Optical Interconnect Market by Product Category (Cable Assemblies, Connectors, Optical Transceivers), Interconnect Level, Fiber Mode, Data Rate, Distance, Application (Data Communication, Telecommunication), Region - Global Forecast to 2025

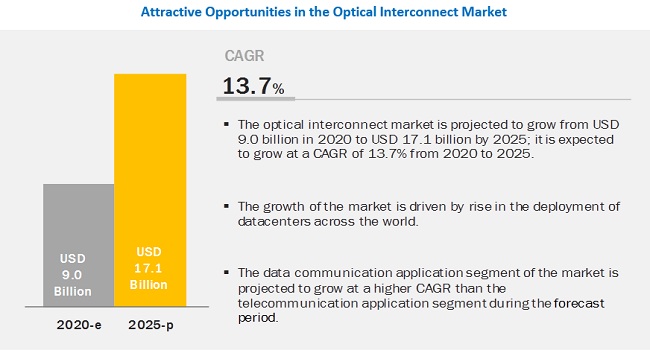

The optical interconnect market is projected to reach USD 17.1 billion by 2025, at a CAGR of 13.7% during the forecast period.

Key factors fueling the growth of this market include the rise in the global deployment of datacenters and the surge in the global adoption of cloud computing, big data analytics, and IoT.

Optical Interconnect Market Segment Overview

The multimode fiber segment of the optical interconnect market expected to grow at a higher CAGR than the single mode segment during the forecast period.

The multimode fiber segment of the market is projected to grow at a higher CAGR than the single mode fiber segment from 2020 to 2025. The growth of this segment can be attributed to the rising demand for increased bandwidth for cloud computing applications.

Multimode fiber optical interconnects are used for short-distance data transmissions in datacenters and high-performance computing applications. Moreover, cloud computing offers a large number of benefits, such as reduced infrastructure costs and improved connectivity, thereby leading to its increased adoption rate globally. The increasing use of cloud computing has created the requirement for high-efficiency processing in datacenters.

The 41 Gbps to 100 Gbps data rate segment projected to grow at the highest CAGR from 2020 to 2025.

The 41 Gbps to 100 Gbps segment of the market is projected to grow at the highest CAGR during the forecast period. This growth can be attributed to the rising demand for high data transmission rate 100G, 200G, and 400G transceivers. With the advent of advanced technologies such as AI and 5G, there is an increased requirement of high bandwidth, which is necessary for datacenters. Thus, optical interconnects are becoming highly predominant for key cloud service providers such as Amazon, Facebook, Google, and Microsoft, thereby leading to the growth of the market during the forecast period.

The less than 1 km distance segment projected to grow at the highest CAGR from 2020 to 2025.

In 2019, the less than 1 km segment held the largest share of the optical interconnect market. This segment is expected to lead the market during the forecast period. The growth of the less than 1 km segment can be attributed to the transitioning of large-scale datacenters toward the adoption of high data rate components, including optical interconnects for data communication.

Datacenters transmit data over short distances and require a high data transmission rate for transferring huge packets of information. The increasing requirement of high-speed communication in datacenters is also driving the market for high data rate optical interconnects such as 100G and 400G for a distance of less than 1 km.

The data communication application segment to lead the optical interconnect market during the forecast period.

The data communication segment is projected to lead the optical interconnect market from 2020 to 2025. The growth of this segment can be attributed to the ongoing adoption of cloud storage and the increasing technological developments taking place in the field of machine learning, artificial intelligence, and deep learning.

This, in turn, increases data traffic across networks, thereby leading to significant demand for high data rate transceivers used for efficient data communication. The development of hyperscale datacenters globally is also driving the growth of the optical interconnect market. Moreover, leading cloud service providers such as Google, Amazon, and Microsoft are implementing high data rate optical interconnects in their datacenters. The advent of driverless vehicles, wireless communication, smart gaming, etc., is also expected to increase data traffic across networks, thereby leading to a rise in demand for optical interconnects.

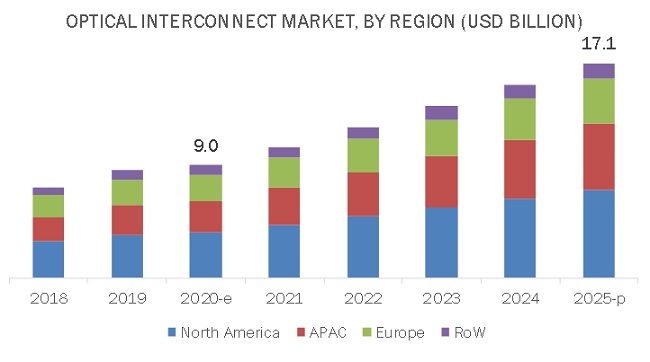

North America accounted for the largest share of the optical interconnect market in 2019.

In 2019, North America held the largest share of the overall optical interconnect market. The growth of the market in North America can be attributed to the presence of some leading datacenter companies such as Microsoft, Google, Amazon, Facebook, and Apple in the US. These companies have a large number of hyperscale datacenters installed across the region, thereby contributing significantly to the growth of the optical interconnect market in North America.

