Multiexperience Development Platforms Market by Component (Platforms, Services), Deployment Type (On-premises, Cloud), Organization Size (Large Enterprises, SMEs), Vertical (BFSI, IT & Telecom) and Region - Global Forecast to 2027

Multiexperience Development Platforms Market Overview

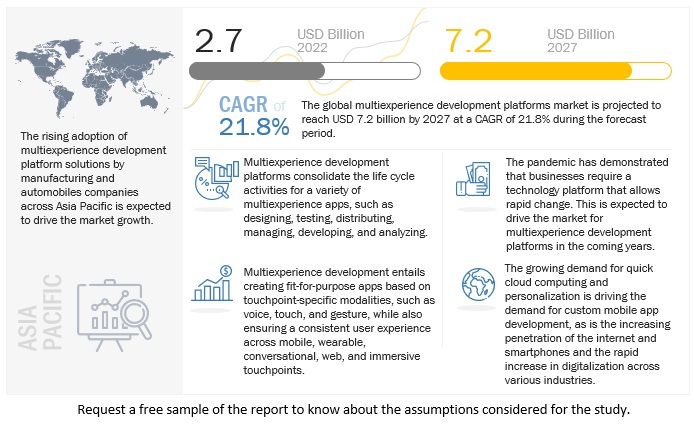

The global Multiexperience Development Platforms Market size was valued $2.7 billion in 2022 and is anticipated to reach over $7.2 billion by 2027 with a robust CAGR of 21.8% during forecast period.

The growing demand for operational efficiency, decrease in security risks, and increase in digital transformation are the major factors fueling the Market growth. A multiexperience development platform is a well-thought-out, integrated front-end development tool with "backend for frontend" (BFF) capabilities. It enables a distributed, scalable development approach for creating purpose-built apps across digital touchpoints and interaction modalities. As everything in a multiexperience business should be connected, there is a growing need for businesses to create or implement MXDP tools for developing multiple applications across multiple devices. Development platform vendors are expanding their value proposition beyond mobile apps and web development to meet user and industry demands. This has resulted in the use of MXDPs to create chat, voice, AR apps, MR apps, and wearable experiences to support digital business.

To know about the assumptions considered for the study, Request for Free Sample Report

Multiexperience Development Platforms Market Growth Dynamics

Driver: Increasing demand for development of apps

Enterprises are increasingly struggling to create digital user experiences (UX) beyond web and mobile app digital experiences. Organizations must therefore use multiexperience technology to transform more than just the digital customer experience of their customers. Personalization and convenience are essential components of customer service, which any customer-centric organization must keep in mind.

Restraint: Lack of skilled professionals or trainers

COVID-19 has compelled many businesses to enter the digital age. This has enabled IT teams to focus on hiring specialized professionals. However, due to the rapid increase in demand, many organizations have failed to meet this end, and not all IT professionals possess expertise in their areas. This disparity is expected to only grow in the future. According to Daxx, a staffing firm, about 1.4 million tech jobs are expected to remain unfilled in the US by 2021, with only 400,000 graduates annually. In Colombia, 5,500 system engineers graduate each year. However, there is a shortage of 80,000 people in various companies. Globally, there is a shortage of 40 million highly skilled and trained people, which is expected to increase to 85 million by 2030. The rapid evolution of trending technologies, such as AI and Blockchain, has piqued the interest of businesses in hiring developers who are experts in these fields. However, these subjects are not taught in the colleges or boot camps where most developers are educated. Many companies are therefore forced to invest in training programs to upskill their developers, which few want because the field has a high turnover rate. This can act as a restraint to the multiexperience development platforms market.

Opportunity: Increasing need to remove security risks

Enabling multiexperience can help enterprises get a 360-degree view of their software landscape, with all applications feeding into a single platform. As a result, all potential security risks, such as Shadow IT, are eliminated. Multiexperience development platforms help reduce security risks. One of the most appealing aspects of these platforms is the security and peace of mind they provide. They include out-of-the-box API management and data and identity protection. The IT department uses a single platform to manage all apps, devices, and services. This minimizes the risk of third-party installs and shadow IT.

Challenge: Complexity involved in designing multiexperience development tools for different screen sizes and resolutions

When some experiences are built with traditional programming, and others live in off-the-shelf technologies, development becomes exponentially more complex, as multiple technologies create problems in data protection and privacy. As a result, gaining consumer trust becomes difficult to obtain. According to an Edelman study, 81% of consumers said they needed to trust the brands before buying from them. Implementing data protection and information security policies and procedures to ensure customer data is kept private is critical to gaining and maintaining consumer trust.

