Nickel Cadmium Battery Market Size, Share, Statistics and Industry Growth Analysis Report by Type (C, D, A, AA, AAA, 9 V), Block Battery Construction (L Range, M Range, H Range), End-user (Aerospace & Defense, Automotive, Consumer Electronics, Healthcare, Industrial, Marine) and Region - Global Forecast to 2027

Updated on : September 23, 2024

Nickel Cadmium Battery Market Size & Growth

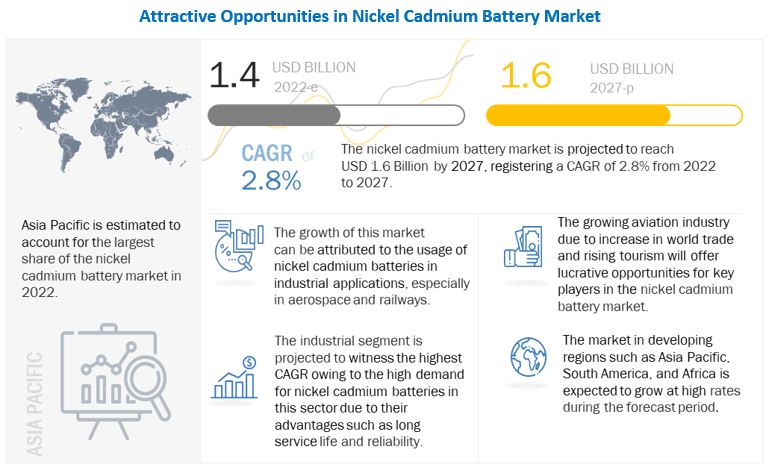

The Nickel Cadmium Battery Market size Report Share is estimated to be USD 1.4 Billion in 2022 and expected to reach USD 1.6 Billion by 2027, growing at a CAGR of 2.8% during the forecast period from 2022 to 2027.

The nickel cadmium (NiCd) battery market is experiencing steady demand, primarily driven by its established applications in various sectors, including telecommunications, emergency lighting, and power tools. One of the key factors contributing to this demand is the superior performance of NiCd batteries in extreme temperatures and their ability to deliver consistent power output over extended periods. Despite the growing competition from newer battery technologies, such as lithium-ion, NiCd batteries remain popular due to their durability, rechargeability, and resistance to overcharging. Key trends influencing the market include advancements in battery technology aimed at improving energy density and reducing environmental impact, as well as a resurgence in interest due to the need for reliable backup power solutions in critical applications. Furthermore, regulatory developments around battery disposal and recycling are prompting manufacturers to innovate and enhance the sustainability of NiCd battery production. As industries continue to prioritize reliability and performance, the nickel cadmium battery market is expected to maintain its relevance and evolve in response to changing technological landscapes.

Presently, the majority of Ni-Cd batteries are adopted in industrial applications as these batteries are being replaced in the majority of consumer applications due to the toxicity of cadmium and its harmful effects on the environment and human health. However, due to advantages such as long life, low maintenance, gradual capacity loss, and resistance to mechanical & environmental abuse, these batteries are still being widely used in industrial applications across sectors such as oil & gas, energy & power, mining, manufacturing, aerospace & defense, automotive & transportation, marine, healthcare, and others. Hence, their adoption in industrial applications will drive the growth of the global Ni-Cd battery Industry during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Nickel Cadmium Battery Market Trends and Dynamics

DRIVERS: Surging adoption in railway applications due to long service life and other advantages

Nickel cadmium batteries are widely used in the railway sector for powering a wide range of systems. The batteries are used in railways and underground metros for backup power systems, emergency lighting, emergency braking systems, coach lighting, heating & air conditioning systems, etc. The batteries can be used to start the locomotive engines, and they store backup power for signaling and warning lights in low-visibility areas. In rail applications, batteries must be resistant to high temperatures, have frequent battery charge-discharge cycling, and be tolerant to overcharge or over-discharge. Due to all these requirements, nickel cadmium batteries are preferred in the railway sector.

