Network Encryption Market by Component (Hardware, Platform and Services), Transmission Type (Traditional Transmission and Optical Transmission), Data Rate, Organization Size, Vertical, and Region - Global Forecast to 2023

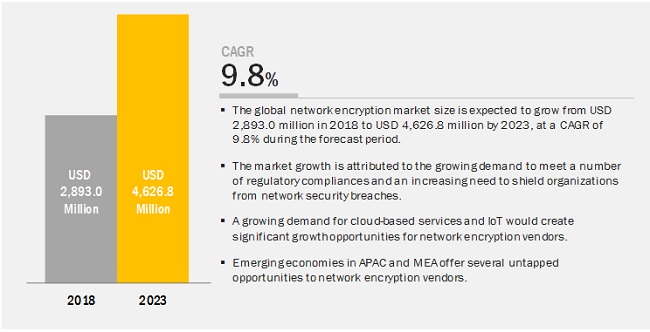

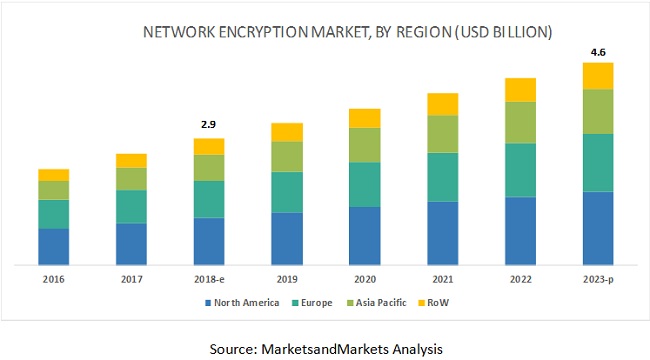

[159 Pages Report] MarketsandMarkets expects the global network encryption market size to grow from USD 2.9 billion in 2018 to USD 4.6 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period. Major growth drivers for the market include increasing adoption of optical transmission, an increasing demand to meet various regulatory compliances, and a growing focus on shielding organizations from network security breaches.

In network encryption market by transmission type, optical transmission segment to grow at the highest CAGR rate during the forecast period

Transmission media is a pathway which facilitates the transfer of data from one place to another. Transmission media enables enterprises to connect with various computers, laptops, mobiles, other devices, and people on the network. The network uses 2 types of transmission medium: optical and traditional transmission mediums. Traditionally transmission is done through coaxial cable, twisted pair cable, and radio waves/microwaves optical. Fiber optics offers numerous benefits, such as enormous bandwidth, reduced noise and interference, and high security of data in transit. Thus, organizations are looking forward to optical transmission through fiber optics owing to a growing demand for high speed data transfer with enhanced security.

Telecom and IT vertical to hold the largest market size during the forecast period

The telecom and IT vertical include IT solution and service providers, consulting companies, Internet Service Providers (ISPs), and communication companies. The development of innovative technologies and the increasing use of the internet, mobile devices, Bring Your Own Device (BYOD), in an organization has increased the need to protect data that is transmitted over the network and comply with the industry regulations. Telecom companies and IT service providers are deploying network encryption solutions to secure business-critical information. Moreover, online fraud is one of the most critical issues causing difficulties for cyber experts, network operators, service providers, and users across the globe. Companies are conducting data security awareness programs for employees and customers. Major vendors offering the network encryption hardware, platform, and services to the IT and telecom service providers include Cisco, Juniper, and Huawei.

The large enterprises segment to hold a larger market size during the forecast period

Large enterprises are the early adopters of network encryption solutions, as they need to secure large volumes of data generated from various application areas, including sales, marketing, HR, operations within the organization. Large enterprises across verticals are at the forefront in adopting network encryption solutions due to voluminous content being generated by applications every second in enterprises to achieve business advantage. The deployment of network encryption solutions enables large enterprises to prevent unauthorized access to critical data. A substantial amount of Capital Expenditure (CAPEX) is made by enterprises to modernize their traditional IT infrastructure to meet the changing business and management trends. In addition, enterprises are investing in security solutions as any unethical use of any enterprise data can hamper the brand image resulting in heavy loss.

