Hybrid Adhesives & Hybrid Sealants Market by Resin Type (MS Polymer Hybrid, Epoxy-Polyurethane, Epoxy-Cyanoacrylate), Application (Building & Construction, Automotive & Transportation, Industrial Assembly), and Region - Global Forecast to 2022

[134 Pages Report] The overall Hybrid Adhesives & Hybrid Sealants market is expected to grow from USD 4.60 billion in 2016 to USD 7.54 billion by 2022, at a CAGR of 8.6% from 2018 to 2023. Hybrid Adhesives & Hybrid Sealants have gained importance in the recent years, as they have the ability to meet unique performance requirements according to the applications. These adhesive & sealants are physical and/or chemical blends of resins such as epoxy, acrylic, silyl-modified polyether, silyl-modified urethane, and urethanes. They are preferred over conventional adhesives & sealants because of their enhanced adhesion and sealing ability, exceptional mechanical and electrical insulating properties, and chemical & heat resistance. The Hybrid Adhesives & Hybrid Sealants market is driven by the increase in environmental regulations in developed counties of North America and Europe and economic growth in emerging countries such as China and India. In addition, the expansion of end-use industries such as building & construction, automotive & transportation, and industrial assembly in the developing countries has contributed to the growth of the market. The base year considered for the study is 2015, and the forecast has been provided for the period between 2017 and 2022.

Market Dynamics

Drivers

- Growing demand for hybrid resins in manufacturing adhesives & sealants

- Unavailability of new polymeric materials

- Environmental regulations in North America and Europe

Restraints

- Lack of acceptance from end users

Opportunities

- Growing demand for sustainable adhesives & sealants

Challenges

- Limited market opportunities in developed countries

Growing demand for hybrid resins in manufacturing adhesives & sealants

A wide range of solutions is being introduced as next-generation adhesives & sealants, with some degree of customization to meet the needs of the customers. The manufacturers are investing heavily in the R&D of combining various adhesive bonding technologies. The hybrid adhesives developed with these combination will have the properties of the resins used in manufacturing them. For example, the resistance and mechanical strength offered by epoxies, elasticity provided by polyurethanes (PU), and the fast assembly rate enabled by methacrylates (MMA). Recently, Henkel launched cyanoacrylate and epoxy technologies-based adhesive, which combines the most critical attributes of structural, instant, and epoxy adhesives, such as bond strength, speed, and durability. Therefore, the development of hybrid resins for the manufacturing of high performance Hybrid Adhesives & Hybrid Sealants plays a significant role in driving the market.

The following are the major objectives of the study.

- To define, describe, and forecast the Hybrid Adhesives & Hybrid Sealants market on the basis of raw material type, product, application, and region

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market segmentation of Hybrid Adhesives & Hybrid Sealants on the basis of major regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders

- To analyze recent developments such as capacity expansion, new product developments, alliances, joint ventures, and mergers & acquisitions in the market

- To provide strategic profiles of the key players in the market and comprehensively analyze the core competencies

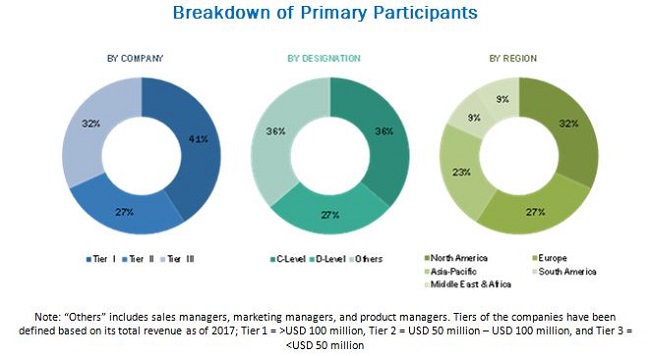

During this research study, major players operating in the Hybrid Adhesives & Hybrid Sealants market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The Hybrid Adhesives & Hybrid Sealants market comprises a network of players involved in the research and product development; raw material supply; product manufacturing; distribution and sale; and post-sales support. Key players considered in the analysis of the Hybrid Adhesives & Hybrid Sealants market are Soudal (Belgium), Bostik (France), Sika (Switzerland), Wacker Chemie (Germany), and Henkel (Germany).