Key Market Players in optical interconnect industry

II-VI Incorporated (US); Lumentum Operations LLC (US); Molex, LLC (US); InnoLight Technology (Suzhou) Ltd. (China); NVIDIA Corporation (US); Fujitsu Ltd. (Japan); Sumitomo Electric Industries, Ltd. (Japan); Broadcom Inc. (US); TE Connectivity (Switzerland); and Infinera Corporation (US) are a few major companies operating in the optical interconnect market. These companies have adopted both organic and inorganic growth strategies such as new product launches and developments, acquisitions, collaborations, contracts, and expansions to strengthen their position in the market.

Optical Interconnect Market Report Scope :

|

Report Metric |

Details |

| Market size value in 2020 | USD 9.0 Billion |

| Market size value in 2025 | USD 17.1 Billion |

| Growth rate | CAGR of 11.2% |

|

Market size available for years |

20172025 |

|

Forecast period |

20202025 |

| Base year | 2019 |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Largest Growing Region | North America |

| Largest Market Share Segment | Multimode fiber segment |

| Highest CAGR Segment | 41 Gbps to 100 Gbps data rate |

| Largest Application Market Share | Data communication application |

This report categorizes the optical interconnect market based on product category, data rate, distance, interconnect level, fiber mode, application, and region.

Market , By Product Category

- Cable Assemblies

- Indoor Cable Assemblies

- Outdoor Cable Assemblies

- Active Optical Cables

- Multi-source Agreements

- Connectors

- LC Connectors

- SC Connectors

- ST Connectors

- MPO/MTO Connectors

- Optical Transceivers

- Free Space Optics, Fiber, and Waveguides

- Silicon Photonics

- PIC-based Interconnects

- Optical Engines

Market , By Interconnect Level:

- Metro and Long-haul Optical Interconnect

- Board-to-Board and Rack-level Optical Interconnect

- Chip- and Board-level Optical Interconnect

Market, By Fiber Mode:

- Single Mode Fiber

- Multimode Fiber

Market, By Data Rate :

- Less than 10 Gbps

- 10 Gbps to 40 Gbps

- 41 Gbps to 100 Gbps

- More than 100 Gbps

Market , By Distance:

- Less than 1 km

- 1 km to 10 km

- 11 km to 100 km

- More than 100 km

Market, By Application:

- Data Communication

- Telecommunication

Market , By Geography:

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Netherlands

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

- Rest of the World (RoW)

- South America

- Middle East and Africa

Major Market Developments in optical interconnect market

- In April 2020, NVIDIA Corporation entered the optical interconnect market by acquiring Mellanox Technologies, Ltd., a US-based provider of optical interconnects. Through this acquisition, NVIDIA aims at combining its datacenter and high-performance computing expertise with the high-performance networking technologies of Mellanox.

- In March 2020, II-VI Incorporated strengthened its position in the market by adding the first pluggable optical line subsystem (POLS) platform of the industry to its portfolio. This POLS platform uses 400ZR coherent transceivers for the next-generation datacenter interconnections (DCIs).

- In September 2019, II-VI Incorporated entered the optical interconnect market by acquiring Finisar Corporation, a US-based company offering optical communication components and subsystems. Through this acquisition, II-VI Incorporated has taken over all business initiatives of Finisar Corporation.

Frequently Asked Questions (FAQ):

How big is the Optical Interconnect Market?

13.7% Annual growth rate is expected and estimated to reach USD 17.1 billion by 2025.

Which is the largest growing region in the optical interconnect market?

North America held the largest share of the overall optical interconnect market. The growth of the market in North America can be attributed to the presence of some leading datacenter companies such as Microsoft, Google, Amazon, Facebook, and Apple in the US.

How much is the Optical Interconnect Market worth?

The optical interconnect market is projected to grow from USD 9.0 billion in 2020 to USD 17.1 billion by 2025.

Who is the leading company in Optical Interconnect Market?

Few major companies operating in the optical interconnect market are II-VI Incorporated (US); Lumentum Operations LLC (US); Molex, LLC (US); InnoLight Technology (Suzhou) Ltd. (China); NVIDIA Corporation (US); Fujitsu Ltd. (Japan); Sumitomo Electric Industries, Ltd. (Japan); Broadcom Inc. (US); TE Connectivity (Switzerland); and Infinera Corporation (US) .

What are the key trends impacting growth of Optical Interconnect Market?

