Commercial Touch Display Market Size, Share, Statistics and Industry Growth Analysis Report by Product (Monitor, POS Terminal, Signage Display), Touch Technology (Resistive, Capacitive, Infrared), Aspect Ratio (Wide, Square), Resolution, Screen Size, Industry, Application and Region - Forecast to 2029

Updated on : July 12, 2025

Commercial Touch Display Market Summary

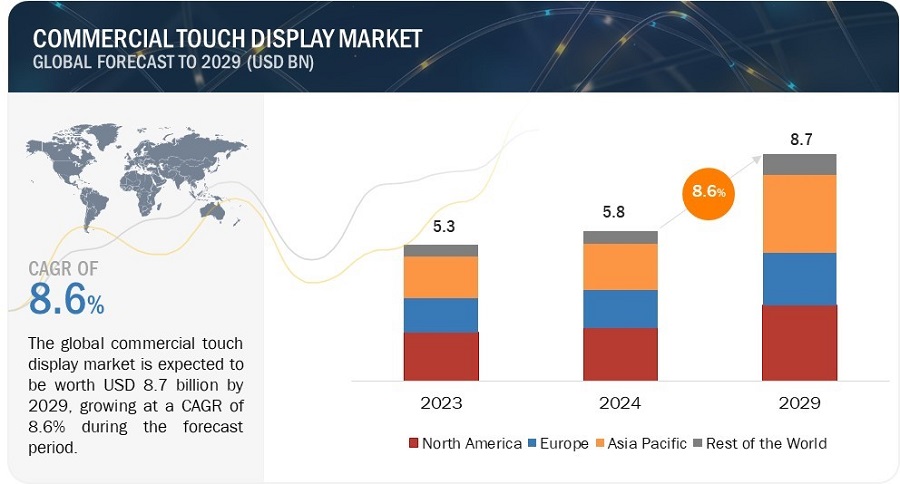

The Commercial Touch Display Market size was estimated at USD 5.3 billion in 2023 and is predicted to increase from USD 5.8 Billion in 2024 to approximately USD 8.7 Billion by 2029, expanding at a CAGR of 8.6% from 2024 to 2029.

Commercial Touch Display Market Key Takeaways

-

By Market Size & Growth, Commercial Touch Display Market is projected to reach USD 8.7 Billion by 2029, growing from USD 5.8 Billion in 2024 at a CAGR of 8.6% during the forecast period from 2024 to 2029.

-

By recognizing growing adoption across retail and hospitality, businesses are increasingly using touch displays for self-service kiosks, enhancing customer engagement and operational efficiency.

-

By tracking the surge in smart classrooms and e-learning, the education sector is fueling demand for intuitive and collaborative multi-touch displays, especially in North America and Asia Pacific.

-

By leveraging advancements in capacitive touch technology, manufacturers are delivering highly responsive and durable screens, making them ideal for high-traffic commercial environments.

-

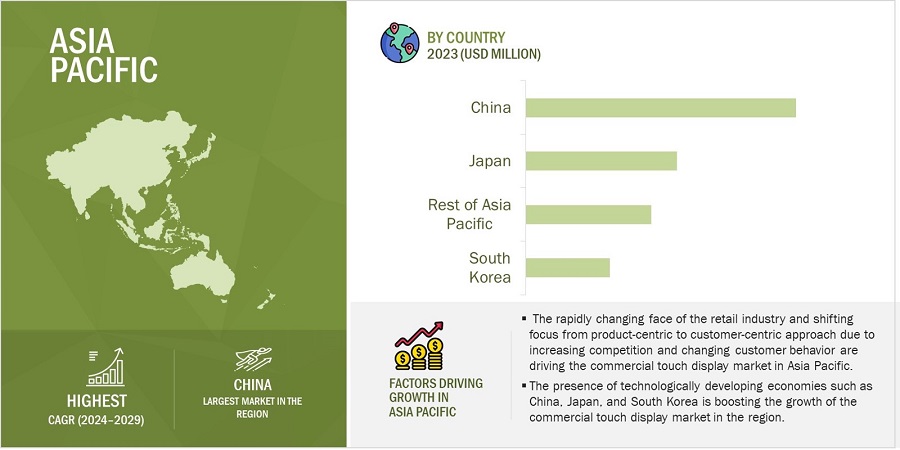

By expanding presence in Asia Pacific, especially in countries like China, South Korea, and India, the region is poised to grow at the fastest rate, driven by digital transformation initiatives and infrastructure investments.

-

By observing the shift toward multi-touch solutions in industrial automation, sectors like manufacturing and healthcare are integrating these displays for better control, visualization, and data interaction.

-

By emphasizing seamless user interface requirements, commercial settings are pushing demand for displays with multi-user capabilities and superior gesture recognition.

-

By strengthening investments in ruggedized and weather-resistant displays, outdoor applications in transport and advertising are gaining traction, particularly across Europe and North America.

Market Size & Forecast Report

-

2024 Market Size: USD 5.8 Billion

-

2029 Projected Market Size: USD 8.7 Billion

-

CAGR (2023-2028): 8.6%

-

Asia Pacific : Grow at the Highest CAGR

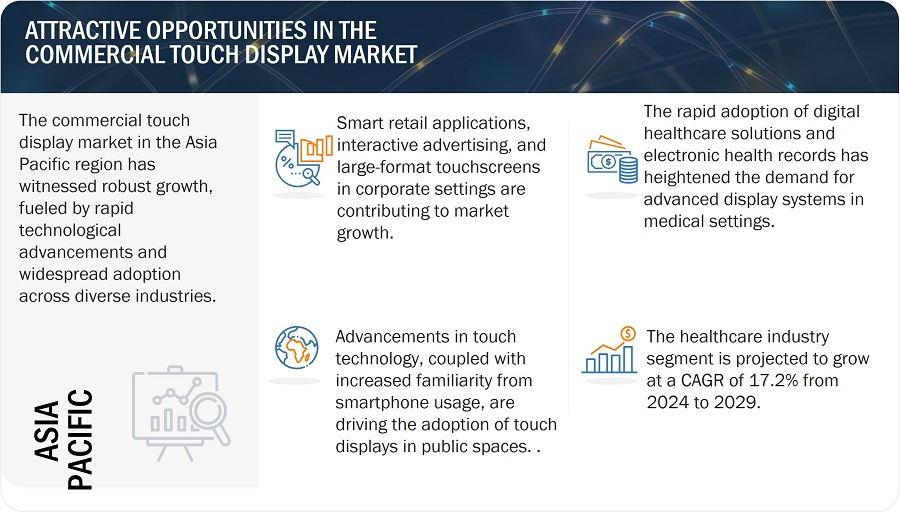

The growing demand for interactive customer experiences in retail, hospitality, and education propels the commercial touch display industry. Advancements in touch technology, coupled with increased familiarity from smartphone usage, are driving the adoption of touch displays in public spaces. Smart retail applications, interactive advertising, and large-format touchscreens in corporate settings contribute to touch display market growth.