North America to hold the largest market size during the forecast period

Major verticals such as telecom and IT, BFSI, media and entertainment, and government, are focusing on deploying network encryption on their platform. North America, being the technologically advanced region, has the largest market size in the network encryption market by regions. The region consists of developed economies, the US and Canada. The North American market offers appropriate platforms for startups and SMEs, in terms of government regulations and compliances. Hence, enterprises are growing rapidly and have a massive demand for network encryption. Therefore, North America has the largest market size in the network encryption market. North American enterprises are also constantly executing a superior business strategy to garner high revenues, thereby expanding their network encryption business in the region. In addition, the region has significant IT expertise and scalable IT infrastructure. As a result, enterprises optimized their Capital Expenditures (CapEx) and Operational Expenditure (OpEx).

Major vendors offering network encryption across the globe include Cisco (US), Juniper Networks (US), Gemalto (Netherlands), Nokia (Finland), Thales eSecurity (US), Atos (France), Ciena (US), Rohde & Schwarz Cybersecurity (Germany), ADVA (Germany), Colt Technology Services (UK), Huawei (China), Aruba (US), F5 Networks (US), Stormshield (France), ECI Telecom (Israel), Senetas (Australia), Viasat (US), Raytheon (US), Quantum (US), TCC (US) , ARRIS (Georgia), atmedia (Germany), Securosys (Switzerland), PacketLight Networks (Israel), and Certes Networks (US).

Recent developments

- In November 2018, Cisco acquired Duo Security. With this acquisition, Cisco’s users can connect any application on any networked device with more ease and security.

- In October 2018, Atos launched Trustway IP Protect, an IP network encryption solution, to offer the highest level of security for protecting its sensitive data against thefts.

- In September 2018, Juniper Networks partnered with Ericsson to deliver and manage comprehensive end-to-end 5G solutions. Moreover, the partnership leverages Juniper Networks’ Cybersecurity platform to secure the entire 5G mobile infrastructure from unpredicted threats. According to the partnership, Juniper Networks would use Ericsson’s go-to-market strategy to provide Ericsson the ability to include Juniper’s solutions for edge, core, and security in its 5G transport portfolio.

Key questions addressed by the report

- What are the factors driving the network encryption market?

- Which are the major industries having major shares in the market?

- Which are the major regions having adoption of network encryption?

- What are the challenges faced by network encryption providers in the global market?

- What are the strategies (New product launches / Partnerships / Acquisitions) major companies are adopting for their growth in the global network encryption market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Assumptions for the Study

2.5 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Network Encryption Market

4.2 Market in North America, By Vertical and Country

4.3 Market Major Countries

5 Market Overview and Industry Trends (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand to Comply With the Large Number of Regulatory Standards

5.2.1.2 Growing Need to Shield Organizations From Network Security Breaches

5.2.2 Restraints

5.2.2.1 Frequent Changes in Government Policies for Data Protection Across Different Regions

5.2.3 Opportunities

5.2.3.1 Rapid Adoption of Cloud Technology Requires Organizations to Deploy Network Encryption Solutions

5.2.3.2 Growing Adoption of IoT in Various Applications

5.2.4 Challenges

5.2.4.1 High Cost of Network Encryption Solutions

5.3 Industry Trends

5.3.1 Use Case 1: Senetas

5.3.2 Use Case 2: Thales

5.3.3 Use Case 3: Certes Networks

6 Network Encryption Market, By Transmission Type (Page No. - 42)

6.1 Introduction

6.2 Optical Transmission

6.2.1 Optical Transmission Empowers Organizations to Achieve Enhanced Performance and Security for Data Transfer

6.3 Traditional Transmission

6.3.1 Twisted Pair Cable

6.3.1.1 Benefits of Cost Efficiency and Ease of Installation to Boost the Adoption of Twisted Pair Cable

6.3.2 Coaxial Cable

6.3.2.1 Capability of Transmitting Higher Frequency Signals to Fuel the Demand for Coaxial Cable

6.3.3 Radiowaves and Microwaves

6.3.3.1 Use of Radiowaves and Microwaves for Data Transfer to Larger Distances

7 Network Encryption Market, By Component (Page No. - 47)

7.1 Introduction

7.2 Hardware

7.2.1 Rising Adoption of Network Encryption Hardware Devices Across the Globe to Drive the Growth of the Hardware Segment in the Market

