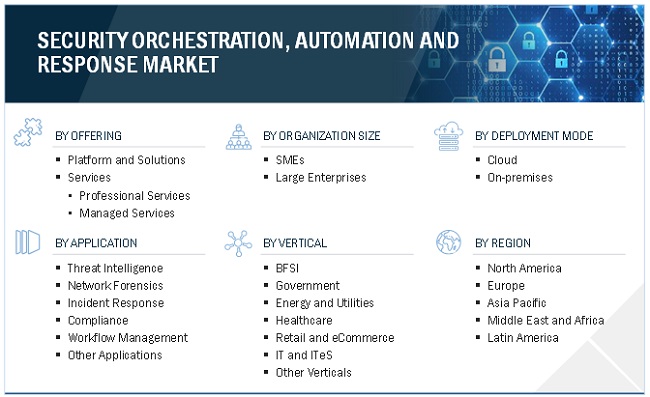

Security Orchestration, Automation and Response (SOAR) Market by Offering (Platform & Solutions, Services), Application (Threat Intelligence, Network Forensics, Compliance), Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027

SOAR Market - Analysis, Industry Size & Forecast

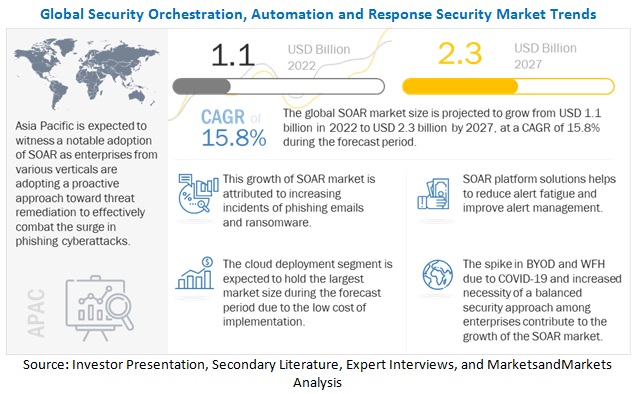

The global Security Orchestration, Automation and Response Market size was valued at USD 1.1 billion in 2022 and is expected to grow at a CAGR of 15.8% from 2022 to 2027. The revenue forecast for 2027 is projected to reach $2.3 billion. The base year for estimation is 2021, and the historical data spans from 2022 to 2027. Growing incidents of phishing emails and ransomware is driving the market growth but lack of modern IT infrastructure may hinder this growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 impact

During pandemic, digital transformation across BFSI, IT and ITeS, healthcare and other verticals is increased. Adoption of remote work trend led to increasing web and cloud traffic and that’s why need of cybersecurity and security orchestration automation and response security is booming across each sector. Due to the COVID-19 pandemic in 2020, the demand for security orchestration automation and response security to tackle various cyber threats and attacks is increasing among enterprises.

Security Orchestration, Automation and Response Market Dynamics

Driver: Growing incidents of phishing emails and ransomware

Enhancing the existing tools and staff significantly is an excellent way to combat phishing problem. Automating phishing triage with SOAR is the way to eliminate most, and in some cases all, of the manual tasks. With SOAR every event and all the supporting steps can be handled at machine speed. Having a SOAR solution ingest and parse emails, perform the threat intelligence lookups, and handle the response and remediation; this indicates that all such steps are executed at speeds well beyond human capability. These steps are performed by the automation playbook. The tedious, monotonous, repetitive tasks that quickly burnout and overwhelm analysts is handled by security orchestration, automation and response. the automation of additional proactive tasks such as threat hunting is automated by SOAR. the SOAR solution can immediately search all the organization’s mailboxes and identify any other mailboxes where malicious indicators are present if malicious email is found. additional emails can be automatically deleted or automatically presented to an analyst with a single click option for the chosen action, depending on the desired level of automation.

Restrain: Lack of trust in third-party applications

Multiple considerations, such as security of the third party’s infrastructure itself and loss of control are involved in outsourcing security operations to a third-party SOAR service provider. It is vital that the service provider’s cyberinfrastructure is secured and up to date to be able to combat the latest advanced threats. Critical business and personnel information of multiple organizations is held by a SOAR platform provider’s infrastructure, which makes it highly susceptible to repeated and complex attacks. This can be a deterrent for companies to hand over their data to these service providers.

