Bone Densitometer Market by Type (DEXA, Peripheral), Application (Osteopenia & Osteoporosis, Cystic Fibrosis, CKD, Body Composition Measurement, Rheumatoid Arthritis), End User (Hospitals & Specialty Clinics, Diagnostic Centres) - Global Forecast to 2027

Market Growth Outlook Summary

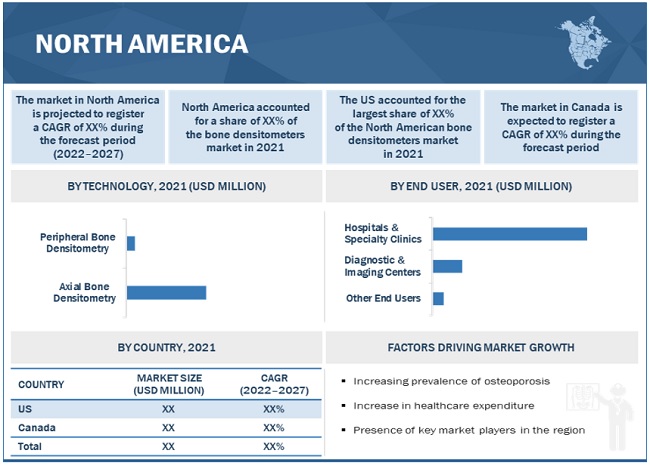

The global bone densitometers market growth forecasted to transform from $299 million in 2022 to $378 million by 2027, driven by a CAGR of 4.7%. In 2021, North America accounted for the largest share of the bone densitometer market, followed by Europe. The growth of the bone densitometers market in North America is primarily driven by the high consumer awareness, increase in healthcare expenditure, increasing prevalence of osteoporosis, and the presence of key market players in the region.

To know about the assumptions considered for the study, Request for Free Sample Report

Bone densitometer Market Dynamics

Driver: Rising Incidence Osteoporosis

Bone densitometers are used to determine and diagnose osteoporosis, osteopenia, and diseases leading to the degeneration of bones, such as osteomalacia, osteoarthritis, and osteoporotic fractures. Bone densitometers are used to measure the bone density of patients, which determines the likelihood of these diseases occurring.

According to the International Osteoporosis Foundation (IOF), osteoporosis causes more than 8.9 million fractures annually—globally, an osteoporotic fracture occurs every three seconds. According to a study conducted by the IOF, it is estimated that the number of people with osteoporosis and osteopenia in China is expected to increase to 286.6 million by 2020 and 533.3 million by 2050. The incidence of hip fractures has already risen two- to three-fold in most Asian countries during the last 30 years. By 2050, more than 50% of all osteoporotic fractures will occur in Asia. With the growing incidence of osteoporosis, the demand for effective diagnostic approaches will increase significantly, thereby driving the demand for bone densitometers.

Growing Geriatric Population

In the last few decades, the geriatric population has increased significantly across the globe. Globally, the population aged 65 and over is growing faster than all other age groups. According to data from World Population Prospects, by 2050, one in six people in the world will be over age 65 (16%), up from one in 11 in 2019 (9%). By 2050, one in four persons living in Europe and Northern America could be aged 65 or over. In 2018, for the first time in history, persons aged 65 or above outnumbered children under five years of age globally. The number of persons aged 80 years or over is projected to triple, from 143 million in 2019 to 426 million in 2050.

Since aging is associated with the physiological deterioration of bones, the cases of osteoporosis, osteoarthritis, fractures, and joint dislocation are expected to increase with growth in this demographic segment. According to Osteoporosis Canada, osteoporosis causes over 80% of all fractures in people aged 50 years and above. The increasing prevalence of target diseases owing to the growing geriatric population will contribute to the demand for bone densitometers in the coming years.

Rising Prevalence Of Kidney Disease

Kidney disease is one of the leading causes of death across the globe. The WHO estimates that approximately 195 million women worldwide are affected by kidney diseases. Chronic kidney disease (CKD) is the sixth-fastest growing cause of death. Around 1.7 million people are estimated to die annually because of acute kidney injury (AKI). CKD is more common in people aged 65 years or older (38%) than in those aged 45–64 (12%) or 18–44.

