Orthobiologics Market by Product (Viscosupplementation, Synthetic Orthobiologics, DBM, BMP, PRP, BMAC, Allograft), Application (Fracture Recovery, Osteoarthritis, Spinal Fusion, Soft Tissue), End User (Hospitals, ASCs, Academia) - Global Forecast to 2022

[159 Pages Report] The global orthobiologics market is expected to reach USD 6.06 Billion by 2022 from USD 4.44 Billion in 2016 at a CAGR of 5.4% during the forecast period.

Orthobiologics Market : Years considered for the study are as follows

- Base Year: 2016

- Forecast Period: 2017–2022

Orthobiologics Market : Objectives of the study are

- To define, describe, and forecast the orthobiologics market on the basis of product, application, end user, and region

- To provide detailed information regarding the major factors influencing growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the market

- To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the orthobiologics market segments with respect to four major regions, namely, North America (US, Canada), Europe (Germany, UK, France, Italy, Spain and RoE), Asia Pacific (Japan, China, India, and RoAPAC), and RoW.

- To profile the key players in the orthobiologics market and comprehensively analyze their market rank and core competencies

- To track and analyze competitive developments such as product launches; agreements, & collaborations; mergers & acquisitions; and research & development activities in the orthobiologics market

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyses market players on various parameters within the broad categories of Business Strategy Excellence and Strength of Product Portfolio

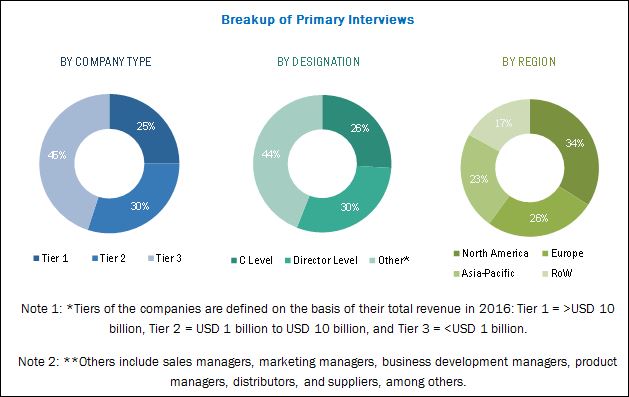

This research study involves the extensive usage of secondary sources, directories, and databases (such as Hoover’s, Bloomberg Business, Factiva, and Avention), in order to identify and collect information useful for this technical, market-oriented, and financial study of the orthobiologics market. In-depth interviews were conducted with various primary respondents, including subject-matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify qualitative and quantitative information and to assess market prospects.

To know about the assumptions considered for the study, download the pdf brochure

As of 2016, Medtronic, DePuy Synthes, and Zimmer Biomet held the leading position in the market. These companies adopted product launches, agreements, and partnerships as their business strategies in past three years to ensure market dominance. Stryker, Bioventus, Harvest Technologies, Globus, Orthofix International, RTI Surgical, K2M Group, Kuros Biosciences, NuVasive, SeaSpine, and Xtant Medical are some of the other major players in the orthobiologics market.

Orthobiologics Market Stakeholders

- Orthobiologics Product Manufacturing Companies

- Product Suppliers, Distributors, and Channel Partners

- Hospitals and Ambulatory Care Centers

- Orthopedic and Dental Clinics

- Research Laboratories and CROs

- Research and Academic Institutes

- National and International Regulatory Authorities

- Government and Non-government Organizations

- Market Research Firms

Orthobiologics Market : Scope of the Report

This report categorizes the global orthobiologics market into the following segments and subsegments:

Global Orthobiologics Market, by Product

- Viscosupplementation Products

- DBM

- Synthetic Orthobiologics

- BMP

- Allografts

- PRP

- BMAC

Global Orthobiologics Market, by Application

- Osteoarthritis and Degenerative Arthritis

- Spinal Fusion

- Fracture Recovery

- Soft Tissue Injuries

- Maxillofacial and Dental Applications

Global Orthobiologics Market, by End User

- Hospitals, Orthopedic Clinics, and Ambulatory Care Centers

- Research and Academic Institutes

- Dental Clinics and Facilities

Global Orthobiologics Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional orthobiologics market players (up to 15)

The global orthobiologics market is projected to reach USD 6.06 Billion by 2022 from USD 4.66 Billion in 2017, at a CAGR of 5.4% during the forecast period. Factors such as rising burden of orthopedic injuries; increasing incidence of sports injuries and road accidents; increasing incidence of spinal fusion surgeries; risk factors associated with increasing aging population, obesity rate, & high incidence of musculoskeletal disorders; and growing patient preference for minimally invasive procedures are driving the market.

