OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2020 VS. 2025 (USD BILLION) 43

FIGURE 8 GLOBAL MARKET, BY DRUG TYPE, 2020 VS. 2025 (USD BILLION) 44

FIGURE 9 GLOBAL MARKET, BY ROUTE OF ADMINISTRATION, 2020 VS. 2025 (USD BILLION)

FIGURE 10 GLOBAL MARKET, BY DISTRIBUTION CHANNEL, 2020 VS. 2025 (USD BILLION)

FIGURE 11 GLOBAL MARKET, BY PURCHASING PATTERN, 2020 VS. 2025 (USD BILLION) 46

FIGURE 12 GLOBAL MARKET, BY REGION, 2020 VS. 2025 (USD BILLION) 47

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 OSTEOARTHRITIS THERAPEUTICS MARKET OVERVIEW

FIGURE 13 INCREASING PREVALENCE OF OSTEOARTHRITIS IS THE MAJOR FACTOR DRIVING THE GROWTH OF THIS MARKET

4.2 EUROPE: MARKET SHARE, BY DRUG TYPE (2019)

FIGURE 14 VISCOSUPPLEMENTATION AGENTS SEGMENT TO DOMINATE THE EUROPEAN MARKET IN 2020

4.3 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

FIGURE 15 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD IN THE GLOBAL MARKET 50

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 OSTEOARTHRITIS THERAPEUTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Significant adoption of pain medications

5.2.1.2 Increasing prevalence of osteoarthritis

5.2.1.3 Growing population susceptible to osteoarthritis

FIGURE 17 SHARE OF OBESE ADULTS, BY REGION (2016)

5.2.1.4 Rising number of sports injuries

FIGURE 18 INJURIES CAUSED BY SPORTS ACTIVITIES IN THE US (2019)

5.2.2 RESTRAINTS

5.2.2.1 Risk of adverse cardiovascular events associated with the use of NSAIDs in osteoarthritis treatment

5.2.2.2 Commercialization of alternatives

5.2.3 OPPORTUNITIES

5.2.3.1 Personalized medicines for osteoarthritis

5.2.3.2 Emerging markets

5.2.3.3 Collaborations for product development

5.2.4 CHALLENGES

5.2.4.1 Adoption of non-drug pain management therapies

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: PHARMACEUTICALS INDUSTRY

TABLE 1 COSTS INCURRED AND VALUE ADDED ACROSS THE VALUE CHAIN, BY COMPONENT

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 20 DIRECT DISTRIBUTION-THE PREFERRED STRATEGY OF PROMINENT COMPANIES

5.5 ECOSYSTEM ANALYSIS

FIGURE 21 ECOSYSTEM ANALYSIS

5.6 COVID-19 IMPACT ANALYSIS ON THE GLOBAL MARKET

5.7 AVERAGE SELLING PRICE TREND

TABLE 2 AVERAGE SELLING PRICE OF OSTEOARTHRITIS DRUGS

5.8 REGULATORY SCENARIO

TABLE 3 LIST OF REGULATORY AUTHORITIES IN THE PHARMA INDUSTRY

5.8.1 REGULATORY REQUIREMENTS

5.8.1.1 EU regulations

5.8.1.2 US regulations

5.9 EPIDEMIOLOGY (PATIENT POPULATION)

5.9.1 SEVERITY

TABLE 4 COUNTRY-WISE OSTEOARTHRITIS EPIDEMIOLOGY, BY SEVERITY (2019)

5.9.2 ANATOMY

TABLE 5 COUNTRY-WISE OSTEOARTHRITIS EPIDEMIOLOGY, BY ANATOMY (2019)

6 OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY (Page No. - 67)

6.1 INTRODUCTION

TABLE 6 GLOBAL MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

6.2 KNEE OSTEOARTHRITIS

6.2.1 RISING OBESE AND GERIATRIC POPULATIONS TO INCREASE THE PREVALENCE OF KNEE OSTEOARTHRITIS

TABLE 7 KNEE OSTEOARTHRITIS-THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

