N-Methyl-2-pyrrolidone (NMP) Market by Application (Petrochemicals, Electronics, Paints & Coatings, Agrochemicals, Pharmaceutical) and Region (Asia Pacific, Europe, North America, Middle East & Africa, South America) - Global Forecast to 2022

The N-Methyl-2-pyrrolidone market is projected to reach USD 795.8 Million by 2022, at a CAGR of 6.8%. The base year considered for the study is 2016, while the forecast period is from 2017 to 2022.

N-Methyl-2-pyrrolidone Market Objectives of the Study are as Follows

- To define, describe, and forecast the N-Methyl-2-pyrrolidone market on the basis of application and region

- To identify factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the NMP market

- To forecast the size of the NMP market in terms of volume and value

- To analyze the detailed segmentation of the NMP market and forecast the market size, in terms of volume and value, for 5 key regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze competitive developments, such as expansions, new product developments, joint ventures, and mergers & acquisitions in the NMP market

- To profile leading players operating in the N-Methyl-2-pyrrolidone (NMP) market and identify their core competencies

N-Methyl-2-pyrrolidone (NMP) Market Research Methodology

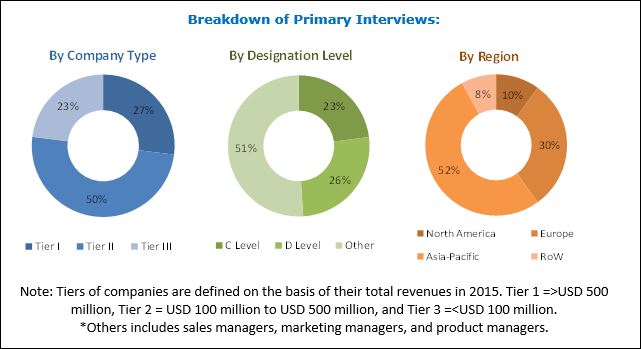

Both, top-down and bottom-up approaches were used to estimate and validate the sizes of the NMP market and various other dependent submarkets. The research study involved extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for this technical, market-oriented, and commercial study of the NMP market.

To know about the assumptions considered for the study, download the pdf brochure

Key Players in N-Methyl-2-Pyrrolidone Market

Some of the major players operating in the NMP market include Ashland (US), BASF (Germany), Eastman (US), Lyondellbasell (US), Mitsubishi Chemical Corporation (Japan), and Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd. (China).

Key Target Audience in N-Methyl-2-Pyrrolidone Market

- Manufacturers, dealers, and suppliers of NMP

- NMP manufacturing plant developers and related service providers

- Lithium-ion battery manufacturers

- Investors

N-Methyl-2-pyrrolidone Market Report Scope

This research report categorizes the NMP market on the basis of application and region.

N-Methyl-2-pyrrolidone Market, by Application:

- Petrochemicals

- Electronics

- Paints & Coatings

- Agrochemicals

- Pharmaceuticals

- Others

NMP Market, by Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

The market has been further analyzed for key countries in each of these regions, except for the Middle East & Africa and South America.

N-Methyl-2-pyrrolidone (NMP) Market Report Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Country Information:

- NMP market analysis for additional countries

Company Information:

- Detailed analysis and profiles of additional market players (up to 5)

Pricing Analysis:

- Detailed pricing analysis for each application of NMP

N-Methyl-2-Pyrrolidone Market Dynamics

Rising demand for lithium-ion battery production to fuel consumption of NMP by 2020

The lithium-ion battery production is one of the major applications of NMP. These batteries are widely used in electric vehicles due to their better performance compared to other batteries. The rising production of electric vehicle will fuel the demand for lithium-ion batteries, thereby increasing the demand for NMP for battery production.

Many countries are aggressively promoting the electric vehicles to reduce the greenhouse gas emissions. Some of them have introduced various policies to promote the purchase and use of electric vehicles. The sale of electric vehicles across the globe has been observed to increase sharply due to the rise in demand from China in 2017. These factors are boosting the demand for lithium-ion batteries and attracting investments in lithium-ion battery production facilities.

Following are the leading lithium-ion battery manufacturers across the globe.

Installed Lithium-Ion Battery Production Capacities (GWH) Q1, 2017

Note: AESC= Automotive Energy Supply Corporation, CALB=China Aviation Lithium Battery Co.

Source: Bloomberg NEF, Benchmark Minerals, Visual Capitalist

Companies are investing in increasing their lithium-ion battery production capacities in emerging markets such as China, the US, and South Korea.

