Motor Protection Market by Device (Overload Relay, Vacuum Contactor, Combination Starter & Motor Protection Circuit Breaker), by Industry (Oil & Gss, Water & Wastewater, Infrastructure, Food & Beverages, Metals & Mining), by Power, and by Region - Global Trends & Forecast to 2020

The global motor protection market size is estimated to be around USD 5.09 Billion in 2015, and is expected to grow at a CAGR of 6.86% during the forecast period. Factors driving the motor protection market include global rise in demand for motors and growing concern towards its safety and growth in HVAC system. Major offshore oil & gas developments and rising expenditures in the water & wastewater industry are the major opportunities of the motor protection market.

The motor protection market has been segmented on the basis of its rated power, device type, end-use industry, and region. The years considered for the study include:

- Base Year – 2014

- Estimated Year – 2015

- Projected Year – 2020

- Forecast Period – 2015 to 2020

For company profiles in the report, 2014 has been considered. Where information is unavailable for the base year, the prior year has been considered.

Research Methodology

This research study involves extensive usage of secondary sources, directories, and databases (such as, Hoovers, Bloomberg, Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the motor protection market. The below points explain the research methodology.

- Analysis of the growth rate of global electric motors for the past five years

- Analysis of country-wise industrial growth rate for the past five years

- Analysis of the growth rate of frequency drives for the past three years

- Estimation of installation cost of various motor protection equipment using cost variance models

- Analysing trends in various countries through major industrial activities and major market player developments

- Arriving at the overall market size of motor protection through supply side across the globe

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below shows the breakdown of primaries on the basis of company, designation, and region, conducted during the research study.

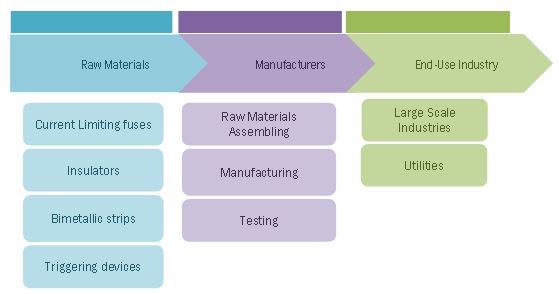

Market Ecosystem:

The motor protection market starts with raw materials which include current limiting fuses, insulators, bimetallic strips, and triggering devices among others. In the later stage, motor protection devices are manufactured where all raw materials are assembled and distributed to large scale industries, utilities, and commercial facilities.

Stakeholders:

The stakeholders include:

- Motor protection devices manufacturers, dealers, and suppliers

- Low and medium voltage switchgear manufacturers, dealers, and suppliers

- Governments and research organizations

- Shareholders/investors

- Consulting companies in energy & power

- Investment banks

Scope of the Report:

- By Device Type:

- Overload Relays

- Vacuum Contactors

- Combination Starters and Motor Protection Circuit Breaker

- By Rated Power:

- Up to 7.5 kW

- 7.5 kW-75 kW

- >75 kW

- By End-Use Industry

- Oil & Gas

- Water & Wastewater

- Infrastructure (Residential & Non-Residential)

- Food & Beverages

- Metals & Mining

- By Region

- Asia-Pacific

- Europe

- North America

- South America

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global motor protection market is projected to grow at a CAGR of 6.86% during the forecast period to reach a value of USD 5.09 Billion by 2020. The growth is attributed to growing focus on safety towards motors and robust growth in the HVAC market.

The motor protection market, on the basis of device type, has been categorized into four segments: overload relays, vacuum contactors, and combination starters & motor protection circuit breaker. The overload relays segment is expected to hold the largest market share during the forecast period, followed by vacuum contactors. Ease of installation, lower price, and wide range of availability are the major growth drivers of this segment. Moreover, overload relays are in-built in various other motor protection & control equipment such as frequency drives and motor soft starters.