Deepfake content is becoming more prevalent these days, spreading misinformation. The perceived credibility of video content is being called into question as users become aware that deepfake content can be created and spread, often with malicious intent. User interfaces must therefore be adaptable to the various ways in which users interact with them, whether using a mouse and keyboard on a desktop computer or a touchscreen on a mobile phone.

Another challenge is creating a consistent experience across multiple devices. Users expect to be able to resume where they left off, regardless of the device they are using.

All these factors are expected to challenge the growth of the multiexperience development platforms market.

Based on organization size, the large enterprises segment estimated to be the largest contributor to multiexperience development platforms market during the forecast period

After over a decade of mobility transformation, businesses and enterprises are looking for new application development opportunities. To meet the ever-increasing user demands, an immersive experience through innovative technology has always been a priority. MXDPs enable businesses to support many internal operations in a single location. Processes can be easily streamlined when all processes are present in one system. An MXDP enables organizations to create digital experiences that are more efficient, faster, and more valuable. To address the digital user journey, the MXDP can create integrated software that can run across various devices. Multiexperience solutions can accommodate the increased number of apps, devices, and modes of interaction. They are critical for enterprises and mid-sized businesses, as they enable them to extend their service or product experience to their target audience.

Based on vertical, BFSI segment estimated to dominate multiexperience development platforms market during the forecast period

Banking has traditionally been a brick-and-mortar business. But with the advent of the internet, businesses have been forced to offer online banking and account management services. Today, nearly all banks have adopted mobile applications and a higher level of digital connectivity. In the strictest sense, they are Omnichannel. A mobile device is the heart of a business model, especially in the banking sector, as people can access the banking information and services they require without visiting a branch. The global pandemic has compelled banks to reclaim control of the digital experiences of their customers. This includes digitizing financial service offerings throughout the client lifecycle, from origination to onboarding, self-service, and back-office operations, which can be quite complex and challenging. To address these digitization challenges, organizations need software platforms that improve user experiences, reduce costs, increase business agility, and accelerate time to market. Many multiexperience development market leaders enable business and IT teams to develop intelligent banking solutions rapidly and easily, which would facilitate automation and innovation.

To know about the assumptions considered for the study, download the pdf brochure