Commercial Touch Display Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Commercial Touch Display Market Trends and Dynamics:

Driver: Growing demand for interactive displays in various applications

Interactive displays enable users to interact with the screen using touch or other input methods like gestures or voice commands. Interactive displays and touch-based devices have become increasingly popular across a range of industries, including smart homes and automobiles, retail, corporate, banking, transportation and more. In the smart home sector, interactive displays are integrated into various appliances such as washing machines, refrigerators, microwaves, and chimneys. Similarly, the automobile industry has incorporated interactive displays in navigation screens, digital rear-view mirrors, and dashboards. Interactive touch screens have become ubiquitous in most industries, with the kiosk industry particularly reliant on them. Interactive kiosks, whiteboards, tables, and monitors are gaining popularity across multiple business verticals. This growing demand for touch-based devices has significantly contributed to the increased demand for interactive displays.

The education sector is rapidly transitioning towards digital learning, with educational institutions, students, and teachers all embracing this trend. Technological advancements have played a vital role in making this transition possible, making it easier to create interactive classrooms. LCD, LED-LCD, and OLED are the display technologies commonly used in interactive displays. Each display technology has its unique advantages and disadvantages, and the choice of display technology will depend on the specific requirements. Displays are also widely used in commercial spaces to enhance the customer experience and facilitate business operations. In retail settings, displays are commonly used for advertising and showcasing products, allowing customers to browse and interact with items before making a purchase. Some of the top global companies that specialize in interactive displays are LG Corporation (South Korea), Samsung Electronics (South Korea), Sharp Corporation (Japan), NEC Corporation (Japan), ViewSonic Corporation (US), Planar Systems (US), and Horizon Display (US).

Restraint: The rise of touchless and antimicrobial display solutions in public settings

The rise of touchless and antimicrobial display solutions in public settings reflects an evolutionary response to the growing concern regarding hygiene and cleanliness in high-traffic areas. These solutions aim to address the challenges posed by conventional touch displays in public spaces, where multiple users interact with the same screens, potentially leading to the transmission of germs. Touchless display solutions have gained prominence by offering innovative interaction methods that eliminate the need for physical contact. Utilizing technologies such as infrared sensors, gesture recognition, or proximity sensors, these systems allow users to engage with the display without physically touching the screen. This touchless approach minimizes the risk of germ transmission, catering to heightened hygiene expectations in public environments like retail stores, transportation hubs, educational institutions, healthcare facilities, and more. Hygiene concerns pose a notable constraint on the widespread adoption of touch displays, particularly in public settings, due to heightened awareness surrounding cleanliness and the potential transmission of germs through constant touching. The prevalence of health crises, such as the COVID-19 pandemic, has significantly amplified these concerns, focusing attention on the importance of mitigating the risk of germ transmission via shared surfaces.

Being interactive by nature, touch displays necessitate direct physical contact for interaction, increasing the possibility of germ transfer from one user to another. In public settings like retail stores, transportation hubs, educational institutions, healthcare facilities, and various other high-traffic areas, touch displays raise the alarm about the potential spread of bacteria and viruses. This concern impacts user confidence and adoption rates, especially among individuals who are conscious of hygiene standards and the potential health risks associated with shared surfaces. The growing awareness of hygiene-related issues has led to an increased demand for touchless or antimicrobial display solutions. Touchless technology, such as gesture-based or proximity sensors, allows users to interact with displays without direct physical contact, reducing the risk of germ transmission. Additionally, the integration of antimicrobial coatings or materials in touch displays aims to inhibit the growth of microorganisms on the display surfaces, promoting a more hygienic user experience.

These hygiene concerns present a substantial challenge for touch display manufacturers and integrators, compelling them to innovate and develop solutions that prioritize cleanliness and user safety. Meeting these demands involves not only technological advancements but also raising awareness and assuring users of the enhanced hygiene measures incorporated into these displays to address the concerns surrounding public health and safety.

Opportunity: Integration of artificial intelligence in touchscreen display devices

The integration of artificial intelligence (AI) within touchscreen display devices has revolutionized user interactions and experiences. AI empowers these displays with advanced capabilities, such as gesture recognition, voice and speech understanding, and adaptive learning algorithms. Powered by AI, gesture recognition technology enables touchless interactions, allowing users to engage with displays without physical contact, thereby enhancing hygiene and accessibility. Voice recognition, employing natural language processing algorithms, enables users to interact with displays through spoken commands, offering hands-free convenience and accessibility.

AI-driven personalization is another significant feature, where touchscreen displays can analyze user behavior and preferences, providing tailored content and recommendations. Through predictive analytics, these displays anticipate user needs based on historical data, improving user efficiency. AI-powered virtual assistants or chatbots integrated into touchscreen displays offer real-time assistance and guidance, enhancing interactivity. Moreover, AI’s adaptive learning capabilities enable touchscreen displays to continuously improve by learning from user interactions, refining the user experience over time. These AI integrations enhance user convenience and personalization and pave the way for more intuitive and intelligent interactions, transforming the functionality and usability of touchscreen displays across various industries.

Challenge: Compatibility and integration with existing infrastructure can pose a significant challenge

The compatibility and integration of touch display systems with existing infrastructure can present a substantial challenge for businesses and organizations. Incorporating touch displays into established setups often requires seamless compatibility with various software, hardware, or network configurations already in place. This challenge arises due to the diversity of systems, operating platforms, and protocols used across different industries and businesses. Ensuring that the touch display technology can interact harmoniously with existing tools, databases, or software applications is crucial for smooth and efficient operation.

Incompatibility issues may lead to functionality limitations, disruptions in workflow, or additional costs for modifications and adaptations to ensure proper integration. Such challenges might demand additional investments in software development, upgrades, or modifications to existing systems, which can extend both the time and financial commitments required for successful implementation. The complexity of integration can often delay the deployment of touch display solutions, impacting the anticipated benefits and efficiency improvements that these systems are meant to offer. Moreover, the need for cross-platform compatibility further intensifies the challenge, especially when integrating touch displays into diverse environments that utilize a range of technologies and interfaces. Addressing these compatibility and integration challenges requires a meticulous approach involving comprehensive compatibility assessments, tailored solutions, and potentially custom development to bridge the gaps between the touch display systems and existing infrastructure, ensuring a cohesive and efficient operation without disruptions.

Commercial Touch Display Market Ecosystem

Prominent companies in this commercial touch display market include well-established, financially stable providers of commercial touch display products. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include LG DISPLAY CO., LTD. (South Korea), SAMSUNG (South Korea), LEYARD (China), Sharp Corporation (Japan), NEC Corporation (Japan), ViewSonic Corporation (US), Elo Touch Solutions, Inc. (US), Innolux Corporation (Taiwan), AUO Corporation (Taiwan), and BOE Technology Group Co., Ltd. (China).