On the basis of end-use industry, the motor protection market has been segmented into oil & gas, water & wastewater, infrastructure, metals & mining, food & beverages, and others. The oil & gas industry is expected to dominate the motor protection market during the forecast period. New oil discoveries coupled with growing focus towards deepwater drilling activities is the major driver for growth. However, infrastructure (residential & commercial) is the fastest growing segment in the market. The developing economies are investing in infrastructure, which is the major driver of this segment.

Asia-Pacific was the leading market for motor protection devices in 2014, owing to large scale industrialization and urbanization in the region China, Japan, and India are the fastest growing markets for motor protection in the region. The figure below indicates the market sizes of Asia-Pacific countries in 2015 and 2020, along with their CAGRs for 2015 to 2020.

The mining industry underwent a serious downturn in 2014. There was a steep fall in prices of iron ore, gold, silver, coal, and copper between 2013 and 2014. For instance, the price of iron ore declined nearly 40% from USD 130 a ton in January 2014 to USD 82 a ton in September 2014. Likewise, from 2012 to 2013, the annual average gold price also dropped from USD 1,669 per troy ounce to USD 1,411 per troy ounce. Weakening prices and a sluggish outlook for demand growth have turned investors away from the mining sector. This has forced several companies to cut costs and postpone projects in order to survive. The CAPEX investment by miners was also recorded low. The resulting decline in CAPEX is not good for mining equipment manufacturers. Hence, all these factors are expected to restrict the growth of motor protection devices used in the mining sector.

Some of the leading players in the motor protection market include ABB Ltd. (Switzerland), Siemens AG (Germany), Schneider Electric (France), Eaton Corporation (Ireland), and General Electric Company (U.S.). Expansions and new product launches were the most widely adopted strategies by top players in the market, constituting 30% each of the total development share during 2012-2015. Contracts & agreements accounted for 24%, while mergers & acquisitions held 16% share during the same period.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered (Subsegments Including Geo Segmentation)

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 36)

4.1 Attractive Market Opportunities In the Motor Protection Devices Market

4.2 Motor Protection Market, By Device Type

4.3 Motor Protection Devices Market By Top Countries In Asia-Pacific

4.4 Asia-Pacific is Expected to Dominate the Motor Protection Devices Market During the Forecast Period

4.5 Market for Motor Protection Devices: Developed vs. Developing Nations, 2015-2020

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Motor Protection Market: By Device Type

5.2.2 Motor Protection Market: By Rated Power

5.2.3 Motor Protection Market: By End-User Industry

5.2.4 Motor Protection Market: By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 the Significance of Electric Motors In Today’s World And Growing Concern Towards Its Protection