In certain cases, control of such a vital aspect of their infrastructure might not be given up by the top management of the organization. Other factors which leads to outsourcing of services that require a high level of trust to be placed in the service provider, such as hidden costs, quality of service provided, matching of cultural, and political values. This may limit the growth of the security orchestration, automation and response market.

Opportunity: SOAR addresses shortage of skilled cybersecurity professionals

It is widely noted that the cybersecurity industry is facing major skilled worker shortages. According to data published on Cyberseek, US employers in the private and public sectors posted an estimated 450,000+ job openings for cybersecurity workers between September 2020 and August 2021. These were in addition to the 800,000+ cybersecurity workers already employed. It is a global problem and the demand for skilled workers to address the growing prevalence and sophistication of cyber-threats is growing exponentially. Even organizations that are willing to spend both time and money might find it difficult to actually acquire the right personnel. Cybersecurity positions are increased from two million In 2016, to four million in 2021.

Significant problems that plague modern businesses are addressed by SOAR. lack of security skills within organizations being the most glaring issue. SOAR addresses significant problems that plague modern businesses. The most glaring issue is a lack of security skills within organizations. For larger organizations training and setting up dedicated security teams that can do full-time threat hunting may be feasible, but it is difficult for most of the companies due to their resource limitations. This is especially true for medium and large organizations that often find themselves being the target of cyberattacks but lack the resources or manpower for such teams.

Challenge: Lack of modern IT infrastructure

IT framework typically comprises diverse segments, for example, complex servers, business applications, system and security environment, tools, and databases. Each of these segments frames the center of each business. However, managing them is quite challenging. Most organizations keep up their set of tools and aptitudes to keep IT foundation up and running, while others require innovative partners to deal with the pressure to bring down the increasing maintenance and administration costs.

With systems becoming more dispersed, customizable, and heterogeneous, the quantity of data collected with regards to security service is vast. The data collected from various components of the infrastructure keeps increasing and hence the segregation of important data becomes a challenge for any IT department. As organizations grow so does the volume and variety of the data that attracts even more diversified threats for which firms are not prepared for. Thus, modern day SOAR vendors are focusing on a shared technology framework that can address such issues.

By application, the network forensics segment to hold the largest market size during the forecast period

Network forensics is the sub-branch of digital forensics that manages, monitors, and analyzes computer network traffic to identify intrusions and cyberattacks. It helps identify unauthorized access to computer systems. The main aim of network forensics is to record network traffic and provide a centralized analysis of network data to enable organizations to secure their data and applications from sophisticated cyberattacks. Computer professionals and security orchestration vendors are integrating security orchestration solutions with advanced network forensic capabilities that help accelerate network traffic investigation, prioritize threats, and resolve security incidents with less time and minimal efforts.

By region, North America to hold the largest market size during the forecast period

The security orchestration, automation and response market of North America is one of the well-established markets among all other regions. The continuous growth of the security orchestration, automation and response market in the region is due to the heavy investment done by companies and countries against the cyberattacks and the presence of market players across the region. According to the report by CPR, the number of cyberattacks per week on corporate network increased 50% in 2021 compared to 2020, an all-time high in December due to the hysteria of Log4j vulnerability, one of the most severe security flaws on the internet. The cyberattacks per week reached 925 per organization in December 2021, with Log4Shell vulnerability as a major bestower. Even before the Log4Shell vulnerabilities came up, CPR reported a 40% increase in the number of cyberattacks in 2021 globally. It is observed that out of every 61 organizations, one has been impacted by ransomware attacks each week. It is observed that North America witnessed the highest increase in the number of cyberattacks in 2021, which increased by 61% from 2020. The increase in the number of cyberattacks is giving a wake-up call to different organizations to safeguard their businesses by using new and innovative technologies, such as SOAR, to prevent the attacks and to guard their organization’s valuable and critical data.