Commercial Touch Display Market Trends:

By Product, open frame touch display is likely to lead the market during the forecast period.

The open-frame touchscreen display is likely to lead the commercial touch display market for many compelling reasons. Government data consistently highlights the push towards smart infrastructure and the integration of digital technologies across sectors. Open frame displays align perfectly with these initiatives, offering a versatile and adaptable solution for applications ranging from retail and healthcare to industrial settings. The modular design of open frame displays allows for easy integration into existing systems, making them ideal for retrofitting and upgrading initiatives supported by government mandates.

By Touch Technology, the capacitive touch segment is likely to grow at the highest CAGR between 2024 and 2029.

Capacitive touchscreens support multi-touch capabilities, allowing users to perform gestures like pinching, zooming, and swiping. This feature is particularly desirable in various commercial contexts, from interactive kiosks to digital signage and point-of-sale terminals, where businesses aim to enhance user engagement and usability. Additionally, capacitive touchscreens offer excellent optical clarity, preserving the visual quality of the display content. This optical clarity is essential for applications like retail displays and advertising, where the visual appeal of the content is a primary consideration. These factors are expected to boost the demand for capacitive touch technology, which, in turn, will result in the highest CAGR over the forecast period.

By Industry, the healthcare segment is to exhibit highest CAGR from 2024 to 2029.

The healthcare segment in the commercial touch display market share is poised for the highest CAGR due to several pivotal factors. The increasing digitization of healthcare processes, including electronic health records (EHR) and advanced medical imaging technologies, is driving the demand for high-performance touch displays in medical settings. The transition towards telemedicine and the need for interactive and collaborative tools for remote consultations further amplify the significance of touch displays in healthcare. These displays facilitate hands-on interaction with patient data, medical images, and diagnostic software, enhancing the efficiency of healthcare professionals. Additionally, the emphasis on infection control in healthcare environments has accelerated the adoption of touch displays with antimicrobial coatings, ensuring a hygienic user interface. The versatility of touch displays in supporting applications like patient monitoring, surgery, and medical education contributes to their indispensable role in modern healthcare, thus fueling the anticipated growth in this segment.

By Application, the indoor segment to dominate the market between 2024 and 2029.

The indoor application segment is anticipated to lead the commercial touch display market growth over the forecast period due to a surge in demand for interactive solutions in indoor environments. Industries such as retail, healthcare, and corporate settings increasingly leverage touch displays for applications like interactive kiosks, digital signage, and collaborative workspaces. The emphasis on enhancing customer engagement, providing intuitive interfaces, and improving operational efficiency within enclosed spaces is propelling the adoption of touch displays. Additionally, the flexibility and adaptability of touch technology to various indoor settings contribute to its widespread use, making indoor applications a focal point for sustained growth in the touch display market.

Commercial Touch Display Industry Regional Analysis

Asia Pacific region is likely to experience the highest growth in the overall commercial touch display market during the forecast period.

Commercial Touch Display Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region is expected to exhibit the highest growth rate in the global commercial touch display industry due to several key factors. Rapid urbanization, increasing disposable incomes, and a burgeoning retail sector in countries like China and India are driving the demand for interactive and engaging displays in commercial spaces. The widespread adoption of digital signage, interactive kiosks, and touch-based point-of-sale systems further fuels touch display market growth. Additionally, advancements in technology, coupled with the rising trend of smart cities and increasing investments in infrastructure development, are contributing to the surge in demand for commercial touch displays in various sectors, including retail, hospitality, and education. The region's proactive approach toward digital transformation and the growing acceptance of touch-based interfaces across industries are anticipated to propel the Asia Pacific commercial touch display market to the forefront of global growth.

Top Commercial Touch Display Companies - Key Market Players

- LG DISPLAY CO., LTD. (South Korea),

- SAMSUNG (South Korea),

- LEYARD (China),

- Sharp Corporation (Japan),

- NEC Corporation (Japan),

- Elo Touch Solutions, Inc. (US),

- Innolux Corporation (Taiwan),

- AUO Corporation (Taiwan),

- BOE Technology Group Co., Ltd. (China).are some of the key players in the commercial touch display companies.

Commercial Touch Display Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size in 2024 |

USD 5.8 Billion in 2024 |

|

Projected Market Size in 2029 |

USD 8.7 Billion by 2029 |

|

Growth Rate |

CAGR of 8.6% |

|

Market size available for years |

2020—2029 |

|

Base year |

2023 |

|

Forecast period |

2024—2029 |

|

Forecast Units |

USD Millions/USD Billions and Million Units |

|

Segments Covered |

By product, touch technology, aspect ratio, screen size, resolution, industry, application, and region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies covered |

LG DISPLAY CO., LTD. (South Korea), SAMSUNG (South Korea), LEYARD (China), Sharp Corporation (Japan), NEC Corporation (Japan). A total of 25 players are covered. |

Commercial Touch Display Market Highlights

This research report categorizes the commercial touch display market based on product, touch technology, aspect ratio, screen size, resolution, industry, application, and region.

|

Segment |

Subsegment |

|

By Product: |

|

|

By Touch Technology |

|

|

By Aspect Ratio: |

|

|

By Screen Size: |

|

|

By Resolution: |

|

|

By Industry: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Commercial Touch Display Industry

- In September 2023, Elo Touch Solutions, Inc. unveiled the 2799L open frame display, a 27-inch touchscreen monitor engineered explicitly for outdoor applications, constructed to endure various environmental conditions. This open-frame solution is well-suited for kiosk manufacturers and integrators seeking to create tailored outdoor or industrial solutions that demand resilience against temperature fluctuations, humidity, and round-the-clock operation.

- In June 2023, Samsung Electronics America, Inc. (Subsidiary of SAMSUNG) introduced its new Interactive Display at the 2023 ISTELive conference in Philadelphia. The Interactive Display marked the first Samsung interactive solution built on the Android Operating System, providing an intuitive user interface that enriched the classroom experience right from the start.

- In July 2023, LEYARD formed a strategic partnership agreement with the IAC, aimed at harnessing their individual strengths to facilitate the advancement of local industrial system modernization, digital transformation, and the enhancement of the real economy's high-quality development.

- In March 2023, Innolux Corporation introduced its electronic paper technology to the Quanlian smart retail field, creating sustainable value and an upgrade. It marked the company's debut in the retail supermarket arena as they collaborated with Taiwan's largest local supermarket, the Quan Lian Welfare Center.

- In March 2023, E Ink Holdings Inc. and Sharp Corporation collaborated to develop and market ePaper posters using E Ink's technology which can be used as digital signage.

Frequently Asked Questions (FAQs):

Which are the major companies in the commercial touch display market? What are their key strategies to strengthen their market presence?