5.3.1.2 Robust Growth In Hvac Systems Worldwide

5.3.2 Restraints

5.3.2.1 Downturn In the Mining Industry

5.3.3 Opportunities

5.3.3.1 Upcoming Developments In the Oil & Gas Sector

5.3.3.2 Growth In Water And Wastewater Industries

5.3.4 Challenges

5.3.4.1 Growing Focus on Renewable Sources for Power Generation

5.4 Supply Chain Analysis

5.5 Porter’s Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Motor Protection Market, By Region (Page No. - 56)

6.1 Introduction

6.2 Asia-Pacific

6.2.1 China

6.2.2 Japan

6.2.3 India

6.2.4 Other Countries of Asia-Pacific:

6.3 North America

6.3.1 U.S.

6.3.2 Canada

6.3.3 Mexico

6.4 Europe

6.4.1 Germany

6.4.2 Russia

6.4.3 U.K.

6.4.4 France

6.4.5 Other Countries of Europe

6.5 South America

6.5.1 Brazil

6.5.2 Argentina

6.5.3 Venezuela

6.5.4 Other Countries of South America

6.6 Middle East & Africa

6.6.1 Saudi Arabia

6.6.2 UAE

6.6.3 South Africa

6.6.4 Rest of Middle East & Africa

6.7 Top Six Countries By End-Use Industry

7 Motor Protection Market, By Rated Power (Kw) (Page No. - 85)

7.1 Introduction

7.2 Motor Protection Devices With Rated Power Up to 7.5 Kw

7.3 Motor Protection Devices With Rated Power 7.5 to 75 Kw

7.4 Motor Protection Devices With Rated Power Above 75 Kw

8 Motor Protection Market, By End-Use Industry (Page No. - 90)

8.1 Introduction

8.2 Oil & Gas

8.3 Water & Wastewater

8.4 Infrastructure (Residential & Commercial)

8.5 Metals & Mining

8.6 Food & Beverages

8.7 Other Industries

8.8 End-Use Industry By Top Six Countries

9 Motor Protection Market, By Device Type (Page No. - 99)

9.1 Introduction

9.2 Overload Relays

9.3 Vacuum Contactors

9.4 Combination Starters & Motor Protection Circuit Breaker

10 Competitive Landscape (Page No. - 105)

10.1 Overview

10.2 Competitive Situation & Trends

10.3 New Product/Technology Launches

10.4 Expansions

10.5 Mergers & Acquisitions

10.6 Contracts & Agreements

11 Company Profiles (Page No. - 113)

11.1 Introduction

11.2 ABB Ltd.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments, 2012-2015

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Siemens AG

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments, 2012-2015

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Eaton Corporation PLC.

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments, 2012-2015

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Schneider Electric SE

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments, 2013-2015

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 General Electric Company

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments, 2012-2015

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 Mitsubishi Electric Corporation

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments, 2013-2014

11.8 Larsen & Toubro Limited

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments, 2012-2013

11.9 Fuji Electric Co. Ltd.

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments, 2012-2014

11.10 Danfoss A/S

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments, 2013-2014

11.11 Toshiba International Corporation

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.12 Chint Electrics Co. Ltd.

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Recent Developments

12 Appendix (Page No. - 140)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Other Recent Developments, 2012-2015

12.4 Available Customizations

12.5 Introducing RT: Real-Time Market Intelligence

12.6 Related Reports

List of Tables (69 Tables)

Table 1 Electricity Consumption By Motors In Various Sectors

Table 2 Faults In Motors With Frequency of Occurrence

Table 3 Focus on Protecting And Improving Motor Efficiency is A Primary Factor Driving the Motor Protection Market

Table 4 Downturn In Mining Industry is Restraining the Growth of the Motor Protection Market

Table 5 Upcoming Developments In the Oil & Gas Sector is an Opportunity for the Motor Protection Market

Table 6 Focus Towards Renewable Sources for Power Generation is A Major Challenge for the Motor Protection Market

Table 7 Motor Protection Market Size, By Region, 2013–2020 (USD Million)

Table 8 Asia-Pacific: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 9 Asia-Pacific: Motor Protection Market Size, By Country, 2013–2020 (USD Million)

Table 10 China: Motor Production Devices Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 11 Japan: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 12 India: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 13 Other Countries In Asia Pacific: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 14 North America: Motor Protection Market Size, By End-Use Industry, 2013-2020

Table 15 North America: Motor Protection Market Size, By Country 2013-2020 (USD Million)

Table 16 U.S.: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 17 Canada: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 18 Mexico: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 19 Europe: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 20 Europe: Motor Protection Market Size, By Country, 2013-2020 (USD Million)

Table 21 Germany: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 22 Russia: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 23 U.K.: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 24 France: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 25 Others: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 26 South America: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 27 South America: Motor Protection Market Size, By Country, 2013-2020 (USD Million)

Table 28 Brazil: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 29 Argentina: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 30 Venezuela: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 31 Others: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 32 Middle East & Africa: Motor Protection Market Size, By End Use Industry, 2013-2020 (USD Million)

Table 33 Middle East & Africa: Motor Protection Market Size, By Country, 2013-2020 (USD Million)