This report broadly segments the orthobiologics market into product, application, and end user. On the basis of product, the market is categorized into allografts, synthetic orthobiologics, PRP, BMAC, DBM, BMP, and viscosupplementation products. In 2017, the viscosupplementation products segment is expected to account for the largest share of the market. The large share of this segment can be attributed to the increasing incidence of osteoarthritis of the knee and hip joints among the baby boomer population and lower cost of viscosupplementations.

Based on application, the market is segmented into fracture recovery, osteoarthritis & degenerative arthritis, spinal fusion, soft-tissue injuries, and maxillofacial & dental applications. The osteoarthritis & degenerative arthritis segment is estimated to command the largest share of the global orthobiologics market in 2017. The large share of this segment is mainly due to factors such as the significant rise in target patient population across major markets, rising public awareness related to clinical side effects associated with oral medications for pain management, clinical advancements in OA management methodologies, robust healthcare infrastructure & facilities for specific joint replacement surgeries across major markets, and growing clinical evidence validating the efficacy of biologics in OA treatment.

On the basis of end user, the orthobiologics market is segmented hospitals, orthopedic clinics, and ambulatory care centers; research & academic institutes; and dental clinics and facilities. The hospitals, orthopedic clinics, and ambulatory care centers segment is poised to grow at the fastest rate during the forecast period. This can be attributed to the growing geriatric population (coupled with the increasing number of spinal fusion surgeries performed); road accident injuries and bone fractures; growing prevalence of spinal disorders; and growing awareness of products.

<

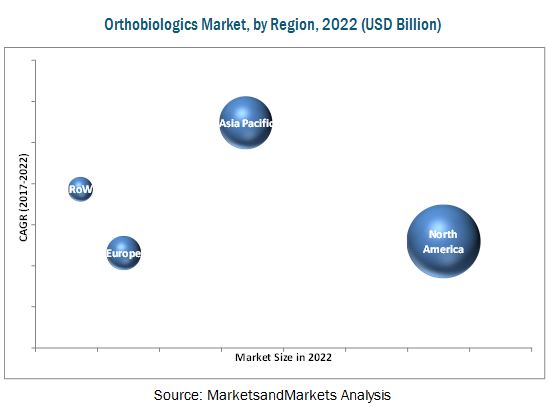

The report covers the orthobiologics market across four major geographies, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to command the largest share of the market in 2017 due to the increasing incidence of spinal disorders, rising geriatric and obese population, growing preference for minimally invasive procedures, and growing physician and patient awareness about newly introduced treatment procedures and technologies. However, Asia Pacific is expected to register the highest growth rate during the forecast period. The presence of a large geriatric and target patient population, high incidence of osteoarthritis and obesity, increasing government spending on healthcare, and improving healthcare infrastructure are some of the major factors driving the growth of the Asia Pacific market.

On the other hand, the high cost associated with orthobiologics-based treatments is the major factor restraining the growth of the orthobiologics market.