The major companies in the commercial touch display market are – LG DISPLAY CO., LTD. (South Korea), SAMSUNG (South Korea), LEYARD (China), Sharp Corporation (Japan), NEC Corporation (Japan), ViewSonic Corporation (US), Elo Touch Solutions, Inc. (US), Innolux Corporation (Taiwan), AUO Corporation (Taiwan), and BOE Technology Group Co., Ltd. (China). The major strategies adopted by these players are product launches and collaborations.

What are the new opportunities for emerging players in the commercial touch display market?

Emerging players in the commercial touch display market are presented with promising opportunities as the demand for interactive and user-centric solutions continues to rise across diverse industries. With an increasing focus on applications such as digital signage, interactive kiosks, and collaborative workspaces, new entrants have the chance to offer innovative, cost-effective, and niche-specific touch display solutions. The growing trend of touch displays in emerging markets and the integration of advanced technologies, including augmented reality (AR) and virtual reality (VR), present avenues for differentiation.

Which industry is likely to drive the commercial touch display market growth in the next five years?

The anticipated high growth rate of commercial touch displays in the healthcare sector is expected to drive the overall market significantly. As healthcare facilities increasingly adopt digital solutions and modernize their infrastructure, there will be a surge in demand for touch displays to facilitate interactive and intuitive interfaces. The integration of touch displays for applications such as patient engagement systems, electronic health records (EHRs), and interactive medical imaging not only enhances operational efficiency but also contributes to an improved overall patient experience.

Which region will likely offer lucrative growth for the commercial touch display market by 2029?

The Asia-Pacific region is set to experience the highest growth rate in the commercial touch display market, driven by a confluence of factors. Rapid urbanization, technological advancements, and the expanding middle class in countries like China, India, and Japan are fostering increased commercial activities. This leads to a heightened demand for touch displays in sectors such as retail, hospitality, and corporate environments. The widespread use of smart devices and a robust digital infrastructure further amplify the necessity for interactive displays across various applications.

Which factors are expected to boost the commercial touch display market in the next 5-6 years?

Over the next 5-6 years, the commercial touch display market is anticipated to experience growth due to the ongoing technological advancements in touch display technology, increasing demand for touch displays in commercial vehicles, growing demand for interactive displays in various applications, and rising digital signage adoption.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Ongoing advancements in touch display technology- Increasing use of touch displays in commercial vehicles- Growing adoption of touch display technology in education and automotive sectors- Rising adoption of digital signage technology in commercial applicationsRESTRAINTS- Declining demand for displays from retail sector owing to growing preference for online shopping- Increasing awareness regarding hygiene-related risks through touch-based surfacesOPPORTUNITIES- Integration of AI technology into touchscreen display devices- Growing utilization of POS in retail and hospitality sectors- Rising adoption of advanced display technology in smart home applicationsCHALLENGES- Incorporating touch displays into existing infrastructure- Deteriorated performance in high-traffic environments due to wear and tear

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY PRODUCT TYPEAVERAGE SELLING PRICE OF COMMERCIAL TOUCH DISPLAYS, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM/MARKET MAP

-

5.7 TECHNOLOGY ANALYSISMICROLED DISPLAYSIMMERSIVE DISPLAYSFLEXIBLE DISPLAYSPROJECTION TECHNOLOGIESQUANTUM DOT DISPLAYS

-

5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS

-

5.11 CASE STUDY ANALYSISINCREASING REVENUE BY PROMOTING TIMELY AND RELEVANT MESSAGES AROUND SYCUAN CASINO RESORT (US)ENHANCING VISUALIZATION OF CONGENITAL HEART DEFECTS, CEREBRAL ANEURYSMS, AND COMPLEX BLOOD VESSELS BY SCIEMENT (JAPAN)PROVIDING TIMELY INFORMATION TO CUSTOMERS VISITING AMU PLAZA KUMAMOTO (JAPAN)ENHANCING VISUAL EXPERIENCE OF CUSTOMERS OF BURT BROTHERS (US)CREATING FRESH AND MODERN LOOK FOR EUROLACKE’S OFFICE SPACE (NETHERLANDS)

-

5.12 TARIFF, STANDARDS, AND REGULATORY LANDSCAPETARIFFSTANDARDS- Global- Europe- Asia Pacific- North AmericaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS- North America- Europe- Asia Pacific

-

5.13 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 LINUX

- 6.3 WINDOWS

- 6.4 ANDROID

- 7.1 INTRODUCTION

-

7.2 MONITORSINCREASING USE TO ENHANCE PRODUCTIVITY AND EASE COLLABORATION BETWEEN USERS TO DRIVE SEGMENTAL GROWTH

-

7.3 SIGNAGE DISPLAYSINCREASING POPULARITY AMONG BUSINESSES TO PROMOTE DIGITAL CONTENT AND ENHANCE USER ENGAGEMENT TO PROPEL SEGMENTAL GROWTH

-

7.4 POS TERMINALSNEED FOR IMPROVED CUSTOMER EXPERIENCE WITH SECURE AND STREAMLINED SALES TRANSACTIONS IN COMMERCIAL SETTINGS TO BOOST SEGMENTAL GROWTH

-

7.5 OPEN FRAME TOUCHSCREEN DISPLAYSWIDESPREAD INTEGRATION INTO CUSTOM ENCLOSURES OR LARGE SYSTEMS TO CONTRIBUTE TO SEGMENTAL GROWTH

-

7.6 MEDICAL DISPLAYSADVANCED TOUCHSCREEN TECHNOLOGY INTEGRATED WITH MEDICAL-GRADE SPECIFICATIONS TO DRIVE SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 WIDEDEMAND FOR ENHANCED IMAGE QUALITY AND CLARITY WITH IMMERSIVE VIEWING EXPERIENCE TO DRIVE SEGMENT

-

8.3 SQUARENEED FOR VISUALLY APPEALING CONTENT IN RETAIL SECTOR AND FOR DIGITAL SIGNAGES TO PROPEL SEGMENT

- 9.1 INTRODUCTION

-

9.2 RESISTIVEHIGH ADAPTABILITY TO VARIOUS ENVIRONMENTS AND COST-EFFECTIVENESS TO DRIVE SEGMENT

-

9.3 CAPACITIVEADVANTAGES SUCH AS PRECISION, RESPONSIVENESS, AND OPTICAL CLARITY TO CONTRIBUTE TO SEGMENTAL GROWTH

-

9.4 SURFACE ACOUSTIC WAVEIMMUNITY TO FALSE TOUCHES IN OUTDOOR AND HEALTHCARE APPLICATIONS TO PROPEL SEGMENTAL GROWTH

-

9.5 INFRAREDRESILIENCE TO SURFACE CONTAMINANTS IN PUBLIC SETTINGS AND OUTDOOR ENVIRONMENTS TO FUEL SEGMENTAL GROWTH

- 10.1 INTRODUCTION

-

10.2 4KINCREASING ADOPTION IN MANUFACTURING AND HEALTHCARE INDUSTRIES FOR HIGH-RESOLUTION IMAGES TO DRIVE SEGMENTAL GROWTH