Of the 2 million people who receive treatment for kidney failure, a majority are treated in only five countries—the US, Japan, Germany, Brazil, and Italy. These five countries represent only 12% of the world population. Only 20% are treated in about 100 developing countries that make up over 50% of the world population. As kidney diseases lead to a decline in the bone mineral density in patients—leading to osteoporosis and osteopenia—their rising incidence can be considered a growth driver for the bone densitometers market.

Restraint: High Cost of Bone Densitometers

Dual-energy X-ray absorptiometry (DEXA) is a standard method for detecting bone mineral density. However, the cost of DEXA scanners is relatively high, which is one of the major factors limiting their adoption in developing countries. Typically, the cost of these products ranges from USD 9,180–199,000.

Most small and medium-sized hospitals with controlled budgets cannot afford these systems and instead prefer significantly lower-priced conventional systems. This is likely to limit the use of detectors in converting conventional analog systems to digital systems, which poses a major challenge to the market.

Furthermore, healthcare facilities that purchase such costly systems often depend on third-party payers (such as Medicare, Medicaid, or private health insurance plans) to get reimbursements for costs incurred in the diagnostic, screening, and therapeutic procedures performed using these systems. As a result, factors such as continuous cuts in reimbursements for bone density testing and diagnostic imaging scans and the increasing costs of these devices are preventing medium-sized and small healthcare facilities from investing in technologically advanced devices.

Opportunity: Growth Opportunities In Emerging Markets

Developing countries such as India, China, and Brazil offer significant growth opportunities for players operating in the bone densitometers market. The presence of a large target patient population, improving healthcare infrastructure, and growing healthcare awareness are some of the major factors expected to support market growth in these countries during the forecast period. To address the growing need for diagnosis and the detection of bone deformities & related diseases in these nations, governments are investing heavily in modernizing their healthcare systems.

Factors such as rising disposable incomes and healthcare spending in these emerging countries are also expected to increase the affordability of treatment procedures for bone diseases.

Challenge: Lack of Access to Diagnostics

Despite their high prevalence, the majority of bone diseases such as osteoporosis and osteopenia remain underdiagnosed and untreated. This can be observed in developing nations due to low or minimal awareness about these diseases, as well as the unavailability of adequate resources to diagnose these diseases. Osteoporosis develops slowly and is usually diagnosed in people over 65 years (and above 45 years in menopausal women).

While osteoporosis prevalence is particularly high in developing countries like India and China, there are a limited number of people diagnosed at an early stage. One of the reasons could be a lack of awareness of preventive healthcare and routine check-ups in these countries. Another factor is limited access to DEXA services.

Unfavorable Reimbursement Scenario

Although DEXA is considered the gold standard in measuring bone density, diagnosing osteoporosis, and helping prevent fractures, many physicians find it cost-prohibitive to offer this service in their private practice. Since 2007, the CMS has cut DEXA reimbursements in the private practice setting by more than 75%; the reimbursement rate dropped from USD 140 in 2007 to USD 42 in 2018. Owing to this, there has been a 50% decline in DEXA testing in the last decade.

Members of the American College of Radiology (ACR) have attended advocacy meetings in Washington, D.C., to support the Increasing Access to Osteoporosis Testing for Medicare Beneficiaries Act (H.R. 2693/S. 283). If passed, this would set the minimum for Medicare reimbursement at USD 98, which would ensure an increase in bone density testing. Although the CMS has raised the reimbursement rate for DEXA testing in hospital settings, the ACR is pushing for higher reimbursement rates in private practice settings as well.

Hospital Budget Cuts

In response to increasing government pressure to reduce healthcare costs, several healthcare providers have aligned themselves with group purchasing organizations (GPOs), integrated health networks (IHNs), and integrated delivery networks (IDNs). These organizations aggregate the purchasing volume of their members and bargain for a competitive price with suppliers and manufacturers of medical devices. GPOs, IHNs, and IDNs negotiate heavily for the bulk purchases of diagnostic imaging devices, dual-energy X-ray bone densitometers, and ultrasound bone densitometers.