RESTRAINT: Harmful effects of cadmium on environment and human health

Cadmium when exposed to open air environments can be harmful to the environment and fatal to human health. Cadmium is toxic and can accumulate as build-ups in plants, animals, and micro-organisms, which are then consumed by other food chain players. In this way, cadmium can go up in the food chain and impact human health too. Cadmium is a toxic chemical, which when exposed to humans can cause severe issues in the human body. Moreover, studies have been carried out on the harmful effects of cadmium exposure, which show that humans who are regularly exposed to cadmium can suffer from lung cancers. The other critical aftereffects of cadmium in the human body are damages related to the kidneys and blood filtration systems, which can be fatal in the long term. The harmful effects of cadmium are acting as a restraint for the usage of this material in Ni-Cd batteries.

OPPORTUNITIES: Growing aviation industry

The aviation industry includes commercial and private sectors. Defense and freight transportation is projected to grow tremendously in the coming years. The commercial aviation sector is booming owing to increased tourism activities post-pandemic and trends such as staycation. The cargo supply chain activities across the world are also increasing due to the rising need for emergency supplies, e-commerce growth, and just-in-time deliveries. The growth in the aviation sector will result in increased aircraft manufacturing. Nickel cadmium batteries are widely used in aircraft for various applications such as emergency lighting, engine starting, intercommunication devices, and critical backup power for aircraft control & signaling systems. Hence, the demand for nickel cadmium batteries in the aviation sector is expected to grow in the coming years.

CHALLENGES: Availability of other superior battery technologies

The nickel cadmium batteries have been around in the industry for a long period. The batteries have been used in small consumer electronics as well as in large aircraft carriers. As the battery industry progresses, new technologies are being researched and developed, which can take over the current battery industry. These new battery technologies being developed are proving to be superior to nickel cadmium batteries. Due to the challenges associated with nickel cadmium batteries such as the toxic nature of cadmium, memory effect, and less energy density, these batteries are being replaced by newer, sustainable, and safer battery options such as lithium-ion and nickel-metal hydride, especially in consumer electronics and small portable tools/devices. The newer battery technologies have enhanced energy density with high-performance traits and are also safe for humans as well as the environment. Hence, improved battery technologies are being adopted across many applications and are replacing Ni-Cd, which may hamper the growth of the nickel cadmium battery market.

Nickel Cadmium Battery Market Segmentation

The L Range segment of nickel cadmium battery market is projected to grow at a reasonable CAGR during the forecast period.

The L range nickel cadmium batteries are typically built for applications where power is required for a longer period. The discharge period of these batteries is long, which provides low currents and a reliable energy supply for a longer period. The battery construction includes typically thick plates and is usually used in bulk storage applications. The capacity of the L-range batteries differs from company to company and is usually between 8 Ah to 1,680 Ah. The L Range batteries are used in applications such as emergency lighting, railway signaling, DC instrumentation, photovoltaic systems, fire alarms, telecom, switchgear protection, and cathodic protection. For instance, Saft Groupe SAS provides a KPL range of batteries for long-lasting performance, which provides energy over a long discharge period.

The industrial end-user is expected to hold largest market share during the forecast period

Nickel cadmium batteries are widely used in industries such as oil & gas, renewable energy, power, mining, chemical, and manufacturing. Batteries used in these industries must be able to offer safe and continuous operation to support critical loads, start alternative generators, control shut-down processes, and safeguard computer data in industries. The process industries need batteries, which do not compromise on providing excellent performance in harsh environments and any temperature extremes. The batteries used in the industries must be free from maintenance and should be able to offer long service life. Nickel cadmium batteries provide reliable backup power and are well suited to operate in complex situations due to which they are preferred in industrial applications.

