Network Forensics Market by Component (Solutions & Professional Services), Application (Endpoint Security & Data Center Security), Vertical, Deployment Mode, Organization Size, and Region - Global Forecast to 2027

Network Forensics Market Size & Trends Analysis, Forecast Report

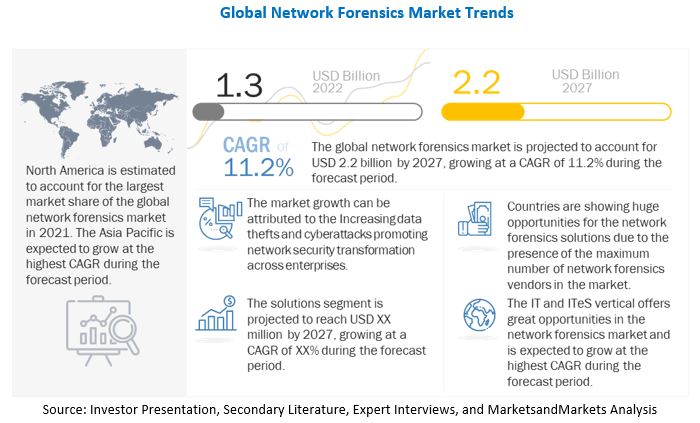

[304 Pages Report] The Network Forensics Market worldwide size was as per revenue was worth approximately $1.3 billion in 2022. It is prognosticated to grow at an effective compound annual growth rate (CAGR) of 11.2% from 2022 to 2027. The revenue forecast for 2027 is set to enjoy a valuation of $2.2 billion. The base year considered for estimation is 2021 and the historical data spans from 2022 to 2027.

Increasing data thefts and cyberattacks across enterprises, increasing traffic on network systems, and increasing demand for cloud-based network forensics solutions are some of the factors that are driving the market growth. However, lack of skilled expertise, lack of infrastructure to store all the data packets are some of the factors that are expected to hinder the Network Forensics Market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Network Forensics Market Growth Dynamics

Driver: Increased network traffic and network systems complexity

The internet population has grown up to 4.9 billion worldwide in 2021, and out of that, Asia has the largest percentage of internet users by continent/region, up to 51.8% of all. The network traffic is going to increase more in the upcoming years due to the advancements in technologies. Heavy data traffic and complex systems make the investigation process tedious for analyzing to get deeper visibility into the systems. The increased need to secure networks from advanced attacks and minimize network crimes would drive the network forensics market in the coming years. Network forensics helps organizations capture, record, and analyze the network traffic for investigation and incident response. It also helps identify insider theft and misuse of networking resources and evaluate the network performance. Organizations across the world have started deploying network forensics solutions to detect network traffic and its effect on sensitive data.

Restraint: Lack of skilled network forensics investigators

According to the leading forensic training institute, International Institute of Forensics and Security Studies, investigators consider deficiencies in standards, tools, and training as an important obstacle while investigating cases related to networks across cloud, mobile devices, and computers. The National Association of Software and Service Companies (NASSCOM) has also stated that there was a need for one million cybersecurity professionals by 2020. When it comes to conducting network forensics investigations, the investigators need to have the required technical skill and knowledge for capturing, processing, storing, and analyzing evidence. For this meaningful analysis of digital evidence, there is a need for trained network forensics experts which is currently market is lagging thereby is expected to be the prime factor that is restraining the market growth.

Opportunity: Increase in use of AI/ML and analytics to provide better network visibility into IT infrastructure

Network forensics investigators are incorporating AI, ML, and analytics concepts into their solutions for addressing critical vulnerabilities with faster threat detection, mitigation, and response capabilities. The advancements in technologies, such as AI and ML, are turning the tides against vulnerabilities. AI and ML-based network security platforms help organizations provide comprehensive security features to their network infrastructure. AI methods are extremely capable of learning and solving complex computational problems due to their uses for learning and reasoning. With ML being the core technology, AI systems have made remarkable achievements in solving increasingly complex computational tasks, and network forensics investigators can take forward ANN in pattern recognition.

Challenge: Issues associated with collection and storage of huge data for investigation

In the changing nature of the criminal world, network forensics investigators have to face various challenges while investigating the most complex networks attacks. The investigators have to collect the data across the company’s networks related to network crimes to prepare for digital evidence. Network forensics investigators go through a variety of technical issues arising due to difficulties in collecting the huge data for investigation. Traditional forensics solutions have some limitations that create difficulties in the collection of digital evidence. There is a need for advanced network forensics solutions, which would help investigators sufficiently collect evidence. The digital evidence contains sensitive information, and they are needed to store and preserve. They also have to go through various examinations without losing their integrity. This huge amount of data requires a multi-terabyte storage system for its preservation. Capacity and scalability are important parameters of storage. Therefore, organizations face challenges while saving this data.