Hospital budgets in some European countries were also reduced in the last couple of years and are expected to further decrease in the coming years. According to an article published in Libération (a French newspaper) in 2019, the French government planned to cut USD 3.9 billion (EUR 3 billion) from the country’s public hospital budget by 2021. Owing to these budget cuts, most hospitals cannot afford costly imaging devices and prefer lower-priced alternatives (such as refurbished devices) or to upgrade existing devices. To address this challenge, market players have to adopt suitable strategies to meet the needs of these hospitals.

The axial bone densitometry accounted for the largest share of the bone densitometer market in 2021

The axial bone densitometry segment dominated the bone densitometer market in 2021. The advantages of DEXA scanners over peripheral bone densitometers and greater accuracy are expected to drive the segment growth.

The osteoporosis & osteopenia diagnosis segment dominated this market with the largest share in 2021

The osteoporosis & osteopenia diagnosis accounted for the largest share of the global bone densitometer market in 2021 and is also expected to grow at the highest CAGR. Growing geriatric population and the subsequent increase in the prevalence of osteoporosis are driving the segment growth.

The hospitals & specialty clinics segment accounted for the largest share of the bone densitometer market in 2021

The hospitals & specialty clinics segment accounted for the largest share of the global bone densitometer market in 2021. A majority of bone density scans are performed in hospitals due to the higher preference of patients for hospital-based treatment monitoring of diseases such as cystic fibrosis, chronic kidney disease, and osteoporosis, thus driving the segment growth.

Asia Pacific to grow at the fastest CAGR during the forecast period

Factors driving the demand in Asia Pacific are rising geriatric population coupled with the significant prevalence of bone-related diseases in this population segment, the increasing healthcare expenditure in APAC countries, and growing public awareness. Moreover, increasing localized product manufacturing and the focus of global product manufacturers on expanding their presence in APAC countries also contribute to market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the Bone densitometer market: GE Healthcare (US), Hologic, Inc. (US), OSI Systems, Inc. (US), Diagnostic Medical Systems Group (France), Swissray Global Healthcare Holding, Ltd. (Taiwan), BeamMed, Ltd. (Israel), Echolight S.P.A (Italy), Scanflex Healthcare AB (Sweden), Medonica Co., Ltd. (South Korea), Eurotec Systems S.r.l (Italy), AMPall Co., Ltd. (South Korea), L’acn L’accessorio Nucleare S.R.L (Italy), Shenzhen XRAY Electric Co., Ltd. (China), YOZMA BMTech Co., Ltd. (South Korea), Nanoomtech Co., Ltd. (South Korea), Osteosys Corporation (South Korea), FURUNO Electric Co., Ltd. (Japan), Xianyang Kanrota Digital Ultrasound System, Co., Ltd. (China), XinGaoYi Co., Ltd. (China), Anjue Medical Equipment (China), Guangzhou Medsinglong Medical Equipment Co., Ltd. (China), Trivitron Healthcare (India), OsCare Medical Oy (Finland), CyberLogic, Inc. (US), and Nanjing Kejin Industrial Co., Ltd. (China).

Scope of the Bone Densitometer Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$299 million |

|

Projected Revenue Size by 2027 |

$378 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 4.7% |

|

Market Driver |

Rising Incidence Osteoporosis |

|

Market Opportunity |

Growth Opportunities In Emerging Markets |

The research report categorizes the bone densitometers market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

- Axial Bone Densitometry

- Dual energy x-ray absorptiometry (DEXA)

- Quantitative computed tomography (QCT)

- Peripheral Bone Densitometry

- Quantitative ultrasound (QUS)

- Radiographic Absorptiometry (RA)

- Other Peripheral Bone Densitometry instruments

By Application

- Osteoporosis and osteopenia diagnosis

- Cystic fibrosis diagnosis

- Chronic kidney diseases diagnosis

- Body composition measurement diagnosis

- Rheumatoid arthritis diagnosis

By End User

- Hospitals & specialty clinics

- Diagnostic & imaging centers

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Recent Developments:

DEALS

|

MONTH & YEAR |

Deal Type |

Company 1 |

Company 2 |

Description |

DEAL SIZE |

|

February 2022 |

Agreement |

Echolight S.P.A. (Italy) |

Aurora Spine Corporation (Canada) |

Aurora Spine Corporation entered into a joint co-marketing agreement with Echolight Medical for patient assessment of bone mineral density (BMD) and the quality of bone microarchitecture independent of BMD. |