Key factors fuelling the growth of this market include the rise in the global deployment of data centres and the surge in the global adoption of cloud computing, big data analytics, and IoT.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKETS COVERED

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size using bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share using top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN OPTICAL INTERCONNECT MARKET

4.2 MARKET, BY COUNTRY

4.3 MARKET, BY REGION

4.4 MARKET, BY APPLICATION AND REGION

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rise in global deployment of datacenters

5.2.1.2 Surge in global adoption of cloud computing, big data analytics, and IoT

5.2.2 RESTRAINTS

5.2.2.1 High deployment costs of optical interconnects

5.2.2.2 Data losses suffered during high-frequency long-distance data transmission

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in use of optical interconnects in high-performance computing applications

5.2.3.2 Rise in demand for chip-level optical interconnects used in multicore processors and 3D chips

5.2.3.3 Continuous developments in 5G network infrastructures

5.2.4 CHALLENGES

5.2.4.1 Continuous requirement to optimize size of optical interconnects

5.3 VALUE CHAIN ANALYSIS

5.3.1 OPTICAL INTERCONNECT VALUE CHAIN

5.4 COVID-19 IMPACT ON OPTICAL INTERCONNECT MARKET

6 CASE STUDIES (Page No. - 52)

6.1 INTRODUCTION

6.2 OAK RIDGE NATIONAL LABORATORY (US)

6.3 OLYMPIA EYE & LASER CENTRE (NAMIBIA)

6.4 EUROPEAN CENTRE FOR MEDIUM-RANGE WEATHER FORECASTS (UK)

7 OPTICAL INTERCONNECT MARKET, BY PRODUCT CATEGORY (Page No. - 53)

7.1 INTRODUCTION

7.2 CABLE ASSEMBLIES

7.2.1 INDOOR CABLE ASSEMBLIES

7.2.1.1 High demand for indoor cable assemblies for intra-datacenter interconnections

7.2.2 OUTDOOR CABLE ASSEMBLIES

7.2.2.1 Rise in adoption of outdoor cable assemblies for long-distance data transmission

7.2.3 ACTIVE OPTICAL CABLES

7.2.3.1 Surge in demand for AOCs for short-distance multilane data communication and interconnection applications

7.2.4 MULTI-SOURCE AGREEMENTS

7.2.4.1 QSFP

7.2.4.1.1 QSFP multi-source agreements support Ethernet, fiber channels, and SONET/SDH standards

7.2.4.2 CXP

7.2.4.2.1 High demand for CXP multi-source agreements for 100G applications

7.2.4.3 CFP

7.2.4.3.1 CFP multi-source agreements enable 40, 100, and 400 Gbps data transmissions

7.2.4.4 CDFP

7.2.4.4.1 Increase in adoption of CDFP multi-source agreements in telecommunication applications

7.2.4.5 Others

7.3 CONNECTORS

7.3.1 LC CONNECTORS

7.3.1.1 Significant demand for LC connectors owing to low insertion losses and high density

7.3.2 SC CONNECTORS

7.3.2.1 Increased adoption of SC connectors in telecommunication networks

7.3.3 ST CONNECTORS

7.3.3.1 Surged demand for ST connectors in LAN and data processing network applications

7.3.4 MPO/MTP CONNECTORS

7.3.4.1 Increased adoption of MPO/MTP connectors in telecommunication and Gigabit Ethernet applications

7.4 OPTICAL TRANSCEIVERS

7.4.1 SIGNIFICANT DEVELOPMENTS IN OPTICAL TRANSCEIVERS WITH ADVENT OF TRANSCEIVERS WITH 10, 40, 100, AND 400 GBPS DATA RATE

