Active Optical Cable & Extender Market Size, Share & Industry Growth Analysis Report by Product, Protocol (InfiniBand, Ethernet, Serial-Attached SCSI (SAS), DisplayPort, HDMI, Thunderbolt, USB), Form Factor (QSFP, QSFP-DD, SFP, SFP+, PCIE, CXP), Application and Region - Global Forecast to 2028

Updated on : Oct 22, 2024

Active Optical Cable & Extender Market Size & Growth

Reliability of AOCs than traditional copper cables, Large-scale adoption of cloud-based services drives market growth during the forecast period. Factors such as digitalization and 5G network rollouts provide market growth opportunities for the active optical cable & extender industry.

Active Optical Cable & Extender Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Active Optical Cable & Extender Market Trends

Driver: Widespread adoption of 4K and 8K video technologies

4K and 8K video technologies have become widespread across industries, such as broadcasting, gaming, medical imaging, and digital signage. This has resulted in a significant increase in demand for high data rates and extended transmission distances. To address these requirements, AOCs & extenders have emerged as critical solutions. These advanced optical interconnects offer seamless and reliable transmission of high-resolution video signals over longer distances, ensuring that the quality and integrity of the video content remain uncompromised.

Traditional copper-based cables may face limitations in data transfer capacity and signal degradation over distance. AOCs overcome these challenges by utilizing optical fiber technology, providing high bandwidth capabilities and immunity to electromagnetic interference. This enables industries to leverage the full potential of ultra-high-definition video technologies, enhancing visual experiences and enabling innovative applications across various sectors.

In addition, integrating 4K and 8K video technologies involves intricate home theater setups with components placed across various locations. AOCs and extenders play a crucial role by facilitating extended reach and flexibility in connecting different devices, screens, and audio systems within these setups. Optical fiber technology’s immunity to electromagnetic interference and signal degradation ensures that the intricate network of devices remains reliably connected, eliminating the risk of pixelation, artifacts, or disruptions that could diminish the cinematic impact of 4K and 8K content.

As consumers increasingly invest in cutting-edge home entertainment systems to elevate their viewing pleasure, AOCs and extenders emerge as indispensable enablers. They ensure the seamless transmission of high-definition content and contribute to the widespread adoption of these advanced video technologies.

Restraint: High power consumption

Power consumption is critical when choosing between active optical cables (AOCs) and direct attach copper cables (DACs). AOC cables tend to have higher power requirements than DAC cables. AOCs typically consume around 1–2 watts of power, while DAC active cables have a lower power consumption of less than 1 watt. Additionally, passive DAC cables have an even lower power consumption, usually below 0.15 watts, due to their efficient thermal design.

AOCs incorporate optoelectronic components, such as laser diodes and photodetectors, within their connectors to convert electrical signals into optical signals for transmission over the optical fiber. These components require power to operate and facilitate the signal conversion process. Power consumption can become a concern in data centers where large numbers of AOCs may be deployed to interconnect network components. Data centers strive to optimize their energy usage to reduce operational costs and minimize their environmental footprint. High power consumption from AOCs could contribute to increased cooling requirements and energy consumption, impacting the overall efficiency of data centers.

Opportunity: Digitalization and 5G network rollouts

Various nations are adopting cutting-edge technologies to improve their data connectivity. The digital revolution is undergoing in emerging countries, such as India, influenced by government initiatives. However, the data rates in these countries are still low than developed economies in Europe, North America, and East Asia. Substantial investment in data centers and other infrastructures is expected to improve the overall data transmission speeds. These factors could provide an opportunity for manufacturers of AOCs as they provide the fastest data exchange rates within data centers.

The rollout of 5G networks requires advanced interconnect solutions to support the higher data rates and lower latency demands. Active optical cables and extenders can enhance the connectivity between 5G base stations and other network elements. As 5G networks expand globally, the demand for AOCs and extenders in this sector is expected to grow.

Challenge: Lack of IT expertise

The installation and maintenance of AOCs and extenders require certain technical skills and expertise, as they involve dealing with advanced optical fiber technology and optoelectronic components. AOCs use optical fibers to transmit data, which requires precise handling and alignment during installation. Improper handling or misalignment can lead to signal loss or degradation, impacting the cable performance.

Additionally, AOCs and extenders often need to be integrated into existing network infrastructures, which can be complex and require specialized knowledge of networking protocols and configurations. Ensuring seamless integration and compatibility with other network components is crucial for the smooth functioning of the entire system.

Moreover, troubleshooting and maintaining AOCs and extenders may require specific troubleshooting skills, as identifying and resolving issues related to optical signals can differ from traditional copper-based cables. A shortage of professionals with the necessary expertise to handle AOCs and extenders effectively could slow their adoption in various industries. Organizations may need to invest in training their IT staff or seek external experts, which could increase the overall deployment costs and implementation timelines.

Active Optical Cable & Extender Market Ecosystem

The active optical cable & extender market is fragmented. It is marked by the presence of a few tier-1 companies, such as Coherent Corp.(US), Broadcom (US), Amphenol Communications Solutions (US), Corning Incorporated (US), and TE Connectivity (Switzerland). These companies have created a fragmented ecosystem by investing in research and development activities to launch highly efficient and reliable active optical cable & extender solutions.

Active Optical Cable & Extender Market Share

Active optical cables segment to witness the highest growth during the forecast period

The requirement of AOC was driven by the need to replace copper technology in data centers and high-performance computing settings. Traditional copper cables faced limitations regarding data rates and reach, particularly as data centers expanded in size.

The rise in data rates, exemplified by the InfiniBand Double Data Rate (DDR) of 20 Gigabits per second (Gbps), made copper cables impractical for larger clusters due to their restricted reach. AOC emerged as a solution, offering longer transmission distances, higher bandwidth, and enhanced reliability. Furthermore, AOC’s resistance to electromagnetic interference (EMI) and radio-frequency interference (RFI) made it an ideal solution for high-density environments.