By application, endpoint security to hold the largest market size during the forecast period

The number of connected devices is rapidly increasing due to the IoT and BYOD trends. This is resulting in a rise in network complexities. The businesses serve their customers through these connected endpoints that are vulnerable to APTs. Therefore, securing these endpoint networks becomes the prime objective of the organizations. Endpoint security is a process of collecting security-related information from endpoints, such as smartphones, PCs, laptops, and Point of Sale (POS) terminals, and analyzing this information to detect malicious activities in the networks. The forensics solution studies the attack behavior and proactively mitigates the risk to secure the endpoints and their data. The forensics analysis tool is integrated with threat intelligence and user behavior analytics techniques to provide valuable insights into threats and secure the critical infrastructure of the organization.

By verticals, IT and ITeS segment to grow with fastest growing CAGR during the forecast period

Information Technology (IT) and ITeS deal with the use of computers and networking devices to produce, process, preserve, and protect various forms of electronic data. This vertical involves high usage of web and mobile-based applications used via endpoint devices, such as desktops, laptops, mobiles, tablets, virtual machines, and other embedded endpoint devices. Therefore, the networks in these industries are frequently attacked by cybercriminals. The increased implementation of the BYOD trend, implementation of IoT infrastructure, and the wide adoption of personal devices among companies in this sector are responsible for the growth in networks attacks and network crimes. To ensure the safety of network infrastructure and technological innovation, IT service providers are now using network forensics solutions for investigations.

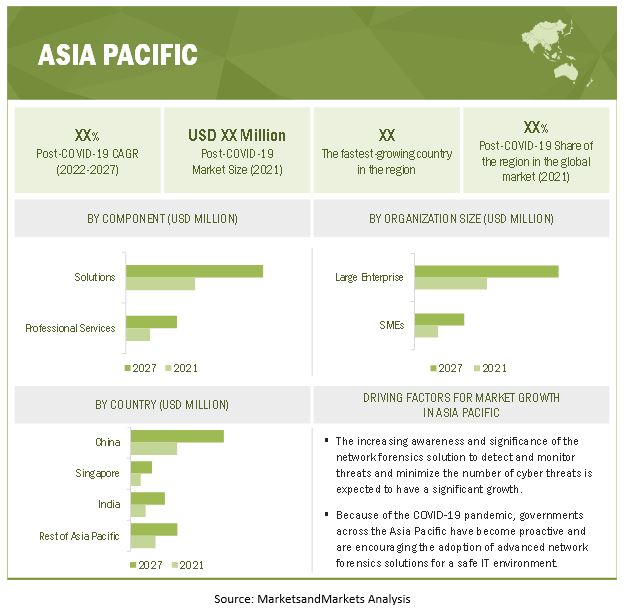

By region, Asia Pacific segment to grow with fastest growing CAGR during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

The threat landscape in the Asia Pacific region is increasing at an alarming rate with the increase in network complexities, forcing organizations to deploy network forensics solutions. The region includes emerging economies such as China, Singapore, India and rest of Asia Pacific countries. Countries across this region have many SMEs, which provide major employment opportunities. Asia Pacific has witnessed advanced and dynamic adoption of new technologies and is expected to record the highest CAGR during the forecast period. The region is taking aggressive initiatives to leverage the IT infrastructure, enabling commercial users to adopt cutting-edge technologies. However, factors such as continual growth in the mobile workforce, increasing complexity of businesses, and the unregulated nature of the internet are now expected to push such SMEs to adopt various cybersecurity solutions that would improve their network performance.

Key Market Players:

Major vendors offering network forensics market solutions are Fireeye ([now Trellix], US), Cisco Systems (US), IBM Corporation (US), Broadcom Inc. (US), NETSCOUT Systems, Inc. (US), RSA Security, LLC (US), VIAVI Solutions (US), Novetta Solutions, LLC (US), SolarWinds Corporation (US), Palo Alto Networks, Inc.(US), SonicWall (US), OpenText Corporation (Canada), ManageEngine (US), LogRhythm, Inc. (US), NIKSUN (US), Corelight, Inc. (US), Securonix (US), Vehere, Inc. (US), Cysight.ai ([IdeaData], Israel), CorCystems (US), Endace Ltd. (New Zealand), and VectraAI, Inc. (US). Some emerging startups, such as LiveAction (US), GrayLog, Inc. (US), DiFose (Ankara, Turkey), Gurucul (US), and BluVector (US) are also included in the research study.