Some of the major players operating in Orthobiologics Market are Medtronic, DePuy Synthes, and Zimmer Biomet. The other players in this market include Bioventus, Arthrex, Harvest Technologies, Globus Medical, Orthofix International, and RTI Surgical.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Orthobiologics Market Definition

1.3 Markets Covered

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Research Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Orthobiologics Market Size Estimation Methodology

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Global Orthobiologics Market Overview

4.2 Global Market: By Product (2017 vs 2022)

4.3 Orthobiologics Market: Regional Analysis (2017–2022)

4.4 Market: By Application, 2017

4.5 Global Orthobiologics Market Size, By End User

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Orthobiologics Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Increasing Incidence of Sports Injuries and Road Accidents

5.2.1.2 Increasing Incidence of Spinal Diseases/Disorders

5.2.1.3 Rising Geriatric and Obese Population

5.2.1.4 Growing Patient Preference for Minimally Invasive Procedures

5.2.2 Market Restraint

5.2.2.1 High Cost Associated With Orthobiologics-Based Treatments

5.2.3 Growth Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Increasing Use of Prp in Other Applications

5.2.4 Orthobiologics Market Challenges

5.2.4.1 Lawsuits Filed Against Major Market Players Affecting Their Brand Value

5.2.4.2 Side Effects Associated With Bmp-Based Treatments

5.3 Key Industry Trend

6 Orthobiologics Market, By Product (Page No. - 38)

6.1 Introduction

6.2 Viscosupplementation Products

6.3 Demineralized Bone Matrices

6.4 Synthetic Orthobiologics

6.5 Bone Morphogenic Protein

6.6 Allografts

6.7 Plasma-Rich Protein

6.8 Bone Marrow Aspirate Concentrate

7 Orthobiologics Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Osteoarthritis and Degenerative Arthritis

7.3 Spinal Fusion

7.4 Soft-Tissue Injuries

7.5 Fracture Recovery

7.6 Maxillofacial and Dental Applications

8 Orthobiologics Market, By End User (Page No. - 54)

8.1 Introduction

8.2 Hospitals, Orthopedic Clinics, & Ambulatory Care Centers

8.3 Research & Academic Institutes

8.4 Dental Clinics and Facilities

9 Orthobiologics Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Spain

9.3.5 Italy

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 94)

10.1 Overview

10.2 Global Orthobiologics Market Ranking, 2016

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Strength of Product Portfolio (25 Players)

10.4.2 Business Strategy Excellence (25 Players)

11 Company Profiles (Page No. - 99)

11.1 Depuy Synthes (A Subsidiary of Johnson & Johnson)

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Strength of Product Portfolio

11.1.4 Business Strategy Excellence

11.1.5 Recent Developments (2014–2017)

11.2 Medtronic PLC.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Strength of Product Portfolio

11.2.4 Business Strategy Excellence

11.2.5 Recent Developments (2014–2017)

11.3 Stryker Corporation

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Strength of Product Portfolio

11.3.4 Business Strategy Excellence

11.4 Zimmer Biomet Holdings, Inc.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Strength of Product Portfolio

11.4.4 Business Strategy Excellence

11.4.5 Recent Developments (2014–2017)

11.5 Harvest Technologies Corporation (A Terumo Bct Company)

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Strength of Product Portfolio

11.5.4 Business Strategy Excellence

11.6 Globus Medical, Inc.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Strength of Product Portfolio

11.6.4 Business Strategy Excellence

11.6.5 Recent Developments (2014–2017)

11.7 Orthofix International N.V.

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Strength of Product Portfolio

11.7.4 Business Strategy Excellence

11.7.5 Recent Developments (2014–2017)

11.8 RTI Surgical, Inc.

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Strength of Products Portfolio

11.8.4 Business Strategy Excellence

11.8.5 Recent Developments (2014–2017)

11.9 K2M Group Holdings, Inc.

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Strength of Product Portfolio

11.9.4 Business Strategy Excellence

11.10 Kuros Biosciences Ltd.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Strength of Product Portfolio

11.10.4 Business Strategy Excellence

11.10.5 Recent Developments (2014–2017)

11.11 Bioventus LLC

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Strength of Product Portfolio

11.11.4 Business Strategy Excellence

11.11.5 Recent Developments (2014–2017)

11.12 Nuvasive, Inc.

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Strength of Product Portfolio