Lithium-Ion Battery Production Capacities, By Country, 2016–2020

|

Country |

2016 Capacity (GWh) |

2020 Capacity (GWh) |

% of Global Total (2020) |

|

|

China |

16.4 |

107.5 |

62% |

|

|

South Korea |

10.5 |

23.00 |

13% |

|

|

US |

1.00 |

38.00 |

22% |

|

|

Poland |

0.00 |

5.00 |

3% |

|

Source: Bloomberg NEF, Benchmark Minerals, and Visual Capitalist

Key Questions in N-Methyl-2-pyrrolidone (NMP) Market

- What are the opportunities for NMP applications globally?

- What are the key factors to be considered while investing in NMP market?

- Who are the leading suppliers of NMP in major markets across the globe?

- Which are the substitute products and how big is the threat from them?

The N-Methyl-2-pyrrolidone (NMP) market size is projected to grow from USD 572.5 Million in 2017 to USD 795.8 Million by 2022, at a CAGR of 6.8% during the forecast period. NMP is used in petrochemical, pharmaceutical, electronics, paints & coatings, and agrochemical industries. In the pharmaceutical industry, NMP is used in the extraction, purification, and crystallization of pharmaceuticals and is also used as an excipient for drugs.

The NMP market is categorized on the basis of application into petrochemicals, electronics, paints & coatings, agrochemicals, and pharmaceuticals. Petrochemicals segment is expected to be the largest application segment while the electronics segment is expected to grow at the highest CAGR during the forecast period.

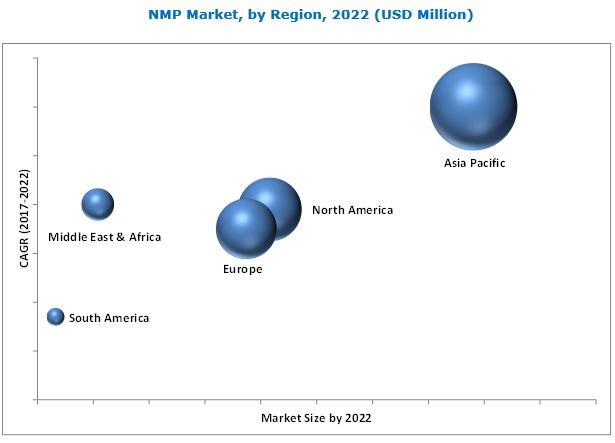

Asia Pacific is projected to remain the largest market for NMP. This market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing lithium-ion battery production and growing pharmaceutical industry in the region. China, South Korea, and India are estimated to experience high investments in the lithium-ion battery production to leverage the increasing domestic demand. Pharmaceutical and agrochemical industries in China and India are increasing their production capacities to meet the rising local demand for respective products. These factors are estimated to drive the demand for NMP in the region during the forecast period.

Several lithium-ion battery manufacturers across the globe are increasing their production capacities to meet its rising demand, thereby fueling the demand for NMP in the electronics applications. However, they are also searching for a substitute for NMP to reduce the cost involved in using NMP in the lithium-ion battery production.

NMP-based drugs are used in anti-tumor treatments and hence, they are experiencing a surge in demand for use in medicines for cancer treatment. The growing pharmaceutical industry in APAC and South America is expected to create opportunities for NMP manufacturers in the respective markets during the forecast period.

Key N-Methyl-2-Pyrrolidone Market Industry Players

Ashland (US), BASF (Germany), Eastman (US), Lyondellbasell (US), Mitsubishi Chemical Corporation (Japan), and Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd. (China) are some of the companies operating in the NMP market.

Frequently Asked Questions (FAQ):

How big is the N-Methyl-2-pyrrolidone Market industry?

The NMP market size is projected to grow from USD 572.5 Million in 2017 to USD 795.8 Million by 2022, at a CAGR of 6.8% during the forecast period.

Who leading market players in N-Methyl-2-pyrrolidone industry?

Key companies operating in the NMP market are Ashland (US), Balaji Amines (India), BASF (Germany), Lyondellbasell (US), and Mitsubishi Chemical Corporation (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Data Triangulation

2.4 Research Assumptions and Limitations

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 23)

4.1 Attractive Opportunities in NMP Market

4.2 APAC N-Methyl-2-pyrrolidone Market, By Application and Country

4.3 NMP Market, By Region

4.4 N-Methyl-2-pyrrolidone (NMP) Market, By End-Use Industry and Region

5 Market Overview (Page No. - 26)

5.1 Introduction

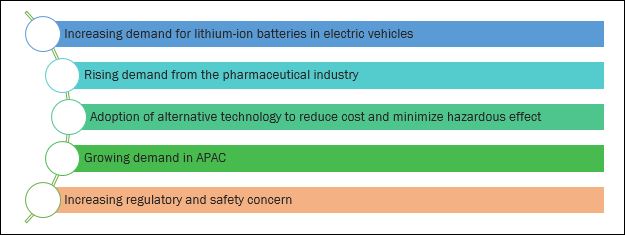

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Lithium-Ion Batteries in Electric Vehicles