Major Market Developments

- In May 2017 Henkel launched Loctite HY 4090 and Loctite HY 4080 GY powered by its patented hybrid technology to address a wide range of design and assembly challenges. These adhesives have created great opportunities for designers and OEM engineers to improve assembly applications and streamline process steps or bond materials in applications with complex requirements.

- In June 2017, Soudal acquired Slovenia-based hybrid adhesive manufacturer, MITOL. With this acquisition, the company added more than 500 high-quality technical adhesives to its product portfolio for strengthening its position in the industrial adhesives market. Soudal is projected to achieve a turnover of 1 billion Euro by 2020 with this acquisition.

- In March 2017, Tremco Illbruck acquired Nurichem Co. Ltd. (South Korea) and invested in a new factory in Uiwang, south of Seoul (its new production location) for manufacturing of sealants and adhesives in South Korea. This is the companys first strategical step toward extending its reach in Asia and gain better access to critical construction markets.

Key Target Audience:

- Hybrid Adhesives & Hybrid Sealants Manufacturers

- Raw Material Suppliers

- Traders, Distributors, and Suppliers of Hybrid Adhesives & Hybrid Sealants

- Regional Manufacturers Associations and General Adhesives & Sealants Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

- Research Institutions and Organizations

- Traders, Distributors, and Suppliers of Technology, Chemicals, or Components

Scope of the Report:

This research report categorizes the Hybrid Adhesives & Hybrid Sealants market on the basis of resin, application, and region.

Hybrid Adhesives & Hybrid Sealants Market, by Resin:

- MS Polymer Hybrid

- Epoxy-Polyurethane

- Epoxy-cyanoacrylate

- Others

Hybrid Adhesives & Hybrid Sealants Market, by Application:

- Building & Construction

- Automotive & Transportation

- Industrial Assembly

- Others

Hybrid Adhesives & Hybrid Sealants Market, by Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

The market is further analyzed for key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the Hybrid Adhesives & Hybrid Sealants market, by resin

Company Information:

- Detailed analysis and profiles of additional market players

The global Hybrid Adhesives & Hybrid Sealants market is projected to reach USD 7.54 billion by 2022, at a CAGR of 8.6% from 2016 to 2022. The demand for Hybrid Adhesives & Hybrid Sealants has been increasing in applications such as building & construction, automotive & transportation, industrial assembly, and others. Currently, key adhesives & sealants players are undertaking R&D to develop new hybrid resins and overcome the limitations of conventional adhesives & sealants.

A hybrid is formed when two or more existing technologies/chemistries are merged to create a new product. The Hybrid Adhesives & Hybrid Sealants are developed by combining of two or more polymer resins. They have the positive characteristics of both the resin types and are highly versatile in nature. They act as high-performance adhesives or sealants and provide high mechanical strength and peerless performance when subjected to extreme conditions. Hybrid Adhesives & Hybrid Sealants are customized according to the design requirements of various end-use applications.

The Hybrid Adhesives & Hybrid Sealants market is segmented on the basis of resin, such as MS polymer hybrid, epoxy-Hybrid Adhesives & Hybrid Sealants, epoxy-cyanoacrylate, and others. The epoxy-cyanoacrylate resin in the Hybrid Adhesives & Hybrid Sealants market is projected to grow at the highest CAGR during the forecast period, 2017 to 2022. Epoxy-cyanoacrylate resin provides exceptional bond strength to various substrates including plastic, metal, composite, rubber, and others. Epoxy-cyanoacrylate resin provide fast fixturing, which reduces the assembly time and a robust cure is quickly achieved even at low temperature.

