Needles Market by Type (Conventional (Bevel, Vented) & Safety), Product (Suture, Blood Collection, Insufflation), Material (Stainless Steel, Plastic), Delivery Mode (IV, IM, Hypodermic), End-User (Hospitals, Diagnostic Centres) & Region - Global Forecast to 2027

Market Growth Outlook Summary

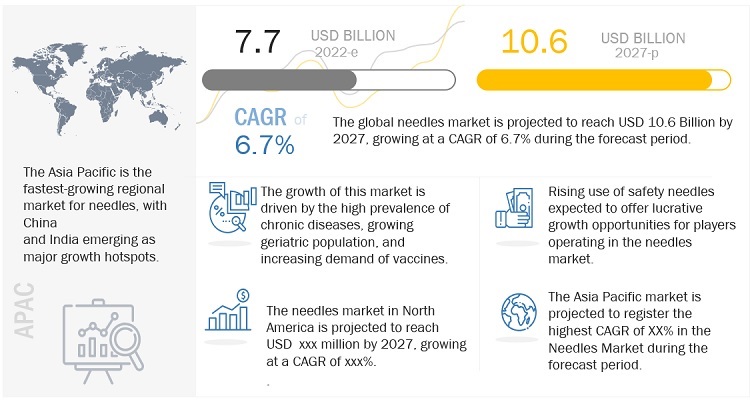

The global needles market growth forecasted to transform from billion USD 7.7 in 2022 to USD 10.6 billion by 2027, driven by a CAGR of 6.7%. The expansion of this market is majorly due to upsurging cases of chronic diseases such as cancer, HIV as well as growing elderly population. However, Growing focus on core development of substitute drug delivery methods is one of the challenge for which may inhibit the growth of this market.

Needles Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Global Needles Market Dynamics

Drivers: Increasing number of hospitals in emerging markets

The number of hospitals and surgical centers is increasing in both developed and emerging countries. The demand for medical or surgical devices (including blood collection devices) is high in these newly established surgical centers and hospitals, owing to the increasing patient population base. For instance, in October 2020, the Prime Minister of the UK announced plans of investing USD 4.3 billion for 40 hospitals and certain schemes for future funding for 48 hospitals by 2030. In addition, in March 2021, Steward Health Care announced plans to construct a new hospital in Washington County.

Over the last decade, developing countries, such as India and China, have witnessed significant improvements in their respective healthcare infrastructure. According to an article published in January 2020, China announced to invest USD 4.6 billion for the construction of hospitals in Wuhan. According to the Commonwealth Fund in 2018, China has approximately 12,000 public hospitals and 21,000 private hospitals. Similarly, in June 2019, the Indian Ministry of Health and Family Welfare announced the opening of 22 new AIIMS across the country. The significant growth in the number of hospitals and surgical centers is expected to support the growth of the needles market.

Opportunities: Rise in self-administration of drugs

The adoption of self-administration of drugs by patients has led to the rise in demand for self-administered injectables, which are easy to use. These self-injecting devices are most used for the treatment of emergency conditions such as allergies or chronic diseases such as diabetes. The use of self-administering injectables helps in reducing the anxiety caused by needles among users.

Self-administration of injectable contraceptives is widely adopted among females to avoid the expense and inconvenience of visits to the clinic. Injectable contraceptives are safer than other contraceptives. They prevent pregnancy 99% of the time when administered correctly. These injections also provide protection against cancer of the womb and pelvic inflammatory diseases, and it can be administered during the menstrual cycle as well.

These self-administered injections are a preferred option for patients suffering from diabetes, breast cancer, liver tumours, or osteoporosis. In line with this, companies are focusing on developing novel self-administration devices.

With the growing adoption of self-administering injectables, the demand for needles will increase, which would contribute to the growth of this market across the globe.