Key Market Players:

The key players in the global Security Orchestration, Automation and Response market include IBM (US), Cisco (US), Rapid7 (US), Palo Alto Networks (US), Splunk (US), Swimlane (US), Tufin (US), Fortinet (US), ThreatConnect (US), Trellix (US), Sumo Logic (US), Siemplify (US), LogRhythm (US), Resolve (US), Exabeam (US), manageEngine (US), KnowBe4 (US), D3 Security (Canada), Qvine (US), Cyware (US), LogicHub (US), Cyberbit (US), Logsign (Netherland), SIRP (UK), Tines (Ireland).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 1.1 billion |

|

Revenue forecast for 2027 |

USD 2.3 billion |

|

Growth Rate |

15.8% CAGR |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

offering, application, deployment mode, organization size, vertical and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America |

|

Major companies covered |

IBM (US), Cisco (US), Rapid7 (US), Palo Alto Networks (US), Splunk (US), Swimlane (US), Tufin (US), Fortinet (US), ThreatConnect (US), Trellix (US), Sumo Logic (US), Siemplify (US), LogRhythm (US), Resolve (US), Exabeam (US), manageEngine (US), KnowBe4 (US), D3 Security (Canada), Qvine (US), Cyware (US), LogicHub (US), Cyberbit (US), Logsign (Netherland), SIRP (UK), Tines (Ireland) |

Security Orchestration, Automation and Response Market Segmentation:

Recent Development

- In May 2022, Bugcrowd collaborated with IBM to Connect to security orchestration, automation and response Space with IBM Resilient Integration. IBM Resilient is a security orchestration automation, and response system used by security teams.

- In May 2022, Palo Alto Networks announced collaboration with Cohesity. Palo Alto Network will integrate its SOAR platform with Cohesity’s AI data management platform to greatly lower customers’ ransomware risk.

- In March 2022, Ridge Security and Splunk partnered to accelerate the speed of response. The effectiveness of security staff with resilient defenses will be strengthened by integrating RidgeBot’s API into Splunk SOAR.

- In July 2021, Rapid7 acquired Threat Intelligence Leader IntSights. This acquisition leads to integrations between the IntSights External Threat Protection Suite and Rapid7’s Insight portfolio.

- In September 2020, ThreatConnect acquired Nehemiah Security. The acquisition adds Cyber Risk Quantification to ThreatConnect’s existing SOAR platform.

Frequently Asked Questions (FAQ):

What is the definition of SOAR security?

Security Orchestration, Automation, and Response (SOAR) refers to a collection of software solutions and tools that allow organizations to streamline security operations in three key areas: threat and vulnerability management, incident response, and security operations automation.

Security Orchestration, Automation and Response (SOAR) enables organizations to collect data from various sources and respond to security operations from a single system. The SOAR platform allows different solutions to integrate with each other and automate tasks across products through workflows, while also allowing human intervention. These solutions are implemented in public or private organizations to manage security alerts and prevent further cyberattacks.

What is the projected market value of the global SOAR market?

The global Security Orchestration, Automation and Response market size is expected to grow from an estimated value of USD 1.1 billion in 2022 to USD 2.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 15.8% from 2022 to 2027.

Who are the key companies influencing the market growth of SOAR?

IBM (US), Cisco (US), Rapid7 (US), Palo Alto Networks (US), Splunk (US) are the leaders in the SOAR market and are recognized as the star players. These companies account for a major share of the SOAR market. They offer wide solutions related to SOAR. These vendors offer customized solutions per user requirements and adopting growth strategies to consistently achieve the desired growth and make their presence in the market.

Who are the emerging start-ups/SMEs that are supporting significantly in the market growth?

Cyberbit (US), SIRP (UK), Tines (Ireland) are few of the emerging SMEs that are nurturing the market growth with their technical skills and expertise. These startups focus on developing product/service portfolios and bringing innovations to the market compared to their competitors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 2 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 3 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y %)

TABLE 4 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 3 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET

FIGURE 4 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE USAGE ENABLES ORGANIZATIONS TO COPE WITH HIGH NUMBER OF FALSE ALERTS

4.2 MARKET SHARE OF TOP THREE VERTICALS AND REGIONS, 2022

FIGURE 5 GOVERNMENT SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES IN 2022

4.3 MARKET, BY OFFERING, 2022–2027

FIGURE 6 PLATFORM AND SOLUTIONS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

4.4 MARKET, TOP THREE APPLICATIONS, 2022–2027

FIGURE 7 THREAT INTELLIGENCE APPLICATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

4.5 MARKET, BY DEPLOYMENT MODE, 2022–2027

FIGURE 8 CLOUD SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET, BY ORGANIZATION SIZE, 2022–2027

FIGURE 9 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.7 INVESTMENT SCENARIO: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET, BY REGION

FIGURE 10 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 11 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing incidents of phishing emails and ransomware

