Motor Lamination Market by Application (Performance, Comfort, and Safety), Material, Technology, Motor Type (Power Steering & Window, Adaptive front light), ICE & Electric Vehicle, ATV by Application and Region - Global Forecast to 2027

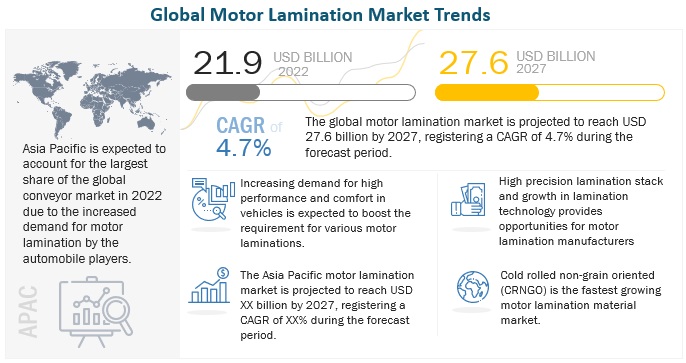

[271 Pages Report] The motor lamination market is estimated to grow from USD 21.9 billion in 2022 to reach USD 27.6 billion by 2027 at a CAGR of 4.7% during the forecast period. The market growth is seen mainly due to the growing demand for luxury vehicle sales across different geographies. Growing safety standards and increased demand for comfort applications are also boosting the demand for motors and lamination stacks globally.

To know about the assumptions considered for the study, Request for Free Sample Report

Motor Lamination Market Dynamics

Driver: Transition to e-mobility solutions and increase in usage of electric motors will drive the motor lamination market

Environmental degradation and air pollution are the major concerns faced by the world today. Growing awareness of the harmful effects of vehicular emissions has forced automotive manufacturers to develop vehicles that comply with regional regulatory standards. Increasing stringency of emission norms has resulted in increased sales of electric vehicles such as BEVs, HEVs, and PHEVs. According to data from the Federation of Automobile Dealers Associations, retail electric vehicle (EV) sales increased threefold in 2021-22 (April-March) (FADA). Also, despite supply chain bottlenecks and the ongoing Covid-19 pandemic, electric car sales set a new high in 2021. Sales nearly doubled to 6.6 million (a sales share of nearly 9%) compared to 2020, bringing the total number of electric vehicles on the road to 16.5 million. With the increasing demand for electric vehicles, the demand for certain stacks will register an increase simultaneously, considering the increasing demand for performance motors with advanced silicon-based materials and high-performance electrical steels for motor laminations. All these factors substantiate the growth in demand for motors and, subsequently, the lamination technologies, which will drive the market growth.

Restraint: Higher up-front investments in lamination technologies

The manufacturing of lamination sheets involves several steps that include bonding, welding, and stamping. Once magnetic metals are processed, they turn into thin lamination sheets. All these steps in developing, producing, and distributing motor laminations require heavy investments in acquiring new technological stamping, bonding, and welding machines. The maintenance and replacement cost is also considered a capital investment. Companies such as R. Bourgeois and Tempel have adopted advanced technologies such as the Full-bond technique and Dots or the Glulock technology to increase the efficiency and productivity of motors. Advanced machines for lamination stacks involve high costs and highly specialized manufacturing and assembly processes. For example, a stacked stator lamination welding machine costs around USD 30,000, and a motor lamination manufacturing stamping and notching machine costs around USD 50,000.

Furthermore, these machines have a high operating cost. These machines' power requirement is high, resulting in high power consumption. Thus, these factors can negatively impact market growth and act as a restraining factor in the motor lamination market.

Opportunity: Advancement in lamination technologies with better operational efficiency

Lamination sheets are magnetic metal sheets with properties that exhibit higher operational effectiveness under various conditions. The quality of lamination sheets depends on the output of an electric motor. With time, the technology of manufacturing lamination sheets has undergone many changes to reduce fabrication costs and operational time. Techniques such as bonding, stamping, and welding are mainly used to make lamination sheets. The rotor and stator can be made from the same material with the help of precision techniques. The full bond technique and dots technology/ glulock are expected to impact the lamination market significantly. The developments in lamination technologies with better performance will drive the demand for motor laminations during the forecast period.