Challenges: Growing focus on the development of alternative drug delivery methods

Traditionally, injectables were invasive and painful, which was the major reason for patients to prefer alternate routes of drug delivery, such as oral, topical, and nasal. Among the various routes of drug delivery, the oral route is the most preferred as it is easy to use, convenient, cost-effective, safe, and acceptable. Owing to the abovementioned factors, the adoption of alternative drug delivery technologies is increasing across the globe. For instance, the development of alternate delivery methods for insulin, such as Pfizer’s Exubera (inhaled insulin) and Veo insulin pump (Medtronic’s inhalable insulin), is limiting the use of injectable insulin. Currently, insulin injections form a significant market for injectable drug delivery technologies. However, the advent of inhalable insulin will negatively impact this market as nasal drug delivery is pain-free and highly patient compliant. The development of alternate delivery techniques such as oral anemia treatment (by GlaxoSmithKline and Bayer) is also hampering the need for needles.

Due to their large molecular size and stability issues, proteins and peptides have been traditionally administered by the injectable route of drug delivery. However, smaller molecules of peptides have been developed recently through complex methods such as nanotechnology, allowing for oral administration of therapeutic proteins and peptides.

China is anticipated to account the largest share of Apac Needles Market

Based on the Apac region, the Needles Market is divided into China, Japan, and India. China is expected to account the largest share of Needles Market. The increasing demand for blood components (owing to the rising number of surgical procedures and the high prevalence of various diseases, inclusive of blood disorders) requiring diagnostic blood tests, growing awareness about therapeutic apheresis, and rising demand for plasma derivatives are the major factors supporting the growth of the Needles Market in China.

Germany is forecasted as the fastest growing country of Needles Market in Europe.

Based on the Europe region, the Needles Market is divided into Germany, UK, Italy, Spain, France, and RoE. Germany is forecasted to the fastest growing market of Needles Market in Europe. The increasing incidence of neoplasm cases is the major factor driving the market for needles in the country.

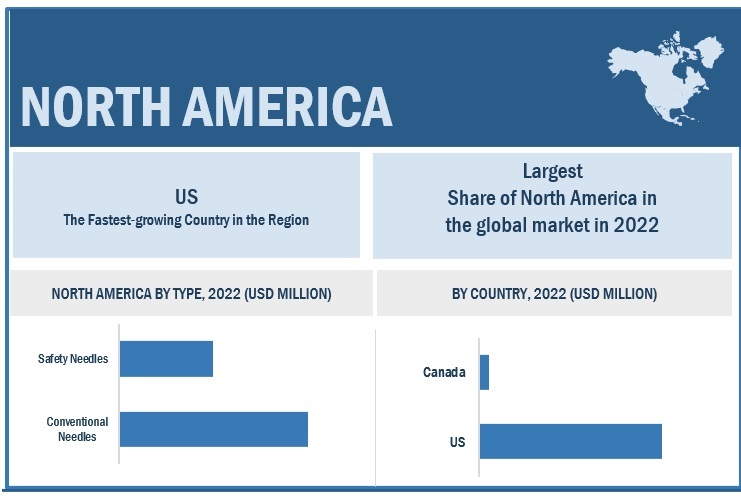

North America dominates the global Needles Market

Based on the region, the Needles Market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to dominate the Needles Market. Growth in the North American market is mainly driven by, increasing cases of severe diseases, and increasing heart diseases as well as medical procedures.

To know about the assumptions considered for the study, download the pdf brochure

Needles Market Key Players

Some of the players operating in North American market are Becton, Dickinson and Company (US), Stryker Corporation (US), Ethicon, Inc. (Subsidiary of Johnson and Johnson) (US), Olympus Corporation (US), Merit Medical (US), Hamilton Company (US) Unimed SA, Argon Medical Devices Inc. (US), Smiths Medical (US), Ultimed Inc. (US).