Scope of the report

|

Report Metric |

Details |

|

Revenue Forecast Size Value in 2027 |

$2.2 billion |

|

Market Size Value in 2022 |

$1.3 billion |

|

Estimated Growth Rate |

11.2% CAGR |

|

Market Growth Drivers |

Increased network traffic and network systems complexity |

|

Market Opportunities |

Increased network traffic and network systems complexity |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components, Deployment Mode, Organization size, Applications, Verticals and Regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa (MEA), and Latin America |

|

Major companies covered |

Fireeye (US), Cisco Systems (US), IBM Corporation (US), Broadcom Inc. (US), NETSCOUT Systems, Inc. (US), RSA Security, LLC (US), VIAVI Solutions (US), Novetta Solutions, LLC (US), and others |

This research report categorizes the Network Forensics Market based on component, deployment mode, organization size, application, vertical, and region.

By components:

-

Solution

- Software

- Hardware

-

Professional Services

- Consulting

- Training and Education

- Design and Integration

- Support and Maintenance

By deployment mode:

- Cloud

- On-premises

By organization size:

- SMEs

- Large Enterprises

By application:

- Endpoint Security

- Datacenter security

By Vertical:

- BFSI

- Government and Defense

- Healthcare

- IT and ITeS

- Manufacturing

- Retail

- Telecommunications

- Transportation

- Other verticals*

*Other verticals include media and entertainment, energy & utilities, and education.

By Region:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Recent Development

- In November 2021, NETSCOUT Systems partnered with AWS to provide greater visibility and security to Amazon Web Services’ customers. The integration between NETSCOUT Systems Omnis Cyber Intelligence (OCI) and Amazon Web Security Services enhances the organizations' security landscape by expanding the scope of visibility to investigate and identify cyber threats.

- In August 2021, Accenture Federal Services (AFS) acquired Novetta Solutions to provide the highly specialized mission solutions. With the acquisition, AFS adds a new National Security portfolio to its business to be led by Novetta President and CEO Tiffanny Gates. This portfolio will provide the highly specialized, mission solutions that clients turn to for expertise in the converging domains of analytics, intelligence expertise, cloud engineering, and cyber.

- In August 2021, Viavi solutions introduced XDR solution to cloud- and identity-based threats to give organizations the holistic analytics needed to protect against increasingly sophisticated cyberattacks. Cortex XDR Forensics module delivers the advanced forensic investigation tool.

Frequently Asked Questions (FAQ):

What is the market size of Network Forensics Market?

What is the growth rate of Network Forensics Market?

What are the key opportunities in the Network Forensics Market?

Who are the key players in Network Forensics Market?

Who will be the leading hub for Network Forensics Market?

What is the Network Forensics Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 6 NETWORK FORENSICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 NETWORK FORENSICS MARKET: DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY-SIDE): REVENUE OF SOLUTIONS AND SERVICES IN MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1: SUPPLY-SIDE ANALYSIS

FIGURE 10 MARKET: MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS [COMPANY REVENUE ESTIMATION]

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1: BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES IN NETWORK FORENSICS MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2: BOTTOM-UP (DEMAND-SIDE) VERTICALS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 13 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 STARTUPS EVALUATION QUADRANT METHODOLOGY

FIGURE 14 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 15 NETWORK FORENSICS MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

FIGURE 16 FASTEST-GROWING SEGMENTS OF MARKET

FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN NETWORK FORENSICS MARKET

FIGURE 18 INCREASING DEMAND FOR CLOUD-BASED NETWORK FORENSICS SOLUTIONS ACROSS VERTICALS TO DRIVE MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2022

FIGURE 19 SOLUTION SEGMENT TO HOLD HIGHER MARKET SHARE IN 2022

4.3 NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022-2027

FIGURE 20 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.4 MARKET, SHARE OF TOP THREE VERTICALS AND REGIONS, 2022

FIGURE 21 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES IN 2022

4.5 MARKET, BY ORGANIZATION SIZE, 2022-2027

FIGURE 22 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.6 NETWORK FORENSICS MARKET, BY VERTICAL, 2022-2027

FIGURE 23 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.7 MARKET INVESTMENT SCENARIO

FIGURE 24 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NETWORK FORENSICS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing data thefts and cyberattacks to promote network security transformation across enterprises

5.2.1.2 Increased network traffic and network systems’ complexity to demand advanced network forensics solutions

5.2.1.3 Increased demand for cloud-based network forensics solutions across verticals

5.2.2 RESTRAINTS

5.2.2.1 Lack of skilled network forensics investigators

5.2.2.2 Lack of data infrastructure to support advanced technologies to drive advanced network forensics tools’ adoption

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for integrated and next-generation network forensics solutions