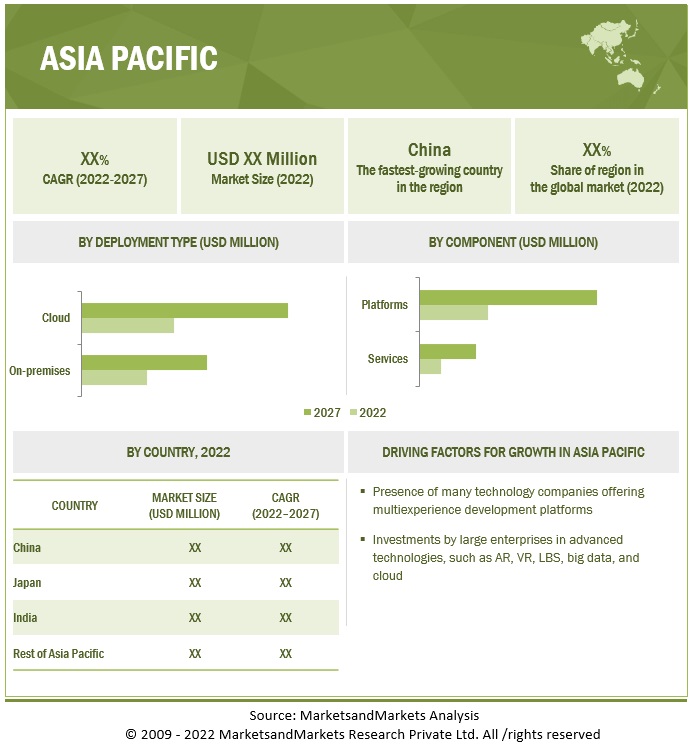

Asia Pacific estimated to grow at the highest CAGR during forecast period

Low-code and no-code development platforms have gained value in China since 2016. In 2016, China recorded ten financial investments in low-code products. By 2020, this figure had risen to 59, with 13 exceeding the RMB 100 million (USD 14.29 million) mark. The number of low-code investments in China has steadily increased, with a few exceeding the RMB 100 million (USD 14.29 million) mark each year. Overall, investments increased by 28.6% between 2016 and 2020, indicating that the low-code market is at its early stages, with a high number of startups and rapid growth. This drives the growth of the multiexperience development platforms market. According to Daxue Consulting, shipments of AR hardware in China in 2018 totaled approximately 730,000 units, with mobile phones accounting for 60.9% of total shipments. All-in-one devices and host-based shipments accounted for 26.8% and 12.2% of total shipments. We can see that the proportion of mobile phone products is absolute, and mobile phones in China will be the key layout objects in future competition in the AR market. Because of 5G's high-speed and low-latency transmission characteristics, true stable millisecond-level real-time data synchronization is possible. 5G is the foundation for the widespread adoption of AR, which will undergo revolutionary change. China Unicom 5G Innovation Center decided to promote its AR business platform cooperation with more than 30 companies to promote the AR technology industry chain layout. The development of 5G in China aids in expanding AR services. For example, the current mini-program ‘+ AR’ has reduced the APP's burden while diversifying its gameplay.

Several Augmented Reality (AR) and Virtual Reality (VR) skilled-based companies offer immersive solutions in India. Hiring an AR/VR company is a wise investment because these technologies are exploding in the Indian market. However, there is a term for the combination of Augmented and Virtual Reality, which is known as Mixed Reality. The digital and physical worlds are combined in Mixed Reality. Physical and digital objects coexist and interact in real-time here. The incorporation of technology into daily life is quickly becoming the norm. Augmented Reality (AR) and Virtual Reality (VR) will be integrated into daily life in the near future to improve the quality of life, experience, efficiency, and productivity. All these factors are driving the growth of the MXDP market in Asia Pacific.

Key Market Players

Salesforce (US), SAP (Germany), Outsystems (US), Oracle (US), Microsoft (US), Mendix (US), Pegasystems (US), Progress (US), IBM (US), ServiceNow (US), Appian (US), GeneXus (US), Temenos (Switzerland), and Convertigo (France) are the key players in the multiexperience development platforms market.

Scope of the Report

|

Report Metrics |

Details |

| Market Size in 2022 | $2.7 billion |

| Revenue Forecast for 2027 | $7.2 billion |

| CAGR (2022-2027) | 21.8% |

| Key Growth Drivers | Increasing demand for development of apps |

| Key Opportunities | Increasing need to remove security risks |

| Market size available for years | 2017–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Million/Billion (USD) |

| Market Segmentation | Component, Organization Size, Vertical, and Region |

| Geographies covered | North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa |

| Major Vendors | Appian (US), GeneXus (US), IBM (US), Mendix (US), Microsoft (US), Oracle (US), Outsystems (US), Pegasystems (US), Progress Software (US), Salesforce (US), SAP SE (GERMANY), ServiceNow (US), Temenos (Switzerland), Neutrinos (Singapore), XOne (Spain), Resco (Slovakia), I-exceed technologies (US), Easy Software (Germany), TDox (Italy), HCL (India), Cigniti (US), Decimal Technologies (India), Neptune Software (Norway), and Convertigo (France) |

Multiexperience Development Platforms Market Market Highlights

This research report categorizes the Market Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

By Component |

|

|

By Deployment |

|

|

By Organization size |

|

|

Based on vertical |

|

|

By Region |

|

Recent Developments

- In August 2022, Outsystems announced that Sodexo Engage had deployed the OutSystems platform in 12 weeks to provide a robust and secure fully managed service to its public sector customers. The new platform not only tightly integrates with Sodexo Engage's systems, such as its CRM, payment gateways, and helpdesk, but it also directly links to the aggregators used to purchase vouchers. This contributes to process improvement, increasing efficiency and streamlining the entire process for customers and end users.

- In June 2021, Mendix executives coined the term ‘low-code operations’ or ‘low-codeOps’ to describe the ability of low-code development platforms to automate and reduce an enterprise's operational burden. Its overarching goal is to leverage low-proven code's ability to quickly launch digital solutions into the adjacent domains of IT maintenance and operations within large, hybrid environments.

- In March 2020, Temenos Quantum, the market-leading multiexperience development platform (MXDP), expanded itself, giving businesses greater control over their digital transformation and enabling them to offer smarter, AI-powered digital experiences. Integrating Temenos Quantum with Explainable AI (XAI) power intelligent and hyper-personalized digital experiences resulted in high user engagement, satisfaction, and origination levels. Temenos Quantum boosts developer productivity, accelerates software delivery, and enables the rapid launch of competitive product innovations through AI-driven development, integrated DevOps processes, and low-code tooling for end-to-end automated testing.

