Water Storage Systems Market by Material (Steel, Fiberglass, Concrete, Plastic), Application, End Use (Residential, Commercial, Industrial, and Municipal), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027

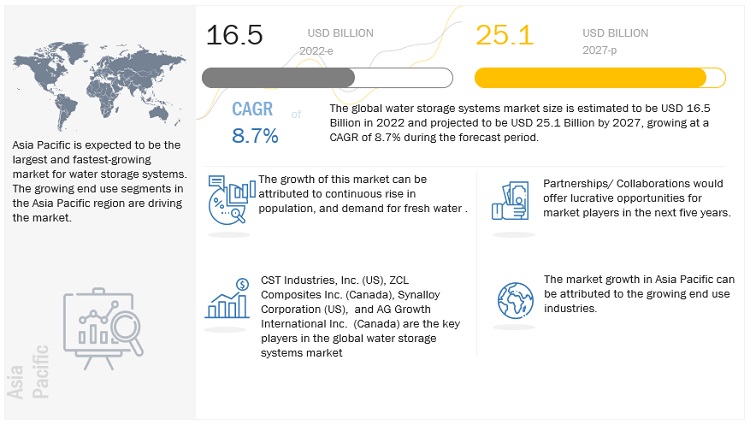

The global water storage systems market was valued at USD 16.5 billion in 2022 and is projected to reach USD 25.1 billion by 2027, growing at a cagr 8.7% from 2022 to 2027. The increased need for water storage systems in the rapidly expanding building and construction industry in residential, commercial, industrial, and municipal end users throughout the world is driving market expansion. This increase is ascribed, among other things, to rising water shortages, rapidly increasing population and urbanization, severe laws for water conservation and discharge, and changing climatic circumstances.

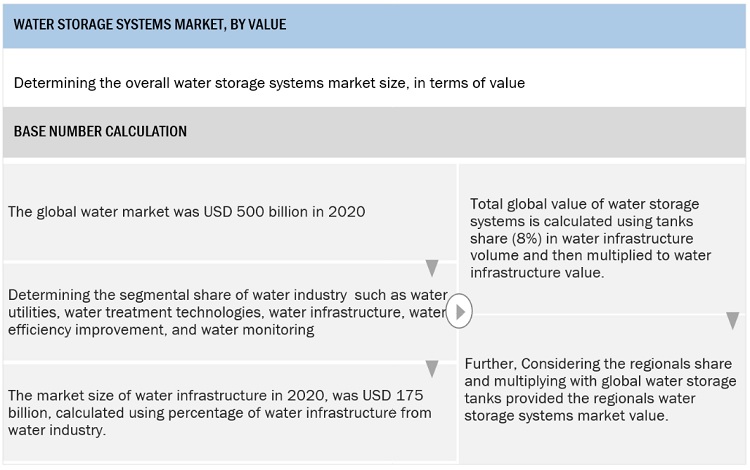

Attractive Opportunities in Water Storage Systems Market

Source: Interviews with Experts, Secondary Research, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rapid increasing population

According to a study published by the United Nations in June 2019, the global population is expected to increase to 9.7 billion by 2050 and could peak at over 11 billion by 2100. The growth is supported by changes in fertility rate and increasing urbanization. China and India are the two most populous countries in the world. The population of India is expected to surpass China by 2027. With 1,252 individuals per square kilometre, Bangladesh has the densest population—almost three times as many as India. According to the European Environment Agency, the EU-28 population will number 505 million now, rise to 510 million by 2030, then decline over the following decades to 465 million by 2100. Africa is anticipated to see more than half of the world's population growth between now and 2050. Among the major regions, Africa is experiencing the fastest population growth. Additionally, the population of sub-Saharan Africa is projected to double by 2050 (99% increase). Regions that may experience lower rates of population growth between 2019 and 2050 include Oceania excluding Australia/New Zealand (56%), Northern Africa and Western Asia (46%), Australia/New Zealand (28%), Central and Southern Asia (25%), Latin America and the Caribbean (18%), Eastern and South-eastern Asia (3%), and Europe and Northern America (2%).

Restraint:Fluctuation in raw material prices

Global steel prices are highly cyclic. Prices fluctuate every several years from peak to low. The most recent notable peaks in the price for common steel products, such as hot rolled coil (HRC) or reinforcing bar, occurred in August 2011, April 2018, and September 2021. Fitch Ratings predicted that prices would continue to decline, reaching USD 800 per ton in 2024 and USD 750 per ton in 2025 before further tumbling to USD 530 per ton in 2031. It is anticipated that a combination of slower Chinese steel consumption growth and increasing global steel market protectionism will loosen the market and increase output in impacted nations, lowering prices in the medium term. The disparity between secondary price and the costs of secondary manufacture and fluctuations in the price of primary material can have a significant impact on the economic feasibility of recycling. In addition to the prices of raw materials, manufacturers are also burdened with the additional cost incurred due to the increased crude prices, which result in higher operating costs and lower profit margins.