-

10.3 FHDNEED FOR AFFORDABLE TOUCHSCREENS WITH SUPERIOR PICTURE QUALITY TO CONTRIBUTE TO SEGMENTAL GROWTH

-

10.4 HDNEED FOR SHARPER AND BRIGHTER VISUALS COMPARED TO REGULAR SCREENS TO FOSTER SEGMENTAL GROWTH

- 11.1 INTRODUCTION

-

11.2 INDOORINCREASING ADOPTION OF TOUCH DISPLAY SOLUTIONS IN RETAIL STORES TO DRIVE MARKET

-

11.3 OUTDOORSURGING ADOPTION OF COMMERCIAL TOUCH DISPLAYS IN OUTDOOR KIOSKS AND DIGITAL SIGNAGES TO BOOST MARKET GROWTH

- 12.1 INTRODUCTION

-

12.2 7 TO 27 INCHESINCREASING FOCUS ON ENHANCING USER EXPERIENCE IN PLACES WITH SPACE CONSTRAINTS TO FUEL DEMAND

-

12.3 28 TO 65 INCHESNEED FOR HIGH VISIBILITY AND INTERACTIVITY IN DISPLAYS FOR COMMERCIAL APPLICATIONS TO BOOST DEMAND

-

12.4 ABOVE 65 INCHESREQUIREMENT FOR DURABLE AND HIGH-RESOLUTION SCREENS FOR ADVERTISING TO PROPEL MARKET GROWTH

- 13.1 INTRODUCTION

-

13.2 RETAIL, HOSPITALITY, AND BFSIUSE OF INTERACTIVE DISPLAYS INTEGRATED WITH AUGMENTED REALITY SOLUTIONS TO BOOST MARKET GROWTH

-

13.3 TRANSPORTATIONINTEGRATION OF TOUCH DISPLAY SYSTEMS WITH REAL-TIME DATABASES TO RETRIEVE INFORMATION ON SCHEDULES AND RESERVATIONS TO DRIVE MARKET

-

13.4 HEALTHCAREGROWING USE OF INTERACTIVE DISPLAYS IN HEALTHCARE ORGANIZATIONS TO EDUCATE PATIENTS TO DRIVE MARKET

-

13.5 CORPORATEINCREASING UTILIZATION OF TOUCH DISPLAYS TO CONDUCT SEMINARS AND PROVIDE IN-DEPTH PRODUCT DESCRIPTIONS TO PROPEL MARKET

-

13.6 SPORTS & ENTERTAINMENTINCREASING PENETRATION OF INTERACTIVE DISPLAYS TO ATTRACT AUDIENCES AND PROMOTE NEW PRODUCTS TO FUEL MARKET GROWTH

-

13.7 EDUCATIONWIDE USAGE OF TOUCH DISPLAYS IN EDUCATION AS WELL AS EMERGENCY BROADCAST SYSTEMS IN EDUCATIONAL INSTITUTIONS TO CONTRIBUTE TO MARKET GROWTH

- 14.1 INTRODUCTION

-

14.2 NORTH AMERICAIMPACT OF RECESSION ON TOUCH DISPLAY MARKET IN NORTH AMERICAUS- Growing business requirements for advanced touch display products integrated with IoT to drive marketCANADA- Thriving tourism industry and related services to contribute to market growthMEXICO- Increasing internet accessibility and smartphone usage to propel market

-

14.3 EUROPEIMPACT OF RECESSION ON TOUCH DISPLAY MARKET IN EUROPEUK- Rising demand for interactive experiences in retail and hospitality sectors to augment market growthGERMANY- Digital transformation across industries, including retail, healthcare, automotive, and manufacturing, to propel marketFRANCE- Increasing use of collaboration displays in various applications to drive marketREST OF EUROPE

-

14.4 ASIA PACIFICIMPACT OF RECESSION ON TOUCH DISPLAY MARKET IN ASIA PACIFICCHINA- Increasing adoption of touch displays to develop smart infrastructure for smart cities to foster market growthJAPAN- Demand for energy-efficient and sustainable display solutions to boost market growthSOUTH KOREA- Presence of numerous touch display manufacturers to foster market growthREST OF ASIA PACIFIC

-

14.5 ROWIMPACT OF RECESSION ON COMMERCIAL TOUCH DISPLAY MARKET IN ROWMIDDLE EAST & AFRICA- Rapid urbanization and retail expansion to foster market growth- GCC countries- Rest of Middle East & AfricaSOUTH AMERICA- Growing retail and hospitality sectors to drive market

- 15.1 INTRODUCTION

-

15.2 KEY PLAYER STRATEGIES/RIGHT TO WINORGANIC/INORGANIC GROWTH STRATEGIESPRODUCT PORTFOLIOREGIONAL PRESENCEMANUFACTURING AND DISTRIBUTION FOOTPRINT

- 15.3 MARKET SHARE ANALYSIS

- 15.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

15.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

15.6 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

15.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

- 16.1 INTRODUCTION

-

16.2 KEY PLAYERSSAMSUNG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEYARD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLG DISPLAY CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHARP CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELO TOUCH SOLUTIONS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsINNOLUX CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsVIEWSONIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsAUO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsBOE TECHNOLOGY GROUP CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments

-

16.3 OTHER PLAYERSPANASONIC HOLDINGS CORPORATIONTIANMA MICROELECTRONICS CO., LTD.QISDA CORPORATIONTRULY INTERNATIONAL HOLDINGS LIMITED.GESTURETEKHORIZON DISPLAY INC.EGAN VISUALBAANTO INTERNATIONAL LTD.CRYSTAL DISPLAY SYSTEMS LIMITEDBARCOBOXLIGHTPROMETHEAN LIMITEDVESTELITS, INC.FIRSTOUCH DIGITAL SOLUTIONS

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE (USD)

- TABLE 3 ROLE OF PARTICIPANTS IN COMMERCIAL TOUCH DISPLAY ECOSYSTEM

- TABLE 4 LIST OF PATENTS PERTAINING TO COMMERCIAL TOUCH DISPLAYS, 2020–2022

- TABLE 5 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 6 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 7 IMPORT DATA FOR HS CODE 8528-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 8528-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 9 COMMERCIAL TOUCH DISPLAY MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2022–2023

- TABLE 10 MFN TARIFF FOR HS CODE 8537-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2022

- TABLE 11 TOUCH DISPLAY MARKET: IMPACT OF PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 14 MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 15 MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 16 MARKET, BY PRODUCT, 2020–2023 (MILLION UNITS)

- TABLE 17 TOUCH DISPLAY MARKET, BY PRODUCT, 2024–2029 (MILLION UNITS)