NA |

|

May 2019 |

Partnership |

Hologic Inc. (US) |

DEXA+ (US) |

Hologic, Inc. announced its partnership with DEXA+ to distribute its DXA system for body composition measurement. The partnership allowed Hologic to expand its expertise in body composition assessment. |

NA |

Source: Press Releases

OTHER DEVELOPMENTS

|

Month & Year |

Company |

TYPE OF DEVELOPMENT |

Location |

Description |

|

June 2021 |

Diagnostic Medical Systems Group (France) |

Contract Extension |

ASEAN and MEA Zone |

DMS Imaging announced the extension of its white-label manufacturing contract for the FUJIFILM Healthcare Group. The first distribution agreement was signed in 2017 to distribute its range of bone densitometers in Europe. The latest contract was extended for the ASEAN and MEA zone. |

Source: Press Releases

Frequently Asked Questions (FAQs):

What is the size of Bone Densitometer Market ?

The global bone densitometers market boasts a total value of $299 million in 2022 and is projected to register a growth rate of 4.7% to reach a value of $378 million by 2027.

What are the major growth factors of Bone Densitometer Market ?

The growth of the bone densitometers market in North America is primarily driven by the high consumer awareness, increase in healthcare expenditure, increasing prevalence of osteoporosis, and the presence of key market players in the region.

Who all are the prominent players of Bone Densitometer Market ?

Key players in the Bone densitometer market: GE Healthcare (US), Hologic, Inc. (US), OSI Systems, Inc. (US), Diagnostic Medical Systems Group (France), Swissray Global Healthcare Holding, Ltd. (Taiwan), BeamMed, Ltd. (Israel), Echolight S.P.A (Italy), Scanflex Healthcare AB (Sweden), Medonica Co., Ltd. (South Korea), Eurotec Systems S.r.l (Italy), AMPall Co., Ltd. (South Korea), L’acn L’accessorio Nucleare S.R.L (Italy), Shenzhen XRAY Electric Co., Ltd. (China), YOZMA BMTech Co., Ltd. (South Korea), Nanoomtech Co., Ltd. (South Korea), Osteosys Corporation (South Korea), FURUNO Electric Co., Ltd. (Japan), Xianyang Kanrota Digital Ultrasound System, Co., Ltd. (China), XinGaoYi Co., Ltd. (China), Anjue Medical Equipment (China), Guangzhou Medsinglong Medical Equipment Co., Ltd. (China), Trivitron Healthcare (India), OsCare Medical Oy (Finland), CyberLogic, Inc. (US), and Nanjing Kejin Industrial Co., Ltd. (China). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKETS COVERED

1.2.2 YEARS CONSIDERED

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary sources

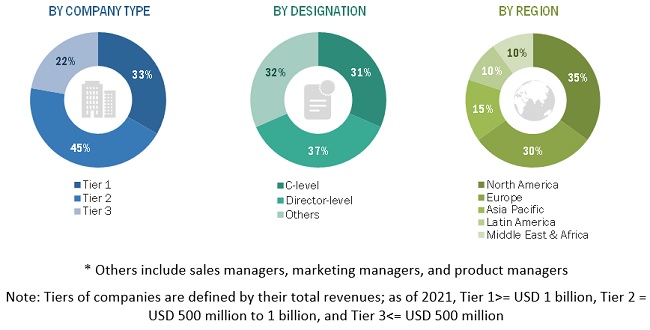

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: COMPANY-WISE REVENUE SHARE ANALYSIS (2021)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 8 BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 9 BONE DENSITOMETERS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 10 BONE DENSITOMETERS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE BONE DENSITOMETERS MARKET

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 BONE DENSITOMETERS MARKET OVERVIEW

FIGURE 12 INCREASING PREVALENCE OF OSTEOPOROSIS TO DRIVE THE MARKET FOR BONE DENSITOMETERS

4.2 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY APPLICATION AND COUNTRY (2021)