5.2.1.2 SOAR helps security teams fight against alert fatigue

5.2.2 RESTRAINTS

5.2.2.1 Lack of trust in third-party applications

5.2.3 OPPORTUNITIES

5.2.3.1 SOAR addresses dearth of skilled cybersecurity professionals

5.2.3.2 Introduction of ML/AI-powered SOAR solutions

5.2.4 CHALLENGES

5.2.4.1 Lack of modern IT infrastructure

5.3 USE CASES

5.3.1 SPLUNK USE CASE

5.3.2 SUMO LOGIC USE CASE

5.3.3 RSA SECURITY USE CASE

5.4 VALUE CHAIN ANALYSIS

FIGURE 12 VALUE CHAIN: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET

5.5 ECOSYSTEM

FIGURE 13 ECOSYSTEM: MARKET

5.6 PORTER’S FIVE FORCES MODEL ANALYSIS

FIGURE 14 PORTER’S FIVE FORCES MODEL ANALYSIS: MARKET

TABLE 5 PORTER’S FIVE FORCES IMPACT ANALYSIS

5.6.1 THREAT FROM NEW ENTRANTS

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 INTENSITY OF COMPETITION RIVALRY

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

5.8 PRICING MODEL ANALYSIS

5.8.1 PRICING MODEL OF KEY PLAYERS

TABLE 7 PRICING MODEL OF RAPID7

5.8.2 SELLING PRICES OF STARTUP/SME PLAYERS

TABLE 8 PRICING MODEL OF LOGICHUB

5.9 TECHNOLOGY ANALYSIS

5.9.1 ADVANCED SIEM PLATFORM

5.9.2 AI AND ML INTEGRATION

5.10 PATENT ANALYSIS

FIGURE 16 PATENT ANALYSIS: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET

5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 17 TRENDS AND DISRUPTIONS IN MARKET IMPACTING CUSTOMER BUSINESS

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.12.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.12.3 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

5.12.4 GRAMM-LEACH-BLILEY ACT

5.12.5 SARBANES-OXLEY ACT

5.12.6 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001

5.12.7 GENERAL DATA PROTECTION REGULATION

5.12.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 MARKET: LIST OF CONFERENCES AND EVENTS

6 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET, BY OFFERING (Page No. - 70)

6.1 INTRODUCTION

FIGURE 18 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 11 MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 12 MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

6.2 PLATFORM AND SOLUTIONS

6.2.1 PLATFORM AND SOLUTIONS: MARKET DRIVERS

TABLE 13 PLATFORM AND SOLUTIONS: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 14 PLATFORM AND SOLUTIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

FIGURE 19 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 16 MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 17 SERVICES: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

6.3.3 MANAGED SERVICES

TABLE 21 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 MANAGED SERVICES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET, BY APPLICATION (Page No. - 78)

7.1 INTRODUCTION

FIGURE 20 INCIDENT RESPONSE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 23 MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 24 MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 THREAT INTELLIGENCE

7.2.1 THREAT INTELLIGENCE: MARKET DRIVERS

TABLE 25 THREAT INTELLIGENCE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 THREAT INTELLIGENCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 NETWORK FORENSICS

7.3.1 NETWORK FORENSICS: MARKET DRIVERS

TABLE 27 NETWORK FORENSICS: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 NETWORK FORENSICS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 INCIDENT RESPONSE

7.4.1 INCIDENT RESPONSE: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET DRIVERS

TABLE 29 INCIDENT RESPONSE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 INCIDENT RESPONSE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.5 COMPLIANCE

7.5.1 COMPLIANCE: MARKET DRIVERS

TABLE 31 COMPLIANCE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 COMPLIANCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.6 WORKFLOW MANAGEMENT

7.6.1 WORKFLOW MANAGEMENT: MARKET DRIVERS

TABLE 33 WORKFLOW MANAGEMENT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 WORKFLOW MANAGEMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.7 OTHER APPLICATIONS

TABLE 35 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET, BY DEPLOYMENT MODE (Page No. - 88)

8.1 INTRODUCTION

FIGURE 21 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 37 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 38 MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

8.2 CLOUD

8.2.1 CLOUD: MARKET DRIVERS

TABLE 39 CLOUD: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 CLOUD: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 ON-PREMISES