Needles Market Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Product, Type, Application, Material, Delivery Mode, End User and Region. |

|

Geographies Covered |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy, and RoE), APAC (China, India, Japan, and the RoAPAC), and Rest of the World (Latin America, Middle East & Africa). |

|

Companies Covered |

Medtronic (Ireland), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Stryker Corporation (US), Ethicon, Inc. (Subsidiary of Johnson and Johnson) (US), Boston Scientific Corporation (US), Terumo Corporation (Japan), Olympus Corporation (US), Merit Medical (US), Greiner Holding AG (Austria), Merck KgA (Germany), Hamilton Company (US) Unimed SA, Argon Medical Devices Inc. (US), Nipro Corporation (Japan), Smiths Medical (US), Ultimed Inc. (US), Hakko Co.Ltd. (Japan), Creganna (Ireland), DTR Medical (UK), and Rocket Medical (UK) |

This research report categorizes the Needle Market into the following segments and subsegments:

By Regional Split

- North America

- Europe

- Asia Pacific

- Rest of the World

By Product

- Suture Needles

- Blood Collection Needles

- Ophthalmic Needles

- Dental Needles

- Insufflation Needles

-

Pen Needles

- Standard Needles

- Safety Needles

-

Biopsy and Aspiration Needles

- Biopsy Needles

- Core Biopsy Needles

- Vaccum Assisted Needles

- Aspiration Needles

- Other Needles

By Type

-

Conventional Needles

- Bevel Needles

- Blunt Fill Needles

- Vented Needles

- Filter Needles

-

Safety Needles

- Active Needles

- Passive Needles

By Application

- Diagnostic Applications

- Therapeutics Applications

By Delivery Mode

- Hypodermic Needles

- Intravenous Needles

- Intramuscular Needles

- Intraperitoneal Needles

By Material

- Glass Needles

- Plastic Needles

- Stainless Steel/Metallic Needles

- Polyetheretherketone (PEEK) Needles

By End User

- Hospitals and Clinics

- Diagnostic Centers

- Home Healthcare

- Other End Users

Recent Developments:

- In 2020, The company Becton, Dickinson and Company (US), entered into strategic partnership agreement with Babson Diagnostics (US) to bring laboratory-quality, small-volume blood collection to retail pharmacies.

- In 2021, The company Olympus Corporation (US), launched the FDA 510(k)-cleared BF-UC190F endobronchial ultrasound (EBUS) bronchoscope for minimally invasive lung cancer diagnosis and staging via needle biopsy.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Needles Market?

The global Needles Market is projected to reach USD 10.6 billion by 2027.

What is the estimated growth rate (CAGR) of the global Needles Market for the next five years?

The global Needles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% from 2022 to 2027.

Who are the major players offering Needles in the market?

Becton, Dickinson, and Company (US), Medtronic (Ireland), B. Braun Melsungen AG (Germany), Boston Scientific Corporation (US), and Stryker Corporation (US).

Which is the fastest growing region of the Needles Market for the next five years?

Asia Pacific is the fastest growing region for the Needles Market during the forecast period.

Which region will occupy most shares for the Needles Market for the next five years?

North America will have most shares for the Needles Market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS

2.2.1 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR STUDY

2.6 INDICATORS AND ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 9 NEEDLES MARKET, BY PRODUCT, 2022 VS. 2027 (USD BILLION)

FIGURE 10 NEEDLES MARKET, BY TYPE, 2022 VS. 2027 (USD BILLION)

FIGURE 11 NEEDLES MARKET, BY DELIVERY MODE, 2022 VS. 2027 (USD BILLION)

FIGURE 12 NEEDLES MARKET, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

FIGURE 13 NEEDLES MARKET, BY END USER, 2022 VS. 2027 (USD BILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF NEEDLES MARKET

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 NEEDLES MARKET OVERVIEW

FIGURE 15 RISING PREVALENCE OF CHRONIC DISEASES TO DRIVE MARKET

4.2 NORTH AMERICA: NEEDLES MARKET, BY TYPE AND COUNTRY (2022)

FIGURE 16 CONVENTIONAL NEEDLES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.3 NEEDLES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 NEEDLES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High prevalence of chronic diseases