5.2.3.2 Rapid evolution in mobile, IoT, and web applications

5.2.3.3 Increase in use of AI/ML and analytics to provide better network visibility into IT infrastructure

5.2.4 CHALLENGES

5.2.4.1 Issues associated with collection and storage of huge data for investigation

5.2.4.2 Lack of awareness related to network forensics tools for analysis of data packets

5.2.5 IMPACT OF COVID- 19 ON MARKET DYNAMICS

5.2.5.1 Drivers and Opportunities

5.2.5.2 Restraints and Challenges

5.2.5.3 Cumulative Growth Analysis

5.3 REGULATORY IMPLICATIONS

5.3.1 INTRODUCTION

5.3.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)

5.3.3 INFORMATION TECHNOLOGY ACT, 2000

5.3.4 GENERAL DATA PROTECTION REGULATION COMPLIANCE

5.3.5 CYBERSECURITY INFORMATION SHARING ACT, 2015

5.3.6 EU CYBERSECURITY ACT

5.3.7 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.3.8 SYSTEM AND ORGANIZATION CONTROLS 2 TYPE II COMPLIANCE

5.3.9 FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA), 2002

5.4 USE CASES

5.4.1 USE CASE 1: PALO ALTO NETWORKS ENHANCED SAMARITAN MINISTRIES INTERNATIONAL’S SECURITY OPERATIONS

5.4.2 USE CASE 2: PALO ALTO NETWORKS PROVIDED THINK WHOLE PERSON HEALTHCARE PROTECTION AGAINST CYBERTHREATS

5.4.3 USE CASE: CISCO HELPED LAKE TRUST CREDIT UNION TO SECURE DISTRIBUTED NETWORK AND ENSURE COMPLIANCE

5.4.4 USE CASE 4: CYSIGHT.AI HELPED A MEDIA AND INFORMATION SERVICES COMPANY IN INCREASE THEIR FLEXIBILITY AND GRANULARITY OF NETWORK REPORTS

5.5 ECOSYSTEM

FIGURE 26 ECOSYSTEM: NETWORK FORENSICS MARKET

TABLE 3 MARKET ECOSYSTEM

5.6 VALUE CHAIN

FIGURE 27 MARKET: VALUE CHAIN

5.6.1 FORENSICS TOOL, SOFTWARE, AND PLATFORM PROVIDERS

5.6.2 HARDWARE PROVIDERS

5.6.3 SYSTEM INTEGRATORS

5.6.4 SERVICE PROVIDERS

5.6.5 RETAIL AND DISTRIBUTION

5.6.6 END USERS

6 NETWORK FORENSICS MARKET, BY COMPONENT (Page No. - 80)

6.1 INTRODUCTION

FIGURE 28 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 4 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 5 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTION

6.2.1 SOLUTION: MARKET DRIVERS

6.2.2 SOLUTION: COVID-19 IMPACT

TABLE 6 SOLUTION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 7 SOLUTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 8 MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 9 NETWORK FORENSICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

6.2.3 SOFTWARE

6.2.3.1 Intrusion detection system/intrusion prevention system

6.2.3.2 Security information and event management

6.2.3.3 Threat Intelligence

6.2.3.4 Packet Capture Analysis

6.2.3.5 Analytics

6.2.3.6 Firewall

6.2.4 HARDWARE

6.3 PROFESSIONAL SERVICES

6.3.1 PROFESSIONAL SERVICES: NETWORK FORENSICS MARKET DRIVERS

6.3.2 PROFESSIONAL SERVICES: COVID-19 IMPACT

TABLE 10 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 11 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 CONSULTING

6.3.4 TRAINING AND EDUCATION

6.3.5 DESIGN AND INTEGRATION

6.3.6 SUPPORT AND MAINTENANCE

7 NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE (Page No. - 89)

7.1 INTRODUCTION

TABLE 12 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 13 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 CLOUD

7.2.1 CLOUD: MARKET DRIVERS

7.2.2 CLOUD: COVID-19 IMPACT

TABLE 14 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 15 CLOUD: NETWORK FORENSICS MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISES

7.3.1 ON-PREMISES: MARKET DRIVERS

7.3.2 ON-PREMISES: COVID-19 IMPACT

TABLE 16 ON-PREMISES: NETWORK FORENSICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 17 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NETWORK FORENSICS MARKET, BY ORGANIZATION SIZE (Page No. - 94)

8.1 INTRODUCTION

FIGURE 29 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 19 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

8.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 20 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 21 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 LARGE ENTERPRISES: MARKET DRIVERS

8.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 22 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 23 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027(USD MILLION)

9 NETWORK FORENSICS MARKET, BY APPLICATION (Page No. - 100)

9.1 INTRODUCTION

FIGURE 30 DATA CENTER SECURITY SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

TABLE 24 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 25 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 ENDPOINT SECURITY

