Wireless Platforms Market - Global Forecasts and Analysis (2011 - 2016)

Wireless networks such as Personal Area Networks (PANs) LANs, Cellular Networks enable effective communication by not depending on the availability of wires or cables. The borderless communication spurred by the invention of wireless network infrastructure and enhancement in application platforms have led to evolving human accessibility using mobile devices.

The wireless computing platforms are expected to have a favorable effect on enterprises as they can utilize new and innovative mobile operating systems, end user devices and wireless network infrastructure. Where personal computers shifted computing power to the desktop from mainframes, wireless devices supplement laptops and desktops, giving employees powerful end user devices that are well-connected and offer vital business data owing to integration with enterprise information systems.

The wireless computing platforms and devices act as trendsetters in the wireless market and are rapidly becoming an essential ingredient amongst information power users. With initial functions such as synchronized calendars, contact management, wireless messaging and email that can be preinstalled on these devices, these applications will steadily expand over the coming years as enterprises find new and innovative ways to their workforce more productive by offering ubiquitous access to enterprise data. The number of off-the-shelf systems and tools for customized solutions will also grow steadily.

These wireless platforms generally fall under two broad categories- smartphones which possess full-blown operating systems and can run enterprise applications and wireless PDAs integrated with cellular, Wi-Fi or both.

This market research study provides detailed qualitative and quantitative analysis of the global market, estimating the market till the end of 2016. The report also provides a comprehensive review of major market drivers, restraints, opportunities, Winning imperatives, challenges, and key issues that are widely prevalent in this market. The market is further segmented and forecasted for major geographic regions, North America, Europe, Middle East, Africa, Asia-Pacific and Rest of the World (ROW). The Competitive scenario and market share of the top players in the market has been discussed in detail. The top players of the industry are profiled in detail with their recent developments and other strategic industry activities.

We have used various secondary sources such as encyclopedia, directories, and databases to identify and collect information useful for this extensive commercial study on Wireless Platforms Market. The primary sources selected experts from related industries and selected suppliers have been interviewed to obtain and verify critical information as well as to assess the future prospects.

In value terms, the global market stood at $61.5 billion in year 2011 and is expected to reach $155.2 billion by year 2016, at 20.3% CAGR during the projected period.

Scope of the report

The Wireless Platforms market research report categorizes the global market on the basis of product type, application, handsets & tablets and geography; forecasting volumes and revenues and analyzing trends in each of the submarkets:

- On the basis of product type: This market is segmented on the basis of wireless baseband, wireless broadband, wireless processors, wireless power management integrated circuit (IC) and wireless sensors.

- On the basis of application: This market is classified onto data processing, communications, consumer electronics, automotive and industrial.

- On the basis of handset & tablets: This market is classified onto air interfaces, OEMs and operating systems.

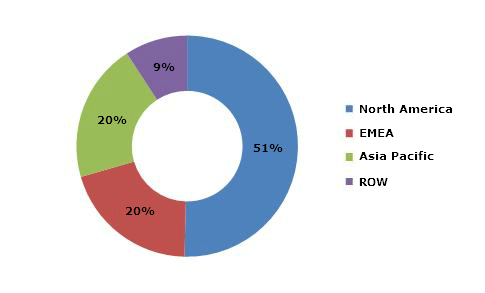

- On the basis of geography: This market is classified onto North America, EMEA, Asia Pacific and ROW.

Wireless platforms have become an integral part of mobile computing, consumer electronics and will act as primary focal-point for product innovation in the near future. The wireless technologies offers low-power and low-cost platform that makes it possible to expand the value of the end user products.

It is segmented on the basis of product type, application, handsets & tablets and geography. The market by product type is classified onto wireless broadband, wireless baseband, wireless processors, wireless sensors and wireless power management integrated circuit. The market by application is classified onto data processing, communications, and consumer electronics, automotive and industrial. The handsets and tablets are segmented onto mobile handsets, smartphones and tablets. The mobile handsets market is classified by air interfaces and OEMs. The smartphones market is classified by OEMs and by operating system. The tablets market is classified by type, by operating system and by geography.