7.5 FREE SPACE OPTICS, FIBER, AND WAVEGUIDES

7.5.1 FREE SPACE OPTICS, FIBERS, AND WAVEGUIDES USE FREE AIR TO TRANSMIT DATA

7.6 SILICON PHOTONICS

7.6.1 LOW- COST AND HIGH-VOLUME ASSEMBLY OF SEMICONDUCTORS ENABLED BY SILICON PHOTONICS

7.7 PIC-BASED INTERCONNECTS

7.7.1 PIC-BASED INTERCONNECTS SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

7.8 OPTICAL ENGINES

7.8.1 OPTICAL ENGINES COMPRISE LOW POWER CONSUMPTION AND HIGHEST-DENSITY OPTICAL INTERFACES

8 OPTICAL INTERCONNECT MARKET, BY INTERCONNECT LEVEL (Page No. - 64)

8.1 INTRODUCTION

8.2 METRO AND LONG-HAUL OPTICAL INTERCONNECT

8.2.1 RISE IN ADOPTION OF METRO AND LONG-HAUL OPTICAL INTERCONNECT FOR TELECOMMUNICATION NETWORKS

8.3 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT

8.3.1 INCREASE IN DEMAND FOR BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECTIONS FOR FAST AND GREEN SYSTEMS

8.4 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT

8.4.1 SURGE IN USE OF CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECTIONS FOR DATACENTERS

9 OPTICAL INTERCONNECT MARKET, BY FIBER MODE (Page No. - 74)

9.1 INTRODUCTION

9.2 SINGLE MODE FIBER

9.2.1 SINGLE MODE FIBERS REDUCE DATA LOSSES IN LONG-DISTANCE DATA TRANSMISSIONS

9.3 MULTIMODE FIBER

9.3.1 STEP-INDEX MULTIMODE FIBER

9.3.1.1 Rise in use of step-index multimode fibers in short-distance applications

9.3.2 GRADED-INDEX MULTIMODE FIBER

9.3.2.1 Surge in demand for graded-index multimode fibers for less attenuation and high bandwidth signal transmissions

10 OPTICAL INTERCONNECT MARKET, BY DATA RATE (Page No. - 79)

10.1 INTRODUCTION

10.2 LESS THAN 10 GBPS

10.2.1 HIGH DEMAND FOR OPTICAL INTERCONNECTS WITH LESS THAN 10 GBPS DATA RATE OWING TO THEIR LOW POWER CONSUMPTION

10.3 10 GBPS TO 40 GBPS

10.3.1 INCREASE IN DEPLOYMENT OF OPTICAL INTERCONNECTS WITH 10 GBPS TO 40 GBPS DATA RATE IN TELECOMMUNICATION APPLICATIONS

10.4 41 GBPS TO 100 GBPS

10.4.1 RISE IN ADOPTION OF OPTICAL INTERCONNECTS WITH 41 GBPS TO 100 GBPS DATA RATE BY CLOUD SERVICE PROVIDERS

10.5 MORE THAN 100 GBPS

10.5.1 INCREASE IN ADOPTION OF MORE THAN 100 GBPS OPTICAL INTERCONNECTS IN 5G INFRASTRUCTURES

11 OPTICAL INTERCONNECT MARKET, BY DISTANCE (Page No. - 83)

11.1 INTRODUCTION

11.2 LESS THAN 1 KM

11.2.1 INCREASE IN DEPLOYMENT OF OPTICAL INTERCONNECTS IN DATACENTERS FOR LESS THAN 1 KM DATA TRANSMISSION

11.3 1 KM TO 10 KM

11.3.1 RISE IN USE OF OPTICAL INTERCONNECTS WITH 1 KM TO 10 KM DISTANCE RANGE FOR INTRA-DATACENTER INTERCONNECTIONS

11.4 11 KM TO 100 KM

11.4.1 SURGE IN DEMAND FOR OPTICAL INTERCONNECTS WITH DATA TRANSMISSION DISTANCE RANGING FROM 11 KM TO 100 KM

11.5 MORE THAN 100 KM

11.5.1 INCREASE IN DEMAND FOR OPTICAL INTERCONNECTS CAPABLE OF TRANSMITTING DATA FOR DISTANCE OF MORE THAN 100 KM

12 OPTICAL INTERCONNECT MARKET, BY APPLICATION (Page No. - 87)

12.1 INTRODUCTION

12.2 DATA COMMUNICATION

12.2.1 DATACENTERS

12.2.1.1 Surged demand for data storage and transfer to contribute to increased use of optical interconnects in datacenters

12.2.2 HIGH-PERFORMANCE COMPUTING (HPC)

12.2.2.1 Increased demand for aggregated computing to fuel use of optical interconnects in high-performance computing applications

12.3 TELECOMMUNICATION

12.3.1 DEVELOPMENTS IN 5G NETWORK INFRASTRUCTURES TO FUEL DEMAND FOR OPTICAL INTERCONNECTS USED IN TELECOMMUNICATION APPLICATIONS

13 GEOGRAPHIC ANALYSIS (Page No. - 103)

13.1 INTRODUCTION

13.2 NORTH AMERICA

13.2.1 US

13.2.1.1 US to lead market in North America from 2020 to 2025

13.2.2 CANADA

13.2.2.1 Surged demand for high-speed wired and wireless networking services to drive growth of market in Canada

13.2.3 MEXICO

13.2.3.1 Increased adoption of 5G network services in Mexico

13.3 EUROPE

13.3.1 UK

13.3.1.1 Significant investments for development of infrastructure to support 5G technology and datacenters in UK

13.3.2 GERMANY

13.3.2.1 Increased adoption of connected and IoT-enabled devices to drive growth of optical interconnect market in Germany

13.3.3 FRANCE

13.3.3.1 Presence of leading telecom operators to facilitate 5G communication in France

13.3.4 NETHERLANDS

13.3.4.1 Initiatives undertaken by government to contribute to growth of optical interconnect market in Netherlands

13.3.5 REST OF EUROPE

13.4 APAC

13.4.1 CHINA

13.4.1.1 Presence of key datacenter companies fueling growth of market in China

13.4.2 JAPAN

13.4.2.1 Transition of manufacturing industry toward high-speed networks to spur growth of optical interconnect market in Japan