11.12.4 Business Strategy Excellence

11.12.5 Recent Developments (2014–2017)

11.13 Seaspine Holdings Corporation

11.13.1 Business Overview

11.13.2 Products Offered

11.13.3 Strength of Product Portfolio

11.13.4 Business Strategy Excellence

11.13.5 Recent Developments (2014–2017)

11.14 Arthrex, Inc.

11.14.1 Business Overview

11.14.2 Products Offered

11.14.3 Strength of Product Portfolio

11.14.4 Business Strategy Excellence

11.14.5 Recent Developments (2014–2017)

11.15 Xtant Medical Holdings, Inc.

11.15.1 Business Overview

11.15.2 Products Offered

11.15.3 Strength of Product Portfolio

11.15.4 Business Strategy Excellence

11.15.5 Recent Developments (2014–2017)

12 Appendix (Page No. - 151)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (60 Tables)

Table 1 Orthobiologics Market, By Product, 2015–2022 (USD Million)

Table 2 Orthobiologics Market for Viscosupplementation Products, By Region, 2015–2022 (USD Million)

Table 3 Market for Demineralized Bone Matrices, By Region, 2015–2022 (USD Million)

Table 4 Market for Synthetic Orthobiologics, By Region, 2015–2022 (USD Million)

Table 5 Market for Bone Morphogenic Protein, By Region, 2015–2022 (USD Million)

Table 6 Market for Allografts, By Region, 2015–2022 (USD Million)

Table 7 Market for Plasma-Rich Protein, By Region, 2015–2022 (USD Million)

Table 8 Orthobiologics Market for Bone Marrow Aspirate Concentrate, By Region, 2015–2022 (USD Million)

Table 9 Orthobiologics Market, By Application, 2015–2022 (USD Million)

Table 10 Market for Osteoarthritis and Degenerative Arthritis, By Region, 2015–2022 (USD Million)

Table 11 Orthobiologics Market for Spinal Fusion, By Region, 2015–2022 (USD Million)

Table 12 Market for Soft-Tissue Injuries, By Region, 2015–2022 (USD Million)

Table 13 Market for Fracture Recovery, By Region, 2015–2022 (USD Million)

Table 14 Market for Maxillofacial and Dental Applications, By Region, 2015–2022 (USD Million)

Table 15 Global Orthobiologics Market, By End User, 2015–2022 (USD Million)

Table 16 Global Market for Hospitals, Orthopedic Clinics, and Ambulatory Care Centers, By Region, 2015–2022 (USD Million)

Table 17 Global Orthobiologics Market for Research & Academic Institutes, By Region, 2015–2022 (USD Million)

Table 18 Global Market for Dental Clinics and Facilities, By Region, 2015–2022 (USD Million)

Table 19 Orthobiologics Market, By Region, 2015–2022 (USD Million)

Table 20 Market, By Country, 2015–2022 (USD Million)

Table 21 North America: Market, By Country, 2015–2022 (USD Million)

Table 22 North America: Market, By Product, 2015–2022 (USD Million)

Table 23 North America: Market, By Application, 2015–2022 (USD Million)

Table 24 North America: Market, By End User, 2015–2022 (USD Million)

Table 25 US: Orthobiologics Market, By Product, 2015–2022 (USD Million)

Table 26 US: Market, By Application, 2015–2022 (USD Million)

Table 27 Canada: Market, By Product, 2015–2022 (USD Million)

Table 28 Canada: Market, By Application, 2015–2022 (USD Million)

Table 29 Europe: Orthobiologics Market, By Country, 2015–2022 (USD Million)

Table 30 Europe: Market, By Product, 2015–2022 (USD Million)

Table 31 Europe: Market, By Application, 2015–2022 (USD Million)

Table 32 Europe: Orthobiologics Market, By End User, 2015–2022 (USD Million)

Table 33 Germany: Market, By Product, 2015–2022 (USD Million)

Table 34 Germany: Market, By Application, 2015–2022 (USD Million)

Table 35 France: Market, By Product, 2015–2022 (USD Million)

Table 36 France: Market, By Application, 2015–2022 (USD Million)

Table 37 UK: Market, By Product, 2015–2022 (USD Million)

Table 38 UK: Orthobiologics Market, By Application, 2015–2022 (USD Million)

Table 39 Spain: Market, By Product, 2015–2022 (USD Million)

Table 40 Spain: Market, By Application, 2015–2022 (USD Million)

