MS Polymer Adhesives Market by Type (Adhesives, Sealants), End Use Industry (Building & Construction, Automotive & Transportation, Industrial Assembly) and Region (Asia Pacific, Europe, North America, South America, Middle East & Africa) - Global Forecast to 2027

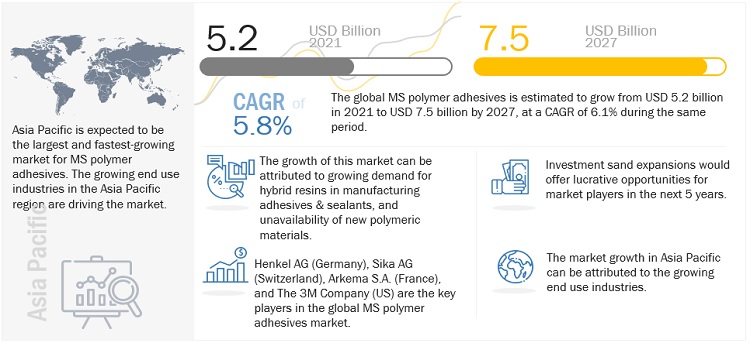

[253 Pages Report] The market size of MS polymer adhesives is estimated to grow from USD 5.2 billion in 2021 to USD 7.5 billion by 2027, at a CAGR of 6.1% during the same period. A wide range of solutions is introduced as next-generation adhesives and sealants, with some degree of customization to meet the needs of the customers. The manufacturers are investing heavily in the R&D of combining various adhesive bonding technologies. The hybrid adhesives developed with these combinations will have the properties of the resins used in manufacturing them. Therefore, the development of hybrid resins like MS polymer for manufacturing high-performance hybrid adhesives and sealants plays a significant role in driving the market.

Attractive Opportunities in MS Polymer Adhesives Market

Source: Interviews with Experts, Secondary Research, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Unavailability of new polymeric materials

Raw materials for adhesives and sealants are mainly naturally occurring and synthetic polymeric materials. Synthetic polymeric materials are obtained from petroleum feedstock. These materials can lead to GHG emissions and, thus, negatively affect the environment. Such concerns have encouraged governments worldwide to regulate the production of these materials. Many regulations limit the manufacturing of high VOC emitting materials. This has restricted the production of new polymeric materials. Therefore, resin manufacturers are increasingly investing in R&D to blend polymers to achieve good performance and improved resins, which cannot be provided by conventional resins. The resins are blended according to the need of the end-use industries. The most common blends are MS polymer, based on MS polyurethane, and MS polyether. Increasing the use of such hybrid resins will help enhance the performance and functional properties of adhesives and sealants, thus driving the market.

Restraints: Lack of acceptance from end users

The rate of acceptance of MS polymer adhesives is still on the lower side from the end users. This lower acceptance rate may be attributed to the lack of awareness about the availability of MS polymer adhesives or their preference to use conventional adhesives. This might be due to negligence of the benefits of MS polymer adhesives, such as improved flexibility/elongation, impact/thermal cycling resistance, peel strength, and long-term durability, which can be obtained by using MS polymer adhesives.

Opportunities: Non-hazardous, green, and sustainable adhesives & sealants

REACH and GHS (Globally Harmonized System of Classification and Labelling of Chemicals) have strict regulations in the European and US markets. More stress is being laid on eliminating the use of banned or dangerous substances such as organotins, mercury, monomeric isocyanates, pyrrolidones, phthalates, and nonylphenols in the production of adhesives and sealants. This contributes to the growth of the MS polymer adhesives market. This, in turn, is expected to increase the use of eco-friendly products.

Challenges: Limited market opportunities in developed countries

US, Germany, UK, and Japan have highly developed economies and advanced industrial activities. They also have a well-established infrastructure for the public, commercial, and transportation sectors. The service sector has become more important than the industrial sector in developed countries, making them post-industrial economies. The developed infrastructure in these countries signifies low prospects for new construction activities. Hence, there is limited scope for the growth of the MS polymer adhesives market in these countries. Manufacturers of MS polymer adhesives need to develop innovative products to capture newer markets, such as healthcare, electronics, and food packaging. Thus, limited market opportunities in developed countries act as a key challenge for the growth of the MS polymer adhesives market.