7.3 Platform

7.3.1 Increasing Need for Safeguarding Sensitive Data Transmitted Over the Network to Drive the Growth of the Platform Segment

7.4 Services

7.4.1 Advisory Services

7.4.1.1 Lack of In-House IT Skills to Drive the Demand for Advisory Services

7.4.2 Integration and Implementation Services

7.4.2.1 Increasing Focus on Enhanced Operational Efficiency to Drive the Market

7.4.3 Training and Support Services

7.4.3.1 Growing Need to Improve Network Encryption Customer Services to Drive the Growth of Training and Support Services

7.4.4 Managed Services

7.4.4.1 Rapid Adoption of Network Encryption Solutions to Boost the Demand for Managed Services

8 Network Encryption Market, By Data Rate (Page No. - 55)

8.1 Introduction

8.2 Less Than 10g

8.2.1 The Advantage of Cost-Efficiency to Organizations to Drive the Market for Less Than 10g Segment

8.3 Greater Than 10g and Less Than 40g

8.3.1 Benefits of Backward Compatibility and Reduced Capex to Drive the Market for Greater Than 10g and Less Than 40g Segment

8.4 Greater Than 40g and Less Than 100g

8.4.1 Growing Demand for High-Speed Connectivity to Drive the Market for Greater Than 40g and Less Than 100g Segment

8.5 Greater Than 100g

8.5.1 Growing Adoption of Hyperscale Data Center Connectivity to Drive the Market for Greater Than 100g Segment

9 Network Encryption Market, By Organization Size (Page No. - 60)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Small and Medium-Sized Enterprises Increasingly Leveraging Network Encryption Solutions to Protect Sensitive Data From Fraud

9.3 Large Enterprises

9.3.1 Growing Need Among Large Enterprises to Comply With Regulatory Requirements to Drive the Adoption of Network Encryption Solutions

10 Network Encryption Market, By Vertical (Page No. - 64)

10.1 Introduction

10.2 Telecom and IT

10.2.1 Rapid Technological Advancements in Network Infrastructure to Boost the Growth of the Network Encryption in the Telecom and IT Vertical

10.3 Banking, Financial Services, and Insurance

10.3.1 Increased Usage of Internet and Mobile Banking Generating the Demand for Network Encryption to Secure Customer Sensitive Data in the BFSI Vertical

10.4 Media and Entertainment

10.4.1 Increasing Demand for Reliable Networks to Boost the Adoption of the Network Encryption in the Media and Entertainment Vertical

10.5 Government

10.5.1 Adoption of Digitalization Among Government Agencies to Increase the Growth Opportunities of the Network Encryption in the Government Vertical

10.6 Others

11 Network Encryption Market, By Region (Page No. - 70)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 High Focus on Innovation for Securing Network Infrastructure to Boost the Growth of Market in the Us

11.2.2 Canada

11.2.2.1 Rapid Adoption of Advanced Technologies to Boost the Growth of Market in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Stringent Regulations and Compliances Regarding Data Security to Drive the Growth of Market in the Uk

11.3.2 Germany

11.3.2.1 Government Initiatives to Drive the Growth of the Network Encryption Market in Germany

11.3.3 France

11.3.3.1 Emphasis on Building Digital Economy to Drive the Growth of the Market in France

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 Japan

11.4.1.1 Growing Need for Highly Efficient Network Encryption Solutions to Drive the Market in Japan

11.4.2 China

11.4.2.1 Growing Demand for High Speed Connectivity to Boost the Market Growth in China

11.4.3 Australia and New Zealand

11.4.3.1 Initiatives for Testing Encryption of Data in Transit at 10 Gbps to Spur the Demand for Network Encryption in Anz

11.4.4 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Kingdom of Saudi Arabia