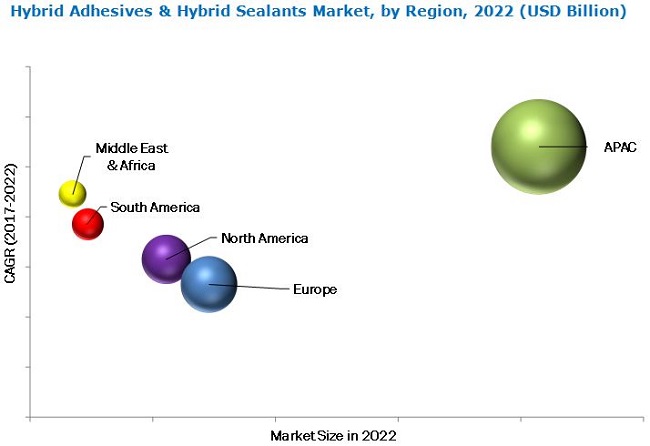

The Asia Pacific Hybrid Adhesives & Hybrid Sealants market is projected to grow at the highest CAGR during the forecast period, which can be attributed to the rising demand for Hybrid Adhesives & Hybrid Sealants from the economies of the Asia Pacific region, which include India, China, South Korea, Vietnam, Taiwan, and Singapore, among others. The robust demand in the Asia Pacific is the major driving factor for the growth of the global Hybrid Adhesives & Hybrid Sealants market. Japan is expected to lead the demand for Hybrid Adhesives & Hybrid Sealants due to the development and adaptation of MS polymer based hybrid many decades ago.

The growth of the Hybrid Adhesives & Hybrid Sealants market is affected due to the lack of acceptance by end users. This lower acceptance rate may be attributed to the lack of awareness about the availability of Hybrid Adhesives & Hybrid Sealants or their preference in using conventional adhesives & sealants.

Building & Construction

Building & construction is the largest application segment of the Hybrid Adhesives & Hybrid Sealants market. The Hybrid Adhesives & Hybrid Sealants are used in a wide range of sub-applications in the building & construction industry such as flooring, tiling, waterproofing, carpet layment, wall covering, insulation, roofing, civil operations, facade, parquet, and others. They are gaining importance in the construction industry, as they are used in bonding, renovation, and maintenance & repair of residential & commercial buildings as well as civil engineering applications.

Automotive & Transportation

In automotive & transportation application, Hybrid Adhesives & Hybrid Sealants are used in cars, commercial vehicles (bus, rail, and truck), and aerospace. The automotive & transportation industry continuously demands more advanced and improved bonding. Hybrid Adhesives & Hybrid Sealants offer excellent adhesion, superior durability, chemical & temperature resistance, and low shrinkage. They are preferred in interior and exterior applications such as bonding of glass fiber, metals, plastics, and composite substrates in the aircraft manufacturing industry, commercial & specialty vehicles (agricultural, construction, military and armor), and OEMs.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for Hybrid Adhesives & Hybrid Sealants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The rate of acceptance of Hybrid Adhesives & Hybrid Sealants is still on a lower side from the end users. This lower acceptance rate may be attributed to the lack of awareness about the availability of Hybrid Adhesives & Hybrid Sealants or their preference to use the conventional adhesives & sealants. The end users are satisfied with the results obtained from the conventional adhesives & sealants. They neglect the additional benefits such as improved flexibility/elongation, impact/thermal cycling resistance, peel strength, and long-term durability, which can be obtained by using Hybrid Adhesives & Hybrid Sealants.

Key players operating in the Hybrid Adhesives & Hybrid Sealants market include Soudal (Belgium), Bostik (France), Sika AG (Switzerland), Wacker Chemie AG (Germany), Henkel AG & Co. KGaA (Germany), 3M Company (U.S.), Tremco illbruck GmbH & Co. KG. (Germany), H.B. Fuller (U.S.), Illinois Tool Works Incorporation (U.S.), and Kisling AG (Switzerland), among others. These companies are adopting various organic and inorganic growth strategies, such as expansions, mergers & acquisitions, and new product launches to enhance their current market shares.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities for Market Players

4.2 Hybrid Adhesives & Hybrid Sealants Market, By Application

4.3 Hybrid Adhesives & Hybrid Sealants Market: Developed vs Emerging Nations

4.4 Asia Pacific Hybrid Adhesives & Hybrid Sealants Market

4.5 Europe Hybrid Adhesives & Hybrid Sealants Market

4.6 Global Hybrid Adhesives & Hybrid Sealants Market

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Hybrid Resins in Manufacturing Adhesives & Sealants