The global wireless platform market is expected to increase from $61.5 billion in 2011 to $155.2 billion by 2016, registering a CAGR of 20.3% during 2011-2016. In terms of geography, North America is leading the pack in terms of revenue; it is expected to reach $80.1 billion in 2016, registering a CAGR of 20.7% from 2011 to 2016, followed by Asia Pacific and Rest of the World (ROW) which are leading in terms of growth rate as the market in this geography is in a nascent stage and many improvements are being made in telecommunication infrastructure sector.

The global market is fuelled by wireless deployments in businesses at an accelerating pace owing to increase in capable devices at affordable and attractive prices, cost-effective, reliable and quicker wireless networks being deployed across wide areas and expansion in the array of mobile applications.

Global Wireless Platform Market Share, By Geography, 2010

Source: MarketsandMarkets

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 TAXONOMY

1.6 FORECAST ASSUMPTIONS

1.7 RESEARCH METHODOLOGY

1.7.1 MARKET SIZE

1.7.2 KEY DATA POINTS TAKEN FROM SECONDARY SOURCES

1.7.3 KEY DATA POINTS TAKEN FROM PRIMARY SOURCES

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 WIRELESS PLATFORMS MARKET DEFINITION

3.2 MARKET SEGMENTATION

3.3 ECOSYSTEM OF WIRELESS PLATFORMS

3.4 COMPONENTS OF WIRELESS PLATFORM

3.5 EVOLUTION OF TECHNOLOGIES IN WIRELESS PLATFORMS

3.6 VALUE CHAIN ANALYSIS

3.7 MARKET SIZE

3.8 WINNING IMPERATIVES

3.8.1 DESIGNING & DEVELOPING ENERGY-EFFICIENT PROCESSORS

3.8.2 SELECTING AN ENTERPRISE-CLASS WIRELESS OPERATING SYSTEM

3.9 BURNING ISSUES

3.9.1 GROWTH OF MOBILE MALWARE

3.10 MARKET DYNAMICS

3.10.1 DRIVERS

3.10.1.1 Increase in power and energy-efficient processors

3.10.1.2 Innovations in operating systems & platforms

3.10.1.3 Advancements in network connectivity

3.10.1.4 Growing wireless broadband industry

3.10.2 RESTRAINTS

3.10.2.1 High fabrication costs

3.10.2.2 Fluidity of standards

3.10.3 OPPORTUNITIES

3.10.3.1 Swift growth in wireless computing devices market

3.11 IMPACT ANALYSIS OF DROS

3.12 PATENT ANALYSIS

3.12.1 BY GEOGRAPHY

3.12.2 BY COMPANY

4 WIRELESS PLATFORM MARKET, BY PRODUCT TYPE

4.1 WIRELESS BASEBAND MARKET

4.1.1 MARKET SIZE & FORECAST

4.2 WIRELESS BROADBAND MARKET

4.2.1 MARKET SIZE & FORECAST

4.3 WIRELESS PROCESSORS MARKET

4.3.1 MARKET SIZE & FORECAST

4.4 WIRELESS POWER MANAGEMENT INTEGRATED CIRCUIT MARKET

4.4.1 MARKET SIZE & FORECAST

4.5 WIRELESS TELECOMMUNICATION MARKET

4.5.1 MARKET SIZE & FORECAST

4.6 WIRELESS SENSORS MARKET

4.6.1 MARKET SIZE & FORECAST

5 WIRELESS PLATFORM APPLICATIONS MARKET