Table 34 Saudi Arabia: Motor Protection Devices Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 35 UAE: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 36 South Africa: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 37 Rest of Middle East & Africa: Motor Protection Market Size, By End-Use Industry, 2013-2020 (USD Million)

Table 38 Top Six Countries: Motor Protection Market Size, By End-Use Industry 2013-2020 (USD Million)

Table 39 Motor Protection Market Size, By Rated Power, 2013–2020 (USD Million)

Table 40 Motor Protection Devices With Rated Power Up to 7.5 Kw Market Size, By Region, 2013–2020 (USD Million)

Table 41 Motor Protection Devices With Rated Power Up to 7.5 Kw Market Size, By Device Type, 2013-2020 (USD Million)

Table 42 Motor Protection Devices With Rated Power 7.5 to 75 Kw Market Size, By Region, 2013–2020 (USD Million)

Table 43 Motor Protection Devices With Rated Power 7.5 to 75 Kw Market Size, By Device Type, 2013-2020 (USD Million)

Table 44 Motor Protection Devices With Rated Power Above 75 Kw Market Size, By Region, 2013–2020 (USD Million)

Table 45 Motor Protection Devices With Rated Power Above 75 Kw Market Size, By Device Type, 2013-2020 (USD Million)

Table 46 Motor Protection Devices Market Size, By End-Use Industry, 2013–2020 (USD Million)

Table 47 Oil & Gas Market Size, By Region, 2013–2020 (USD Million)

Table 48 Water & Wastewater Market Size, By Region, 2013–2020 (USD Million)

Table 49 Infrastructure (Residential & Commercial) Market Size, By Region, 2013–2020 (USD Million)

Table 50 Metals & Mining Market Size, By Region, 2013–2020 (USD Million)

Table 51 Food & Beverages Market Size, By Region, 2013–2020 (USD Million)

Table 52 Other Industries Market Size, By Region, 2013–2020 (USD Million)

Table 53 China: End-Use Industry Market Size, 2013-2020 (USD Million)

Table 54 U.S.: End-Use Industry Market Size,2013-2020 (USD Million)

Table 55 Germany: End-Use Industry Market Size, 2013-2020 (USD Million)

Table 56 Japan: End-Use Industry Market Size, 2013-2020 (USD Million)

Table 57 India: End-Use Industry Market Size, 2013-2020 (USD Million)

Table 58 Russia: End-Use Industry Market Size, 2013-2020 (USD Million)

Table 59 Motor Protection Market Size, By Device Type, 2013–2020 (USD Million)

Table 60 Overload Relays Market Size, By Region, 2013–2020 (USD Million)

Table 61 Overload Relays Market Size, By Rated Power, 2013-2020 (USD Million)

Table 62 Vacuum Contactors Market Size, By Region, 2013–2020 (USD Million)

Table 63 Vacuum Contactors Market Size, By Rated Power, 2013-2020 (USD Million)

Table 64 Combination Starters & Motor Protection Circuit Breaker Market Size, By Region, 2013–2020 (USD Million)

Table 65 Combination Starters & Motor Protection Circuit Breaker Market Size, By Rated Power, 2013-2020 (USD Million)

Table 66 New Product/Technology Launches, 2012-2015

Table 67 Expansions, 2012-2014

Table 68 Mergers & Acquisitions, 2012-2015

Table 69 Contracts & Agreements, 2012-2015

List of Figures (56 Figures)

Figure 1 Markets Covered: Motor Protection Devices

Figure 2 Motor Protection Devices Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Asia-Pacific Occupied the Largest Market Share In 2014

Figure 7 Motor Protection Devices Market Snapshot (2015 vs. 2020): Europe & Asia-Pacific to Exhibit the Highest Growth Rates During the Forecast Period

Figure 8 Overload Relays Held the Largest Market Size(By Device Type)

