Elastic Adhesives & Sealants Market by Resin Type (Polyurethane, Silicone, SMP), End-Use Industry (Construction, Industrial, Automotive & Transportation), Region (North America, Europe, APAC, South America, Middle East & Africa) - Global Forecast to 2024

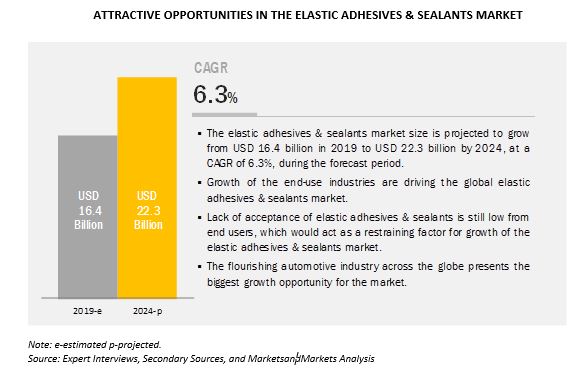

The elastic adhesives & sealants market is projected to reach USD 22.3 billion by 2024, at a CAGR of 6.3%. The growth of end-use industries such as construction, industrial, and automotive & transportation as well as the growing demand for silicone and SMP adhesives are key factors driving the elastic adhesives & sealants market. Elastic adhesives & sealants provide improved aesthetics in various applications such as windows, consumer durables, and glazing by limiting the use of screws, nails, fillet bonders, and lightweight fittings. These are widely used in applications such as glazing, flooring, and assembling.

Polyurethane (PU) segment is estimated to account for the largest share during the forecast period.

Polyurethanes are used mainly for bonding windscreens, side and rear windows of passenger cars, trucks, tractors and special vehicles, as they have better adhesion and paintability characteristics. Due to their high elongation properties and stronger bonding, PU adhesives are used in bonding windscreens and windows of passenger cars, trucks, tractors, and special vehicles. They are also used for bonding fiberglass-reinforced plastic elements such as roof, side, and frontal panels.

Automotive & transportation is projected to register the highest CAGR during the forecast period.

Elastic adhesives & sealants find numerous uses in automobiles, such as in front glass windshield, side glass, and car body. They are used in places requiring moderate adhesion but high elongation. For vehicle manufacturers, the use of elastic adhesives with their multi-function properties reduces the number of separate processing stages and enables a more streamlined production operation. Further, the customer also benefits from fuel savings with the use of lightweight and elastic bonded materials.

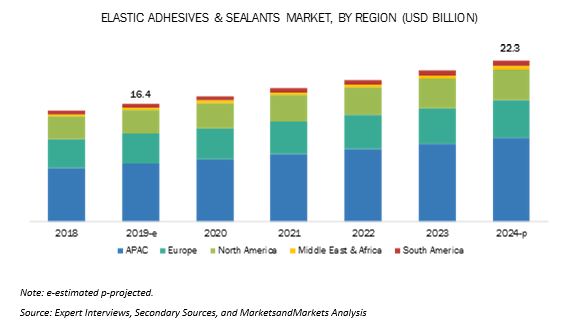

APAC is projected to register the highest CAGR during the forecast period.

The APAC elastic adhesives & sealants market is segmented into China, Japan, India, South Korea, Thailand, Malaysia, and Rest of APAC. APAC is an emerging and lucrative market for elastic adhesives & sealants, owing to industrial development and improving economic conditions. This region constitutes approximately 61% of the world’s population, resulting in the growth of the manufacturing and processing sectors.

Market Dynamics

Increasing demand from the glazing and window panel applications. The glazing and window panels in many new high-rise buildings are not attached with screws but are bonded with adhesives, as they provide better joining properties, aesthetics, and longer bond life. These buildings have improved aesthetics and provide outstanding UV and weathering resistance. Bonding window panes and window panels using elastic adhesives & sealants offer several advantages such as vibration dampening; lesser assembly time; excellent finish quality; and lower requirement for cold-conducting metal frames in panes and panels. The developed infrastructural designs, architectural setups, and the advantages of glazing are majorly driving the demand for elastic adhesives & sealants.