Opportunity: Recycling and reuse offer opportunities for growth

Currently, the plastics market has been affected due to the rise in the cost of feedstock prices. The high cost of feedstock will increase the cost of intermediate and finished goods. The plastic value chain is more circular, and recycled plastics can be more price competitive. Financial incentives to limit the use and promote circularity can be created by policies like plastics fees and recycled content targets. Several countries have lately reinforced regulations to simultaneously push supply and pull demand through recycled content targets in order to support secondary plastics markets. Positive indicators that these measures are assisting in bolstering secondary markets include the recent decoupling of prices for primary and secondary polyethylene terephthalate (PET) in Europe and rising innovation in recycling technology. The use of recycled plastic will bring down the price of finished goods, which will make the end product more economical and preferable.

Challenge: Tank and water quality issues

The goal of operating water storage tanks is to deliver the highest quality of water available to users. Inadequate tank design, inadequate maintenance, intrusion of fauna, and incorrectly applied or cured coatings and linings are some factors that can cause water quality issues in water storage tanks. It is advised by the American Water Works Association (AWWA) to examine potable water towers every three to five years. Potable water tank checks are essential for good water maintenance in addition to the tank itself. Sediment may accumulate around the bottom of tanks over time. Small levels of silt have no effect on the water's purity or the storage tank's structural integrity. These factors can affect the quality and properties of both water and tank.

The fiberglass segment is expected to register the highest CAGR during the forecast period.

The fiberglass material segment is expected to register the highest CAGR during the forecast period. Fiberglass is a strong plastic matrix reinforced with tiny glass fibers. Glass-reinforced plastic or glass-fiber reinforced plastic are other names for it. Fiberglass structures have superior mechanical strength and are resistant to degradation, rust, and corrosion. Because of its lightweight and durable qualities, fiberglass is a popular material for a variety of industrial applications. Fiberglass storage tanks have a food-grade coating on their inside surface, making the stored water drinkable for a longer duration of time.

Municipalities and facility owners are looking for ways to better manage their water resources as concerns about water shortages develop in many states across the country. Because fiberglass tanks may be constructed for dual-purpose usage, they are appropriate for commercial fire protection applications. A frequent example is fire protection backup as well as potable water.

The onsite water & wastewater collection segment is expected to be the fastest-growing segment, by application, in the water storage systems market during the forecast period.

Onsite wastewater systems are multi-stage systems that gather, filter, and distribute wastewater from a residential area or plant. Rather than being collected and transported to a wastewater treatment facility, wastewater is treated and released into the soil. A typical onsite wastewater system includes a septic tank and some type of leach field to disperse wastewater into the ground.

For effective performance, all components of an onsite wastewater system should be routinely serviced. When the sediments or scum reach a particular amount in the tank, the septic tank should be monitored and pumped. Filters in septic tanks should be examined and cleaned on a regular basis (either once or twice a year for most households and filters). To ensure equitable distribution, distribution boxes should be examined and altered. Pump tanks should be inspected for solids buildup and control panel functionality (including checking the alarm).

Water is used in chemical, petrochemical, food, textile, manufacturing, automobile, oil & gas, and several other industries. Various government and environmental rules & regulations stipulate the treatment of the water used by these industries before further reuse or release.

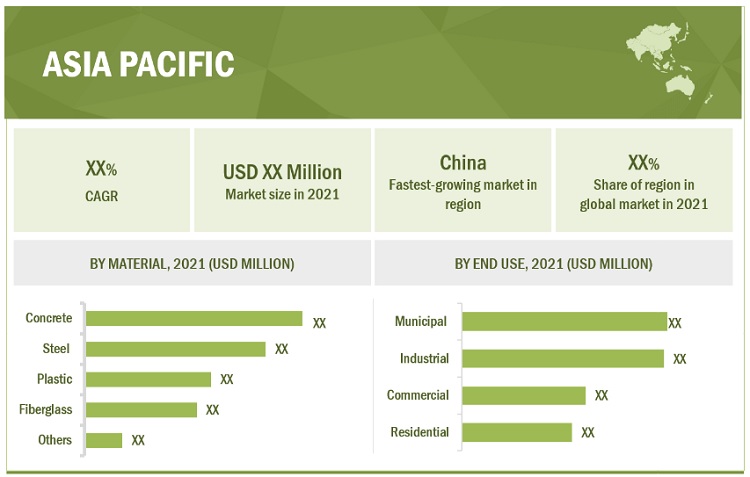

The water storage systems market in Asia Pacific is expected to register the highest CAGR during the forecast period.

The Asia Pacific region is the largest market for water storage systems across the globe. Over the previous few decades, Asia has experienced rapid economic and social development. Good water management and human capital development will continue to be critical throughout Asia and the Pacific to promote economic growth and enhance overall social wellbeing, particularly in the aftermath of the coronavirus disease 2019 (COVID-19) pandemic. Despite improvements throughout Asia and the Pacific (home to 60% of the world's population), 1.5 billion people in rural regions and 0.6 billion in urban areas continue to lack access to safe drinking water and sanitation. Of the 49 Asian Growth Bank (ADB) countries from Asia and the Pacific, 27 suffer severe water limits to economic development, and 18 have yet to adequately protect their citizens from water-related disasters..