FIGURE 13 OSTEOPOROSIS & OSTEOPENIA DIAGNOSIS SEGMENT DOMINATED THE ASIA PACIFIC BONE DENSITOMETERS MARKET IN 2021

4.3 BONE DENSITOMETERS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 14 CHINA TO WITNESS THE HIGHEST GROWTH IN THE BONE DENSITOMETERS MARKET FROM 2022 TO 2027

4.4 REGIONAL MIX: BONE DENSITOMETERS MARKET (2022–2027)

FIGURE 15 ASIA PACIFIC TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD (2022–2027)

4.5 BONE DENSITOMETERS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 16 DEVELOPING COUNTRIES TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

FIGURE 17 BONE DENSITOMETERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2 MARKET DRIVERS

5.2.1 RISING INCIDENCE OF OSTEOPOROSIS

5.2.2 GROWING GERIATRIC POPULATION

5.2.3 RISING PREVALENCE OF KIDNEY DISEASE

5.3 MARKET RESTRAINTS

5.3.1 HIGH COST OF BONE DENSITOMETERS

5.4 MARKET OPPORTUNITIES

5.4.1 GROWTH OPPORTUNITIES IN EMERGING MARKETS

TABLE 1 EMERGING COUNTRIES: HEALTHCARE EXPENDITURE (% OF GDP), 2015 VS. 2019

5.5 MARKET CHALLENGES

5.5.1 LACK OF ACCESS TO DIAGNOSTICS

5.5.2 UNFAVORABLE REIMBURSEMENT SCENARIO

5.5.3 HOSPITAL BUDGET CUTS

5.6 ASSESSMENT OF COVID-19 IMPACT ON THE ECONOMIC SCENARIO OF THE BONE DENSITOMETERS MARKET

6 BONE DENSITOMETERS MARKET, BY TECHNOLOGY (Page No. - 46)

6.1 INTRODUCTION

TABLE 2 BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

6.2 AXIAL BONE DENSITOMETRY

TABLE 3 AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 4 AXIAL BONE DENSITOMETRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1 DUAL-ENERGY X-RAY ABSORPTIOMETRY (DEXA)

6.2.1.1 Several advantages of DEXA scanners to drive growth in this market segment

TABLE 5 DUAL-ENERGY X-RAY ABSORPTIOMETRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 QUANTITATIVE COMPUTED TOMOGRAPHY (QCT)

6.2.2.1 Several drawbacks of QCT scanners, including relatively high radiation exposure and a higher precision error than that of DEXA, to limit market growth

TABLE 6 QUANTITATIVE COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 PERIPHERAL BONE DENSITOMETRY

TABLE 7 PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 8 PERIPHERAL BONE DENSITOMETRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.1 QUANTITATIVE ULTRASOUND (QUS)

6.3.1.1 Quantitative ultrasound scanners offer advantages such as low exposure to radiation and non-invasive measurement—key factors driving market growth

TABLE 9 QUANTITATIVE ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2 RADIOGRAPHIC ABSORPTIOMETRY (RA)

6.3.2.1 Technical limitations associated with RA devices to limit market growth

TABLE 10 RADIOGRAPHIC ABSORPTIOMETRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.3 OTHER PERIPHERAL BONE DENSITOMETRY TECHNOLOGIES

TABLE 11 OTHER PERIPHERAL BONE DENSITOMETRY TECHNOLOGIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 BONE DENSITOMETERS MARKET, BY APPLICATION (Page No. - 55)

7.1 INTRODUCTION

TABLE 12 BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 OSTEOPOROSIS & OSTEOPENIA DIAGNOSIS

7.2.1 LARGE GERIATRIC POPULATION SUFFERING FROM OSTEOPOROSIS AND INCREASING RISK OF OSTEOPOROSIS IN MENOPAUSAL WOMEN—KEY FACTORS DRIVING GROWTH

TABLE 13 BONE DENSITOMETERS MARKET FOR OSTEOPOROSIS & OSTEOPENIA DIAGNOSIS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 CYSTIC FIBROSIS DIAGNOSIS

7.3.1 GROWING PREVALENCE OF CYSTIC FIBROSIS AND SUBSEQUENT INCREASE IN CASES OF OSTEOPOROSIS & OSTEOPENIA TO DRIVE THE DEMAND FOR BONE DENSITY TESTS