5.1 INTRODUCTION

5.2 DATA PROCESSING

5.2.1 MARKET SIZE & FORECAST

5.3 COMMUNICATIONS

5.3.1 MARKET SIZE & FORECAST

5.4 CONSUMER ELECTRONICS

5.4.1 MARKET SIZE & FORECAST

5.5 AUTOMOTIVE

5.5.1 MARKET SIZE & FORECAST

5.6 INDUSTRIAL

5.6.1 MARKET SIZE & FORECAST

6 HANDSETS & TABLETS WIRELESS MARKET SEGMENTATION

6.1 MOBILE HANDSETS MARKET

6.1.1 BY AIR INTERFACES

6.1.1.1 Market size & forecast

6.1.2 BY OEM

6.1.2.1 Market size & forecast

6.2 SMARTPHONES MARKET

6.2.1 BY OEM

6.2.1.1 Market size & forecast

6.2.2 BY OPERATING SYSTEM(OS)

6.2.2.1 Market size & forecast

6.3 TABLETS MARKET

6.3.1 BY TYPE

6.3.1.1 Market size & forecast

6.3.2 BY OPERATING SYSTEM

6.3.2.1 Market size & forecast

6.3.3 BY GEOGRAPHY

6.3.3.1 Market size & forecast

7 GEOGRAPHIC ANALYSIS

7.1 NORTH AMERICA

7.1.1 OVERVIEW

7.1.2 MARKET SIZE & FORECAST

7.2 EMEA

7.2.1 OVERVIEW

7.2.2 MARKET SIZE & FORECAST

7.3 ASIA-PACIFIC

7.3.1 OVERVIEW

7.3.2 MARKET SIZE & FORECAST

7.4 ROW

7.4.1 OVERVIEW

7.4.2 MARKET SIZE & FORECAST

8 COMPETITIVE LANDSCAPE

8.1 INTRODUCTION

8.2 MERGERS & ACQUISITIONS

8.3 PARTNERSHIPS, COLLABORATIONS, JOINT VENTURES, AGREEMENTS, MANAGEMENT CONTRACTS

8.4 NEW PRODUCT LAUNCHES & DEVELOPMENTS,

8.5 OTHERS

9 COMPANY PROFILES

9.1 APPLE INC.

9.1.1 OVERVIEW

9.1.2 PRIMARY BUSINESS

9.1.3 FINANCIALS

9.1.4 STRATEGY

9.1.5 DEVELOPMENTS

9.2 ARM HOLDINGS INC.

9.2.1 OVERVIEW

9.2.2 PRIMARY BUSINESS

9.2.3 FINANCIALS

9.2.4 STRATEGY

9.2.5 DEVELOPMENTS

9.3 BROADCOM CORPORATION

9.3.1 OVERVIEW

9.3.2 PRIMARY BUSINESS

9.3.3 FINANCIALS

9.3.4 STRATEGY

9.3.5 DEVELOPMENTS

9.4 FREESCALE SEMICONDUCTOR

9.4.1 OVERVIEW

9.4.2 PRIMARY BUSINESS

9.4.3 FINANCIALS

9.4.4 STRATEGY

9.4.5 DEVELOPMENTS

9.5 INFINEON TECHNOLOGIES AG

9.5.1 OVERVIEW

9.5.2 PRIMARY BUSINESS

9.5.3 FINANCIALS

9.5.4 STRATEGY

9.5.5 DEVELOPMENTS

9.6 INTEL INC

9.6.1 OVERVIEW

9.6.2 PRIMARY BUSINESS

9.6.3 FINANCIALS

9.6.4 STRATEGY

9.6.5 DEVELOPMENTS

9.7 MARVELL TECHNOLOGY GROUP LIMITED

9.7.1 OVERVIEW

9.7.2 PRIMARY BUSINESS

9.7.3 FINANCIALS

9.7.4 STRATEGY

9.7.5 DEVELOPMENTS

9.8 MEDIATEK

9.8.1 OVERVIEW

9.8.2 PRIMARY BUSINESS

9.8.3 FINANCIALS

9.8.4 STRATEGY

9.8.5 DEVELOPMENTS

9.9 MIPS TECHNOLOGIES INC

9.9.1 OVERVIEW

9.9.2 PRIMARY BUSINESS

9.9.3 FINANCIALS

9.9.4 STRATEGY

9.9.5 DEVELOPMENTS

9.10 NVIDIA CORPORATION

9.10.1 OVERVIEW

9.10.2 PRIMARY BUSINESS

9.10.3 FINANCIALS

9.10.4 STRATEGY

9.10.5 DEVELOPMENTS

9.11 NXP

9.11.1 OVERVIEW

9.11.2 PRIMARY BUSINESS

9.11.3 FINANCIALS

9.11.4 STRATEGY

9.11.5 DEVELOPMENTS

9.12 QUALCOMM CORPORATION

9.12.1 OVERVIEW

9.12.2 PRIMARY BUSINESS

9.12.3 FINANCIALS

9.12.4 STRATEGY