8.3.1 ON-PREMISES: MARKET DRIVERS

TABLE 41 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 ON-PREMISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET, BY ORGANIZATION SIZE (Page No. - 92)

9.1 INTRODUCTION

FIGURE 22 SMALL- AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 43 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 44 MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

9.2 SMALL- AND MEDIUM-SIZED ENTERPRISES

9.2.1 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 45 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 47 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET, BY VERTICAL (Page No. - 97)

10.1 INTRODUCTION

FIGURE 23 GOVERNMENT VERTICAL TO LEAD MARKET DURING FORECAST PERIOD

TABLE 49 MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 50 MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES AND INSURANCE

10.2.1 BFSI: MARKET DRIVERS

TABLE 51 BFSI: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 BFSI: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 GOVERNMENT

10.3.1 GOVERNMENT: MARKET DRIVERS

TABLE 53 GOVERNMENT: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 GOVERNMENT: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.4 ENERGY AND UTILITIES

10.4.1 ENERGY AND UTILITIES: MARKET DRIVERS

TABLE 55 ENERGY AND UTILITIES: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.5 HEALTHCARE

10.5.1 HEALTHCARE: MARKET DRIVERS

TABLE 57 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 HEALTHCARE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.6 RETAIL AND ECOMMERCE

10.6.1 RETAIL AND ECOMMERCE: MARKET DRIVERS

TABLE 59 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.7 IT AND ITES

10.7.1 IT AND ITES: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET DRIVERS

TABLE 61 IT AND ITES: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 IT AND ITES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.8 OTHER VERTICALS

TABLE 63 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 OTHER VERTICALS: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET, BY REGION (Page No. - 109)

11.1 INTRODUCTION

FIGURE 24 NORTH AMERICA TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 65 MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 25 NORTH AMERICA: MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.3 UNITED STATES

TABLE 81 UNITED STATES: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 82 UNITED STATES: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 83 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 84 UNITED STATES: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 85 UNITED STATES: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 86 UNITED STATES: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 88 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 89 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 90 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 91 UNITED STATES: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 92 UNITED STATES: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.2.4 CANADA

TABLE 93 CANADA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 94 CANADA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 95 CANADA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 97 CANADA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 99 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 100 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 101 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 102 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 103 CANADA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET DRIVERS

11.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 105 EUROPE: MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.3 UNITED KINGDOM

TABLE 119 UNITED KINGDOM: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 120 UNITED KINGDOM: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 121 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 122 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 123 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 124 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 125 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 126 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 127 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 129 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 130 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.4 GERMANY

TABLE 131 GERMANY: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 132 GERMANY: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 133 GERMANY: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 135 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 137 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 138 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 139 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 140 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 141 GERMANY: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 142 GERMANY: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.5 FRANCE

TABLE 143 FRANCE: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 144 FRANCE: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 145 FRANCE: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 146 FRANCE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 147 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 148 FRANCE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 149 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 150 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 151 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 152 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 153 FRANCE: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 154 FRANCE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 155 REST OF EUROPE: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 156 REST OF EUROPE: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 157 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 158 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 159 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 160 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 161 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 162 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 163 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 164 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 165 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 166 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET DRIVERS

11.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.3 CHINA

TABLE 181 CHINA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 182 CHINA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 183 CHINA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 184 CHINA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 185 CHINA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 186 CHINA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 187 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 188 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 189 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 190 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 191 CHINA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 192 CHINA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.4 JAPAN

TABLE 193 JAPAN: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 194 JAPAN: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 195 JAPAN: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 196 JAPAN: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 197 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 198 JAPAN: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 199 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 200 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 201 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 202 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 203 JAPAN: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 204 JAPAN: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.5 AUSTRALIA

TABLE 205 AUSTRALIA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 206 AUSTRALIA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 207 AUSTRALIA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 208 AUSTRALIA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 209 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 210 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 211 AUSTRALIA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 212 AUSTRALIA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 213 AUSTRALIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 214 AUSTRALIA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 215 AUSTRALIA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 216 AUSTRALIA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 217 REST OF ASIA PACIFIC: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 218 REST OF ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 219 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 222 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 223 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 224 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 225 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 226 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 227 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 228 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 229 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 230 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 231 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 232 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 233 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 234 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 235 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 236 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 237 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 238 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 239 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 240 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 241 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 242 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.3 MIDDLE EAST