TABLE 14 BONE DENSITOMETERS MARKET FOR CYSTIC FIBROSIS DIAGNOSIS, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 CHRONIC KIDNEY DISEASE DIAGNOSIS

7.4.1 GROWING PREVALENCE OF CHRONIC KIDNEY DISEASES TO INCREASE THE DEMAND FOR BONE DENSITOMETRY TESTS

TABLE 15 BONE DENSITOMETERS MARKET FOR CHRONIC KIDNEY DISEASE DIAGNOSIS, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 BODY COMPOSITION MEASUREMENT

7.5.1 GROWING FOCUS ON ATHLETE PERFORMANCE TO SUPPORT MARKET GROWTH

TABLE 16 BONE DENSITOMETERS MARKET FOR BODY COMPOSITION MEASUREMENT, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 RHEUMATOID ARTHRITIS DIAGNOSIS

7.6.1 HIGH RISK OF OSTEOPOROSIS AND OSTEOPOROTIC FRACTURES ASSOCIATED WITH RHEUMATOID ARTHRITIS TO FUEL THE NEED FOR BONE DENSITOMETERS

TABLE 17 BONE DENSITOMETERS MARKET FOR RHEUMATOID ARTHRITIS DIAGNOSIS, BY COUNTRY, 2020–2027 (USD MILLION)

8 BONE DENSITOMETERS MARKET, BY END USER (Page No. - 62)

8.1 INTRODUCTION

TABLE 18 BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 HOSPITALS & SPECIALTY CLINICS

8.2.1 HIGH PURCHASING CAPACITY OF HOSPITALS COMPARED TO DIAGNOSTIC AND AMBULATORY CENTERS TO DRIVE THE ADOPTION OF HIGH-COST DEXA SCANNERS AMONG HOSPITALS

TABLE 19 BONE DENSITOMETERS MARKET FOR HOSPITALS & SPECIALTY CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 DIAGNOSTIC & IMAGING CENTERS

8.3.1 HIGH COST OF BONE DENSITOMETERS AND CONTINUOUS REIMBURSEMENT CUTS IN OUTPATIENT DIAGNOSTIC IMAGING TO LIMIT GROWTH IN THIS END-USER SEGMENT

TABLE 20 BONE DENSITOMETERS MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 OTHER END USERS

TABLE 21 BONE DENSITOMETERS MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

9 BONE DENSITOMETERS MARKET, BY REGION (Page No. - 67)

9.1 INTRODUCTION

FIGURE 18 BONE DENSITOMETERS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 22 BONE DENSITOMETERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 BONE DENSITOMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 19 NORTH AMERICA: BONE DENSITOMETERS MARKET SNAPSHOT

TABLE 24 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 26 NORTH AMERICA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 27 NORTH AMERICA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 29 NORTH AMERICA: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Favorable reimbursement scenario in the US to drive market growth

TABLE 30 US: KEY MACROINDICATORS

TABLE 31 US: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 32 US: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 33 US: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 34 US: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 35 US: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing geriatric population in Canada to support market growth

TABLE 36 CANADA: KEY MACROINDICATORS

TABLE 37 CANADA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 38 CANADA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 39 CANADA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 CANADA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 41 CANADA: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 42 EUROPE: BONE DENSITOMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 EUROPE: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 EUROPE: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 46 EUROPE: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 47 EUROPE: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Growing prevalence of osteoporosis in Germany to fuel the demand for bone densitometers in the country

TABLE 48 GERMANY: KEY MACROINDICATORS

TABLE 49 GERMANY: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 50 GERMANY: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 GERMANY: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 GERMANY: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 53 GERMANY: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Increasing healthcare expenditure in France to boost the adoption of bone densitometers

TABLE 54 FRANCE: KEY MACROINDICATORS

TABLE 55 FRANCE: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 56 FRANCE: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 FRANCE: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 FRANCE: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 FRANCE: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 UK

9.3.3.1 Increasing number of fragility fracture cases to drive growth in the UK bone densitometers market

TABLE 60 UK: KEY MACROINDICATORS

TABLE 61 UK: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 62 UK: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 UK: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 UK: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 65 UK: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Large geriatric population in the country and subsequent increase in the prevalence of age-related chronic conditions to fuel growth in the market