6.3 HIP OSTEOARTHRITIS

6.3.1 SIMILAR TO KNEE OSTEOARTHRITIS, HIP OSTEOARTHRITIS IS MORE COMMON IN THE GERIATRIC AND OBESE POPULATIONS

TABLE 8 HIP OSTEOARTHRITIS-THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

6.4 HAND OSTEOARTHRITIS

6.4.1 RISING PREVALENCE OF SHOULDER OSTEOARTHRITIS TO DRIVE MARKET GROWTH

TABLE 9 HAND OSTEOARTHRITIS-THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

6.5 SMALL JOINT OSTEOARTHRITIS

6.5.1 RISING NUMBER OF ANKLE-RELATED SPORTS INJURIES TO INCREASE THE PREVALENCE OF ANKLE OSTEOARTHRITIS

TABLE 10 SMALL JOINT OSTEOARTHRITIS-THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

7 OSTEOARTHRITIS THERAPEUTICS MARKET, BY DRUG TYPE (Page No. - 72)

7.1 INTRODUCTION

TABLE 11 GLOBAL MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

7.2 VISCOSUPPLEMENTATION AGENTS

7.2.1 VISCOSUPPLEMENTATION AGENTS DOMINATED THE MARKET IN 2019

TABLE 12 GLOBAL MARKET FOR VISCOSUPPLEMENTATION AGENTS, BY REGION, 2018-2025 (USD MILLION)

7.3 NONSTEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.1 NSAIDS CAN RELIEVE PAIN AND INFLAMMATION WITHOUT THE ADVERSE EFFECTS OF CORTICOSTEROIDS

TABLE 13 GLOBAL MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 14 GLOBAL MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY REGION, 2018-2025 (USD MILLION)

7.3.1.1 Ibuprofen

TABLE 15 GLOBAL MARKET FOR IBUPROFEN, BY REGION, 2018-2025 (USD MILLION)

7.3.1.2 Aspirin

TABLE 16 GLOBAL MARKET FOR ASPIRIN, BY REGION, 2018-2025 (USD MILLION)

7.3.1.3 Diclofenac

TABLE 17 GLOBAL MARKET FOR DICLOFENAC, BY REGION, 2018-2025 (USD MILLION)

7.3.1.4 Naproxen

TABLE 18 GLOBAL MARKET FOR NAPROXEN, BY REGION, 2018-2025 (USD MILLION)

7.3.1.5 Other NSAIDs

TABLE 19 GLOBAL MARKET FOR OTHER NSAIDS, BY REGION, 2018-2025 (USD MILLION)

7.4 ANALGESICS

7.4.1 ACETAMINOPHEN HOLDS THE LARGEST SHARE OF THE ANALGESICS MARKET

TABLE 20 GLOBAL MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 21 GLOBAL MARKET FOR ANALGESICS, BY REGION, 2018-2025 (USD MILLION)

7.4.1.1 Acetaminophen

TABLE 22 GLOBAL MARKET FOR ACETAMINOPHEN, BY REGION, 2018-2025 (USD MILLION)

7.4.1.2 Duloxetine

TABLE 23 GLOBAL MARKET FOR DULOXETINE, BY REGION, 2018-2025 (USD MILLION)

7.5 CORTICOSTEROIDS

7.5.1 EUROPE AND NORTH AMERICA ARE THE LARGEST MARKETS FOR CORTICOSTEROIDS

TABLE 24 GLOBAL MARKET FOR CORTICOSTEROIDS, BY REGION, 2018-2025 (USD MILLION)

8 OSTEOARTHRITIS THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION (Page No. - 81)

8.1 INTRODUCTION

TABLE 25 GLOBAL MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

8.2 PARENTERAL ROUTE

8.2.1 DRUGS INEFFECTIVE WHEN ADMINISTERED ORALLY CAN BE DELIVERED VIA PARENTERAL ROUTE

TABLE 26 PARENTERAL OSTEOARTHRITIS-THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