Challenges: Transition to newer technologies with higher cost

As electric motors are available in different sizes, there is no standard process to manufacture motor lamination. Manufacturers choose technology. Stamping, welding, and bonding of lamination sheets are commonly used technologies. For example, bonding offers many benefits, such as joining magnets and lamination stacks, joining shaft and rotor, and joining stator and housing. Advancements in technology have led to innovations in the manufacturing of lamination sheets/stacks. Companies such as R. Bourgeois have adopted new technologies such as glue bond technology and Backlack technology for producing laminations. Maintenance and repair costs and the resources invested in acquiring skilled labor add to the overall cost. Thus, adopting new technologies is a key challenge for lamination stack manufacturers.

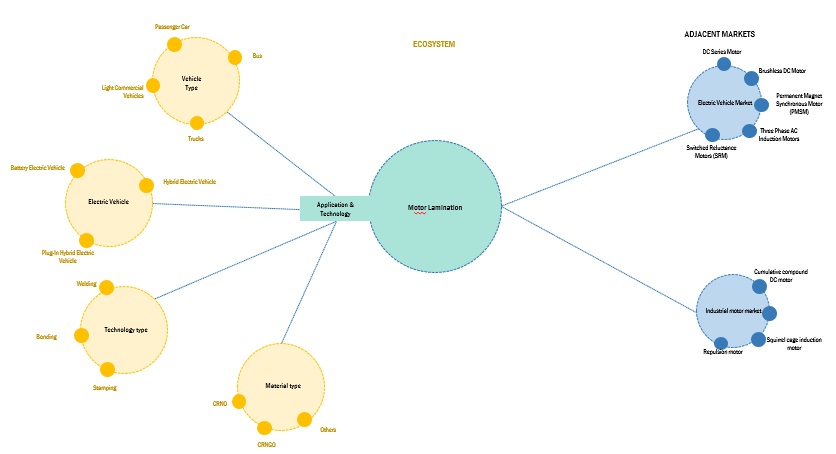

Motor Lamination Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

BEV segment for the motor lamination market is estimated to be the largest market during the forecast period

Global BEV sales increased significantly in recent years and have shown strong growth despite the COVID-19 pandemic. Around 4.3 million new batteries-powered EVs (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold worldwide in the first six months of 2022. BEV sales grew by 75% in the January-June 2022 period. The growth is mainly attributed to the expansion of BEV models to new segments in most regions, continued purchase incentives, and stringent emission standards. According to World Economic Forum, an EU-wide ban on sales of petrol and diesel cars will come into force by 2035, while the UK has brought its phase-out date forward to 2030 from 2035. China, the world’s biggest car market, aims for 40% of vehicles sold in the country to be electric by 2030. Thus, growing BEV sales, the demand for motor laminations is expected to grow in the coming years. Also, according to primary respondents and secondary research, BEVs are expected to witness a greater penetration of advanced automotive solutions with better performance and comfort application motors than PHEVs and HEVs. Considering the developments in advanced systems for better performance and safety, the market for the BEV segment for lamination stacks is expected to grow.

The passenger car segment for the motor lamination market is estimated to be the largest market during the forecast period

The passenger car segment is expected to have the largest market share in the motor lamination market for the vehicle type. With growing investments in R&D and manufacturing capacity of major automotive players in different regions, the demand for motors for comfort and safety applications is certain to register growth. Implementing stringent safety regulatory standards mandates the use of ABS and electronic stability controls, which will ultimately result in more demand for motors. An increase in demand for premium and luxury cars with additional comfort application motors is expected to propel the demand for motors, thus driving the market during the forecast period.