Use in bonding, renovation, and maintenance & repair of buildings to boost the demand

Building & construction is the largest end use industry segment of the MS polymer adhesives market. MS polymer adhesives are used in a wide range of applications in the building & construction industry, such as flooring, tiling, waterproofing, carpet laying, wall coverings, insulation, roofing, civil operations, facade, parquet, and others. They are gaining importance in the construction industry as they are used in bonding, renovation, maintenance & repair of residential & commercial buildings and civil engineering applications.

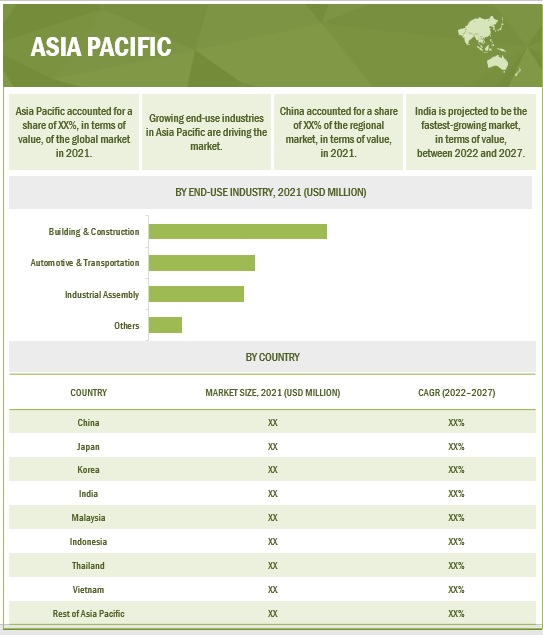

Asia Pacific to be fastest-growing MS polymer adhesives market

Asia Pacific is projected to lead the global MS polymer adhesives market during the forecast period. The MS polymer adhesives market in the region is projected to grow at the highest CAGR of 7.9% between 2022 and 2027 in terms of value, owing to the growing automotive and aerospace industry in China, the increasing demand for electric vehicles, and the shifting focus toward eco-friendly adhesives and sealants. Europe and North America are the second- and third-largest markets for MS polymer adhesives. These 2 regions collectively accounted for a share of nearly 50.5% of the global MS polymer adhesives market in 2021. The MS polymer adhesives market in Europe is driven by newer applications such as biomedical and electronics. The stable automobile production is projected to drive the MS polymer adhesives market in North America during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the MS polymer adhesives market are Henkel AG (Germany), Sika AG (Switzerland), Arkema (Bostik) (France), 3M Company (US), H.B. Fuller (US), Wacker Chemie AG (Germany), Tremco Illbruck GmbH & Co. KG (Germany), Hermann Otto GmbH (Germany), Mapei S.p.A (Italy), and Soudal Group (Belgium).

Scope of the report

|

Report Metric |

Details |

|

Years Considered |

20182027 |

|

Base Year |

2021 |

|

Forecast Period |

20222027 |

|

Units Considered |

Value (USD Billion) and Volume (kiloton) |

|

Segments |

Type And End Use Industry |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Henkel AG (Germany), Sika AG (Switzerland), Arkema (Bostik) (France), 3M Company (US), H.B. Fuller (US), Wacker Chemie AG (Germany), Tremco Illbruck GmbH & Co. KG (Germany), Hermann Otto GmbH (Germany), Mapei S.p.A (Italy), and Soudal Group (Belgium) |

This research report categorizes the MS polymer adhesives market based on type, end -use industry, and region.

Based on type, the MS polymer adhesives market has been segmented as follows:

- Adhesives

- Sealants

Based on end use industry, the MS polymer adhesives market has been segmented as follows:

- Automotive & Transportation

- Building & Construction

- Industrial Assembly

- Others

Based on the region, the MS polymer adhesives market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2022, Henkel AG expanded its production capabilities in Mexico by opening a new state-of-the-art plant for hot melt adhesives in Guadalupe, Nuevo Leon. The new facility has been designed to primarily manufacture pressure-sensitive and non-pressure-sensitive hot melts under the leading Technomelt brand.

- In February 2022, Arkema expanded engineering adhesives with the planned acquisition of Shanghai Zhiguan Polymer Materials (PMP), which specializes in hot-melt adhesives for the consumer electronics market. This initiative is consistent with the aim of Arkema to strengthen its position in the lucrative engineering adhesives industry and to hasten its growth in the electronics business, which is expanding quickly, particularly in Asia.