9.2.1 ENDPOINT SECURITY: MARKET DRIVERS

9.2.2 ENDPOINT SECURITY: COVID-19 IMPACT

9.3 DATA CENTER SECURITY

9.3.1 DATA CENTER SECURITY: MARKET DRIVERS

9.3.2 DATA CENTER SECURITY: COVID-19 IMPACT

10 NETWORK FORENSICS MARKET, BY VERTICAL (Page No. - 104)

10.1 INTRODUCTION

FIGURE 31 BFSI VERTICAL TO HAVE HIGHEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 26 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 27 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

10.2.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 IMPACT

TABLE 28 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 RETAIL

10.3.1 RETAIL: NETWORK FORENSICS MARKET DRIVERS

10.3.2 RETAIL: COVID-19 IMPACT

TABLE 30 RETAIL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 31 RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 GOVERNMENT AND DEFENSE

10.4.1 GOVERNMENT AND DEFENSE: NETWORK FORENSICS MARKET DRIVERS

10.4.2 GOVERNMENT AND DEFENSE: COVID-19 IMPACT

TABLE 32 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 33 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 HEALTHCARE

10.5.1 HEALTHCARE: MARKET DRIVERS

10.5.2 HEALTHCARE: COVID-19 IMPACT

TABLE 34 HEALTHCARE: MARKET, BY REGION 2016–2021 (USD MILLION)

TABLE 35 HEALTHCARE: NETWORK FORENSICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 MANUFACTURING

10.6.1 MANUFACTURING: MARKET DRIVERS

10.6.2 MANUFACTURING: COVID-19 IMPACT

TABLE 36 MANUFACTURING: NETWORK FORENSICS MARKET, BY REGION 2016–2021 (USD MILLION)

TABLE 37 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES (IT AND ITES)

10.7.1 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET DRIVERS

10.7.2 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: COVID-19 IMPACT

TABLE 38 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 39 INFORMATION TECHNOLOGY & INFORMATION TECHNOLOGY-ENABLED SERVICES: NETWORK FORENSICS MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 TELECOMMUNICATIONS

10.8.1 TELECOMMUNICATIONS: MARKET DRIVERS

10.8.2 TELECOMMUNICATIONS: COVID-19 IMPACT

TABLE 40 TELECOMMUNICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.9 TRANSPORTATION

10.9.1 TRANSPORTATION: NETWORK FORENSICS MARKET DRIVERS

10.9.2 TRANSPORTATION: COVID-19 IMPACT

TABLE 42 TRANSPORTATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.10 OTHER VERTICALS

TABLE 44 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 45 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 NETWORK FORENSICS MARKET, BY REGION (Page No. - 122)

11.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 46 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 47 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: NETWORK FORENSICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.4 UNITED STATES

TABLE 62 UNITED STATES: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 63 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 64 UNITED STATES: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 65 UNITED STATES: NETWORK FORENSICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 66 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 67 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 68 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 69 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 70 UNITED STATES: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 71 UNITED STATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 72 UNITED STATES: NETWORK FORENSICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 73 UNITED STATES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2.5 CANADA

TABLE 74 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 75 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 76 CANADA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 77 CANADA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 78 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 79 CANADA: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 80 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 81 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 82 CANADA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 83 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 84 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 85 CANADA: NETWORK FORENSICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 86 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 89 EUROPE: NETWORK FORENSICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: NETWORK FORENSICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 99 EUROPE NETWORK FORENSICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 100 UNITED KINGDOM: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 101 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 102 UNITED KINGDOM: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 103 UNITED KINGDOM: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 104 UNITED KINGDOM: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 105 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 106 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 107 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 108 UNITED KINGDOM: NETWORK FORENSICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 109 UNITED KINGDOM: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 110 UNITED KINGDOM: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 111 UNITED KINGDOM: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.5 GERMANY

TABLE 112 GERMANY: NETWORK FORENSICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 113 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 114 GERMANY: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 115 GERMANY: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 116 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 117 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 118 GERMANY: NETWORK FORENSICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 119 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 120 GERMANY: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 121 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 122 GERMANY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 123 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.6 FRANCE

TABLE 124 FRANCE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 125 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 126 FRANCE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 128 FRANCE: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 129 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 130 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 131 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 132 FRANCE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 133 FRANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 134 FRANCE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 135 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 136 REST OF EUROPE: NETWORK FORENSICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 143 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 144 REST OF EUROPE: NETWORK FORENSICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: NETWORK FORENSICS MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 148 ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.4 CHINA

TABLE 162 CHINA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 163 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 164 CHINA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 165 CHINA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 166 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 167 CHINA: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 168 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 169 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 170 CHINA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 171 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 173 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.5 SINGAPORE

TABLE 174 SINGAPORE: NETWORK FORENSICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 175 SINGAPORE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 176 SINGAPORE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 177 SINGAPORE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 178 SINGAPORE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 179 SINGAPORE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 180 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 181 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 182 SINGAPORE: NETWORK FORENSICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 183 SINGAPORE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 184 SINGAPORE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 185 SINGAPORE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.6 INDIA