5.2.1.2 Rising Demand From Pharmaceutical Industry

5.2.2 Restraints

5.2.2.1 Adoption of Alternative Technology to Reduce Cost and Minimise Hazardous Effect

5.2.3 Opportunities

5.2.3.1 Growing Demand in APAC

5.2.4 Challenges

5.2.4.1 Increasing Regulatory and Safety Concern

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Indicators (Page No. - 32)

6.1 Introduction

6.1.1 GDP Growth Rate Forecast of Major Economies

6.1.2 Increasing Number of Lithium-Ion Battery Production Facilities During 2016 and 2020

7 NMP Market, By Application (Page No. - 34)

7.1 Introduction

7.2 Petrochemicals

7.3 Electronics

7.4 Paints & Coatings

7.5 Agrochemicals

7.6 Pharmaceuticals

7.7 Others

8 N-Methyl-2-pyrrolidone Market, By Region (Page No. - 45)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 APAC

8.3.1 China

8.3.2 Japan

8.3.3 India

8.3.4 South Korea

8.3.5 Rest of APAC

8.4 Europe

8.4.1 Germany

8.4.2 UK

8.4.3 France

8.4.4 Netherlands

8.4.5 Rest of Europe

8.5 Middle East & Africa

8.6 South America

9 Company Profiles (Page No. - 72)

(Overview, Financial*, Products & Services, Strategy, and Developments)

9.1 Mitsubishi Chemical Corporation

9.2 BASF

9.3 Ashland

9.4 Lyondellbasell

9.5 Eastman

9.6 Abtonsmart Chemical Group

9.7 Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd

9.8 Hefei TNJ Chemicals Industry Co.,Ltd

9.9 Tokyo Chemical Industry Co., Ltd

9.10 Balaji Amines

9.11 Other Industry Players

9.11.1 Puyang Guangming Chemicals Co.,Ltd

9.11.2 Santa Cruz Biotechnology

*Details Might Not Be Captured in Case of Unlisted Companies

10 Appendix (Page No. - 88)

10.1 Insights of Industry Experts

10.2 Discussion Guide

10.3 Knowledge Store: Marketsandmarkets Subscription Portal

10.4 Introducing RT: Real Time Market Intelligence

10.5 Available Customizations

10.6 Related Reports

10.7 Author Details

List of Tables (60 Tables)

Table 1 Trends and Forecast of GDP Growth Rates Between 2016 and 2022

Table 2 Lithium-Ion Battery Production Capacities, By Country, 2016- 2020

Table 3 NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 4 N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 5 N-Methyl-2-pyrrolidone (NMP) Market Size in Petrochemical Applications, By Region, 2015–2022 (Ton)

Table 6 NMP Market Size in Petrochemical ApPLCiations, By Region 2015–2022 (USD ’000)

Table 7 N-Methyl-2-pyrrolidone Market Size in Electronics Applications, By Region, 2015–2022 (Ton)

Table 8 N-Methyl-2-pyrrolidone (NMP) Market Size in Electronics Applications, By Region 2015–2022 (USD ’000)

Table 9 NMP Market Size in Paints & Coatings Applications, By Region, 2015–2022 (Ton)

Table 10 N-Methyl-2-pyrrolidone Market Size in Paints & Coatings Applications, By Region 2015–2022 (USD ’000)

Table 11 N-Methyl-2-pyrrolidone (NMP) Market Size in Agrochemical Applications, By Region, 2015–2022 (Ton)

Table 12 NMP Market Size in Agrochemical Applications, By Region 2015–2022 (USD ’000)

Table 13 N-Methyl-2-pyrrolidone Market Size in Pharmaceutical Applications, By Region, 2015–2022 (Ton)

Table 14 N-Methyl-2-pyrrolidone (NMP) Market Size in Pharmaceutical Applications, By Region 2015–2022 (USD ’000)

Table 15 NMP Market Size in Other Applications, By Region, 2015–2022 (Ton)

Table 16 N-Methyl-2-pyrrolidone Market Size in Other Applications, By Region 2015–2022 (USD ’000)

Table 17 N-Methyl-2-pyrrolidone (NMP) Market Size, By Region, 2015–2022 (Kiloton)

Table 18 NMP Market Size, By Region, 2015–2022 (USD Million)