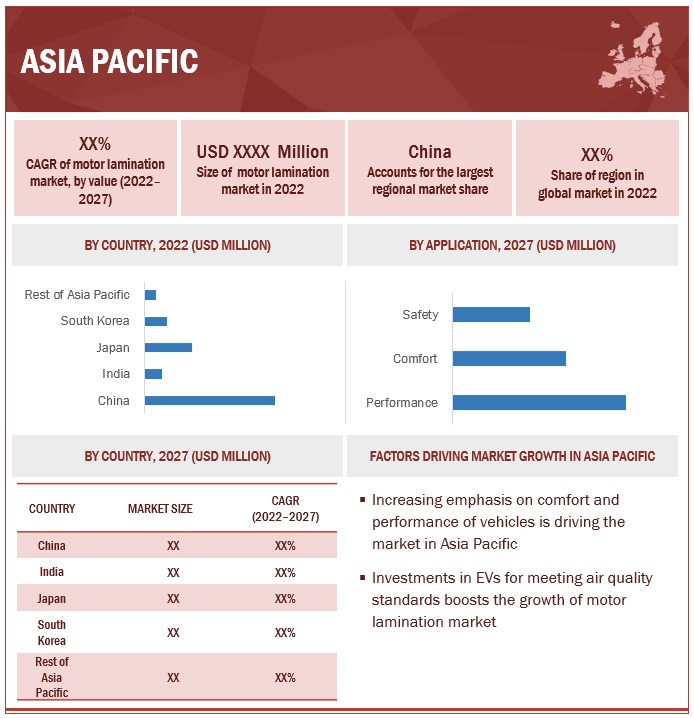

Asia Pacific is likely to be the largest market during the forecast period

Asia Pacific has emerged as a hub for automotive production in recent years. The increasing production of vehicles is the region are primarily attributed to the facilitative regulatory policies of the government like ‘Make in India’. Countries like China has emerged as the leading export hub for vehicle production due to availability of cheap capital, raw materials and skilled labour force to cater to the needs of other regions. Nearly all the major automation and additions for performance, safety, and comfort in vehicles are primarily driven by motors, which indicates that the demand for motor lamination will pick up in sync with the demand for motors. Thus, considering the above factors, it is evident that the motor lamination market is expected to grow significantly in the coming years.

Key Market Players

Tempel (US), Pitti Engineering Ltd (India), Alinabal, Inc (US), EuroGroup Laminations S.p.A. (Italy), R. Bourgeois (France), and LCS Company (US). The key strategies adopted by major companies to sustain their position in the market are expansions, contracts and agreements, and partnerships.

Scope of the Report

|

Report Metrics |

Details |

| Base year for estimation | 2021 |

| Forecast period | 2027 |

| Value (USD Bn) | 27.6 |

| Market Growth and Revenue forecast | 4.7% |

| Top Players | Tempel (US), Pitti Engineering Ltd (India), Alinabal, Inc (US), EuroGroup Laminations S.p.A. (Italy), R. Bourgeois (France), and LCS Company (US) |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia Pacific |

| Segments covered | By application, By technology, By material, By vehicle type, By motor type, By electric vehicle type, electric vehicle motor lamination market by application (performance, safety & comfort), all-terrain vehicle motor lamination market by application (performance, safety & comfort), By Region (Asia Pacific, Europe, North America, and Row |

| By application | Performance, safety and comfort |

| By technology | Welding, bonding, stamping and others |

| By vehicle type | Passenger cars, light commercial vehicles, buses, and trucks |

| By material | Cold Rolled Non-Oriented Steel, Cold Rolled Non-Grained Oriented Steel, Other materials |

| By motor type | Electric Water pump motor, Radiator cooling fan motor, electronic throttle valve control motor, electronic variable gear ratio motor, Electronic variable valve timing motor Variable nozzle turbo motor, adjustable pedal motor, Electric power steering motor, Wiper motor, Starter motor, EGR Motor, Fuel pump motor, Power antenna motor, Air conditioner motor, Door mirror motor, power window motor, Tilt steering column motor, Blower motor, Power Seat motor, Electric sunroof motor, Door closer motor, Cruise control motor, Adaptive front light motor, Electronic stability control motor, ABS motor, Electronic parking brake motor |

| By electric type | BEV, PHEV, and FCEV |

| Electric vehicle motor lamination market, by application | Performance, safety and comfort |

| All-terrain vehicle motor lamination market | Performance, safety and comfort |

| By Region | Asia Pacific, Europe, North America, and RoW |

This research report categorizes the given market, based motor lamination market by application, technology, vehicle type, material, motor type, electric vehicle type, region, electric vehicle motor lamination market, by application and all-terrain vehicle motor lamination market.