PCI Express (PCIE) segment to exhibit the highest CAGR between 2023 and 2028.

The PCI Express (PCIe) protocol aids a high-speed serial IO designed to provide connections between peripherals (graphics cards, memory/disk drives, external IO cards) and the central processing unit (CPU). AOCs use PCIe to connect servers, switches, and storage elements.

They can lower overall system costs by reducing or eliminating the number of protocol conversion chips. They interfaced with PCIe and are used in data centers, HPC, and consumer electronics. PCIe active optical cables have several advantages, including high bandwidth, low weight, immunity to EMI interference, and ruggedness of electrical connector interface. Therefore, it can also be used in avionics applications. The most common versions of PCIe are PCIe 1.0, PCIe 2.0, PCIe 3.0, PCIe 4.0, and PCIe 5.0, each offering faster data rates. The version number indicates the data rate per lane, with the latest PCIe 5.0 supporting a data rate of 32 GT/s (Giga transfers per second) per lane.

QSFP segment to dominate the active optical cable & extender market during the forecast period

QSFP modules are high-density transceiver modules used in networking and data communication applications. They provide a compact and efficient solution for transmitting high-speed data, typically over fiber optic cables, in various network environments, including data centers, telecommunications, and high-performance computing. They feature four independent transmit and receive channels, enabling them to reach data rates of 40 Gbps (Gigabits per second). This increased capacity makes QSFP modules particularly valuable for bandwidth-intensive tasks, such as large-scale data transfers, high-definition video streaming, and cloud computing.

Active Optical Cable & Extender Market Regional Analysis

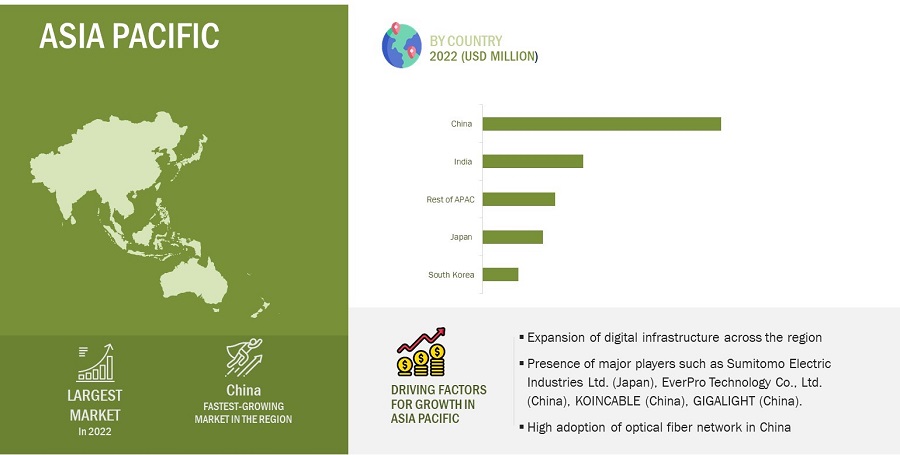

Asia Pacific to grow at the fastest CAGR during the forecast period.

Asia Pacific has witnessed high growth in the active optical cable & extender market, driven by the rapid expansion of data centers and cloud computing facilities. This has increased the demand for high-speed, reliable, and efficient connectivity solutions, propelling the adoption of AOCs and extenders. As businesses and consumers increasingly rely on online services, seamless data transmission and reduced latency have become paramount. AOCs and extenders offer a compelling solution to address these demands. The proliferation of high-definition content, virtual reality (VR), and augmented reality (AR) applications have also contributed to the growth of this market, as these technologies require enhanced bandwidth and consistent signal quality.

Countries, such as China, Japan, South Korea, and India, have witnessed robust industrial growth, leading to increased investments in technology infrastructure. As these nations embrace Industry 4.0 initiatives and advanced manufacturing processes, the demand for high-performance connectivity solutions has surged, driving the adoption of AOCs & extenders. Moreover, the emergence of this region as a global hub for electronics manufacturing has fuelled the production and distribution of consumer electronics, boosting the need for efficient data transmission solutions. This trend is expected to continue as Asia Pacific economies invest in developing smart cities and digital infrastructure.

Active Optical Cable & Extender Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Active Optical & Extender Companies - Key Market Players

The active optical cable & extender companies is dominated by globally established players such as

- Coherent Corp.(US),

- Broadcom (US),

- Amphenol Communications Solutions (US),

- Corning Incorporated (US),

- TE Connectivity (Switzerland),

- 3M (US),

- Molex (US),

- Sumitomo Electric Industries Ltd.(Japan),

- Dell Inc.(US),

- Eaton (Ireland),

- EverPro Technology Co., Ltd. (China),

- Alysium-Tech GmbH (US),

- Mobix Labs Inc. (US),

- Unixtar Technology, Inc. (Taiwan),

- IOI Technology Corporation (Taiwan),

- GIGALIGHT (China), Siemon(US), Koincable (China), Black Box (US), ATEN INTERNATIONAL Co., Ltd. (Taiwan), T&S Communication Co, Ltd. (China), ACT(Netherlands), APAC Opto Electronics Inc. (Taiwan), Shenzhen Sopto Technology Co., Ltd., (China), Anfkom Telecom (China), Extron (US), and Roctest (Canada). These players have adopted product launches/developments, contracts, collaborations, agreements, and acquisitions for growth in the market.