Table 41 Italy: Market, By Product, 2015–2022 (USD Million)

Table 42 Italy: Orthobiologics Market, By Application, 2015–2022 (USD Million)

Table 43 RoE: Market, By Product, 2015–2022 (USD Million)

Table 44 RoE: Orthobiologics Market, By Application, 2015–2022 (USD Million)

Table 45 Asia Pacific: Market, By Country, 2015–2022 (USD Million)

Table 46 Asia Pacific: Orthobiologics Market, By Product, 2015–2022 (USD Million)

Table 47 Asia Pacific: Market, By Application, 2015–2022 (USD Million)

Table 48 Asia Pacific: Market, By End User, 2015–2022 (USD Million)

Table 49 Japan: Market, By Product, 2015–2022 (USD Million)

Table 50 Japan: Market, By Application, 2015–2022 (USD Million)

Table 51 China: Market, By Product, 2015–2022 (USD Million)

Table 52 China: Orthobiologics Market, By Application, 2015–2022 (USD Million)

Table 53 India: Market, By Product, 2015–2022 (USD Million)

Table 54 India: Market, By Application, 2015–2022 (USD Million)

Table 55 RoAPAC: Orthobiologics Market, By Product, 2015–2022 (USD Million)

Table 56 RoAPAC: Market, By Application, 2015–2022 (USD Million)

Table 57 RoW: Market, By Product, 2015–2022 (USD Million)

Table 58 RoW: Market, By Application, 2015–2022 (USD Million)

Table 59 RoW: Orthobiologics Market, By End User, 2015–2022 (USD Million)

Table 60 Global Market Ranking By Key Players, 2016

List of Figures (38 Figures)

Figure 1 Research Design

Figure 2 Key Data From Secondary Sources

Figure 3 Key Data From Primary Sources

Figure 4 Breakdown of Primaries

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Orthobiologics Market, By Type, 2017 vs 2022

Figure 10 Orthobiologics Market, By Application 2017 vs 2022

Figure 11 Market, By End User, 2017 vs 2022

Figure 12 Geographical Snapshot of the Market, 2017

Figure 13 Rising Incidence of Musculoskeletal Diseases is Expected to Drive Growth of the Orthobiologics Market During the Forecast Period

Figure 14 Viscosupplementation Products Segment is Expected to Dominate the Orthobiologics Market in 2022

Figure 15 India and China are Expected to Be the Most Lucrative Markets for Orthobiologics Manufacturers

Figure 16 Osteoarthritis and Degenerative Arthritis Segment is Expected to Dominate the Market in 2017

Figure 17 Hospitals, Orthopedic Clinics, and Ambulatory Care Centers Segment Will Continue to Dominate the Market During the Forecast Period

Figure 18 Orthobiologics Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Number of Road Accidents Worldwide: 2010 vs 2014

Figure 20 Geriatric Population, By Region, 2015 vs 2030 vs 2050

Figure 21 Viscosupplementation Products to Dominate the Market During the Forecast Period

Figure 22 Spinal Fusions Form the Fastest-Growing Application Segment in the Global Orthobiologics Market

Figure 23 Hospitals, Orthopedic Clinics, and Ambulatory Care Centers to Form the Fastest-Growing End-User Segment in the Global Market

Figure 24 North America: Orthobiologics Market Snapshot

Figure 25 Europe: Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 RoW: Orthobiologics Market Snapshot

Figure 28 Competitive Leadership Mapping: Global Orthobiologics Market, 2017

Figure 29 Johnson & Johnson: Company Snapshot

Figure 30 Medtronic PLC: Company Snapshot

Figure 31 Stryker Corporation: Company Snapshot

Figure 32 Zimmer Biomet Holdings, Inc.: Company Snapshot

Figure 33 Terumo Corporation: Company Snapshot

Figure 34 Globus Medical, Inc.: Company Snapshot

Figure 35 Orthofix International N.V.: Company Snapshot

Figure 36 RTI Surgical: Company Snapshot

Figure 37 K2M Group Holdings, Inc.: Company Snapshot

Figure 38 Kuros Biosciences Ltd.: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Orthobiologics Market