Based on the motor lamination market by application, the market has been segmented as follows:

- Performance

- Comfort

- Safety

Based on the motor lamination market by technology, the market has been segmented as follows:

- Welding

- Bonding

- Stamping

- Others

Based on the motor lamination market by motor type, the market has been segmented as follows:

- Electric Water pump motor

- Radiator cooling fan motor

- Electronic throttle valve control motor

- Electronic variable gear ratio motor

- Electronic variable valve timing motor

- Variable nozzle turbo motor

- Adjustable pedal motor

- Electric power steering motor

- Wiper motor

- Starter motor

- EGR Motor

- Fuel pump motor

- Power antenna motor

- Air conditioner motor

- Door mirror motor

- Power window motor

- Tilt steering column motor

- Blower motor

- Power Seat motor

- Electric sunroof motor

- Door closer motor

- Cruise control motor

- Adaptive front light motor

- Electronic stability control motor

- ABS motor

- Electronic parking brake motor

Based on the motor lamination market by vehicle type, the market has been segmented as follows:

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

Based on motor lamination market by material type, the market has been segmented as follows:

- Cold Rolled Non-Oriented Steel

- Cold Rolled Non-Grained Oriented Steel

- Other materials

Based on motor lamination market by electric vehicle type, the market has been segmented as follows:

- BEV

- PHEV

- FCEV

Based on the Electric vehicle motor lamination market, by application, the market has been segmented as follows:

- Performance

- Comfort

- Safety

Based on All-terrain vehicle motor lamination market, the market has been segmented as follows:

- Performance

- Comfort

- Safety

Based on motor lamination market by region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- France

- GermanyItaly

- Russia

- Spain

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Rest of the World

- Brazil

- South Africa

- Rest of RoW

Frequently Asked Questions (FAQ):

What is the motor lamination market scenario in different regions (Europe/North America /Asia Pacific/Brazil/Russia)?

The Asia Pacific is the largest motor lamination market. It has the highest penetration of performance application motors, especially in cost-sensitive countries such as India, Thailand, etc. North America and the European region will register growth due to rising demand for comfort and safety applications in passenger vehicles.

Which of the motor lamination by the application will fare ahead of the others?

In 2021, Kia Motors announced an investment of USD 25 billion for development of new electric vehicles as well as business diversification worldwide.

What are the key market trends impacting the growth of the motor lamination market?

Increased R&D by the automakers to develop advanced lamination systems with silicon or cobalt-based materials is expected to boost the motor lamination market. Also, global OEMs continuously collaborate with domestic players in emerging economies to develop products tailored to motors manufacturers' requirements.

What are the key challenges for the seamless motor lamination market growth?

Key challenges include high development costs, high maintenance costs, and lower penetration in the developing market.

What are the key trends concerning technology?

Bonding technology is estimated to be the largest market for motor laminations, followed with welding and stamping, owing to rising demand for customizable requirements by the OEMs.

What will be the market trends for materials?

CRNGO material is estimated to register the fastest growth along with others with cobalt and silicon based electrical grade steels for motor lamination market.

What are the reasons for revenue shift for motor lamination market?

Though currently, majority of the revenue comes from ICE vehicles segment but with developments in the field of electric-mobility, there will be revenue shift in the motor lamination market.

What are the key driving factor for motor lamination market?

Increasing demand for advanced features and luxury segment cars, along with the stringent safety regulatory norms are some of the key factors driving the motor lamination market.

What are the key challenges that can be faced due to supply chain disruptions?