However, the rate of acceptance of elastic sealants is still low from end users. This low acceptance rate may be due to the lack of awareness about the availability of elastic adhesives & sealants or the end user preference to use conventional sealants. End users are satisfied with results obtained from the conventional adhesives & sealants even though these adhesives lack the advantages of elastic sealants but serve the purpose of bonding substrates together. To maintain the lower costs of end-products, manufacturers still neglect additional benefits such as improved flexibility/elongation, impact/thermal cycling resistance, peel strength, and long-term durability, which can be obtained by using elastic adhesives & sealants.

Elastic Adhesives & Sealants Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments |

Resin, and End-use Industry |

|

Regions |

APAC, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Henkel AG & CO. KGAA (Germany), Arkema S.A. (France), H.B. Fuller Company (US), DowDuPont Inc. (US), Sika AG (Switzerland), and 3M Company (US) |

This research report categorizes the elastic adhesives & sealants market based on resin, end-use industry, and region.

Based on resin, the elastic adhesives & sealants market has been segmented as follows:

- Polyurethane

- Silicone

- SMP

- Others (Rubber, Acrylic, SPS (Polystyrene Sulfonate), Copolymer dispersion, and Epoxy)

Based on end-use industries, the elastic adhesives & sealants market has been segmented as follows:

- Construction

- Industrial

- Automotive & transportation

Based on the region, the elastic adhesives & sealants market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Africa

- South America

Leading Players in Elastic Adhesives & Sealants Market

Henkel is engaged in consumer and industrial businesses. The company operates through various segments, including adhesive technologies; laundry & home care, and beauty care, and corporate. The company’s adhesive technologies segment is a leader in the adhesives market across all the end-use industries, globally. The company manufactures elastic adhesives & sealants under this segment. Henkel markets elastic adhesives & sealants under brand names, LOCTITE, and TEROSON. The company has a strong portfolio for this market, covering major resins such as PU and SMP. Henkel has operations in North America, Latin America, APAC, Europe, Middle East, and Africa. The company focuses on R&D to maintain its leading position in the adhesives business.

Arkema S.A. is a global player in specialty chemicals and advanced materials market. Arkema is among the top four adhesives & sealants producers in the world. It operates through three business segments, namely, High Performance Materials, Industrial Specialties, and Coating Solutions. Arkema has 137 production sites across 50 countries. The company operates three R&D centers (France, China, and the US) and 11 technical centers. It has over 400 researchers that work on new generation adhesives. Arkema markets its elastic adhesives & sealants offering under its brands such as 1100 Series, 2100 Series, 2200 Series, and 70- Series.

Recent Developments

- In September 2018, Henkel started the construction of its new state-of-the-art facility in Düsseldorf for Adhesive Technologies business. The company planned to invest around USD 150 million for this facility. Once completed, the facility is expected to host 350 Henkel experts to develop new technologies and applications for various industries.

- In October 2016, Arkema (Bostik) launched high-performance olefin-based elastic attachment adhesive. This product set a new standard of increased performance and operational efficiency for olefin adhesives.

- In May 2017, Henkel signed an agreement to acquire Sonderhoff Holding GmbH (Germany), which offers high-impact sealing solutions for industrial assembly. With this acquisition, the company will reinforce its position in the adhesive technologies business.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the elastic adhesives & sealants market, by country

Company Information

Detailed analysis and profiling of additional market players (up to five)

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of elastic adhesive?

Why elastic adhesive is gaining market share?

What are the major applications for elastic adhesive?

Which resin is estimated to account for the largest share of the overall elastic adhesives?

What are the major sub-applications of construction for elastic adhesives?

Which technology is estimated to register the highest CAGR?

Who are the major manufacturers?

What is the biggest restraint for elastic adhesive?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Significant Opportunities in the Elastic Adhesives & Sealants Market

4.2 Elastic Adhesives & Sealants Market Growth, By Resin

4.3 Elastic Adhesives & Sealants Market in APAC, By Resin and Country

4.4 Elastic Adhesives & Sealants Market, By Key Countries

4.5 Elastic Adhesives & Sealants Market, Developed Vs. Developing Countries

4.6 APAC: Elastic Adhesives & Sealants Market, By Key Countries

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand From the Glazing and Window Panel Applications

5.2.1.2 Advancements in Adhesive Bonding Leading to New Applications

5.2.1.3 Rising Demand From End-Use Industries in Developing Countries

5.2.1.4 Increased Usage of Elastic Adhesives & Sealants in Vehicles Due to Properties Such as Reduction in Weight and Increased Fuel Efficiency