- In December 2021, Sika AG set up a new technology center and manufacturing plant for high-quality adhesives and sealants in Pune, India. Developments at the new R&D laboratories and production in the new plant meet rapidly growing demand in the Indian market.

- In October 2021, Wacker Chemie AG acquired a 60% stake in specialty silane manufacturer SICO Performance Material Co., Ltd, Jining (China).

Frequently Asked Questions (FAQ):

Does this report cover the new applications of MS polymer adhesives?

Yes, the report covers the new applications of MS polymer adhesives.

Does this report cover the volume tables in addition to value tables?

Yes, the report covers the market in terms of volume and value.

What is the current competitive landscape in the MS polymer adhesives market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing, thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK, and France are the major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MS POLYMER ADHESIVES: MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

FIGURE 2 REGIONAL SCOPE

1.3.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.3.1 Market inclusions

1.3.3.2 Market exclusions

1.3.4 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 3 MS POLYMER ADHESIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Critical primary inputs

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.1.2.5 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MS POLYMER ADHESIVES MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 MS POLYMER ADHESIVES MARKET SIZE ESTIMATION, BY VALUE

FIGURE 8 MS POLYMER ADHESIVES MARKET SIZE ESTIMATION, BY REGION

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY SIDE FORECAST

FIGURE 9 MS POLYMER ADHESIVES MARKET: SUPPLY SIDE FORECAST

FIGURE 10 METHODOLOGY FOR SUPPLY SIDE SIZING OF MS POLYMER ADHESIVES MARKET

2.3.2 DEMAND SIDE FORECAST

FIGURE 11 MS POLYMER ADHESIVES MARKET: DEMAND SIDE FORECAST

2.4 FACTOR ANALYSIS

FIGURE 12 FACTOR ANALYSIS OF MS POLYMER ADHESIVES MARKET

2.5 DATA TRIANGULATION

FIGURE 13 MS POLYMER ADHESIVES MARKET: DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 1 MS POLYMER ADHESIVES MARKET SNAPSHOT (2022 VS. 2027)

3.1 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY

FIGURE 14 MS POLYMER ADHESIVES TO ACCOUNT FOR HIGHEST SHARE IN BUILDING & CONSTRUCTION SEGMENT

3.2 MS POLYMER ADHESIVES MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN MS POLYMER ADHESIVES MARKET

FIGURE 16 MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

4.2 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY

FIGURE 17 BUILDING & CONSTRUCTION TO BE LARGEST END-USE INDUSTRY

4.3 MS POLYMER ADHESIVES MARKET: DEVELOPED VS. EMERGING COUNTRIES

FIGURE 18 EMERGING COUNTRIES TO WITNESS HIGHER GROWTH

4.4 ASIA PACIFIC MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY AND COUNTRY, 2021

FIGURE 19 BUILDING & CONSTRUCTION AND CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.5 MS POLYMER ADHESIVES MARKET, BY MAJOR COUNTRIES

FIGURE 20 INDIA TO BE LUCRATIVE MARKET

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 VALUE CHAIN OVERVIEW

5.2.1 VALUE CHAIN ANALYSIS

FIGURE 21 MS POLYMER ADHESIVES: VALUE CHAIN ANALYSIS

TABLE 2 MS POLYMER ADHESIVES MARKET: SUPPLY CHAIN ECOSYSTEM

5.3 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MS POLYMER ADHESIVES MARKET

5.3.1 DRIVERS

5.3.1.1 Demand for hybrid resins in adhesives & sealants

5.3.1.2 Nonavailability of new polymeric materials

5.3.1.3 Environmental regulations in North America and Europe

5.3.2 RESTRAINTS

5.3.2.1 Low acceptance by end users

5.3.3 OPPORTUNITIES

5.3.3.1 Non-hazardous, green, and sustainable adhesives & sealants

5.3.4 CHALLENGES

5.3.4.1 Limited opportunities in developed countries

5.4 PORTERS FIVE FORCES ANALYSIS

FIGURE 23 PORTERS FIVE FORCES ANALYSIS: MS POLYMER ADHESIVES MARKET

TABLE 3 MS POLYMER ADHESIVES MARKET: PORTERS FIVE FORCES ANALYSIS

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP INDUSTRIES (%)