TABLE 186 INDIA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 187 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 188 INDIA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 189 INDIA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 190 INDIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 191 INDIA: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 192 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 193 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 194 INDIA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 195 INDIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 196 INDIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 197 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 198 REST OF ASIA PACIFIC: NETWORK FORENSICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 199 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 200 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 201 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 202 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 203 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 204 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 207 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 209 REST OF ASIA PACIFIC: NETWORK FORENSICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: NETWORK FORENSICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 215 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: NETWORK FORENSICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: NMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 221 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 222 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 223 MIDDLE EAST & AFRICA NETWORK FORENSICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.4 UNITED ARAB EMIRATES

TABLE 224 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 225 UNITED ARAB EMIRATES: NETWORK FORENSICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 226 UNITED ARAB EMIRATES: NETWORK FORENSICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 227 UNITED ARAB EMIRATES: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 228 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 229 UNITED ARAB EMIRATES: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 230 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 231 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 232 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 233 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 234 UNITED ARAB EMIRATES: NETWORK FORENSICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 235 UNITED ARAB EMIRATES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.5 KINGDOM OF SAUDI ARABIA

TABLE 236 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 237 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 238 KINGDOM OF SAUDI ARABIA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 239 KINGDOM OF SAUDI ARABIA: NETWORK FORENSICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 240 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 241 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 242 KINGDOM OF SAUDI ARABIA: NETWORK FORENSICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 243 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 244 KINGDOM OF SAUDI ARABIA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 245 KINGDOM OF SAUDI ARABIA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 246 KINGDOM OF SAUDI ARABIA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 247 KINGDOM OF SAUDI ARABIA: NETWORK FORENSICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.6 SOUTH AFRICA

TABLE 248 SOUTH AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 249 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 250 SOUTH AFRICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 251 SOUTH AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 252 SOUTH AFRICA: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 253 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 254 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 255 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 256 SOUTH AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 257 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 258 SOUTH AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 259 SOUTH AFRICA: NETWORK FORENSICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.7 REST OF MIDDLE EAST & AFRICA

TABLE 260 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 261 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 262 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 263 REST OF MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 264 REST OF MIDDLE EAST & AFRICA: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 265 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 266 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 267 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 268 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 269 REST OF MIDDLE EAST & AFRICA: NETWORK FORENSICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 270 REST OF MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 271 REST OF MIDDLE EAST & AFRICA: NETWORK FORENSICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: NETWORK FORENSICS MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 272 LATIN AMERICA: NETWORK FORENSICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 273 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 274 LATIN AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 275 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 276 LATIN AMERICA: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 277 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 278 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 279 LATIN AMERICA: NETWORK FORENSICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 280 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 281 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 282 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 283 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 284 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 285 LATIN AMERICA NETWORK FORENSICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.4 BRAZIL

TABLE 286 BRAZIL: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 287 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 288 BRAZIL: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 289 BRAZIL: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 290 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 291 BRAZIL: NETWORK FORENSICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 292 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 293 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 294 BRAZIL: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 295 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 296 BRAZIL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 297 BRAZIL: NETWORK FORENSICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.5 MEXICO

TABLE 298 MEXICO: NMARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 299 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 300 MEXICO: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 301 MEXICO: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 302 MEXICO: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 303 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 304 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 305 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 306 MEXICO: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 307 MEXICO: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 308 MEXICO: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 309 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

TABLE 310 REST OF LATIN AMERICA: NETWORK FORENSICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 311 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 312 REST OF LATIN AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 313 REST OF LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 314 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 315 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 316 REST OF LATIN AMERICA: NETWORK FORENSICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 317 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 318 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 319 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 320 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 321 REST OF LATIN AMERICA: NETWORK FORENSICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 223)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET EVALUATION FRAMEWORK: 2019, 2020, AND 2021 TO WITNESS NETWORK FORENSICS MARKET DEVELOPMENTS AND CONSOLIDATION

12.3 COMPANY EVALUATION QUADRANT

12.3.1 OVERVIEW

12.3.2 COMPANY FOOTPRINT

FIGURE 36 PRODUCT, INDUSTRY, AND REGION FOOTPRINT OF KEY COMPANIES

TABLE 322 EVALUATION CRITERIA

12.3.3 STARS

12.3.4 EMERGING LEADERS

12.3.5 PERVASIVE PLAYERS

12.3.6 PARTICIPANTS

FIGURE 37 NETWORK FORENSICS MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2021