5.2.1.5 Increasing use of Silicone and SMP Elastic Adhesives & Sealants in Various Industries

5.2.2 Restraints

5.2.2.1 Lack of Acceptance From End Users for Elastic Adhesives & Sealants

5.2.3 Opportunities

5.2.3.1 Growing Demand for Non-Hazardous, Green, and Sustainable Elastic Adhesives & Sealants

5.2.3.2 Innovations Across End-Use Industries

5.2.4 Challenges

5.2.4.1 Stringent Regulatory Approvals Required for Production

5.3 Porter’s Five Forces Analysis

5.3.1 Intensity of Competitive Rivalry

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Threat of New Entrants

5.4 Macroeconomic Overview and Key Indicators

5.4.1 Global GDP Trends and Forecasts

5.4.2 Trends in the Construction Industry

5.4.3 Growth Indicators in the Automotive Industry

6 Elastic Adhesives & Sealants Market, By Resin Type (Page No. - 47)

6.1 Introduction

6.2 PU

6.2.1 Pu-Based Elastic Adhesives & Sealants are Used Extensively in Automotive & Transportation Applications Because of Their Versatility and High Strength

6.3 Silicone

6.3.1 Less Emission of VoC as Compared to Other Major Resins Leads to High Demand

6.4 Silane-Modified Polymers (SMP)

6.4.1 Silane-Modified Polymer is Projected to be the Fastest-Growing Resin in the Market

6.5 Others

7 Elastic Adhesives & Sealants Market, By End-Use Industry and Application (Page No. - 59)

7.1 Introduction

7.2 Construction

7.2.1 Flooring

7.2.1.1 Growing Spending on Housing and Infrastructural Activities, Low Cost, and Low Maintenance is Driving the Demand

7.2.2 Off-Site Operations

7.2.2.1 Properties Such as Structural Strength, Elasticity, and Durability Drive the Market for Elastic Adhesives

7.2.3 Glazing

7.2.3.1 The Demand for Elastic Adhesives & Sealants Which Provides Flexibility and Resist Cracks is Increasing in Houses, Hospitals, Schools, and Public Buildings

7.2.4 Sanitary & Kitchen

7.2.4.1 Properties Such as Fast Curing Time, Flexibility, Durability, and Excellent Adhesion Drive the Market

7.2.5 Civil Engineering

7.2.5.1 There is High Demand for Elastic Adhesives & Sealants in Construction of Bridges, Dams, Airports, Railroad Crossing, Tunneling, and in Other Infrastructural Activities

7.2.6 Others

7.3 Industrial

7.3.1 Assembly

7.3.1.1 Properties Such as Better Design, Aesthetics, and Tough Bonds Over Conventional Adhesives & Sealants Drives the Market

7.3.2 Direct Glazing

7.3.2.1 Reduction of Water and Air Infiltration Drive the Market

7.3.3 Others

7.4 Automotive & Transportation

7.4.1 The Growing Automotive Industry is a Key Driver for the Elastic Adhesives & Sealants Market

8 Elastic Adhesives & Sealants Market, By Region (Page No. - 76)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Automotive & Transportation is the Fastest-Growing Application

8.2.2 Canada

8.2.2.1 Construction Industry to Boost the Market for Elastic Adhesives & Sealants

8.2.3 Mexico

8.2.3.1 New Investments in Infrastructure, Energy, and Commercial Construction Project Will Drive the Elastic Adhesives & Sealants Market

8.3 Europe

8.3.1 Germany

8.3.1.1 Automotive and Construction Industry to Drive the Demand

8.3.2 France

8.3.2.1 New Projects in the Transportation Industry are Expected to Drive the Demand for Elastic Adhesives & Sealants

8.3.3 Italy

8.3.3.1 The Growth in the Automotive Industry is Expected to Increase the Demand for Elastic Adhesives & Sealants

8.3.4 UK

8.3.4.1 Automotive & Transportation is One of the Major End-Use Industries of Elastic Adhesives & Sealants

8.3.5 Russia

8.3.5.1 The Automotive Industry is Driving the Market

8.3.6 Turkey

8.3.6.1 Turkey is Rapidly Emerging as One of the Fastest-Growing Markets in Europe, Owing to the Current Economic Situation