Frequently Asked Questions (FAQ):

How big is the global Multiexperience Development Platforms Market?

The global Multiexperience Development Platforms Market size was surpassed $2.7 billion in 2022 and is poised to reach $7.2 billion by 2027.

What is the CAGR of global Market ?

Multiexperience Development Platform Market is registering a CAGR of 21.8% during the forecast period, 2022-2027.

What are the major revenue pockets in the Multiexperience Development Platforms Market currently?

North America region has the highest market share in the MXDP market due to a huge market for BFSI and IT industries.

Who are the leading vendors in the Multiexperience Development Platforms Market?

Major vendors in Multiexperience Development Platform (MXDP) Market are Salesforce (US), SAP (Germany), Outsystems (US), Oracle (US), Microsoft (US), Mendix (US), Pegasystems (US), Progress (US), IBM (US), ServiceNow (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing need for rapid customization and scalability- Enterprise mobility to enable users to develop business applications using MXDP- Elimination of gaps in required IT skills- Increasing demand for chatbots, AI, and ML technologies- Increased demand for app development- Growing demand to decrease time to market for mobile appsRESTRAINTS- Dependence on vendor-supplied customization- Lack of skilled professionals or trainers among developersOPPORTUNITIES- Growing digital transformation in IT industry- Rising demand for robust solutions to maximize visibility and control over processes- Increasing demand to reduce security riskCHALLENGES- Upgrades to legacy software- Selecting right time and right process to implement automation- Complexity of designing multiexperience development for different screen sizes and resolutions- Multiple complex technologies to create data protection and privacy issues

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: GENEXUS IMPLEMENTED AUTOMATION TO ELIMINATE MANUAL CODING FOR JBCCCASE STUDY 2: NEPTUNE SOFTWARE DEPLOYED NEPTUNE DXP TO IMPROVE WORKPLACE SAFETY IN INFRASERV HÖCHSTCASE STUDY 3: RESCO IMPLEMENTED RESCO MOBILE CRM TO DERBIGUM TO PROVIDE MICROSOFT DYNAMICS CRMCASE STUDY 4: OUTSYSTEMS DEPLOYED ITS PRODUCT TO GEN RE TO CREATE INNOVATIVE SOLUTIONS

-

5.4 ECOSYSTEM MAPPING

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 TECHNOLOGICAL ANALYSISARTIFICIAL INTELLIGENCEAUGMENTED REALITYINTERNET OF THINGS

-

5.7 PATENT ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.10 REGULATIONSASIA PACIFICLATIN AMERICA

-

5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.12 KEY CONFERENCES & EVENTS IN 2022–2023

-

6.1 INTRODUCTIONCOMPONENT: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERS

-

6.2 PLATFORMSPLATFORMS TO ENABLE BUSINESSES TO CREATE APPS, AUGMENTED REALITY, VIRTUAL REALITY, AND WEARABLE EXPERIENCES

-

6.3 SERVICESIMPLEMENTATION AND INTEGRATION SERVICES TO OFFER COHESIVE SERVICES TO END USERS

-

7.1 INTRODUCTIONDEPLOYMENT TYPE: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERS

-

7.2 CLOUDSMALL AND MEDIUM-SIZED ENTERPRISES TO IMPLEMENT CLOUD DEPLOYMENT DUE TO FOCUS ON CORE COMPETENCIES

-

7.3 ON-PREMISESPREFERENCE OF DEPLOYING TRADITIONAL ON-PREMISES SOLUTIONS BY LARGE ENTERPRISES TO DRIVE MARKET

-

8.1 INTRODUCTIONORGANIZATION SIZE: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERS

-

8.2 SMALL AND MEDIUM-SIZED ENTERPRISESRAPID ADOPTION OF DIGITAL AND CLOUD TECHNOLOGY TO AUGMENT PROFITS TO ENHANCE BUSINESS PRODUCTIVITY

-

8.3 LARGE ENTERPRISESGROWING CONNECTIVITY OF BANDWIDTH AND MOBILITY TRENDS TO DRIVE MARKET

-

9.1 INTRODUCTIONVERTICAL: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCEINCREASING NUMBER OF CUSTOMERS ACCESSING BANKING AND OTHER RELATED SERVICES TO BOOST MARKET GROWTH

