Non-Volatile Memory Market by Type (Flash, EPROM, nvSRAM, EEPROM, 3D NAND, MRAM, FRAM, NRAM, ReRAM, PMC), Wafer Size (200 mm, 300mm), End-user (Consumer Electronics, Enterprise Storage, Healthcare, Automotive) and Region - Global Forecast to 2027

Updated on : Oct 23, 2024

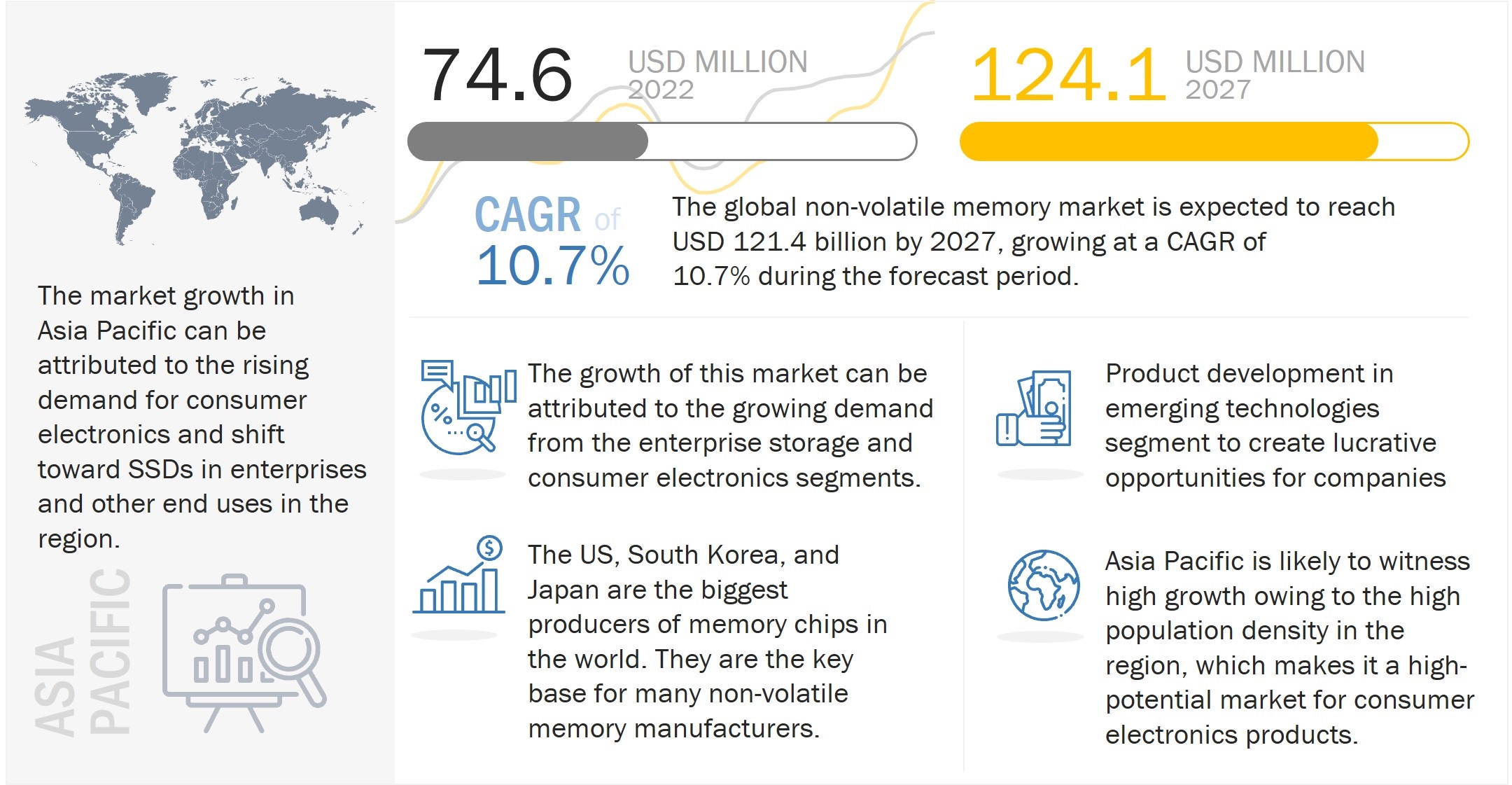

The Global Non-volatile memory market size is projected to grow to USD 124.1 billion by 2027 from USD 74.6 billion in 2022; growing at a CAGR of 10.7% from 2022 to 2027.

The market is driven by the increasing demand for high-speed, low-power, and reliable memory solutions. Non-volatile memory is a type of computer memory that can retain data even when the power is turned off, unlike volatile memory such as RAM. These memories are widely used in various applications such as smartphones, tablets, laptops, and data centers. The growing demand for data storage and processing capabilities, as well as the increasing adoption of emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT), are some of the key drivers of the non-volatile memory market.

Non-Volatile Memory Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Non-Volatile Memory Market Dynamics

Driver: Surging demand for smartphones and smart wearables

Smart technologies and consumer electronics are key end users of non-volatile memory. High-capacity memory solutions with a high data transfer rate are used in various connected devices, wearable devices, and other portable devices to store data. Flash memory provides a high-speed serial interface and optimized protocol that significantly improves throughput and overall system performance. It is designed with a high-performance interface for applications where power consumption needs to be reduced, such as mobile devices. These characteristics support the design of a new generation of devices that operate swiftly and have longer battery life, whether the user is taking photos, recording video, asking for directions, communicating with friends and coworkers, or simply accessing data from internal storage. NVM is also gaining traction in next-gen wearables such as smartwatches and glasses. It is highly preferred for applications requiring less density, such as streaming media devices, smart speakers, printers, wearables, and IoT devices, as it provides high memory storage and performance capability. For instance, Samsung (South Korea) has started the mass production of 3D NAND flash memories that are extensively used in connected device applications. Micron Technology, Inc. (US) launched SLC NAND flash with embedded applications for the IoT market. Other companies, such as Adesto Technologies (US) and Everspin Technologies (US), are also focusing on offering dedicated memory solutions for IoT and wearable sensors. As per the Semiconductor Industry Association, in 2021, the demand for semiconductor memory chips, logic, and ICs grew by over 20%. Consumer electronics such as smartphones, PCs, laptops, and smart wearables accounted for about 45% of the global semiconductor demand. Also, of this demand, over one-third was for memory chips. Thus, the recent influx in consumer electronics demand, especially smartphones, AI/NLP integrated home entertainment, infotainment, security systems, appliances, and PCs, is expected to drive the demand for non volatile memory across the globe.

Restraint: Decline in the growth of the semiconductor industry

The semiconductor industry is cyclic in nature and always faces highs and lows in intervals. In September 2022, the Semiconductor Sector Association (SIA) reported that sales for the semiconductor industry worldwide in July 2022 totaled USD 49.0 billion, an increase of 7.3% over the USD 45.7 billion total from July 2021 but a reduction of 2.3% from the USD 50.2 billion total from June 2022. The decreased demand for laptops, Chromebooks, TVs, and smartphones and the growth in client inventory levels were caused by the persistently low consumer demand. Strong enterprise SSD spending has continued, counteracting weak consumer demand. Even while average smartphone capacity is still increasing, the drop in shipments has negated demand for mobile NAND Flash due to the low consumer demand. Client SSD shipments have remained steady because of PC customers’ continued reduction in shipment expectations. Thus, it seems the US–Taiwan–China geopolitical tensions, Russia–Ukraine war, and rising inflation are expected to depress the demand in the last two quarters of FY2022, slowing the growth of the non-volatile memory market.