9.12.5 DEVELOPMENTS

9.13 RENESAS ELECTRONICS CORPORATION

9.13.1 OVERVIEW

9.13.2 PRIMARY BUSINESS

9.13.3 FINANCIALS

9.13.4 STRATEGY

9.13.5 DEVELOPMENTS

9.14 RF MICRO DEVICES

9.14.1 OVERVIEW

9.14.2 PRIMARY BUSINESS

9.14.3 FINANCIALS

9.14.4 STRATEGY

9.14.5 DEVELOPMENTS

9.15 SAMSUNG CORPORATION

9.15.1 OVERVIEW

9.15.2 PRIMARY BUSINESS

9.15.3 FINANCIALS

9.15.4 STRATEGY

9.15.5 DEVELOPMENTS

9.16 SKYWORKS SOLUTIONS

9.16.1 OVERVIEW

9.16.2 PRIMARY BUSINESS

9.16.3 FINANCIALS

9.16.4 STRATEGY

9.16.5 DEVELOPMENTS

9.17 ST-ERICSSON

9.17.1 OVERVIEW

9.17.2 PRIMARY BUSINESS

9.17.3 FINANCIALS

9.17.4 STRATEGY

9.17.5 DEVELOPMENTS

9.18 STMICROELECTRONICS

9.18.1 OVERVIEW

9.18.2 PRIMARY BUSINESS

9.18.3 FINANCIALS

9.18.4 STRATEGY

9.18.5 DEVELOPMENTS

9.19 TEXAS INSTRUMENTS INC

9.19.1 OVERVIEW

9.19.2 PRIMARY BUSINESS

9.19.3 FINANCIALS

9.19.4 STRATEGY

9.19.5 DEVELOPMENTS

9.20 VIA INC

9.20.1 OVERVIEW

9.20.2 PRIMARY BUSINESS

9.20.3 FINANCIALS

9.20.4 STRATEGY

9.20.5 DEVELOPMENTS

APPENDIX

U.S. PATENTS

EUROPE PATENTS

JAPAN PATENTS

LIST OF TABLES

TABLE 1 FORECAST ASSUMPTIONS

TABLE 2 GLOBAL WIRELESS PLATFORM MARKET REVENUE, BY PRODUCT TYPES, 2011 2016 ($BILLION)

TABLE 3 MARKET REVENUE OF WIRELESS PLATFORM , BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 4 GLOBAL WIRELESS PLATFORM REVENUE MARKET SIZE, BY PRODUCT TYPES, 2011 2016 ($BILLION)

TABLE 5 GLOBAL MARKET OF WIRELESS PLATFORM SIZE PROPORTION,

BY PRODUCT TYPES, 2011 2016 (%)

TABLE 6 IMPACT ANALYSIS OF DROS ON GLOBAL MARKET OF WIRELESS PLATFORM

TABLE 7 WIRELESS PLATFORM DEVELOPMENTS & MARKET SHARE, BY COMPANY, 2010 2011

TABLE 8 WIRELESS PLATFORM PATENTS & MARKET SHARE, BY COMPANY, 2009 2011

TABLE 9 GLOBAL WIRELESS BASEBAND UNIT SHIPMENT MARKET, BY COMPANY, 2011 2016 (MILLION)

TABLE 10 GLOBAL WIRELESS BASEBAND MARKET VOLUME PROPORTION, BY COMPANY, 2011 2016 (%)

TABLE 11 GLOBAL WIRELESS BASEBAND MARKET REVENUE, BY COMPANY, 2011 2016 ($MILLION)

TABLE 12 GLOBAL WIRELESS BASEBAND MARKET REVENUE PROPORTION, BY COMPANY, 2011 2016 (%)

TABLE 13 GLOBAL WIRELESS BROADBAND MODULE SHIPMENT, BY DEVICE TYPES, 2011 2016 (MILLION)

TABLE 14 GLOBAL WIRELESS BROADBAND MODULE SHIPMENT PROPORTION, BY DEVICE TYPES, 2011 2016 (%)

TABLE 15 GLOBAL WIRELESS BASEBAND PROCESSOR UNIT SHIPMENT, BY END USER DEVICES, 2011 2016 (MILLION)

TABLE 16 GLOBAL WIRELESS BASEBAND PROCESSOR UNIT SHIPMENT PROPORTION, BY END USER DEVICES, 2011 2016 (%)

TABLE 17 GLOBAL WIRELESS S/A APPLICATION PROCESSOR UNIT SHIPMENT, BY END USER DEVICES, 2011 2016 (MILLION)

TABLE 18 GLOBAL WIRELESS IM PROCESSOR UNIT SHIPMENT, BY END USER DEVICES, 2011 2016 (MILLION)