Figure 9 The Oil & Gas Segment is Likely to Dominate the Motor Protection Market During the Forecast Period

Figure 10 ABB Ltd. & Eaton Corporation Were the Most Active Companies In Terms of Market Developments From 2012 to 2015

Figure 11 Robust Growth In HVAC Systems Would Boost the Motor Protection Market

Figure 12 The Overload Relays Segment is Expected to Grow at the Fastest Pace In the Motor Protection Market During the Forecast Period

Figure 13 Infrastructure Segment Was the Dominant Industry In Asia-Pacific Motor Protection Market In 2014

Figure 14 Asia-Pacific, Europe, & North America Dominated the Motor Protection Market In 2014

Figure 15 Developing Economies are Expected to Grow at the Fastest Rate

Figure 16 Asia-Pacific Occupied the Largest Share In the Motor Protection Market In 2014

Figure 17 Motor Protection Market Segmentation

Figure 18 Motor Protection Market: By Device Type

Figure 19 Motor Protection Market: By Rated Power

Figure 20 Motor Protection Market: By End-User Industry

Figure 21 Motor Protection Market: By Region

Figure 22 Drive Towards Motor Protection And Global HVAC Systems Growth Will Propel the Motor Protection Market

Figure 23 Supply Chain Analysis: Motor Protection Market

Figure 24 Porter’s Five Forces Analysis: Motor Protection Market

Figure 25 Regional Snapshot: Asia-Pacific, North America, & Europe are Major Markets for Motor Protection Devices During the Forecast Period

Figure 26 Asia-Pacific: Motor Protection Market Snapshot

Figure 27 Asia-Pacific: Motor Protection Market, By End-Use Industry, 2013-2020 (USD Million)

Figure 28 North America: Motor Protection Devices By End-Use Industry, 2013-2020 (USD Million)

Figure 29 Europe: Motor Protection Devices Market Snapshot

Figure 30 Europe: Motor Protection Devices, By End-Use Industry, 2013-2020 (USD Million)

Figure 31 South America: Motor Production Devices, By End-Use Industry, 2013-2020 (USD Million)

Figure 32 Middle East & Africa: Motor Protection Devices, By End-Use Industry, 2013-2020 (USD Million)

Figure 33 Motor Protection Devices With Rated Power > 75 Kw to Dominate the Market During the Forecast Period

Figure 34 Oil & Gas Accounted for the Largest Market Share (Value)

Figure 35 Global Snapshot: the Overload Relays Segment is Expected to Dominate the Motor Protection Devices Market During the Forecast Period

Figure 36 Companies Adopted New Product Launches & Expansions as Key Growth Strategies, 2012-2015

Figure 37 Battle for Market Share: Expansions & New Product Launches Were the Key Strategies

Figure 38 Market Evaluation Framework

Figure 39 Market Leaders Based on Recent Developments, 2012-2015

Figure 40 Regional Revenue Mix of the Top Five Players

Figure 41 ABB Ltd.: Company Snapshot

Figure 42 ABB Ltd.: SWOT Analysis

Figure 43 Siemens AG: Company Snapshot

Figure 44 Siemens AG: SWOT Analysis

Figure 45 Eaton Corporation PLC: Company Snapshot

Figure 46 Eaton Corporation PLC: SWOT Analysis

Figure 47 Schneider Electric SE: Company Snapshot

Figure 48 Schneider Electric SE: SWOT Analysis

Figure 49 General Electric Company: Company Snapshot

Figure 50 General Electric Company: SWOT Analysis

Figure 51 Mitsubishi Electric Corporation: Company Snapshot

Figure 52 Larsen & Toubro Limited: Company Snapshot

Figure 53 Fuji Electric Co. Ltd.: Company Snapshot

Figure 54 Danfoss A/S: Company Snapshot

Figure 55 Toshiba International Corporation Pty Ltd: Company Snapshot

Figure 56 Chint Electrics Co. Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Motor Protection Market