11.5.1.1 Vision 2030 to Boost Digital Transformation in Ksa

11.5.2 United Arab Emirates

11.5.2.1 Growing Focus on Digital Transformation and Economic Diversification to Drive the Network Encryption Market in UAE

11.5.3 South Africa

11.5.3.1 Increasing Focus on Network Security to Drive the Growth of the Market in South Africa

11.5.4 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Growing Internet Penetration and Rise in Number of IT Companies to Drive the Growth of Market in Brazil

11.6.2 Mexico

11.6.2.1 Increasing Investments in IT Organization to Drive the Growth of Market in Mexico

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 97)

12.1 Overview

12.2 Competitive Scenario

12.2.1 Product/Service/Solution Launches and Enhancements

12.2.2 Business Expansions

12.2.3 Acquisitions

12.2.4 Partnerships, Contracts, and Collaborations

13 Company Profiles (Page No. - 103)

(Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 Introduction

13.2 Cisco

13.3 Thales Esecurity

13.4 Atos

13.5 Juniper Networks

13.6 Certes Networks

13.7 Rohde & Schwarz Cybersecurity

13.8 Adva

13.9 Gemalto

13.10 Nokia

13.11 Colt Technology Services

13.12 Aruba

13.13 Huawei

13.14 Ciena

13.15 Eci Telecom

13.16 Senetas

13.17 Viasat

13.18 F5 Networks

13.19 Raytheon

13.20 Arris

13.21 Stormshield

13.22 Atmedia

13.23 Securosys

13.24 Packetlight Networks

13.25 Quantum Corporation

13.26 Technical Communication Corporation

*Details on Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 152)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (67 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Network Encryption Market Size, By Transmission Type, 2016–2023 (USD Million)

Table 3 Optical Transmission: Market Size, By Region, 2016–2023 (USD Million)

Table 4 Traditional Transmission: Market Size, By Region, 2016–2023 (USD Million)

Table 5 Network Encryption Market Size, By Component, 2016–2023 (USD Million)

Table 6 Hardware: Market Size, By Region, 2016–2023 (USD Million)

Table 7 Platform: Market Size By Region, 2016–2023 (USD Million)

Table 8 Network Encryption Market Size, By Services, 2016–2023 (USD Million)

Table 9 Services: Market Size By Region, 2016–2023 (USD Million)

Table 10 Advisory Services: Market Size By Region, 2016–2023 (USD Million)

Table 11 Integration and Implementation Services: Market Size, By Region, 2016–2023 (USD Million)

Table 12 Training and Support Services: Market Size, By Region, 2016–2023 (USD Million)

Table 13 Managed Services: Market Size, By Region, 2016–2023 (USD Million)

Table 14 Network Encryption Market Size, By Data Rate, 2016–2023 (USD Billion)

Table 15 Less Than 10g: Market Size By Region, 2016–2023 (USD Million)

Table 16 Greater Than 10g and Less Than 40g: Market Size By Region, 2016–2023 (USD Billion)

Table 17 Greater Than 40g and Less Than 100g: Market Size By Region, 2016–2023 (USD Billion)

Table 18 Greater Than 100g: Market Size By Region, 2016–2023 (USD Billion)

Table 19 Network Encryption Market Size, By Organization Size, 2016–2023 (USD Million)

Table 20 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 22 Network Encryption Market Size, By Vertical, 2016–2023 (USD Million)

Table 23 Telecom and IT: Market Size By Region, 2016–2023 (USD Million)

Table 24 Banking, Financial Services, and Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 25 Media and Entertainment: Market Size By Region, 2016–2023 (USD Million)

Table 26 Government: Market Size By Region, 2016–2023 (USD Million)

Table 27 Others: Market Size By Region, 2016–2023 (USD Million)

Table 28 Network Encryption Market Size, By Region, 2016–2023 (USD Million)

Table 29 North America: Market Size By Transmission Type, 2016–2023 (USD Million)

Table 30 North America: Market Size By Component, 2016–2023 (USD Million)

Table 31 North America: Market Size By Service, 2016–2023 (USD Million)

Table 32 North America: Market Size By Data Rate, 2016–2023 (USD Million)