TABLE 19 GLOBAL WIRELESS IM PROCESSOR UNIT SHIPMENT PROPORTION, BY END USER DEVICES, 2011 2016 (%)

TABLE 20 GLOBAL WIRELESS PROCESSOR UNIT SHIPMENT, BY TYPES, 2011 2016 (MILLION)

TABLE 21 GLOBAL WIRELESS PROCESSOR UNIT SHIPMENT PROPORTION, BY TYPES, 2011 2016 (%)

TABLE 22 GLOBAL WIRELESS PROCESSOR MARKET REVENUE, BY TYPES, 2011 2016 ($BILLION)

TABLE 23 GLOBAL WIRELESS PROCESSOR MARKET REVENUE PROPORTION, BY TYPES, 2011 2016 (%)

TABLE 24 CARRIER MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 25 GLOBAL CARRIER MARKET REVENUE PROPORTION, BY REGION, 2011 2016 (%)

TABLE 26 GLOBAL TELECOMMUNICATION MARKET REVENUE, BY SERVICES, 2011 2016 ($MILLION)

TABLE 27 GLOBAL TELECOMMUNICATION MARKET REVENUE PROPORTION, BY SERVICES, 2011 2016 (%)

TABLE 28 GLOBAL MEMS MOTION SENSORS MARKET REVENUE, BY END USER DEVICES, 2011 2016 ($MILLION)

TABLE 29 GLOBAL MEMS MOTION SENSORS MARKET REVENUE PROPORTION, BY END USER DEVICES, 2011 2016 (%)

TABLE 30 GLOBAL MARKET OF WIRELESS PLATFORM REVENUE, BY APPLICATION, 2011 2016 ($BILLION)

TABLE 31 GLOBAL WIRELESS PLATFORM APPLICATION MARKET, BY PROPORTION, 2011 2016 (%)

TABLE 32 GLOBAL HANDSET UNIT SHIPMENT, BY AIR INTERFACE TECHNOLOGY, 2011 2016 (MILLION)

TABLE 33 GLOBAL HANDSET UNIT SHIPMENT PROPORTION, BY AIR INTERFACE TECHNOLOGY, 2011 2016 (%)

TABLE 34 GLOBAL MOBILE HANDSET UNIT SHIPMENT, BY OEM, 2011 2016 (MILLION)

TABLE 35 GLOBAL MOBILE HANDSET UNIT SHIPMENT PROPORTION, BY OEM, 2011 2016 (%)

TABLE 36 GLOBAL MOBILE HANDSET MARKET REVENUE, BY OEM, 2011 2016 ($BILLION)

TABLE 37 GLOBAL SMARTPHONE UNIT SHIPMENT MARKET, BY OPERATING SYSTEM, 2011 2016 (MILLION)

TABLE 38 GLOBAL SMARTPHONE UNIT SHIPMENT PROPORTION, BY OPERATING SYSTEM, 2011 2016 (%)

TABLE 39 GLOBAL SMARTPHONE MARKET REVENUE, BY OPERATING SYSTEM, 2011 2016 ($BILLION)

TABLE 40 GLOBAL TABLET UNIT SHIPMENT MARKET, BY TYPES, 2011 2016 (MILLION)

TABLE 41 GLOBAL TABLET UNIT SHIPMENT MARKET PROPORTION, BY TYPES, 2011 2016 (%)

TABLE 42 GLOBAL TABLET MARKET REVENUE, BY TYPES, 2011 2016 ($BILLION)

TABLE 43 GLOBAL TABLET MARKET REVENUE PROPORTION, BY TYPES, 2011 2016 (%)

TABLE 44 GLOBAL TABLET UNIT SHIPMENT, BY OPERATING SYSTEM, 2011 2016 (MILLION)

TABLE 45 GLOBAL TABLET UNIT SHIPMENT PROPORTION, BY OPERATING SYSTEM, 2011 2016 (%)

TABLE 46 GLOBAL TABLET MARKET REVENUE, BY OPERATING SYSTEM, 2011 2016 ($BILLION)

TABLE 47 TABLET UNIT SHIPMENTS, BY GEOGRAPHY, 2011 2016 (MILLION UNITS)

TABLE 48 TABLET UNIT SHIPMENTS PROPORTION, BY GEOGRAPHY, 2011 2016 (%)

TABLE 49 TABLET MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($BILLION)