FIGURE 19 US: NUMBER OF PEOPLE WITH CHRONIC CONDITIONS, 1995–2030 (MILLION)

FIGURE 20 INCIDENCES OF DIABETES, 2021 VS. 2025 (MILLION)

5.2.1.2 Growing geriatric population

5.2.1.3 Rising number of accidents and trauma cases

5.2.1.4 Increasing number of hospitals in emerging markets

5.2.1.5 Increasing preference for minimally invasive biopsies

5.2.1.6 Increasing demand for vaccines

5.2.2 RESTRAINTS

5.2.2.1 Rising incidence of needlestick injuries and infections

5.2.2.2 Risk of infections associated with use of aspiration and biopsy needles

5.2.3 OPPORTUNITIES

5.2.3.1 Expanding injectables market

5.2.3.2 Rise in self-administration of drugs

5.2.3.3 Rising use of safety needles

5.2.3.4 Emerging markets

5.2.4 CHALLENGES

5.2.4.1 Use of needle-free injection technology

5.2.4.2 Growing focus on development of alternative drug delivery methods

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 22 DIRECT DISTRIBUTION—PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.5 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 INTENSITY OF COMPETITIVE RIVALRY

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 THREAT OF SUBSTITUTES

5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

5.6.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 3 KEY BUYING CRITERIA FOR TOP THREE END USERS

5.7 REGULATORY LANDSCAPE

5.7.1 NORTH AMERICA

5.7.1.1 US

5.7.1.2 Canada

TABLE 4 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.7.2 EUROPE

5.7.3 ASIA PACIFIC

5.7.3.1 Japan

TABLE 5 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.7.3.2 China

TABLE 6 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.7.3.3 India

5.8 TRADE ANALYSIS

TABLE 7 IMPORT DATA FOR HS CODE 901839, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 8 EXPORT DATA FOR HS CODE 901839, BY COUNTRY, 2017–2021 (USD MILLION)

5.9 ECOSYSTEM ANALYSIS

TABLE 9 ROLE IN ECOSYSTEM

FIGURE 25 KEY PLAYERS OPERATING IN NEEDLES MARKET

5.1 PATENT ANALYSIS

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 LIST OF CONFERENCES AND EVENTS, 2022–2023

5.12 PRICING ANALYSIS

5.12.1 AVERAGE SELLING PRICE OF PRODUCTS, BY KEY PLAYER

TABLE 11 PRICE RANGE OF KEY PRODUCTS IN NEEDLES MARKET (USD)

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.14 TECHNOLOGY ANALYSIS

6 NEEDLES MARKET, BY PRODUCT (Page No. - 64)

6.1 INTRODUCTION

TABLE 12 NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 BLOOD COLLECTION NEEDLES

6.2.1 INCREASING NUMBER OF BLOOD COLLECTION PROCEDURES TO DRIVE MARKET

TABLE 13 EXAMPLES OF BLOOD COLLECTION NEEDLES

TABLE 14 BLOOD COLLECTION NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 PEN NEEDLES

TABLE 15 EXAMPLES OF PEN NEEDLES

TABLE 16 PEN NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 PEN NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1 STANDARD NEEDLES

6.3.1.1 Standard pen needles preferred over safety pen needles as they are more affordable

TABLE 18 STANDARD PEN NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 SAFETY NEEDLES

6.3.2.1 Growing concerns over needlestick injuries to drive growth

TABLE 19 SAFETY PEN NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 SUTURE NEEDLES

6.4.1 INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET

TABLE 20 EXAMPLES OF SUTURE NEEDLES

TABLE 21 SUTURE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.5 OPHTHALMIC NEEDLES

6.5.1 GROWING NUMBER OF BLOOD COLLECTION PROCEDURES TO DRIVE MARKET

TABLE 22 EXAMPLES OF OPHTHALMIC NEEDLES

TABLE 23 OPHTHALMIC NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.6 DENTAL NEEDLES