Opportunity: Advent of innovative technologies for IoT applications

The increasing replacement of traditional memories with emerging non-volatile memories offers a significant opportunity for market players. Traditional memory technologies, such as DRAM and flash, have captured a major share of the memory technology market. The Non-Volatile Memory Industry is currently experiencing a significant shift as emerging technologies are increasingly replacing traditional memories like DRAM and flash. Traditional flash memories have limitations, such as slow switching rate, high latency, and low scalability. They face limitations of scalability below 90 nm while using floating gate technology and consume more power than other emerging memory technologies. Currently, flash memories are being used in smartphones, tablets, and PDAs. The major alternatives to flash memories are 3D NAND, ReRAM, NRAM, and MRAM, which are superior to flash memories in terms of latency, switching time, endurance, write cycle, and data retention. AI and IoT integrated solutions are major users of such technologies. A NVM that supports fast writes and can be shut down fully but quickly restarted. MRAM is a good fit for the IoT and AI use cases since it has better capacity, density, power requirements, quick writing performance, and extremely low read latency. While ReRam is suited for in-memory computing. A second-generation ReRAM device is being developed in collaboration between Fujitsu and Panasonic. Additionally, SMIC (China) is developing a 40 nm ReRAM technology that Crossbar Inc. is sampling.

Challenge: Optimization of storage densities and capacities

Memory storage density stores the information bits on a computer storage medium. Higher-density memory is more in demand as it allows greater volumes of data to be stored in the same physical space. Thus, storage density directly correlates with a given medium’s storage capacity. Storage density also has a fairly direct effect on performance and price.

High-density memories such as RRAM, NAND flash, and NVDIMM face numerous challenges related to poor scalability. Scalability refers to the ability of a product to function well even when there is a change in its size and capacity. These memories cannot adhere to the required endurance, noise margin, and reliability levels. There are also issues related to scalability in flash memory, which have been difficult to overcome. In addition, there is limited capacity for electron storage in high-density non-volatile memories. The impact of this challenge is high at present, but it is expected to reduce in the near future.

The 300 mm wafer size segment exhibits the highest CAGR in the Non-volatile memory market

Nearly all new fab upgrades and construction activities are taking place with 300 mm wafer processing. Over the last several years, there has been a tremendous increase in 300 mm (12″) wafer usage. Nearly all major chip manufacturers have either already built or have plans to build 300 mm fabrications, and nearly all equipment manufacturers have designed their new equipment with 12″ wafers. All 300 mm wafers are double-side polished and have a notch identical to the notch found on 200 mm wafers. Typically, over 600 or more chips can be manufactured from one 300 mm wafer. There are about 28 companies that own and operate 300 mm wafer fabs. The distribution of 300 mm wafers is controlled by the five manufacturers who own over three-quarters of the global 300 mm IC capacity including SAMSUNG, Micron Technology, Inc., SK HYNIX INC., TSMC, and Western Digital Technologies, Inc.

Flash memory segment to hold the largest size of Non-volatile memory market

Flash memory is an electronic non-volatile computer storage device that can be electrically erased and reprogrammed. There are two main types of flash memory – NAND and NOR. The internal characteristics of the individual flash memory cells exhibit characteristics like those of the corresponding NAND and NOR gates. Unlike EPROMs where data needs to be completely erased before being rewritten, NAND-type flash memory may be written and read in blocks (or pages), which are generally much smaller than the entire device. The NOR type allows a single machine word (byte) to be written or read independently. Flash memory is widely adopted in consumer electronics, enterprise storage, and industrial applications.

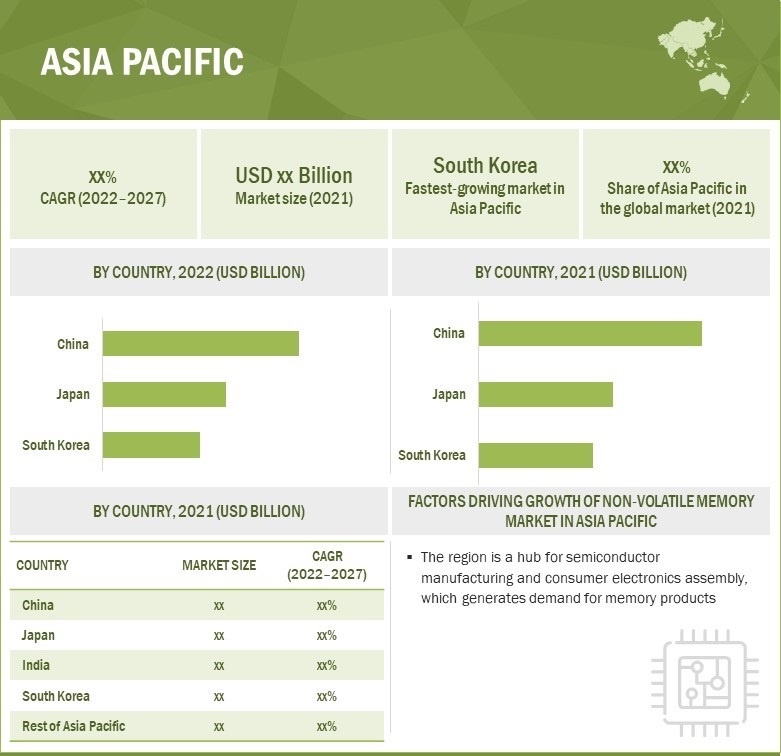

Non-volatile memory market in Asia Pacific to grow at the highest rate during the forecast period

The non-volatile memory market in Asia Pacific region is expected to be one of the key market for NVM in the future, owing to the varied applications of non-volatile memory. The market growth can be attributed to the region's high population density, making it a high-potential market for consumer electronic products. The increasing demand for non volatile memory (NVM) in consumer electronic products is driving the market in Asia Pacific. The Asia Pacific region comprises some of the leading countries in the field of electronics, such as China, Japan, Taiwan, and India. The region is a hub for significant semiconductor and electronics manufacturing. This is one of the vital factors fueling the market in the region.

Non-Volatile Memory Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Non-Volatile Memory Market Key Players

The non-volatile memory market players have implemented various types of organic as well as inorganic growth strategies, such as new product launches, and acquisitions to strengthen their offerings in the market.

The non-volatile memory companies are SAMSUNG (South Korea), Western Digital Technologies, Inc. (US), KIOXIA Holdings Corporation (Japan), Micron Technology, Inc. (US), and SK HYNIX INC. (South Korea) among others. The other companies profiled in the report are Microchip Technology Inc. (US), ROHM CO., LTD. (Japan), Renesas Electronics Corporation (Japan), STMicroelectronics (US), Infineon Technologies AG (Germany), Nantero, Inc. (US), Crossbar Inc. (US), Everspin Technologies Inc. (US), Winbond (Taiwan), Pure Storage, Inc. (US), Fujitsu (Japan), Viking Technology (US), NVMdurance (Ireland), Avalanche Technology (US), SMART Modular Technologies (US), Flexxon Pte Ltd (Singapore), YMTC (China), ATP Electronics, Inc. (Taiwan), HT Micron (Brazil), and SkyHigh Memory Limited (China).