5.5.2 BUYING CRITERIA

FIGURE 25 KEY BUYING CRITERIA FOR MS POLYMER ADHESIVES

TABLE 5 KEY BUYING CRITERIA FOR MS POLYMER ADHESIVES

5.6 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.6.1 INTRODUCTION

5.6.2 GDP TRENDS AND FORECAST

TABLE 6 GDP TRENDS AND FORECAST: PERCENTAGE CHANGE

5.7 TECHNOLOGY OVERVIEW

FIGURE 26 HISTORY OF DEVELOPMENT

5.8 CASE STUDY

5.9 AVERAGE PRICING ANALYSIS

FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN MS POLYMER ADHESIVES MARKET, BY REGION

FIGURE 28 AVERAGE PRICE COMPETITIVENESS IN MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY

5.10 KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 7 INTENSITY OF TRADE, BY KEY COUNTRIES

5.10.1 EXPORT-IMPORT TRADE STATISTICS

5.10.1.1 Trade Scenario 20192021

TABLE 8 EXPORT DATA FOR PAINTS AND VARNISHES, INCLUDING ENAMELS AND LACQUERS, BASED ON SYNTHETIC POLYMERS OR CHEMICALLY MODIFIED NATURAL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM (USD THOUSAND)

TABLE 9 IMPORT DATA OF PREPARED GLUES AND OTHER PREPARED ADHESIVES, N.E.S.; PRODUCTS SUITABLE FOR USE AS GLUES OR ADHESIVES, FOR RETAIL SALE (USD THOUSAND)

5.11 ECOSYSTEM MAP

FIGURE 29 ADHESIVES & SEALANTS ECOSYSTEM

5.12 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTIONS ON MANUFACTURERS OF ADHESIVES & SEALANTS: YC AND YCC SHIFT

FIGURE 30 ADHESIVE INDUSTRY: YC AND YCC SHIFT

5.12.1 AUTOMOTIVE & TRANSPORTATION

5.12.1.1 Electric vehicles

5.12.1.2 Shared mobility

5.12.1.3 Battery types for electric vehicles

5.12.2 AEROSPACE

5.12.2.1 Ultralight and light aircraft

5.12.2.2 Unmanned aircraft systems (UAS) or drones

5.12.3 HEALTHCARE

5.12.3.1 Wearable medical devices

5.12.3.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

5.12.4 ELECTRONICS

5.12.4.1 Digitalization

5.12.4.2 Artificial intelligence

5.12.4.3 Augmented reality

5.13 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON MS POLYMER ADHESIVES MARKET

5.13.1 LEED STANDARDS

TABLE 10 BY ARCHITECTURAL APPLICATIONS

TABLE 11 BY SPECIALTY APPLICATIONS

TABLE 12 BY SUBSTRATE-SPECIFIC APPLICATIONS

TABLE 13 BY SECTOR

TABLE 14 BY SEALANT PRIMERS

5.14 PATENT ANALYSIS

5.14.1 METHODOLOGY

5.14.2 PUBLICATION TRENDS

FIGURE 31 PUBLICATION TRENDS, 20182022

5.14.3 JURISDICTION

FIGURE 32 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 20182022

5.14.4 TOP APPLICANTS

FIGURE 33 TOP APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 15 MAJOR PATENTS PUBLISHED BY COMPANIES

5.15 KEY CONFERENCES AND EVENTS IN 20222023

TABLE 16 MS POLYMER ADHESIVES MARKET: LIST OF CONFERENCES AND EVENTS

6 MS POLYMER ADHESIVES MARKET, BY TYPE (Page No. - 90)

6.1 INTRODUCTION

6.2 ADHESIVES

6.3 SEALANTS

7 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY (Page No. - 91)

7.1 INTRODUCTION

FIGURE 34 AUTOMOTIVE & TRANSPORTATION SEGMENT TO GROW AT HIGHEST CAGR

TABLE 17 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 18 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 19 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 20 MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

7.2 BUILDING & CONSTRUCTION

7.2.1 BONDING, RENOVATION, AND MAINTENANCE & REPAIR OF BUILDINGS

TABLE 21 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 22 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (KILOTON)

TABLE 23 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (USD MILLION)

TABLE 24 BUILDING & CONSTRUCTION: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (KILOTON)

7.3 AUTOMOTIVE & TRANSPORTATION

7.3.1 AUTOMOBILES AND AEROSPACE APPLICATIONS TO DRIVE MARKET

TABLE 25 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 26 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (KILOTON)

TABLE 27 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (USD MILLION)

TABLE 28 AUTOMOTIVE & TRANSPORTATION: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (KILOTON)