TABLE 66 ITALY: KEY MACROINDICATORS

TABLE 67 ITALY: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 68 ITALY: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 ITALY: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 ITALY: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 ITALY: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Improved monitoring of fragility fractures and their management through national registries to propel the market for bone densitometers in Spain

TABLE 72 SPAIN: KEY MACROINDICATORS

TABLE 73 SPAIN: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 74 SPAIN: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 SPAIN: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 SPAIN: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 SPAIN: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 78 REST OF EUROPE: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 79 REST OF EUROPE: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 REST OF EUROPE: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 REST OF EUROPE: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 REST OF EUROPE: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 20 ASIA PACIFIC: BONE DENSITOMETERS MARKET SNAPSHOT

TABLE 83 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 84 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 ASIA PACIFIC: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Large geriatric population in Japan to fuel the demand for bone densitometers

TABLE 89 JAPAN: KEY MACROINDICATORS

TABLE 90 JAPAN: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 91 JAPAN: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 JAPAN: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 JAPAN: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 JAPAN: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing incidence of fractures due to osteoporosis to support market growth

TABLE 95 CHINA: KEY MACROINDICATORS

TABLE 96 CHINA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 97 CHINA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 CHINA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 CHINA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 CHINA: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising osteoporosis & osteoarthritis rates to support the demand for bone densitometers in India

TABLE 101 INDIA: KEY MACROINDICATORS

TABLE 102 INDIA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 103 INDIA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 INDIA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 INDIA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 106 INDIA: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 107 REST OF ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 108 REST OF ASIA PACIFIC: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 REST OF ASIA PACIFIC: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 REST OF ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 111 REST OF ASIA PACIFIC: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 EFFORTS TO CLOSE THE CARE GAP AND INCREASE HEALTHCARE ACCESSIBILITY TO SUPPORT MARKET GROWTH IN LATIN AMERICA

TABLE 112 LATIN AMERICA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 113 LATIN AMERICA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 LATIN AMERICA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 LATIN AMERICA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 LATIN AMERICA: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 POLITICAL INSTABILITY IN THE MIDDLE EAST & AFRICA TO HINDER MARKET GROWTH

TABLE 117 MIDDLE EAST & NORTH AFRICA: NUMBER OF HIP FRACTURES, 2010 VS. 2020

TABLE 118 MIDDLE EAST & AFRICA: BONE DENSITOMETERS MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 119 MIDDLE EAST & AFRICA: AXIAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 MIDDLE EAST & AFRICA: PERIPHERAL BONE DENSITOMETRY MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 MIDDLE EAST & AFRICA: BONE DENSITOMETERS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: BONE DENSITOMETERS MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 111)

10.1 INTRODUCTION

10.2 COMPETITIVE LEADERSHIP MAPPING

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE PLAYERS

10.2.4 PARTICIPANTS

FIGURE 21 BONE DENSITOMETERS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.3 BONE DENSITOMETERS MARKET: GEOGRAPHICAL ASSESSMENT

FIGURE 22 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN THE BONE DENSITOMETERS MARKET (2021)

10.4 MARKET SHARE ANALYSIS

FIGURE 23 BONE DENSITOMETERS MARKET SHARE, BY KEY PLAYER, 2021

10.5 COMPETITIVE SITUATION AND TRENDS

10.5.1 DEALS (2019–2022)

10.5.2 OTHER DEVELOPMENTS (2021)

11 COMPANY PROFILES (Page No. - 116)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 GE HEALTHCARE

TABLE 123 GE HEALTHCARE: BUSINESS OVERVIEW

FIGURE 24 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

11.1.2 HOLOGIC, INC.

TABLE 124 HOLOGIC, INC.: BUSINESS OVERVIEW

FIGURE 25 HOLOGIC, INC.: COMPANY SNAPSHOT (2021)

11.1.3 OSI SYSTEMS, INC.

TABLE 125 OSI SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 26 OSI SYSTEMS, INC.: COMPANY SNAPSHOT (2021)