6.6.1 MOST COMMONLY MADE OF STAINLESS STEEL

TABLE 24 EXAMPLES OF DENTAL NEEDLES

TABLE 25 DENTAL NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.7 INSUFFLATION NEEDLES

6.7.1 GROWING NUMBER OF MINIMALLY INVASIVE PROCEDURES TO BOOST MARKET GROWTH

TABLE 26 EXAMPLES OF INSUFFLATION NEEDLES

TABLE 27 INSUFFLATION NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.8 ASPIRATION AND BIOPSY NEEDLES

TABLE 28 EXAMPLES OF ASPIRATION AND BIOPSY NEEDLES

TABLE 29 ASPIRATION AND BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 30 ASPIRATION AND BIOPSY NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.8.1 BIOPSY NEEDLES

TABLE 31 BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 32 BIOPSY NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.8.1.1 Core biopsy needles

6.8.1.1.1 Widely used for sample collection in most prevalent cancer types

TABLE 33 CORE BIOPSY NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.8.1.2 Vacuum-assisted biopsy needles

6.8.1.2.1 High-volume sampling and greater specificity of VAB procedures to drive growth

TABLE 34 VACUUM-ASSISTED BIOPSY NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.8.2 ASPIRATION NEEDLES

6.8.2.1 Cost-effectiveness of needles to support market growth

TABLE 35 ASPIRATION NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

6.9 OTHER NEEDLES

TABLE 36 OTHER NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

7 NEEDLES MARKET, BY DELIVERY MODE (Page No. - 81)

7.1 INTRODUCTION

TABLE 37 NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

7.2 HYPODERMIC NEEDLES

7.2.1 FASTEST-GROWING DELIVERY MODE SEGMENT

TABLE 38 HYPODERMIC NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 INTRAVENOUS NEEDLES

7.3.1 INCREASING DEMAND FOR VACCINES TO BOOST MARKET GROWTH

TABLE 39 INTRAVENOUS NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 INTRAMUSCULAR NEEDLES

7.4.1 INCREASING PREVALENCE OF CHRONIC DISEASES TO SUPPORT MARKET GROWTH

TABLE 40 INTRAMUSCULAR NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 INTRAPERITONEAL NEEDLES

7.5.1 RISING NUMBER OF OVARIAN CANCER CASES TO DRIVE ADOPTION OF INTRAPERITONEAL NEEDLES

TABLE 41 INTRAPERITONEAL NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8 NEEDLES MARKET, BY TYPE (Page No. - 86)

8.1 INTRODUCTION

TABLE 42 NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.2 CONVENTIONAL NEEDLES

TABLE 43 CONVENTIONAL NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 44 CONVENTIONAL NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2.1 BEVEL NEEDLES

8.2.1.1 Bevel needles to dominate market in 2022

TABLE 45 BEVEL NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2.2 BLUNT FILL NEEDLES

8.2.2.1 Increasing prevalence of needlestick injuries to drive market

TABLE 46 BLUNT FILL NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2.3 VENTED NEEDLES

8.2.3.1 Increasing focus on vaccination to boost market growth

TABLE 47 VENTED NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2.4 FILTER NEEDLES

8.2.4.1 Increasing usage for medication administration

TABLE 48 FILTER NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 SAFETY NEEDLES

TABLE 49 SAFETY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 SAFETY NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3.1 ACTIVE NEEDLES

8.3.1.1 Largest and fastest-growing segment of safety needles market

TABLE 51 ACTIVE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3.2 PASSIVE NEEDLES

8.3.2.1 Increasing prevalence of chronic diseases to drive market growth

TABLE 52 PASSIVE NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

9 NEEDLES MARKET, BY MATERIAL (Page No. - 94)

9.1 INTRODUCTION

TABLE 53 NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

9.2 STAINLESS STEEL/METALLIC NEEDLES

9.2.1 WIDESPREAD USE IN MEDICAL AND RESEARCH APPLICATIONS

TABLE 54 EXAMPLES OF STAINLESS STEEL/METALLIC NEEDLES

TABLE 55 STAINLESS STEEL/METALLIC NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 GLASS NEEDLES

9.3.1 INCREASED APPLICATION IN DRUG DELIVERY TO DRIVE GROWTH

TABLE 56 GLASS NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 PLASTIC NEEDLES