12.4 STARTUP EVALUATION QUADRANT

12.4.1 PROGRESSIVE COMPANIES

12.4.2 RESPONSIVE COMPANIES

12.4.3 DYNAMIC COMPANIES

12.4.4 STARTING BLOCKS

FIGURE 38 NETWORK FORENSICS MARKET (GLOBAL), STARTUP EVALUATION QUADRANT, 2021

12.5 REVENUE ANALYSIS

FIGURE 39 FIVE-YEAR REVENUE ANALYSIS OF KEY NETWORK FORENSICS VENDORS

TABLE 323 PRODUCT LAUNCHES, 2020-2021

TABLE 324 DEALS, 2020-2021

12.6 MARKET SHARE ANALYSIS

FIGURE 40 NETWORK FORENSICS MARKET (GLOBAL), MARKET SHARE, 2021

TABLE 325 DEGREE OF COMPETITION

13 COMPANY PROFILES (Page No. - 233)

13.1 INTRODUCTION

13.2 LARGE PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

13.2.1 FIREEYE INC.

TABLE 326 FIREEYE: BUSINESS OVERVIEW

FIGURE 41 FIREEYE: COMPANY SNAPSHOT

TABLE 327 FIREEYE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 328 FIREEYE: PRODUCT LAUNCHES

TABLE 329 FIREEYE: DEALS

13.2.2 CISCO

TABLE 330 CISCO: BUSINESS OVERVIEW

FIGURE 42 CISCO: COMPANY SNAPSHOT

TABLE 331 CISCO: PRODUCTS/SOLUTIONS OFFERED

TABLE 332 CISCO: PRODUCT LAUNCHES

TABLE 333 CISCO: DEALS

13.2.3 IBM

TABLE 334 IBM: BUSINESS OVERVIEW

FIGURE 43 IBM: COMPANY SNAPSHOT

TABLE 335 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 336 IBM: PRODUCT LAUNCHES

TABLE 337 IBM: DEALS

13.2.4 SYMANTEC (BROADCOM)

TABLE 338 SYMANTEC: BUSINESS OVERVIEW

FIGURE 44 SYMANTEC: COMPANY SNAPSHOT

TABLE 339 SYMANTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 340 SYMANTEC: PRODUCT LAUNCHES

TABLE 341 SYMANTEC: DEALS

13.2.5 NETSCOUT SYSTEMS

TABLE 342 NETSCOUT SYSTEMS: BUSINESS OVERVIEW

FIGURE 45 NETSCOUT SYSTEMS: COMPANY SNAPSHOT

TABLE 343 NETSCOUT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 344 NETSCOUT SYSTEMS: PRODUCT LAUNCHES

TABLE 345 NETSCOUT SYSTEMS: DEALS

13.2.6 RSA SECURITY

TABLE 346 RSA SECURITY: BUSINESS OVERVIEW

TABLE 347 RSA SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 348 RSA SECURITY: DEALS

13.2.7 VIAVI SOLUTIONS

TABLE 349 VIAVI SOLUTIONS: BUSINESS OVERVIEW

FIGURE 46 VIAVI SOLUTIONS: COMPANY SNAPSHOT

TABLE 350 VIAVI SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 351 VIAVI SOLUTIONS: PRODUCT LAUNCHES

TABLE 352 VIAVI SOLUTIONS: DEALS

13.2.8 NOVETTA SOLUTIONS

TABLE 353 NOVETTA SOLUTIONS: BUSINESS OVERVIEW

TABLE 354 NOVETTA SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 355 NOVETTA SOLUTIONS: DEALS

13.2.9 SOLARWINDS

TABLE 356 SOLARWINDS: BUSINESS OVERVIEW

FIGURE 47 SOLARWINDS: COMPANY SNAPSHOT

TABLE 357 SOLARWINDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 358 SOLARWINDS: PRODUCT LAUNCHES

TABLE 359 SOLARWINDS: DEALS

13.2.10 PALO ALTO NETWORKS

TABLE 360 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 48 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 361 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS OFFERED

TABLE 362 PALO ALTO NETWORKS: PRODUCT LAUNCHES

TABLE 363 PALO ALTO NETWORKS: DEALS

13.2.11 SONICWALL

TABLE 364 SONICWALL: BUSINESS OVERVIEW

TABLE 365 SONICWALL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 366 SONICWALL: PRODUCT LAUNCHES

13.2.12 OPENTEXT

TABLE 367 OPENTEXT: BUSINESS OVERVIEW

FIGURE 49 OPENTEXT: COMPANY SNAPSHOT

TABLE 368 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 369 OPENTEXT: PRODUCT LAUNCHES