Countries and companies manufacturing materials for laminations are facing issues in production which has caused a ripple-down effect across all domains, including the automotive sector, which is dependent on various grades of electrical steel. This has resulted in severe shortages, pushing back deadlines by years in some cases. As a result, companies are looking to diversify their supply chains and frame several long-term and short-term strategies to mitigate this challenge. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

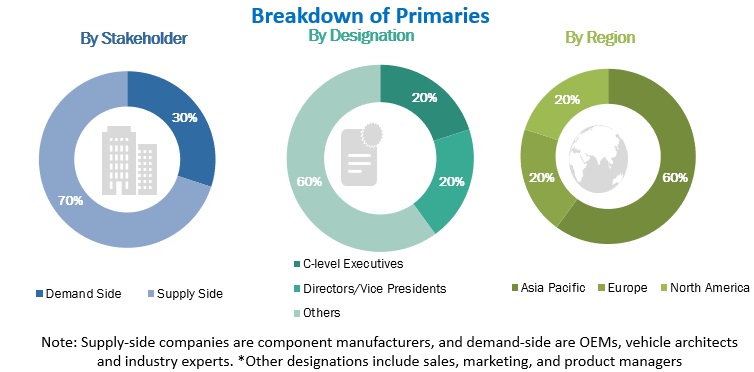

The study involved four major activities in estimating the current size of the motor lamination market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include publications from government sources [such as country-level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; free and paid automotive databases [Organisation Internationale des Constructeurs d'Automobiles (OICA), MarkLines, etc.] and trade, business, and professional associations; among others. Trade websites and technical articles have been used to identify and collect information useful for an extensive commercial study of the motor lamination market.

Primary Research

In the primary research process, various primary sources from both the supply side and demand side and other stakeholders were interviewed to obtain qualitative and quantitative information on the market. Primary interviews have been conducted to gather insights such as motor lamination penetration demand by application, material, technology, and highest potential region for the motor lamination market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, vehicle architecture experts and related key executives from various key companies. Below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the motor lamination market. In these approaches, the production statistics for passenger cars, LCVs, trucks, and buses in a country and production statistics of BEVs, PHEVs, FCEVs, along with ATVs at the regional level were considered to estimate the aggregate market of various motor lamination segments. The research methodology used to estimate the market size includes the following:

- Key players in the motor lamination market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts for detailed market insights.

- All application-level penetration rates, percentage shares, splits, and breakdowns for the motor lamination market was determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

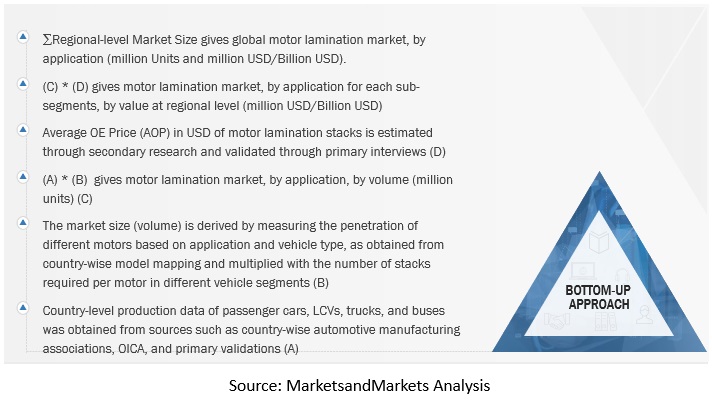

Bottom-Up Approach

In the bottom-up approach, the market size, by volume, of the automotive motor lamination market has been derived by identifying the country level production trend. The detailed model mapping was conducted to understand the usage of motors, in terms of application (performance, comfort, and safety). To estimate the market, country level production has been derived. The derived production volume is then distinguished by the requirement of motors as per the applications and the number of motors required for each application. This was further categorized by understanding the average lamination stack required/used by each application and motor. This led us to the total number of lamination stack used in each country, by motor type and application. This was further summed at the regional level to get the global volume, in terms of units. Further, the summation of the regional markets provided the global motor lamination market size.