To know about the assumptions considered for the study, download the pdf brochure

Nickel Cadmium Battery Industry Regional Analysis

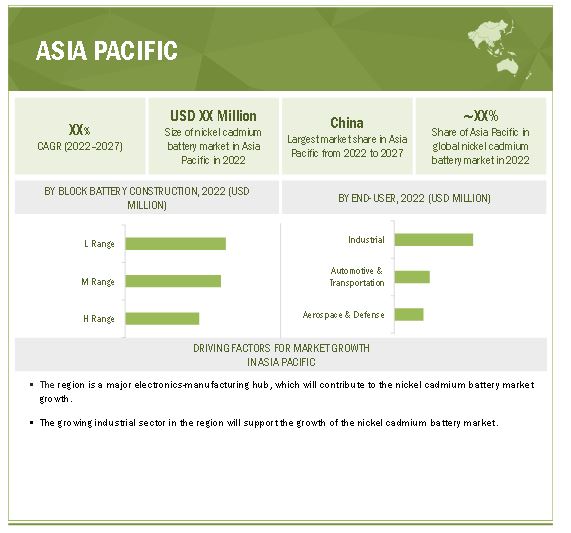

The market in Asia Pacific projected to grow at the highest CAGR from 2022 to 2027.

The Asia Pacific nickel cadmium battery market size are expected to exhibit high growth rates in the coming years. The region mainly consists of developing countries where the industrial sector is booming. Nickel cadmium batteries are used in various industries such as oil & gas, renewable energy, power, mining, and manufacturing. High growth in the manufacturing and power sectors is anticipated to drive the demand for Ni-Cd batteries in the region. China is a global manufacturing hub for batteries, consumer electronics, automotive, electronic components, and others. Growing industrial manufacturing activities and the increasing demand for consumer electronics are creating an opportunity for the players in the nickel cadmium battery market. Moreover, the country also has a strong medical devices and pharmaceutical manufacturing industry, which creates a significant potential market for nickel cadmium batteries. Nickel cadmium batteries are widely used in medical equipment as they provide better energy density than any other battery in the same domain with long service life. Also, the battery is rechargeable with fast charging, which makes it ideal for medical devices

Top Nickel Cadmium Battery Companies - Key Market Players

- ALCAD A.B. (Sweden),

- EnerSys (US),

- GS Yuasa Corporation (Japan),

- HOPPECKE Batterien GmbH & Co. KG (Germany),

- HBL Power Systems Limited (India),

- Saft Groupe SAS (France) are among a few top players in the Nickel Cadmium Battery Companies.

Nickel Cadmium Battery Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 1.4 Billion |

| Revenue Forecast in 2027 | USD 1.6 Billion |

| Growth Rate | 2.8% |

|

Historical Data Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | Surging adoption in railway applications due to long service life and other advantages |

| Key Market Opportunity | Growing aviation industry |

| Largest Growing Region | Asia Pacific |

| Highest CAGR Segment | L range nickel cadmium batteries |

This research report categorizes the Nickel Cadmium Battery Market share by Cell Type, Type, Block Battery Construction, End-user, and Region.

Based on Cell Type, the Nickel Cadmium Battery Market been Segmented as follows:

- Vented Cells

- Sealed Cells

Based on Type, the Nickel Cadmium Battery Market been Segmented as follows:

- C Batteries

- D Batteries

- A Batteries

- AA Batteries

- AAA Batteries

- 9 V Batteries

Based on Block Battery Construction, the Nickel Cadmium Battery Market been Segmented as follows:

- L Range

- M Range

- H Range

Based on End-User, the Nickel Cadmium Battery Market been Segmented as follows:

- Aerospace & Defense

- Automotive & Transportation

- Consumer Electronics

- Healthcare

- Industrial

- Marine

- Others

Based on Region, the Nickel Cadmium Battery Market been Segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- South America

Recent Developments in Nickel Cadmium Battery Industry

- In April 2022, EnerSys partnered with Orogenic ApS to allow Orogenic to handle all sales and distribution of Motive Power products in Denmark, Iceland, the Faroe Islands, and Greenland.

- In December 2020, ALCAD A.B. launched a range of space-saving maintenance-free batteries for stationary applications, where space is limited, and reliable power supply is critical.