Scope Active Optical & Extender Market Report Scope

|

Report Metric |

Details |

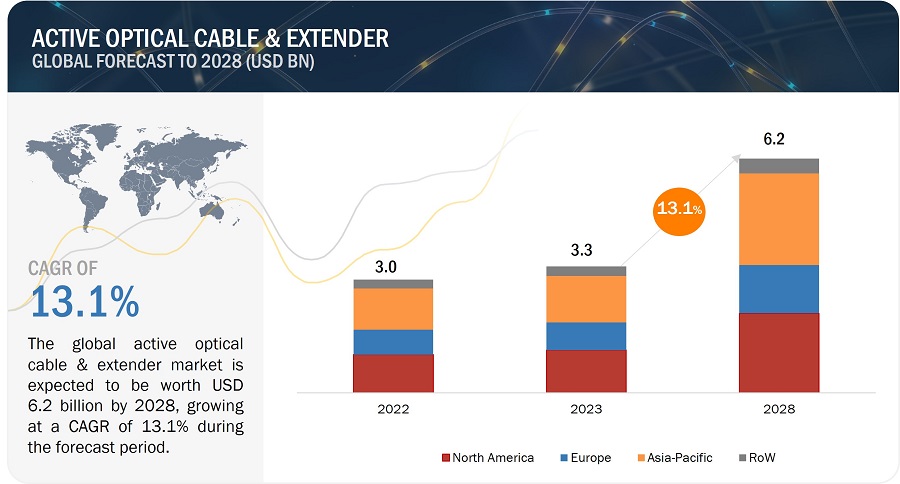

| Estimated Market Size | USD 3.3 billion in 2023 |

| Projected Market Size | USD 6.2 billion by 2028 |

| Active Optical Cable & Extender Market Growth Rate | CAGR of 13.1% |

|

Active Optical Cable & Extender Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Million) |

|

Segments Covered |

By Product, By Protocol, By Form Factor, By Application, and By Region |

|

Region covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies covered |

The key players in the active optical cable & extender market are Coherent Corp.(US), Broadcom (US), Amphenol Communications Solutions (US), Corning Incorporated (US), TE Connectivity (Switzerland), 3M (US), Molex (US), Sumitomo Electric Industries Ltd.(Japan), Dell Inc.(US), Eaton (Ireland), EverPro Technology Co., Ltd. (China), Alysium-Tech GmbH (US), Mobix Labs Inc. (US), Unixtar Technology, Inc. (Taiwan), IOI Technology Corporation (Taiwan), GIGALIGHT (China), Siemon(US), Koincable (China), Black Box (US), ATEN INTERNATIONAL Co., Ltd. (Taiwan), T&S Communication Co, Ltd. (China), ACT(Netherlands), APAC Opto Electronics Inc. (Taiwan), Shenzhen Sopto Technology Co., Ltd., (China), Anfkom Telecom (China), Extron (US), and Roctest (Canada). |

Active Optical Cable & Extender Market Highlights

The study categorizes the active optical cable & extender market-based product, protocol, form factor, application, and region.

|

Segment |

Subsegment |

|

By Product |

|

|

By Protocol |

|

|

By Form Factor |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Active Optical Cable & Extender Industry

- In March 2023, Broadcom (US) unveiled BCM85812, a transceiver optimized for 800G DR8, 2x400G FR4, and 800G AOC module applications. It enables high-performance and efficient active optical cable solutions for hyper-scale data centers.

- In February 2022, II-VI Incorporated (US) launched Pluggable Optical Line Subsystem (POLS) in the QSFP form factor, designed for 400ZR/ZR+ transport in data center interconnects. This compact system supports full-duplex multichannel transmission, reducing power consumption and space usage while remaining compatible with widely available sockets.

- In June 2021, Broadcom (US) introduced 100Gbps Multimode AOCs and pluggable optical transceivers that connect modern servers and support link speeds up to 100-Gb/s per lane.

Frequently Asked Questions (FAQ):

Which are the major companies in the active optical cable & extender market? What are their major strategies to strengthen their market presence?

Coherent Corp.(US), Broadcom (US), Amphenol Communications Solutions (US), Corning Incorporated (US), and TE Connectivity (Switzerland) are some of the major companies operating in the active optical cable & extender market. Partnerships were the key strategies these companies adopted to strengthen their active optical cable & extender market presence.

What are the drivers for the active optical cable & extender market?

Drivers for the active optical cable & extender market are:

- Requirement for fiber optic modules in data centers

- Large-scale adoption of cloud-based services

- Reliability of AOCs than traditional copper cables

- Reliance on HPC and AI architectures

- Widespread adoption of 4K and 8K video technologies

What are the challenges in the active optical cable & extender market?

Availability of alternatives, security issues related to fiber optic-based storage systems, and lack of it expertise are among the challenges faced by the active optical cable & extender market.

What are the technological trends in the active optical cable & extender market?

Edge computing, Fan-out active optical cables, and flame-resistant active optical cables are a few of the key technology trends in the active optical cable & extender market

What is the total CAGR expected to be recorded for the active optical cable & extender market from 2023 to 2028?

The CAGR is expected to record a CAGR of 13.1% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Key Questions Addressed by the Report

Key Questions Addressed by the Report

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Requirement for fiber optic modules in data centers- Large-scale adoption of cloud-based solutions- Reliability of AOCs than traditional copper cables- Increased popularity of HPC and AI architectures- Widespread adoption of 4K and 8K video technologiesRESTRAINTS- Rising installation and maintenance costs- Susceptibility to physical damage and transmission losses- High power consumptionOPPORTUNITIES- Digitalization and 5G network rollouts- Popularity of digital signage technology- Smart infrastructure development- Acceptance of VR and AR technologiesCHALLENGES- Availability of alternatives- Security issues related to fiber optic-based storage systems- Lack of IT expertise

-

5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTS

-

5.6 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE TREND, BY PRODUCTAVERAGE SELLING PRICE OF ACTIVE OPTICAL CABLES OFFERED BY 3 KEY PLAYERS, BY FORM FACTOR

- 5.7 TRADE ANALYSIS

- 5.8 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN ACTIVE OPTICAL CABLE & EXTENDER MARKET