13.4.3 INDIA

13.4.3.1 Increased Internet penetration to fuel demand for optical interconnects in India

13.4.4 SOUTH KOREA

13.4.4.1 Early adoption of 5G network services driving demand for optical interconnects in South Korea

13.4.5 REST OF APAC

13.5 REST OF THE WORLD (ROW)

13.5.1 SOUTH AMERICA

13.5.1.1 Initiatives undertaken by 5G service providers to create demand for optical interconnects in South America

13.5.2 MIDDLE EAST AND AFRICA

13.5.2.1 Surged demand for high-speed data communication in Middle East and Africa

14 COMPETITIVE LANDSCAPE (Page No. - 129)

14.1 INTRODUCTION

14.2 MARKET RANKING ANALYSIS, 2019

14.3 MARKET EVALUATION FRAMEWORK

14.3.1 PRODUCT LAUNCHES AND DEVELOPMENTS

14.3.2 ACQUISITIONS

14.3.3 COLLABORATIONS AND CONTRACTS

14.3.4 EXPANSIONS

15 COMPANY EVALUATION MATRIX (Page No. - 137)

15.1 OVERVIEW

15.2 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

15.2.1 MARKET SHARE/RANKING

15.2.2 STAR

15.2.3 PERVASIVE

15.2.4 EMERGING LEADERS

15.2.5 BURGEONING PLAYERS

15.3 COMPANY EVOLUTIONS MATRIX, 2019

15.4 STRENGTH OF PRODUCT PORTFOLIO

15.5 BUSINESS STRATEGY EXCELLENCE

16 COMPANY PROFILES (Page No. - 142)

16.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, SWOT Analysis, and MnM View)*

16.1.1 II-VI INCORPORATED

16.1.2 LUMENTUM OPERATIONS LLC

16.1.3 MOLEX, LLC

16.1.4 INNOLIGHT TECHNOLOGY (SUZHOU) LTD.

16.1.5 NVIDIA CORPORATION

16.1.6 SUMITOMO ELECTRIC INDUSTRIES, LTD.

16.1.7 BROADCOM INC.

16.1.8 TE CONNECTIVITY

16.1.9 FUJITSU LTD.

16.1.10 INFINERA CORPORATION

* Business Overview, Products/Solutions/Services offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

16.2 RIGHT TO WIN

16.3 OTHER KEY PLAYERS

16.3.1 ACACIA COMMUNICATIONS, INC.

16.3.2 ACCELINK TECHNOLOGY CO. LTD.

16.3.3 JUNIPER NETWORKS, INC.

16.3.4 AMPHENOL CORPORATION

16.3.5 NEOPHOTONICS CORPORATION

16.4 STARTUP ECOSYSTEM

16.4.1 OPTOSCRIBE LTD.

16.4.2 SMITHS INTERCONNECT

16.4.3 CAILABS

16.4.4 FIBERPLEX TECHNOLOGIES, LLC

16.4.5 CLEERLINE TECHNOLOGY GROUP

17 APPENDIX (Page No. - 175)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

LIST OF TABLES (109 TABLES)

TABLE 1 OPTICAL INTERCONNECT MARKET, BY PRODUCT CATEGORY, 20172025 (USD MILLION)

TABLE 2 MARKET FOR CABLE ASSEMBLIES, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 3 MARKET FOR CABLE ASSEMBLIES, BY MULTI-SOURCE AGREEMENT, 20172025 (USD MILLION)

TABLE 4 MARKET FOR CONNECTORS, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 5 MARKET FOR OPTICAL TRANSCEIVERS, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 6 MARKET, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 7 METRO AND LONG-HAUL MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 8 METRO AND LONG-HAUL MARKET, BY PRODUCT CATEGORY, 20172025 (USD MILLION)

TABLE 9 METRO AND LONG-HAUL MARKET, BY APPLICATION, 20172025 (USD MILLION)

TABLE 10 METRO AND LONG-HAUL MARKET FOR DATA COMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 11 METRO AND LONG-HAUL MARKET FOR TELECOMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 12 BOARD-TO-BOARD AND RACK-LEVEL MARKET, BY PRODUCT CATEGORY, 20172025 (USD MILLION)

TABLE 13 BOARD-TO-BOARD AND RACK-LEVELMARKET FOR CONNECTORS, BY TYPE, 20172025 (USD MILLION)

TABLE 14 BOARD-TO-BOARD AND RACK-LEVEL MARKET, BY APPLICATION, 20172025 (USD MILLION)

TABLE 15 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 16 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT FOR DATA COMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 17 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR DATACENTERS, BY REGION, 20172025 (USD MILLION)

TABLE 18 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR HIGH-PERFORMANCE COMPUTING, BY REGION, 20172025 (USD MILLION)

TABLE 19 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT FOR TELECOMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 20 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT , BY PRODUCT CATEGORY, 20172025 (USD MILLION)

TABLE 21 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 22 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT FOR DATA COMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 23 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR DATACENTERS, BY REGION, 20172025 (USD MILLION)

TABLE 24 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR HIGH-PERFORMANCE COMPUTING, BY REGION, 20172025 (USD MILLION)

TABLE 25 MARKET, BY FIBER MODE, 20172025 (USD MILLION)

TABLE 26 MARKET FOR SINGLE MODE FIBER, BY APPLICATION, 20172025 (USD MILLION)

TABLE 27 MARKET FOR SINGLE MODE FIBER, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 28 MARKET FOR MULTIMODE FIBER, BY APPLICATION, 20172025 (USD MILLION)

TABLE 29 MARKET FOR MULTIMODE FIBER, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 30 MARKET, BY DATA RATE, 20172025 (USD MILLION)

TABLE 31 MARKET, BY DISTANCE, 20172025 (USD MILLION)