- In September 2020, Saft Groupe SAS launched a new range of reliable, compact, maintenance-free nickel batteries with the lowest cost of ownership (TCO) for industrial applications.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the nickel cadmium battery market size during 2022-2027?

The global nickel cadmium battery market is expected to record a CAGR of 2.8% from 2022–2027.

What are the driving factors for the nickel cadmium battery market share?

Surging adoption in railway applications due to long service life of Ni-Cd batteries and growing adoption in critical industries for emergency backup power applications are key driving factors for this nickel cadmium battery market.

Which are the significant players operating in the nickel cadmium battery market share?

ALCAD A.B. (Sweden), EnerSys (US), GS Yuasa Corporation (Japan), HOPPECKE Batterien GmbH & Co. KG (Germany), and Saft Groupe SAS (France) are among a few key players in the nickel cadmium battery market.

Which region will grow at a fast rate in the future?

The nickel cadmium battery market in Asia Pacific region is expected to grow at the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 NICKEL CADMIUM BATTERY MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 MARKET: RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach used to arrive at market size by bottom-up analysis (demand-side)

FIGURE 4 NICKEL CADMIUM BATTERY MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach used to capture market size by using top-down analysis (supply-side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET USING SUPPLY-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 9 NICKEL CADMIUM BATTERY MARKET, 2018–2027 (USD MILLION)

FIGURE 10 C-TYPE BATTERIES TO HOLD LARGEST MARKET SIZE IN 2027

FIGURE 11 L-RANGE BATTERIES TO CONTINUE TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 12 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2027

FIGURE 13 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MARKET

FIGURE 14 GROWING AVIATION SECTOR TO FUEL MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET, BY TYPE

FIGURE 15 C-TYPE BATTERIES TO HOLD LARGEST MARKET SIZE IN 2027

4.3 MARKET, BY BLOCK BATTERY CONSTRUCTION

FIGURE 16 M-RANGE BATTERIES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY END-USER

FIGURE 17 INDUSTRIAL SEGMENT TO HOLD LARGEST SIZE OF MARKET IN 2027

4.5 MARKET IN NORTH AMERICA, BY COUNTRY AND END-USER

FIGURE 18 INDUSTRIAL AND US TO BE LARGEST SHAREHOLDERS OF NORTH AMERICAN MARKET IN 2027

4.6 MARKET, BY COUNTRY

FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 GLOBAL NICKEL CADMIUM BATTERY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Surging adoption in railway applications due to long service life and other advantages

5.2.1.2 Growing adoption in critical industries for emergency power backup applications

TABLE 1 BATTERY COMPARISON: NI-CD VS. LEAD-ACID

FIGURE 21 MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Harmful effects of cadmium on environment and human health

5.2.2.2 Limited energy density and other performance issues

TABLE 2 LIMITATIONS OF NI-CD BATTERIES

FIGURE 22 MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing aviation industry

5.2.3.2 Increasing renewable energy practices globally

FIGURE 23 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Availability of other superior battery technologies

TABLE 3 COMPARISON BETWEEN DIFFERENT BATTERY TECHNOLOGIES

FIGURE 24 MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 26 MARKET: ECOSYSTEM ANALYSIS

TABLE 4 MARKET: ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 5 INDICATIVE PRICE OF NICKEL CADMIUM BATTERIES, BY TYPE

5.5.1 AVERAGE SELLING PRICE OF NICKEL CADMIUM BATTERIES OFFERED BY KEY PLAYERS

FIGURE 27 AVERAGE SELLING PRICE OF NICKEL CADMIUM BATTERIES OFFERED BY KEY PLAYERS

TABLE 6 AVERAGE SELLING PRICE OF NICKEL CADMIUM BATTERIES OFFERED BY KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 METAL-AIR BATTERIES