-

5.9 TECHNOLOGY ANALYSISEDGE COMPUTINGFLAME-RESISTANCE AOCFAN-OUT AOCPFAS

-

5.10 PATENTS ANALYSIS

-

5.11 CASE STUDY ANALYSISVIAVI SOLUTIONS OFFERS TESTING DEVICE TO REDUCE TRANSMISSION DEFECTS IN DATA CENTERSINNEOS PROVIDES ACTIVE OPTICAL CABLES TO ALLOW HD-SDI VIDEO AND ETHERNET SIGNAL TRANSMISSIONSBLACK BOX INSTALLS DISPLAYPORT ACTIVE OPTICAL CABLES TO DRIVE MEDICAL TEAM SATISFACTION

-

5.12 REGULATORY LANDSCAPETARIFF ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS- ISO/IEC 11801- ISO/IEC 24764:2010(E)- ISO/IEC 14763-3:2014(E)- IEC 60794-1-2:2021- IEC 61281-1:2017REGULATIONS- US- Europe- China- India

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 KEY STAKEHOLDERS AND BUYING PROCESSKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ACTIVE OPTICAL CABLESPREFERENCE FOR ALTERNATIVES TO TRADITIONAL COPPER CABLES TO FUEL SEGMENTAL GROWTH

-

6.3 EXTENDERSADOPTION OF EXTENDERS TO ENABLE EFFICIENT DATA TRANSMISSION TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 INFINIBANDDEPLOYMENT OF INFINIBAND TECHNOLOGY IN GPU SERVERS TO BOOST MARKET GROWTH

-

7.3 ETHERNETRELIANCE ON ETHERNET FOR HIGH-SPEED DATA TRANSMISSION TO FUEL SEGMENTAL GROWTH

-

7.4 SERIAL-ATTACHED SCSI (SAS)IMPLEMENTATION OF SAS PROTOCOL TO TRANSFER DATA FROM COMPUTER STORAGE SYSTEMS TO DRIVE MARKET

-

7.5 DISPLAYPORTUSE OF DISPLAYPORT PROTOCOL TO MEET DIGITAL INTERFACE INDUSTRY STANDARDS TO ACCELERATE MARKET GROWTH

-

7.6 PCI EXPRESS (PCIE)ADOPTION OF PCIE PROTOCOL IN AVIONICS APPLICATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

-

7.7 HDMIUTILIZATION OF HDMI AOC & EXTENDER CABLES TO SUPPORT HIGH-BANDWIDTH DATA TRANSMISSION TO PROPEL MARKET GROWTH

-

7.8 THUNDERBOLTDEPLOYMENT OF THUNDERBOLT TECHNOLOGY TO DELIVER HIGH-VOLUME HD DATA TO BOOST SEGMENTAL GROWTH

-

7.9 USBAPPLICATION OF USB IN ACTIVE OPTICAL CABLES TO ALLOW INTEROPERABILITY BETWEEN DEVICES TO DRIVE MARKET

-

7.10 MIPIDEPLOYMENT OF MIPI TECHNOLOGY TO ENSURE HIGHER DATA TRANSMISSION TO FUEL MARKET GROWTH

-

7.11 FIBER CHANNELRELIANCE ON FIBER CHANNEL TO SUPPORT COPPER AND OPTICAL CABLING TO PROPEL MARKET

- 7.12 OTHER PROTOCOLS

- 8.1 INTRODUCTION

-

8.2 QSFPADOPTION OF QSFP OPTICAL TRANSCEIVERS FOR HIGH-SPEED NETWORKING TO ACCELERATE MARKET GROWTH

-

8.3 QSFP-DDUSE OF QSFP-DD TRANSCEIVER MODULES TO ADDRESS BANDWIDTH REQUIREMENTS TO BOOST SEGMENTAL GROWTH

-

8.4 OSFP/CFP8/COBOIMPLEMENTATION OF OSFP/CFP8/COBO MODULES IN HIGH-PERFORMANCE NETWORKING APPLICATIONS TO DRIVE MARKET

-

8.5 SFP+DEPLOYMENT OF SFP+ MODULES TO INCREASE DATA CENTER EFFICIENCY TO SUPPORT MARKET GROWTH

-

8.6 PCIEAPPLICATION OF PCIE INTERFACE STANDARD IN MODERN COMPUTER SYSTEMS TO CONTRIBUTE TO SEGMENTAL GROWTH

-

8.7 SFPIMPLEMENTATION OF SFP MODULES FOR HIGH-PERFORMANCE COMPUTING TO FUEL MARKET GROWTH

-

8.8 CXPDEPLOYMENT OF CXP TRANSCEIVERS TO SUPPORT HIGH-DENSITY HPC SIGNAL TRANSMISSIONS TO ACCELERATE MARKET GROWTH

-

8.9 CX4RELIANCE ON CX4 AOC CABLES TO FACILITATE HIGH-SPEED DATA TRANSMISSIONS TO BOOST SEGMENTAL GROWTH

-

8.10 CFPUTILIZATION OF CFP AOC CABLES IN HPC CENTERS TO CONTRIBUTE TO MARKET GROWTH

-

8.11 CDFPADOPTION OF CDFP MODULES TO ADDRESS BANDWIDTH REQUIREMENTS IN DATA CENTERS TO PROPEL MARKET GROWTH

- 8.12 OTHER FORM FACTORS

- 9.1 INTRODUCTION

-

9.2 DATA CENTERSADOPTION OF AOCS AND EXTENDERS IN DATA CENTERS TO ADDRESS BANDWIDTH NEEDS TO DRIVE MARKET

-

9.3 HIGH-PERFORMANCE COMPUTING (HPC)REQUIREMENT FOR HIGH-SPEED NETWORKS FOR HPC APPLICATIONS TO FUEL SEGMENTAL GROWTH

-

9.4 CONSUMER ELECTRONICSADOPTION OF AOCS AND EXTENDERS TO ENABLE DATA TRANSMISSIONS BETWEEN CONSUMER ELECTRONICS TO DRIVE MARKET