9.4.1 ISSUES ASSOCIATED WITH GLASS NEEDLES TO DRIVE ADOPTION OF PLASTIC NEEDLES

TABLE 57 PLASTIC NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

9.5 POLYETHERETHERKETONE (PEEK) NEEDLES

9.5.1 APPLICATION OF PEEK NEEDLES IN WIDE RANGE OF SURGERIES AND PROCEDURES TO DRIVE GROWTH

TABLE 58 EXAMPLES OF PEEK NEEDLES

TABLE 59 PEEK NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

10 NEEDLES MARKET, BY APPLICATION (Page No. - 100)

10.1 INTRODUCTION

TABLE 60 NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

10.2 DIAGNOSTICS

10.2.1 LARGEST AND FASTEST-GROWING APPLICATION SEGMENT

TABLE 61 NEEDLES MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

10.3 THERAPEUTICS

10.3.1 RISING PREVALENCE OF DISEASES TO DRIVE MARKET

TABLE 62 NEEDLES MARKET FOR THERAPEUTIC APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

11 NEEDLES MARKET, BY END USER (Page No. - 103)

11.1 INTRODUCTION

TABLE 63 NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2 HOSPITALS

11.2.1 HIGH VOLUME OF BLOOD TRANSFUSIONS CONDUCTED IN HOSPITALS TO SUPPORT MARKET GROWTH

TABLE 64 NEEDLES MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

11.3 DIAGNOSTIC CENTERS

11.3.1 INCREASING NUMBER OF DIAGNOSTIC TESTS TO DRIVE ADOPTION OF NEEDLES

TABLE 65 NEEDLES MARKET FOR DIAGNOSTIC CENTERS, BY REGION, 2020–2027 (USD MILLION)

11.4 HOME HEALTHCARE

11.4.1 INCREASING USE OF INJECTIONS IN HOME CARE FOR MANAGEMENT OF CHRONIC DISEASES TO DRIVE MARKET

TABLE 66 NEEDLES MARKET FOR HOME HEALTHCARE, BY REGION, 2020–2027 (USD MILLION)

11.5 OTHER END USERS

TABLE 67 NEEDLES MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

12 NEEDLES MARKET, BY REGION (Page No. - 109)

12.1 INTRODUCTION

TABLE 68 NEEDLES MARKET, BY REGION, 2020–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: NEEDLES MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: NEEDLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: CONVENTIONAL NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: SAFETY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: PEN NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: ASPIRATION AND BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.1 US

12.2.1.1 US dominates North American needles market

TABLE 81 US: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 US: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 83 US: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 84 US: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 85 US: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 US: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 High prevalence of diseases in Canada to support market growth

TABLE 87 CANADA: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 CANADA: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 89 CANADA: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 90 CANADA: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 91 CANADA: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 CANADA: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3 EUROPE

TABLE 93 EUROPE: NEEDLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 94 EUROPE: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 EUROPE: CONVENTIONAL NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 EUROPE: SAFETY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 EUROPE: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 98 EUROPE: PEN NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 EUROPE: ASPIRATION AND BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 EUROPE: BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 EUROPE: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 102 EUROPE: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 103 EUROPE: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Largest and fastest-growing market for needles in Europe

TABLE 105 GERMANY: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 GERMANY: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 107 GERMANY: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 108 GERMANY: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 109 GERMANY: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 GERMANY: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.2 FRANCE

12.3.2.1 Rising need for blood components to support market growth

TABLE 111 FRANCE: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 FRANCE: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 113 FRANCE: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 114 FRANCE: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 115 FRANCE: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 FRANCE: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.3 UK

