Cloud Field Service Management Market by Solution (Mobile Field Service Management, Scheduling and Dispatch), Service, Organization Size, Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Vertical, and Region - Global Forecast to 2022

[139 Pages Report] The Cloud Field Service Management Market size accounted for USD 903.7 Million in 2016 and is projected to reach USD 2,254.5 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 17.3% during the forecast period.

With the increasing penetration of cloud computing and related technologies, such as Internet of Things (IoT), big data, and serverless architecture, the demand for cloud FSM solutions and services among enterprises is gaining huge traction. The base year considered for this study is 2016 and the forecast period is 20172022.

Objectives of the Study

- To describe and forecast the global cloud Field Service Management market on the basis of types, organization size, deployment models, verticals, and regions

- To forecast the market size of the 5 main regional segments, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments with respect to the individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of competitive landscape for the major players

- To profile the key players and comprehensively analyze their core competencies and market positioning

- To track and analyze the competitive developments, such as mergers and acquisitions, new product developments, and partnerships, agreements, and collaborations, in the cloud FSM market

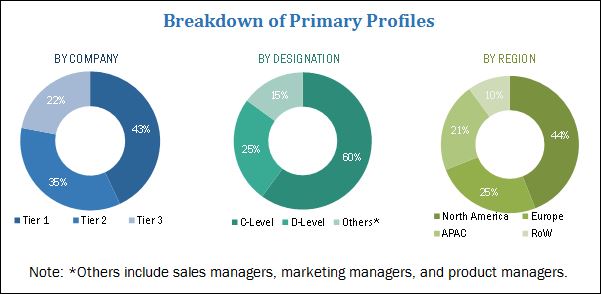

The research methodology used to estimate and forecast the cloud Field Service Management market began with capturing data on the key vendor revenues through secondary research via sources such as Cloud Computing Association, Associations for Financial Professionals, and Information Systems Security Association. The vendor offerings were also taken into consideration to determine the market segmentations. The bottom-up procedure was employed to arrive at the overall market size of the global cloud FSM market from the revenues of the key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research, by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The market comprises various service providers, such as Industrial and Financial Systems (IFS) AB (Sweden, Europe), ServiceNow, Inc. (California, US), Salesforce.com, Inc. (California, US), SAP SE (Germany, Europe), Oracle Corporation (California, US), International Business Machines Corporation (New York, US), ServicePower Technologies plc (Cheshire, UK), ClickSoftware Technologies Ltd. (Massachusetts, US), ServiceMax, Inc. (California, US), Acumatica, Inc. (Washington, US), Microsoft Corporation (Washington, US), and Astea International Inc. (Pennsylvania, US). The other stakeholders in the cloud FSM market include systems integrators, application designers, development service providers, and network service providers. These Cloud Field Service Management Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy.

Key Target Audience For Cloud Field Service Management Market

- Training and consulting service providers

- Cloud FSM vendors

- Cloud service providers

- Telecom service providers

- System integrators

- Cloud service providers

- Government agencies

- Managed service providers

The research study answers several questions for the stakeholders, primarily which market segments to focus on in the next 2 to 5 years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the cloud Field Service Management market to forecast the revenues and analyze the trends in each of the following submarkets:

By Type

- Solution

- Scheduling and Dispatch

- Service Project Management

- Mobile FSM

- Reporting and Analytics

- Work Order Management

- Warranty Management

- Inventory Management

- Others (Billing and Invoicing, and Tracking and Performance Management)

- Service

- Integration and Migration

- Training, Education, and Consulting

- Support and Maintenance

Cloud Field Service Management Market Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Vertical

- Manufacturing

- Transportation and Logistics

- Construction and Real Estate

- Energy and Utilities

- Healthcare and Life Sciences

- Retail and Consumer Goods

- BFSI

- Telecommunications and ITES

- Others (Government and Public Sector, and Hospitality and Entertainment)

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The cloud Field Service Management market is expected to grow from USD 1,013.2 Million in 2017 to USD 2,254.5 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 17.3% during the forecast period. The demand for cloud computing is driven by many factors, such as cost, flexibility, agility, and security. Cloud FSM combines the know-hows of research and innovation with the complete life cycle of cloud-ready solutions to offer reduced Time-to-Market (TTM) and enhanced operational processes.