-

9.5 TELECOMMUNICATIONSUSE OF AOCS IN MOBILE TELECOMMUNICATIONS TO ESTABLISH HIGH-SPEED CONNECTIONS TO PROPEL MARKET

-

9.6 INDUSTRIALDEPLOYMENT OF AOCS AND EXTENDERS TO ENHANCE INDUSTRIAL CONNECTIVITY TO CONTRIBUTE TO MARKET GROWTH

-

9.7 ENERGYEMPLOYMENT OF AOCS AND EXTENDERS TO ENHANCE GRID RELIABILITY TO BOOST MARKET GROWTH

-

9.8 OIL & GASRELIANCE ON AOCS AND EXTENDERS FOR REAL-TIME DATA TRANSMISSION THROUGHOUT OIL & GAS VALUE CHAIN TO ACCELERATE SEGMENTAL GROWTH

-

9.9 MEDICALUTILIZATION OF AOCS AND EXTENDERS TO FACILITATE SHARING OF CRITICAL PATIENT INFORMATION TO DRIVE MARKET

-

9.10 MILITARY/AEROSPACEADOPTION OF AOCS AND EXTENDERS TO SUPPORT MILITARY/AEROSPACE DATA TRANSFER TO FUEL SEGMENTAL GROWTH

- 9.11 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Rising number of data centers and use of cloud computing to contribute to market growthCANADA- Pressing need for high-speed Internet connectivity to drive demand for AOCs and extendersMEXICO- Expansion of fiber optic networks to deliver high-speed internet to boost market growth

-

10.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEUK- Investments in wireless infrastructure developments to support market growthFRANCE- Deployment of 5G and 6G telecommunication networks to propel market growthGERMANY- Reliance on digital technologies to contribute to market growthREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Rising deployment of AI, ML, and IoT technologies to propel market growthJAPAN- Increasing focus on enhancing digital infrastructure to augment demand for AOCs and extender cablesINDIA- Rapid expansion of optical fiber-based connectivity to drive marketSOUTH KOREA- Surging deployment of 5G base stations to accelerate market growthREST OF ASIA PACIFIC

-

10.5 ROWRECESSION IMPACT ON MARKET IN ROWMIDDLE EAST & AFRICA- Rising adoption of cutting-edge communication technologies to contribute to market growthSOUTH AMERICA- Increasing demand for high-speed data transmission solutions to fuel market growth

- 11.1 INTRODUCTION

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR COMPANIES IN ACTIVE OPTICAL CABLE & EXTENDER MARKET

- 11.3 REVENUE ANALYSIS OF TOP PLAYERS, 2020–2022

- 11.4 MARKET SHARE ANALYSIS, 2022

-

11.5 EVALUATION MATRIX OF KEY COMPANIES, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT, BY PRODUCTCOMPANY FOOTPRINT, BY APPLICATIONCOMPANY FOOTPRINT, BY REGIONOVERALL COMPANY FOOTPRINT

-

11.7 EVALUATION MATRIX OF STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSCOHERENT CORP.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTE CONNECTIVITY- Business overview- Products/Solutions/Services offered- MnM viewBROADCOM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMPHENOL COMMUNICATIONS SOLUTIONS- Business overview- Products/Solutions/Services offered- MnM viewCORNING INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM view3M- Business overview- Products/Solutions/Services offered- Recent developmentsMOLEX- Business overview- Products/Solutions/Services offeredSUMITOMO ELECTRIC INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offeredEATON- Business overview- Products/Solutions/Services offeredDELL INC.- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSEVERPRO TECHNOLOGY CO., LTD.ALYSIUM-TECH GMBHMOBIX LABS, INC.UNIXTAR TECHNOLOGY, INC.IOI TECHNOLOGY CORPORATIONGIGALIGHTKOINCABLEBLACK BOXATEN INTERNATIONAL CO., LTD.T&S COMMUNICATION CO., LTD.SIEMONACTAPAC OPTO ELECTRONICS INC.SHENZHEN SOPTO TECHNOLOGY CO., LTD.ANFKOM TELECOMEXTRONROCTEST

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 CURRENCY CONVERSION RATES

- TABLE 2 ACTIVE OPTICAL CABLE & EXTENDER MARKET: RISK ASSESSMENT

- TABLE 3 COMPANIES AND THEIR ROLES IN ACTIVE OPTICAL CABLE & EXTENDER ECOSYSTEM

- TABLE 4 ACTIVE OPTICAL CABLE & EXTENDER MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 TOP 20 PATENT OWNERS, 2013–2022

- TABLE 6 MAJOR PATENTS RELATED TO ACTIVE OPTICAL CABLES & EXTENDERS

- TABLE 7 MFN TARIFF FOR OPTICAL FIBER CABLES IMPORTED BY CHINA, 2023

- TABLE 8 MFN TARIFF FOR OPTICAL FIBER CABLES IMPORTED BY US, 2023

- TABLE 9 MFN TARIFF FOR OPTICAL FIBER CABLES IMPORTED BY JAPAN, 2023

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ACTIVE OPTICAL CABLE & EXTENDER MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 17 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PRODUCT, 2019–2022 (USD MILLION)

- TABLE 18 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 19 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PRODUCT, 2023–2028 (MILLION UNITS)

- TABLE 20 ACTIVE OPTICAL CABLES: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 21 ACTIVE OPTICAL CABLES: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 EXTENDERS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 EXTENDERS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 25 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 26 INFINIBAND: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 INFINIBAND: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 ETHERNET: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 ETHERNET: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 SERIAL-ATTACHED SCSI (SAS): ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 31 SERIAL-ATTACHED SCSI (SAS): ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 DISPLAYPORT: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 DISPLAYPORT: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 PCI EXPRESS (PCIE): ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 PCI EXPRESS (PCIE): ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 HDMI: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 HDMI: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 THUNDERBOLT: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 THUNDERBOLT: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 USB: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 USB: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 MIPI: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 MIPI: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 FIBER CHANNEL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 FIBER CHANNEL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 OTHER PROTOCOLS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 47 OTHER PROTOCOLS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 49 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY FORM FACTOR, 2023–2028 (USD MILLION)