12.3.3.1 Increasing incidence of cancer to drive market growth

TABLE 117 UK: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 UK: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 119 UK: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 120 UK: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 121 UK: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 122 UK: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.4 SPAIN

12.3.4.1 Growing road accidents to drive market

TABLE 123 SPAIN: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 SPAIN: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 125 SPAIN: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 126 SPAIN: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 127 SPAIN: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 128 SPAIN: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Increasing number of blood donations to drive adoption of needles

TABLE 129 ITALY: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 ITALY: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 131 ITALY: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 132 ITALY: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 133 ITALY: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 134 ITALY: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 135 REST OF EUROPE: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 REST OF EUROPE: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 137 REST OF EUROPE: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 138 REST OF EUROPE: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 139 REST OF EUROPE: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 140 REST OF EUROPE: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: NEEDLES MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: NEEDLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: CONVENTIONAL NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: SAFETY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: PEN NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: ASPIRATION AND BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Increasing number of surgical procedures to drive market

TABLE 153 CHINA: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 CHINA: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 155 CHINA: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 156 CHINA: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 157 CHINA: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 158 CHINA: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Rising geriatric population to drive market

TABLE 159 JAPAN: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 JAPAN: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 161 JAPAN: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 162 JAPAN: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 163 JAPAN: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 164 JAPAN: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Rising demand for innovative technologies to support market growth

TABLE 165 INDIA: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 INDIA: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 167 INDIA: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 168 INDIA: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 169 INDIA: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 170 INDIA: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.4.4 REST OF ASIA PACIFIC

TABLE 171 REST OF ASIA PACIFIC: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 REST OF ASIA PACIFIC: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

12.5 REST OF THE WORLD

TABLE 177 REST OF THE WORLD: NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 REST OF THE WORLD: CONVENTIONAL NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 REST OF THE WORLD: SAFETY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 REST OF THE WORLD: NEEDLES MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 181 REST OF THE WORLD: PEN NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 REST OF THE WORLD: ASPIRATION AND BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 REST OF THE WORLD: BIOPSY NEEDLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 REST OF THE WORLD: NEEDLES MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 185 REST OF THE WORLD: NEEDLES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 186 REST OF THE WORLD: NEEDLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 187 REST OF THE WORLD: NEEDLES MARKET, BY END USER, 2020–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 163)

13.1 OVERVIEW

13.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 188 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NEEDLES MARKET

13.3 REVENUE SHARE ANALYSIS

FIGURE 28 REVENUE ANALYSIS OF KEY PLAYERS IN NEEDLES MARKET

13.4 MARKET SHARE ANALYSIS

TABLE 189 NEEDLES MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION MATRIX

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 29 NEEDLES MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS

13.6 COMPANY EVALUATION MATRIX FOR SMES/STARTUPS

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 30 NEEDLES MARKET: COMPANY EVALUATION MATRIX FOR SMES/STARTUPS

13.7 COMPANY FOOTPRINT ANALYSIS

13.7.1 REGIONAL FOOTPRINT OF COMPANIES

13.7.2 PRODUCT FOOTPRINT OF COMPANIES

13.7.3 OVERALL FOOTPRINT OF COMPANIES

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES

TABLE 190 KEY PRODUCT LAUNCHES

13.8.2 DEALS

TABLE 191 KEY DEALS

13.8.3 OTHER DEVELOPMENTS

TABLE 192 OTHER KEY DEVELOPMENTS

14 COMPANY PROFILES (Page No. - 173)

(Business overview, Products offered, Recent developments & MnM View)*

14.1 KEY PLAYERS

14.1.1 BECTON, DICKINSON AND COMPANY

TABLE 193 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 31 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

14.1.2 HAMILTON COMPANY

TABLE 194 HAMILTON COMPANY: BUSINESS OVERVIEW

14.1.3 MEDTRONIC PLC

TABLE 195 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 32 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

