Inverter Duty Motors Market by Application, by End-User, by Standards, by Construction Material, and by Region (North America, Europe, Asia-Pacific, and Rest of the World) - Global forecasts to 2021

[156 Pages Report] The global inverter duty motors market stands at USD 2.38 Billion in 2015, and is expected to grow at a CAGR of 9.6% during 20162021.

The inverter duty motors market is segmented on the basis of its application, end-user, construction material, standards, enclosure type, and region. Objectives of the study are:

- To define and segment the global inverter duty motors market

- To estimate the global inverter duty motors market size, in terms of value

- To analyze the market with respect to standards, end-user, construction material, application, and region

- To provide a detailed information on major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the major stakeholders of the global inverter duty motors market and provide details of the competitive landscape for key market leaders

- To study industrial trends and forecast the market in North America, Europe, Asia-Pacific, Rest of the World

- To track and analyze competitive developments such as contract agreements, mergers & acquisitions, new product developments, and Research & Development (R&D) in the inverter duty motors market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of the global inverter duty motors market. Primary sources are mainly several industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standards and certification organizations from companies, and organizations related to all the segments of this industrys value chain. The research methodology is explained below:

- Analysis of top companys inverter duty motors-related revenues

- Analysis of major applications, end-user industrys demand for inverter duty motors

- Assessment of future trends & industrial growth of end-user industries

- Analysis of major international standards for inverter duty motors

- Analysis of market trends in various regions/and countries

- Finalization of the overall market size values by triangulation with the supply-side data which include the product developments, supply chain and annual revenues of inverter duty motors across the globe

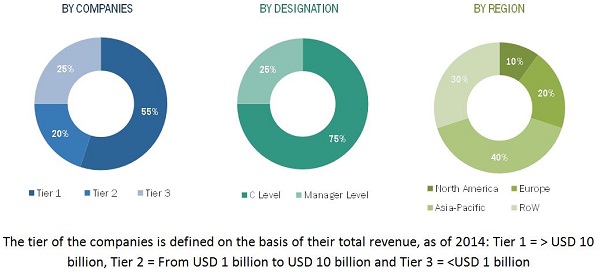

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figures given below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

The figure given below shows the breakdown of the primaries on the basis of company, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

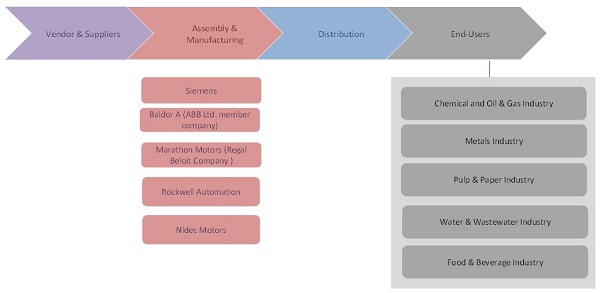

The ecosystem of the global inverter duty motors market starts with suppliers of basic components such as construction material, winding wires, frames, and electric connections, among others. The manufactured parts are then assembled by the OEMs to form an inverter duty motor, which is then tested. After this stage, distribution comes next in which majority of the production is directed toward end-users.

Target Audience:

The target audience for the report includes:

- Inverter duty motors manufacturers, dealers, and suppliers

- Consulting companies in the energy and power sector

- Government and research organizations

- Investors/shareholders

- Environmental research institutes

- Process industries and power industry associations

- Petroleum companies (diesel and natural gas suppliers)

- Manufacturing industry

- Energy efficiency consultancies

Scope of the Report:

- By Application

- Pumps

- Fans

- Extruders

- Conveyors

- Others

- By End-User

- Chemicals and Oil & Gas

- Metal & Mining

- Paper & Pulp

- Food & Beverage

- Others

- By Standards

- IEEE

- NEMA

- Others

- By Construction Material

- Laminated Steel

- Cast Iron

- Aluminum

- By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of region/country-specific analysis

- Company Information

Detailed analysis and profiling of additional market players (Up to 5)