8.3.7 Spain

8.3.7.1 Automotive & Transportation is One of the Major Industries of Elastic Adhesives & Sealants

8.3.8 Netherlands*

8.3.8.1 The Automotive Industry is Driving the Market

8.3.9 Poland*

8.3.9.1 The Growth in the Automotive Industry is Expected to Increase the Demand for Elastic Adhesives & Sealants

8.3.10 Belgium*

8.3.10.1 Automotive & Transportation is One of the Major Industries of Elastic Adhesives & Sealants

8.3.11 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 China Accounted for the Largest Share of the Elastic Adhesives & Sealants Market in APAC

8.4.2 India

8.4.2.1 India is the Fastest-Growing Elastic Adhesives & Sealants Market in APAC and Globally

8.4.3 Japan

8.4.3.1 Japan Witnessing Moderate Growth Due to the Maturity of the Adhesives Market

8.4.4 South Korea

8.4.4.1 Presence of Top Automotive Players to Dominate the Elastic Adhesives & Sealants Market in South Korea

8.4.5 Taiwan

8.4.5.1 High Investments in Transportation Will Drive the Elastic Adhesives & Sealants Market in Taiwan

8.4.6 Thailand

8.4.6.1 Rapid Industrialization and Increasing Consumer Spending are Expected to Boost the Demand for Elastic Adhesives & Sealants

8.4.7 Malaysia

8.4.7.1 Automobile Industry to Impact the Elastic Adhesives & Sealants Market in Malaysia

8.4.8 Singapore*

8.4.8.1 High Investments in Transportation Will Drive the Elastic Adhesives & Sealants Market

8.4.9 Australia*

8.4.9.1 Automobile Industry to Impact the Elastic Adhesives & Sealants Market

8.4.10 Rest of APAC

8.5 South America

8.5.1 Brazil

8.5.1.1 Brazil Accounted for the Largest Share of the South American Elastic Adhesives & Sealants Market

8.5.2 Argentina

8.5.2.1 The High Dependence on Imports is Restraining the Market Growth

8.5.3 Colombia

8.5.3.1 The Automotive Industry is Expected to Impact the Demand for Elastic Adhesives & Sealants in Columbia

8.5.4 Rest of South America

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.1.1 Rapidly Emerging as One of the Fastest-Growing Markets, Owing to the Current Economic Situation

8.6.2 Africa

8.6.2.1 Limited Applications of Elastic Adhesives & Sealants are Posing a Challenge to the Growth of the Market

8.6.3 UAE*

8.6.3.1 Automotive and Construction Industries are Expected to Dominate the Elastic Adhesives & Sealants Market

8.6.4 Iran*

8.6.4.1 Automotive Industry is Expected to Dominate the Elastic Adhesives & Sealants Market

8.6.3 Rest of the Middle East

9 Competitive Landscape (Page No. - 111)

9.1 Overview

9.2 Competitive Leadership Mapping, 2018

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.3 Competitive Benchmarking

9.3.1 Strength of Product Portfolio

9.3.2 Business Strategy Excellence

9.4 Competitive Scenario

9.4.1 New Product Launch

9.4.2 Investment & Expansion

9.4.3 Merger & Acquisition

9.4.4 Partnership & Agreement

10 Company Profiles (Page No. - 120)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

10.1 Henkel AG & Co. KGaA

10.2 H.B. Fuller Company

10.3 3M

10.4 DowDuPont Inc.

10.5 Sika AG

10.6 Arkema (Bostik)

10.7 Weicon GmbH & Co. Kg

10.8 Threebond Holdings Co., Ltd.

10.9 Cemedine Co., Ltd.

10.10 Beijing Comens New Materials Co., Ltd.

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not be Captured in Case of Unlisted Companies.