TABLE 370 OPENTEXT: DEALS

13.2.13 MANAGEENGINE (ZOHO)

TABLE 371 MANAGEENGINE: BUSINESS OVERVIEW

TABLE 372 MANAGEENGINE: PRODUCTS OFFERED

TABLE 373 MANAGEENGINE: PRODUCT LAUNCHES

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

13.3 SME PLAYERS

13.3.1 LOGRHYTHM INC.

13.3.2 NIKSUN

13.3.3 CORELIGHT

13.3.4 SECURONIX

13.3.5 VECTRA AI

13.3.6 VEHERE INC.

13.3.7 CYSIGHT.AI (IDEADATA)

13.3.8 CORCYSTEMS, INC.

13.3.9 ENDACE LTD.

13.4 STARTUP PLAYERS

13.4.1 LIVEACTION

13.4.2 GRAYLOG

13.4.3 DIFOSE

13.4.4 GURUCUL

13.4.5 BLUVECTOR

14 ADJACENT MARKETS (Page No. - 287)

14.1 OVERVIEW

TABLE 374 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 DIGITAL FORENSICS MARKET

TABLE 375 DIGITAL FORENSICS MARKET SIZE, BY COMPONENT, 2015–2022 (USD MILLION)

TABLE 376 DIGITAL FORENSICS MARKET SIZE, BY SERVICE, 2015–2022 (USD MILLION)

TABLE 377 DIGITAL FORENSICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2022 (USD MILLION)

TABLE 378 DIGITAL FORENSICS MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 379 DIGITAL FORENSICS MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 380 DIGITAL FORENSICS MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

14.4 DEEP PACKETS INSPECTION AND PROCESSING MARKET

14.4.1 INCLUSIONS AND EXCLUSIONS

TABLE 381 DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 382 DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY SOLUTION, 2017–2024 (USD MILLION)

TABLE 383 DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY INSTALLATION TYPE, 2017–2024 (USD MILLION)

TABLE 384 DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

TABLE 385 DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

TABLE 386 DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 387 DEEP PACKET INSPECTION AND PROCESSING MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.5 SIEM MARKET

14.5.1 INCLUSIONS AND EXCLUSIONS

TABLE 388 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 389 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 390 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 391 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 392 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 393 SECURITY INFORMATION AND EVENT MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15 APPENDIX (Page No. - 296)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

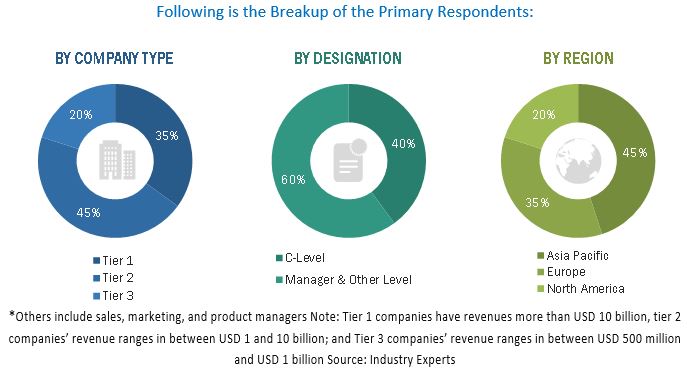

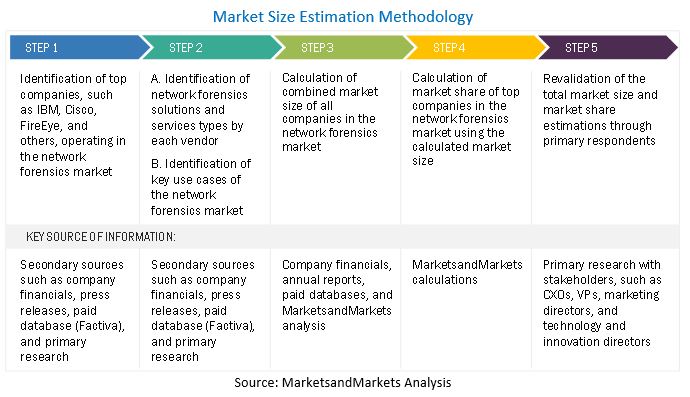

The study involved major activities in estimating the current market size for the network forensics market. Exhaustive secondary research was done to collect information on the network forensics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, bottom up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the network forensics market.

Secondary Research

Various secondary sources were referred to in the secondary research process to identify and collect information regarding the study. The secondary sources included annual reports, press releases, investor presentations of network forensics solutions and service vendors, forums, certified publications, and whitepapers. The secondary research was mainly used to obtain key information about the industry's supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the network forensics market.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. The complete market engineering process was extensive qualitative and quantitative analysis to list key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of network forensics market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global network forensics market and the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This entire procedure included studying the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market and have been covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the network forensics market by component, deployment mode, organization size, application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to four main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, and expansions, in the market

- To analyze the impact of COVID-19 on the market growth

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Forensics Market