In recent years, India and China have seen double-digit GDP growth, as well as a population explosion. The countries' river basins are inadequate to supply the water demands of these densely populated countries. Furthermore, socioeconomic issues induce population growth, which is predicted to contribute to water shortages in the Asia Pacific area. Water shortage has also resulted from changing rainfall levels in various Asia Pacific nations, which is projected to raise demand for water storage systems in the near future.

To know about the assumptions considered for the study, download the pdf brochure

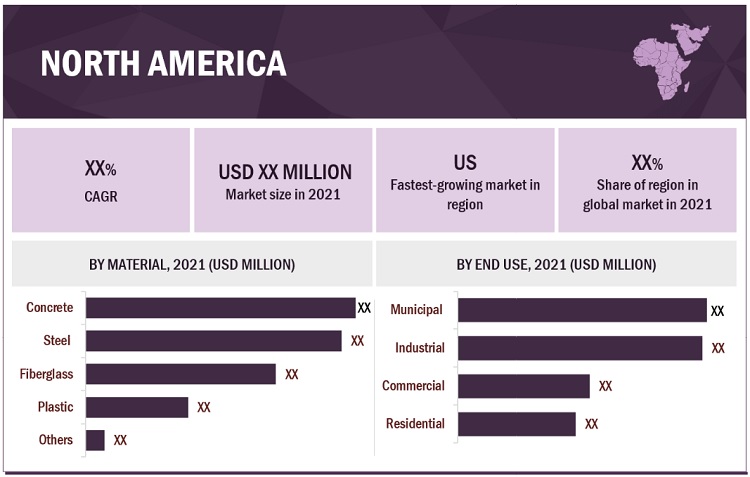

North America to grow at a similar rate as that of Asia Pacific during the forecast period.

According to Trading Economics, the GDP of the US was USD 22.99 trillion in 2021. Water is used on a large scale in the US for industrial, commercial, irrigation, and residential applications. The country has one of the main shale gas reserves in the world. Additionally, the increasing oil & gas activities, which is one of the prime sectors, along with the thermoelectric power generation sector, use large amounts of water. Factors such as growing industrialization and increasing population have led to the depletion of water resources. Government intervention and growing concerns about the availability of water have driven the country's water storage systems market to grow at a significant pace.

The exploitation of water resources has led to the monitoring of water usage by each sector as well as the adoption of conservation and effective usage plans to avoid wastage. This acts as a driver for the water storage systems market as these systems also help in the monitoring of water resources. Due to the presence of large industries and diversified applications, the demand for storage tanks is high in the US.

According to the EPA, every day at home, the typical American household uses more than 300 gallons of water. About 70% of this use takes place indoors.

Although outdoor water consumption makes up 30% of home use nationwide, it can be significantly greater in drier regions and in landscapes that require more water. Due to landscape irrigation, the arid West has some of the greatest per capita domestic water demand.

According to the US Census Bureau, the construction industry of the country is among the largest in the world, with annual spending of over USD 1,762.3 billion in June 2022. Rising GDP, growing urbanization, and increasing consumption are also encouraging the growth of the water storage systems market.

Key Market Players

CST Industries Inc. (US), ZCL Composites Inc. (Canada), Synalloy Corporation (US), AG Growth International Inc. (Canada), McDermott International Inc. (US), BH Tank (US), Fiber Technology Corporation (US), Caldwell Tanks (US), Containment Solutions Inc. (US), and Maguire Iron Inc. (US) are the key players operating in the global market.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2017–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion) |

|

Segments |

Material, Application, and End Use |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

CST Industries Inc. (US), ZCL Composites Inc. (Canada), Synalloy Corporation (US), AG Growth International Inc. (Canada), McDermott International Inc. (US), BH Tank (US), Fiber Technology Corporation (US), Caldwell Tanks (US), Containment Solutions Inc. (US), Maguire Iron Inc. (US) |

This research report categorizes the water storage systems market based on material, application, end use, and region.

Based on material, the water storage systems market has been segmented as follows:

- Steel

- Fiberglass

- Concrete

- Plastic

- Others (collapsible tanks, wood tanks, and open-lined pits)

Based on application, the water storage systems market has been segmented as follows:

- Hydraulic fracture storage & collection

- Onsite water & wastewater collection

- Potable water storage systems

- Fire suppression reserve & storage

- Rainwater harvesting & collection

- Others (irrigation, secondary containment systems, and marine)

Based on end use, the water storage systems market has been segmented as follows:

- Residential

- Commercial

- Industrial

- Municipal

Based on the region, the water storage systems market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In July 2021, CST Industries, Inc. (CST) announced the strategic territory expansion with Adams Brothers, Inc. Adam Brothers is based in Atlanta, Georgia, specializing in process equipment to the dry bulk industry. The company has been representing CST's iconic industry-leading epoxy coated bolted and welded storage solutions, TecTank (formerly known as Peabody TecTank and Columbian TecTank), for over six decades. Under this new agreement, Adams Brothers will be responsible for an additional two states in the eastern region of the US, Virginia and North Carolina. Its offerings in the new territory will include construction services.