10.11 Other Players

10.11.1 New Pu Technologies (NPT)

10.11.2 Mapei S.P.A.

10.11.3 Soudal

10.11.4 Jowat Se

10.11.5 Permabond

10.11.6 Dymax

10.11.7 Grupo Celo

10.11.8 Hermann Otto

10.11.9 Kleiberit

10.11.10 Recoll

10.11.11 Aderis Technologies

10.11.12 Shanghai Sepna Chemical Technology

10.11.13 TrEMCo Illbruck

10.11.14 Illinois Tool Works Inc.

10.11.15 Huntsman Corporation

10.11.16 Merz+Benteli AG

11 Appendix (Page No. - 170)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (145 Tables)

Table 1 Elastic Adhesives & Sealants Market is Expected to Register a High Growth Rate Between 2019 and 2024

Table 2 GDP Percentage Change of Key Countries, 2019–2024

Table 3 Contribution of Construction Industry to Gdp, Change 2017 & 2018

Table 4 Global Automotive Production in Key Countries, 2017—2018 (Units)

Table 5 Adhesive Curing Mechanism, Raw Materials, and Applications

Table 6 Elastic Adhesives & Sealants Market Size, By Resin, 2017—2024 (USD Million)

Table 7 Elastic Adhesives & Sealants Market, By Resin, 2017—2024 (Kiloton)

Table 8 Pu Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (USD Million)

Table 9 Pu Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (Kiloton)

Table 10 Silicone Elastic Adhesives & Sealants Applications

Table 11 Silicone Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (USD Million)

Table 12 Silicone Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (Kiloton)

Table 13 Comparison of Different Types of Elastic Adhesives & Sealants

Table 14 SMP Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (USD Million)

Table 15 SMP Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (Kiloton)

Table 16 Other Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (USD Million)

Table 17 Other Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (Kiloton)

Table 18 Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017–2024 (USD Million)

Table 19 Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017–2024 (Kiloton)

Table 20 Elastic Adhesives & Sealants Market Size in Construction, By Region, 2017–2024 (USD Million)

Table 21 Elastic Adhesives & Sealants Market Size in Construction, By Region, 2017–2024 (Kiloton)

Table 22 Elastic Adhesives & Sealants Market Size in the Flooring Application, By Region, 2017–2024 (USD Million)

Table 23 Elastic Adhesives & Sealants Market Size in the Flooring Application, By Region, 2017–2024 (Kiloton)

Table 24 Elastic Adhesives & Sealants Market Size in the Off-Site Operations Application, By Region, 2017–2024 (USD Million)

Table 25 Elastic Adhesives & Sealants Market Size in the Off-Site Operations Application, By Region, 2017–2024 (Kiloton)

Table 26 Elastic Adhesives & Sealants Market Size in Glazing Application, By Region, 2017–2024 (USD Million)

Table 27 Elastic Adhesives & Sealants Market Size in Glazing Application, By Region, 2017–2024 (Kiloton)

Table 28 Elastic Adhesives & Sealants Market Size in Sanitary & Kitchen Application, By Region, 2017–2024 (USD Million)

Table 29 Elastic Adhesives & Sealants Market Size in Sanitary & Kitchen Application, By Region, 2017–2024 (Kiloton)

Table 30 Elastic Adhesives & Sealants Market Size in the Civil Engineering Application, By Region, 2017–2024 (USD Million)

Table 31 Elastic Adhesives & Sealants Market Size in the Civil Engineering Application, By Region, 2019—2024 (Kiloton)

Table 32 Elastic Adhesives & Sealants Market Size in the Other Applications, By Region, 2017–2024 (USD Million)

Table 33 Elastic Adhesives & Sealants Market Size in the Other Applications, By Region, 2017–2024 (Kiloton)

Table 34 Elastic Adhesives & Sealants Market Size in the Industrial Segment, By Region, 2017–2024 (USD Million)

Table 35 Elastic Adhesives & Sealants Market Size in the Industrial Segment, By Region, 2017–2024 (Kiloton)

Table 36 Elastic Adhesives & Sealants Market Size in the Assembly Application, By Region, 2017–2024 (USD Million)

Table 37 Elastic Adhesives & Sealants Market Size in the Assembly Application, By Region, 2017–2024 (Kiloton)

Table 38 Elastic Adhesives & Sealants Market Size in the Direct Glazing Application, By Region, 2017–2024 (USD Million)

Table 39 Elastic Adhesives & Sealants Market Size in the Direct Glazing Application, By Region, 2017–2024 (Kiloton)

Table 40 Elastic Adhesives & Sealants Market Size in the Other Applications, By Region, 2017–2024 (USD Million)

Table 41 Elastic Adhesives & Sealants Market Size in the Other Applications, By Region, 2017–2024 (Kiloton)

Table 42 Elastic Adhesives & Sealants Market Size in the Automotive & Transportation End-Use Industry, By Region, 2017–2024 (USD Million)