Scope of the Report

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 74.6 Billion |

|

Revenue Forecast in 2027 |

USD 124.1 billion |

|

Growth Rate |

10.7% |

|

Base Years considered |

2021 |

|

Historical Data Available for Years |

2018-2027 |

|

Forecast Period |

2022–2027 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Type, Wafer Size, and End User |

|

Regions covered |

Non-volatile Memory Market regions – North America, Europe, APAC, and Rest of World |

|

Companies covered |

SAMSUNG (South Korea), Western Digital Technologies, Inc. (US), KIOXIA Holdings Corporation (Japan), Micron Technology, Inc. (US), and SK HYNIX INC. (South Korea) among others. The other companies profiled in the report are Microchip Technology Inc. (US), ROHM CO., LTD. (Japan), Renesas Electronics Corporation (Japan), STMicroelectronics (US), Infineon Technologies AG (Germany), Nantero, Inc. (US), Crossbar Inc. (US), Everspin Technologies Inc. (US), Winbond (Taiwan), Pure Storage, Inc. (US), Fujitsu (Japan), Viking Technology (US), NVMdurance (Ireland), Avalanche Technology (US), SMART Modular Technologies (US), Flexxon Pte Ltd (Singapore), YMTC (China), ATP Electronics, Inc. (Taiwan), HT Micron (Brazil), and SkyHigh Memory Limited (China). The study includes an in-depth competitive analysis of these key players in the non-volatile memory (NVM) market with their company profiles, and key market strategies. |

|

Largest Growing Region |

Asia Pacific |

|

Largest Market Share Segment |

Flash Memory |

|

Highest CAGR Segment |

300 mm Wafer Size |

|

Largest Application Market Share |

Consumer Electronics |

Non-Volatile Memory Market Highlights

In this report, the overall NVM market has been segmented based on type, wafer size, , end use, and region.

|

Aspect |

Details |

|

By Type: |

|

|

By Wafer Size: |

|

|

By End User: |

|

|

By Region: |

|

Recent Developments

- September 2022, KIOXIA America, Inc., a subsidiary of KIOXIA Holdings Corporation, introduced industrial-grade flash dive - KIOXIA BiCS FLASH 3D memory.

- August 2022, SAMSUNG launched a high-performance 990 PRO SSD for gaming and creative applications.

- August 2022, SAMSUNG unveiled an array of next-gen flash memory solutions - Petabyte Storage, Memory-semantic SSD, and two enterprise SSDs. SAMSUNG also developed 2nd generation SmartSSD storage drive with upgraded processing functionality.

- July 2022, Western Digital Technologies, Inc. launched 2 HDDs for three key market segments – IT/data center, network attached storage (NAS), and smart video/surveillance.

Frequently Asked Questions (FAQs):

Who are the top 5 players in the non-volatile memory market?

The major vendors operating in the industry market are SAMSUNG (South Korea), Western Digital Technologies, Inc. (US), KIOXIA Holdings Corporation (Japan), Micron Technology, Inc. (US), and SK HYNIX INC. (South Korea)

What are some of the technological advancements in the non-volatile memory market?

The merging of memory and storage and hybrid main memory is the key trend in this industry to save costs and space for the overall system and improve efficiency and performance. Hybrid main memory is one of the trending technology trends in the market. Hybrid main memory is a type where DRAM serves as a cache for non-volatile memory. This is accomplished either by dividing the memory address across two or more memory technologies or by using the faster memory technology with a longer lifespan, typically the DRAM, as a cache for the NVM-based main memory, which has a higher capacity but is slower and less responsive.

What are the factors driving the growth of the non-volatile memory market?

Surging demand for consumer electronics and the shift towards SSDs from HDDs is driving the demand for non-volatile memory market.

What are their major strategies to strengthen non-volatile memory market presence?

The major strategies adopted by these players are product launches and contracts.

Which major countries are considered in the European region of non-volatile memory market?

The report includes an analysis of the UK, Germany, France, and the Rest of Europe.

Which major countries are considered in the APAC region of non-volatile memory market?

The report includes an analysis of China, Japan, India, South Korea, and the Rest of Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 NON-VOLATILE MEMORY MARKET

FIGURE 2 NON-VOLATILE MEMORY MARKET, BY GEOGRAPHY

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 3 NON-VOLATILE MEMORY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 4 RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from secondary sources

2.1.3.3 Primary interviews

2.1.3.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 5 BOTTOM-UP APPROACH: MARKET SIZE ESTIMATION METHODOLOGY

FIGURE 6 MARKET SIZE ESTIMATION RESEARCH METHODOLOGY

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

FIGURE 9 NON-VOLATILE MEMORY MARKET, 2018–2027

FIGURE 10 NON VOLATILE MEMORY MARKET (THOUSAND PETABYTES), 2018–2027

FIGURE 11 CONSUMER ELECTRONICS SEGMENT HELD LARGEST SHARE OF NON VOLATILE MEMORY MARKET, BY END USER, IN 2021

FIGURE 12 NON VOLATILE MEMORY MARKET, BY TYPE, 2022 VS 2027

FIGURE 13 NON VOLATILE MEMORY MARKET, BY WAFER SIZE, 2022

FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF NON VOLATILE MEMORY MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR NON-VOLATILE MEMORY MARKET PLAYERS

FIGURE 15 HIGH ADOPTION OF MEMORY STORAGE DEVICES IN CONSUMER ELECTRONICS TO PROPEL MARKET GROWTH

4.2 NON VOLATILE MEMORY MARKET, BY TYPE

FIGURE 16 TRADITIONAL SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2021

4.3 NON VOLATILE MEMORY MARKET, BY END USER

FIGURE 17 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 NON VOLATILE MEMORY MARKET, BY REGION

FIGURE 18 MARKET IN ASIA PACIFIC TO GROW SIGNIFICANTLY DURING FORECAST PERIOD

4.5 ASIA PACIFIC: NVM MARKET, BY END USER AND COUNTRY

FIGURE 19 CONSUMER ELECTRONICS AND CHINA LARGEST SHAREHOLDERS OF NVM MARKET IN ASIA PACIFIC IN 2021

4.6 NVM MARKET, BY GEOGRAPHY

FIGURE 20 SOUTH KOREA TO REGISTER HIGHEST CAGR IN NVM MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 NON-VOLATILE MEMORY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 22 IMPACT OF DRIVERS ON NON VOLATILE MEMORY MARKET

5.2.1.1 Surging demand for smartphones and smart wearables

5.2.1.2 Shift from hard disk drives (HDDs) toward solid-state drives (SSDs) in enterprise storage

TABLE 1 DIFFERENCE BETWEEN SSD AND HDD

5.2.1.3 Increasing demand for fast access and low power-consuming memory devices

TABLE 2 ATTRIBUTES OF DIFFERENT TYPES OF NON-VOLATILE MEMORIES

5.2.1.4 Integration of emerging technologies to support digitalization in automotive sector

FIGURE 23 GLOBAL VEHICLE PRODUCTION, 2017–2021 (MILLION UNITS)