- TABLE 18 MONITORS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 19 MONITORS: MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 20 MONITORS: MARKET, BY ASPECT RATIO, 2020–2023 (USD MILLION)

- TABLE 21 MONITORS: MARKET, BY ASPECT RATIO, 2024–2029 (USD MILLION)

- TABLE 22 MONITORS: MARKET, BY TOUCH TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 23 MONITORS: TOUCH DISPLAY MARKET, BY TOUCH TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 24 MONITORS: TOUCH DISPLAY MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 25 MONITORS: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 26 MONITORS: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 27 MONITORS: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 28 MONITORS: MARKET, BY SCREEN SIZE, 2020–2023 (USD MILLION)

- TABLE 29 MONITORS: MARKET, BY SCREEN SIZE, 2024–2029 (USD MILLION)

- TABLE 30 MONITORS: MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 31 MONITORS: MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 32 SIGNAGE DISPLAYS: COMMERCIAL TOUCH DISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 33 SIGNAGE DISPLAYS: TOUCH DISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 34 SIGNAGE DISPLAYS: MARKET, BY ASPECT RATIO, 2020–2023 (USD MILLION)

- TABLE 35 SIGNAGE DISPLAYS: MARKET, BY ASPECT RATIO, 2024–2029 (USD MILLION)

- TABLE 36 SIGNAGE DISPLAYS: MARKET, BY TOUCH TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 37 SIGNAGE DISPLAYS: MARKET, BY TOUCH TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 38 SIGNAGE DISPLAYS: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 39 SIGNAGE DISPLAYS: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 40 SIGNAGE DISPLAYS: MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 41 SIGNAGE DISPLAYS: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 42 SIGNAGE DISPLAYS: MARKET, BY SCREEN SIZE, 2020–2023 (USD MILLION)

- TABLE 43 SIGNAGE DISPLAYS: MARKET, BY SCREEN SIZE, 2024–2029 (USD MILLION)

- TABLE 44 SIGNAGE DISPLAYS: MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 45 SIGNAGE DISPLAYS: MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 46 POS TERMINALS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 47 POS TERMINALS: TOUCH DISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 48 POS TERMINALS: MARKET, BY ASPECT RATIO, 2020–2023 (USD MILLION)

- TABLE 49 POS TERMINALS: MARKET, BY ASPECT RATIO, 2024–2029 (USD MILLION)

- TABLE 50 POS TERMINALS: MARKET, BY TOUCH TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 51 POS TERMINALS: MARKET, BY TOUCH TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 52 POS TERMINALS: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 53 POS TERMINALS: COMMERCIAL TOUCH DISPLAY MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 54 POS TERMINALS: TOUCH DISPLAY MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 55 POS TERMINALS: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 56 POS TERMINALS: MARKET, BY SCREEN SIZE, 2020–2023 (USD MILLION)

- TABLE 57 POS TERMINALS: MARKET, BY SCREEN SIZE, 2024–2029 (USD MILLION)

- TABLE 58 POS TERMINALS: MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 59 POS TERMINALS: MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 60 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 61 OPEN FRAME TOUCHSCREEN DISPLAYS: TOUCH DISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 62 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY ASPECT RATIO, 2020–2023 (USD MILLION)

- TABLE 63 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY ASPECT RATIO, 2024–2029 (USD MILLION)

- TABLE 64 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY TOUCH TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 65 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY TOUCH TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 66 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 67 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 68 OPEN FRAME TOUCHSCREEN DISPLAYS: TOUCH DISPLAY MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 69 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 70 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY SCREEN SIZE, 2020–2023 (USD MILLION)

- TABLE 71 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY SCREEN SIZE, 2024–2029 (USD MILLION)

- TABLE 72 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 73 OPEN FRAME TOUCHSCREEN DISPLAYS: MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 74 MEDICAL DISPLAYS: COMMERCIAL TOUCH DISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 75 MEDICAL DISPLAYS: TOUCH DISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 76 MEDICAL DISPLAYS: MARKET, BY ASPECT RATIO, 2020–2023 (USD MILLION)

- TABLE 77 MEDICAL DISPLAYS: MARKET, BY ASPECT RATIO, 2024–2029 (USD MILLION)

- TABLE 78 MEDICAL DISPLAYS: MARKET, BY TOUCH TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 79 MEDICAL DISPLAYS: MARKET, BY TOUCH TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 80 MEDICAL DISPLAYS: MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 81 MEDICAL DISPLAYS: MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 82 MEDICAL DISPLAYS: COMMERCIAL TOUCH DISPLAY MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 83 MEDICAL DISPLAYS: TOUCH DISPLAY MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 84 MEDICAL DISPLAYS: MARKET, BY SCREEN SIZE, 2020–2023 (USD MILLION)

- TABLE 85 MEDICAL DISPLAYS: MARKET, BY SCREEN SIZE, 2024–2029 (USD MILLION)

- TABLE 86 MEDICAL DISPLAYS: MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 87 MEDICAL DISPLAYS: MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 88 MARKET, BY ASPECT RATIO, 2020–2023 (USD MILLION)

- TABLE 89 TOUCH DISPLAY MARKET, BY ASPECT RATIO, 2024–2029 (USD MILLION)

- TABLE 90 WIDE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 91 WIDE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 92 SQUARE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 93 SQUARE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 94 COMMERCIAL TOUCH DISPLAY MARKET, BY TOUCH TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 95 TOUCH DISPLAY MARKET, BY TOUCH TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 96 RESISTIVE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 97 RESISTIVE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 98 CAPACITIVE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 99 CAPACITIVE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 100 SURFACE ACOUSTIC WAVE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 101 SURFACE ACOUSTIC WAVE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 102 INFRARED: TOUCH DISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 103 INFRARED: TOUCH DISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 104 MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 105 MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 106 4K: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 107 4K: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 108 FHD: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 109 FHD: TOUCH DISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 110 HD: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 111 HD: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 112 COMMERCIAL TOUCH DISPLAY MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 113 TOUCH DISPLAY MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 114 INDOOR: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 115 INDOOR: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 116 OUTDOOR: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 117 OUTDOOR: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 118 MARKET, BY SIZE, 2020–2023 (USD MILLION)

- TABLE 119 TOUCH DISPLAY MARKET, BY SIZE, 2024–2029 (USD MILLION)

- TABLE 120 7 TO 27 INCHES: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 121 7 TO 27 INCHES: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 122 28 TO 65 INCHES: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 123 28 TO 65 INCHES: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 124 ABOVE 65 INCHES: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 125 ABOVE 65 INCHES: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 126 COMMERCIAL TOUCH DISPLAY MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 127 TOUCH DISPLAY MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 128 RETAIL, HOSPITALITY, AND BFSI: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 129 RETAIL, HOSPITALITY, AND BFSI: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 130 TRANSPORTATION: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 131 TRANSPORTATION: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 132 HEALTHCARE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 133 HEALTHCARE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 134 CORPORATE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 135 CORPORATE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 136 SPORTS & ENTERTAINMENT: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 137 SPORTS & ENTERTAINMENT: TOUCH DISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 138 EDUCATION: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 139 EDUCATION: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 140 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 141 COMMERCIAL TOUCH DISPLAY, BY REGION, 2024–2029 (USD MILLION)