- TABLE 50 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 51 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 52 DATA CENTERS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 53 DATA CENTERS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 54 DATA CENTERS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 DATA CENTERS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 HIGH-PERFORMANCE COMPUTING (HPC): ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 57 HIGH-PERFORMANCE COMPUTING (HPC): ACTIVE OPTICAL CABLE & EXTENDER, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 58 HIGH-PERFORMANCE COMPUTING (HPC): ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 HIGH-PERFORMANCE COMPUTING (HPC): ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 CONSUMER ELECTRONICS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 61 CONSUMER ELECTRONICS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 62 CONSUMER ELECTRONICS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 CONSUMER ELECTRONICS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 TELECOMMUNICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 65 TELECOMMUNICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 66 TELECOMMUNICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 TELECOMMUNICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 INDUSTRIAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 69 INDUSTRIAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 70 INDUSTRIAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 INDUSTRIAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 ENERGY: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 73 ENERGY: ACTIVE OPTICAL CABLE & EXTENDER, BY PROTOCOL MARKET, 2023–2028 (USD MILLION)

- TABLE 74 ENERGY: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 ENERGY: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 OIL & GAS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 77 OIL & GAS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 78 OIL & GAS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 OIL & GAS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 MEDICAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 81 MEDICAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 82 MEDICAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 MEDICAL: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 MILITARY/AEROSPACE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 85 MILITARY/AEROSPACE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 86 MILITARY/AEROSPACE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 MILITARY/AEROSPACE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 OTHER APPLICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2019–2022 (USD MILLION)

- TABLE 89 OTHER APPLICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL, 2023–2028 (USD MILLION)

- TABLE 90 OTHER APPLICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 91 OTHER APPLICATIONS: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 92 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: ACTIVE OPTICAL CABLE & EXTENDER MARKET BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 ROW: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 107 ROW: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 ROW: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 ROW: ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ACTIVE OPTICAL CABLE & EXTENDER MARKET

- TABLE 111 ACTIVE OPTICAL CABLE MARKET: DEGREE OF COMPETITION

- TABLE 112 ACTIVE OPTICAL CABLE & EXTENDER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 113 ACTIVE OPTICAL CABLE & EXTENDER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 114 ACTIVE OPTICAL CABLE & EXTENDER MARKET: PRODUCT LAUNCHES

- TABLE 115 ACTIVE OPTICAL CABLE & EXTENDER MARKET: DEALS

- TABLE 116 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 117 COHERENT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 119 COHERENT CORP.: DEALS

- TABLE 120 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 121 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 BROADCOM: COMPANY OVERVIEW

- TABLE 123 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 BROADCOM: PRODUCT LAUNCHES

- TABLE 125 BROADCOM: DEALS

- TABLE 126 AMPHENOL COMMUNICATIONS SOLUTIONS: COMPANY OVERVIEW

- TABLE 127 AMPHENOL COMMUNICATIONS SOLUTIONS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 128 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 129 CORNING INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 CORNING INCORPORATED: DEALS

- TABLE 131 3M: COMPANY OVERVIEW

- TABLE 132 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 3M: PRODUCT LAUNCHES

- TABLE 134 3M: DEALS

- TABLE 135 MOLEX: COMPANY OVERVIEW

- TABLE 136 MOLEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 138 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 EATON: COMPANY OVERVIEW

- TABLE 140 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 DELL INC.: COMPANY OVERVIEW

- TABLE 142 DELL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 ACTIVE OPTICAL CABLE & EXTENDER MARKET: RESEARCH DESIGN

- FIGURE 2 ACTIVE OPTICAL CABLE & EXTENDER MARKET: RESEARCH FLOW

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 ACTIVE OPTICAL CABLE & EXTENDER MARKET: BOTTOM-UP APPROACH

- FIGURE 5 ACTIVE OPTICAL CABLE & EXTENDER MARKET: TOP-DOWN APPROACH

- FIGURE 6 ACTIVE OPTICAL CABLE & EXTENDER MARKET: DATA TRIANGULATION

- FIGURE 7 ACTIVE OPTICAL CABLE & EXTENDER MARKET: RESEARCH ASSUMPTIONS

- FIGURE 8 ACTIVE OPTICAL CABLE & EXTENDER MARKET: RESEARCH LIMITATIONS

- FIGURE 9 ACTIVE OPTICAL CABLES SEGMENT TO HOLD LARGER MARKET SHARE IN 2028

- FIGURE 10 INFINIBAND SEGMENT TO DOMINATE ACTIVE OPTICAL CABLE & EXTENDER MARKET DURING FORECAST PERIOD

- FIGURE 11 QSFP SEGMENT TO ACCOUNT FOR LARGEST SHARE OF ACTIVE OPTICAL CABLE & EXTENDER MARKET IN 2028

- FIGURE 12 DATA CENTERS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 13 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN ACTIVE OPTICAL CABLE & EXTENDER MARKET BETWEEN 2023 AND 2028

- FIGURE 14 RAPID EXPANSION OF DIGITAL INFRASTRUCTURE TO DRIVE ACTIVE OPTICAL CABLE & EXTENDER MARKET DURING FORECAST PERIOD

- FIGURE 15 ACTIVE OPTICAL CABLES SEGMENT TO DEPICT HIGHER CAGR BETWEEN 2023 AND 2028

- FIGURE 16 INFINIBAND SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 17 DATA CENTERS SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC ACTIVE OPTICAL CABLE & EXTENDER MARKET IN 2023