5.2.2 RESTRAINTS

FIGURE 24 IMPACT OF RESTRAINTS ON NVM MARKET

5.2.2.1 Low write endurance rate

TABLE 3 WRITE ENDURANCE OF DIFFERENT MEMORY TECHNOLOGIES

5.2.2.2 Decline in growth of semiconductor industry

5.2.3 OPPORTUNITIES

FIGURE 25 IMPACT OF OPPORTUNITIES ON NVM MARKET

5.2.3.1 Advent of innovative technologies for IoT applications

5.2.3.2 Increasing traction of industrial-grade flash memories

5.2.4 CHALLENGES

FIGURE 26 IMPACT OF CHALLENGES ON NVM MARKET

5.2.4.1 Optimization of storage densities and capacities

5.2.4.2 High design costs and complexities

5.3 VALUE CHAIN ANALYSIS

FIGURE 27 NON-VOLATILE MEMORY MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 28 NON VOLATILE MEMORY MARKET: ECOSYSTEM ANALYSIS

TABLE 4 NVM MARKET: ROLE IN ECOSYSTEM

5.5 TRENDS IMPACTING CUSTOMERS’ BUSINESSES

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 NON-VOLATILE MEMORY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

5.7.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA, BY END USER

TABLE 7 KEY BUYING CRITERIA, BY END USER

5.8 PRICING ANALYSIS

FIGURE 31 AVERAGE SELLING PRICE OF NON-VOLATILE MEMORY MODULES, BY TECHNOLOGY TYPE

TABLE 8 AVERAGE SELLING PRICE OF NON-VOLATILE MEMORY MODULES, BY COMPANY

TABLE 9 PRICE OF NON-VOLATILE MEMORY, BY COMPANY

5.9 CASE STUDY ANALYSIS

5.9.1 EVERSPIN SIGNED CONTRACT WITH QUICK LOGIC CORPORATION TO PROVIDE MRAM

5.9.2 NVMDURANCE EXTENDED NAND FLASH LIFETIME OF ALTERA’S NVME DATA STORAGE SOLUTION

5.9.3 EVERSPIN TECHNOLOGIES HELPS BMW OPTIMIZE MOTORSPORT SUPERBIKE WITH MRAM MEMORY

5.10 TECHNOLOGY ANALYSIS

5.10.1 COMPLEMENTARY TECHNOLOGY

5.10.2 ADJACENT TECHNOLOGY

5.11 PATENT ANALYSIS

FIGURE 32 PATENT ANALYSIS

TABLE 10 PATENTS RELATED TO NON-VOLATILE MEMORY MARKET

5.12 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 11 NON-VOLATILE MEMORY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 REGULATORY LANDSCAPE

5.13.2.1 US regulations

5.13.2.1.1 California Consumer Privacy Act

5.13.2.1.2 Anticybersquatting Consumer Protection Act

5.13.2.2 EU regulations

5.13.2.2.1 General Data Protection Regulation

5.13.3 STANDARDS

5.13.3.1 CEN/ISO

5.13.3.2.1 ISO/IEC JTC 1/SC 3 1

5.13.3.2.2 ISO/IEC JTC 1/SC 27

5.13.3.3 European Technical Standards Institute (ETSI)

5.13.3.4 Institute of Electrical and Electronics Engineers Standards Association (IEEE)

5.13.4 TARIFF ANALYSIS

TABLE 16 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY US, 2020

TABLE 17 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY CHINA, 2020

TABLE 18 TARIFF FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY GERMANY, 2020

5.14 TRADE ANALYSIS

TABLE 19 EXPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 33 EXPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 20 IMPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 34 IMPORT DATA FOR HS CODE 854232, BY COUNTRY, 2017–2021 (USD MILLION)

6 NON-VOLATILE MEMORY MARKET, BY TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 35 NON-VOLATILE MEMORY MARKET, BY TYPE, 2022–2027

TABLE 21 NON VOLATILE MEMORY MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 22 NVM MARKET, BY TYPE, 2022–2027 (USD BILLION)

6.2 TRADITIONAL NON-VOLATILE MEMORY

TABLE 23 TRADITIONAL: NVM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 24 TRADITIONAL: NVM MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2.1 FLASH MEMORY

6.2.1.1 Most prominently used non-volatile memory type

6.2.1.2 NAND flash

6.2.1.3 NOR flash

TABLE 25 FLASH MEMORY: NOR AND NAND

TABLE 26 FLASH MEMORY: NVM MARKET, BY END USER, 2018–2021 (USD MILLION)

FIGURE 36 NON-VOLATILE FLASH MEMORY MARKET, BY END USER (USD BILLION), 2022–2027

TABLE 27 FLASH MEMORY: NVM MARKET, BY END USER, 2022–2027 (USD MILLION)

6.2.2 ELECTRICALLY ERASABLE PROGRAMMABLE READ-ONLY MEMORY (EEPROM)

6.2.2.1 Offers non-volatility, byte-level control, simplicity of usage, and low power consumption

TABLE 28 EEPROM: NVM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 29 EEPROM: NVM MARKET, BY END USER, 2022–2027 (USD MILLION)

6.2.3 NON-VOLATILE SRAM (NVSRAM)

6.2.3.1 Provides unlimited read and write cycles

TABLE 30 NVSRAM: NVM MARKET, BY END USER, 2018–2021 (USD THOUSAND)

TABLE 31 NVSRAM: NVM MARKET, BY END USER, 2022–2027 (USD THOUSAND)

6.2.4 ERASABLE PROGRAMMABLE READ-ONLY MEMORY (EPROM)

6.2.4.1 Addresses limitations of ROM and PROM

TABLE 32 EPROM: NVM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 33 EPROM: NON VOLATILE MEMORY MARKET, BY END USER, 2022–2027 (USD MILLION)

6.3 EMERGING NON-VOLATILE MEMORY

FIGURE 37 EMERGING NON VOLATILE MEMORY MARKET, BY END USER (USD BILLION), 2022–2027

TABLE 34 EMERGING: NVM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 EMERGING: NVM MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.1 3D NAND

6.3.1.1 Market for 3D NAND reaching maturity stage

TABLE 36 3D NAND: NON VOLATILE MEMORY MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 37 3D NAND: NVM MARKET, BY END USER, 2022–2027 (USD MILLION)

6.3.2 MAGNETO-RESISTIVE RANDOM ACCESS MEMORY (MRAM)

6.3.2.1 Offers improved data fidelity and system form factor

TABLE 38 MRAM: NON VOLATILE MEMORY MARKET, BY END USER, 2018–2021 (USD MILLION)

FIGURE 38 MRAM: NVM MARKET, BY END USER (USD MILLION), 2022–2027

TABLE 39 MRAM: NVM MARKET, BY END USER, 2022–2027 (USD MILLION)

6.3.3 FERROELECTRIC RANDOM ACCESS MEMORY (FRAM)

6.3.3.1 Apt for mission-critical applications

TABLE 40 FRAM: NON VOLATILE MEMORY MARKET, BY END USER, 2018–2021 (USD THOUSAND)

TABLE 41 FRAM: NVM MARKET, BY END USER, 2022–2027 (USD THOUSAND)

6.3.4 RESISTIVE RANDOM ACCESS MEMORY (RERAM)

6.3.4.1 Deployed in low-power applications

TABLE 42 RERAM: NON VOLATILE MEMORY MARKET, BY END USER, 2018–2021 (USD MILLION)