5.2.1.2 Unavailability of New Polymeric Materials

5.2.1.3 Environmental Regulations in North America and Europe

5.2.2 Restraints

5.2.2.1 Lack of Acceptance From End Users

5.2.3 Opportunities

5.2.3.1 Growing Demand for Sustainable Adhesives & Sealants

5.2.4 Challenges

5.2.4.1 Limited Market Opportunities in Developed Countries

5.3 Porters Five Forces Analysis

5.3.1 Intensity of Competitive Rivalry

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Threat of New Entrants

5.4 Macroeconomic Indicators

5.4.1 Trends and Forecast of GDP

5.4.2 Trends and Forecast of Construction Industry

5.4.2.1 Trends and Forecast of Construction Industry in North America

5.4.2.2 Trends and Forecast of Construction Industry in Europe

5.4.2.3 Trends and Forecast of Construction Industry in Asia Pacific

5.4.2.4 Trends and Forecast of Construction Industry in Middle East & Africa

5.4.2.5 Trends and Forecast of Construction Industry in South America

5.4.3 Trends of Automotive Industry

5.4.4 Trends and Forecast of Aerospace Industry

6 Hybrid Adhesives & Hybrid Sealants Market, By Resin (Page No. - 45)

6.1 Introduction

6.2 MS Polymer Hybrid

6.3 Epoxy-Polyurethane

6.4 Epoxy-Cyanoacrylate

6.5 Others

7 Hybrid Adhesives & Hybrid Sealants Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Building & Construction

7.3 Automotive & Transportation

7.4 Industrial Assembly

7.5 Others

8 Hybrid Adhesives & Hybrid Sealants, By Region (Page No. - 58)

8.1 Introduction

8.2 Asia Pacific

8.2.1 Hybrid Adhesives & Hybrid Sealants Market, By Application

8.2.2 Hybrid Adhesives & Hybrid Sealants Market, By Country

8.2.2.1 China

8.2.2.2 Japan

8.2.2.3 India

8.2.2.4 South Korea

8.2.2.5 Taiwan

8.2.2.6 Malaysia

8.2.2.7 Thailand

8.2.2.8 Vietnam

8.2.2.9 Rest of Asia Pacific

8.3 North America

8.3.1 Hybrid Adhesives & Hybrid Sealants Market, By Application

8.3.2 Hybrid Adhesives & Hybrid Sealants Market, By Country

8.3.2.1 Us

8.3.2.2 Canada

8.3.2.3 Mexico

8.4 Europe

8.4.1 Hybrid Adhesives & Hybrid Sealants Market, By Application

8.4.2 Hybrid Adhesives & Hybrid Sealants Market, By Country

8.4.2.1 Germany

8.4.2.2 France

8.4.2.3 Italy

8.4.2.4 UK

8.4.2.5 Russia

8.4.2.6 Turkey

8.4.2.7 Spain

8.4.2.8 Rest of Europe

8.5 South America

8.5.1 Hybrid Adhesives & Hybrid Sealants Market,By Application

8.5.2 Hybrid Adhesives & Hybrid Sealants Market, By Country

8.5.2.1 Brazil

8.5.2.2 Argentina

8.5.2.3 Rest of South America

8.6 Middle East & Africa

8.6.1 Hybrid Adhesives & Hybrid Sealants Market, By Application

8.6.2 Hybrid Adhesives & Hybrid Sealants Market, By Country

8.6.2.1 UAE

8.6.2.2 Africa

8.6.2.3 Rest of Middle East

9 Competitive Landscape (Page No. - 89)

9.1 Introduction

9.2 Competitive Leadership Mapping

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.3 Competitive Benchmarking

9.3.1 Strength of Product Portfolio

9.3.2 Business Strategy Excellence

9.4 Market Ranking

9.4.1 Market Ranking of Key Players (2016)

10 Company Profiles (Page No. - 94)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

10.1 Henkel AG & Co. KGaA

10.2 Sika AG

10.3 3M Company

10.4 Illinois Tool Works Incorporation

10.5 Wacker Chemie AG

10.6 Bostik

10.7 H.B. Fuller

10.8 Soudal

10.9 Tremco Illbruck GmbH & Co. Kg.

10.10 Hermann Otto GmbH

10.11 Permabond LLC.

10.12 Dymax Corporation

10.13 List of Other Companies

10.13.1 Weiss Chemie + Technik GmbH & Co. Kg

10.13.2 Kisling Ag

10.13.3 Weicon GmbH & Co.Kg

10.13.4 Lord Corporation

10.13.5 Merz+Benteli Ag

10.13.6 American Sealants, Inc.