-

9.3 IT & TELECOMTECHNICALLY SKILLED WORKFORCE INVOLVED IN DEVELOPING SOLUTIONS TO GROW DEMAND FOR MXDP SOLUTIONS

-

9.4 GOVERNMENT & PUBLIC SECTORRAPID ADOPTION OF ADVANCED TECHNOLOGIES IN GOVERNMENT & PUBLIC SECTOR TO BOOST MARKET GROWTH

-

9.5 MANUFACTURINGDEMAND FOR SOFTWARE TO AUTOMATE PROCESSES, MANAGE SUPPLY CHAINS, AND FACILITATE RESEARCH AND DEVELOPMENT TO DRIVE MARKET

-

9.6 RETAIL & CONSUMER GOODSDIGITAL TRANSFORMATION IN RETAIL & CONSUMER GOODS INDUSTRY TO HELP ORGANIZATIONS GROW RAPIDLY

-

9.7 HEALTHCARE & LIFE SCIENCESDEMAND FOR SOLUTIONS TO STAY TECHNOLOGICALLY ADVANCED TO INCREASE OPERATIONAL EFFICIENCY TO DRIVE MARKET

- 9.8 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERSUS- High percentage of employees using smart devices at work to drive marketCANADA- High internet penetration rates to boost market growth

-

10.3 EUROPEEUROPE: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERSUK- Rising demand for software development automation due to cost savings benefit to drive marketGERMANY- Developed cloud industry along with diverse business needs to boost marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERSCHINA- Government initiatives toward R&D and investments from global players to drive marketJAPAN- High connectivity and digital dependence of population to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSKSA- Strong presence of oil and gas industries constituting major share of economy to drive marketUAE- Rise in technological adoption due to solid fiscal balances and strong investments in ICT sector to boost market growthREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET DRIVERSBRAZIL- Companies transforming legacy applications and building applications reducing maintenance costs to drive marketREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE OF TOP VENDORS

- 11.3 HISTORICAL REVENUE ANALYSIS OF TOP FIVE VENDORS

-

11.4 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES AND ENHANCEMENTSDEALSOTHERS

-

11.5 COMPANY EVALUATION QUADRANTMATRIX DEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUP/SME EVALUATION QUADRANTDEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSSALESFORCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOUTSYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMENDIX- Business overview- Products/Solutions/Services offered- Recent developmentsPEGASYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsPROGRESS SOFTWARE- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsSERVICENOW- Business overview- Products/Solutions/Services offered- Recent developments

-

12.3 OTHER COMPANIESNEPTUNE SOFTWAREGENEXUSAPPIANCONVERTIGONEUTRINOSTEMENOSXONERESCOI-EXCEED TECHNOLOGY SOLUTIONSEASY SOFTWARETDOXHCLCIGNITIDECIMAL TECHNOLOGIES

-

13.1 INTRODUCTIONRELATED MARKETS

- 13.2 LIMITATIONS

-

13.3 LOW-CODE DEVELOPMENT PLATFORM MARKETINTRODUCTIONMARKET OVERVIEWLOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT

- 13.4 PLATFORM

-

13.5 SERVICESLOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION TYPE

- 13.6 WEB-BASED

- 13.7 MOBILE-BASED

-

13.8 DESKTOP AND SERVER-BASEDLOW-CODE DEVELOPMENT PLATFORM MARKET, BY DEPLOYMENT TYPE

- 13.9 ON-PREMISES

-

13.10 CLOUDLOW-CODE DEVELOPMENT PLATFORM MARKET, BY INDUSTRYLOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2021

- TABLE 2 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 MARKET GROWTH FORECAST

- TABLE 4 MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MARKET: DETAILED LIST OF CONFERENCES & EVENTS IN 2022–2023