FIGURE 39 RERAM NVM MARKET, BY END USER (USD MILLION), 2022–2027

TABLE 43 RERAM: NVM MARKET, BY END USER, 2022–2027 (USD MILLION)

6.3.5 PHASE CHANGE MEMORY (PCM)

6.3.5.1 Most developed emerging NVM technology

TABLE 44 PCM: NON VOLATILE MEMORY MARKET, BY END USER, 2018–2021 (USD THOUSAND)

TABLE 45 PCM: NVM MARKET, BY END USER, 2022–2027 (USD THOUSAND)

6.3.6 NANOTUBE-BASED NON-VOLATILE RANDOM-ACCESS MEMORY (NRAM)

6.3.6.1 Provides very-high-density memory solutions

TABLE 46 NRAM: NON VOLATILE MEMORY MARKET, BY END USER, 2018–2021 (USD THOUSAND)

FIGURE 40 NRAM: NVM MARKET, BY END USER (MILLION), 2022–2027

TABLE 47 NRAM: NVM MARKET, BY END USER, 2022–2027 (USD THOUSAND)

6.3.7 NON-VOLATILE DUAL IN-LINE MEMORY MODULE (NVDIMM)

6.3.7.1 Hybrid memory that retains data during service outage

TABLE 48 NVDIMM: NON VOLATILE MEMORY MARKET, BY END USER, 2018–2021 (USD THOUSAND)

TABLE 49 NVDIMM: NVM MARKET, BY END USER, 2022–2027 (USD THOUSAND)

6.3.8 OTHERS (NANOBRIDGE, QUANTUM-DOT, MILLIPEDE, MOLECULAR, TRANSPARENT/FLEXIBLE)

TABLE 50 OTHERS: NVM MARKET, BY END USER, 2018–2021 (USD THOUSAND)

TABLE 51 OTHERS: NVM MARKET, BY END USER, 2022–2027 (USD THOUSAND)

7 NON-VOLATILE MEMORY MARKET, BY WAFER SIZE (Page No. - 111)

7.1 INTRODUCTION

FIGURE 41 NON VOLATILE MEMORY MARKET, BY WAFER SIZE

TABLE 52 NVM MARKET, BY WAFER SIZE, 2018–2021 (USD BILLION)

TABLE 53 NVM MARKET, BY WAFER SIZE, 2022–2027 (USD BILLION)

7.2 200 MM

7.2.1 USED IN ELECTRONIC PRODUCTS

7.3 300 MM

7.3.1 MOST NVM CHIPS MANUFACTURED FROM 300 MM WAFERS

TABLE 54 WAFER FABRICATION FACILITIES IN US, 2021

8 NON-VOLATILE MEMORY MARKET, BY END USER (Page No. - 115)

8.1 INTRODUCTION

FIGURE 42 NON VOLATILE MEMORY MARKET, BY END USER, 2022 & 2027

TABLE 55 NVM MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 56 NVM MARKET, BY END USER, 2022–2027 (USD MILLION)

8.2 CONSUMER ELECTRONICS

8.2.1 CONSUMER ELECTRONICS EQUIPPED WITH NON-VOLATILE MEMORY DELIVER HIGH PERFORMANCE WHILE CONSUMING LOW POWER

8.2.1.1 Use case: Mobile phones, tablets, and laptops

8.2.1.2 Use case: Wearable electronic devices

8.2.1.3 Use case: Smart home (lighting control, security & access control, smart kitchen, and others)

8.2.1.4 Use case: Others (washing machines, dishwashers, and more)

FIGURE 43 CONSUMER ELECTRONICS: NVM MARKET, BY TYPE, 2022–2027

TABLE 57 CONSUMER ELECTRONICS: NVM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 58 CONSUMER ELECTRONICS: NVM MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 59 CONSUMER ELECTRONICS: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 60 CONSUMER ELECTRONICS: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 61 CONSUMER ELECTRONICS: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 62 CONSUMER ELECTRONICS: NVM MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD MILLION)

8.3 ENTERPRISE STORAGE

8.3.1 HYBRID MEMORY CUBE AND HIGH-BANDWIDTH MEMORY SUITABLE FOR ENTERPRISE STORAGE APPLICATIONS

FIGURE 44 ENTERPRISE STORAGE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022–2027

TABLE 63 ENTERPRISE STORAGE: NVM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 64 ENTERPRISE STORAGE: NVM MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 65 ENTERPRISE STORAGE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 66 ENTERPRISE STORAGE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 67 ENTERPRISE STORAGE: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 68 ENTERPRISE STORAGE: NON VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD MILLION)

8.4 AUTOMOTIVE & TRANSPORTATION

8.4.1 EMERGENCE OF INFOTAINMENT AND TELEMATICS TO FUEL DEMAND FOR NVM

8.4.1.1 Use case: Smart airbags

8.4.1.2 Use case: Navigation

8.4.1.3 Use case: Black box

TABLE 69 AUTOMOTIVE & TRANSPORTATION: NON VOLATILE MEMORY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 70 AUTOMOTIVE & TRANSPORTATION: NVM MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 71 AUTOMOTIVE & TRANSPORTATION: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 72 AUTOMOTIVE & TRANSPORTATION: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 73 AUTOMOTIVE & TRANSPORTATION: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD THOUSAND)

TABLE 74 AUTOMOTIVE & TRANSPORTATION: NVM MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD THOUSAND)

8.5 MILITARY & AEROSPACE

8.5.1 HIGH STORAGE DENSITY AND LOW COST MAKE FLASH MEMORY IDEAL FOR MILITARY & AEROSPACE APPLICATIONS

TABLE 75 MILITARY & AEROSPACE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 76 MILITARY & AEROSPACE: NON VOLATILE MEMORY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 77 MILITARY & AEROSPACE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 78 MILITARY & AEROSPACE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 79 MILITARY & AEROSPACE: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD THOUSAND)

TABLE 80 MILITARY & AEROSPACE: NVM MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD THOUSAND)

8.6 INDUSTRIAL

8.6.1 NON-VOLATILE MEMORY USED FOR DATA BACKUP AND FASTER READ/WRITE OPERATIONS

8.6.1.1 Use case: Industrial automation

8.6.1.2 Use case: HMI

8.6.1.3 Use case: PLC

TABLE 81 INDUSTRIAL: NVM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 82 INDUSTRIAL: NVM MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 83 INDUSTRIAL: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 84 INDUSTRIAL: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 85 INDUSTRIAL: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD THOUSAND)

TABLE 86 INDUSTRIAL: NVM MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD THOUSAND)

8.7 TELECOMMUNICATION

8.7.1 ADVENT OF 5G TO GENERATE DEMAND FOR EMERGING NVM

8.7.1.1 Use case: Cybersecurity & networking

TABLE 87 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 88 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 89 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 90 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 91 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 92 TELECOMMUNICATION: NON-VOLATILE MEMORY MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD MILLION)

8.8 ENERGY & POWER

8.8.1 FLASH MEMORY USED WIDELY IN ENERGY AND POWER APPLICATIONS

8.8.1.1 Use case: Smart grid

8.8.1.2 Use case: Smart metering

8.8.1.3 Use case: Solar and wind applications

TABLE 93 ENERGY & POWER: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 94 ENERGY & POWER: NON VOLATILE MEMORY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 95 ENERGY & POWER: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 96 ENERGY & POWER: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 97 ENERGY & POWER: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD THOUSAND)