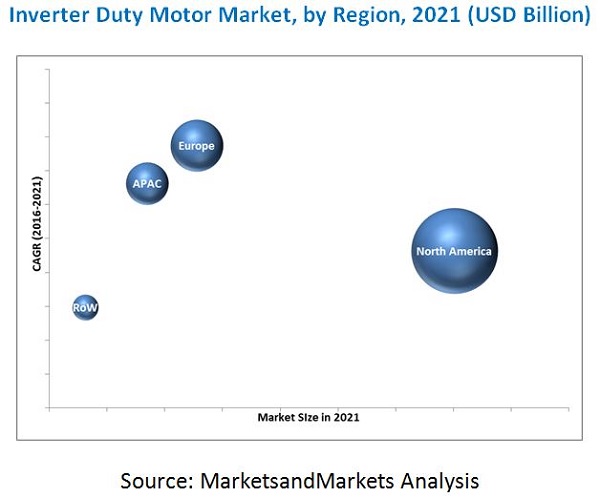

The global inverter duty motors market is projected to grow at a CAGR of 9.6% during 20162021, to reach a value of USD 4.08 Billion by 2021. This growth is attributed to increasing demand for energy efficiency, energy density of motors, and growing urbanization leading to infrastructural growth across the globe.

The inverter duty motors market, by application, in this report, has been divided into pumps, fans, extruders, conveyers, and others. Others include cranes & hoists, winders, and mixers. The pumps segment is estimated to dominate the inverter duty motors market during the forecast period. The major factors driving the growth of this market include higher energy efficiency and superior energy density offered by inverter duty motors. This comparison is in regard to general purpose motors with inverter duty motors.

On the basis of end-user industry, the report segments the inverter duty motors market into chemicals and oil & gas, metals & mining, pulp & paper, food & beverage, and others. Others include pharma, textile processing, and cement industries. Meanwhile, the global inverter duty motors market is expected to register a substantial growth rate during the forecast period. The European market is forecast to lead in terms of growth rate during the forecast period. This growth can be attributed to government initiatives to achieve higher energy-efficiency targets and regulation of industrial motors applications, which oblige to use standard-specific inverter duty motors in variable speed applications.

In this report, the inverter duty motors market has been analyzed with respect to four regions, namely, North America, Europe, Asia-Pacific, and Rest of the World. Rest of the World includes South America, the Middle East, and Africa regions. North America is expected to dominate the global inverter duty motors market owing to its large unconventional oil & gas industry base, and stringent motor efficiency regulations in the region.

Decrease in Greenfield investments by oil & gas industry is one of the restraining factors for the inverter duty motors market, globally. The recent oil price slump has resulted in contraction of exploration & production company budgets, which led to the decrease in revenues for inverter duty motors market as well. Another factor restraining the growth of inverter duty motors is lack of information among end-users of these kinds of motors. It has been observed that the information related to benefits associated with inverter duty motors lacks between end-users. This restrains them from adopting inverter duty motors over comparatively cheaper general purpose motors. These are some of the factors which have proved to be a restraining factor in the inverter duty motors market.

The report includes profile of some of the leading players in the inverter duty motors market, namely, ABB Ltd. (Switzerland), Nidec Corporation (Japan), Regal Beloit Corporation (U.S.), Rockwell Corporation (U.S.), Siemens AG (Germany), General Electric (U.S.), WEG SA (Brazil), Crompton Greaves (India), and Havells India Ltd. (India), among others. Dominant players are trying to penetrate developing economies and adopting various methods to grab the market share.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 24)

3.1 Introduction

3.2 Historical Backdrop

3.3 Current Scenario

3.4 Future Outlook

3.5 Conclusion

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Inverter Duty Motors Market, 20162021

4.2 North America Accounted for the Largest Market Share (By Value) in 2015

4.3 Inverter Duty Motors Market, By Application, 20162021

4.4 The U.S. & Canada are Expected to Drive the Inverter Duty Motors Market in North America During the Forecast Period

4.5 IEEE Standards Segment is Expected to Dominate the Inverter Duty Motors Market During the Forecast Period

4.6 Inverter Duty Motors Market, By End-User

4.7 Inverter Duty Motors Market Size, By Frame Type

4.8 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Inverter Duty Motor: Market Segmentation

5.2.1 By End-User

5.2.2 By Application

5.2.3 By Construction Material

5.2.4 By Standards

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Urbanization & Industrialization