TABLE 32 MARKET, BY APPLICATION, 20172025 (USD MILLION)

TABLE 33 MARKET FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 34 MARKET FOR DATA COMMUNICATION, BY FIBER MODE, 20172025 (USD MILLION)

TABLE 35 MARKET FOR DATA COMMUNICATION, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 36 MARKET FOR DATA COMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 37 MARKET IN NORTH AMERICA FOR DATA COMMUNICATION, BY COUNTRY, 20172025 (USD MILLION)

TABLE 38 MARKET IN EUROPE FOR DATA COMMUNICATION, BY COUNTRY, 20172025 (USD MILLION)

TABLE 39 MARKET IN APAC FOR DATA COMMUNICATION, BY COUNTRY, 20172025 (USD MILLION)

TABLE 40 MARKET IN ROW FOR DATA COMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 41 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR DATACENTERS, BY FIBER MODE, 20172025 (USD MILLION)

TABLE 42 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR DATACENTERS, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 43 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR DATACENTERS, BY REGION, 20172025 (USD MILLION)

TABLE 44 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN NORTH AMERICA FOR DATACENTERS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 45 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN EUROPE FOR DATACENTERS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 46 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN APAC FOR DATACENTERS, BY COUNTRY, 20172025 (USD MILLION)

TABLE 47 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN ROW FOR DATACENTERS, BY REGION, 20172025 (USD MILLION)

TABLE 48 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR HIGH-PERFORMANCE COMPUTING, BY FIBER MODE, 20172025 (USD MILLION)

TABLE 49 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR HIGH-PERFORMANCE COMPUTING, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 50 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET FOR HIGH-PERFORMANCE COMPUTING, BY REGION, 20172025 (USD MILLION)

TABLE 51 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN NORTH AMERICA FOR HIGH-PERFORMANCE COMPUTING, BY COUNTRY, 20172025 (USD MILLION)

TABLE 52 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN EUROPE FOR HIGH-PERFORMANCE COMPUTING, BY COUNTRY, 20172025 (USD MILLION)

TABLE 53 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN APAC FOR HIGH-PERFORMANCE COMPUTING, BY COUNTRY, 20172025 (USD MILLION)

TABLE 54 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN ROW FOR HIGH-PERFORMANCE COMPUTING, BY REGION, 20172025 (USD MILLION)

TABLE 55 OPTICAL INTERCONNECT MARKET FOR TELECOMMUNICATION, BY EQUIPMENT TYPE, 20172025 (USD MILLION)

TABLE 56 MARKET FOR TELECOMMUNICATION, BY FIBER MODE, 20172025 (USD MILLION)

TABLE 57 MARKET FOR TELECOMMUNICATION, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 58 MARKET FOR TELECOMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 59 MARKET IN NORTH AMERICA FOR TELECOMMUNICATION, BY COUNTRY, 20172025 (USD MILLION)

TABLE 60 MARKET IN EUROPE FOR TELECOMMUNICATION, BY COUNTRY, 20172025 (USD MILLION)

TABLE 61 MARKET IN APAC FOR TELECOMMUNICATION, BY COUNTRY, 20172025 (USD MILLION)

TABLE 62 MARKET IN ROW FOR TELECOMMUNICATION, BY REGION, 20172025 (USD MILLION)

TABLE 63 MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 64 MARKET IN NORTH AMERICA, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 65 MARKET IN NORTH AMERICA, BY APPLICATION, 20172025 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA, BY COUNTRY, 20172025 (USD MILLION)

TABLE 67 MARKET IN US, BY APPLICATION, 20172025 (USD MILLION)

TABLE 68 MARKET IN US FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 69 MARKET IN CANADA, BY APPLICATION, 20172025 (USD MILLION)

TABLE 70 MARKET IN CANADA FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 71 MARKET IN MEXICO, BY APPLICATION, 20172025 (USD MILLION)

TABLE 72 MARKET IN MEXICO FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 73 MARKET IN EUROPE, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 74 MARKET IN EUROPE, BY APPLICATION, 20172025 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY COUNTRY, 20172025 (USD MILLION)

TABLE 76 MARKET IN UK, BY APPLICATION, 20172025 (USD MILLION)

TABLE 77 MARKET IN UK FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 78 MARKET IN GERMANY, BY APPLICATION, 20172025 (USD MILLION)

TABLE 79 MARKET IN GERMANY FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 80 MARKET IN FRANCE, BY APPLICATION, 20172025 (USD MILLION)

TABLE 81 MARKET IN FRANCE FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 82 MARKET IN NETHERLANDS, BY APPLICATION, 20172025 (USD MILLION)

TABLE 83 MARKET IN NETHERLANDS FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 84 MARKET IN REST OF EUROPE, BY APPLICATION, 20172025 (USD MILLION)

TABLE 85 MARKET IN REST OF EUROPE FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 86 MARKET IN APAC, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 87 MARKET IN APAC, BY APPLICATION, 20172025 (USD MILLION)