- FIGURE 18 CHINA TO GROW AT HIGHEST CAGR IN ACTIVE OPTICAL CABLE & EXTENDER MARKET FROM 2023 TO 2028

- FIGURE 19 ACTIVE OPTICAL CABLE & EXTENDER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 NUMBER OF DATA CENTERS IN 2022, BY COUNTRY

- FIGURE 21 ACTIVE OPTICAL CABLE & EXTENDER MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 22 ACTIVE OPTICAL CABLE & EXTENDER MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 23 DIGITAL SIGNAGE MARKET SIZE

- FIGURE 24 ACTIVE OPTICAL CABLE & EXTENDER MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 25 ACTIVE OPTICAL CABLE & EXTENDER MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 26 ACTIVE OPTICAL CABLE & EXTENDER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 KEY PLAYERS IN ACTIVE OPTICAL CABLE & EXTENDER ECOSYSTEM

- FIGURE 28 ACTIVE OPTICAL CABLE & EXTENDER MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICE OF QSFP-BASED ACTIVE OPTICAL CABLES, 2023–2028

- FIGURE 30 AVERAGE SELLING PRICE OF SFP+-BASED ACTIVE OPTICAL CABLES, 2023–2028

- FIGURE 31 AVERAGE SELLING PRICE OF CXP-BASED ACTIVE OPTICAL CABLES, 2023–2028

- FIGURE 32 AVERAGE SELLING PRICE OF ACTIVE OPTICAL CABLES OFFERED BY 3 KEY PLAYERS, BY FORM FACTOR

- FIGURE 33 IMPORT DATA FOR HS CODE 9001, BY COUNTRY, 2018–2022

- FIGURE 34 EXPORT DATA FOR HS CODE 9001, BY COUNTRY, 2018–2022

- FIGURE 35 REVENUE SHIFTS AND NEW REVENUE POCKET FOR PLAYERS IN ACTIVE OPTICAL CABLE & EXTENDER MARKET

- FIGURE 36 NUMBER OF PUBLISHED PATENTS RELATED TO ACTIVE OPTICAL CABLES & EXTENDERS, 2013–2022

- FIGURE 37 TOP 10 PATENT APPLICANTS, 2013–2022

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 39 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 40 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PRODUCT

- FIGURE 41 ACTIVE OPTICAL CABLES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY PROTOCOL

- FIGURE 43 PCI EXPRESS (PCIE) SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 44 DATA CENTERS SEGMENT TO DOMINATE ACTIVE OTPICAL CABLES & EXTENDERS MARKET FOR INFINIBAND PROTOCOL DURING FORECAST PERIOD

- FIGURE 45 TELECOMMUNICATIONS SEGMENT TO DOMINATE MARKET FOR ETHERNET PROTOCOL FROM 2023 TO 2028

- FIGURE 46 DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF ACTIVE OPTICAL CABLE & EXTENDER MARKET FOR PCI EXPRESS (PCIE) DURING FORECAST PERIOD

- FIGURE 47 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY FORM FACTOR

- FIGURE 48 QSFP SEGMENT TO DOMINATE ACTIVE OPTICAL CABLE & EXTENDER MARKET DURING FORECAST PERIOD

- FIGURE 49 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY APPLICATION

- FIGURE 50 HIGH-PERFORMANCE COMPUTING (HPC) SEGMENT TO DEPICT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 51 ASIA PACIFIC TO HOLD LARGEST SHARE OF ACTIVE OTPICAL CABLES & EXTENDERS MARKET FOR DATA CENTERS IN 2028

- FIGURE 52 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN ACTIVE OPTICAL CABLE & EXTENDER MARKET FOR HIGH-PERFORMANCE COMPUTING (HPC) DURING FORECAST PERIOD

- FIGURE 53 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN ACTIVE OPTICAL CABLE & EXTENDER MARKET FOR TELECOMMUNICATIONS BETWEEN 2023 AND 2028

- FIGURE 54 ACTIVE OPTICAL CABLE & EXTENDER MARKET, BY REGION

- FIGURE 55 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 56 NORTH AMERICA: ACTIVE OPTICAL CABLE & EXTENDER MARKET SNAPSHOT

- FIGURE 57 EUROPE: ACTIVE OPTICAL CABLE & EXTENDER MARKET SNAPSHOT

- FIGURE 58 ASIA PACIFIC: ACTIVE OPTICAL CABLE & EXTENDER MARKET SNAPSHOT

- FIGURE 59 REVENUE ANALYSIS OF TOP PLAYERS IN ACTIVE OPTICAL CABLE & EXTENDER MARKET, 2020–2022

- FIGURE 60 ACTIVE OPTICAL CABLE MARKET SHARE ANALYSIS, 2022

- FIGURE 61 EVALUATION MATRIX OF KEY COMPANIES, 2022

- FIGURE 62 EVALUATION MATRIX OF STARTUPS/SMES, 2022

- FIGURE 63 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 64 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 65 BROADCOM: COMPANY SNAPSHOT

- FIGURE 66 AMPHENOL COMMUNICATIONS SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 67 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 68 3M: COMPANY SNAPSHOT

- FIGURE 69 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 70 EATON: COMPANY SNAPSHOT

- FIGURE 71 DELL INC.: COMPANY SNAPSHOT

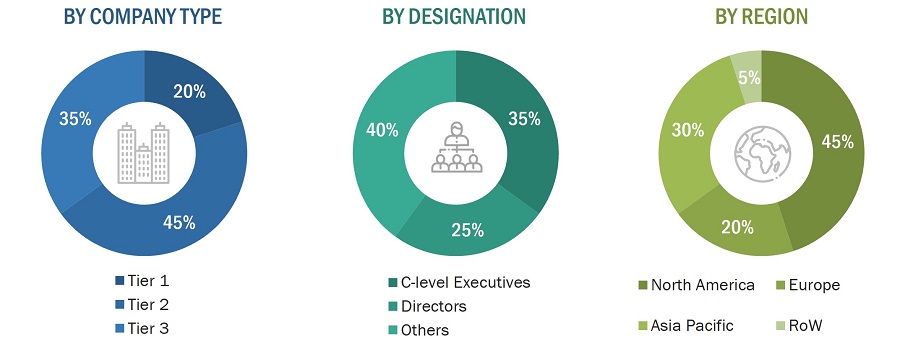

The study involved four major activities in estimating the size of the active optical cable & extender market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were referred to in the secondary research process for identifying and collecting information pertinent to this study. Secondary sources included annual reports, press releases, investor presentations, white papers, journals & certified publications, articles by recognized authors, directories, and databases. Secondary research was conducted to obtain key information about the active optical cable & extender supply chain, value chain, the total pool of the key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary sources for this research study include government sources, corporate filings (annual reports, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from the major companies and organizations operating in the active optical cable & extender market.