11.1.4 DIAGNOSTIC MEDICAL SYSTEMS GROUP

TABLE 126 DIAGNOSTIC MEDICAL SYSTEMS GROUP: BUSINESS OVERVIEW

11.1.5 SWISSRAY GLOBAL HEALTHCARE HOLDING, LTD.

TABLE 127 SWISSRAY GLOBAL HEALTHCARE HOLDING, LTD.: BUSINESS OVERVIEW

11.1.6 BEAMMED, LTD.

TABLE 128 BEAMMED, LTD.: BUSINESS OVERVIEW

11.1.7 ECHOLIGHT S.P.A

TABLE 129 ECHOLIGHT S.P.A.: BUSINESS OVERVIEW

11.1.8 SCANFLEX HEALTHCARE AB

TABLE 130 SCANFLEX HEALTHCARE AB: BUSINESS OVERVIEW

11.1.9 MEDONICA CO., LTD.

TABLE 131 MEDONICA CO., LTD.: BUSINESS OVERVIEW

11.1.10 EUROTEC MEDICAL SYSTEMS S.R.L.

TABLE 132 EUROTEC MEDICAL SYSTEMS S.R.L.: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 AMPALL CO., LTD.

TABLE 133 AMPALL CO., LTD.: BUSINESS OVERVIEW

11.2.2 L’ACN L’ACCESSORIO NUCLEARE S.R.L

TABLE 134 L’ACN L’ACCESSORIO NUCLEARE S.R.L.: BUSINESS OVERVIEW

11.2.3 SHENZHEN XRAY ELECTRIC CO., LTD.

TABLE 135 SHENZHEN XRAY ELECTRIC CO., LTD.: BUSINESS OVERVIEW

11.2.4 YOZMA BMTECH CO., LTD.

TABLE 136 YOZMA BMTECH CO., LTD.: BUSINESS OVERVIEW

11.2.5 NANOOMTECH CO., LTD.

TABLE 137 NANOOMTECH CO., LTD.: BUSINESS OVERVIEW

11.2.6 OSTEOSYS CORPORATION

TABLE 138 OSTEOSYS CORPORATION: BUSINESS OVERVIEW

11.2.7 FURUNO ELECTRIC CO., LTD.

TABLE 139 FURUNO ELECTRIC CO., LTD.: BUSINESS OVERVIEW

11.2.8 XIANYANG KANROTA DIGITAL ULTRASOUND SYSTEM, CO., LTD.

TABLE 140 XIANYANG KANROTA DIGITAL ULTRASOUND SYSTEM, CO., LTD.: BUSINESS OVERVIEW

11.2.9 XINGAOYI CO., LTD.

TABLE 141 XINGAOYI CO., LTD.: BUSINESS OVERVIEW

11.2.10 ANJUE MEDICAL EQUIPMENT CO., LTD.

TABLE 142 ANJUE MEDICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

11.2.11 GUANGZHOU MEDSINGLONG MEDICAL EQUIPMENT CO., LTD.

TABLE 143 GUANGZHOU MEDSINGLONG MEDICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

11.2.12 TRIVITRON HEALTHCARE

TABLE 144 TRIVITRON HEALTHCARE: BUSINESS OVERVIEW

11.2.13 OSCARE MEDICAL OY

TABLE 145 OSCARE MEDICAL OY: BUSINESS OVERVIEW

11.2.14 CYBERLOGIC, INC.

TABLE 146 CYBERLOGIC, INC.: BUSINESS OVERVIEW

11.2.15 NANJING KEJIN INDUSTRIAL CO., LTD.

TABLE 147 NANJING KEJIN INDUSTRIAL CO., LTD.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 147)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources and various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the bone densitometers market. It was also used to obtain important information about the key players, market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report.

Primary sources from the supply side include CEOs, vice presidents, marketing & sales directors, business development managers, key opinion leaders, and suppliers & distributors. Primary sources from the demand side include distributors & suppliers and experts from corporate entities and hospitals.

A breakdown of the primary respondents for Bone Densitometer market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends and pricing by technology and geography).

Data Triangulation

After arriving at the market size, the total bone densitometers market was divided into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, in order to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Objectives of the Study

- To define, describe, and forecast the bone densitometers market based on technology, application, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall bone densitometers market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the bone densitometers market in five regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies2 in the bone densitometers market

- To track and analyze competitive developments in the bone densitometers market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific Bone Densitometer market into Australia, New Zealand, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bone Densitometer Market