TABLE 88 MARKET IN APAC, BY COUNTRY, 20172025 (USD MILLION)

TABLE 89 MARKET IN CHINA, BY APPLICATION, 20172025 (USD MILLION)

TABLE 90 MARKET IN CHINA FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 91 MARKET IN JAPAN, BY APPLICATION, 20172025 (USD MILLION)

TABLE 92 MARKET IN JAPAN FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 93 MARKET IN INDIA, BY APPLICATION, 20172025 (USD MILLION)

TABLE 94 MARKET IN INDIA FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 95 MARKET IN SOUTH KOREA, BY APPLICATION, 20172025 (USD MILLION)

TABLE 96 MARKET IN SOUTH KOREA FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 97 MARKET IN REST OF APAC, BY APPLICATION, 20172025 (USD MILLION)

TABLE 98 MARKET IN REST OF APAC FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 99 MARKET IN ROW, BY INTERCONNECT LEVEL, 20172025 (USD MILLION)

TABLE 100 MARKET IN ROW, BY APPLICATION, 20172025 (USD MILLION)

TABLE 101 MARKET IN ROW, BY REGION, 20172025 (USD MILLION)

TABLE 102 MARKET IN SOUTH AMERICA, BY APPLICATION, 20172025 (USD MILLION)

TABLE 103 MARKET IN SOUTH AMERICA FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 104 MARKET IN MIDDLE EAST AND AFRICA, BY APPLICATION, 20172025 (USD MILLION)

TABLE 105 MARKET IN MIDDLE EAST AND AFRICA FOR DATA COMMUNICATION, BY APPLICATION TYPE, 20172025 (USD MILLION)

TABLE 106 PRODUCT LAUNCHES AND DEVELOPMENTS, SEPTEMBER 2018 APRIL 2020

TABLE 107 ACQUISITIONS, SEPTEMBER 2018 APRIL 2020

TABLE 108 COLLABORATIONS AND CONTRACTS, SEPTEMBER 2018 APRIL 2020

TABLE 109 EXPANSIONS, SEPTEMBER 2018 APRIL 2020

LIST OF FIGURES (65 FIGURES)

FIGURE 1 OPTICAL INTERCONNECT MARKET: RESEARCH DESIGN

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SALES OF OPTICAL INTERCONNECTS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE): ILLUSTRATIVE EXAMPLE OF COMPANY OPERATING IN MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 BOTTOM-UP APPROACH FOR ESTIMATION OF SIZE OF OPTICAL TRANSCEIVER MARKET BASED ON FIBER MODE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 7 DATA TRIANGULATION

FIGURE 8 MULTIMODE FIBER SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 9 41 GBPS TO 100 GBPS SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 10 DATA COMMUNICATION SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 11 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 12 RISE IN GLOBAL DEPLOYMENT OF DATACENTERS TO FUEL MARKET GROWTH

FIGURE 13 MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2025

FIGURE 15 DATA COMMUNICATION SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST SHARES OF MARKET IN 2025

FIGURE 16 RISE IN GLOBAL DEPLOYMENT OF DATACENTERS

FIGURE 17 GROWTH IN GLOBAL NUMBER OF INTERNET USERS FROM 2018 TO 2023

FIGURE 18 MARKET DRIVERS AND THEIR IMPACT

FIGURE 19 MARKET RESTRAINTS AND THEIR IMPACT

FIGURE 20 GLOBAL 5G MARKET FORECAST TO 2025

FIGURE 21 MARKET OPPORTUNITIES AND THEIR IMPACT

FIGURE 22 MARKET CHALLENGES AND THEIR IMPACT

FIGURE 23 OPTICAL INTERCONNECT ECOSYSTEM: MAJOR VALUE ADDED BY OPTICAL INTERCONNECT MANUFACTURERS AND SYSTEM INTEGRATORS

FIGURE 24 MARKET, BY PRODUCT CATEGORY

FIGURE 25 PIC-BASED INTERCONNECTS SEGMENT OF OPTICAL INTERCONNECT MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 26 CDFP MULTI-SOURCE AGREEMENTS SEGMENT OF MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 27 MARKET, BY INTERCONNECT LEVEL

FIGURE 28 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT SEGMENT OF MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 29 METRO AND LONG-HAUL OPTICAL INTERCONNECT IN APAC FOR DATA COMMUNICATION PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 30 HIGH-PERFORMANCE COMPUTING SEGMENT OF CHIP- AND BOARD-LEVEL MARKET FOR DATA COMMUNICATION TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 31 MARKET, BY FIBER MODE

FIGURE 32 MULTIMODE FIBER SEGMENT OF MARKET TO GROW AT HIGHER CAGR FROM 2020 TO 2025

FIGURE 33 DATA COMMUNICATION SEGMENT OF MARKET FOR MULTIMODE FIBER TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 34 MARKET, BY DATA RATE