- In October 2019, CST Industries, Inc., the world's leading bolted storage tank, aluminium dome, and specialty cover manufacturer announced substantial company growth led by deploying USD 8 Million in capital investments from Solace Capital Partners, a private investment firm based out of California. Since the acquisition by Solace in January 2018, CST invested heavily in the company's manufacturing operations and office facilities, from new equipment, software and hardware tools, and facility upgrades.

- In April 2019, CST Industries, Inc. partnered with Greatario Engineered Storage Systems, an established and recognized market leader in Ontario, Canada, to design and build bolted steel tanks and covers for liquid storage. With this partnership, CST Industries intends to expand its Aquastore brand of storage tanks in six province territories in the western region of Canada, including British Columbia, Alberta, Saskatchewan, Manitoba, Yukon, Northwest Territories, and Nunavut.

- In May 2018, McDermott International acquired Chicago Bridge & Iron Company N.V. (CB&I), headquartered in Hague, The Netherlands, a leading provider of conceptual design, technology, engineering, procurement, fabrication, modularization, construction, commissioning, maintenance, program management, and environmental services in the energy and infrastructure market. This business combination with CB&I has transformed McDermott International, Inc. into a top-tier, integrated provider of engineering and construction solutions for the energy industry.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of water storage systems?

Yes the report covers the new applications of water storage systems.

What is the current competitive landscape in the water storage systems market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 WATER STORAGE SYSTEMS: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 WATER STORAGE SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 3 WATER STORAGE SYSTEMS MARKET SIZE ESTIMATION, BY REGION

FIGURE 4 WATER STORAGE SYSTEMS MARKET, BY END USE

2.2.2 SUPPLY-SIDE FORECAST

FIGURE 5 WATER STORAGE SYSTEMS MARKET: SUPPLY-SIDE FORECAST

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF WATER STORAGE SYSTEMS MARKET

2.2.3 DEMAND-SIDE FORECAST

FIGURE 7 WATER STORAGE SYSTEMS MARKET: DEMAND-SIDE FORECAST

2.2.4 FACTOR ANALYSIS

FIGURE 8 FACTOR ANALYSIS OF WASTE STORAGE SYSTEMS MARKET

2.3 DATA TRIANGULATION

FIGURE 9 WATER STORAGE SYSTEMS MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE FORECAST

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 WATER STORAGE SYSTEMS MARKET SNAPSHOT (2022 VS. 2027)

FIGURE 10 CONCRETE WATER STORAGE SYSTEMS TO LEAD OVERALL MARKET DURING FORECAST PERIOD

FIGURE 11 ONSITE WATER & WASTEWATER COLLECTION SEGMENT EXPECTED TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 12 MUNICIPAL END USE TO ACCOUNT FOR HIGHEST SHARE DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN WATER STORAGE SYSTEMS MARKET

FIGURE 14 MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

4.2 WATER STORAGE SYSTEMS MARKET, BY END USE

FIGURE 15 MUNICIPAL TO BE LARGEST END-USE SEGMENT DURING FORECAST PERIOD

4.3 WATER STORAGE SYSTEMS MARKET: DEVELOPED VS. EMERGING COUNTRIES

FIGURE 16 EMERGING COUNTRIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

4.4 ASIA PACIFIC WATER STORAGE SYSTEMS MARKET, BY END USE AND COUNTRY, 2021

FIGURE 17 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

4.5 WATER STORAGE SYSTEMS MARKET, BY MAJOR COUNTRIES

FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN WATER STORAGE SYSTEMS MARKET

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WATER STORAGE SYSTEMS MARKET

5.1.1 DRIVERS

5.1.1.1 Rapidly increasing population

TABLE 2 POPULATION OF TOP FOUR COUNTRIES, 2009 & 2050

5.1.1.2 Limited availability of water

5.1.1.3 Growth of end-use industries

5.1.2 RESTRAINTS

5.1.2.1 Fluctuation in raw material prices

5.1.2.2 High initial investment

5.1.3 OPPORTUNITIES

5.1.3.1 Recycling and reuse offer opportunities for growth

5.1.3.2 Significant opportunities for growth in emerging countries

5.1.4 CHALLENGES

5.1.4.1 Tank and water quality issues

5.2 TYPES OF WATER STORAGE SYSTEMS

5.2.1 UNDERGROUND TANKS

5.2.2 ABOVEGROUND TANKS

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 WATER STORAGE SYSTEMS MARKET: VALUE CHAIN ANALYSIS

TABLE 3 WATER STORAGE SYSTEMS MARKET: ECOSYSTEM

5.4 PORTER'S FIVE FORCES ANALYSIS

FIGURE 21 PORTER'S FIVE FORCES ANALYSIS: WATER STORAGE SYSTEMS MARKET

TABLE 4 WATER STORAGE SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 MACROECONOMIC INDICATORS

5.5.1 INTRODUCTION

5.5.2 GDP TRENDS AND FORECAST

TABLE 5 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

5.5.3 TRENDS AND FORECASTS FOR GLOBAL CONSTRUCTION INDUSTRY

FIGURE 22 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

5.5.4 EXPORT-IMPORT TRADE STATISTICS

TABLE 6 EXPORT DATA FOR RESERVOIRS, TANKS, VATS, AND SIMILAR CONTAINERS, OF IRON OR STEEL, FOR ANY MATERIAL OTHER THAN COMPRESSED OR LIQUEFIED GAS, OF A CAPACITY OF > 300 L, NOT FITTED WITH MECHANICAL OR THERMAL EQUIPMENT, WHETHER OR NOT LINED OR HEAT-INSULATED (USD THOUSAND) – HS CODE (730900)