8.3 ORAL ROUTE

8.3.1 ORAL ROUTE IS WIDELY PREFERRED BY BOTH CLINICIANS AND PATIENTS

TABLE 27 ORAL OSTEOARTHRITIS-THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

8.4 TOPICAL ROUTE

8.4.1 EASE OF USE, PAINLESS AND NON-INVASIVE ADMINISTRATION HAVE SUPPORTED USE OF TOPICAL ROUTE

TABLE 28 TOPICAL OSTEOARTHRITIS-THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

9 OSTEOARTHRITIS THERAPEUTICS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 85)

9.1 INTRODUCTION

TABLE 29 GLOBAL MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

9.2 HOSPITAL PHARMACIES

9.2.1 HOSPITAL PHARMACIES ARE THE LARGEST DISTRIBUTION CHANNEL FOR OSTEOARTHRITIS THERAPEUTICS

TABLE 30 GLOBAL MARKET FOR HOSPITAL PHARMACIES, BY REGION, 2018-2025 (USD MILLION)

9.3 RETAIL PHARMACIES

9.3.1 GREATER PREFERENCE FOR RETAIL PHARMACIES HAS AFFECTED MARKET SHARE

TABLE 31 GLOBAL MARKET FOR RETAIL PHARMACIES, BY REGION, 2018-2025 (USD MILLION)

9.4 ONLINE PHARMACIES

9.4.1 ONLINE PHARMACIES TO REGISTER THE HIGHEST GROWTH

TABLE 32 GLOBAL MARKET FOR ONLINE PHARMACIES, BY REGION, 2018-2025 (USD MILLION)

10 OSTEOARTHRITIS THERAPEUTICS MARKET, BY PURCHASING PATTERN (Page No. - 89)

10.1 INTRODUCTION

TABLE 33 GLOBAL MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

10.2 PRESCRIPTION DRUGS

10.2.1 PRESCRIPTION DRUGS TO ACCOUNT FOR A LARGER SHARE OF THE MARKET

TABLE 34 GLOBAL MARKET FOR PRESCRIPTION DRUGS, BY REGION, 2018-2025 (USD MILLION)

10.3 OVER-THE-COUNTER DRUGS

10.3.1 EASE OF PURCHASE AND ADMINISTRATION ARE RESULTING IN A RISING DEMAND FOR OTC DRUGS

TABLE 35 GLOBAL MARKET FOR OVER-THE-COUNTER DRUGS, BY REGION, 2018-2025 (USD MILLION)

11 OSTEOARTHRITIS THERAPEUTICS MARKET, BY REGION (Page No. - 92)

11.1 INTRODUCTION

TABLE 36 GLOBAL MARKET, BY REGION, 2018-2025 (USD MILLION)

11.2 EUROPE

FIGURE 22 EUROPE: OSTEOARTHRITIS THERAPEUTICS MARKET SNAPSHOT

TABLE 37 EUROPE: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 38 EUROPE: MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 39 EUROPE: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 40 EUROPE: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 41 EUROPE: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 42 EUROPE: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 43 EUROPE: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.2.1 ITALY

11.2.1.1 Italy dominates the European market for osteoarthritis therapeutics

TABLE 45 ITALY: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 46 ITALY: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 47 ITALY: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 48 ITALY: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 49 ITALY: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 50 ITALY: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 51 ITALY: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.2.2 GERMANY

11.2.2.1 Road accidents in the country to propel the demand for osteoarthritis therapeutics

TABLE 52 GERMANY: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 53 GERMANY: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 54 GERMANY: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 55 GERMANY: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 56 GERMANY: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 57 GERMANY: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 58 GERMANY: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.2.3 SPAIN