FIGURE 35 41 GBPS TO 100 GBPS SEGMENT OF MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 36 MARKET, BY DISTANCE

FIGURE 37 LESS THAN 1 KM SEGMENT OF MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 38 MARKET, BY APPLICATION

FIGURE 39 DATA COMMUNICATION SEGMENT OF MARKET PROJECTED TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 40 MARKET FOR DATA COMMUNICATION IN APAC PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 41 OPTICAL INTERCONNECT DATA COMMUNICATION MARKET IN CHINA FOR DATACENTERS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 42 SINGLE MODE FIBER SEGMENT OF MARKET FOR TELECOMMUNICATION TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 43 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 45 MARKET IN US TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 46 EUROPE: MARKET SNAPSHOT

FIGURE 47 MARKET IN UK TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 48 APAC: MARKET SNAPSHOT

FIGURE 49 MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 50 MARKET IN SOUTH AMERICA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 51 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS AS KEY GROWTH STRATEGY FROM SEPTEMBER 2018 TO APRIL 2020

FIGURE 52 RANKING OF TOP 5 PLAYERS IN MARKET

FIGURE 53 MARKET EVALUATION FRAMEWORK-PRODUCT LAUNCHES AND DEVELOPMENTS FUELED GROWTH AND INNOVATIONS FROM SEPTEMBER 2018 TO APRIL 2020

FIGURE 54 II-VI INCORPORATED LED MARKET IN 2019

FIGURE 55 COMPETITIVE EVOLUTION MATRIX, 2019

FIGURE 56 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 57 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 58 II-VI INCORPORATED: COMPANY SNAPSHOT

FIGURE 59 LUMENTUM OPERATIONS LLC: COMPANY SNAPSHOT

FIGURE 60 MELLANOX TECHNOLOGIES, LTD. (PART OF NVIDIA CORPORATION): COMPANY SNAPSHOT

FIGURE 61 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 62 BROADCOM INC.: COMPANY SNAPSHOT

FIGURE 63 TE CONNECTIVITY: COMPANY SNAPSHOT

FIGURE 64 FUJITSU LTD.: COMPANY SNAPSHOT

FIGURE 65 INFINERA CORPORATION: COMPANY SNAPSHOT

The study involves four major activities for estimating the size of the optical interconnect market. Exhaustive secondary research has been carried out to collect information relevant to the market, the peer markets, and the parent market. Primary research has been undertaken to validate these findings, assumptions, and sizing with the industry experts across the value chain of the optical interconnect market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. These have been followed by the market breakdown and data triangulation methods that have been used to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the optical interconnect market began with the capturing of data related to the revenues of key vendors in the market through secondary research. This study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for a technical, market-oriented, and commercial study of the optical interconnect market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology includes the study of the annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

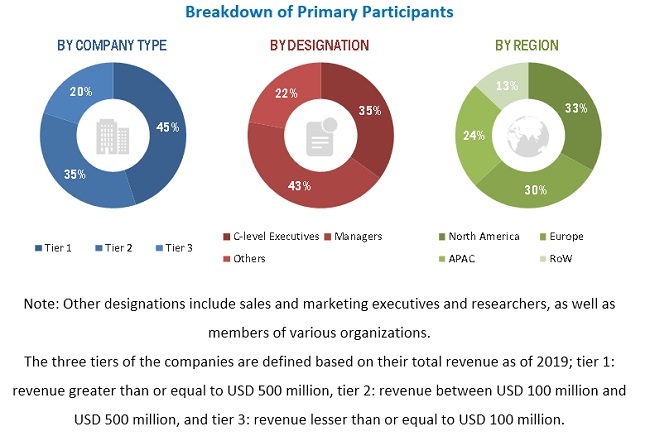

Primary Research

The optical interconnect market comprises several stakeholders, such as suppliers of the standard products and original equipment manufacturers (OEMs). The demand side of this market has been characterized by the development of optical interconnect products, as well as their use in different applications. The supply side has been characterized by advancements carried out in different optical interconnect products such as cable assemblies; connectors; optical transceivers; free space optics, fibers, and waveguides; silicon photonics; PIC-based interconnects; and optical engines. Various primary sources from both supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the optical interconnect market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain of the manufacturing industry and the size of the optical interconnect market, in terms of value has been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market sizeusing the market size estimation process explained abovethe total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from both demand and supply sides of the optical interconnect market.

Research Objectives

- To describe, segment, and forecast the optical interconnect market based on product category, data rate, distance, interconnect level, fiber mode, and application in terms of value

- To describe and forecast the optical interconnect market size with regard to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms

of value - To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contribution to the overall optical interconnect market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the optical interconnect market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape for the market leaders

- To provide a detailed overview of the optical interconnect value chain

- To analyze competitive developments such as new product launches and developments , acquisitions, collaborations, contracts, and expansions, along with research and development (R&D) activities undertaken in the optical interconnect market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the optical interconnect value chain

Critical Questions

- What are new application areas being explored by the providers of optical interconnect products?

- Who are the key players in the optical interconnect market, and how intense is the competition in this market?

Growth opportunities and latent adjacency in Optical Interconnect Market

I am interested in optical interconnects; photonic/electro-photonic integration for telecommuncations. Do you have such information in the report?