TABLE 7 IMPORT DATA FOR RESERVOIRS, TANKS, VATS, AND SIMILAR CONTAINERS, OF IRON OR STEEL, FOR ANY MATERIAL OTHER THAN COMPRESSED OR LIQUEFIED GAS, OF A CAPACITY OF > 300 L, NOT FITTED WITH MECHANICAL OR THERMAL EQUIPMENT, WHETHER OR NOT LINED OR HEAT-INSULATED (USD THOUSAND) – HS CODE (730900)

5.5.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 WATER STORAGE SYSTEMS MARKET, BY MATERIAL (Page No. - 74)

6.1 INTRODUCTION

FIGURE 23 FIBERGLASS SEGMENT PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 12 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

6.2 CONCRETE

6.2.1 SUPERIOR STRENGTH, RESISTANCE TO CORROSION, AND DURABILITY TO DRIVE DEMAND FOR CONCRETE WATER STORAGE TANKS

TABLE 13 CONCRETE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 14 CONCRETE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 STEEL

6.3.1 COST-EFFECTIVENESS OF STEEL WATER STORAGE SYSTEMS TO DRIVE GROWTH

TABLE 15 STEEL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 16 STEEL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 FIBERGLASS

6.4.1 FIBERGLASS OFFERS HIGH MECHANICAL STRENGTH, MINIMAL DETERIORATION, AND NON-CORROSION

TABLE 17 FIBERGLASS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 FIBERGLASS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 PLASTIC

6.5.1 ASIA PACIFIC TO WITNESS HIGHEST GROWTH FOR PLASTIC WATER STORAGE SYSTEMS MARKET

TABLE 19 PLASTIC: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 PLASTIC: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.6 OTHERS

6.6.1 ASIA PACIFIC TO REMAIN DOMINANT MARKET FOR OTHERS SEGMENT

TABLE 21 OTHERS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 OTHERS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7 WATER STORAGE SYSTEMS MARKET, BY APPLICATION (Page No. - 82)

7.1 INTRODUCTION

FIGURE 24 RAINWATER HARVESTING & COLLECTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 HYDRAULIC FRACTURE STORAGE & COLLECTION

7.2.1 INCREASING OIL & GAS ACTIVITIES TO DRIVE GROWTH OF HYDRAULIC FRACTURE STORAGE & COLLECTION SYSTEMS

TABLE 25 HYDRAULIC FRACTURE STORAGE & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 HYDRAULIC FRACTURE STORAGE & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ONSITE WATER & WASTEWATER COLLECTION

7.3.1 STRINGENT ENVIRONMENTAL REGULATIONS ABOUT REUSE & RELEASE OF POLLUTED PROCESSED WATER TO DRIVE MARKET

TABLE 27 ONSITE WATER & WASTEWATER COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 ONSITE WATER & WASTEWATER COLLECTION: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

7.4 POTABLE WATER STORAGE

7.4.1 FRESHWATER SCARCITY COUPLED WITH INCREASING POPULATION TO DRIVE DEMAND IN POTABLE WATER STORAGE APPLICATION

TABLE 29 POTABLE WATER STORAGE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 POTABLE WATER STORAGE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 RAINWATER HARVESTING & COLLECTION

7.5.1 INCREASING CONCERNS REGARDING AVAILABILITY OF WATER RESOURCES TO DRIVE RAINWATER HARVESTING & COLLECTION

TABLE 31 RAINWATER HARVESTING & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 RAINWATER HARVESTING & COLLECTION: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 FIRE SUPPRESSION RESERVE & STORAGE

7.6.1 INCREASING SAFETY STANDARDS AND GOVERNMENT REGULATIONS REGARDING PROTECTION AGAINST FIRE TO FUEL GROWTH

TABLE 33 FIRE SUPPRESSION RESERVE & STORAGE: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 34 FIRE SUPPRESSION RESERVE & STORAGE: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 OTHERS

7.7.1 INCREASING IRRIGATION ACTIVITIES TO DRIVE MARKET IN OTHER APPLICATIONS SEGMENT

TABLE 35 OTHER APPLICATIONS: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 OTHER APPLICATIONS: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8 WATER STORAGE SYSTEMS MARKET, BY END USE (Page No. - 92)

8.1 INTRODUCTION

FIGURE 25 MUNICIPAL SEGMENT DOMINATES WATER STORAGE SYSTEMS MARKET

TABLE 37 WATER STORAGE SYSTEMS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 38 WATER STORAGE SYSTEMS MARKET, BY END USE, 2022–2027 (USD MILLION)

8.2 MUNICIPAL

8.2.1 INCREASING POPULATION AND RAPID URBANIZATION DRIVING DEMAND IN MUNICIPAL SEGMENT

TABLE 39 MUNICIPAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MUNICIPAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 INDUSTRIAL