11.2.3.1 High prevalence of osteoarthritis to drive the growth of the market

TABLE 59 SPAIN: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 60 SPAIN: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 61 SPAIN: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 62 SPAIN: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 63 SPAIN: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 64 SPAIN: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 65 SPAIN: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.2.4 FRANCE

11.2.4.1 Rising geriatric population to accelerate the growth of the market during the forecast period

TABLE 66 FRANCE: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 67 FRANCE: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 68 FRANCE: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 69 FRANCE: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 70 FRANCE: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 71 FRANCE: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 72 FRANCE: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.2.5 UK

11.2.5.1 Increasing obesity rate and rising incidence of musculoskeletal diseases drive the market in the UK

TABLE 73 UK: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 74 UK: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 75 UK: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 76 UK: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 77 UK: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 78 UK: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 79 UK: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.2.6 REST OF EUROPE

TABLE 80 ROE: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 81 ROE: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 82 ROE: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 83 ROE: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 84 ROE: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 85 ROE: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 86 ROE: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.3 NORTH AMERICA

TABLE 87 NORTH AMERICA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.3.1 US

11.3.1.1 The US holds the largest share in the North American market

TABLE 95 US: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 96 US: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 97 US: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 98 US: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 99 US: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 100 US: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 101 US: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Rising geriatric and obese populations will drive the incidence of osteoarthritis therapeutics

TABLE 102 CANADA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 103 CANADA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 104 CANADA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 105 CANADA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 106 CANADA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 107 CANADA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 108 CANADA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: OSTEOARTHRITIS THERAPEUTICS MARKET SNAPSHOT

TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Japan dominates the osteoarthritis therapeutics market in the APAC

TABLE 117 JAPAN: MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 118 JAPAN: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 119 JAPAN: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 120 JAPAN: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 121 JAPAN: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 122 JAPAN: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 123 JAPAN: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Rising geriatric population to propel the demand for osteoarthritis therapeutics in China

TABLE 124 CHINA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 125 CHINA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 126 CHINA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 127 CHINA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 128 CHINA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 129 CHINA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 130 CHINA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Rising prevalence of osteoarthritis to accelerate market growth in India

TABLE 131 INDIA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 132 INDIA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 133 INDIA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 134 INDIA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 135 INDIA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 136 INDIA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 137 INDIA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Initiatives by market players to support the growth of the market

TABLE 138 SOUTH KOREA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 139 SOUTH KOREA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 140 SOUTH KOREA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 141 SOUTH KOREA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 142 SOUTH KOREA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 143 SOUTH KOREA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 144 SOUTH KOREA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 Prevalence of osteoarthritis to accelerate the growth of the market

TABLE 145 AUSTRALIA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 146 AUSTRALIA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 147 AUSTRALIA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 148 AUSTRALIA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 149 AUSTRALIA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 150 AUSTRALIA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 151 AUSTRALIA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 152 ROAPAC: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 153 ROAPAC: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 154 ROAPAC: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 155 ROAPAC: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 156 ROAPAC: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 157 ROAPAC: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 158 ROAPAC: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.5 REST OF THE WORLD

TABLE 159 ROW: OSTEOARTHRITIS THERAPEUTICS MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 160 ROW: MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 161 ROW: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 162 ROW: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 163 ROW: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 164 ROW: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 165 ROW: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 166 ROW: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.5.1 LATIN AMERICA

11.5.1.1 Latin America holds a larger share of the RoW market

TABLE 167 LATIN AMERICA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

11.5.2 MIDDLE EAST AND AFRICA

11.5.2.1 Rising obesity rates to propel market growth

TABLE 174 MIDDLE EAST AND AFRICA: OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY, 2018-2025 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET, BY DRUG TYPE, 2018-2025 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET FOR ANALGESICS, BY TYPE, 2018-2025 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET FOR NONSTEROIDAL ANTI-INFLAMMATORY DRUGS, BY MOLECULE, 2018-2025 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET, BY ROUTE OF ADMINISTRATION, 2018-2025 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET, BY DISTRIBUTION CHANNEL, 2018-2025 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET, BY PURCHASING PATTERN, 2018-2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE & COMPANY PROFILES (Page No. - 148)