Table 19 North America: NMP Market Size, By Country, 2015–2022 (Kiloton)

Table 20 North America: N-Methyl-2-pyrrolidone Market Size, By Country, 2015–2022 (USD Million)

Table 21 North America: N-Methyl-2-pyrrolidone (NMP) Market Size, By Application, 2015–2022 (Kiloton)

Table 22 North America: Market Size, By Application, 2015–2022 (USD Million)

Table 23 US: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 24 US: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 25 Canada: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 26 Canada: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 27 Mexico: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 28 Mexico: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 29 APAC: NMP Market Size, By Country, 2015–2022 (Kiloton)

Table 30 APAC: N-Methyl-2-pyrrolidone Market Size, By Country, 2015–2022 (USD Million)

Table 31 APAC: N-Methyl-2-pyrrolidone (NMP) Market Size, By Application, 2015–2022 (Kiloton)

Table 32 APAC: Market Size, By Application, 2015–2022 (USD Million)

Table 33 China: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 34 China: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 35 Japan: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 36 Japan: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 37 India: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 38 India: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 39 South Korea: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 40 South Korea: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 41 Rest of APAC: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 42 Rest of APAC: Market Size, By Application, 2015–2022 (USD Million)

Table 43 Europe: NMP Market Size, By Country, 2015–2022 (Kiloton)

Table 44 Europe: N-Methyl-2-pyrrolidone Market Size, By Country, 2015–2022 (USD Million)

Table 45 Europe: N-Methyl-2-pyrrolidone (NMP) Market Size, By Application, 2015–2022 (Kiloton)

Table 46 Europe: Market Size, By Application, 2015–2022 (USD Million)

Table 47 Germany: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 48 Germany: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 49 UK: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 50 UK: Market Size, By Application, 2015–2022 (USD Million)

Table 51 France: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 52 France: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 53 Netherlands: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 54 Netherlands: Market Size, By Application, 2015–2022 (USD Million)

Table 55 Rest of Europe: NMP Market Size, By Application, 2015–2022 (Kiloton)

Table 56 Rest of Europe: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD Million)

Table 57 Middle East & Africa: NMP Market Size, By Application, 2015–2022 (Ton)

Table 58 Middle East & Africa: Market Size, By Application, 2015–2022 (USD ’000)

Table 59 South America: NMP Market Size, By Application, 2015–2022 (Ton)

Table 60 South America: N-Methyl-2-pyrrolidone Market Size, By Application, 2015–2022 (USD ’000)

List of Figures (27 Figures)

Figure 1 NMP Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation: N-Methyl-2-pyrrolidone (NMP) Market

Figure 5 Petrochemcials to Lead N-Methyl-2-pyrrolidone Market Between 2017 and 2022

Figure 6 APAC Market to Witness Highest Growth During Forecast Period

Figure 7 Increasing Demand From Electronics and Pharmaceutical Industries to Drive the NMP Marekt

Figure 8 China Dominated NMP Market in APAC in 2016

Figure 9 APAC to Lead N-Methyl-2-pyrrolidone Market During Forecast Period

Figure 10 APAC Accounted for Major Market Share in 2016

Figure 11 Factors Governing the N-Methyl-2-pyrrolidone (NMP) Market

Figure 12 Porter’s Five Forces Analysis

Figure 13 Installed Lithium-Ion Battery Production Capacities (GWH) Q1, 2017

Figure 14 Middle East & Africa is Projected to Be the Fastest-Growing Market for NMP in Petrochemicals Applications

Figure 15 APAC Dominated the Electronics Applications Market of NMP In

Figure 16 North America to Remain Second-Largest Market for NMP in Paints & Coatings Applications

Figure 17 APAC to Remain the Largest Market for NMP in Agrochemical Applications

Figure 18 North America to Lead Market for NMP in Pharmaceutical Applications During the Forecast Period

Figure 19 APAC to Remain the Largest Market for NMP in Other Applications

Figure 20 Regional Snapshot: China to Lead Global Market Growth, 2017–2022

Figure 21 North American NMP Market Snapshot: US Projected to Be Fastest-Growing Market

Figure 22 APAC N-Methyl-2-pyrrolidone (NMP) Market Snapshot: China Largest Market, 2017–2022

Figure 23 BASF: Company Snapshot

Figure 24 Ashland: Company Snapshot

Figure 25 Lyondellbasell: Company Snapshot

Figure 26 Eastman: Company Snapshot

Figure 27 Balaji Amines: Company Snapshot

Growth opportunities and latent adjacency in N-Methyl-2-pyrrolidone (NMP) Market