14.1.4 B. BRAUN MELSUNGEN

TABLE 196 B. BRAUN MELSUNGEN: BUSINESS OVERVIEW

FIGURE 33 B. BRAUN MELSUNGEN: COMPANY SNAPSHOT (2021)

14.1.5 STRYKER

TABLE 197 STRYKER: BUSINESS OVERVIEW

FIGURE 34 STRYKER: COMPANY SNAPSHOT (2021)

14.1.6 ETHICON (SUBSIDIARY OF JOHNSON & JOHNSON)

TABLE 198 JOHNSON & JOHNSON: BUSINESS OVERVIEW

FIGURE 35 JOHNSON & JOHNSON: COMPANY SNAPSHOT (2021)

14.1.7 BOSTON SCIENTIFIC CORPORATION

TABLE 199 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 36 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2021)

14.1.8 UNIMED SA

TABLE 200 UNIMED SA: BUSINESS OVERVIEW

14.1.9 TERUMO CORPORATION

TABLE 201 TERUMO CORPORATION: BUSINESS OVERVIEW

FIGURE 37 TERUMO CORPORATION: COMPANY SNAPSHOT (2021)

14.1.10 OLYMPUS CORPORATION

TABLE 202 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 38 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2021)

14.1.11 NIPRO CORPORATION

TABLE 203 NIPRO CORPORATION: BUSINESS OVERVIEW

FIGURE 39 NIPRO CORPORATION: COMPANY SNAPSHOT (2021)

14.1.12 ARGON MEDICAL DEVICES INC.

TABLE 204 ARGON MEDICAL DEVICES, INC.: BUSINESS OVERVIEW

14.1.13 MERCK KGAA

TABLE 205 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 40 MERCK KGAA: COMPANY SNAPSHOT (2021)

14.1.14 MERIT MEDICAL SYSTEMS

TABLE 206 MERIT MEDICAL SYSTEMS: BUSINESS OVERVIEW

FIGURE 41 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT (2021)

14.1.15 GREINER HOLDING AG

TABLE 207 GREINER HOLDING AG: BUSINESS OVERVIEW

FIGURE 42 GREINER HOLDING: COMPANY SNAPSHOT (2021)

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14.2 OTHER COMPANIES

14.2.1 SMITHS MEDICAL (NOW ICU MEDICAL)

14.2.2 ULTIMED, INC.

14.2.3 HAKKO CO., LTD.

14.2.4 CREGANNA

14.2.5 DTR MEDICAL

14.2.6 ROCKET MEDICAL PLC

15 APPENDIX (Page No. - 212)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Needles Market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Doctors, Surgeons) and supply sides (Needle manufacturers and distributors).

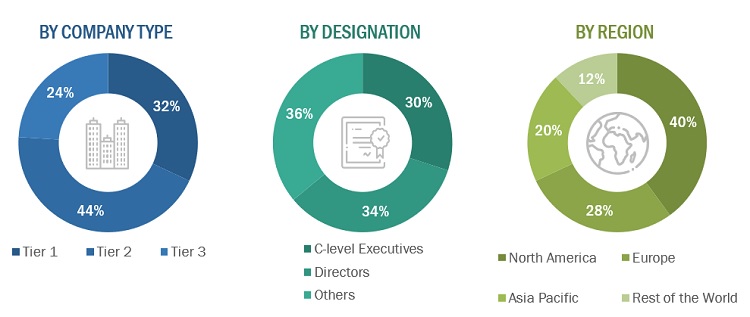

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2. Tiers of companies are defined based on their total revenue. As of 2021: Tier 1 = >USD 5 billion, Tier 2 = USD 500 million to USD 5 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Needles Market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Needle Market industry.

Report Objectives

- To define, describe, and forecast the global Needle Market based on Product, Type, Application, Material, Delivery Mode, End User and Region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific and the Rest of the World (RoW)2

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies3

- To track and analyze competitive developments such as acquisitions, expansions, new product launches, and partnerships in the Needle Market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the European Needle Market into specific countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Needles Market