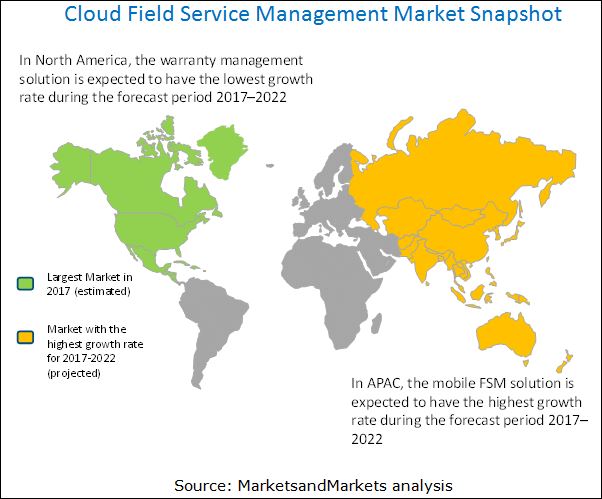

The market has been segmented on the basis of types, organization size, deployment models, verticals, and regions. The mobile FSM solution is expected to grow at the highest CAGR during the forecast period, and the scheduling and dispatch solution is estimated to have the largest market size in 2017 in the cloud FSM market. Adoption of cloud services among the Small and Medium-sized Enterprises (SMEs) segment has become an essential part of the business processes, due to the ease of use and flexibility offered by cloud services. The adoption trend is expected to continue in the coming years.

The public cloud deployment model is estimated to have the largest market share in 2017. With the help of cloud FSM solutions, enterprises are developing new and better ways to enhance the operational benefits, while reducing the overall costs. Lower costs and greater efficiency, and the growing adoption of Internet of Things (IoT) are driving the demand for cloud FSM solutions. The enterprises that are adopting cloud FSM solutions are also increasingly inclined toward deploying cloud-based solutions to run their other critical business functions, including finance, Human Resources (HR), operations, and logistics.

North America is estimated to have the largest market share in 2017, whereas the Asia Pacific (APAC) region is projected to grow at the highest CAGR during the forecast period in the cloud FSM market. The increasing need for efficient computing frameworks and the shifting of the workloads to the cloud environment are driving the growth of the cloud FSM market, globally.

The adoption of cloud FSM is increasing in the market, owing to the growing adoption of cloud-based services and the emergence of IoT. However, enterprises face some obstacles while adopting cloud FSM, due to the lack of awareness about cloud FSM solutions and the concerns related to regulatory compliance.

The major vendors providing cloud FSM solutions are Industrial and Financial Systems (IFS) AB (Sweden, Europe), ServiceNow, Inc. (California, US), Salesforce.com, Inc. (California, US), SAP SE (Germany, Europe), Oracle Corporation (California, US), International Business Machines (IBM) Corporation (New York, US), ServicePower Technologies plc (Cheshire, UK), ClickSoftware Technologies Ltd. (Massachusetts, US), ServiceMax, Inc. (California, US), Acumatica, Inc. (Washington, US), Microsoft Corporation (Washington, US), and Astea International Inc. (Pennsylvania, US). These players have adopted various strategies, such as new product developments, mergers and acquisitions, collaborations, and partnerships, to expand their presence in the global cloud Field Service Management market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Cloud Field Service Management Market

4.2 Market Size of Deployment Models, 20172022

4.3 Market Investment Scenario

4.4 Market, By Vertical, 20172022

5 Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Regulatory Implications

5.2.1 Payment Card Industry Data Security Standard (PCI-DSS)

5.2.2 Federal Information Security Management Act (FISMA)

5.2.3 International Organization for Standardization/ International Electrotechnical Commission 27018 ((ISO/IEC 27018)

5.3 Innovation Spotlight

5.4 Cloud Field Service Management Market: By Business Function

5.4.1 Human Resources

5.4.2 Information Technology

5.4.3 Finance

5.4.4 Operation

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Increasing Demand to Enhance Operational Productivity and Reduce Operating Costs