10.13.7 Adhesives Technology Corporation

10.13.8 Novachem Corporation Ltd.

10.13.9 Hodgson Sealants (Holdings) Ltd.

10.13.10 Polytec PT GmbH

10.13.11 Forgeway Limited

10.13.12 Protavic America, Inc.

10.13.13 2k Adhesive Systems Limited

*Details Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 127)

11.1 Key Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (72 Tables)

Table 1 Hybrid Adhesives & Hybrid Sealants Market Snapshot (2017 & 2022)

Table 2 Trends and Forecast of GDP, 20152021 (USD Billion)

Table 3 Contribution of Construction Industry to the GDP of North America, 20142021 (USD Billion)

Table 4 Contribution of Construction Industry to the GDP of Europe, 20142021 (USD Billion)

Table 5 Contribution of Construction Industry to the GDP of Asia Pacific, 20142021 (USD Billion)

Table 6 Contribution of Construction Industry to the GDP of Middle East & Africa, 20142021 (USD Billion)

Table 7 Contribution of Construction Industry to the GDP of South America, 20142021 (USD Billion)

Table 8 Automotive Production, 20122016 (Million Units)

Table 9 Global Growth Indicators of Aerospace Industry, 20162035

Table 10 Growth Indicators of Aerospace Industry, By Region 20162035

Table 11 New Airplane Deliveries, By Region, 20162035

Table 12 Hybrid Adhesives & Hybrid Sealants Market Size, By Resin, 20152022 (USD Million)

Table 13 Hybrid Adhesives & Hybrid Sealants Market Size, By Resin, 20152022 (Kiloton)

Table 14 Performance Comparison of MS Polymer Hybrid, Polyurethane, and Silicone

Table 15 Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 16 Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 17 Hybrid Adhesives & Hybrid Sealants Market in Building & Construction, By Region, 20152022 (USD Million)

Table 18 Hybrid Adhesives & Hybrid Sealants Market in Building & Construction, By Region, 20152022 (Kiloton)

Table 19 Hybrid Adhesives & Hybrid Sealants Market in Automotive & Transportation, By Region, 20152022 (USD Million)

Table 20 Hybrid Adhesives & Hybrid Sealants Market in Automotive & Transportation, By Region, 20152022 (Kiloton)

Table 21 Hybrid Adhesives & Hybrid Sealants Market in Industrial Assembly, By Region, 20152022 (USD Million)

Table 22 Hybrid Adhesives & Hybrid Sealants Market in Industrial Assembly, By Region, 20152022 (Kiloton)

Table 23 Hybrid Adhesives & Hybrid Sealants Market in Others, By Region, 20152022 (USD Million)

Table 24 Hybrid Adhesives & Hybrid Sealants Market in Others, By Region, 20152022 (Kiloton)

Table 25 Hybrid Adhesives & Hybrid Sealants Market Size, By Region, 20152022 (USD Million)

Table 26 Hybrid Adhesives & Hybrid Sealants Market Size, By Region, 20152022 (Kiloton)

Table 27 Asia-Pacific: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (USD Million)

Table 28 Asia Pacific: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (Kiloton)

Table 29 Asia Pacific: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 30 Asia Pacific: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 31 China: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 32 China: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 33 Japan: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 34 Japan: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 35 India: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 36 India: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 37 South Korea: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 38 South Korea: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 39 North America: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (USD Million)