5.7.2 LIQUID-METAL BATTERIES

5.7.3 ZINC-MANGANESE BATTERIES

5.7.4 VANADIUM-FLOW BATTERIES

5.7.5 LITHIUM-SILICON BATTERIES

5.7.6 LITHIUM-COBALT OXIDE

5.7.7 NICKEL-MANGANESE-COBALT

5.7.8 LITHIUM-NICKEL-COBALT-ALUMINUM OXIDE

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 NICKEL CADMIUM BATTERY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USERS

TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USERS (%)

5.9.2 BUYING CRITERIA

FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END-USERS

TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USERS

5.10 CASE STUDIES

TABLE 10 NICKEL CADMIUM BATTERY AS EMERGENCY BACKUP SYSTEM IN UNDERGROUND SUBWAY TRAIN

TABLE 11 NICKEL CADMIUM BATTERY AS LARGEST UPS SYSTEM FOR DATA CENTERS IN EUROPE

TABLE 12 NICKEL CADMIUM STORAGE BATTERY TO BE INSTALLED IN SAHARA DESERT

5.11 TRADE ANALYSIS

FIGURE 31 IMPORT DATA FOR NICKEL CADMIUM ACCUMULATORS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

FIGURE 32 EXPORT DATA FOR NICKEL CADMIUM ACCUMULATORS, BY KEY COUNTRY, 2017−2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 34 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

TABLE 13 LIST OF A FEW PATENTS IN MARKET, 2019–2021

TABLE 14 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 15 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.1 STANDARDS

TABLE 20 STANDARDS FOR NICKEL CADMIUM BATTERIES

6 VARIOUS CELL TYPES USED IN NICKEL CADMIUM BATTERIES (Page No. - 79)

6.1 INTRODUCTION

FIGURE 35 MARKET, BY CELL TYPE

6.2 VENTED CELLS

6.2.1 POCKET PLATE

6.2.2 FIBER PLATE

6.2.3 SINTERED PLATE

TABLE 21 SINTERED PLATE NICKEL CADMIUM BATTERY: ADVANTAGES AND DISADVANTAGES

6.3 SEALED CELLS

TABLE 22 SEALED NICKEL CADMIUM BATTERIES: ADVANTAGES AND DISADVANTAGES

7 NICKEL CADMIUM BATTERY MARKET, BY TYPE (Page No. - 81)

7.1 INTRODUCTION

FIGURE 36 MARKET, BY TYPE

TABLE 23 NI-CD VS. NIMH BATTERIES: COMPARISON

FIGURE 37 C-TYPE BATTERIES TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 24 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 C BATTERIES

7.2.1 GROWING ADOPTION OF C-TYPE BATTERIES IN INDUSTRIAL APPLICATIONS

TABLE 26 C BATTERIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 C BATTERIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 D BATTERIES

7.3.1 LONG BATTERY LIFE OF D-TYPE BATTERIES

TABLE 28 D BATTERIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 D BATTERIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 A BATTERIES

7.4.1 WIDE USAGE OF A-TYPE BATTERIES IN PORTABLE ELECTRONIC DEVICES

TABLE 30 A BATTERIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 A BATTERIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 AA BATTERIES

7.5.1 RISING ADOPTION OF LOW-DRAIN PORTABLE DEVICES ACROSS INDUSTRIES

TABLE 32 AA BATTERIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 AA BATTERIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 AAA BATTERIES

7.6.1 INCREASING ADOPTION OF PORTABLE ELECTRONICS

TABLE 34 AAA BATTERIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 AAA BATTERIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.7 9 V BATTERIES

7.7.1 GROWING ADOPTION OF MEDICAL DEVICES AND POWER TOOLS

TABLE 36 9 V BATTERIES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 9 V BATTERIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NICKEL CADMIUM BATTERY MARKET, BY BLOCK BATTERY CONSTRUCTION (Page No. - 90)

8.1 INTRODUCTION

FIGURE 38 MARKET, BY BLOCK BATTERY CONSTRUCTION

TABLE 38 MARKET, BY BLOCK BATTERY CONSTRUCTION

FIGURE 39 L RANGE SEGMENT TO CONTINUE TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 39 MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 40 MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