- TABLE 142 NORTH AMERICA: COMMERCIAL TOUCH DISPLAY MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 143 NORTH AMERICA: TOUCH DISPLAY MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 144 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 145 NORTH AMERICA: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 146 EUROPE: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 147 EUROPE: MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 148 EUROPE: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 149 EUROPE: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 151 ASIA PACIFIC: TOUCH DISPLAY MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 154 ROW: MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 155 ROW: TOUCH DISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 156 ROW: MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 157 ROW: MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: COMMERCIAL TOUCH DISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: TOUCH DISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 160 KEY DEVELOPMENTS UNDERTAKEN BY LEADING MARKET PLAYERS, 2020–2023

- TABLE 161 MARKET: DEGREE OF COMPETITION, 2022

- TABLE 162 OVERALL COMPANY FOOTPRINT

- TABLE 163 COMPANY PRODUCT FOOTPRINT

- TABLE 164 COMPANY INDUSTRY FOOTPRINT

- TABLE 165 COMPANY REGION FOOTPRINT

- TABLE 166 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 167 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES, BY PRODUCT

- TABLE 168 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES, BY INDUSTRY

- TABLE 169 COMPETITIVE BENCHMARKING OF STARTUP/SMES, BY REGION

- TABLE 170 COMMERCIAL TOUCH DISPLAY MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 171 TOUCH DISPLAY MARKET: DEALS, 2020–2023

- TABLE 172 MARKET: OTHERS, 2019–2023

- TABLE 173 SAMSUNG: COMPANY OVERVIEW

- TABLE 174 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SAMSUNG: PRODUCT LAUNCHES

- TABLE 176 SAMSUNG: OTHERS

- TABLE 177 LEYARD: COMPANY OVERVIEW

- TABLE 178 LEYARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 LEYARD: PRODUCT LAUNCHES

- TABLE 180 LEYARD: DEALS

- TABLE 181 LG DISPLAY CO., LTD.: COMPANY OVERVIEW

- TABLE 182 LG DISPLAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 LG DISPLAY CO., LTD.: PRODUCT LAUNCHES

- TABLE 184 LG DISPLAY CO., LTD.: DEALS

- TABLE 185 LG DISPLAY CO., LTD.: OTHERS

- TABLE 186 SHARP CORPORATION: COMPANY OVERVIEW

- TABLE 187 SHARP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 SHARP CORPORATION: PRODUCT LAUNCHES

- TABLE 189 SHARP CORPORATION: DEALS

- TABLE 190 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 191 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 NEC CORPORATION: DEALS

- TABLE 193 ELO TOUCH SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 194 ELO TOUCH SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ELO TOUCH SOLUTIONS, INC.: PRODUCT LAUNCHES

- TABLE 196 ELO TOUCH SOLUTIONS, INC.: DEALS

- TABLE 197 ELO TOUCH SOLUTIONS, INC.: OTHERS

- TABLE 198 INNOLUX CORPORATION: COMPANY OVERVIEW

- TABLE 199 INNOLUX CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 200 INNOLUX CORPORATION: PRODUCT LAUNCHES

- TABLE 201 INNOLUX CORPORATION: DEALS

- TABLE 202 VIEWSONIC CORPORATION: COMPANY OVERVIEW

- TABLE 203 VIEWSONIC CORPORATION: PRODUCT /SOLUTIONS/SERVICES OFFERED

- TABLE 204 VIEWSONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 205 AUO CORPORATION: COMPANY OVERVIEW

- TABLE 206 AUO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 AUO CORPORATION: PRODUCT LAUNCHES

- TABLE 208 AUO CORPORATION: DEALS

- TABLE 209 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 210 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCT LAUNCHES

- TABLE 212 BOE TECHNOLOGY GROUP CO., LTD.: DEALS

- FIGURE 1 COMMERCIAL TOUCH DISPLAY MARKET: SEGMENTATION

- FIGURE 2 TOUCH DISPLAY MARKET: RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE), BY KEY PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)—BOTTOM-UP ESTIMATION OF TOUCH DISPLAY MARKET, BY PRODUCT

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 LIMITATIONS FOR RESEARCH STUDY

- FIGURE 10 COMMERCIAL TOUCH DISPLAY MARKET, 2020–2029 (USD MILLION)

- FIGURE 11 OPEN FRAME TOUCHSCREEN DISPLAYS SEGMENT TO LEAD MARKET IN 2029

- FIGURE 12 WIDE ASPECT RATIO SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 13 CAPACITIVE TOUCH TECHNOLOGY SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 4K RESOLUTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 OUTDOOR APPLICATIONS SEGMENT TO RECORD HIGHER CAGR FROM 2024 TO 2029

- FIGURE 16 28 TO 65 INCHES DISPLAY SEGMENT TO GROW AT FASTEST RATE DURING FORECAST PERIOD

- FIGURE 17 HEALTHCARE SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 18 MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 RISING ADOPTION OF TOUCH DISPLAYS IN HEALTHCARE INDUSTRY TO DRIVE MARKET

- FIGURE 20 OPEN FRAME TOUCHSCREEN DISPLAYS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BETWEEN 2020 AND 2029

- FIGURE 21 WIDE ASPECT RATIO SEGMENT HELD LARGER MARKET SHARE IN 2029

- FIGURE 22 INDOOR APPLICATIONS TO DOMINATE MARKET IN 2029

- FIGURE 23 7 TO 27 INCHES SEGMENT TO HOLD LARGEST MARKET SHARE FROM 2020 TO 2029

- FIGURE 24 CAPACITIVE TOUCH TECHNOLOGY TO DOMINATE MARKET IN 2029

- FIGURE 25 4K SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 26 RETAIL, HOSPITALITY, AND BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 27 ASIA PACIFIC TO DOMINATE MARKET IN 2029

- FIGURE 28 TOUCH DISPLAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 IMPACT OF DRIVERS ON COMMERCIAL TOUCH DISPLAY MARKET

- FIGURE 30 IMPACT OF RESTRAINTS ON TOUCH DISPLAY MARKET

- FIGURE 31 IMPACT OF OPPORTUNITIES ON MARKET

- FIGURE 32 IMPACT OF CHALLENGES ON MARKET

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 34 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE (USD)

- FIGURE 35 AVERAGE SELLING PRICE OF COMMERCIAL TOUCH DISPLAYS, BY REGION (USD)