5.3.1.2 Rising Need for Energy Efficiency

5.3.1.3 Stringent Regulations

5.3.2 Restraints

5.3.2.1 Decrease in Greenfield Investment

5.3.2.2 Lack of Information

5.3.3 Opportunities

5.3.3.1 Huge Opportunity in the Replacement Sector

5.3.3.2 Growth in Fixed Speed Applications

5.3.4 Challenges

5.3.4.1 High Installation Costs

5.4 Supply Chain Analysis

5.5 Porters Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

5.6 Standards

5.6.1 Nema Definite Purpose Inverter Fed Motors Polyphase Motors Standard

5.6.2 IEEE 841-2009 Standard for Inverter Duty Motors

6 Inverter Duty Motors Market, By Application (Page No. - 47)

6.1 Introduction

6.2 Pumps

6.3 Fans

6.4 Extruders

6.5 Conveyors

6.6 Others

7 Inverter Duty Motors Market, By End-User (Page No. - 53)

7.1 Introduction

7.2 Chemicals and Oil & Gas

7.3 Metals & Mining

7.4 Pulp & Paper

7.5 Food & Beverage

7.6 Others

8 Inverter Duty Motors Market, By Standard (Page No. - 59)

8.1 Introduction

8.2 IEEE Standards

8.3 Nema Standards

8.4 Others

9 Inverter Duty Motors Market, By Construction Material (Page No. - 63)

9.1 Introduction

9.2 Laminated Steel

9.3 Cast Iron

9.4 Aluminum

10 Inverter Duty Motors Market, By Region (Page No. - 67)

10.1 Introduction

10.2 North America

10.2.1 The U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Russia

10.3.4 The U.K.

10.3.5 Italy

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World

10.5.1 Egypt

10.5.2 Saudi Arabia

10.5.3 Brazil

11 Competitive Landscape (Page No. - 98)

11.1 Overview

11.2 Market Share Analysis, By Key Players

11.3 Competitive Situations & Trends

11.3.1 Investments & Expansions

11.3.2 Mergers & Acquisitions

11.3.3 New Product Developments

11.3.4 Contracts & Agreements

11.3.5 Divesture & Other Developments

12 Company Profiles (Page No. - 105)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 Regal Beloit Corporation

12.3 Rockwell Automation Inc.

12.4 ABB Ltd.

12.5 Siemens AG

12.6 General Electric Company (GE)

12.7 Bison Gear and Engineering Corporation

12.8 Havells India Ltd.

12.9 Nidec Corporation

12.10 Crompton Greaves Limited

12.11 Adlee Powertronic Co. Ltd.

12.12 Nord Drivesystems

12.13 WEG SA

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 134)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.5 Available Customizations

13.6 Related Reports

List of Tables (73 Tables)

Table 1 Inverter Duty Motors Market Size, By Frame Type, 20142021 (USD Million)

Table 2 Inverter Duty Motors Market Size, By Application, 20142021 (USD Million)

Table 3 Pumps: Inverter Duty Motors Market Size, By Region, 20142021 (USD Million)

Table 4 Fans: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 5 Extruders: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 6 Conveyors: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 7 Others: Inverter Duty Motor Market Size, By Region, 20142020 (USD Million)

Table 8 Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 9 Chemicals and Oil & Gas: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 10 Metals & Mining: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 11 Pulp & Paper: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 12 Food & Beverage: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 13 Others: Inverter Duty Motor Market Size, By Region, 20142020 (USD Million)

Table 14 Inverter Duty Motor Market Size, By Standard, 20142021 (USD Million)

Table 15 IEEE Standards: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 16 Nema Standards: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 17 Others: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 18 Inverter Duty Motor Market Size, By Construction Material, 20142021 (USD Million)

Table 19 Laminated Steel: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 20 Cast Iron: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 21 Aluminum: Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 22 Inverter Duty Motor Market Size, By Region, 20142021 (USD Million)

Table 23 North America: Inverter Duty Motor Market Size, By Country, 20142021 (USD Million)

Table 24 North America: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 25 North America: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 26 U.S.: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 27 U.S.: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 28 Canada: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 29 Canada: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 30 Mexico: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 31 Mexico: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 32 Europe: Inverter Duty Motor Market Size, By Country, 20142021 (USD Million)

Table 33 Europe: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 34 Europe: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 35 Germany: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 36 Germany: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 37 France: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 38 France: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 39 Russia: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 40 Russia: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 41 U.K.: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 42 U.K.: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 43 Italy: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 44 Italy: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 45 Rest of Europe: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 46 Rest of Europe: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 47 Asia-Pacific: Inverter Duty Motor Market Size, By Country, 20142021 (USD Million)

Table 48 Asia-Pacific: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 49 Asia-Pacific: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 50 China: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 51 China: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 52 Japan: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 53 Japan: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 54 India: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 55 India: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 56 Australia: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 57 Australia: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 58 Rest of Asia-Pacific: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 59 Rest of Asia-Pacific: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 60 Rest of the World: Inverter Duty Motor Market Size, By Country, 20142021 (USD Million)