8.3.1 GOVERNMENT REGULATIONS, ENVIRONMENTAL NORMS, AND INDUSTRIALIZATION TO DRIVE INDUSTRIAL WATER STORAGE SYSTEMS MARKET

TABLE 41 INDUSTRIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 INDUSTRIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 COMMERCIAL

8.4.1 GROWING URBANIZATION DRIVING GROWTH OF MARKET IN COMMERCIAL SECTOR

TABLE 43 COMMERCIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 COMMERCIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 RESIDENTIAL

8.5.1 RISING WATER DEMAND AND GROWING WATER SCARCITY FUELING NEED FOR RESIDENTIAL WATER STORAGE SYSTEMS

TABLE 45 RESIDENTIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 RESIDENTIAL: WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

9 WATER STORAGE SYSTEMS MARKET, BY REGION (Page No. - 99)

9.1 INTRODUCTION

FIGURE 26 ASIA PACIFIC WATER STORAGE SYSTEMS MARKET PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 47 WATER STORAGE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 WATER STORAGE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 50 WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

TABLE 51 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 WATER STORAGE SYSTEMS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 54 WATER STORAGE SYSTEMS MARKET, BY END USE, 2022–2027 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET SNAPSHOT

TABLE 55 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 56 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 58 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 61 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 62 ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022–2027 (USD MILLION)

9.2.1 CHINA

9.2.1.1 China to lead water storage systems market in Asia Pacific

TABLE 63 CHINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 64 CHINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.2.2 JAPAN

9.2.2.1 Fiberglass to be fastest-growing material type during forecast period

TABLE 65 JAPAN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 66 JAPAN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.2.3 INDIA

9.2.3.1 Booming economy, population growth, and rapid urbanization to drive market

TABLE 67 INDIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 68 INDIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Growing awareness about water scarcity to drive water storage systems market

TABLE 69 SOUTH KOREA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 70 SOUTH KOREA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.2.5 AUSTRALIA

9.2.5.1 Stringent regulations and fluctuating rainfall to drive growth of water storage systems

TABLE 71 AUSTRALIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 72 AUSTRALIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.2.6 REST OF ASIA PACIFIC

9.2.6.1 Increasing population and scarcity of water to drive growth in Rest of Asia Pacific

TABLE 73 REST OF ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 74 REST OF ASIA PACIFIC: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET SNAPSHOT

TABLE 75 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022–2027 (USD MILLION)

9.3.1 US

9.3.1.1 Aging water infrastructure and significant capital investment to drive market

TABLE 83 US: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 84 US: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Lack of investment in water infrastructure to restrain market growth during forecast period

TABLE 85 CANADA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 86 CANADA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Rainwater harvesting to cope with severe water scarcity to drive market

TABLE 87 MEXICO: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 88 MEXICO: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.4 EUROPE

FIGURE 29 EUROPE: WATER STORAGE SYSTEMS MARKET SNAPSHOT

TABLE 89 EUROPE: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 91 EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 92 EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

TABLE 93 EUROPE: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 94 EUROPE: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022–2027 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 High population expected to drive growth of water storage systems market

TABLE 97 GERMANY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 98 GERMANY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 Climate change expected to influence water storage systems market in France

TABLE 99 FRANCE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 100 FRANCE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.4.3 UK

9.4.3.1 Scarcity of water to drive growth of water storage systems market in UK

TABLE 101 UK: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 102 UK: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Rainwater harvesting and stringent regulations to fuel growth of market

TABLE 103 ITALY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 104 ITALY: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 Dependence on reservoirs to drive growth of water storage systems market

TABLE 105 SPAIN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 106 SPAIN: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.4.6 REST OF EUROPE

9.4.6.1 Increasing capital expenditure on maintenance of water reserves to fuel growth

TABLE 107 REST OF EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 108 REST OF EUROPE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

FIGURE 30 SOUTH AFRICA TO REGISTER HIGHEST GROWTH IN MIDDLE EAST & AFRICA

TABLE 109 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022–2027 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Concrete remains dominant water storage systems market in Saudi Arabia

TABLE 117 SAUDI ARABIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 118 SAUDI ARABIA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.5.2 UAE

9.5.2.1 High consumption in air conditioning systems driving growth in UAE

TABLE 119 UAE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 120 UAE: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.5.3 SOUTH AFRICA

9.5.3.1 Government support to drive growth of water storage systems market in South Africa

TABLE 121 SOUTH AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 122 SOUTH AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.5.4 REST OF MIDDLE EAST & AFRICA

9.5.4.1 Increasing population and water scarcity fueling growth of water storage systems

TABLE 123 REST OF MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 124 REST OF MIDDLE EAST & AFRICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.6 SOUTH AMERICA

FIGURE 31 BRAZIL ACCOUNTS FOR HIGHEST SHARE OF SOUTH AMERICAN WATER STORAGE SYSTEMS MARKET

TABLE 125 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 127 SOUTH AMERICA WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 128 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

TABLE 129 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 131 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 132 SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY END USE, 2022–2027 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Brazil dominates water storage systems market in South America