TABLE 243 MIDDLE EAST: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 244 MIDDLE EAST: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 245 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 246 MIDDLE EAST: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 247 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 248 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 249 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 250 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 251 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 252 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 253 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 254 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.5.4 AFRICA

TABLE 255 AFRICA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 256 AFRICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 257 AFRICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 258 AFRICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 259 AFRICA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 260 AFRICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 261 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 262 AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 263 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 264 AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 265 AFRICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 266 AFRICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET DRIVERS

11.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 267 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 268 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 269 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 270 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 271 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 272 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 273 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 274 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 275 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 276 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 277 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 278 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 279 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 280 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.3 BRAZIL

TABLE 281 BRAZIL: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 282 BRAZIL: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 283 BRAZIL: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 284 BRAZIL: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 285 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 286 BRAZIL: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 287 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 288 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 289 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 290 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 291 BRAZIL: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 292 BRAZIL: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.4 MEXICO

TABLE 293 MEXICO: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 294 MEXICO: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 295 MEXICO: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 296 MEXICO: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 297 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 298 MEXICO: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 299 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 300 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 301 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 302 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 303 MEXICO: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 304 MEXICO: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

11.6.5 REST OF LATIN AMERICA

TABLE 305 REST OF LATIN AMERICA: SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET SIZE, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 306 REST OF LATIN AMERICA: MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 307 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 308 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 309 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 310 REST OF LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 311 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 312 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 313 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 314 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 315 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 316 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 203)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 27 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE: MARKET EVALUATION FRAMEWORK

12.3 REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 28 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET: REVENUE ANALYSIS

12.4 MARKET SHARE ANALYSIS OF THE TOP MARKET PLAYERS

TABLE 317 MARKET: DEGREE OF COMPETITION

12.5 HISTORICAL REVENUE ANALYSIS

FIGURE 29 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF KEY PUBLIC SECTOR SECURITY ORCHESTRATION AUTOMATION AND RESPONSE PROVIDERS

12.6 RANKING OF KEY PLAYERS IN MARKET

FIGURE 30 KEY PLAYERS RANKING

12.7 EVALUATION QUADRANT OF KEY COMPANIES

FIGURE 31 MARKET: KEY COMPANY EVALUATION QUADRANT 2022

12.7.1 STARS

12.7.2 EMERGING LEADERS

12.7.3 PERVASIVE PLAYERS

12.7.4 PARTICIPANTS

12.8 COMPETITIVE BENCHMARKING

12.8.1 EVALUATION CRITERIA OF KEY COMPANIES

TABLE 318 INDUSTRY FOOTPRINT OF KEY COMPANIES

TABLE 319 REGION FOOTPRINT OF KEY COMPANIES

12.8.2 EVALUATION CRITERIA OF SMALL- AND MEDIUM-SIZED ENTERPRISES/STARTUP COMPANIES

TABLE 320 DETAILED LIST OF SMALL- AND MEDIUM-SIZED ENTERPRISES/STARTUPS

TABLE 321 REGION FOOTPRINT OF SMALL- AND MEDIUM-SIZED ENTERPRISES/STARTUP COMPANIES

12.9 COMPANY EVALUATION QUADRANT OF SMALL- AND MEDIUM-SIZED ENTERPRISES/STARTUPS

12.9.1 PROGRESSIVE COMPANIES

12.9.2 RESPONSIVE COMPANIES

12.9.3 DYNAMIC COMPANIES

12.9.4 STARTING BLOCKS

FIGURE 32 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET: SMALL- AND MEDIUM-SIZED ENTERPRISES/STARTUP EVALUATION QUADRANT 2022

12.1 COMPETITIVE SCENARIO AND TRENDS

12.10.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 322 MARKET: NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019–2022

12.10.2 DEALS

TABLE 323 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE MARKET: DEALS, 2019–2022

13 COMPANY PROFILES (Page No. - 219)

13.1 INTRODUCTION

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

13.2 KEY PLAYERS

13.2.1 IBM

TABLE 324 IBM: BUSINESS OVERVIEW

FIGURE 33 IBM: COMPANY SNAPSHOT

TABLE 325 IBM: SOLUTIONS OFFERED

TABLE 326 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 327 IBM: DEALS

13.2.2 CISCO

TABLE 328 CISCO: BUSINESS OVERVIEW

FIGURE 34 CISCO: COMPANY SNAPSHOT

TABLE 329 CISCO: SOLUTIONS OFFERED

TABLE 330 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 331 CISCO: DEALS

13.2.3 RAPID7

TABLE 332 RAPID7: BUSINESS OVERVIEW

FIGURE 35 RAPID7: COMPANY SNAPSHOT

TABLE 333 RAPID7: SOLUTIONS OFFERED

TABLE 334 RAPID7: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 335 RAPID7: DEALS