Motor Lamination Market (by Application): Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

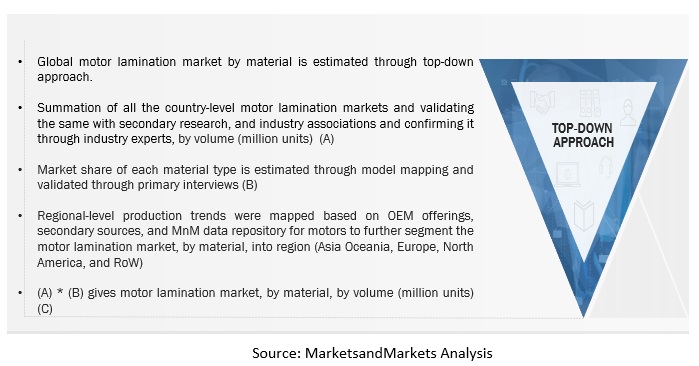

Top-Down Approach

The top-down approach was used to estimate and validate the market size of the motor lamination market, by material, in terms of volume. To derive the market size for lamination by material type (million units), the global motor lamination market (million units) has been multiplied by the respective market share of motor type in each industry from secondary research and validated by primary respondents. The global market has been segmented at the regional level based on secondary findings and data repository for motors to further segment the motor lamination market by material at regional level.

Motor Lamination Market (by Material): Top-Down Approach

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and sub-segments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

-

To define, describe, and project the motor lamination market in terms of volume (thousand units) and value (USD million) based on:

- Application (performance, safety, and comfort)

- Technology (welding, bonding, stamping, and others)

- Vehicle type (passenger cars, LCVs, trucks, and buses)

- Electric vehicle type (BEVs, PHEVs, and FCEVs)

- Material type (cold-rolled non-oriented steels, cold-rolled non-grained-oriented steels, and others)

- Motor type (electric water pump motors, radiator cooling fan motors, electronic throttle valve control motors, electronic variable gear ratio motors, electronic variable valve timing motors, variable nozzle turbo motors, adjustable pedal motors, electric power steering motors, wiper motors, starter motors, EGR motors, fuel pump motors, power antenna motors, air conditioner motors, door mirror motors, power window motors, tilt steering column motors, blower motors, power seat motors, electric sunroof motors, door closer motors, cruise control motors, adaptive front light motors, electronic stability control motors, ABS motors, and electronic parking brake motors)

- Electric vehicle motor lamination market, by application (performance, safety, and comfort)

- All-terrain vehicle motor lamination market, by application (performance, safety, and comfort)

- Region (Asia Pacific, Europe, North America, and RoW)

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the motor lamination market

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions in the motor lamination market

- To conduct a case study analysis, technology analysis, supply chain analysis, trade analysis, market ecosystem analysis, tariff and regulatory landscape analysis, Porter’s Five Forces analysis, and average selling price analysis

- To analyze the market share of key players in the motor lamination market and conduct a revenue analysis of the top five players

- To formulate the competitive leadership mapping of key players in the motor lamination market.

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Motor Lamination Market, by End use type

- Appliances

- Infrastructure

- Electrical industry

(Note: Countries included in the study: China, India, Japan, South Korea, Thailand, Germany, UK, France, Spain, Italy, US, Canada, Mexico, Brazil, Russia)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Motor Lamination Market

Architecture,Transmission,Motor Output,final drive,Drive Type, Power Electronics, Vehicle type, Region-Global Forecast to 2025

Dear Madam and Sire, I read the presentation of the motor lamination report and would like a brochure to share more widely in my company. Reading the information, I have the below questions : - What about lamination for all other electrical motor outside Automotive (white good, e-mobility, power plant, …) ? - What about electrical motor to replace combustion engine ? This aspect which can represent the main growth and challenge in this sector seems to be not considered, or really lightly ? - Point 5.1.2.3 of table of content : have you been able to interview auto OEMs or at least OEM like Bosch, Siemens, Leroy Somer ? - When has the report been made ? and has it been updated considering acceleration of electrical vehicle development (not only premium as suggest in the report table of content) ? NB : my company is supplying stamping lubricant to lamination producers. Thanks Regards