Table 40 North America: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (Kiloton)

Table 41 North America: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 42 North America: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 43 Us: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 44 Us: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 45 Canada: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 46 Canada: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 47 Mexico: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 48 Mexico: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 49 Europe: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (USD Million)

Table 50 Europe Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (Kiloton)

Table 51 Europe: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 52 Europe: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 53 Germany: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 54 Germany: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 55 France: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 56 France: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 57 Italy: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 58 Italy: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 59 UK: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 60 UK: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 61 South America: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (USD Million)

Table 62 South America: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (Kiloton)

Table 63 South America: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 64 South America: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 65 Brazil: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 66 Brazil: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 67 Middle East & Africa: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (USD Million)

Table 68 Middle East & Africa: Hybrid Adhesives & Hybrid Sealants Market Size, By Country, 20152022 (Kiloton)

Table 69 Middle East & Africa: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 70 Middle East & Africa: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

Table 71 UAE: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (USD Million)

Table 72 UAE: Hybrid Adhesives & Hybrid Sealants Market Size, By Application, 20152022 (Kiloton)

List of Figures (31 figures)

Figure 1 Hybrid Adhesives & Hybrid Sealants Market Segmentation

Figure 2 Hybrid Adhesives & Hybrid Sealants Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Hybrid Adhesives & Hybrid Sealants: Data Triangulation

Figure 6 Asia Pacific Projected to Lead Hybrid Adhesives & Hybrid Sealants Market Between 2017 and 2022

Figure 7 MS Polymer Hybrids Resin Segment Projected to Lead the Hybrid Adhesives & Hybrid Sealants Market During the Forecast Period

Figure 8 Asia Pacific to Be Fastest-Growing Hybrid Adhesives & Hybrid Sealants Market Between 2017 and 2022

Figure 9 Emerging Economies to Offer Lucrative Growth Opportunities During the Forecast Period

Figure 10 Automotive & Transportation Application of the Market to Grow at the Highest CAGR Between 2017 and 2022

Figure 11 Hybrid Adhesives & Hybrid Sealants Market in Emerging Countries is Projected to Grow at Higher Rates

Figure 12 Building & Construction Segment Accounted for Largest Share of Asia Pacific Hybrid Adhesives & Hybrid Sealants Market in 2016

Figure 13 Hybrid Adhesives & Hybrid Sealants Market in Germany Projected to Be Largest Market During the Forecast Period

Figure 14 Japan and US Accounted for Largest Shares of Hybrid Adhesives & Hybrid Sealants Market in 2016

Figure 15 Drivers, Restraints, Opportunities, and Challenges of Hybrid Adhesives & Hybrid Sealants Market

Figure 16 Porters Five Forces Analysis

Figure 17 MS Polymer Hybrid is Projected to Lead Hybrid Adhesives & Hybrid Sealants Market, 20172022

Figure 18 Automotive & Transportation to Register the Highest CAGR During Forecast Period

Figure 19 Building & Construction to Lead Hybrid Adhesives & Hybrid Sealants Market By 2022

Figure 20 China and India are Emerging as Lucrative Markets for Hybrid Adhesives & Hybrid Sealants

Figure 21 Asia Pacific is Expected to Be A Lucrative Hybrid Adhesives & Hybrid Sealants Market

Figure 22 Asia Pacific Market Snapshot: Japan is the Largest Hybrid Adhesives & Hybrid Sealants Market

Figure 23 North America Hybrid Adhesives & Hybrid Sealants Market Snapshot: the US to Account for the Largest Market Share

Figure 24 Competitive Leadership Mapping, 2016

Figure 25 Henkel AG & Co. KGaA: Company Snapshot

Figure 26 Sika AG: Company Snapshot

Figure 27 3M Company: Company Snapshot

Figure 28 Illinois Tool Works Incorporation: Company Snapshot

Figure 29 Wacker Chemie AG: Company Snapshot

Figure 30 H.B. Fuller: Company Snapshot

Figure 31 Soudal: Company Snapshot

Growth opportunities and latent adjacency in Hybrid Adhesives & Hybrid Sealants Market