7.4 INDUSTRIAL ASSEMBLY

7.4.1 MARINE AND WIND ENERGY APPLICATIONS TO DRIVE MARKET

TABLE 29 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 30 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (KILOTON)

TABLE 31 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (USD MILLION)

TABLE 32 INDUSTRIAL ASSEMBLY: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (KILOTON)

7.5 OTHERS

TABLE 33 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 34 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (KILOTON)

TABLE 35 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (USD MILLION)

TABLE 36 OTHERS: MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (KILOTON)

8 MS POLYMER ADHESIVES, BY REGION (Page No. - 102)

8.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC EMERGING STRATEGIC MARKET

TABLE 37 MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (USD MILLION)

TABLE 38 MS POLYMER ADHESIVES MARKET, BY REGION, 20182021 (KILOTON)

TABLE 39 MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (USD MILLION)

TABLE 40 MS POLYMER ADHESIVES MARKET, BY REGION, 20222027 (KILOTON)

8.2 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET SNAPSHOT

TABLE 41 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 42 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET SIZE, BY COUNTRY, 20182021 (KILOTON)

TABLE 43 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (USD MILLION)

TABLE 44 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 45 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 46 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 47 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 48 ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.1 CHINA

8.2.1.1 Cheap labor and raw materials

TABLE 49 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 50 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 51 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 52 CHINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.2 JAPAN

8.2.2.1 Environmental regulations to drive demand

TABLE 53 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 54 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 55 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 56 JAPAN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.3 INDIA

8.2.3.1 Government initiatives to lead to market growth

TABLE 57 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 58 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 59 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 60 INDIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.4 SOUTH KOREA

8.2.4.1 Automotive industry to lead market growth

TABLE 61 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 62 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 63 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 64 SOUTH KOREA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.5 INDONESIA

8.2.5.1 Cheap labor and raw materials to propel market

TABLE 65 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 66 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 67 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 68 INDONESIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.6 MALAYSIA

8.2.6.1 Auto manufacturing hub to boost demand

TABLE 69 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 70 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 71 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 72 MALAYSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.7 THAILAND

8.2.7.1 Growing aviation industry to boost demand

TABLE 73 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 74 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 75 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 76 THAILAND: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.8 VIETNAM

8.2.8.1 Increased investments in automotive industry

TABLE 77 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 78 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 79 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 80 VIETNAM: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.2.9 REST OF ASIA PACIFIC

TABLE 81 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 82 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 83 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.3 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MS POLYMER ADHESIVES MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 86 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (KILOTON)

TABLE 87 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (USD MILLION)

TABLE 88 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 89 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 90 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 91 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 92 NORTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.3.1 US

8.3.1.1 Largest share of regional market

TABLE 93 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 94 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 95 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 96 US: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.3.2 CANADA

8.3.2.1 Growing end-use industries to lead demand

TABLE 97 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 98 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 99 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 100 CANADA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.3.3 MEXICO

8.3.3.1 Low-cost manufacturing to drive market

TABLE 101 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 102 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 103 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 104 MEXICO: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4 EUROPE

FIGURE 38 EUROPE: MS POLYMER ADHESIVES MARKET SNAPSHOT

TABLE 105 EUROPE: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 106 EUROPE MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (KILOTON)

TABLE 107 EUROPE: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (USD MILLION)

TABLE 108 EUROPE MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 109 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 110 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 111 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 112 EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.1 GERMANY

8.4.1.1 Largest producer in Europe

TABLE 113 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 114 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 115 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 116 GERMANY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.2 FRANCE

8.4.2.1 Growth in end-use industries to boost market

TABLE 117 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 118 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 119 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 120 FRANCE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.3 ITALY

8.4.3.1 Automobile production and exports to drive market

TABLE 121 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 122 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 123 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 124 ITALY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.4 UK

8.4.4.1 Advancements in manufacturing technology

TABLE 125 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 126 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 127 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 128 UK: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.5 RUSSIA

8.4.5.1 Currency devaluation to hamper market growth

TABLE 129 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 130 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 131 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 132 RUSSIA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.6 TURKEY

8.4.6.1 Government infrastructure investments to boost demand

TABLE 133 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 134 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 135 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 136 TURKEY: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.7 SPAIN

8.4.7.1 Large automotive sector to lead market growth

TABLE 137 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 138 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 139 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 140 SPAIN: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.4.8 REST OF EUROPE