TABLE 98 ENERGY & POWER: NVM MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD THOUSAND)

8.9 HEALTHCARE

8.9.1 EMERGENCE OF DATA-DRIVEN DIAGNOSIS TO CREATE DEMAND FOR NVM

8.9.1.1 Use case: Pacemakers

8.9.1.2 Use case: Heart rate monitors and health monitoring devices

TABLE 99 HEALTHCARE: NVM MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 100 HEALTHCARE: NVM MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 101 HEALTHCARE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 102 HEALTHCARE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 103 HEALTHCARE: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 104 HEALTHCARE: NVM MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD MILLION)

8.10 AGRICULTURE

8.10.1 HEIGHTENED FOCUS ON MONITORING AND ANALYSIS IN AGRICULTURE TO GENERATE DEMAND FOR NVM

8.10.1.1 Use case: Field/crop management

8.10.1.2 Use case: Soil analysis/monitoring

TABLE 105 AGRICULTURE: NON-VOLATILE MEMORY MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 106 AGRICULTURE: NON VOLATILE MEMORY MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 107 AGRICULTURE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD MILLION)

TABLE 108 AGRICULTURE: NVM MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD MILLION)

TABLE 109 AGRICULTURE: NVM MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD THOUSAND)

TABLE 110 AGRICULTURE: NVM MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD THOUSAND)

8.11 RETAIL

8.11.1 RETAIL SEGMENT TO BE DRIVEN BY DIGITAL TRANSFORMATION

8.11.1.1 Use case: Inventory management

TABLE 111 RETAIL: NON-VOLATILE MEMORY (NVM) MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 112 RETAIL: NON-VOLATILE MEMORY (NVM) MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 113 RETAIL: NON-VOLATILE MEMORY (NVM) MARKET, BY TRADITIONAL MEMORY TYPE, 2018–2021 (USD THOUSAND)

TABLE 114 RETAIL: NON-VOLATILE MEMORY (NVM) MARKET, BY TRADITIONAL MEMORY TYPE, 2022–2027 (USD THOUSAND)

TABLE 115 RETAIL: NON-VOLATILE MEMORY (NVM) MARKET, BY EMERGING MEMORY TYPE, 2018–2021 (USD THOUSAND)

TABLE 116 RETAIL: NON-VOLATILE MEMORY (NVM) MARKET, BY EMERGING MEMORY TYPE, 2022–2027 (USD THOUSAND)

9 NON-VOLATILE MEMORY MARKET, BY REGION (Page No. - 148)

9.1 INTRODUCTION

FIGURE 45 NON-VOLATILE MEMORY (NVM) MARKET IN ASIA PACIFIC TO GROW AT SIGNIFICANT PACE FROM 2022 TO 2027

TABLE 117 NON-VOLATILE MEMORY (NVM) MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 NON-VOLATILE MEMORY (NVM) MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: NON-VOLATILE MEMORY MARKET SNAPSHOT

9.2.1 US

9.2.1.1 Surge in enterprise storage applications to support market

9.2.2 CANADA

9.2.2.1 Close ties with US to pivot NVM market growth in Canada

9.2.3 MEXICO

9.2.3.1 Focus on improving semiconductor production capability to boost market

TABLE 119 NORTH AMERICA: NVM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 NORTH AMERICA: NVM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 47 EUROPE: NON VOLATILE MEMORY MARKET SNAPSHOT

9.3.1 GERMANY

9.3.1.1 Growth of end user industries to accelerate market growth

9.3.2 UK

9.3.2.1 High consumption of non-volatile memory to drive market

9.3.3 FRANCE

9.3.3.1 High demand from enterprise storage segment to foster market growth

9.3.4 REST OF EUROPE

TABLE 121 EUROPE: NVM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 EUROPE: NVM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: NON VOLATILE MEMORY MARKET SNAPSHOT

9.4.1 CHINA

9.4.1.1 Government support for R&D of non-volatile memory technologies to back market growth

9.4.2 JAPAN

9.4.2.1 Presence of memory and digital device manufacturers to favor market

9.4.3 INDIA

9.4.3.1 Focus on domestic production of semiconductors to augment market growth

9.4.4 SOUTH KOREA

9.4.4.1 Presence of established consumer electronics industry to support market expansion

9.4.5 REST OF ASIA PACIFIC

TABLE 123 ASIA PACIFIC: NON VOLATILE MEMORY (NVM) MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: NON VOLATILE MEMORY (NVM) MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 125 REST OF THE WORLD: NVM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 REST OF THE WORLD: NVM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 166)

10.1 STRATEGIES ADOPTED BY KEY PLAYERS

10.1.1 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

TABLE 127 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

10.2 NON-VOLATILE MEMORY MARKET: REVENUE ANALYSIS

FIGURE 49 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN NON VOLATILE MEMORY MARKET

10.3 MARKET SHARE ANALYSIS (2021)

TABLE 128 NON VOLATILE MEMORY MARKET: MARKET SHARE ANALYSIS

10.4 COMPANY EVALUATION QUADRANT, 2021

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 50 NON-VOLATILE MEMORY (NVM) MARKET (GLOBAL): KEY COMPANY EVALUATION QUADRANT, 2021

10.4.5 COMPETITIVE BENCHMARKING

TABLE 129 NVM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 130 NVM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

10.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 51 MARKET (GLOBAL), SME EVALUATION QUADRANT, 2021

TABLE 131 MARKET: COMPANY FOOTPRINT

TABLE 132 MARKET: TYPE FOOTPRINT

TABLE 133 MARKET: END USER FOOTPRINT

TABLE 134 MARKET: REGION FOOTPRINT

10.6 COMPETITIVE SCENARIOS AND TRENDS

10.6.1 PRODUCT LAUNCHES

TABLE 135 MARKET: PRODUCT LAUNCHES, JUNE 2018–SEPTEMBER 2022

10.6.2 DEALS

TABLE 136 MARKET: DEALS, MAY 2018–SEPTEMBER 2022

10.6.3 OTHERS

TABLE 137 NON-VOLATILE MEMORY MARKET: OTHERS, DECEMBER 2020–OCTOBER 2022

11 COMPANY PROFILES (Page No. - 186)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

11.1 KEY PLAYERS

11.1.1 SAMSUNG

TABLE 138 SAMSUNG: COMPANY OVERVIEW

FIGURE 52 SAMSUNG: COMPANY SNAPSHOT

TABLE 139 SAMSUNG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 140 SAMSUNG: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 141 SAMSUNG: DEALS

TABLE 142 SAMSUNG: OTHERS

11.1.2 WESTERN DIGITAL TECHNOLOGIES, INC.

TABLE 143 WESTERN DIGITAL TECHNOLOGIES, INC.: COMPANY OVERVIEW

FIGURE 53 WESTERN DIGITAL TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 144 WESTERN DIGITAL TECHNOLOGIES, INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

TABLE 145 WESTERN DIGITAL TECHNOLOGIES, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 146 WESTERN DIGITAL TECHNOLOGIES, INC.: DEALS