13.2.4 PALO ALTO NETWORKS

TABLE 336 PALO ALTO NETWORKS: BUSINESS OVERVIEW

FIGURE 36 PALO ALTO NETWORKS: COMPANY SNAPSHOT

TABLE 337 PALO ALTO NETWORKS: SOLUTIONS OFFERED

TABLE 338 PALO ALTO NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 339 PALO ALTO NETWORKS: DEALS

13.2.5 SPLUNK

TABLE 340 SPLUNK: BUSINESS OVERVIEW

FIGURE 37 SPLUNK: COMPANY SNAPSHOT

TABLE 341 SPLUNK: SOLUTIONS OFFERED

TABLE 342 SPLUNK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 343 SPLUNK: DEALS

13.2.6 SWIMLANE

TABLE 344 SWIMLANE: BUSINESS OVERVIEW

TABLE 345 SWIMLANE: SOLUTIONS OFFERED

TABLE 346 SWIMLANE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 347 SWIMLANE: DEALS

13.2.7 TUFIN

TABLE 348 TUFIN: BUSINESS OVERVIEW

FIGURE 38 TUFIN: COMPANY SNAPSHOT

TABLE 349 TUFIN: SOLUTIONS OFFERED

TABLE 350 TUFIN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 351 TUFIN: DEALS

13.2.8 FORTINET

TABLE 352 FORTINET: BUSINESS OVERVIEW

FIGURE 39 FORTINET: COMPANY SNAPSHOT

TABLE 353 FORTINET: SOLUTIONS OFFERED

TABLE 354 FORTINET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 355 FORTINET: DEALS

13.2.9 THREATCONNECT

TABLE 356 THREATCONNECT: BUSINESS OVERVIEW

TABLE 357 THREATCONNECT: SOLUTIONS OFFERED

TABLE 358 THREATCONNECT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 359 THREATCONNECT: DEALS

13.2.10 TRELLIX

TABLE 360 TRELLIX: BUSINESS OVERVIEW

TABLE 361 TRELLIX: SOLUTIONS OFFERED

TABLE 362 TRELLIX: DEALS

13.2.11 SUMO LOGIC

13.2.12 SIEMPLIFY

13.2.13 LOGRHYTHM

13.2.14 RESOLVE

13.2.15 EXABEAM

13.2.16 MANAGEENGINE

13.2.17 KNOWBE4

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.3 OTHER PLAYERS

13.3.1 D3 SECURITY

13.3.2 QVINE

13.3.3 CYWARE

13.3.4 LOGICHUB

13.3.5 CYBERBIT

13.3.6 LOGSIGN

13.3.7 SIRP

13.3.8 TINES

14 ADJACENT MARKETS (Page No. - 260)

14.1 INTRODUCTION

TABLE 363 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 SECURITY ORCHESTRATION AUTOMATION AND RESPONSE: ADJACENT MARKETS

14.4 MANAGED SECURITY SERVICES MARKET

14.4.1 ADJACENT MARKET: MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE

TABLE 364 MANAGED SECURITY SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 365 SMALL- AND MEDIUM-SIZED ENTERPRISES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 366 LARGE ENTERPRISES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 367 NORTH AMERICA: MANAGED SECURITY SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 368 EUROPE: MANAGED SECURITY SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 369 ASIA PACIFIC: MANAGED SECURITY SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 370 MIDDLE EAST AND AFRICA: MANAGED SECURITY SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 371 LATIN AMERICA: MANAGED SECURITY SERVICES MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 372 MANAGED SECURITY SERVICES MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 373 BANKING, FINANCIAL SERVICES, AND INSURANCE: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 374 GOVERNMENT: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 375 RETAIL: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 376 HEALTHCARE: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 377 INFORMATION TECHNOLOGY AND ENTERPRISES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 378 TELECOMMUNICATIONS: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 379 ENERGY AND UTILITIES: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 380 MANUFACTURING: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 381 OTHER VERTICALS: MANAGED SECURITY SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14.5 CYBERSECURITY MARKET