12.1 COMPETITIVE LANDSCAPE

12.1.1 OVERVIEW

FIGURE 24 KEY DEVELOPMENTS IN THE OSTEOARTHRITIS THERAPEUTICS MARKET, JANUARY 2017-NOVEMBER 2020

FIGURE 25 MARKET EVOLUTION FRAMEWORK: JANUARY 2017 TO NOVEMBER 2020

12.1.2 COMPETITIVE SCENARIO

12.1.2.1 Product launches and approvals

TABLE 181 KEY PRODUCT LAUNCHES & APPROVALS, JANUARY 2017?NOVEMBER 2020

12.1.2.2 Collaborations and agreements

TABLE 182 KEY COLLABORATIONS AND AGREEMENTS, JANUARY 2017?NOVEMBER 2020

12.1.2.3 Expansions

TABLE 183 KEY EXPANSIONS, JANUARY 2017?NOVEMBER 2020

12.1.2.4 Mergers and acquisitions

TABLE 184 KEY MERGERS AND ACQUISITIONS, JANUARY 2017?NOVEMBER 2020

12.1.2.5 Other developments

TABLE 185 OTHER DEVELOPMENTS, JANUARY 2017?NOVEMBER 2020

12.1.3 VISCOSUPPLEMENTATION AGENTS MARKET SHARE ANALYSIS, 2019

FIGURE 26 VISCOSUPPLEMENTATION AGENTS MARKET SHARE ANALYSIS, 2019

12.1.4 COMPANY EVALUATION MATRIX

12.1.4.1 Stars

12.1.4.2 Emerging leaders

12.1.4.3 Pervasive companies

12.1.4.4 Participants

FIGURE 27 OSTEOARTHRITIS THERAPEUTICS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2019

12.2 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.2.1 PFIZER, INC.

FIGURE 28 PFIZER, INC.: COMPANY SNAPSHOT (2019)

12.2.2 HORIZON THERAPEUTICS PLC

FIGURE 29 HORIZON THERAPEUTICS PLC: COMPANY SNAPSHOT (2019)

12.2.3 SANOFI

FIGURE 30 SANOFI: COMPANY SNAPSHOT (2019)

12.2.4 JOHNSON & JOHNSON

FIGURE 31 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2019)

12.2.5 BAYER AG

FIGURE 32 BAYER AG: COMPANY SNAPSHOT (2019)

12.2.6 ABBOTT

FIGURE 33 ABBOTT: COMPANY SNAPSHOT (2019)

12.2.7 GLAXOSMITHKLINE PLC

FIGURE 34 GLAXOSMITHKLINE PLC: COMPANY SNAPSHOT (2019)

12.2.8 ZIMMER BIOMET HOLDINGS

FIGURE 35 ZIMMER BIOMET HOLDINGS, INC.: COMPANY SNAPSHOT (2019)

12.2.9 NOVARTIS AG

FIGURE 36 NOVARTIS: COMPANY SNAPSHOT (2019)

12.2.10 FLEXION THERAPEUTICS, INC.

FIGURE 37 FLEXION THERAPEUTICS: COMPANY SNAPSHOT (2019)

12.2.11 ANIKA THERAPEUTICS

FIGURE 38 ANIKA THERAPEUTICS, INC.: COMPANY SNAPSHOT (2019)

12.2.12 ELI LILLY

FIGURE 39 ELI LILLY: COMPANY SNAPSHOT (2019)

12.2.13 HANMI PHARM. CO., LTD.

FIGURE 40 HANMI PHARM.CO., LTD.: COMPANY SNAPSHOT (2019)