- TABLE 10 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 11 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 12 PLATFORMS: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 13 PLATFORMS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 14 SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 15 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 16 MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 17 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 18 CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 19 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 20 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 21 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 22 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 23 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 24 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 25 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 27 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 28 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 29 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 30 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 31 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 IT & TELECOM: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 33 IT & TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 34 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 35 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 36 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 37 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 39 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 40 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 41 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 42 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 43 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 44 MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 45 MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 47 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 56 US: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 57 US: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 58 US: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 59 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 60 CANADA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 61 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 62 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 63 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 64 EUROPE: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 67 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 68 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 69 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 71 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 72 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 73 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 74 UK: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 75 UK: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 76 UK: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 77 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 78 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 79 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 80 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 81 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 82 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 83 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 84 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 85 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 96 CHINA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 97 CHINA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 98 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 99 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 100 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 101 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 102 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 103 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 118 KSA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 119 KSA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 120 KSA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 121 KSA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 122 UAE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 123 UAE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 124 UAE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 125 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 126 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 127 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 128 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 130 LATIN AMERICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 131 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 132 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 133 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 134 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 135 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 136 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 137 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 138 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 139 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 140 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 141 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 142 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 143 BRAZIL: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 145 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 146 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 147 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 148 PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2022

- TABLE 149 DEALS, 2020–2022

- TABLE 150 OTHERS, 2020–2022

- TABLE 151 COMPANY EVALUATION MATRIX: CRITERIA

- TABLE 152 GLOBAL COMPANY FOOTPRINT

- TABLE 153 COMPANY COMPONENT FOOTPRINT

- TABLE 154 COMPANY VERTICAL FOOTPRINT (1/2)

- TABLE 155 COMPANY VERTICAL FOOTPRINT (2/2)

- TABLE 156 COMPANY REGIONAL FOOTPRINT

- TABLE 157 STARTUP/SME COMPANY EVALUATION MATRIX: CRITERIA

- TABLE 158 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 159 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 160 SALESFORCE: BUSINESS OVERVIEW

- TABLE 161 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 SALESFORCE: PRODUCT LAUNCHES

- TABLE 163 SALESFORCE: DEALS

- TABLE 164 SAP: BUSINESS OVERVIEW

- TABLE 165 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SAP: PRODUCT LAUNCHES

- TABLE 167 SAP: DEALS

- TABLE 168 OUTSYSTEMS: BUSINESS OVERVIEW

- TABLE 169 OUTSYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 OUTSYSTEMS: PRODUCT LAUNCHES

- TABLE 171 OUTSYSTEMS: DEALS

- TABLE 172 ORACLE: BUSINESS OVERVIEW

- TABLE 173 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 ORACLE: PRODUCT LAUNCHES

- TABLE 175 ORACLE: DEALS

- TABLE 176 ORACLE: OTHERS

- TABLE 177 MICROSOFT: BUSINESS OVERVIEW

- TABLE 178 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 MICROSOFT: PRODUCT LAUNCHES

- TABLE 180 MENDIX: BUSINESS OVERVIEW

- TABLE 181 MENDIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 MENDIX: PRODUCT LAUNCHES

- TABLE 183 MENDIX: DEALS

- TABLE 184 PEGASYSTEMS: BUSINESS OVERVIEW

- TABLE 185 PEGASYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 PEGASYSTEMS: PRODUCT LAUNCHES

- TABLE 187 PEGASYSTEMS: DEALS

- TABLE 188 PROGRESS SOFTWARE: BUSINESS OVERVIEW

- TABLE 189 PROGRESS SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 PROGRESS SOFTWARE: PRODUCT LAUNCHES

- TABLE 191 PROGRESS SOFTWARE: DEALS

- TABLE 192 IBM: BUSINESS OVERVIEW

- TABLE 193 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 IBM: PRODUCT LAUNCHES

- TABLE 195 IBM: DEALS

- TABLE 196 SERVICENOW: BUSINESS OVERVIEW

- TABLE 197 SERVICENOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 SERVICENOW: PRODUCT LAUNCHES

- TABLE 199 SERVICENOW: DEALS

- TABLE 200 RELATED MARKETS

- TABLE 201 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 202 PLATFORM: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 203 SERVICES: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 204 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION TYPE, 2018–2025 (USD MILLION)

- TABLE 205 WEB-BASED: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 206 MOBILE-BASED: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 207 DESKTOP AND SERVER-BASED: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 208 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY DEPLOYMENT TYPE, 2018–2025 (USD MILLION)

- TABLE 209 ON-PREMISES: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 210 CLOUD: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 211 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY INDUSTRY, 2018–2025 (USD MILLION)

- TABLE 212 BANKING, FINANCIAL SERVICES, AND INSURANCE: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 213 RETAIL AND ECOMMERCE: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 214 GOVERNMENT AND DEFENSE: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 215 HEALTHCARE: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 216 INFORMATION AND TECHNOLOGY: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 217 ENERGY AND UTILITIES: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 218 MANUFACTURING: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 219 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018–2025 (USD MILLION)