8.2 L RANGE

8.2.1 GROWING DEMAND FOR LONG-LIFE BATTERIES IN INDUSTRIAL APPLICATIONS

TABLE 41 L RANGE: MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 42 L RANGE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 43 L RANGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 L RANGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 M RANGE

8.3.1 RISING DEMAND FROM MIXED-LOAD APPLICATIONS WITH MEDIUM DISCHARGE REQUIREMENTS

TABLE 45 M RANGE: MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 46 M RANGE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 47 M RANGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 M RANGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 H RANGE

8.4.1 INCREASING USE IN HIGH-DISCHARGE APPLICATIONS

TABLE 49 H RANGE: MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 50 H RANGE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 51 H RANGE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 H RANGE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 NICKEL CADMIUM BATTERY MARKET, BY END-USER (Page No. - 98)

9.1 INTRODUCTION

FIGURE 40 MARKET, BY END-USER

TABLE 53 MARKET, BY END-USER: KEY APPLICATIONS

FIGURE 41 INDUSTRIAL END-USER SEGMENT TO CONTINUE TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 54 MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 55 MARKET, BY END-USER, 2022–2027 (USD MILLION)

9.2 AEROSPACE & DEFENSE

9.2.1 INCREASED AIRCRAFT MANUFACTURING AND TOURISM

TABLE 56 AEROSPACE & DEFENSE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 57 AEROSPACE & DEFENSE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 58 AEROSPACE & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 AEROSPACE & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 AUTOMOTIVE & TRANSPORTATION

9.3.1 HIGH ADOPTION IN RAILWAYS SECTOR

TABLE 60 AUTOMOTIVE & TRANSPORTATION: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 61 AUTOMOTIVE & TRANSPORTATION: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 62 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 CONSUMER ELECTRONICS

9.4.1 INCREASED DEMAND FOR LONG LIFE CYCLE AND LOW MAINTENANCE

TABLE 64 CONSUMER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 HEALTHCARE

9.5.1 HIGH RELIABILITY AND STABILITY OFFERED BY NI-CD BATTERIES

TABLE 66 HEALTHCARE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 67 HEALTHCARE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 68 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 INDUSTRIAL

9.6.1 REQUIREMENT FOR CONSISTENT PERFORMANCE IN HARSH ENVIRONMENTS

TABLE 70 INDUSTRIAL: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 71 INDUSTRIAL: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 72 INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 MARINE

9.7.1 NEED FOR RELIABLE POWER SUPPLY IN EMERGENCY SITUATIONS

TABLE 74 MARINE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 75 MARINE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 76 MARINE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 77 MARINE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 OTHERS

TABLE 78 OTHERS: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 79 OTHERS: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 80 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 NICKEL CADMIUM BATTERY MARKET, BY REGION (Page No. - 114)

10.1 INTRODUCTION

FIGURE 42 MARKET, BY GEOGRAPHY

FIGURE 43 CHINA TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2022 TO 2027

TABLE 82 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 44 NORTH AMERICA: SNAPSHOT OF MARKET

FIGURE 45 US TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN MARKET DURING FORECAST PERIOD

TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET IN, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Rising adoption of Ni-Cd batteries in power grids for emergency backup

10.2.2 CANADA

10.2.2.1 Increasing aircraft manufacturing activities

10.2.3 MEXICO

10.2.3.1 Growing demand for energy storage

10.3 EUROPE

FIGURE 46 EUROPE: SNAPSHOT OF NICKEL CADMIUM BATTERY MARKET

FIGURE 47 GERMANY TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN MARKET DURING FORECAST PERIOD

TABLE 92 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Increasing demand for railway emergency power backup systems

10.3.2 GERMANY

10.3.2.1 Growing medical device and equipment manufacturing

10.3.3 FRANCE

10.3.3.1 Rising focus on renewable energy generation

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: SNAPSHOT OF MARKET

FIGURE 49 CHINA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN ASIA PACIFIC IN 2027