TABLE 141 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 142 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 143 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 144 REST OF EUROPE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.5 SOUTH AMERICA

FIGURE 39 BRAZIL TO BE FASTER-GROWING MARKET

TABLE 145 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 146 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (KILOTON)

TABLE 147 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (USD MILLION)

TABLE 148 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 149 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 150 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 151 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 152 SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.5.1 BRAZIL

8.5.1.1 Automotive industry to fuel market

TABLE 153 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 154 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 155 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 156 BRAZIL: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.5.2 ARGENTINA

8.5.2.1 Increasing population and improved economic conditions

TABLE 157 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 158 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 159 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 160 ARGENTINA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.5.3 REST OF SOUTH AMERICA

TABLE 161 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 162 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 163 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 164 REST OF SOUTH AMERICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.6 MIDDLE EAST & AFRICA

FIGURE 40 AFRICA TO BE LARGEST MARKET

TABLE 165 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20182021 (KILOTON)

TABLE 167 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY COUNTRY, 20222027 (KILOTON)

TABLE 169 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 171 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.6.1 UAE

8.6.1.1 Growing aircraft manufacturing activities

TABLE 173 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 174 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 175 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 176 UAE: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.6.2 AFRICA

8.6.2.1 Automotive industry to boost demand

TABLE 177 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 178 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 179 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 180 AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

8.6.3 REST OF MIDDLE EAST & AFRICA

TABLE 181 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (USD MILLION)

TABLE 182 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20182021 (KILOTON)

TABLE 183 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (USD MILLION)

TABLE 184 REST OF MIDDLE EAST & AFRICA: MS POLYMER ADHESIVES MARKET, BY END-USE INDUSTRY, 20222027 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 173)

9.1 OVERVIEW

TABLE 185 STRATEGIES ADOPTED BY KEY MANUFACTURERS OF MS POLYMER ADHESIVES

9.2 MARKET SHARE ANALYSIS

FIGURE 41 GLOBAL MS POLYMER ADHESIVES MARKET SHARE, BY KEY PLAYERS (2021)

TABLE 186 MS POLYMER ADHESIVES MARKET: DEGREE OF COMPETITION

9.3 MARKET RANKING ANALYSIS

FIGURE 42 RANKING OF KEY PLAYERS

9.4 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 187 STRATEGIC POSITIONING OF KEY PLAYERS

9.5 COMPANY REVENUE ANALYSIS

FIGURE 43 REVENUE ANALYSIS FOR KEY COMPANIES DURING PAST FIVE YEARS

9.6 COMPETITIVE LEADERSHIP MAPPING, 2021

9.6.1 STAR PLAYERS

9.6.2 EMERGING LEADERS

9.6.3 PERVASIVE PLAYERS

9.6.4 EMERGING COMPANIES

FIGURE 44 MS POLYMER ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

9.7 SME MATRIX, 2021

9.7.1 PROGRESSIVE COMPANIES

9.7.2 DYNAMIC COMPANIES

9.7.3 STARTING BLOCKS

9.7.4 RESPONSIVE COMPANIES

FIGURE 45 MS POLYMER ADHESIVES MARKET: EMERGING COMPANIES' COMPETITIVE LEADERSHIP MAPPING, 2021

9.8 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MS POLYMER ADHESIVES MARKET

9.9 BUSINESS STRATEGY EXCELLENCE

FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MS POLYMER ADHESIVES MARKET

9.10 COMPETITIVE BENCHMARKING

TABLE 188 MS POLYMER ADHESIVES MARKET: DETAILED LIST OF KEY PLAYERS

9.11 COMPETITIVE SCENARIO

9.11.1 MARKET EVALUATION FRAMEWORK

TABLE 189 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 190 HIGHEST ADOPTED STRATEGIES

TABLE 191 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

9.11.2 MARKET EVALUATION MATRIX

TABLE 192 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 193 COMPANY REGION FOOTPRINT