- TABLE 220 NORTH AMERICA: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 221 NORTH AMERICA: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION TYPE, 2018–2025 (USD MILLION)

- TABLE 222 NORTH AMERICA: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY INDUSTRY 2018–2025 (USD MILLION)

- TABLE 223 EUROPE: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 224 EUROPE: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION TYPE, 2018–2025 (USD MILLION)

- TABLE 225 ASIA PACIFIC: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 226 ASIA PACIFIC: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION TYPE, 2018–2025 (USD MILLION)

- TABLE 227 MIDDLE EAST AND AFRICA: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 228 MIDDLE EAST AND AFRICA: LOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION TYPE, 2018–2025 (USD MILLION)

- FIGURE 1 MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF MULTIEXPERIENCE DEVELOPMENT PLATFORMS FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE) - COLLECTIVE REVENUE OF MULTIEXPERIENCE DEVELOPMENT PLATFORMS VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): MARKET

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): VENDOR-REVENUE ESTIMATION

- FIGURE 9 MARKET: GLOBAL SNAPSHOT

- FIGURE 10 HIGH GROWTH SEGMENTS IN MARKET

- FIGURE 11 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 MARKET: REGIONAL SNAPSHOT

- FIGURE 13 GROWING USE OF ARTIFICIAL INTELLIGENCE, AUGMENTED REALITY, AND VIRTUAL REALITY TO DRIVE MARKET GROWTH

- FIGURE 14 PLATFORMS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET

- FIGURE 20 MARKET: ECOSYSTEM

- FIGURE 21 MARKET: VALUE CHAIN

- FIGURE 22 NUMBER OF PATENTS PUBLISHED, 2011–2021

- FIGURE 23 TOP PATENT OWNERS (GLOBAL)

- FIGURE 24 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 26 SERVICES SUBSEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 CLOUD SUBSEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 SMALL AND MEDIUM-SIZED ENTERPRISES SUBSEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO GROW AT HIGHEST CAGR AMONG REGIONS

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 MARKET EVALUATION FRAMEWORK, 2020–2022

- FIGURE 34 MULTIEXPERIENCE DEVELOPMENT PLATFORMS MARKET: VENDOR SHARE ANALYSIS

- FIGURE 35 HISTORICAL REVENUE ANALYSIS OF TOP FIVE VENDORS, 2017–2021

- FIGURE 36 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 37 MULTIEXPERIENCE DEVELOPMENT PLATFORMS (STARTUP/SME): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 38 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 39 SAP: COMPANY SNAPSHOT

- FIGURE 40 ORACLE: COMPANY SNAPSHOT

- FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 42 PEGASYSTEMS: COMPANY SNAPSHOT

- FIGURE 43 PROGRESS SOFTWARE: COMPANY SNAPSHOT

- FIGURE 44 IBM: COMPANY SNAPSHOT

- FIGURE 45 SERVICENOW: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for multiexperience development platforms and services. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

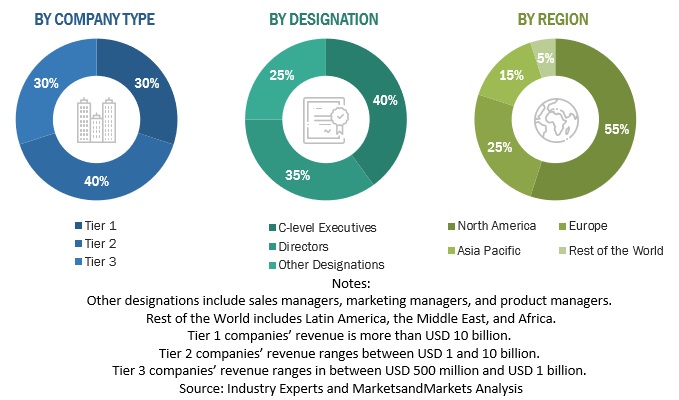

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various leading companies and organizations operating in the multiexperience development platforms market, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The breakup of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the multiexperience development platforms market, and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to determine the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the global multiexperience development platforms market based on component, deployment type, organization size, vertical, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To forecast the market size with respect to five main regions - North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America

- To profile the key players and comprehensively analyze their core competencies

- To track and analyze the competitive developments, such as joint ventures, mergers and acquisitions, new product developments, and research and development (R&D) activities, in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per company-specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Multiexperience Development Platforms Market