Table 61 Rest of the World: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 62 Rest of the World: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 63 Egypt: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 64 Egypt: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 65 Saudi Arabia: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 66 Saudi Arabia: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 67 Brazil: Inverter Duty Motor Market Size, By End-User, 20142021 (USD Million)

Table 68 Brazil: Inverter Duty Motor Market Size, By Application, 20142021 (USD Million)

Table 69 Investments & Expansions, 20142015

Table 70 Mergers & Acquisitions, 20142016

Table 71 New Product Developments, 20152016

Table 72 Contracts & Agreements, 20142016

Table 73 Divesture & Other Developments, 20152016

List of Figures (49 Figures)

Figure 1 Markets Covered: Inverter Duty Motors Market

Figure 2 Inverter Duty Motors Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Estimation Approach & Data Triangulation Methodology

Figure 7 North America Occupied the Largest Market Share (Value) in 2015

Figure 8 Inverter Duty Motors Market Share (Value), By Standard, 2015

Figure 9 Chemicals and Oil & Gas End-User Segment is Expected to Account for the Maximum Share During the Forecast Period

Figure 10 Pumps Segment is Estimated to Be the Largest Application in 2016 & is Projected to Remain So Till 2020

Figure 11 Inverter Duty Motors Market Share (Value), By Construction Material, 2016 & 2021

Figure 12 Europe is Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 13 Increasing Urbanization, Rising Demand for High Energy Density, & Need for Energy Saving are Expected to Drive the Inverter Duty Motors Market During the Forecast Period

Figure 14 Europe & Asia-Pacific are Expected to Grow at A Fast Pace During the Forecast Period

Figure 15 Pumps Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 16 The U.S. Inverter Duty Motors Market is Projected to Hold the Largest Share in North America During the Forecast Period

Figure 17 IEEE Standards Segment Accounted for the Largest Market Share in 2015

Figure 18 Chemical and Oil & Gas Segment is Expected to Hold the Largest Market Share in the Inverter Duty Motors Market During the Forecast Period

Figure 19 The European Market is Expected to Grow at the Highest Rate During the Forecast Period

Figure 20 Inverter Duty Motors Market Segmentation: By Voltage, Application, Construction Material, End-User, Standard, & Region

Figure 21 Market Dynamics: Inverter Duty Motors Market

Figure 22 Urbanization Trend: 2014 vs 2015

Figure 23 Crude Oil Price Trend (June 2014March 2016)

Figure 24 Supply Chain Analysis: Major Value is Added During the Manufacturing & Assembly Phase

Figure 25 Porters Five Forces Analysis: Inverter Duty Motors Market

Figure 26 Global Snapshot: Pumps Segment is Expected to Dominate the Inverter Duty Motors Market During the Forecast Period

Figure 27 Chemicals and Oil & Gas Segment Held the Largest Market Share (By Value) in 2015

Figure 28 Inverter Duty Motors Market Share (Value), By Region, 2015

Figure 29 Regional Snapshot Growth Rate of Inverter Duty Motors Market in Major Countries, 20162021

Figure 30 Europe Inverter Duty Motors Market: an Overview

Figure 31 Asia-Pacific Inverter Duty Motors Market: an Overview

Figure 32 Companies Adopted Investments& Expansions as the Key Growth Strategy During 2012 to April 2016

Figure 33 Siemens Held the Largest Share in the Inverter Duty Motors Market, 2015

Figure 34 Market Evaluation Framework: Investments & Expansions, Mergers & Acquisitions, & New Product Developments Fueled the Growth of Companies From 2013 to April 2016

Figure 35 Regional Revenue Mix of the Top 5 Market Players

Figure 36 Regal Beloit Corporation: Company Snapshot

Figure 37 Regal Beloit Corporation: SWOT Analysis

Figure 38 Rockwell Automation Inc.: Company Snapshot

Figure 39 Rockwell Automation Inc.: SWOT Analysis

Figure 40 ABB Ltd.: Company Snapshot

Figure 41 ABB Ltd.: SWOT Analysis

Figure 42 Siemens AG: Company Snapshot

Figure 43 SWOT Analysis: Siemens AG

Figure 44 General Electric Company: Company Snapshot

Figure 45 General Electric Company: SWOT Analysis

Figure 46 Havells India Ltd.: Company Snapshot

Figure 47 Nidec Corporation: Company Snapshot

Figure 48 Crompton Greaves: Company Snapshot

Figure 49 WEG SA: Company Snapshot

Growth opportunities and latent adjacency in Inverter Duty Motors Market