Table 33 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 34 North America: Market Size By Vertical, 2016–2023 (USD Million)

Table 35 North America: Market Size By Country, 2016–2023 (USD Million)

Table 36 Europe: Network Encryption Market Size, By Transmission Type, 2016–2023 (USD Million)

Table 37 Europe: Market Size By Component, 2016–2023 (USD Million)

Table 38 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 39 Europe: Market Size By Data Rate, 2016–2023 (USD Million)

Table 40 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 41 Europe: Market Size By Vertical, 2016–2023 (USD Million)

Table 42 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 43 Asia Pacific: Network Encryption Market Size, By Transmission Type, 2016–2023 (USD Million)

Table 44 Asia Pacific: Market Size By Component, 2016–2023 (USD Million)

Table 45 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 46 Asia Pacific: Market Size By Data Rate, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market Size By Vertical, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 50 Middle East and Africa: Network Encryption Market Size, By Transmission Type, 2016–2023 (USD Million)

Table 51 Middle East and Africa: Market Size By Component, 2016–2023 (USD Million)

Table 52 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 53 Middle East and Africa: Market Size By Data Rate, 2016–2023 (USD Million)

Table 54 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 55 Middle East and Africa: Market Size By Vertical, 2016–2023 (USD Million)

Table 56 Middle East and Africa: Market Size By Country, 2016–2023 (USD Million)

Table 57 Latin America: Network Encryption Market Size, By Transmission Type, 2016–2023 (USD Billion)

Table 58 Latin America: Market Size By Component, 2016–2023 (USD Million)

Table 59 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 60 Latin America: Market Size By Data Rate, 2016–2023 (USD Million)

Table 61 Latin America: Market Size By Organization Size, 2016–2023 (USD Billion)

Table 62 Latin America: Market Size By Vertical, 2016–2023 (USD Million)

Table 63 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 64 Product/Service/Solution Launches and Enhancements, 2016–2018

Table 65 Business Expansions, 2016–2018

Table 66 Acquisitions, 2016–2018

Table 67 Partnerships, Contracts, Collaborations, 2016–2018

List of Figures (42 Figures)

Figure 1 Network Encryption Market: Research Design

Figure 2 Market Bottom-Up Approach

Figure 3 Market Top-Down Approach

Figure 4 Asia Pacific to Grow at the Highest Rate During the Forecast Period

Figure 5 Hardware to Hold the Highest Share in the Network Encryption Market By Component in 2018

Figure 6 Managed Services Segment to Account for the Highest Share in the Market By Service in 2018

Figure 7 Greater Than 10g and Less Than 40g Segment to Dominate the Market By Data Rate in 2018

Figure 8 Increasing Incidence of Sophisticated Cyber-Attacks and Data Breaches to Drive the Network Encryption Market During the Forecast Period

Figure 9 Telecom and IT Vertical and the US to Dominate the North American Market in 2018

Figure 10 China to Grow at the Highest Rate in the Market During the Forecast Period

Figure 11 Encryption Rate in Network Traffic By 2021

Figure 12 Rate of Cyber-Attacks in Organizations in 2017

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Network Encryption Market

Figure 14 Optical Transmission Segment to Grow at A Higher CAGR During the Forecast Period

Figure 15 Platform Segment to Grow at the Highest CAGR During the Forecast Period

Figure 16 Greater Than 100g Segment to Grow at the Highest CAGR During the Forecast Period

Figure 17 Small and Medium-Sized Enterprises Segment to Grow at the Highest CAGR During the Forecast Period

Figure 18 Banking, Financial Services, and Insurance Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America to Account for the Highest Market Share in the Market

Figure 21 North America: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Key Developments in the Network Encryption Market, 2016–2018