5.5.1.2 Focus on Offering Enhanced Customer Experience and Engagement

5.5.1.3 Emergence of IoT

5.5.2 Restraints

5.5.2.1 Lack of Awareness About Cloud Field Service Management Solutions

5.5.2.2 Compliance With Stringent Regulations

5.5.3 Opportunities

5.5.3.1 Increasing Adoption of SaaS

5.5.3.2 Machine Learning to Simplify Cloud Field Service Management

5.5.3.3 Increasing Demand for Highly Automated Solutions

5.5.4 Challenges

5.5.4.1 Maintaining Integration of the Existing Systems With Cloud Field Service Management Solutions

5.5.4.2 Change Management

6 Cloud Field Service Management Market Analysis, By Type (Page No. - 37)

6.1 Introduction

6.2 Solutions

6.2.1 Scheduling and Dispatch

6.2.2 Mobile Field Service Management

6.2.3 Reporting and Analytics

6.2.4 Service Project Management

6.2.5 Work Order Management

6.2.6 Inventory Management

6.2.7 Warranty Management

6.2.8 Others

6.3 Services

6.3.1 Training, Education, and Consulting

6.3.2 Integration and Migration

6.3.3 Support and Maintenance

7 Cloud Field Service Management Market Analysis, By Organization Size (Page No. - 48)

7.1 Introduction

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises

8 Cloud Field Service Management Market Analysis, By Deployment Model (Page No. - 52)

8.1 Introduction

8.2 Public Cloud

8.3 Private Cloud

8.4 Hybrid Cloud

9 Cloud Field Service Management Market Analysis, By Vertical (Page No. - 57)

9.1 Introduction

9.2 Manufacturing

9.3 Transportation and Logistics

9.4 Construction and Real Estate

9.5 Energy and Utilities

9.6 Healthcare and Life Sciences

9.7 Retail and Consumer Goods

9.8 Banking, Financial Services, and Insurance

9.9 Telecommunication and It

9.10 Others

10 Geographic Analysis (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Kingdom of Saudi Arabia

10.5.2 Africa

10.5.3 Rest of Middle East

10.6 Latin America

10.6.1 Brazil

10.6.2 Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 92)

11.1 Microquadrant Overview

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Benchmarking

11.2.1 Strength of Product Portfolio Adopted By Major Players in theMarket (25 Players)

11.2.2 Business Strategy Excellence Adopted By Major Players in the Market (25 Players)

12 Company Profiles (Page No. - 96)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

12.1 Industrial and Financial Systems AB

12.2 Servicenow, Inc.

12.3 Salesforce.Com, Inc.

12.4 SAP SE

12.5 Oracle Corporation

12.6 International Business Machines Corporation

12.7 Servicepower Technologies PLC

12.8 Clicksoftware Technologies Ltd.

12.9 Servicemax, Inc.

12.10 Acumatica, Inc.

12.11 Microsoft Corporation

12.12 Astea International Inc.

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 130)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (69 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Cloud Field Service Management Market Size, By Type, 20152022 (USD Million)

Table 3 Solutions: Market Size, By Type, 20152022 (USD Million)

Table 4 Scheduling and Dispatch Market Size, By Region, 20152022 (USD Million)

Table 5 Mobile Field Service Management Market Size, By Region, 20152022 (USD Million)

Table 6 Reporting and Analytics Market Size, By Region, 20152022 (USD Million)

Table 7 Service Project Management Market Size, By Region, 20152022 (USD Million)

Table 8 Work Order Management Market Size, By Region, 20152022 (USD Million)

Table 9 Inventory Management Market Size, By Region, 20152022 (USD Million)

Table 10 Warranty Management Market Size, By Region, 20152022 (USD Million)

Table 11 Other Solutions Market Size, By Region, 20152022 (USD Million)

Table 12 Services: Market Size, By Type, 20152022 (USD Million)

Table 13 Training, Education, and Consulting Market Size, By Region, 20152022 (USD Million)

Table 14 Integration and Migration Market Size, By Region, 20152022 (USD Million)

Table 15 Support and Maintenance Market Size, By Region, 20152022 (USD Million)

Table 16 Cloud Field Service Management Market Size, By Organization Size, 20152022 (USD Million)

Table 17 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 18 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 19 Market Size, By Deployment Model, 20152022 (USD Million)

Table 20 Public Cloud: Market Size, By Region, 20152022 (USD Million)

Table 21 Private Cloud: Market Size, By Region, 20152022 (USD Million)