TABLE 194 COMPANY FOOTPRINT

9.12 STRATEGIC DEVELOPMENTS

9.12.1 NEW PRODUCT DEVELOPMENTS

TABLE 195 NEW PRODUCT LAUNCHES, 2017-2022

9.12.2 DEALS

TABLE 196 DEALS, 2018-2022

9.12.3 OTHER DEVELOPMENTS

TABLE 197 OTHERS, 20182022

10 COMPANY PROFILES (Page No. - 193)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

10.1 KEY PLAYERS

10.1.1 HENKEL AG

TABLE 198 HENKEL AG: COMPANY OVERVIEW

FIGURE 48 HENKEL AG: COMPANY SNAPSHOT

TABLE 199 HENKEL AG: OTHERS

10.1.2 SIKA AG

TABLE 200 SIKA AG: COMPANY OVERVIEW

FIGURE 49 SIKA AG: COMPANY SNAPSHOT

TABLE 201 SIKA AG: NEW PRODUCT LAUNCHES

TABLE 202 SIKA AG: DEALS

TABLE 203 SIKA AG: OTHERS

10.1.3 ARKEMA (BOSTIK)

TABLE 204 ARKEMA (BOSTIK): COMPANY OVERVIEW

FIGURE 50 ARKEMA (BOSTIK): COMPANY SNAPSHOT

TABLE 205 ARKEMA (BOSTIK): NEW PRODUCT LAUNCHES

TABLE 206 ARKEMA (BOSTIK): DEALS

TABLE 207 ARKEMA (BOSTIK): OTHERS

10.1.4 THE 3M COMPANY

TABLE 208 THE 3M COMPANY: COMPANY OVERVIEW

FIGURE 51 THE 3M COMPANY: COMPANY SNAPSHOT

10.1.5 WACKER CHEMIE AG

TABLE 209 WACKER CHEMIE AG: COMPANY OVERVIEW

FIGURE 52 WACKER CHEMIE AG: COMPANY SNAPSHOT

TABLE 210 WACKER CHEMIE AG: NEW PRODUCT LAUNCHES

TABLE 211 WACKER CHEMIE AG: DEALS

TABLE 212 WACKER CHEMIE AG: OTHERS

10.1.6 H.B. FULLER

TABLE 213 H.B. FULLER: COMPANY OVERVIEW

FIGURE 53 H.B. FULLER: COMPANY SNAPSHOT

TABLE 214 H.B. FULLER: DEALS

TABLE 215 H.B. FULLER: OTHERS

10.1.7 TREMCO ILLBRUCK GMBH & CO. KG.

TABLE 216 TREMCO ILLBRUCK GMBH & CO. KG.: COMPANY OVERVIEW

TABLE 217 TREMCO ILLBRUCK GMBH & CO. KG: PRODUCT LAUNCHES

TABLE 218 TREMCO ILLBRUCK GMBH & CO. KG: DEALS

10.1.8 HERMANN OTTO GMBH

TABLE 219 HERMANN OTTO GMBH: COMPANY OVERVIEW

10.1.9 SOUDAL GROUP

TABLE 220 SOUDAL GROUP: BUSINESS OVERVIEW

FIGURE 54 SOUDAL GROUP: COMPANY SNAPSHOT

TABLE 221 SOUDAL GROUP: DEALS

TABLE 222 SOUDAL GROUP: OTHERS

10.1.10 MAPEI S.P.A.

TABLE 223 MAPEI S.P.A.: COMPANY OVERVIEW

FIGURE 55 MAPEI S.P.A.: COMPANY SNAPSHOT

10.2 OTHER KEY PLAYERS

10.2.1 NOVACHEM CORPORATION LTD

TABLE 224 NOVACHEM CORPORATION LTD: COMPANY OVERVIEW

10.2.2 PERMABOND LLC.

TABLE 225 PERMABOND LLC.: COMPANY OVERVIEW

10.2.3 KISLING AG

TABLE 226 KISLING AG: COMPANY OVERVIEW

10.2.4 WEICON GMBH & CO.KG

TABLE 227 WEICON GMBH & CO.KG: COMPANY OVERVIEW

10.2.5 MERZ+BENTELI AG

TABLE 228 MERZ+BENTELI AG: COMPANY OVERVIEW

10.2.6 AMERICAN SEALANTS, INC

10.2.7 WEISS CHEMIE + TECHNIK GMBH & CO. KG

TABLE 230 WEISS CHEMIE + TECHNIK GMBH & CO. KG: COMPANY OVERVIEW

10.2.8 DL CHEMICALS

TABLE 231 DL CHEMICALS: COMPANY OVERVIEW

10.2.9 FORGEWAY LIMITED

TABLE 232 FORGEWAY LIMITED: COMPANY OVERVIEW

10.2.10 TECH-MASTERS

TABLE 233 TECH-MASTERS: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS (Page No. - 238)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 MS POLYMERS MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.3.3 MS POLYMERS MARKET, BY TYPE