12.2.14 ASSERTIO THERAPEUTICS, INC.

FIGURE 41 ASSERTIO THERAPEUTICS: COMPANY SNAPSHOT (2019)

12.2.15 LABORATORIO REIG JOFRE

FIGURE 42 LABORATORIO REIG JOFRE: COMPANY SNAPSHOT (2019)

12.2.16 KITOV PHARMACEUTICALS

FIGURE 43 KITOV PHARMACEUTICALS LTD.: COMPANY SNAPSHOT (2019)

12.2.17 VIRCHOW BIOTECH

12.2.18 FERRING PHARMACEUTICALS

12.2.19 BIOVENTUS

12.2.20 ALMATICA PHARMA LLC

12.2.21 ATNAHS

12.2.22 PHARMED LIMITED

12.2.23 ORTHOGENRX

12.2.24 LABRHA

12.2.25 FIDIA FARMACEUTICI S.P.A.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 192)

13.1 INDUSTRY INSIGHTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

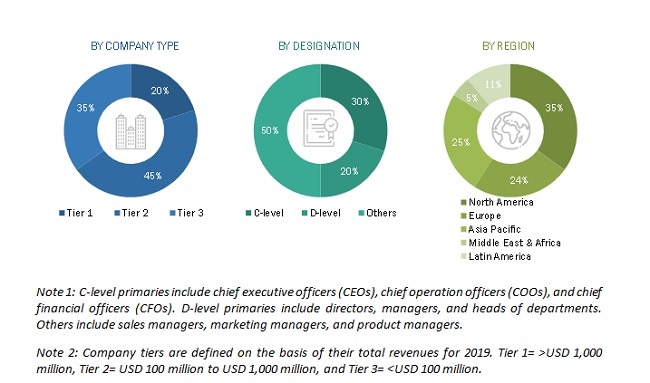

The study involved four major activities to estimate the current size of the osteoarthritis therapeutics market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

Several stakeholders such as osteoarthritis therapeutics manufacturers, vendors, distributors, researchers, and doctors from hospitals and clinics were consulted for this report. The demand side of this market is characterized by significant use of osteoarthritis therapeutics due to , significant adoption of pain medications, increasing prevalence of osteoarthritis, growing population susceptible to osteoarthritis, and rising number of sports injuries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

BREAKDOWN OF PRIMARY PARTICIPANTS:

To know about the assumptions considered for the study, download the pdf brochure

Note 1: C-level primaries include chief executive officers (CEOs), chief operation officers (COOs), and chief financial officers (CFOs). D-level primaries include directors, managers, and heads of departments. Others include sales managers, marketing managers, and product managers.

Note 2: Company tiers are defined on the basis of their total revenues for 2019. Tier 1= >USD 1,000 million, Tier 2= USD 100 million to USD 1,000 million, and Tier 3= < USD EM million.< 100>

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the osteoarthritis therapeutics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the osteoarthritis therapeutics industry.

Report Objectives

- To define, describe, and forecast the osteoarthritis therapeutics market on the basis of product, cell type, process, end user, and region.

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, and opportunities, Covid-19 Impact Analysis)

- To strategically analyse micromarkets with respect to individual growth trends, prospects, and contributions to the overall osteoarthritis therapeutics market

- To analyse market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in four geographical regions, namely, North America, Europe, the Asia Pacific, and Rest of the World.

- To profile the key players and comprehensively analyse their product portfolios, market positions, and core competencies.

- To track and analyse competitive developments such as product launches and approvals, partnerships, expansions, and acquisitions in the osteoarthritis therapeutics market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis:

- Further breakdown of the osteoarthritis therapeutics market into specific countries/regions in the Rest of Europe and the Rest of Asia Pacific.

Company Information:

-

Detailed analysis and profiling of additional market players (up to 3) inclusive of:

- Business Overview

- Financial Information

- Product Portfolio

- Developments (last three years)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Osteoarthritis Therapeutics Market