TABLE 133 BRAZIL: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 134 BRAZIL: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Increasing oil & gas exploration to drive growth of market in Argentina

TABLE 135 ARGENTINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 136 ARGENTINA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

9.6.3.1 Plastic material segment to account for largest share in Rest of South America

TABLE 137 REST OF SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2018–2021 (USD MILLION)

TABLE 138 REST OF SOUTH AMERICA: WATER STORAGE SYSTEMS MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 146)

10.1 OVERVIEW

TABLE 139 OVERVIEW OF STRATEGIES ADOPTED BY KEY WATER STORAGE SYSTEMS PLAYERS (2018–2022)

10.2 COMPETITIVE LEADERSHIP MAPPING, 2021

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PARTICIPANTS

10.2.4 PERVASIVE PLAYERS

FIGURE 32 WATER STORAGE SYSTEMS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.3 SME MATRIX, 2021

10.3.1 RESPONSIVE COMPANIES

10.3.2 PROGRESSIVE COMPANIES

10.3.3 STARTING BLOCKS

10.3.4 DYNAMIC COMPANIES

FIGURE 33 WATER STORAGE SYSTEMS MARKET: START-UP/SME COMPETITIVE LEADERSHIP MAPPING, 2021

10.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN WATER STORAGE SYSTEMS MARKET

10.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN WATER STORAGE SYSTEMS MARKET

10.6 COMPETITIVE BENCHMARKING

TABLE 140 WATER STORAGE SYSTEMS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 141 WATER STORAGE SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 142 COMPANY EVALUATION MATRIX: WATER STORAGE SYSTEMS

10.7 MARKET SHARE ANALYSIS

FIGURE 36 MARKET SHARE OF KEY PLAYERS (2021)

TABLE 143 WATER STORAGE SYSTEMS MARKET: DEGREE OF COMPETITION, 2021

10.8 MARKET RANKING ANALYSIS

FIGURE 37 MARKET RANKING ANALYSIS, 2021

10.9 REVENUE ANALYSIS

FIGURE 38 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2016–2020

10.1 COMPETITIVE SCENARIO

10.10.1 MARKET EVALUATION FRAMEWORK

TABLE 144 STRATEGIC DEVELOPMENTS BY MARKET PLAYERS

TABLE 145 MOST ADOPTED STRATEGIES

TABLE 146 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

10.10.2 MARKET EVALUATION MATRIX

TABLE 147 COMPANY END-USE FOOTPRINT

TABLE 148 COMPANY REGION FOOTPRINT

TABLE 149 COMPANY OVERALL FOOTPRINT

10.11 STRATEGIC DEVELOPMENTS

TABLE 150 WATER STORAGE SYSTEMS MARKET: PRODUCT LAUNCHES, 2018–2022

TABLE 151 WATER STORAGE SYSTEMS MARKET: DEALS, 2018–2022

TABLE 152 WATER STORAGE SYSTEMS MARKET: OTHERS, 2018–2022

11 COMPANY PROFILES (Page No. - 162)

11.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

11.1.1 CST INDUSTRIES, INC.

TABLE 153 CST INDUSTRIES, INC.: COMPANY OVERVIEW

TABLE 154 CST INDUSTRIES, INC.: PRODUCT LAUNCHES

TABLE 155 CST INDUSTRIES, INC.: DEALS

TABLE 156 CST INDUSTRIES, INC.: OTHERS

11.1.2 ZCL COMPOSITES, INC.

TABLE 157 ZCL COMPOSITES, INC: COMPANY OVERVIEW

11.1.3 SYNALLOY CORPORATION

TABLE 158 SYNALLOY CORPORATION: COMPANY OVERVIEW

FIGURE 39 SYNALLOY CORPORATION: COMPANY SNAPSHOT

11.1.4 AG GROWTH INTERNATIONAL INC.

TABLE 159 AG GROWTH INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 40 AG GROWTH INTERNATIONAL INC.: COMPANY SNAPSHOT