After the complete market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at in this process. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by the players operating in the active optical cable & extender market.

Extensive primary research has been conducted after acquiring knowledge about active optical cable & extender market scenarios through secondary research. Several primary interviews have been conducted with experts from demand (end users) and supply sides (semiconductor, connectivity, and application providers) across four major regions: North America, Europe, Asia Pacific, and RoW. Approximately 60% and 40% of primary interviews have been conducted from the demand and supply sides, respectively. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

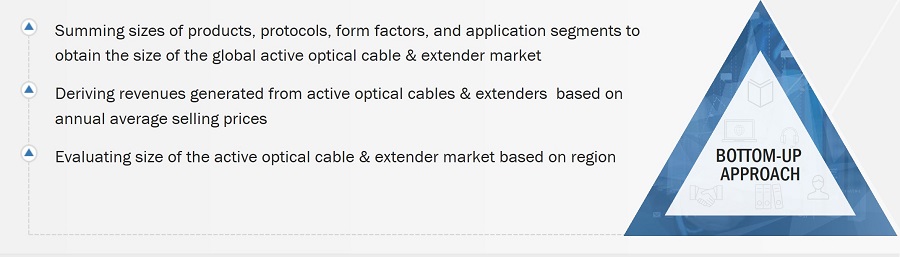

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the active optical cable & extender market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying verticals that are either using or will use active optical cables & extenders

- Tracking the leading companies and system integrators catering to various applications

- Deriving the size of the active optical cable & extender market through the data sanity method, analyzing revenues of more than 27 key providers through their annual reports and press releases, and summing them up to estimate the overall market size

- Conducting multiple discussions with key opinion leaders to understand the demand for active optical cables & extenders and analyzing the breakup of the scope of work carried out by each major company

- Carrying out the market trend analysis to obtain the CAGR of the active optical cable & extender market by understanding the industry penetration rate and analyzing the demand and supply of active optical cables & extenders in different applications

- Assigning a percentage to the overall revenue or, in a few cases, to segmental revenues of each company to derive their revenues from the sale of active optical cables & extenders. This percentage for each company has been assigned based on their product portfolios.

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, including CXOs, directors, and operation managers, and with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases

- Tracking the ongoing and identifying the upcoming projects related to active optical cables & extenders by companies and forecasting the market size based on these developments and other critical parameters

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall size of the active optical cable & extender market from the market size estimation processes explained above, the total market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends, and the market size has been validated using top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, and forecast the size of the active optical cable & extender market based on product, protocol, form factor, application, and region, in terms of value

- To define, describe, segment, and forecast the size of the active optical cable & extender market based on a product in terms of volume

- To provide market statistics with detailed classifications along with the respective market sizes for some of the segments

- To strategically analyze micro-markets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities for stakeholders and detail the competitive landscape of market leaders

- To forecast the market segments with respect to four main regions: North America, Europe, Asia Pacific, and RoW

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To provide a detailed Porter’s analysis along with the technology trends for the active optical cable & extender market

- To analyze the competitive developments, such as acquisitions, partnerships, and product launches, in the active optical cable & extender market

Market Definition

An active optical cable (AOC) technology uses optical fiber between the connectors. AOC is ideal for data centers, storage networks, and high-performance computing applications. This cable overcomes many drawbacks of copper wires. It relies on electrical-to-optical conversion and is used to improve the speed and distance performance of the network. It is lightweight, small, EMI resistant, and has higher speed data communication than the copper cable. An extension optical cable, also known as an optical fiber extension cable, is an active and passive cable used to extend the reach of an optical fiber connection between two devices or locations. It is designed to transmit data, signals, or information using light pulses through optical fibers.

Stakeholders

- Active optical cable and extender suppliers

- Fiber optic cable manufacturers and system integrators

- End users, which include data centers, high-performance computing (HPC), consumer electronics, telecommunications, industrial, energy, oil & gas, medical, military/aerospace, and others (test & measurement equipment, simulation systems, security & surveillance systems

- Governments

- Investors (private equity, venture capital, and others)

- Distributors and resellers: Companies that handle the distribution and resale of active optical cables and extenders, ensuring wider market availability

- Technology developers: Companies that design, develop, and produce active optical cables & extenders and invest in research, engineering, and production to create reliable and high-performance products

Research Objectives

- To define, describe, and forecast the active optical cable & extender market size, product, protocol, form factor, application, and region in terms of value

- To forecast the market size, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify the drivers, restraints, opportunities, and challenges impacting the growth of the market and submarkets

- To analyze the active optical cable & extender supply chain and identify opportunities for the supply chain participants

- To provide key technology trends and patent analysis related to the active optical cable & extender market

- To provide information regarding trade data related to the active optical cable & extender market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the active optical cable & extender ecosystem

- To strategically profile the key players in the active optical cable & extender market and comprehensively analyze their market shares and core competencies in each segment

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as product launches, alliances and partnerships, joint ventures, and mergers and acquisitions in the active optical cable & extender market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions at the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Active Optical Cable & Extender Market

What are the emerging applications of optical cables? I would like to understand latent opportunities in the market.