TABLE 100 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET IN, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Robust presence of battery manufacturers

10.4.2 JAPAN

10.4.2.1 Increasing adoption of Ni-Cd batteries in industrial applications

10.4.3 INDIA

10.4.3.1 Rising infrastructure development and industrial growth

10.4.4 SOUTH KOREA

10.4.4.1 Growing automotive and telecommunication sectors

10.4.5 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 50 MIDDLE EAST TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF NICKEL CADMIUM BATTERY MARKET IN ROW DURING FORECAST PERIOD

TABLE 108 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 109 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 110 ROW: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 111 ROW: MARKET IN, BY TYPE, 2022–2027 (USD MILLION)

TABLE 112 ROW: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2018–2021 (USD MILLION)

TABLE 113 ROW: MARKET, BY BLOCK BATTERY CONSTRUCTION, 2022–2027 (USD MILLION)

TABLE 114 ROW: MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 115 ROW: MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST

10.5.1.1 Increasing renewable power generation projects

TABLE 116 MIDDLE EAST: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 117 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 AFRICA

10.5.2.1 Rising development of transportation and telecom infrastructure

10.5.3 SOUTH AMERICA

10.5.3.1 Growing industrial developments

11 COMPETITIVE LANDSCAPE (Page No. - 138)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 118 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NICKEL CADMIUM BATTERY MARKET

11.3 TOP 3 COMPANY REVENUE ANALYSIS

FIGURE 51 MARKET: REVENUE ANALYSIS OF TOP 3 PLAYERS, 2017–2021

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 119 MARKET: MARKET SHARE ANALYSIS (2021)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 52 MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 53 MARKET, SME EVALUATION QUADRANT, 2021

11.7 NICKEL CADMIUM BATTERY MARKET: COMPANY FOOTPRINT

TABLE 120 COMPANY FOOTPRINT

TABLE 121 END-USER: COMPANY FOOTPRINT

TABLE 122 REGIONAL: COMPANY FOOTPRINT

11.8 COMPETITIVE BENCHMARKING

TABLE 123 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 124 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.9 COMPETITIVE SITUATIONS AND TRENDS