TABLE 234 MS POLYMERS MARKET SIZE, BY TYPE, 20192026 (USD MILLION)

TABLE 235 MS POLYMERS MARKET SIZE, BY TYPE, 20192026 (KILOTON)

11.3.3.1 Silyl Modified Polyethers

11.3.3.2 Silyl Terminated Polyurethanes (Spur)

11.3.4 MS POLYMERS MARKET, BY APPLICATION

TABLE 236 MS POLYMERS MARKET SIZE, BY APPLICATION, 20192026 (USD MILLION)

TABLE 237 MS POLYMERS MARKET SIZE, BY APPLICATION, 20192026 (KILOTON)

11.3.4.1 Adhesives & Sealants

11.3.4.2 Coatings

11.3.5 MS POLYMERS MARKET, BY END-USE INDUSTRY

TABLE 238 MS POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 20192026 (USD MILLION)

TABLE 239 MS POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 20192026 (KILOTON)

11.3.5.1 Building & Construction

11.3.5.2 Automotive & Transportation

11.3.5.3 Electronics

11.3.5.4 Industrial Assembly

11.3.5.5 Others

11.3.6 MS POLYMERS MARKET, BY REGION

TABLE 240 MS POLYMERS MARKET SIZE, BY REGION, 20192026 (USD MILLION)

TABLE 241 MS POLYMERS MARKET SIZE, BY REGION, 20192026 (KILOTON)

11.3.6.1 Asia Pacific

11.3.6.2 North America

11.3.6.3 Europe

11.3.6.4 South America

11.3.6.5 Middle East & Africa

12 APPENDIX (Page No. - 246)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global MS polymer adhesives market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; databases such as D&B, Bloomberg, Chemical Weekly, and Factiva; white papers and articles from recognized authors; and publications and databases from associations, such as the Association of European Adhesives and sealants (FEICA), British Adhesives and sealants Association (BASA), Adhesives and sealants Manufacturers Association of Canada, Japan Adhesive Industry Association (JAIA), Adhesive and Sealant Council (ASC), China Adhesives and Tape Industry Association (CATIA), and other government and private sources to identify and collect information useful for this technical, market-oriented, and commercial study of the MS polymer adhesives market.

Secondary research has been mainly conducted to obtain key information about the industrys supply chain, monetary chain, total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included CEOs, vice presidents, marketing and sales directors, business development managers, and technology and innovation directors of MS polymer adhesives manufacturing companies as well as suppliers and distributors. The primary sources from the demand side included industry experts - directors of end use industries and related key opinion leaders.

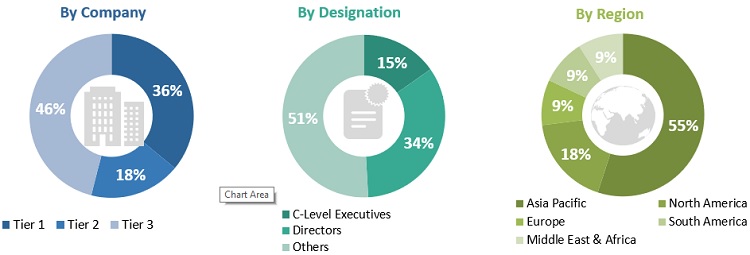

Following is the breakdown of primary respondents:

Note: Companies are classified on the basis of their revenue. As of 2021, Tier I = > USD 7 billion, Tier II = > USD 500 millionUSD 7 billion, and Tier III = < USD 500 million.

Other designations include sales, marketing, and product managers.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both the top-down and bottom-up approaches have been extensively used, along with several data triangulation methods to gather, verify, and validate the market figures arrived at. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to provide key information/insights throughout the report. The research methodology used to estimate the market size included the following steps:

- The key players in the market have been identified in the respective regions through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market and submarkets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated and added with detailed inputs and analysis from the MarketsandMarkets data repository and presented in this report.

Global MS Polymer Adhesives Market: Top-down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are 3 sources top-down approach, bottom-up approach, and expert interviews. This data was assumed to be correct only when the values arrived at from the 3 points matched.

Study Objectives

- To define, describe, and forecast the size of the MS polymer adhesives market in terms of both value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by type, end use industry, and region

- To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product developments, mergers and acquisitions, and investments and expansions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Customization Options

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a country with respect to end use industries

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MS Polymer Adhesives Market