- FIGURE 36 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 37 COMMERCIAL TOUCH DISPLAY ECOSYSTEM: KEY PLAYERS

- FIGURE 38 NUMBER OF PATENTS GRANTED FOR COMMERCIAL TOUCH DISPLAYS, 2013–2022

- FIGURE 39 REGIONAL ANALYSIS OF PATENTS GRANTED FOR COMMERCIAL TOUCH DISPLAYS, 2013–2022

- FIGURE 40 IMPORT DATA FOR MAJOR COUNTRIES FOR HS CODE 8537-COMPLIANT PRODUCTS, 2018–2022

- FIGURE 41 EXPORT DATA FOR MAJOR COUNTRIES FOR HS CODE 8537-COMPLIANT PRODUCTS, 2018–2022

- FIGURE 42 IMPORT DATA FOR MAJOR COUNTRIES FOR HS CODE 8528-COMPLIANT PRODUCTS, 2018–2022

- FIGURE 43 EXPORT DATA FOR MAJOR COUNTRIES FOR HS CODE 8528-COMPLIANT PRODUCTS, 2018–2022

- FIGURE 44 COMMERCIAL TOUCH DISPLAY MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 45 HIGH INTENSITY OF COMPETITIVE RIVALRY IN TOUCH DISPLAY MARKET

- FIGURE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 47 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 48 OPEN FRAME TOUCHSCREEN DISPLAYS SEGMENT TO LEAD MARKET IN 2029

- FIGURE 49 NORTH AMERICA TO DOMINATE MARKET FOR MONITORS IN 2029

- FIGURE 50 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN SIGNAGE DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN POS TERMINAL MARKET IN 2029

- FIGURE 52 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN OPEN FRAME TOUCHSCREEN DISPLAY MARKET IN 2029

- FIGURE 53 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MEDICAL DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 54 WIDE ASPECT RATIO SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 55 CAPACITIVE TOUCH TECHNOLOGY SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 56 4K SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 57 OUTDOOR APPLICATIONS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 58 28 TO 65 INCHES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 59 HEALTHCARE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 60 COMMERCIAL TOUCH DISPLAY MARKET, BY REGION

- FIGURE 61 SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 62 ASIA PACIFIC TO RECORD FASTEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 63 TOUCH DISPLAY MARKET: IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 64 NORTH AMERICA: DISPLAY MARKET SNAPSHOT

- FIGURE 65 MARKET: IMPACT OF RECESSION ON EUROPE

- FIGURE 66 EUROPE: DISPLAY MARKET SNAPSHOT

- FIGURE 67 DISPLAY MARKET: IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 68 ASIA PACIFIC: DISPLAY MARKET SNAPSHOT

- FIGURE 69 MARKET: IMPACT OF RECESSION ON ROW

- FIGURE 70 ROW: DISPLAY MARKET SNAPSHOT

- FIGURE 71 FIVE-YEAR REVENUE ANALYSIS OF MAJOR COMPANIES IN COMMERCIAL TOUCH DISPLAY MARKET, 2018–2022

- FIGURE 72 TOUCH DISPLAY MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 73 DISPLAY MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 74 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 75 LEYARD: COMPANY SNAPSHOT

- FIGURE 76 LG DISPLAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 77 SHARP CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 79 INNOLUX CORPORATION: COMPANY SNAPSHOT

- FIGURE 80 AUO CORPORATION: COMPANY SNAPSHOT

- FIGURE 81 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the commercial touch display market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the commercial touch displays market. The secondary sources included the Consumer Technology Association (CTA), Electronic Retail Association (ERA), Digital Signage Federation (DSF), Society for Information Display (SID), annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the commercial touch display market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

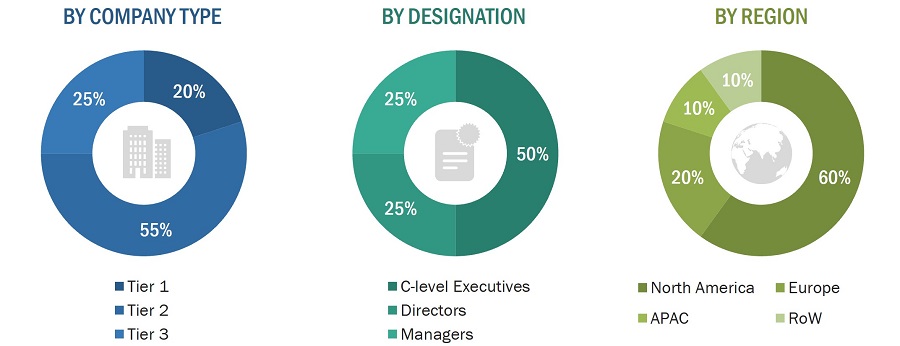

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions—Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the commercial touch display market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall commercial touch displays market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players' annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Global Commercial Touch Display Market Size: Bottom-Up Approach

Global Commercial Touch Display Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A commercial touch display, at its core, represents a technologically advanced interface that seamlessly integrates touch-sensitive capabilities into display systems, catering to a myriad of commercial applications. This innovative technology allows users to interact directly with the digital content presented on the screen by employing touch gestures, such as tapping, swiping, or pinching. Unlike traditional displays, commercial touch displays are specifically designed for deployment in business and public settings, offering a dynamic and engaging user experience. These displays find diverse applications across industries, including retail, hospitality, healthcare, education, and corporate environments. From interactive kiosks and point-of-sale systems to digital signage and collaborative meeting room solutions, commercial touch displays have become integral components in modern business strategies, enhancing customer engagement, facilitating efficient information dissemination, and fostering interactive communication in various professional settings. Touch display technology's evolution continues to shape how businesses and organizations approach user interaction, creating a versatile and immersive platform that transcends conventional display methodologies.

Key Stakeholders

- Raw material and testing equipment suppliers

- Research organizations

- Original equipment manufacturers (OEMs)

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users who want to know more about testing, inspection, and certification services and the latest standards in the testing, inspection, and certification market

Report Objectives

- To define, describe, estimate, and forecast the commercial touch display market, in terms of value, on the basis of product, screen size, aspect ratio, resolution, touch technology, industry, application, and geography

- To forecast the market size of concerned segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To provide a detailed overview of the value chain of the commercial touch display market and analyze the market trends

- To highlight the impact of Porter's five forces on the commercial touch display market ecosystem and analyze the underlying market opportunities

- To analyze the associated use cases in the commercial touch display market business and their impact on the business strategies adopted by key players

- To provide key industry trends and associated important regulations impacting the global commercial touch display market

- To profile key players and comprehensively analyze their market ranks and core competencies2, along with detailing the competitive landscape for market leaders

- To forecast and compare the market size of pre-recession with that of the post-recession at global and regional levels.

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) activities in the commercial touch display market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape to the market leaders

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Growth opportunities and latent adjacency in Commercial Touch Display Market