TABLE 147 WESTERN DIGITAL TECHNOLOGIES, INC.: OTHERS

11.1.3 KIOXIA HOLDINGS CORPORATION

TABLE 148 KIOXIA HOLDINGS CORPORATION: COMPANY OVERVIEW

FIGURE 54 KIOXIA HOLDINGS CORPORATION: COMPANY SNAPSHOT

TABLE 149 KIOXIA HOLDINGS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 150 KIOXIA HOLDINGS CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 151 KIOXIA HOLDINGS CORPORATION: DEALS

TABLE 152 KIOXIA HOLDINGS CORPORATION: OTHERS

11.1.4 MICRON TECHNOLOGY, INC.

TABLE 153 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

FIGURE 55 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

TABLE 154 MICRON TECHNOLOGY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 155 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 156 MICRON TECHNOLOGY, INC.: OTHERS

11.1.5 SK HYNIX INC.

TABLE 157 SK HYNIX INC.: COMPANY OVERVIEW

FIGURE 56 SK HYNIX INC.: COMPANY SNAPSHOT

TABLE 158 SK HYNIX INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 159 SK HYNIX INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 160 SK HYNIX INC.: DEALS

11.1.6 MICROCHIP TECHNOLOGY INC.

TABLE 161 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

FIGURE 57 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

TABLE 162 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 163 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.7 ROHM CO., LTD.

TABLE 164 ROHM CO., LTD.: COMPANY OVERVIEW

FIGURE 58 ROHM CO., LTD.: COMPANY SNAPSHOT

TABLE 165 ROHM CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.1.8 RENESAS ELECTRONICS CORPORATION

TABLE 166 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

FIGURE 59 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

TABLE 167 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

11.1.9 STMICROELECTRONICS

TABLE 168 STMICROELECTRONICS: COMPANY OVERVIEW

FIGURE 60 STMICROELECTRONICS: COMPANY SNAPSHOT

TABLE 169 STMICROELECTRONICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 170 STMICROELECTRONICS: PRODUCT LAUNCHES

11.1.10 INFINEON TECHNOLOGIES AG

TABLE 171 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

FIGURE 61 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

TABLE 172 INFINEON TECHNOLOGIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 173 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.11 NANTERO, INC.

TABLE 174 NANTERO, INC.: COMPANY OVERVIEW

TABLE 175 NANTERO, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 176 NANTERO, INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.12 CROSSBAR, INC.

TABLE 177 CROSSBAR, INC.: COMPANY OVERVIEW

TABLE 178 CROSSBAR, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 179 CROSSBAR, INC.: DEALS

11.1.13 EVERSPIN TECHNOLOGIES INC.

TABLE 180 EVERSPIN TECHNOLOGIES INC.: COMPANY OVERVIEW

FIGURE 62 EVERSPIN TECHNOLOGIES INC.: COMPANY SNAPSHOT

TABLE 181 EVERSPIN TECHNOLOGIES INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

TABLE 182 EVERSPIN TECHNOLOGIES INC.: PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 183 EVERSPIN TECHNOLOGIES INC.: DEALS

TABLE 184 EVERSPIN TECHNOLOGIES INC.: OTHERS

11.1.14 WINBOND

TABLE 185 WINBOND: COMPANY OVERVIEW

FIGURE 63 WINBOND: COMPANY SNAPSHOT

TABLE 186 WINBOND: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 187 WINBOND: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.15 PURE STORAGE, INC.

TABLE 188 PURE STORAGE, INC.: COMPANY OVERVIEW

FIGURE 64 PURE STORAGE, INC.: COMPANY SNAPSHOT

TABLE 189 PURE STORAGE, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 FUJITSU

11.2.2 VIKING TECHNOLOGY

11.2.3 NVMDURANCE

11.2.4 AVALANCHE TECHNOLOGY

11.2.5 SMART MODULAR TECHNOLOGIES

11.2.6 FLEXXON PTE LTD

11.2.7 YMTC

11.2.8 ATP ELECTRONICS, INC.

11.2.9 HT MICRON

11.2.10 SKYHIGH MEMORY LIMITED

12 APPENDIX (Page No. - 240)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

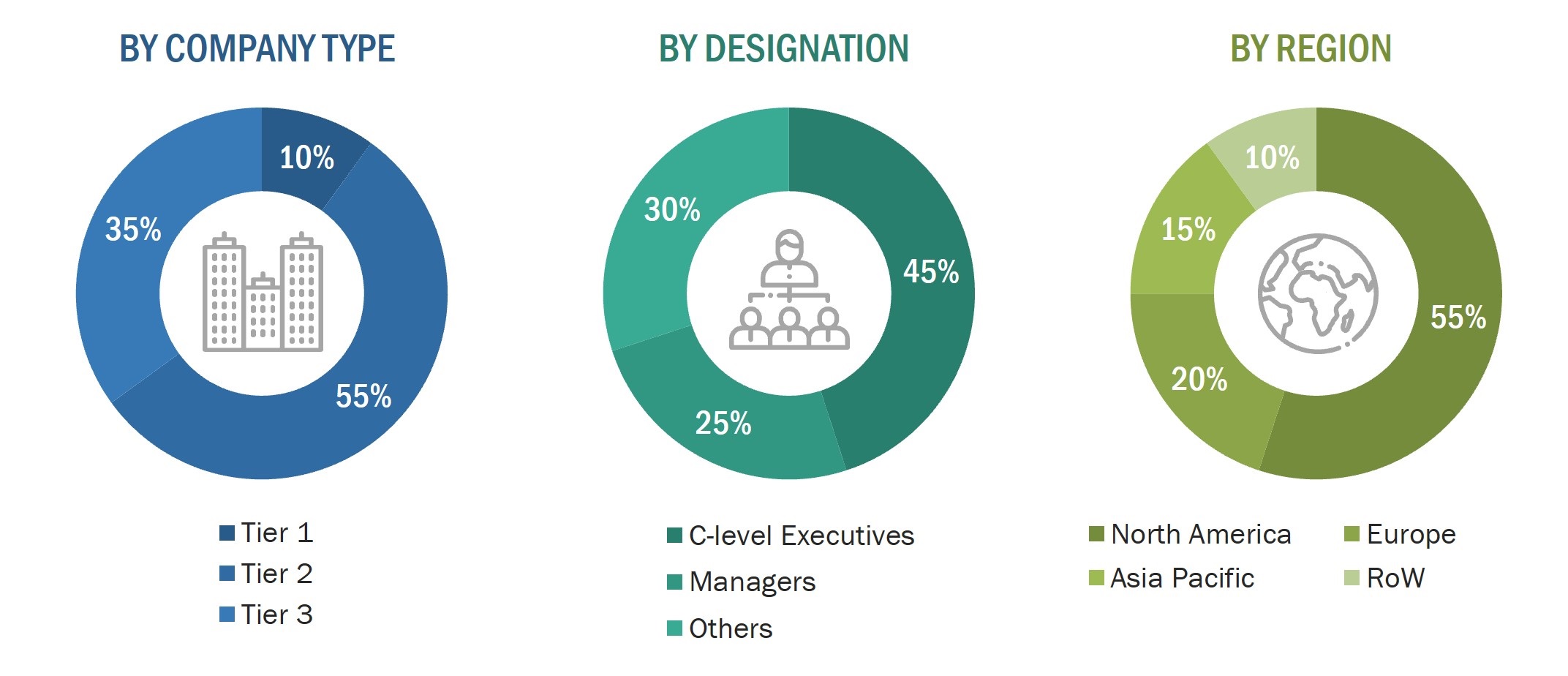

The study involves four major activities for estimating the size of the non-volatile memory market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Bottom-up approaches have been used to estimate and validate the size of the non-volatile memory market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as the United States Government Accountability Office, the Organization for Economic Co-operation and Development (OECD), the Federation of American Scientists, the Center for Security and Emerging Technology, the Japan External Trade Organization (JETRO), Semiconductor Industry Association, and SEMI others have been used to identify and collect information for an extensive technical and commercial study of the non-volatile memory market.