14.5.1 ADJACENT MARKET: CYBERSECURITY MARKET, BY VERTICAL

TABLE 382 CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 383 CYBERSECURITY MARKET SIZE FOR AEROSPACE AND DEFENSE, BY REGION, 2020–2026 (USD MILLION)

TABLE 384 CYBERSECURITY MARKET SIZE FOR GOVERNMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 385 CYBERSECURITY MARKET SIZE FOR BANKING, FINANCIAL SERVICES, AND INSURANCE, BY REGION, 2020–2026 (USD MILLION)

TABLE 386 CYBERSECURITY MARKET SIZE FOR IT, BY REGION, 2020–2026 (USD MILLION)

TABLE 387 CYBERSECURITY MARKET SIZE FOR HEALTHCARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 388 CYBERSECURITY MARKET SIZE FOR RETAIL AND CONSUMER GOODS, BY REGION, 2020–2026 (USD MILLION)

TABLE 389 CYBERSECURITY MARKET SIZE FOR MANUFACTURING, BY REGION, 2020–2026 (USD MILLION)

TABLE 390 CYBERSECURITY MARKET SIZE FOR ENERGY AND UTILITIES, BY REGION, 2020–2026 (USD MILLION)

TABLE 391 CYBERSECURITY MARKET SIZE FOR TELECOMMUNICATIONS, BY REGION, 2020–2026 (USD MILLION)

TABLE 392 CYBERSECURITY MARKET SIZE FOR MEDIA AND ENTERTAINMENT, BY REGION, 2020–2026 (USD MILLION)

TABLE 393 CYBERSECURITY MARKET SIZE FOR OTHERS, BY REGION, 2020–2026 (USD MILLION)

14.5.2 ADJACENT MARKET: CYBERSECURITY MARKET, BY REGION

TABLE 394 NORTH AMERICA: CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 395 EUROPE: CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 396 ASIA PACIFIC: CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 397 MIDDLE EAST AND AFRICA: CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 398 LATIN AMERICA: CYBERSECURITY MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

15 APPENDIX (Page No. - 274)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved major activities in estimating the current market size for the SOAR market. Exhaustive secondary research was done to collect information on the SOAR industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, bottom up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the SOAR market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Various research reports from a few consortiums and councils, such as Agile Alliance, JISA, Journal of Information Security and Applications, and Journal of Network and Computer Applications; and associations, including TSIA and WITSA, were also referred to structure the qualitative content. Secondary research was conducted to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from different key companies and organizations operating in the SOAR market.

Primary interviews were conducted to gather insights, such as market statistics, the data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, verticals, and regions.

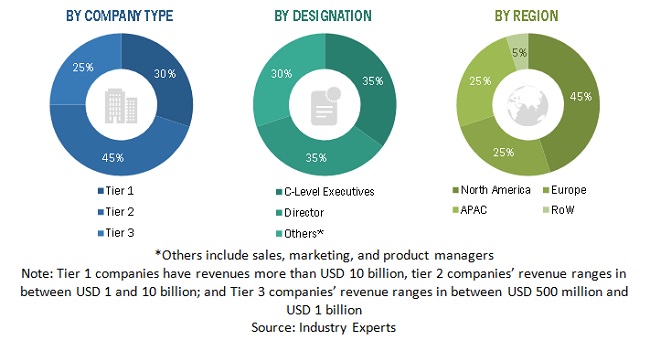

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

In the top-down approach, an exhaustive list of all vendors that offer SOAR was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid data sources, and primary interviews. Each vendor was evaluated based on service offering. The aggregate of revenues of all companies was extrapolated to reach the overall size of the market. Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both, primary and secondary research. The primary procedure included extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives for key insights. The market numbers were further triangulated with the existing repository of MarketsandMarkets for validation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, determine, and forecast the global Security Orchestration Automation and Response (SOAR) market by offering, application, deployment mode, organization size, vertical, and region

- To forecast the size of market segments with respect to the five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities for stakeholders by identifying high-growth segments in the market

- To profile the key market players; provide a competitive analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research & Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Security Orchestration, Automation and Response (SOAR) Market

what are the major challenges in Security Orchestration Automation and Response market?