Table 43 Elastic Adhesives & Sealants Market Size in the Automotive & Transportation End-Use Industry, By Region, 2017–2024 (Kiloton)

Table 44 Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (USD Million)

Table 45 Elastic Adhesives & Sealants Market Size, By Region, 2017—2024 (Kiloton)

Table 46 North America: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (USD Million)

Table 47 North America: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (Kiloton)

Table 48 North America: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (USD Million)

Table 49 North America: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (Kiloton)

Table 50 North America: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (USD Million)

Table 51 North America: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (Kiloton)

Table 52 US: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (USD Million)

Table 53 US: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017–2024 (Kiloton)

Table 54 Canada: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 55 Canada: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 56 Mexico: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 57 Mexico: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 58 Europe: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (USD Million)

Table 59 Europe: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (Kiloton)

Table 60 Europe: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (USD Million)

Table 61 Europe: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (Kiloton)

Table 62 Europe: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017–2024 (USD Million)

Table 63 Europe: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (Kiloton)

Table 64 Germany: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (USD Million)

Table 65 Germany: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (Kiloton)

Table 66 France: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 67 France: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 68 Italy: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 69 Italy: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 70 UK: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 71 UK: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 72 Russia: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 73 Russia: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 74 Turkey: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 75 Turkey: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 76 Spain: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 77 Spain: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 78 Netherlands: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 79 Netherlands: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 80 Poland: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 81 Poland: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 82 Belgium: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 83 Belgium: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 84 Rest of Europe: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 85 Rest of Europe: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 86 APAC: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (USD Million)

Table 87 APAC: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (Kiloton)

Table 88 APAC: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (USD Million)

Table 89 APAC: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (Kiloton)

Table 90 APAC: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (USD Million)

Table 91 APAC: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (Kiloton)

Table 92 China: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (USD Million)

Table 93 China: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (Kiloton)

Table 94 India: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (USD Million)

Table 95 India: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (Kiloton)

Table 96 Japan: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (USD Million)

Table 97 Japan: Elastic Adhesives & Sealants Market Size, By End-Use Industry, 2017—2024 (Kiloton)

Table 98 South Korea: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 99 South Korea: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 100 Taiwan: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 101 Taiwan: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 102 Thailand: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 103 Thailand: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 104 Malaysia: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 105 Malaysia: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 106 Singapore: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 107 Singapore: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 108 Australia: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 109 Australia: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 110 Rest of APAC: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 111 Rest of APAC: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 112 South America: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (USD Million)

Table 113 South America: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (Kiloton)

Table 114 South America: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (USD Million)

Table 115 South America: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (Kiloton)

Table 116 South America: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (USD Million)

Table 117 South America: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (Kiloton)

Table 118 Brazil: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 119 Brazil: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 120 Argentina: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 121 Argentina: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 122 Colombia: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 123 Colombia: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 124 Rest of South America: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 125 Rest of South America: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 126 Middle East & Africa: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (USD Million)

Table 127 Middle East & Africa: Elastic Adhesives & Sealants Market Size, By Country, 2017—2024 (Kiloton)

Table 128 Middle East & Africa: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (USD Million)

Table 129 Middle East & Africa: Elastic Adhesives & Sealants Market Size, By Resin Type, 2017—2024 (Kiloton)

Table 130 Middle East & Africa: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (USD Million)

Table 131 Middle East & Africa: Elastic Adhesives & Sealants Market Size, By End-Use Industry and Application, 2017—2024 (Kiloton)

Table 132 Saudi Arabia: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 133 Saudi Arabia: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 134 Africa: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 135 Africa: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 136 UAE: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 137 UAE: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 138 Iran: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 139 Iran: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 140 Rest of the Middle East: Elastic Adhesives & Sealants Market Size, 2017—2024 (USD Million)

Table 141 Rest of the Middle East: Elastic Adhesives & Sealants Market Size, 2017–2024 (Kiloton)

Table 142 New Product Launch, 2014–2019

Table 143 Investment & Expansion, 2014–2019

Table 144 Merger & Acquisition, 2014–2019

Table 145 Partnership & Agreement, 2014–2019

List of Figures (40 Figures)

Figure 1 Market Segmentation

Figure 2 Regions Covered

Figure 3 Elastic Adhesives & Sealants Market: Research Design

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Elastic Adhesives & Sealants Market: Data Triangulation