Primary Research

Extensive primary research was conducted after understanding and analyzing the non-volatile memory market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across major regions—North America, Europe, APAC, and RoW. Approximately 30% of the primary interviews were conducted with the demand-side vendors and 70% with the supply-side vendors. This primary data was mainly collected through telephonic interviews/web conferences, which consist of 85% of total primary interviews, as well as questionnaires and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The non-volatile memory market consists of technology types: traditional and emerging. Non-volatile memory is usually employed in the following end-users; consumer electronics, enterprise storage, automotive and transportation, military & aerospace, industrial, telecommunication, energy & power, healthcare, agricultural, and retail.

Top-down and bottom-up approaches have been used to estimate and validate the size of the non-volatile memory market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the non-volatile memory market, in terms of value, by type, wafer size, and end user.

- To describe and forecast the non-volatile memory market, in terms of value, for four main regions – North America, Europe, APAC, and Rest of the World.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the non-volatile memory market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the non-volatile memory ecosystem

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D), in the non-volatile memory market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Non-Volatile Memory Market Growth

The non-volatile memory (NVM) market is a growing segment of the semiconductor industry that is driven by factors such as the neexd for faster and more efficient storage solutions, data security, and the adoption of connected devices.

NVM includes several types such as flash memory, magnetic RAM (MRAM), resistive RAM (RRAM), phase change memory (PCM), and ferroelectric RAM (FeRAM), each with its own advantages and disadvantages.

The market is highly competitive, with major players such as Samsung, Intel, Micron Technology, Toshiba, and Western Digital.

Growth Opportunities for Flash Memory Market

The flash memory market is a subset of the non-volatile memory market and is expected to experience significant growth opportunities in the coming years. Flash memory is a type of NVM that is widely used in consumer electronics, including smartphones, digital cameras, USB drives, and memory cards. The following are some of the key growth opportunities for the flash memory market:

- Increasing demand for smartphones: The growing adoption of smartphones worldwide is a major driver of the flash memory market. As consumers demand more storage space for their smartphones, the need for higher-capacity flash memory chips increases. In addition, the rising popularity of mobile gaming and high-quality video streaming is also driving demand for larger capacity flash memory chips.

- Growth of the Internet of Things (IoT): The IoT is a network of connected devices that collect and exchange data. These devices require low-power, high-capacity storage solutions, making flash memory an ideal choice. As the IoT continues to grow, the demand for flash memory chips is expected to increase.

- Expansion of cloud computing: Cloud computing has become an increasingly popular way for businesses to store and access their data. Flash memory is a preferred storage solution for cloud providers because of its speed, durability, and energy efficiency. The growth of cloud computing is expected to drive the demand for flash memory in the data center market.

Scope of NAND Memory Market

The NAND memory market is a subset of the non-volatile memory market. It is a significant segment of the semiconductor industry and is driven by factors such as the growing demand for high-capacity storage, the proliferation of mobile devices, the growth of the data center market, technological advancements, and the competitive landscape.

NAND memory is used in consumer electronics, such as smartphones and tablets, as well as in data centers and other storage devices. Manufacturers are developing new technologies to improve the performance and capacity of NAND memory chips, and the market is highly competitive. The market is expected to continue to grow in the coming years as the demand for data storage and processing continues to increase.

Future Growth of 3D NAND Memory Market

The 3D NAND memory market is expected to experience significant growth in the coming years due to increasing demand for high-capacity storage, advancements in technology, growth of the data center market, increasing adoption of solid-state drives, and the competitive landscape. 3D NAND memory provides higher storage densities and faster data access than traditional hard disk drives, making it attractive to businesses and consumers. The market is highly competitive, with major players investing in research and development to gain a competitive edge.

Future Use-Cases of Flash Memory Market

The flash memory market is expected to experience significant growth in the coming years, with a wide range of use cases in various industries. Here are some potential future use cases for flash memory:

- Autonomous vehicles: As the development of autonomous vehicles continues, the demand for high-capacity, reliable storage solutions is likely to increase. Flash memory is an ideal solution for storing the vast amounts of data generated by autonomous vehicles, such as sensor data, maps, and navigation information.

- Internet of Things (IoT): The growth of the IoT is creating new opportunities for flash memory, as devices such as smart home appliances, wearables, and industrial sensors require low-power, high-capacity storage solutions.

- Artificial intelligence (AI): The growth of AI is driving the demand for high-performance computing and storage solutions. Flash memory can provide the fast data access speeds and high-capacity storage required for AI applications.

- Cloud computing: Cloud computing is driving the demand for high-capacity, reliable storage solutions. Flash memory is widely used in solid-state drives (SSDs) for cloud storage, as it provides fast data access speeds and high levels of reliability.

- Gaming: The gaming industry is increasingly reliant on fast storage solutions to provide a seamless gaming experience. Flash memory can provide the fast data access speeds required for high-performance gaming.

- Mobile devices: The proliferation of smartphones and tablets is driving the demand for high-capacity, low-power storage solutions. Flash memory is widely used in mobile devices, as it provides high levels of reliability, low power consumption, and fast data access speeds.

Key Challenges for Flash Memory Market

The flash memory market is expected to experience significant growth in the coming years, but it also faces several key challenges that could impact its growth potential. Here are some of the key challenges for the flash memory market:

- Cost: The cost of flash memory is relatively high compared to traditional hard disk drives, which may limit its adoption in some markets. The cost of flash memory is expected to decline over time, but it may still be a significant barrier to adoption in some industries.

- Limited endurance: Flash memory has a limited number of write cycles, which can affect its long-term reliability. This is a particular concern in applications where data is frequently overwritten, such as video surveillance or other high-write applications.

- Density limitations: While flash memory has higher storage densities than traditional hard disk drives, it also has density limitations. As the demand for higher capacity storage solutions continues to grow, manufacturers will need to develop new technologies to increase the storage density of flash memory.

- Security: As the amount of sensitive data stored on flash memory devices continues to grow, so too does the need for secure storage solutions. Flash memory devices may be vulnerable to hacking or other security breaches, which could compromise the data stored on them.

- Technological obsolescence: The flash memory market is highly competitive, with manufacturers constantly developing new technologies to improve performance and capacity. This can lead to rapid technological obsolescence, with older flash memory technologies quickly becoming outdated.

- Environmental concerns: The production of flash memory devices can have environmental impacts, as it involves the use of chemicals and other resources. The disposal of end-of-life flash memory devices can also be a concern, as they may contain hazardous materials.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Non-Volatile Memory Market

This reports would be of great interest to me