Figure 24 Market Evaluation Framework

Figure 25 Geographic Revenue Mix of the Top Market Players

Figure 26 Cisco: Company Snapshot

Figure 27 SWOT Analysis: Cisco

Figure 28 Atos: Company Snapshot

Figure 29 SWOT Analysis: Atos

Figure 30 Juniper Networks: Company Snapshot

Figure 31 Adva: Company Snapshot

Figure 32 Gemalto: Company Snapshot

Figure 33 Nokia: Company Snapshot

Figure 34 Huawei: Company Snapshot

Figure 35 Ciena: Company Snapshot

Figure 36 Senetas: Company Snapshot

Figure 37 Viasat: Company Snapshot

Figure 38 F5 Networks: Company Snapshot

Figure 39 Raytheon: Company Snapshot

Figure 40 Arris: Company Snapshot

Figure 41 Quantum Corporation: Company Snapshot

Figure 42 Technical Communication Corporation: Company Snapshot

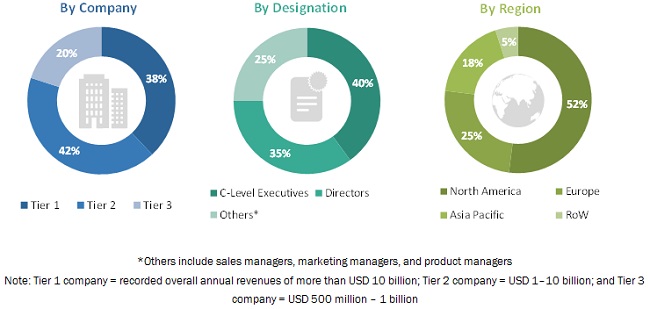

The study involved 4 major activities to estimate the current market size for network encryption. Exhaustive secondary research was done to collect information on the network encryption market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments of the network encryption market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary research

The network encryption market comprises several stakeholders, such as network encryption vendors, network encryption service providers, managed service providers, system integrators, consulting service providers, resellers and distributors, research organizations, enterprise users, and technology providers. The demand side of the network encryption market consists of enterprises across verticals: telecom and IT, BFSI, media and entertainment, government, and others (energy and utilities, retail, and healthcare). The supply side includes the providers of network encryption hardware, platform, and service. Various primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the network encryption market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from demand and supply sides.

Report objectives

- To define, describe, and forecast the network encryption market based on components, transmission types, data rates, organization size, verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze the competitive developments, such as product launches, business expansions, contracts, partnerships, and mergers and acquisitions in the network encryption market

Scope of report

Report Metrics |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Transmission Type, Data Rate, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

It includes 25 major vendors, namely, Cisco (US), Juniper Networks (US), Gemalto (Netherlands), Nokia (Finland), Thales eSecurity (US), Atos (France), Ciena (US), Rohde & Schwarz Cybersecurity (Germany), ADVA (Germany), Colt Technology Services (UK), Huawei (China), Aruba (US), F5 Networks (US), Stormshield (France), ECI Telecom (Israel), Senetas (Australia), Viasat (US), Raytheon (US), Quantum (US), TCC (US), ARRIS (Georgia), atmedia (Germany), Securosys (Switzerland), PacketLight Networks (Israel), and Certes Networks (US). |

This research report categorizes the network encryption market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of components, the network encryption market has been segmented as follows:

- Hardware

- Platform

- Services

- Advisory Services

- Integration and Implementation Services

- Training and Support Services

- Managed Services

On the basis of transmission types, the network encryption market has been segmented as follows:

- Optical Transmission

- Traditional Transmission

- Twisted Pair Cable

- Coaxial Cable

- Radiowaves and Microwaves

On the basis of data rate, the network encryption market has been segmented as follows:

- Less than 10G

- Greater than 10G Less than 40G

- Greater than 40G Less than 100G

- Greater than 100G

On the basis of organization size, the network encryption market has been segmented as follows:

- Large Enterprises

- SMEs

On the basis of verticals, the network encryption market has been segmented as follows:

- Telecom and IT

- BFSI

- Media and Entertainment

- Government

- Others (Energy and Utilities, Retail, and Healthcare)

On the basis of regions, the network encryption market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific (APAC)

- Japan

- China

- Australia and New Zealand (ANZ)

- Rest of APAC

- Middle East and Africa (MEA)

- Kingdom of Saudi Arabia (KSA)

- South Africa

- United Arab Emirates

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the European network encryption market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin American market into countries

Company information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Network Encryption Market