TABLE 125 MARKET: PRODUCT LAUNCHES

TABLE 126 MARKET: DEALS

12 COMPANY PROFILES (Page No. - 153)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1.1 ALCAD A.B.

TABLE 127 ALCAD A.B.: COMPANY OVERVIEW

TABLE 128 ALCAD A.B.: PRODUCT OFFERINGS

TABLE 129 ALCAD A.B.: PRODUCT LAUNCHES

TABLE 130 ALCAD A.B.: DEALS

12.1.2 ENERSYS

TABLE 131 ENERSYS: COMPANY OVERVIEW

FIGURE 54 ENERSYS: COMPANY SNAPSHOT

TABLE 132 ENERSYS: PRODUCT OFFERINGS

TABLE 133 ENERSYS: DEALS

12.1.3 GS YUASA CORPORATION

TABLE 134 GS YUASA CORPORATION: COMPANY OVERVIEW

FIGURE 55 GS YUASA CORPORATION: COMPANY SNAPSHOT

TABLE 135 GS YUASA CORPORATION: PRODUCT OFFERINGS

12.1.4 HBL POWER SYSTEMS LIMITED

TABLE 136 HBL POWER SYSTEMS LIMITED: COMPANY OVERVIEW

FIGURE 56 HBL POWER SYSTEMS LIMITED: COMPANY SNAPSHOT

TABLE 137 HBL POWER SYSTEMS LIMITED: PRODUCT OFFERINGS

12.1.5 SAFT GROUPE SAS

TABLE 138 SAFT GROUPE SAS: COMPANY OVERVIEW

TABLE 139 SAFT GROUPE SAS: PRODUCT OFFERINGS

TABLE 140 SAFT GROUPE SAS: PRODUCT LAUNCHES

TABLE 141 SAFT GROUPE SAS: DEALS

TABLE 142 SAFT GROUPE SAS: OTHERS

12.1.6 HOPPECKE BATTERIEN GMBH & CO. KG

TABLE 143 HOPPECKE BATTERIEN GMBH & CO. KG: COMPANY OVERVIEW

TABLE 144 HOPPECKE BATTERIEN GMBH & CO. KG: PRODUCT OFFERINGS

12.1.7 THE FURUKAWA BATTERY CO., LTD.

TABLE 145 THE FURUKAWA BATTERY CO., LTD.: COMPANY OVERVIEW

FIGURE 57 THE FURUKAWA BATTERY CO., LTD.: COMPANY SNAPSHOT

TABLE 146 THE FURUKAWA BATTERY CO., LTD.: PRODUCT OFFERINGS

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 ACEON BATTERY SOLAR TECHNOLOGY LTD.

12.2.2 CANTEC SYSTEMS CANADA

12.2.3 CELL-CON

12.2.4 CUSTOM POWER

12.2.5 DANTONA INDUSTRIES INC.

12.2.6 GAZ GMBH

12.2.7 GERMAREL GMBH

12.2.8 HENAN XINTAIHANG POWER SOURCE CO., LTD.

12.2.9 HONDA DENKI CO., LTD.

12.2.10 JIANGMEN JJJ BATTERY CO., LTD.

12.2.11 QUALMEGA, INC.

12.2.12 SHENZHEN NOVA ENERGY CO., LTD.

12.2.13 STATRON LTD.

12.2.14 TENERGY CORPORATION

12.2.15 UKB (UNIKOR BATTERY) CO., LTD.

12.2.16 ZEUS

13 ADJACENT & RELATED MARKETS (Page No. - 185)

13.1 INTRODUCTION

13.2 BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION

TABLE 147 BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 148 BATTERY ENERGY STORAGE SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2.1 NORTH AMERICA

13.2.1.1 US

13.2.1.1.1 Increasing adoption of large-scale battery storage systems in power grids to drive market

13.2.1.2 Canada

13.2.1.2.1 Growing focus on advancements in battery energy storage technology to meet peak demand for electricity in urban centers

13.2.1.3 Mexico

13.2.1.3.1 Rising demand for electricity to propel market growth

14 APPENDIX (Page No. - 190)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

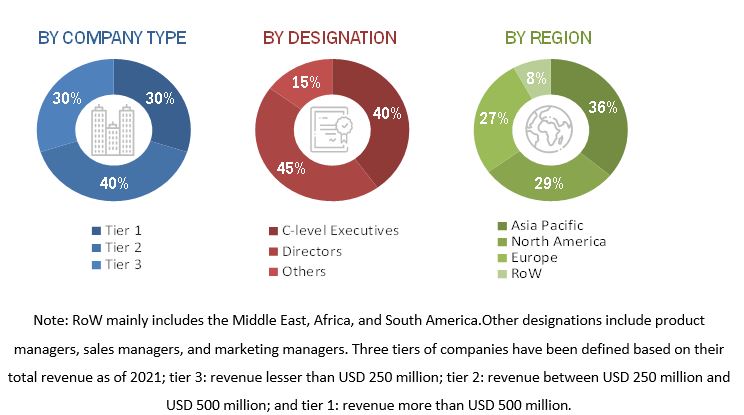

The study involved four major activities in estimating the current size of the nickel cadmium battery market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the nickel cadmium battery market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred nickel cadmium battery providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from nickel cadmium battery providers, such as ALCAD A.B. (Sweden), EnerSys (US), GS Yuasa Corporation (Japan), and Saft Groupe SAS (France); industry associations; independent consultants and importers; distributors; and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the nickel cadmium battery market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the nickel cadmium battery market based on type, block battery construction, and end-user

- To describe various cell types used in the nickel cadmium batteries

- To describe and forecast the size of the market based on four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the process flow of the market

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders & buying criteria, key conferences & events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments, such as product launches, acquisitions, agreements, and partnerships, in the nickel cadmium battery market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nickel Cadmium Battery Market