11.1.5 MCDERMOTT INTERNATIONAL, INC.

TABLE 160 MCDERMOTT INTERNATIONAL, INC.: COMPANY OVERVIEW

FIGURE 41 MCDERMOTT INTERNATIONAL, INC.: COMPANY SNAPSHOT

TABLE 161 MCDERMOTT INTERNATIONAL, INC.: DEALS

11.1.6 BH TANK

TABLE 162 BH TANK: COMPANY OVERVIEW

11.1.7 FIBER TECHNOLOGY CORPORATION

TABLE 163 FIBER TECHNOLOGY CORPORATION: COMPANY OVERVIEW

11.1.8 CALDWELL TANKS

TABLE 164 CALDWELL TANKS: COMPANY OVERVIEW

11.1.9 CONTAINMENT SOLUTIONS INC.

TABLE 165 CONTAINMENT SOLUTIONS INC: COMPANY OVERVIEW

11.1.10 MAGUIRE IRON INC.

TABLE 166 MAGUIRE IRON INC.: COMPANY OVERVIEW

11.2 OTHER PLAYERS

11.2.1 SNYDER INDUSTRIES

TABLE 167 SNYDER INDUSTRIES: COMPANY OVERVIEW

11.2.2 CROM CORPORATION

TABLE 168 CROM CORPORATION: COMPANY OVERVIEW

11.2.3 TANK CONNECTION

TABLE 169 TANK CONNECTION: COMPANY OVERVIEW

11.2.4 CONTAIN ENVIRO SERVICES LTD

TABLE 170 CONTAIN ENVIRO SERVICES LTD: COMPANY OVERVIEW

11.2.5 HMT LLC

TABLE 171 HMT LLC: COMPANY OVERVIEW

11.2.6 DN TANKS

TABLE 172 DN TANKS: COMPANY OVERVIEW

11.2.7 SINTEX PLASTICS TECHNOLOGY LIMITED

TABLE 173 SINTEX PLASTICS TECHNOLOGY LIMITED: COMPANY OVERVIEW

11.2.8 BALMORAL TANKS LIMITED

TABLE 174 BALMORAL TANKS LIMITED: COMPANY OVERVIEW

11.2.9 SUPERIOR TANK CO. INC

TABLE 175 SUPERIOR TANK CO. INC: COMPANY OVERVIEW

11.2.10 PITTSBURG TANK & TOWER GROUP

TABLE 176 PITTSBURG TANK & TOWER GROUP: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 195)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 WASTEWATER TREATMENT SERVICES MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 WASTEWATER TREATMENT SERVICES MARKET, BY SERVICE TYPE

TABLE 177 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY SERVICE TYPE, 2016–2019 (USD MILLION)

TABLE 178 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY SERVICE TYPE, 2020–2026 (USD MILLION)

12.3.3.1 Design & engineering consulting

12.3.3.2 Building & installation service

12.3.3.3 Operation & process control

12.3.3.4 Maintenance & repair

12.3.3.5 Others

12.3.4 WASTEWATER TREATMENT SERVICES MARKET, BY END-USE INDUSTRY

TABLE 179 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 180 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

12.3.4.1 Municipal

12.3.4.2 Industrial

TABLE 181 WASTEWATER TREATMENT SERVICES MARKET SIZE IN INDUSTRIAL END-USE INDUSTRY, BY INDUSTRY TYPE, 2016–2019 (USD MILLION)

TABLE 182 WASTEWATER TREATMENT SERVICES MARKET SIZE IN INDUSTRIAL END-USE INDUSTRY, BY INDUSTRY TYPE, 2020–2026 (USD MILLION)

12.3.4.2.1 Chemical & pharma

12.3.4.2.2 Oil & gas

12.3.4.2.3 Food, pulp & paper

12.3.4.2.4 Metal & mining

12.3.4.2.5 Power generation

12.3.4.2.6 Others

12.3.5 WASTEWATER TREATMENT SERVICES MARKET, BY REGION

TABLE 183 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 184 WASTEWATER TREATMENT SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.3.5.1 North America

12.3.5.2 Europe

12.3.5.3 Asia Pacific

12.3.5.4 Middle East & Africa

12.3.5.5 South America

13 APPENDIX (Page No. - 204)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of water storage systems. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both supply-side and demand-side approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the water storage systems market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The water storage systems market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the construction industry and its end uses such as residential, commercial, industrial, and municipal. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

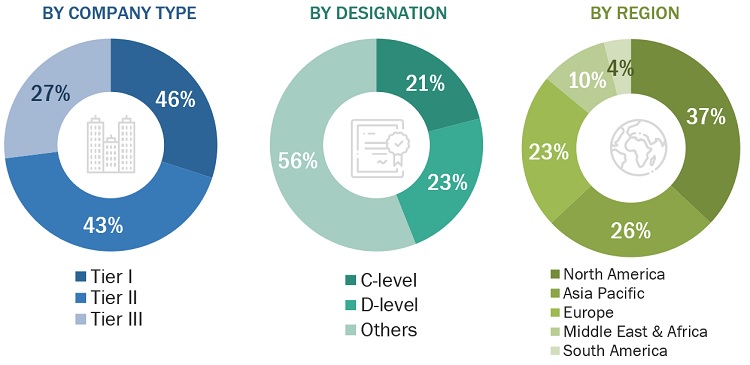

Following is the breakdown of primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 =

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both the top-down and bottom-up approaches have been extensively used, along with several data triangulation methods to gather, verify, and validate the market figures arrived at. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to provide key information/insights throughout the report. The research methodology used to estimate the market size included the following steps:

- The key players in the market have been identified in the respective regions through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

- All possible parameters that affect the market and submarkets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated and added with detailed inputs and analysis from MNM data repository and presented in this report.

Global Water Storage Systems Market: Top-Down Approach

Source: Secondary Research, and Interviews with Experts

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points matched, the data has been assumed to be correct.

Report Objectives

- To analyze and forecast the size of the water storage systems market in terms of value

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market and its submarkets

- To define, describe, and forecast the size of the market by material, application, end use, and region

- To forecast the size of the market and its submarkets with respect to five regions (along with their major countries), namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To strategically analyze each micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments and provide a competitive landscape of market leaders

- To track and analyze competitive developments such as new product launches, mergers & acquisitions, investment & expansions, and joint ventures in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Water Storage Systems Market