TABLE 50 NORTH AMERICA: TABLET UNIT SHIPMENT, BY OPERATING SYSTEM, 2011 2016 (MILLION UNITS)

TABLE 51 NORTH AMERICA: TABLET REVENUE, BY OPERATING SYSTEM, 2011 2016 ($BILLION)

TABLE 52 EMEA: TABLET UNIT SHIPMENT, BY OPERATING SYSTEM, 2011 2016 (MILLION UNITS)

TABLE 53 EMEA: TABLET REVENUE, BY OPERATING SYSTEM, 2011 2016 ($BILLION)

TABLE 54 APAC: TABLET UNIT SHIPMENT, BY OPERATING SYSTEM, 2011 2016 (MILLION)

TABLE 55 APAC: TABLET MARKET REVENUE, BY OPERATING SYSTEM, 2011 2016 ($BILLION)

TABLE 56 ROW: TABLET UNIT SHIPMENT, BY OPERATING SYSTEM, 2011 2016 (MILLION UNITS)

TABLE 57 ROW: TABLET REVENUE, BY OPERATING SYSTEM, 2011 2016 ($BILLION)

TABLE 58 MERGERS & ACQUISITIONS, JULY 2010 NOVEMBER 2011

TABLE 59 PARTNERSHIPS, COLLABORATIONS, JOINT VENTURES, AGREEMENTS, MANAGEMENT CONTRACTS, AUGUST 2008 NOVEMBER 2011

TABLE 60 NEW PRODUCT LAUNCHES & DEVELOPMENTS, JANUARY 2009 DECEMBER 2011

TABLE 61 OTHERS, JANUARY 2009 DECEMBER 2011

TABLE 62 APPLE INC: NET SALES, BY OPERATING SEGMENT, 2010 2011 (MILLION)

TABLE 63 APPLE INC: NET SALES, BY PRODUCT, 2010 2011 ($MILLION)

TABLE 64 APPLE INC: UNIT SALES, BY PRODUCT, 2010 2011 (MILLION)

TABLE 65 ARM HOLDINGS: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

TABLE 66 ARM HOLDINGS: MARKET REVENUE, BY BUSINESS DIVISION, 2009 2010 ($MILLION)

TABLE 67 FREESCALE: MARKET REVENUE, BY SEGMENTS, 2010 2011 ($MILLION)

TABLE 68 INTEL CORPORATION: MARKET REVENUE, 2009 2010 ($MILLION)

TABLE 69 MARVELL: MARKET REVENUE, BY BUSINESS SEGMENT, 2010 2011 ($MILLION)

TABLE 70 MARVELL: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 71 TEXAS INSTRUMENTS INCORPORATED: MARKET REVENUE, BY SEGMENTS, 2009 2010 ($MILLION)

TABLE 72 TEXAS INSTRUMENTS INCORPORATED: MARKET REVENUE, BY GEOGRAPHY, 2009 2010 ($MILLION)

LIST OF FIGURES

FIGURE 1 SEGMENTATION OF MARKET OF WIRELESS PLATFORM

FIGURE 2 WIRELESS PLATFORM FOR MOBILE PHONES

FIGURE 3 TECHNOLOGIES IN WIRELESS PLATFORMS

FIGURE 4 EVOLUTION OF AIR INTERFACE TECHNOLOGY

FIGURE 5 VALUE CHAIN OF WIRELESS PLATFORM

FIGURE 6 MARKET PRESENCE ANALYSIS, BY COMPANY, 2010 2011

FIGURE 7 PATENT ANALYSIS, BY GEOGRAPHY, JANUARY 2009 DECEMBER 2011

FIGURE 8 PATENT ANALYSIS, BY COMPANY,

JANUARY 2009 DECEMBER 2011 (%)

FIGURE 9 GLOBAL SMARTPHONE MARKET SHARE, BY HANDSET OEM, 2010 (%)

FIGURE 10 GROWTH STRATEGY OF MARKET PLAYERS, 2008 2011

FIGURE 11 PERCENTAGE OF NET REVENUE OF BROADCOM CORPORATION

FIGURE 12 NVIDIA CORPORATION REVENUE, BY BUSINESS SEGMENTS, 2011

FIGURE 13 NVIDIA CORPORATION REVENUE, BY GEOGRAPHY, 2011

Growth opportunities and latent adjacency in Wireless Platforms Market