Figure 7 PU Was the Leading Resin Segment in the Overall Elastic Adhesives & Sealants Market in 2018

Figure 8 Construction Was the Leading End-Use Industry in 2018

Figure 9 APAC Was the Largest Market for Elastic Adhesives & Sealants in 2018

Figure 10 Elastic Adhesives & Sealants Market to Witness High Growth Between 2019 and 2024

Figure 11 SMP to be the Fastest-Growing Segment in the Overall Elastic Adhesives & Sealants Market

Figure 12 PU Was the Largest Resin and China Was the Largest Market in APAC

Figure 13 India Emerging as a Lucrative Market for Elastic Adhesives & Sealants

Figure 14 Market in Developing Countries to Grow Faster Than in Developed Countries

Figure 15 India to Witness the Highest Growth in Global Elastic Adhesives & Sealants Market

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Elastic Adhesives & Sealants Market

Figure 17 Porter’s Five Forces Analysis: Elastic Adhesives & Sealants Market

Figure 18 PU to Account for a Major Share of the Elastic Adhesives & Sealants Market

Figure 19 Construction Industry to Dominate the Elastic Adhesives & Sealants Market

Figure 20 North America: Elastic Adhesives & Sealants Market Snapshot

Figure 21 Europe: Elastic Adhesives & Sealants Market Snapshot

Figure 22 APAC: Elastic Adhesives & Sealants Market Snapshot

Figure 23 Companies Adopted Merger & Acquisition as the Key Growth Strategy Between 2014 and 2019

Figure 24 Elastic Adhesives & Sealants Market (Global) Competitive Leadership Mapping, 2018

Figure 25 Henkel AG & Co. KGaA: Company Snapshot

Figure 26 Henkel AG & Co. KGaA: SWOT Analysis

Figure 27 H.B. Fuller Company: Company Snapshot

Figure 28 H.B. Fuller Company: SWOT Analysis

Figure 29 3M: Company Snapshot

Figure 30 3M: SWOT Analysis

Figure 31 DowDuPont Inc.: Company Snapshot

Figure 32 Dodupont Inc.: SWOT Analysis

Figure 33 Sika AG: Company Snapshot

Figure 34 Sika AG: SWOT Analysis

Figure 35 Arkema (Bostik): Company Snapshot

Figure 36 Weicon GmbH & Co. Kg: SWOT Analysis

Figure 37 Threebond Holdings Co., Ltd.: Company Snapshot

Figure 38 Threebond Holdings Co., Ltd.: SWOT Analysis

Figure 39 Cemedine Co., Ltd.: Company Snapshot

Figure 40 Cemedine Co., Ltd.: SWOT Analysis

The study involved four major activities in estimating the current market size of elastic adhesives & sealants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the elastic adhesives & sealants market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The elastic adhesives & sealants market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the construction, industrial, and automotive & transportation industries. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

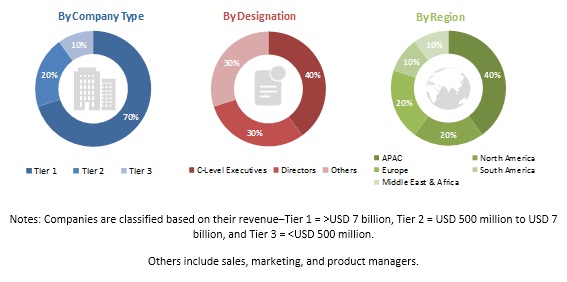

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the elastic adhesives & sealants market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the elastic adhesives & sealants market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market based on technology, resin type, and end-use industry

- To estimate and forecast the market size based on five regions, namely, Asia Pacific (APAC), North America, Europe, the Middle East & Africa, and South America

- To estimate and forecast the elastic adhesives & sealants market at the country-level in each of the regions

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as new product launch, investment & expansion, partnership & agreement, and merger & acquisition, in the elastic adhesives & sealants market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the elastic adhesives & sealants market, by country

Company Information

-

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Elastic Adhesives & Sealants Market

Sealant market for Asia-Pacific

Interested in Market Landscape, Value Chain, Porters, Opportunities and Threats, Application Targeting, Customer Activity Cycle, Critical Purchase Criteria in the Elastic Adhesives market