Table 22 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 23 Cloud Field Service Management Market Size, By Vertical, 20152022 (USD Million)

Table 24 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 25 Transportation and Logistics: Market Size, By Region, 20152022 (USD Million)

Table 26 Construction and Real Estate: Market Size, By Region, 20152022 (USD Million)

Table 27 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 28 Healthcare and Life Sciences: Market Size, By Region, 20152022 (USD Million)

Table 29 Retail and Consumer Goods: Market Size, By Region, 20152022 (USD Million)

Table 30 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 31 Telecommunication and It: Market Size, By Region, 20152022 (USD Million)

Table 32 Others: Market Size, By Region, 20152022 (USD Million)

Table 33 Cloud Field Service Management Market Size, By Region, 20152022 (USD Million)

Table 34 North America: Market Size, By Country, 20152022 (USD Million)

Table 35 North America: Market Size, By Type, 20152022 (USD Million)

Table 36 North America: Market Size, By Solution, 20152022 (USD Million)

Table 37 North America: Market Size, By Service, 20152022 (USD Million)

Table 38 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 39 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 40 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 41 Europe: Cloud Field Service Management Market Size, By Country, 20152022 (USD Million)

Table 42 Europe: Market Size, By Type, 20152022 (USD Million)

Table 43 Europe: Market Size, By Solution, 20152022 (USD Million)

Table 44 Europe: Market Size, By Service, 20152022 (USD Million)

Table 45 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 46 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 47 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 48 Asia Pacific: Cloud Field Service Management Market Size, By Country, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 50 Asia Pacific: Market Size, By Solution, 20152022 (USD Million)

Table 51 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 52 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 53 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 55 Middle East and Africa: Cloud Field Service Management Market Size, By Country, 20152022 (USD Million)

Table 56 Middle East and Africa: Market Size, By Type, 20152022 (USD Million)

Table 57 Middle East and Africa: Market Size, By Solution, 20152022 (USD Million)

Table 58 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 59 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 60 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 61 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 62 Latin America: Cloud Field Service Management Market Size, By Country, 20152022 (USD Million)

Table 63 Latin America: Market Size, By Type, 20152022 (USD Million)

Table 64 Latin America: Market Size, By Solution, 20152022 (USD Million)

Table 65 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 66 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 67 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 68 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 69 Market Ranking for the Cloud Field Service Management Market, 2017

List of Figures (32 Figures)

Figure 1 Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Cloud Field Service Management Market: Assumptions

Figure 8 Market is Expected to Record High Growth During the Forecast Period

Figure 9 North America is Estimated to Hold the Largest Market Share in 2017

Figure 10 Top 3 Segments With the Largest Market Shares of the Market

Figure 11 Emergence of Internet of Things is Expected to Contribute to the Growth of the Market

Figure 12 Public Cloud is Estimated to Have the Largest Market Size in 2017

Figure 13 Asia Pacific is Expected to Emerge as the Best Market for Investment in the Next 5 Years

Figure 14 Manufacturing Vertical is Estimated to Have the Largest Market Share in 2017

Figure 15 Cloud Field Service Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Solutions Segment is Expected to Have A Larger Market Size During the Forecast Period

Figure 17 Scheduling and Dispatch Segment is Estimated to Have the Largest Market Size in 2017

Figure 18 Training, Education, and Consulting Segment is Estimated to Have the Largest Market Size in 2017

Figure 19 Large Enterprises Segment is Expected to Have A Larger Market Size During the Forecast Period

Figure 20 Public Cloud Deployment Model is Expected to Have the Largest Market Size During the Forecast Period

Figure 21 Manufacturing Vertical is Expected to Hold the Largest Market Size During the Forecast Period

Figure 22 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Cloud Field Service Management Market (Global), Competitive Leadership Mapping, 2017

Figure 26 Servicenow, Inc.: Company Snapshot

Figure 27 Salesforce.Com, Inc.: Company Snapshot

Figure 28 SAP SE: Company Snapshot

Figure 29 Oracle Corporation: Company Snapshot

Figure 30 International Business Machines Corporation: Company Snapshot

Figure 31 Microsoft Corporation: Company Snapshot

Figure 32 Astea International Inc.: Company Snapshot

Growth opportunities and latent adjacency in Cloud Field Service Management Market